Professional Documents

Culture Documents

Financial Markets 2

Uploaded by

Angel Chane OstrazCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets 2

Uploaded by

Angel Chane OstrazCopyright:

Available Formats

LELA Co.

has been assigned the task of determining the cost of capital for her division of the firm. Her

first step is to determine the cost of debt. The firm has P1,000 par value bonds outstanding that have an

annual coupon rate of 10.00% and makes semiannual payments. These bonds have twenty-three years

remaining to maturity and currently sell for P1,153. What is the yield-to-maturity on these bonds?

EILA Inc. has a target capital structure of 30% debt, 15% preferred stock, and 55% common equity. The

company's after-tax cost of debt is 7%, its cost of preferred stock is 11%, its cost of retained earnings is

15%, and its cost of new common stock is 16%. The company stock has a beta of 1.5 and the company's

marginal tax rate is 35%. What is the company's weighted average cost of capital if retained earnings are

used to fund the common equity portion?

LEN is considering buying a share of stock in a firm that has the following two possible payoffs with the

corresponding probability of occurring. The stock has a purchase price of P100.00. You forecast that there

is a 40% chance that the stock will sell for P140.00 at the end of one year. The alternative expectation is

that there is a 60% chance that the stock will sell for P60.00 at the end of one year. What is the standard

deviation of returns on this stock?

Your firm intends to issue new common stock. Your investment bankers have determined that the stock

should be offered at a price of P60.00 per share and that you should anticipate paying a dividend of P1.70

in one year. If you anticipate a constant growth in dividends of 4.50% per year and the investment banking

firm will take 8.00% per share as flotation costs, what is the required rate of return for this issue of new

common stock?

You might also like

- Income Taxation ExercisesDocument2 pagesIncome Taxation ExercisesAngel Chane OstrazNo ratings yet

- Merger and AcquisitionDocument2 pagesMerger and AcquisitionAngel Chane OstrazNo ratings yet

- TaxationDocument5 pagesTaxationAngel Chane OstrazNo ratings yet

- Audit of CashDocument3 pagesAudit of CashAngel Chane OstrazNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsAngel Chane OstrazNo ratings yet

- Summary of FWT ThresholdDocument4 pagesSummary of FWT ThresholdAngel Chane OstrazNo ratings yet

- Maceda and Condo ActDocument4 pagesMaceda and Condo ActAngel Chane OstrazNo ratings yet

- AnnuityDocument7 pagesAnnuityAngel Chane OstrazNo ratings yet

- Chapter 3 - Industrial Revolution in The 17th CenturyDocument14 pagesChapter 3 - Industrial Revolution in The 17th CenturyAngel Chane OstrazNo ratings yet

- Gov Major ExamsDocument12 pagesGov Major ExamsAngel Chane OstrazNo ratings yet

- Basic Accounting ConceptsDocument58 pagesBasic Accounting ConceptsAngel Chane Ostraz100% (1)

- Strategic Business Analysis IIDocument46 pagesStrategic Business Analysis IIAngel Chane OstrazNo ratings yet

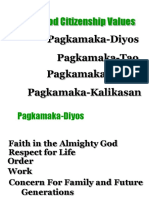

- Maka-Diyos-Cluster For Upload - PDF Version 1Document16 pagesMaka-Diyos-Cluster For Upload - PDF Version 1Angel Chane OstrazNo ratings yet

- 3 Major Types of Business: Service Enterprise Merchandising Enterprise Manufacturing EnterpriseDocument51 pages3 Major Types of Business: Service Enterprise Merchandising Enterprise Manufacturing EnterpriseAngel Chane OstrazNo ratings yet

- P.E.2 Rhythmic Activities Definition of Terms:: Physical Reaction To Rhythm or MusicDocument5 pagesP.E.2 Rhythmic Activities Definition of Terms:: Physical Reaction To Rhythm or MusicAngel Chane OstrazNo ratings yet

- The Good LifeDocument19 pagesThe Good LifeAngel Chane OstrazNo ratings yet

- 17 INDISPUTABLE LAWS OF TEAMWORK - PDF Version 1Document40 pages17 INDISPUTABLE LAWS OF TEAMWORK - PDF Version 1Angel Chane Ostraz100% (1)

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAngel Chane OstrazNo ratings yet

- Barriers To Effective CommunicationDocument13 pagesBarriers To Effective CommunicationAngel Chane OstrazNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)