Professional Documents

Culture Documents

Maarij Khan (8166) : Mr. Waseem Computation of Capital at End and at Start

Uploaded by

Maarij KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maarij Khan (8166) : Mr. Waseem Computation of Capital at End and at Start

Uploaded by

Maarij KhanCopyright:

Available Formats

Maarij Khan (8166)

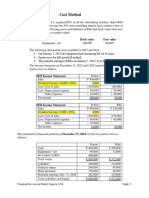

MR. WASEEM

COMPUTATION OF CAPITAL AT END AND AT START.

ACCOUNTS TITLE JANUARY 1ST,2016 DECEMBER 31ST,2016

ADD : ASSETS

Cash Rs 320,000 Rs 600,000

Account Receivables Rs 800,000 Rs 950,000

Merchandise Inventory Rs 100,000 Rs 300,000

Sales Equipment 0 Rs 100,000

Machinery Rs 400,000 Rs 600,000

TOTAL ASSETS Rs 1,620,000 Rs 2,550,000

LESS : LIABILITIES

Account Payable Rs 98,500 Rs 139,200

Salaries Payable Rs 58,800 Rs 68,900

TOTAL LIABILITIES -157300 -208,100

CAPITAL RS 1,462,700 Rs 2,341,900

ER 31ST,2016

MR. WASEEM

STATEMENT OF PROFIT AND LOSS

FOR THE YEAR ENDED DECEMBER 31ST, 2016

Capital at End 2,341,900

ADD: Drawings 96,000

2,437,900

LESS: Additional Investment -128,560

LESS: Capital at Start -1,462,700

Unadjusted Net Profit 846,640

LESS: Expense:

Depreciation Expense (600,000 * 14%) 84,000

Rent Expense 20,000

Salaries Expense 16,500

Bad debts Expense 8,000

-128,500

ADD: Prepaid Advertising 30,000

Total Expense -98,500

NET PROFIT : 748,140

IT AND LOSS

1ST, 2016

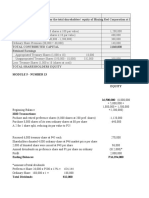

MR. WASEEM

BALANCE SHEET

AS ON DECEMBER 31ST, 2016

ASSETS

CURRENT ASSETS:

Cash 600,000

Merchandise Inventory 300,000

Account Receivables 950,000

LESS: Allowance for bad debts -8000

942,000

Sales Equipment 100,000

Prepaid Advertising 30,000

TOTAL CURRENT ASSETS 1,972,000

FIXED ASSETS:

Machinery 600,000

LESS: Allowance for dep -84,000

516,000

TOTAL FIXED ASSETS 516,000

TOTAL ASSETS = 2,488,000

BALANCE SHEET

ER 31ST, 2016

EQUITIES

LIABILITIES:

Account Payable 139,200

Rent Payable 20,000

Salaries Payable 85,400

TOTAL LIABILITIES 244,600

OWNER'S EQUITY:

Capital at Start 1,462,700

ADD: Investment 128,560

LESS: Drawings -96,000

ADD: Net Profit 748,140

ADJUSTED CAPITAL 2,243,400

TOTAL EQUITIES = 2,488,000

KAREEM LIMITED

GENERAL JOURNAL

S.NO DATE PARTICULARS DEBIT

1 ─ Bank (100,000 * 10) 1,000,000

Share Application

( to record the receiving of 100,000 shares @

Rs 10)

2 ─ Share Application (80,000*10) 800,000

Share Capital

( to record the allotment of 80,000 shares @

Rs 10)

3 ─ Share Application (20,000*10) 200,000

Bank

( to record the refund of 20,000 shares @

Rs 10)

4 ─ Land (6000* 12) 72,000

Share premium (6000 * 2)

Share Capital ( 6000 * 10)

( to record the issuance of 6000 shares @

Rs 12)

5 ─ Bonds Payable ( 5000 * 12) 60,000

Share Premium ( 5000*2)

Share Capital (5000*10)

( to record the issuance of 5000 shares for the settl-

ement @ Rs 12)

6 ─ Preliminiary Expense (7000 * 16) 112,000

Share Premium (7000 * 6)

Share Capital (7000 * 10)

( to record the issuance of 7000 shares to promote-

rs @ Rs 16)

7 ─ Account Payable 950,000

Share Premium

Share Capital

(to record issuance of shares for the acquisition of

business @ Rs 25)

CREDIT

1,000,000

800,000

200,000

12,000

60,000

10,000

50,000

42,000

70,000

570,000

380,000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- D. in Any of TheseDocument3 pagesD. in Any of TheseAlrac Garcia100% (1)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Corporation Law ReviewerDocument216 pagesCorporation Law ReviewerJobi BryantNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Business and Management Dictionary and Glossary of Terminology, Words, Terms, and Definitions - Mian Terms and Unsusual Amusing Business-SpeakDocument118 pagesBusiness and Management Dictionary and Glossary of Terminology, Words, Terms, and Definitions - Mian Terms and Unsusual Amusing Business-SpeakSophia Yeiji ShinNo ratings yet

- JPMorgan Chase Mortgage Settlement DocumentsDocument291 pagesJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (2)

- Ic Exam Review: VariableDocument122 pagesIc Exam Review: VariableJL RangelNo ratings yet

- ACTIVITY NO1and2Document5 pagesACTIVITY NO1and2Patricia Nicole Barrios100% (1)

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Business Policy and Strategic ManagementDocument89 pagesBusiness Policy and Strategic Managementanmol100% (1)

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- SOLUTIONSDocument7 pagesSOLUTIONSIvan dela CruzNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- SOLUTIONS To FAR FINAL PREDocument6 pagesSOLUTIONS To FAR FINAL PRELezyl UntalanNo ratings yet

- 5 - Assign - Pad & Sad Co.Document2 pages5 - Assign - Pad & Sad Co.Pinky DaisiesNo ratings yet

- Audit of Financial Statements Part 2Document2 pagesAudit of Financial Statements Part 2Brit NeyNo ratings yet

- SFP and SCF - Practice QuestionsDocument3 pagesSFP and SCF - Practice QuestionsFazelah YakubNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Zartiga PrEDocument4 pagesZartiga PrEFritzie Ann ZartigaNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- Piecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsDocument13 pagesPiecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsMario KaunangNo ratings yet

- Piecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsDocument13 pagesPiecemeal Acquisition-With Minority Interest: Show Your Calculation For The FollowingsMario KaunangNo ratings yet

- Seatwork Problem 1Document11 pagesSeatwork Problem 1Zihr EllerycNo ratings yet

- Ass.1 Acctng. For Special TransactionDocument17 pagesAss.1 Acctng. For Special TransactionJea Ann CariñozaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Activity 7Document16 pagesActivity 7JEWELL ANN PENARANDANo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- ASSIGNMENT OF ACCOUNTING II JJJJDocument5 pagesASSIGNMENT OF ACCOUNTING II JJJJJunaid AhmedNo ratings yet

- Lecture 21 Working SheetDocument2 pagesLecture 21 Working Sheetsobian356No ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Partnership AppDocument22 pagesPartnership AppPeter AkramNo ratings yet

- Activity 1 Intact 3Document7 pagesActivity 1 Intact 3Kate NuevaNo ratings yet

- 06 Notes Receivable Section 2 PSDocument4 pages06 Notes Receivable Section 2 PSkyle mandaresioNo ratings yet

- Chapter 1 - Some Solved ProblemsDocument12 pagesChapter 1 - Some Solved ProblemsBracu 2023No ratings yet

- ExerciseDocument12 pagesExercisesde.ofcl20No ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Financial Reporting and Analysis 2017Document10 pagesFinancial Reporting and Analysis 2017SagarPirtheeNo ratings yet

- Q1 and Q2 (Maarij Khan)Document11 pagesQ1 and Q2 (Maarij Khan)Maarij KhanNo ratings yet

- Income Statement: Gross Profit Operating ExpensesDocument11 pagesIncome Statement: Gross Profit Operating ExpensesMaarij KhanNo ratings yet

- Equity SHE Transactions MARPDocument2 pagesEquity SHE Transactions MARPKrisha Joselle MilloNo ratings yet

- Accts Imp QnsDocument4 pagesAccts Imp QnsnishabilochiNo ratings yet

- Adobe Scan 27-Feb-2023Document9 pagesAdobe Scan 27-Feb-2023SudeepNo ratings yet

- Solution To Problems - Chapter 10Document14 pagesSolution To Problems - Chapter 10GFGSHSNo ratings yet

- Assignment Ia2Document6 pagesAssignment Ia2Gwen TimoteoNo ratings yet

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- 1Document4 pages1Nguyen Hoang Gia UyenNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- 2016 Vol 3 CH 6 AnsDocument6 pages2016 Vol 3 CH 6 Ansjohn lloyd JoseNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Problem No 5.2-A Affordable Lawn Care IncDocument5 pagesProblem No 5.2-A Affordable Lawn Care IncZeeshan AjmalNo ratings yet

- Accounting 22 2016Document10 pagesAccounting 22 2016Thulani NdlovuNo ratings yet

- Module 5 Exercises 3 and 13Document3 pagesModule 5 Exercises 3 and 13Reign TambasacanNo ratings yet

- UV0806 North Mountain Nursery, Inc - Statement of Cahs FlowDocument3 pagesUV0806 North Mountain Nursery, Inc - Statement of Cahs Flowpaocvl892No ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Model Ans - Sas - I April 2018Document68 pagesModel Ans - Sas - I April 2018প্রীতম সেনNo ratings yet

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet

- 1 Partnership SolutionsDocument34 pages1 Partnership SolutionsLuna SanNo ratings yet

- Assignment 1 (Maarij Khan)Document5 pagesAssignment 1 (Maarij Khan)Maarij KhanNo ratings yet

- Industry Visit Report (Maarij)Document4 pagesIndustry Visit Report (Maarij)Maarij KhanNo ratings yet

- CSR Report PDVDocument5 pagesCSR Report PDVMaarij KhanNo ratings yet

- SWOT Analysis: Maarij Khan (F19BBA15)Document5 pagesSWOT Analysis: Maarij Khan (F19BBA15)Maarij KhanNo ratings yet

- Agency Structre - Examine Struture and RolesDocument20 pagesAgency Structre - Examine Struture and RolesMaarij KhanNo ratings yet

- Media PlanningDocument9 pagesMedia PlanningMaarij KhanNo ratings yet

- Agency TypesDocument7 pagesAgency TypesMaarij KhanNo ratings yet

- Q1 and Q2 (Maarij Khan)Document11 pagesQ1 and Q2 (Maarij Khan)Maarij KhanNo ratings yet

- My Goals For The Next 5 Years: Goal#1: Obtain My Master'S DegreeDocument3 pagesMy Goals For The Next 5 Years: Goal#1: Obtain My Master'S DegreeMaarij KhanNo ratings yet

- Q3 (Maarij Khan)Document1 pageQ3 (Maarij Khan)Maarij KhanNo ratings yet

- 32 Power Words (Maarij Khan)Document2 pages32 Power Words (Maarij Khan)Maarij KhanNo ratings yet

- Survey Proposal (Revised)Document9 pagesSurvey Proposal (Revised)Maarij KhanNo ratings yet

- Survey ProposalDocument2 pagesSurvey ProposalMaarij KhanNo ratings yet

- Maarij Khan (Pathan) Financial Ratios. Helper: Rimshaaa (The Great Legend) Thank Me Later!!Document5 pagesMaarij Khan (Pathan) Financial Ratios. Helper: Rimshaaa (The Great Legend) Thank Me Later!!Maarij KhanNo ratings yet

- Outline: 1. Introduction To Tort LawDocument1 pageOutline: 1. Introduction To Tort LawMaarij KhanNo ratings yet

- Introduction To Law: Simple Definition of LawDocument44 pagesIntroduction To Law: Simple Definition of LawMaarij KhanNo ratings yet

- Security and TradeDocument16 pagesSecurity and TradeMaarij KhanNo ratings yet

- Nestle Pakistan Limited Financial Ratio AnalysisDocument5 pagesNestle Pakistan Limited Financial Ratio AnalysisMaarij KhanNo ratings yet

- Q1 AND Q4 (MCQS)Document3 pagesQ1 AND Q4 (MCQS)Maarij KhanNo ratings yet

- Brand Personality Brand PersonalityDocument6 pagesBrand Personality Brand PersonalityMaarij KhanNo ratings yet

- Maarij Khan (BBA 2) : Q3) Define The FollowingDocument2 pagesMaarij Khan (BBA 2) : Q3) Define The FollowingMaarij KhanNo ratings yet

- Art and Society (Maarij Khan)Document2 pagesArt and Society (Maarij Khan)Maarij KhanNo ratings yet

- Warren Larsen Chp1 (Principles of Accounting)Document147 pagesWarren Larsen Chp1 (Principles of Accounting)annie100% (1)

- Chap 015Document53 pagesChap 015ALEXANDRANICOLE OCTAVIANONo ratings yet

- Click The Blue Buttons Below To Navigate Part 1 More EfficientlyDocument89 pagesClick The Blue Buttons Below To Navigate Part 1 More Efficientlyelite writerNo ratings yet

- Time Value of MoneyDocument2 pagesTime Value of MoneyChristianNo ratings yet

- Starbucks Company ProfileDocument2 pagesStarbucks Company Profilearaby_mhNo ratings yet

- Wikimart: Building A Russian Version of AmazonDocument7 pagesWikimart: Building A Russian Version of Amazonapi-329688545100% (1)

- Blue Ridge School District 16.57 Group 3 IPMI Reg Jan 2010Document19 pagesBlue Ridge School District 16.57 Group 3 IPMI Reg Jan 2010Jovan Chrismarth HutajuluNo ratings yet

- Working Capital and Current Assets Management: Learning GoalsDocument2 pagesWorking Capital and Current Assets Management: Learning GoalsKristel SumabatNo ratings yet

- CMA Part 1 Unit 3 (2021)Document138 pagesCMA Part 1 Unit 3 (2021)athul16203682No ratings yet

- Analysing The Financial Ratios of DHFL (Ex-Ante) :: D/E RatioDocument3 pagesAnalysing The Financial Ratios of DHFL (Ex-Ante) :: D/E RatioGunadeep ReddyNo ratings yet

- Some Strategies For Managing Working Capital: Duke Ghosh IIFT, 2015Document44 pagesSome Strategies For Managing Working Capital: Duke Ghosh IIFT, 2015Ishu GargNo ratings yet

- Morgan MotorsDocument17 pagesMorgan MotorsKashaanNazikBalochNo ratings yet

- Guide To Marketing Strategy PresentationDocument21 pagesGuide To Marketing Strategy PresentationKago KhachanaNo ratings yet

- Abrasive Peeling of PotatoesDocument12 pagesAbrasive Peeling of PotatoesJoseph LouiseNo ratings yet

- Finance Assignment 2Document3 pagesFinance Assignment 2vish100% (1)

- FM 105 Module 1 RevisedDocument9 pagesFM 105 Module 1 RevisedAilex StoreNo ratings yet

- Main ProjectDocument91 pagesMain ProjectJyothirmai PediredlaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarNo ratings yet

- A Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Document34 pagesA Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Trang HuỳnhNo ratings yet

- IB Bussiness Management Financial Statements Layout GuideDocument2 pagesIB Bussiness Management Financial Statements Layout GuideBhavish Adwani100% (1)

- CEO List LahoreDocument2 pagesCEO List Lahorehelping handNo ratings yet

- In Company 3.0 ESP Investment: Glossary (By Unit)Document11 pagesIn Company 3.0 ESP Investment: Glossary (By Unit)LUISA CASTRO CUNEONo ratings yet

- Prime Bank LimitedDocument29 pagesPrime Bank LimitedShouravNo ratings yet

- Cost of Capital 4Document5 pagesCost of Capital 4sudarshan1985No ratings yet