Professional Documents

Culture Documents

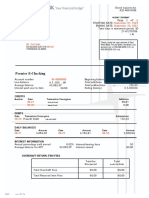

Our Protagonists: The Firm The Investor

Uploaded by

Srabasti NandiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Our Protagonists: The Firm The Investor

Uploaded by

Srabasti NandiCopyright:

Available Formats

Our protagonists

A firm is a commercial enterprise, a company that

buys and sells products and/or services to

An investor is a person that allocates capital with the expectation

consumers with the aim of making a profit. A of a future financial return or to gain an advantage. Types of

investments include: equity, debt securities, real estate, currency,

business entity such as a corporation, limited

liability company, public limited company, sole commodity, token, derivatives such as put and call options,

proprietorship, or partnership that has products or futures, forwards, etc.

services for sale is a firm.

The Firm The Investor

IIM Kozhikode - Financial Markets and Instruments 2

Protagonist #2: The investor

Who is an investor?

• Could be an individual, group of individuals, households, a firm (public or

private), a financial intermediary, government and municipalities etc.

• The defining characteristics is that they seek to transfer and preferably increase,

the value of assets they currently own, across time and/or states of the world.

IIM Kozhikode - Financial Markets and Instruments 3

Who is an investor?

• The defining characteristics is that they seek to transfer and preferably increase

value of assets they currently own, across time and/or states of the world.

What is an asset?

A resource with economic value controlled by the owner as a result of

past events (transaction); from which future economic benefits are

expected to flow. https://www.investopedia.com/terms/a/asset.asp

IIM Kozhikode - Financial Markets and Instruments 4

In financial accounting, an asset is any resource owned by a

business or an economic entity. It is anything that can be owned or

controlled to produce value and that is held by an economic entity Economic productivity is the value of output obtained with

and that could produce positive economic value one unit of input.

Use of an asset?

• store of value to facilitate transactions

• To create incremental value through conducting economically productive

activity, or having a claim against the benefits of economically productive

activity.

Firms consumes money to own real assets,

which are expected to generate money

greater than the money consumed. ex:

farming, manufacturing.

IIM Kozhikode - Financial Markets and Instruments 5

Categories of assets: Machines, land, gold

• Real asset: Resources used in production of goods and services.

• Financial asset: Claims on underlying real assets or cashflows thereof.

• Tangible assets: Physical form, can hold value and are measurable. ex:

plant, property and equipment, cash, securities etc.

• Intangible assets: lack physical form and tough to measure. ex: patents

etc.

IIM Kozhikode - Financial Markets and Instruments 6

https://www.investopedia.com/terms/f/financialasset.asp

Financial assets:

• Equity

• Residual claim

• Payout through dividends

https: • Debt

• Guaranteed payments

• Payout through coupon payments and maturity payment.

• Derivatives

• Derive value from an underlying financial asset, commodities or interest rate.

• Futures (Predetermined price at a specific future date. Obligatory contract.)

• Options (Right, but not obligation to buy/sell at a specified price, up till or at a specified date.)

• Hybrid claims

• Preferred shares

• Convertible bonds

IIM Kozhikode - Financial Markets and Instruments 7

The main difference between preferred and common stock is that preferred stock gives no

a convertible bond gives the holder

the option to convert or exchange it voting rights to shareholders while common stock does.

for a predetermined number of Preferred shareholders have priority over a company's income, meaning they are paid dividends

shares in the issuing company. before common shareholders.

Common stockholders are last in line when it comes to company assets, which means they will

be paid out after creditors, bondholders, and preferred shareholders.

Who is an investor?

• The defining characteristics is that they seek to transfer and preferably increase

value of assets they currently own, across time and/or states of the world.

https://www.investopedia.com/ask/answers/difference-between-preferred-stock-and-common-stock/

https://www.investopedia.com/investing/introduction-convertible-bonds/

Value of asset -> monetary value

Money -> Money is a medium of exchange for goods and services, with an agreed upon value.

IIM Kozhikode - Financial Markets and Instruments 8

Who is an investor?

• The defining characteristics is that they seek to transfer and preferably increase

value of assets they currently own, across time and/or states of the world.

https://www.investopedia.com/terms/i/investor.asp

Increase in value through conducting economically productive activity, or having a claim against

the benefits of economically productive activity.

IIM Kozhikode - Financial Markets and Instruments 9

Who is an investor?

• The defining characteristics is that they seek to transfer and preferably increase

value of assets they currently own, across time and/or states of the world.

Saving and investment

Insurance

IIM Kozhikode - Financial Markets and Instruments 10

Protagonist #2: The investor

Investor in a nutshell

• Objective: Deploy surplus resources in economically productive activity

• Characteristics: Rational

• Constraint: Inefficient in doing economically productive activity by self

NEEDS

RESOURCES

IIM Kozhikode - Financial Markets and Instruments 11

Protagonist #1: The firm

What is a firm?

• Firm refers to a generic business, could be:

• large or small, manufacturing or service, private or public.

• Basic legal forms of organizing firms:

• Sole proprietorship

• Partnership

• Corporation

IIM Kozhikode - Financial Markets and Instruments 0

https://www.investopedia.com/terms/s/soleproprietorship.asp

• Sole proprietorship

• Business owned by a single person.

• Income from business taxed as personal income.

• Pro: Easiest to setup and manage.

• Con: Unlimited liability for the owner. Non-transferable ownership.

IIM Kozhikode - Financial Markets and Instruments 1

https://www.entrepreneur.com/encyclopedia/partnership

• Partnership

• Business ownership of 2 or more people

• May be of 2 types

• General partnership: Unlimited liability for all debts

• Limited partnership: Limited liability to partner contribution to the partnership

• Pro: Partnerships are easy and cheap to setup and run. More flexible than proprietorship.

• Con: Unlimited liability and difficulty in raising finances. Non-transferable ownership for

general partner.

IIM Kozhikode - Financial Markets and Instruments 2

https://www.investopedia.com/terms/c/corporation.asp

• Corporation (most important form of setting up a business)

an individual, company, or organization that

has legal rights and obligations.

• Distinct legal entity from its owners.

• Governed under articles of incorporation and set of bylaws.

Articles of incorporation are a set of formal documents filed with a government body to legally document the creation of a

corporation. Articles of incorporation generally contain pertinent information, such as the firm's name, street address, agent for

• Pro: Separate legal entity. Limited liability. Perpetual life (potentially). Transferable

ownership. Ease of raising finances.

• Con: Double taxation. Complexity and cost of setup and exacting compliance.

lifting the corporate veil is a legal decision to treat the rights or duties of a

corporation as the rights or liabilities of its shareholders.

Separate legal entity. Limited liability. -> Lifting of the Corporate Veil

Limited liability is a legal status where a person's financial liability is limited to a fixed sum, most commonly the value of a

person's investment in a company or partnership. If a company with limited liability is sued, then the claimants are suing the

company, not its owners or investors.

IIM Kozhikode - Financial Markets and Instruments

3

You might also like

- 2018 Sav1455 RedemptionDocument5 pages2018 Sav1455 Redemptiondouglas jonesNo ratings yet

- East West Bank StatementDocument1 pageEast West Bank StatementHalon GlenNo ratings yet

- Case Interviews CrackedDocument208 pagesCase Interviews CrackedSaurabhYadav100% (11)

- Consult Club IIMA Casebook (2020-21) PDFDocument214 pagesConsult Club IIMA Casebook (2020-21) PDFIndranil Biswas , B.Tech., Chemical Engg., IIT (BHU), Varanasi (INDIA)100% (2)

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- CCW 0043274 5 7533Document1 pageCCW 0043274 5 7533Jehosafat PresasNo ratings yet

- SECTION 303-01B: Engine - 4.6L and 5.4L 2000 F-150 Workshop Manual AssemblyDocument35 pagesSECTION 303-01B: Engine - 4.6L and 5.4L 2000 F-150 Workshop Manual AssemblyHassan Vela VenegasNo ratings yet

- Fake Election Observation As Russias TooDocument43 pagesFake Election Observation As Russias TooMikkoNo ratings yet

- Subcontracting work order to Go Green Vision SolutionsDocument2 pagesSubcontracting work order to Go Green Vision SolutionsN PiclabNo ratings yet

- Government of India Manual for Unit-Run-CanteensDocument206 pagesGovernment of India Manual for Unit-Run-CanteensShyam Prabhu50% (2)

- Case Studies on Successful and Failed PPP Projects in IndiaDocument37 pagesCase Studies on Successful and Failed PPP Projects in IndiaDHANA LAKSHMINo ratings yet

- Bank Box Go SpecificationDocument8 pagesBank Box Go Specificationsafe upiNo ratings yet

- Muse Accounting Reporting Endowment FundsDocument11 pagesMuse Accounting Reporting Endowment FundsEllyanna JunitaNo ratings yet

- GRI2009 EBrochureDocument27 pagesGRI2009 EBrochurenjaloualiNo ratings yet

- NikeadidasDocument2 pagesNikeadidasNgọc Huyền NguyễnNo ratings yet

- CV - Sr. SQA Engineer - UsmanAliDocument3 pagesCV - Sr. SQA Engineer - UsmanAliUsman AliNo ratings yet

- Background Check ConsentDocument1 pageBackground Check ConsentRakesh RaulNo ratings yet

- Porter's Five Forces Analysis of the Philippine Real Estate IndustryDocument2 pagesPorter's Five Forces Analysis of the Philippine Real Estate IndustryJasonHrvyNo ratings yet

- Income Tax Bba 5 Sem QuestionDocument18 pagesIncome Tax Bba 5 Sem QuestionArun GuptaNo ratings yet

- User Guide Exp - COPYLOT 2019 EnglishDocument28 pagesUser Guide Exp - COPYLOT 2019 Englishนวเรศ สุวรรณมงคล100% (1)

- Ind Niftymicrocap250 ListDocument6 pagesInd Niftymicrocap250 ListAshish JainNo ratings yet

- Colony Apartments NOD 1.2023Document4 pagesColony Apartments NOD 1.2023T RNo ratings yet

- Strategic Management: Dr. Ashraf Abdel KhalekDocument57 pagesStrategic Management: Dr. Ashraf Abdel KhalekMohammadNo ratings yet

- Building ISO 20022 Payment Framework in R12: Ravikanth Prabhu, PMPDocument12 pagesBuilding ISO 20022 Payment Framework in R12: Ravikanth Prabhu, PMPRajendra PilludaNo ratings yet

- Lesson Guide 2.2 Beware of Banking FeesDocument4 pagesLesson Guide 2.2 Beware of Banking FeesKent TiclavilcaNo ratings yet

- Vic Leaner GuideDocument162 pagesVic Leaner GuideSachNo ratings yet

- Agriculture Padhai Online ClassesDocument18 pagesAgriculture Padhai Online ClassesYogita SharmaNo ratings yet

- Dispute BoardDocument16 pagesDispute BoardSaief AhmadNo ratings yet

- Moody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableDocument4 pagesMoody's Upgrades To Aaa Carroll County's (MD) GO Bonds Outlook StableChris SwamNo ratings yet

- Reliance Industries Limited - 12Document6 pagesReliance Industries Limited - 12Amish GangarNo ratings yet

- Fillip HelpDocument16 pagesFillip HelpTHOUFEEQ 3No ratings yet

- 11-22 IRD Awarded $65 Million Agricultural Development Project in Afghanistan's Kandahar and Helmand ProvincesDocument2 pages11-22 IRD Awarded $65 Million Agricultural Development Project in Afghanistan's Kandahar and Helmand ProvincesInternational Relief and DevelopmentNo ratings yet

- Financial Performance Analysis of Mercantile BankDocument9 pagesFinancial Performance Analysis of Mercantile BankKhalil RushdiNo ratings yet

- (2003) - SGCA - 30 Roberto's CaseDocument22 pages(2003) - SGCA - 30 Roberto's CasematthewpediaNo ratings yet

- P6 M3 Unit 8Document18 pagesP6 M3 Unit 8Cameron Sammakieh100% (1)

- RDO No. 45 - Marikina CityDocument388 pagesRDO No. 45 - Marikina CityAljon Llanera Vibar100% (1)

- Istanbul Bilgi University Department of Industrial Engineering IE 270 - Engineering Project Management 2020-2021 Spring - Case Study 01Document2 pagesIstanbul Bilgi University Department of Industrial Engineering IE 270 - Engineering Project Management 2020-2021 Spring - Case Study 01Salim GündüzNo ratings yet

- Fdocuments - in - Hero-Motocorp-Ltd-55844bb02b8ee (Repaired)Document66 pagesFdocuments - in - Hero-Motocorp-Ltd-55844bb02b8ee (Repaired)HIMANSHU KUMAR TIWARINo ratings yet

- Assignment Cover Sheet Coventry University Bachelor of Arts International Business (BAIB) Top-UpDocument26 pagesAssignment Cover Sheet Coventry University Bachelor of Arts International Business (BAIB) Top-UpVy ĐỗNo ratings yet

- FERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesDocument165 pagesFERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesKPLC 7 NewsNo ratings yet

- IOCL Call Letter Appln No 6010412004694 PDFDocument3 pagesIOCL Call Letter Appln No 6010412004694 PDFsagarNo ratings yet

- PS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyDocument1 pagePS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyJhansi RokatiNo ratings yet

- Parryware Toilet Seats PDFDocument53 pagesParryware Toilet Seats PDFSrinivas MVNo ratings yet

- Jean - Pierre Protzen y Stella Nair - Who Taught The Inca Stonemasons Their Skills. A Comparison oDocument23 pagesJean - Pierre Protzen y Stella Nair - Who Taught The Inca Stonemasons Their Skills. A Comparison oGabriela Castillo EspinozaNo ratings yet

- 5.23.2023 School Resource Officers AgreementDocument11 pages5.23.2023 School Resource Officers AgreementJennifer CuevasNo ratings yet

- Chaff Countermeasure Tm-Rr-170: ApplicationDocument1 pageChaff Countermeasure Tm-Rr-170: ApplicationRoberto PitaNo ratings yet

- Kolkata Port Visit Report-Puneet Kathuria 2241588Document9 pagesKolkata Port Visit Report-Puneet Kathuria 2241588Puneet KathuriaNo ratings yet

- Process: Corporate Office: Plot No: 313, Udyog Vihar Phase-IV, Gurugram, Haryana-122015 Ph. 0124-4763400Document6 pagesProcess: Corporate Office: Plot No: 313, Udyog Vihar Phase-IV, Gurugram, Haryana-122015 Ph. 0124-4763400Mukunda MukundaNo ratings yet

- Sample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentDocument20 pagesSample PDF of STD 12th Board Question With Solutions PCMB Sampel ContentSujata ChavanNo ratings yet

- Mini ProjectDocument27 pagesMini ProjectAnju MuthuNo ratings yet

- New ReportDocument51 pagesNew ReportAhmed KhanNo ratings yet

- PO 4600062173 SDBiosensorHealthcarePvtLtdDocument7 pagesPO 4600062173 SDBiosensorHealthcarePvtLtdChinna ThambiNo ratings yet

- 12420/gomti Express Second Sitting (2S) : WL WLDocument2 pages12420/gomti Express Second Sitting (2S) : WL WLMohd HashimNo ratings yet

- The Death of Equities (Business Week)Document7 pagesThe Death of Equities (Business Week)highwaysix100% (2)

- Chimay-Mf1 FSM en Final 280219Document847 pagesChimay-Mf1 FSM en Final 280219Nikolaos MavridisNo ratings yet

- Capital Market: Long-Term Funding MechanismDocument13 pagesCapital Market: Long-Term Funding MechanismNayan Krishna SureshbabuNo ratings yet

- Edit 430Document101 pagesEdit 430nisp cokeovensNo ratings yet

- SP4000 EN 45011 System 5 Certificate 20140107Document2 pagesSP4000 EN 45011 System 5 Certificate 20140107Yenny OrtegaNo ratings yet

- LV Motors: IE2 Safe Area: Reliable - Long Las NGDocument16 pagesLV Motors: IE2 Safe Area: Reliable - Long Las NGAvish ShahNo ratings yet

- SRS Document - Dhaval PaswalaDocument8 pagesSRS Document - Dhaval PaswalaQIT HarikaNo ratings yet

- E-Newsletter VDMA Bangalore July - Sep-2020Document18 pagesE-Newsletter VDMA Bangalore July - Sep-2020Raj VitkarNo ratings yet

- Pioneer - SC 71 - SC 1228 K - SC 1223 K - rrv4450Document71 pagesPioneer - SC 71 - SC 1228 K - SC 1223 K - rrv4450David FrostNo ratings yet

- Module-I - Introduction To Computer FundamentalsDocument63 pagesModule-I - Introduction To Computer FundamentalsUtshav RoyNo ratings yet

- Topic 1 The Investment EnvironmentDocument19 pagesTopic 1 The Investment EnvironmentDavid Adeabah Osafo100% (1)

- primary market ppt (1)Document15 pagesprimary market ppt (1)Kapil KumarNo ratings yet

- Corporate Banking, Business Financing & Capital Ratios ExplainedDocument26 pagesCorporate Banking, Business Financing & Capital Ratios ExplainedElvia SanchezNo ratings yet

- The Experience Curve PDFDocument4 pagesThe Experience Curve PDFViddhi ParekhNo ratings yet

- DA Course Outline - To UploadDocument7 pagesDA Course Outline - To UploadSrabasti NandiNo ratings yet

- Case Interview FrameworksDocument6 pagesCase Interview Frameworkserika KNo ratings yet

- PGP24 FMI AssignmentDocument3 pagesPGP24 FMI AssignmentSrabasti NandiNo ratings yet

- Fin Accounting Quiz-1 - Sec CDE - To StudentsDocument3 pagesFin Accounting Quiz-1 - Sec CDE - To StudentsSrabasti NandiNo ratings yet

- Note On Recurrent ErrorsDocument1 pageNote On Recurrent ErrorsSrabasti NandiNo ratings yet

- Atlan Case StudyDocument35 pagesAtlan Case StudySrabasti NandiNo ratings yet

- Salary Slip NewDocument1 pageSalary Slip Newfakiv83032No ratings yet

- Uber CLDDocument9 pagesUber CLDKHALKAR SWAPNILNo ratings yet

- 2023 EwtDocument4 pages2023 Ewtdivine mercyNo ratings yet

- DEMAND AND SUPPLY dqs156Document3 pagesDEMAND AND SUPPLY dqs156asyiqinNo ratings yet

- Merck Innovation Centre Case StudyDocument11 pagesMerck Innovation Centre Case StudyGokul ThilakNo ratings yet

- Marketing Strategy ReportDocument10 pagesMarketing Strategy ReportYi YeshiNo ratings yet

- Risk and ReturnDocument43 pagesRisk and ReturnRochelle Anne BaclayNo ratings yet

- Full Download Shapland and Turner Cases in Financial Accounting 1st Edition Julia Solutions ManualDocument36 pagesFull Download Shapland and Turner Cases in Financial Accounting 1st Edition Julia Solutions Manuallmawlamarukow100% (29)

- Jan PayslipDocument1 pageJan PayslipSidvik InfotechNo ratings yet

- PFL New Form 4 1Document3 pagesPFL New Form 4 1Neil PilosopoNo ratings yet

- Chapter-5-Accounting for Partnerships in EthiopiaDocument17 pagesChapter-5-Accounting for Partnerships in EthiopiaYasinNo ratings yet

- BT Bank AnswersDocument5 pagesBT Bank AnswersKereen Ruie LingcoNo ratings yet

- Swami Keshvanand Institute of Technology, Management and Gramothan (SKIT Jaipur)Document19 pagesSwami Keshvanand Institute of Technology, Management and Gramothan (SKIT Jaipur)Mayank kumawatNo ratings yet

- Galaxy Surfactants Limited: Niranjan Arun KetkarDocument41 pagesGalaxy Surfactants Limited: Niranjan Arun KetkarparthchillNo ratings yet

- CH-1 Cost SheetDocument6 pagesCH-1 Cost SheetIftekhar Uddin M.D EisaNo ratings yet

- BUS 102 Fundamentals of Buiness II 2022Document4 pagesBUS 102 Fundamentals of Buiness II 2022Hafsa YusifNo ratings yet

- Wood Products and Panels: Chilean Plywood Exports Increase Slightly in 2020Document1 pageWood Products and Panels: Chilean Plywood Exports Increase Slightly in 2020Pablo Carrasco OrozcoNo ratings yet

- Mark Scheme (Provisional) Summer 2021Document16 pagesMark Scheme (Provisional) Summer 2021Tahmid AliNo ratings yet

- Wholesale Fruit Suppliers in Bangalore - Glee ImpexDocument2 pagesWholesale Fruit Suppliers in Bangalore - Glee ImpexGlee ImpexNo ratings yet

- Globalization Opportunities and ChallengesDocument23 pagesGlobalization Opportunities and ChallengesuraneeNo ratings yet

- ACC101 BASIC ACCOUNTING CONCEPTS PRACTICEDocument6 pagesACC101 BASIC ACCOUNTING CONCEPTS PRACTICETimileyin AjibadeNo ratings yet

- Chapter 2: Negotiating Payment: What Points Should Be Mentioned in A Payment Clause of An IBC ?Document55 pagesChapter 2: Negotiating Payment: What Points Should Be Mentioned in A Payment Clause of An IBC ?Minh Ngan NguyenNo ratings yet

- Economic GlobalizationDocument2 pagesEconomic GlobalizationFerly Ann BaculinaoNo ratings yet

- My Book Industrial Relations PDFDocument590 pagesMy Book Industrial Relations PDFVikram SinghNo ratings yet

- IDFC BANK Repayment Schedule-10865556Document2 pagesIDFC BANK Repayment Schedule-10865556Dinesh KumarNo ratings yet

- In Exercise 2 13 You Considered The Food Stamp Programs inDocument2 pagesIn Exercise 2 13 You Considered The Food Stamp Programs intrilocksp SinghNo ratings yet