Professional Documents

Culture Documents

Equity Method (First Year of Acquisition)

Uploaded by

Angel Chane OstrazCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Method (First Year of Acquisition)

Uploaded by

Angel Chane OstrazCopyright:

Available Formats

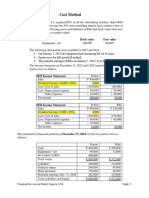

Cost Method VS Equity Method

Cost Method Equity Method

Date of Acquisition

Separate financial position

Investment in subsidiary @ Cost @ Cost

Subsequent to Date of Acquisition

Separate financial performance

Income Dividend income Investment income

Separate financial position

Investment in subsidiary @ Cost – impairment loss of Cost – share in dividend +/- share in

investment net income(loss) +/- share in amor. –

impairment of goodwill

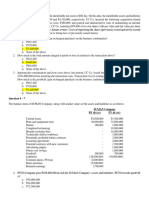

Problem 01:

On January 1, 2020, P Company acquired 40,000 of S Company in the open market for P2,280,000. On that date, the assets

and liabilities of S Company had book values that approximate their respective fair market values except inventory that has

a value of P120,000 and a book value of P100,000 and equipment that has a value of P100,000 more than its carrying

amount. This equipment has a remaining useful life of 5 years. Goodwill, if any, is to be tested for impairment at the end of

each year. P Company elects to measure non-controlling interest at its proportionate share of the identifiable net assets.

On December 31, 2020, S Company owed P Company P10,000 on open account from purchases made last year. Goodwill

impairment losses in 2020 is P10,000.

Financial statements for the two corporations for the year ended December 31, 2020 are as follows:

Books of P Company Jan. 1, 2020

Investment in subsidiary 2,280,000

Cash 2,280,000

Dec. 31, 2020

Cash 96,000

Investment in subsidiary 96,000

Share in dividend declared by S Company

Investment in subsidiary 288,000

Investment income 288,000

Share in net income reported by S Company

Investment income 16,000

Investment in subsidiary 16,000

Share in amortization of inventory

Investment income 16,000

Investment in subsidiary 16,000

Share in amortization of equipment

Investment income 10,000

Investment in subsidiary 10,000

Impairment of goodwill

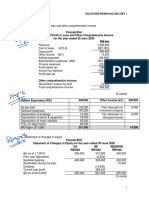

Under Equity Method

Income Statement P Company S Company Adjustment Consolidated

Sales P4,000,000 P2,000,000 6,000,000

Cost of sales (1,600,000) (1,200,000) 20,000 2,820,000

Gross profit P2,400,000 P800,000 3,180,000

Operating expenses (440,000) 20,000+10,000 2,030,000

Operating income P360,000 1,150,000

Investment income -246,000 -

Net Profit P1,086,000 P360,000 1,150,000

Share of NCI in Net income 64,000 (64,000)

Share of Controlling interest 1,086,000

Statement of Changes in

RE

Balance, January 1, 2020 P6,000,000 P1,600,000 -1,600,000 6,000,0000

Profit 1,086,000 360,000 1,086,000

Dividend declared (800,000) (120,000) -120,000

Balance, December 31, 2020 P6,286,000 P1,840,000

Financial Position

Cash P600,000 P200,000 800,000

Accounts receivable 400,000 400,000 -10,000 790,000

Inventories 800,000 600,000 20,000-20,000 1,400,000

Land 1,200,000 1,200,000

Building (net) 800,000 800,000

Equipment (net) 2,456,000 2,000,000 100,000-20,000 4,536,000

Investment in subsidiary 2,430,000 - -

2,080,000200,000+96,000246,000

Goodwill 104,000-10,000 94,000

Total Assets P8,686,000 P3,200,000 9,620,000

Accounts payable P604,000 P360,000 -10,000 954,000

Bonds payable (face amount 196,000 196,000

P200,000)

Ordinary share capital, P100 1,000,000 1,000,000

par

Ordinary share capital, P20 1,000,000 -1,000,000 -

par

Additional paid in capital 600,000 600,000

Retained earnings 6,286,000 1,840,000 6,286,000

NCI 520,000+24,000- 584,000

24,000+64,000

Totals P8,686,000 P3,200,000 9,620,000

Eliminating entries:

Ordinary Share capital, P20 par 1,000,000

Retained earnings – S company 1,600,000

Investment in subsidiary 2,080,000

Noncontrolling interest 520,000

Equipment 100,000

Inventory 20,000

Goodwill 104,000

Investment in subsidiary 200,000

Noncontrolling interest 24,000

Depreciation 20,000

Accumulated Depreciation 20,000

Cost of sales 20,000

Inventory 20,000

Impairment loss 10,000

Goodwill 10,000

AP-S Company 10,000

AR-P Company 10,000

Intercompany accounts

Investment in Subsidiary 94,000

NCI 24,000

RE/Dividend paid 120,000

Share of NCI in Net income 64,000

NCI 64,000

Investment income 246,000

Investment in Subsidiary 246,000

You might also like

- Business Com ActivityDocument2 pagesBusiness Com ActivityAlyssa AnnNo ratings yet

- Christian Colleges of Southeast Asia Advanced Accounting 2 Danny Boy D Monloy, Cpa Final ExamDocument13 pagesChristian Colleges of Southeast Asia Advanced Accounting 2 Danny Boy D Monloy, Cpa Final Examgeraldine martinezNo ratings yet

- PREA4Document7 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Len Company acquires 80% of Lyn Company stock and consolidates financialsDocument14 pagesLen Company acquires 80% of Lyn Company stock and consolidates financialsMerliza JusayanNo ratings yet

- Bus ComDocument14 pagesBus ComSITTIE AINNAH SHIREEHN DIDAAGUNNo ratings yet

- Module 3Document17 pagesModule 3Alpha RamoranNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Intersale AnswerDocument2 pagesIntersale AnswerJJ JaumNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainNo ratings yet

- Abuscom Journal EntriesDocument27 pagesAbuscom Journal EntriesMac b IBANEZNo ratings yet

- Consolidated Financial Position StatementDocument10 pagesConsolidated Financial Position StatementLhyn Cantal CalicaNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- ACC401-Goodwill and Conso SOCIEDocument3 pagesACC401-Goodwill and Conso SOCIEOhene Asare PogastyNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- Consolidated FS ExerciseDocument6 pagesConsolidated FS ExerciseJealyn Noblesa LlagasNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Additional Cash Flow Problems QuestionsDocument3 pagesAdditional Cash Flow Problems QuestionsChelle HullezaNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Module 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Module 3 - Subsequent To AcquisitionDocument8 pagesModule 3 - Subsequent To AcquisitionRENZ ALFRED ASTRERONo ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet

- Joint VentureDocument24 pagesJoint VentureRoma Dela CruzNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- AA-4101-Midterm-with-answersDocument9 pagesAA-4101-Midterm-with-answersAlyssa AnnNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Owl Co. and Owlet Co. - NCI in Net AssetsDocument11 pagesOwl Co. and Owlet Co. - NCI in Net AssetsKristine Esplana ToraldeNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Chapter Four Problem P4-8 Part B Adjusted Without VoiceDocument13 pagesChapter Four Problem P4-8 Part B Adjusted Without Voicehassan nassereddineNo ratings yet

- Module 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument10 pagesModule 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionApril Ross TalipNo ratings yet

- Foreign Subsidiary Balance Sheet AnalysisDocument31 pagesForeign Subsidiary Balance Sheet AnalysisMitch MinglanaNo ratings yet

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- 3. BT IAS1 (SV)Document3 pages3. BT IAS1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- Cash Flow Statement for Passaic CompanyDocument7 pagesCash Flow Statement for Passaic CompanyShane TabunggaoNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Final Quiz 1 Set A With AnswerDocument9 pagesFinal Quiz 1 Set A With Answer11mahogany.hazelnicoletiticNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- Module 9 and 10Document9 pagesModule 9 and 10French Jame RianoNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Merger and AcquisitionDocument2 pagesMerger and AcquisitionAngel Chane OstrazNo ratings yet

- Financial MarketDocument1 pageFinancial MarketAngel Chane OstrazNo ratings yet

- Financial Markets 2Document1 pageFinancial Markets 2Angel Chane OstrazNo ratings yet

- Fpsyg 08 01784Document13 pagesFpsyg 08 01784Angel Chane OstrazNo ratings yet

- Fringe Benefit Tax RulesDocument2 pagesFringe Benefit Tax RulesAngel Chane OstrazNo ratings yet

- Branch ActivityDocument1 pageBranch ActivityAngel Chane OstrazNo ratings yet

- Chapter 3 - Industrial Revolution in The 17th CenturyDocument14 pagesChapter 3 - Industrial Revolution in The 17th CenturyAngel Chane OstrazNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsAngel Chane OstrazNo ratings yet

- TaxationDocument5 pagesTaxationAngel Chane OstrazNo ratings yet

- Audit of CashDocument3 pagesAudit of CashAngel Chane OstrazNo ratings yet

- ConnectedDocument2 pagesConnectedAngel Chane OstrazNo ratings yet

- Summary of FWT ThresholdDocument4 pagesSummary of FWT ThresholdAngel Chane OstrazNo ratings yet

- How Much Would a Father Save in Six Months Making P5K Monthly Deposits at 12% InterestDocument7 pagesHow Much Would a Father Save in Six Months Making P5K Monthly Deposits at 12% InterestAngel Chane OstrazNo ratings yet

- Gov Major ExamsDocument12 pagesGov Major ExamsAngel Chane OstrazNo ratings yet

- Other AnnuityDocument29 pagesOther AnnuityAngel Chane OstrazNo ratings yet

- Maceda and Condo ActDocument4 pagesMaceda and Condo ActAngel Chane OstrazNo ratings yet

- Biodiversity and Society's HealthDocument10 pagesBiodiversity and Society's Healthvhon daryl78% (9)

- 1.98m X 3.281 6.49638 or 6'5" (6 Feet and 5 Inches)Document1 page1.98m X 3.281 6.49638 or 6'5" (6 Feet and 5 Inches)Angel Chane OstrazNo ratings yet

- Basic Accounting ConceptsDocument58 pagesBasic Accounting ConceptsAngel Chane Ostraz100% (1)

- 3 Major Types of Business: Service Enterprise Merchandising Enterprise Manufacturing EnterpriseDocument51 pages3 Major Types of Business: Service Enterprise Merchandising Enterprise Manufacturing EnterpriseAngel Chane OstrazNo ratings yet

- Be It Enacted by The Senate and Hose of Representatives of The Philippines in Congress AssembledDocument22 pagesBe It Enacted by The Senate and Hose of Representatives of The Philippines in Congress AssembledColleen Rose GuanteroNo ratings yet

- Maka-Diyos-Cluster For Upload - PDF Version 1Document16 pagesMaka-Diyos-Cluster For Upload - PDF Version 1Angel Chane OstrazNo ratings yet

- Understanding The Self - East and WestDocument5 pagesUnderstanding The Self - East and WestAngel Chane OstrazNo ratings yet

- The Good LifeDocument19 pagesThe Good LifeAngel Chane OstrazNo ratings yet

- 17 INDISPUTABLE LAWS OF TEAMWORK - PDF Version 1Document40 pages17 INDISPUTABLE LAWS OF TEAMWORK - PDF Version 1Angel Chane Ostraz100% (1)

- OMMRC Presentation HELMETSDocument28 pagesOMMRC Presentation HELMETSAngel Chane OstrazNo ratings yet

- P.E.2 Rhythmic Activities Definition of Terms:: Physical Reaction To Rhythm or MusicDocument5 pagesP.E.2 Rhythmic Activities Definition of Terms:: Physical Reaction To Rhythm or MusicAngel Chane OstrazNo ratings yet

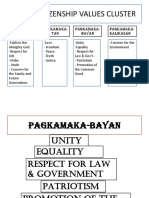

- Good Citizenship Values Cluster - PDF Version 1Document14 pagesGood Citizenship Values Cluster - PDF Version 1Angel Chane OstrazNo ratings yet

- Ethics in a NutshellDocument32 pagesEthics in a NutshellAngel Chane OstrazNo ratings yet

- KASUS 1 - TranslasiDocument3 pagesKASUS 1 - TranslasiainopeNo ratings yet

- Guide To Self Directed Investing - Equity Trust CompanyDocument24 pagesGuide To Self Directed Investing - Equity Trust CompanyEquityTrustNo ratings yet

- Bai Tap Chuong 7Document19 pagesBai Tap Chuong 7Nguyen Quang PhuongNo ratings yet

- Investment Flashing Red LightDocument4 pagesInvestment Flashing Red LightOjas GuptaNo ratings yet

- MBA Project TopicsDocument14 pagesMBA Project Topicspunith02No ratings yet

- GDP Chapter 15 GuideDocument8 pagesGDP Chapter 15 GuideTienNo ratings yet

- Understanding the P/E RatioDocument8 pagesUnderstanding the P/E RatioVaidyanathan RavichandranNo ratings yet

- BHM EntrepreneurshipDocument106 pagesBHM EntrepreneurshipSabinaNo ratings yet

- Foreign Currency TranslationDocument3 pagesForeign Currency TranslationMarietzaNo ratings yet

- Business plan as a management toolDocument6 pagesBusiness plan as a management toolAda KuprowskaNo ratings yet

- Applied Optoelectronics (AAOI) - LONG RecommendationDocument3 pagesApplied Optoelectronics (AAOI) - LONG RecommendationJulia LaskowskaNo ratings yet

- SEC v. Goldman Sachs & Co - Summary of ComplaintDocument2 pagesSEC v. Goldman Sachs & Co - Summary of ComplaintGeorge ConkNo ratings yet

- IFT Course Overview and Key ConceptsDocument34 pagesIFT Course Overview and Key ConceptsAnkita AroraNo ratings yet

- Charles Schwab and Co, Inc Investor Risk Profile-2Document4 pagesCharles Schwab and Co, Inc Investor Risk Profile-2MinhNo ratings yet

- Flowers Industries, Inc. (Abridged) : October 2008Document24 pagesFlowers Industries, Inc. (Abridged) : October 2008MJ SapiterNo ratings yet

- 3 Methods Calculate Firm Goodwill Under 40 CharactersDocument4 pages3 Methods Calculate Firm Goodwill Under 40 CharactersJosé Edson Jr.No ratings yet

- Financial Markets and Institutions 6Th Edition: Powerpoint Slides ForDocument33 pagesFinancial Markets and Institutions 6Th Edition: Powerpoint Slides ForPratik PatelNo ratings yet

- MGMT 41150 - Chapter 2 - Mechanics of Futures MarketsDocument20 pagesMGMT 41150 - Chapter 2 - Mechanics of Futures MarketsLaxus DreyerNo ratings yet

- Alternative InvestmentsDocument12 pagesAlternative InvestmentsYogesh AgarwalNo ratings yet

- Determinants of The Cost of International Projects & Their Management by Rajat JhinganDocument8 pagesDeterminants of The Cost of International Projects & Their Management by Rajat Jhinganrajat_marsNo ratings yet

- Securities Regulation Code (RA 8799)Document2 pagesSecurities Regulation Code (RA 8799)Sheila Mae BenedictoNo ratings yet

- 33,200 and Pays A Yearly of 13.7% If Purchased at 36,700Document4 pages33,200 and Pays A Yearly of 13.7% If Purchased at 36,700Darrell Ranoco100% (1)

- Financial Planning and Forecasting Sales & Income StatementsDocument56 pagesFinancial Planning and Forecasting Sales & Income Statementsayman mansourNo ratings yet

- Accountancy & Financial ManagementDocument12 pagesAccountancy & Financial ManagementNitin FardeNo ratings yet

- Master the Game with 7 Steps to Financial FreedomDocument40 pagesMaster the Game with 7 Steps to Financial FreedomEric Silva89% (18)

- AC78.6.2 Final Examinations Questions and Answers 1Document15 pagesAC78.6.2 Final Examinations Questions and Answers 1rheaNo ratings yet

- Ijsms: Camels Rating Model For Evaluating Financial Performance of Banking Sector: A Theoretical PerspectiveDocument6 pagesIjsms: Camels Rating Model For Evaluating Financial Performance of Banking Sector: A Theoretical PerspectiverajNo ratings yet

- FM QPDocument4 pagesFM QPtimepass3595No ratings yet

- Enron Case StudyDocument6 pagesEnron Case Studyali goharNo ratings yet

- Activity 4Document13 pagesActivity 4Lala FordNo ratings yet