Professional Documents

Culture Documents

Islamic Economics (: Fiqh Al-Mu'āmalāt

Uploaded by

chris williamsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Islamic Economics (: Fiqh Al-Mu'āmalāt

Uploaded by

chris williamsCopyright:

Available Formats

Islamic economics

(Arabic: )االقتصاد اإلسالمي

The term means knowledge of economics or economic activities and processes in terms of Islamic

principles and teachings.[1]Islam has a set of special moral norms and values about individual and

social economic behavior. Therefore, it has its own economic system, which is based on its

philosophical views and is compatible with the Islamic organization of other aspects of human

behavior: social and political systems.[2]

is a term used to refer to Islamic commercial jurisprudence (Arabic: فقه المعامالت, fiqh al-mu'āmalāt),

and also to an ideology of economics based on the teachings of Islam that takes a middle ground

between the systems of Marxism and capitalism, mostly similar to the labour theory of value, which

is "labour-based exchange and exchange-based labour".[3][4]

Islamic commercial jurisprudence entails the rules of transacting finance or other economic activity in

a Shari'a compliant manner,[5] i.e., a manner conforming to Islamic scripture (Quran and sunnah).

Islamic jurisprudence (fiqh) has traditionally dealt with determining what is required, prohibited,

encouraged, discouraged, or just permissible,[6] according to the revealed word of God (Quran) and

the religious practices established by Muhammad (sunnah). This applied to issues like property,

money, employment, taxes, loans, along with everything else. The social science of economics,[6] on

the other hand, works to describe, analyse and understand production, distribution,

and consumption of goods and services,[7] and studied how to best achieve policy goals, such as full

employment, price stability, economic equity and productivity growth.[8]

Early forms of mercantilism and capitalism are thought to have been developed in the Islamic

Golden Age[9][10][11] from the 9th century and later became dominant in European Muslim territories

like Al-Andalus and the Emirate of Sicily.[12][13]

The Islamic economic concepts taken and applied by the states Age of the Islamic Gunpowders and

various Islamic kingdoms and sultanates led to systemic changes in their economy. Particularly in

the Mughal India,[14][15] its wealthiest region of Bengal, a major trading nation of the medieval world,

signaled the period of proto-industrialization,[16][17][18][19] making direct contribution to the world's

first Industrial Revolution after the British conquests.[20][21][22]

In the mid-twentieth century, campaigns began promoting the idea of specifically Islamic patterns of

economic thought and behavior.[23] By the 1970s, "Islamic economics" was introduced as an

academic discipline in a number of institutions of higher learning throughout the Muslim world and in

the West.[5] The central features of an Islamic economy are often summarized as: (1) the "behavioral

norms and moral foundations" derived from the Quran and Sunnah; (2) collection of zakat and

other Islamic taxes, (3) prohibition of interest (riba) charged on loans.[24][25][26][27]

Advocates of Islamic economics generally describe it as neither socialist nor capitalist, but as a "third

way", an ideal mean with none of the drawbacks of the other two systems.[28][29][30] Among the claims

made for an Islamic economic system by Islamic activists and revivalists are that the gap between

the rich and the poor will be reduced and prosperity enhanced[31][32] by such means as the

discouraging of the hoarding of wealth,[33][34] taxing wealth (through zakat) but not trade,

exposing lenders to risk through Profit sharing and venture capital,[35][36][37] discouraging

of hoarding of food for speculation,[38][39][40] and other activities that Islam regards as sinful such as

unlawful confiscation of land.[41][42] However, critics like Timur Kuran have described it as primarily a

"vehicle for asserting the primacy of Islam", with economic reform being a secondary motive.[43][44]

You might also like

- Islamic Economics SystemDocument2 pagesIslamic Economics SystemAqsa RiazNo ratings yet

- Zakat - The "Taxing of Certain Goods, Such As Harvest, With An Eye To Allocating TheseDocument14 pagesZakat - The "Taxing of Certain Goods, Such As Harvest, With An Eye To Allocating TheseWL RazakNo ratings yet

- Asutay (2007) PDFDocument16 pagesAsutay (2007) PDFanwaradem225No ratings yet

- 04asutay PDFDocument16 pages04asutay PDFM Ridwan UmarNo ratings yet

- Critical Overview of The History of Islamic EconomicDocument23 pagesCritical Overview of The History of Islamic EconomicAZMI SMANDANo ratings yet

- Critical Overview of The History of Islamic Economics: Formation, Transformation, and New HorizonsDocument23 pagesCritical Overview of The History of Islamic Economics: Formation, Transformation, and New HorizonsNahli Brilianti MaslakhahNo ratings yet

- Ibadat (Worship) Mu 'AmalatDocument4 pagesIbadat (Worship) Mu 'AmalatHoài Sơn VũNo ratings yet

- Arif M. 1985. Toward A Definition of Islamic Economics Some Scientific Considerations 2Document15 pagesArif M. 1985. Toward A Definition of Islamic Economics Some Scientific Considerations 2muhammad taufikNo ratings yet

- Rethinking Islamic Economics: Is it Relevant and in Need of ReformDocument6 pagesRethinking Islamic Economics: Is it Relevant and in Need of ReformAn WismoNo ratings yet

- Fundamentals of An Islamic Economic System Compared To The Social Market EconomyDocument22 pagesFundamentals of An Islamic Economic System Compared To The Social Market EconomySyed MehboobNo ratings yet

- The Basic Principles of Islamic Economy and Their Effects On Accounting StandardsDocument11 pagesThe Basic Principles of Islamic Economy and Their Effects On Accounting StandardsawaisdotcomNo ratings yet

- Praktek Implementasi Ekonomi Islam Di Era Umar Bin Khattab, Iman Abdulah EditDocument20 pagesPraktek Implementasi Ekonomi Islam Di Era Umar Bin Khattab, Iman Abdulah Editjaharuddin.hannoverNo ratings yet

- Dr. Mehmet AsutayDocument17 pagesDr. Mehmet AsutayHasanovMirasovičNo ratings yet

- What Is Islamic Economics? The View of Muhammad Baqir Al-SadrDocument9 pagesWhat Is Islamic Economics? The View of Muhammad Baqir Al-SadrJEKINo ratings yet

- Accountancy Article PDFDocument7 pagesAccountancy Article PDFAmer RasticNo ratings yet

- Comparative Analysis of Capitalism and Islamic Economic SystemsDocument15 pagesComparative Analysis of Capitalism and Islamic Economic SystemsAbdul Salam NMNo ratings yet

- SOCIO ReportDocument17 pagesSOCIO ReportAli NaqiNo ratings yet

- Understanding Islamic EconomicsDocument30 pagesUnderstanding Islamic Economicsmsa11pkNo ratings yet

- Islamic Economics Principles and CharacteristicsDocument7 pagesIslamic Economics Principles and Characteristicsarid WanaNo ratings yet

- Islamic Economy in EnglishDocument45 pagesIslamic Economy in EnglishDwi rezky YuliantyNo ratings yet

- Chapter 2 Scope and MethodologyDocument33 pagesChapter 2 Scope and MethodologyNur Auni Nabihah ZakariaNo ratings yet

- Islamic Finance Social Failure Causes and SolutionsDocument21 pagesIslamic Finance Social Failure Causes and SolutionsŞehmus AYDINNo ratings yet

- 153876_IEI-VOL-26-1-10E-FahimDocument34 pages153876_IEI-VOL-26-1-10E-FahimRifaldy MajidNo ratings yet

- Hamidullah Islamic LegacyDocument22 pagesHamidullah Islamic LegacyAhmad Hakimi OthmanNo ratings yet

- ISLAMIC ECONOMICS, What Went Wrong?: Historical BackgroundDocument10 pagesISLAMIC ECONOMICS, What Went Wrong?: Historical BackgroundArdi PrawiroNo ratings yet

- Advantages of Islamic EconomyDocument12 pagesAdvantages of Islamic Economyherdiansyah wahyu saputraNo ratings yet

- Artikel Jurnal (M. Hadi & A. Rokhim) Rev. 26.06.23Document20 pagesArtikel Jurnal (M. Hadi & A. Rokhim) Rev. 26.06.23MOHAMMAD HADINo ratings yet

- Islam and Mammon: The Economic Predicaments of IslamismFrom EverandIslam and Mammon: The Economic Predicaments of IslamismRating: 2.5 out of 5 stars2.5/5 (4)

- Islamic Economics: Still in Search of An Identity: Abdulkader Cassim MahomedyDocument14 pagesIslamic Economics: Still in Search of An Identity: Abdulkader Cassim MahomedySon Go HanNo ratings yet

- Aslam Haneef Contemporary Islamic Economics The Missing Dimension of Genuine IslamizationDocument20 pagesAslam Haneef Contemporary Islamic Economics The Missing Dimension of Genuine IslamizationmohammedzaidiNo ratings yet

- Asutay Islamicmoraleconomyasthefoundationofislamicfinance Inislamicfinanceineurope Ee 2013Document17 pagesAsutay Islamicmoraleconomyasthefoundationofislamicfinance Inislamicfinanceineurope Ee 2013Francisco AssisoNo ratings yet

- The Economic System of Islam Part 1 of 2 277 enDocument4 pagesThe Economic System of Islam Part 1 of 2 277 enDaniel EspinosaNo ratings yet

- MPRA Paper 80149Document22 pagesMPRA Paper 80149omr dogarNo ratings yet

- Islamic Financial SystemDocument24 pagesIslamic Financial System✬ SHANZA MALIK ✬No ratings yet

- Mixed Economy - WikipediaDocument21 pagesMixed Economy - Wikipediavineetha Tated jainNo ratings yet

- K.HosainDocument6 pagesK.HosainSaqib GondalNo ratings yet

- Chapter 1 IeDocument23 pagesChapter 1 IeSaleh AbukarNo ratings yet

- Introduction to Islamic Banking PrinciplesDocument53 pagesIntroduction to Islamic Banking PrinciplesVarun JainNo ratings yet

- 157-Article Text-1690-1-10-20220305Document20 pages157-Article Text-1690-1-10-20220305Yolifia OplitaNo ratings yet

- Durham Research OnlineDocument16 pagesDurham Research OnlineFarah DibaNo ratings yet

- PERAN NEGARA DALAM BANK SYARIAH en-GBDocument24 pagesPERAN NEGARA DALAM BANK SYARIAH en-GBMOHAMMAD HADINo ratings yet

- Sustainability 10 00637 PDFDocument11 pagesSustainability 10 00637 PDFDila Estu KinasihNo ratings yet

- Al-Ghazālī and The Intellectual History of Islamic EconomicsDocument21 pagesAl-Ghazālī and The Intellectual History of Islamic EconomicsBeBent100% (1)

- Islamic Econ Journal Article ReviewedDocument7 pagesIslamic Econ Journal Article ReviewedDiaz HasvinNo ratings yet

- Islamic Economicsof Research in Islamic EconomicsDocument34 pagesIslamic Economicsof Research in Islamic EconomicsTmr Gitu Looh100% (1)

- Book Review Early Islam and The Birth of CapitalismDocument5 pagesBook Review Early Islam and The Birth of CapitalismKomitet PotrebiteliNo ratings yet

- Chapter - II Literature ReviewDocument73 pagesChapter - II Literature Reviewياسر العريقيNo ratings yet

- Economic SystemDocument4 pagesEconomic SystemSamina HaiderNo ratings yet

- Topic 5: Islamic Economics As Plea For Liberal Capitalism: Wrong Answer To The Wrong QuestionDocument20 pagesTopic 5: Islamic Economics As Plea For Liberal Capitalism: Wrong Answer To The Wrong QuestionUmer SaeedNo ratings yet

- Paper of MethdologyDocument43 pagesPaper of MethdologyHud SabriNo ratings yet

- Islamic Economic SystemDocument5 pagesIslamic Economic SystemMukhlis NasriNo ratings yet

- Journey of Islamic Economics in The Modern World: Masyhudi MuqorobinDocument19 pagesJourney of Islamic Economics in The Modern World: Masyhudi MuqorobinAbdul Qadeer Rehmani AdvNo ratings yet

- Shariah Economics and The Progress of Islamic Finance The Role of Shariah ExpertsDocument5 pagesShariah Economics and The Progress of Islamic Finance The Role of Shariah ExpertsmohamedNo ratings yet

- Islamic Economics DefinitionDocument6 pagesIslamic Economics DefinitionComrade Ibrahim M. Gani100% (4)

- 4 - Iftakhar Ahmad ArticalDocument21 pages4 - Iftakhar Ahmad ArticalHind AmhaouchNo ratings yet

- Isalmic EnterprenuershipDocument6 pagesIsalmic EnterprenuershipMuhammad Umer Farooq AwanNo ratings yet

- Self-Interest, Homo Islamicus and Behavioral AssumptionsDocument15 pagesSelf-Interest, Homo Islamicus and Behavioral AssumptionsJobaiyerNo ratings yet

- I Begin: in The Name ofDocument43 pagesI Begin: in The Name ofsamiulla khanNo ratings yet

- FND GFM 485743Document31 pagesFND GFM 485743Zakir HossenNo ratings yet

- 100 Tareekhi KahanianDocument71 pages100 Tareekhi KahanianShia Books For DownloadNo ratings yet

- Juz 14 PDFDocument63 pagesJuz 14 PDFRiyaz MarikarNo ratings yet

- A. Hafalan Surat Al Buruj: Pesantren Kilat Ramadhan Al-Zahra Islamic CentreDocument20 pagesA. Hafalan Surat Al Buruj: Pesantren Kilat Ramadhan Al-Zahra Islamic CentreIndah Halimatu TsaniahNo ratings yet

- Islam's Early Expansion into the MediterraneanDocument28 pagesIslam's Early Expansion into the MediterraneanMariamKakauridzeNo ratings yet

- Affectation Seg PFEDocument54 pagesAffectation Seg PFEray7an.3No ratings yet

- Pillars of Islam - Benedictine - Chicago - Catholic Universities - 1636919559411Document5 pagesPillars of Islam - Benedictine - Chicago - Catholic Universities - 1636919559411IMRAN USSINo ratings yet

- Report2014 16englishDocument60 pagesReport2014 16englishtruecalller4No ratings yet

- An-Najm Tafseer SimplifiedDocument18 pagesAn-Najm Tafseer Simplifiedmhasnath1No ratings yet

- Class: 2: Total Time: 2 HoursDocument12 pagesClass: 2: Total Time: 2 HoursZuniButtNo ratings yet

- Medieval India: Vetrii Ias Study CircleDocument14 pagesMedieval India: Vetrii Ias Study CircleGladie AngieNo ratings yet

- Foundations of the Islamic Economy ParadigmDocument27 pagesFoundations of the Islamic Economy ParadigmFatin AtirahNo ratings yet

- Tinjauan Al Qur'An Terhadap Perilaku Manusia: Dalam Perspektif Psikologi IslamDocument10 pagesTinjauan Al Qur'An Terhadap Perilaku Manusia: Dalam Perspektif Psikologi IslamHaifa NurhandiniNo ratings yet

- ISLAMIAT Important & Selected Solved MCQs For Competitive Exams (Set IV)Document9 pagesISLAMIAT Important & Selected Solved MCQs For Competitive Exams (Set IV)Muhammad AnasNo ratings yet

- Terra Conquistata Di Conquista e PredonDocument23 pagesTerra Conquistata Di Conquista e PredonGraziano SerraNo ratings yet

- District-South-KarachiDocument21 pagesDistrict-South-KarachiUmar ShahNo ratings yet

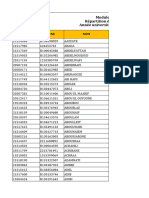

- Hasil Quiz 1 PKDocument1 pageHasil Quiz 1 PKhalil ariantoNo ratings yet

- Eshal Zainab Pary - 8C - SST - Holiday Homework Q.1Document2 pagesEshal Zainab Pary - 8C - SST - Holiday Homework Q.1EshalNo ratings yet

- Shams Al-Ma'Arif - WikipediaDocument16 pagesShams Al-Ma'Arif - Wikipediariyadshukri0No ratings yet

- We Are Muslims Wherever We Are by Hazrat Maulana Yunus Patel Saheb (Rahmatullah Alayh)Document1 pageWe Are Muslims Wherever We Are by Hazrat Maulana Yunus Patel Saheb (Rahmatullah Alayh)takwaniaNo ratings yet

- Baby NamesDocument3 pagesBaby NamesumairleoNo ratings yet

- Nov Dec 2022 - DomesticDocument12 pagesNov Dec 2022 - Domesticameyawpius87No ratings yet

- Chemin GrenierDocument4 pagesChemin GrenierL'express MauriceNo ratings yet

- Caliphate of Hazrat Umar Farooq RADocument15 pagesCaliphate of Hazrat Umar Farooq RAsyed babar khan babar khanNo ratings yet

- Mukhta Ar Al-Qudūrī (Mukhtasar Al-Quduri)Document1 pageMukhta Ar Al-Qudūrī (Mukhtasar Al-Quduri)al-Kiani35% (31)

- Sir Syed Ahmed Khan and His ContributionsDocument3 pagesSir Syed Ahmed Khan and His ContributionsAleeha IlyasNo ratings yet

- Jamia Masjid Behzad ReportDocument14 pagesJamia Masjid Behzad Reportbaap playerNo ratings yet

- Class K.G. Syllabus & Date Sheet For FA-IIDocument1 pageClass K.G. Syllabus & Date Sheet For FA-IISayedAsgarAliNo ratings yet

- Long Live Khomeini (R.a.), Long Live Wilayat Al - Faqih On The 38th Anniversary of The Islamic Revolution, Iran Is Mightier Than EveDocument8 pagesLong Live Khomeini (R.a.), Long Live Wilayat Al - Faqih On The 38th Anniversary of The Islamic Revolution, Iran Is Mightier Than Evetrk868581No ratings yet