Professional Documents

Culture Documents

Investment Flashing Red Light

Uploaded by

Ojas GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Flashing Red Light

Uploaded by

Ojas GuptaCopyright:

Available Formats

Ojas Gupta

BUSI 710: Financial Reporting and Analysis

Professor: Thomas Nickles

Case study: 2

Loren Rathbone’s Real estate investment

Loren Rathbone is a 68-year-old farmer from Moose Jaw, Saskatchewan. He bought his family

farm land by stretching his finances as much as he could, he experimented and diversified his

farmland and as going ahead he was settling for retirement. During these days he understood

that inherited family business combined with risky financial could be devastating so hedging the

total risk and opting for conservative financial approach is the best option. In 2002, he sold his

farm land for CA$900,000 and brought his net worth to $2.7 million. Instead of keeping this

money in a low- interest bank account he wanted to diversify and invested in the Canadian

Equity market. Although Rathbone is form a conservative family, his trust in the investment

representative led him to make this investment decision, but the equity market didn’t do well. He

realised that he was fine with the volatility but the short- term losses rattled him, and he took out

the money form this investment bring his portfolio back to the square one. In this case of

investing in the stock market it was guided by a good investment company, and they had certain

fiduciary responsibilities against Mr. Rathbone, along with this they did told him to be patient

and to hold on for a long time period as it’s a long term investment. But as we know the

conservative behaviour of Mr, Rathbone he took out his money as soon as he lost ¼ of his

investment. Mr. Rathbone, after losing 1/4th of his investment in the equity market, wants

something less volatile, he is looking for an investment with the least amount of risk along with

the trust of setting him up for his retirement This event, along with the prior events paints a

canvas of Mr. Rathbone’s risk tolerance ability. In addition, even at a young age to protect his

assets and avoid any significant loss and practicing the investment Mr. Rathbone admittedly

knows best, farming, Mr. Rathbone took a conservative approach.

Moving ahead looking at the second opportunity he got sounds lucrative as it was of low risk

and decent returns. The investment opportunity given by the Canadian Conference of

Mennonite Brethren Churches was highly stable and a low volatility investment. This was a great

opportunity for Mr. Rathbone and I think the 4% return on investment was also decent, this

direction of investment was within his risk tolerance level. But was this investment enough to

fulfil his retirement heeds, I don’t think so, yes he had a stable return but as humans we always

want a bit more for ourselves. In order to find new investment opportunities and diversify his

investment to build his portfolio in 2007 his son introduced him to Ms. Denise Dirks. This

investment proposal brought allot of red flags in Mr. Rathbone’s minds, and I would be

addressing these red lights further in the letter.

Investment flashing Red light

Now that we have begun understanding Mr. Rathbone’s investment history and risk tolerance,

we will better be able to recognize both the glaringly obvious and more hidden aspects of the

2008 real estate investment decision that is giving him pause. The pause that flickered red light in

his brain. The first red light is the behaviour of Ms Dirks, her responses towards Mr Rathbone

concerns reflects her general nature that raises doubts in terms of trusting her. While she may be

enthusiastic and convincing, she is unlicensed, ill-prepared, and ill-informed in offering sound

investment advice. Moreover, she is not an investment advisor to Mr Rathbone, she is a

commission based sales representative for companies, so she holds no fiduciary responsibilities

towards benefiting her client (Mr. Rathbone).

The second red light was the Exhibit 3: Baseline Capital’s Risk Acknowledgement form. The

form states that “no securities commission has evaluated or endorsed the merits of these

securities or the disclosure in the offering memorandum”. This means that he might land up in a

situation where he loses all his invested money and won’t be able to sell the securities. Along

with this, besides not being able to sell his securities his portion of the retirement saving will be

tied up and illiquid.

Moving ahead the investment opportunities in baseline capital corporation and the Yield group

with 11% and 18% coupon rate on the bonds issued seems too good to be true. This can be

termed as the third red light. Investing is bonds according to allot of investors is safe but comes

with its own risk factors included. Though this current investment opportunity, with the 11%

coupon rate looks lucrative, the Canadian real estate market at that time was suspected to be

widely over inflated. In most of the real estate investment with such sort of coupon rate, takes

around 5 to 6 years to be developed. Furthermore, the long duration of the development process

is directly proportional to returns, along with the inflated market comes the risk of change in the

interest rate if the bubble burst, leading the company into default state. According to investors

higher coupon rate comes with higher risk factors and the second investment, with the Yield

group, with 18% coupon rate seems allot riskier. Mr. Rathbone was looking at an investment that

has lower risk and volatility and this investment raises a huge red light. Even if he invests his

money and analysis that the market’s going down and tries to pull out the money from the

investment, it might come with certain terms and conditions that might not be in his favour.

Before making any assumptions about the market and company let’s look into the factors that

Mr. Rathbone should analyse and look for before investing.

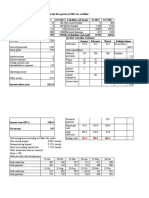

Things to see before investing: Recommendations and Analysis

According to the events mentioned above, looking at Mr Rathbones conservative nature and Ms.

Dirks, unprofessional behaviour the first though that comes that the money should be invested

in any of the two companies. But nothing can be said exactly without analysing eth opportunity

in depth. Moving ahead I would recommend a few things to analyse that might stop the red light.

Firstly, it is really important to know the background of the company, since when it started, what

all projects has the company completed, what is the yield return. Along with this determioning

the property valuation is important for financing, investment analysis, insurance and taxation.

Also, the organisations expected cash flow, i.e. the money left after expenses, current ratio and

operating expenses to profit ratio of Baseline Capital to make a better investment decision.

Gathering this information by studying their financial statement and the 3 years return, would

help Mr. Rathbone formulate a base outline about the company. As said the advisor Ms. Dirks

that the company had a 3 years of interest payment history and has not missed any payment,

from these two things can be incurred. One that the Baseline capital group is not that old of a

developer company and is new to the market. Second, with the 11% coupon rate, keeping in

mind the 6% rate in eth market, it seems that the company is in a desperate need of money and

this desperation can be risky if they are not able to complete their project and give the returns as

said. Analysing the companies would also clear any bias that would be created by the sales

representatives and would also provide the clarity required to move forward.

However, in 2008 the Edmonton, Alberta, was a financial hub, with influx of people moving in

attracting wealthy people with the evolving oil and gas industry, this offer seems profitable. One

can incur that people who were shifting in the Edmonton city could afford these prices but the

over inflation puts a huge risk the financials. Also, at that time the market rate was 6% and in

terms of the investment opportunities 11% coupon rate by Baseline Capital looks less riskier and

believable than the 18% given by Yield Group. Also, because of the predicted inflation in the

market, and knowing that inflation erodes the real value of bond’s face value, which can affect

the long term maturity debts. Looking into this linkage, the bond prices are very sensitive to

change with the inflation and forecasted inflation. In my recommendation Mr. Rathbone could

invest some amount in base line group but should not consider the Yield group. As Yield groups

18% return rate would be a longer term investment as compared to the 11% by Baseline capital.

But Ms Dirks offering of 11% and then of 18% creates a suspicious scenario and reflects the risk

involved.

Secondly, looking on these analysis, Mr. can formulate a SWOT data sheet that would help him

analysing the Strength, weakness, threat and the opportunities in all. Looking into this there is

another weakness that I could analyse, Mr. Rathbones age, as he is already 68 and looking for a

stable investment, with low risk factors, and he does not have enough time or income as before

to convert his losses into profitable investments. Also, as mentioned in the letter above, the risk

acknowledgment letter shows that the company would not be held responsible for any losses

incurred by the investor reflects its culture and ethics. To sum up, this current investment

proposal highlights more alarming red lights of threats than green light of strengths and

opportunities for Mr, Rathbone. Moving ahead according to the analysing and forecasting I have

some solutions that Mr. Rathbone can look into for his risk free investment.

Solution and Path Forward

In this situation as the investment opportunity was brought in by the family member, there

should be some boundaries set from the start. Along with this, he should be given the

information he requires to make a trustworthy investment. In these circumstances the family and

investor disputes are likely to happen if thing go south so saying No should be considered

insensitive from both the sides. As a result of this Mr. Rathbone should trust his instincts and

should not be swayed away by the family and friends. Moving ahead with the suggestions that I

would propose to Mr Rathbone.

Analysing the SWOT, Edmonton’s real estate market condition and Ms Dirks behaviour toward

the investor and the conservative nature of Mr Rathbone, I would suggest him to not invest in

the Baseline Capital group and nor in the Yield group. Though the 11% return looks appealing

but it includes allot of risk that Mr. Rathbone at the age of 68 should not be a part of.

If Mr Rathbone still wants to invest the safest option with low risk and decent amount of returns

would be the US treasury bonds. As they give security and returns as said and keeps the investor

in a safe place.

Another think that Mr. Rathbone can look into after analysing the companies is to diversify his

investment, Such as 50% in US treasury bonds of funds, 15% in the Canadian conference of

Mennonite brethren churches and 15 % in the Baseline capital. This can be done to keep

maximum of his investment at a safe place with low risk with only 15% in the high risk zone. But

in order to invest in the baseline Capital group I would recommend him to change his advisor

and connect with someone that shows fiduciary responsibilities towards Mr. Rathbone.

References

Lane, B. (2016). ” Loren Rathborne’s Investment: Red Flashing Light”. IVEY Publishing.

NIELSEN, B. (2021, June 17). Understanding Interest Rates, Inflation, and Bonds. Retrieved July 24,

2021

You might also like

- A Study On Customer Satisfaction Towards AmazonDocument91 pagesA Study On Customer Satisfaction Towards Amazonpuja poddar82% (50)

- Friedrich Ulrich Maximilian Johann Count of LuxburgDocument4 pagesFriedrich Ulrich Maximilian Johann Count of LuxburgjohnpoluxNo ratings yet

- Nag Et Al (2007) What Is Strategic Management ReallyDocument21 pagesNag Et Al (2007) What Is Strategic Management ReallyLuis Angel Mns100% (1)

- Case Study 1 - Strategic HR Integration at The Walt Disney CompanyDocument2 pagesCase Study 1 - Strategic HR Integration at The Walt Disney CompanyTrần Thanh HuyềnNo ratings yet

- Managerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreDocument35 pagesManagerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreRAHUL SINGHNo ratings yet

- Charles Case StudyDocument4 pagesCharles Case StudyTracy KiarieNo ratings yet

- Fina2209 Week 4 Tutorial Questions - Solns PDFDocument6 pagesFina2209 Week 4 Tutorial Questions - Solns PDFjunzhe tangNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Investment Flashing Red LightDocument4 pagesInvestment Flashing Red LightOjas GuptaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- PLCR TutorialDocument2 pagesPLCR TutorialSyed Muhammad Ali SadiqNo ratings yet

- Jwi 530 Assignment 4Document3 pagesJwi 530 Assignment 4gadisika0% (1)

- INTERNAL SECURITY IN INDIA (Changing Scenario & Needed Reforms)Document58 pagesINTERNAL SECURITY IN INDIA (Changing Scenario & Needed Reforms)Om Prakash Yadav100% (1)

- DR StrangeloveDocument5 pagesDR StrangeloveKaterina BelesovaNo ratings yet

- Analysis of ICICI BankDocument61 pagesAnalysis of ICICI BankManjunath ShettyNo ratings yet

- Karan Project PDF 2 Word 2Document11 pagesKaran Project PDF 2 Word 2Nikhil Shukla100% (1)

- Lecture 02 - The Time Value of MoneyDocument41 pagesLecture 02 - The Time Value of Moneyanujgoyal31No ratings yet

- Regulating Act of 1773Document4 pagesRegulating Act of 1773BhoomiNo ratings yet

- Empowerment of Women: MethodsDocument3 pagesEmpowerment of Women: MethodsmonicaNo ratings yet

- STRATEGY VALUE CREATION AND MANAGEMENT AT DISCOVERYDocument2 pagesSTRATEGY VALUE CREATION AND MANAGEMENT AT DISCOVERYNehaTaneja0% (1)

- Social Media Marketing and Business Performance of MSMEs During The COVID-19 PandemicDocument9 pagesSocial Media Marketing and Business Performance of MSMEs During The COVID-19 PandemicshaumiNo ratings yet

- Catastrophic Success: A Case Study of The Times of IndiaDocument17 pagesCatastrophic Success: A Case Study of The Times of IndiaSukumar MuralidharanNo ratings yet

- Case StudyDocument7 pagesCase StudyMary ClaireNo ratings yet

- A Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.vijiDocument6 pagesA Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.vijiInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Financial Analysis TATA STEElDocument18 pagesFinancial Analysis TATA STEElneha mundraNo ratings yet

- British Economic Policy in India and the Drain of Wealth TheoryDocument26 pagesBritish Economic Policy in India and the Drain of Wealth TheoryAbhishek VermaNo ratings yet

- Colonialism and The Indian EconomyDocument15 pagesColonialism and The Indian Economyjasmine woodNo ratings yet

- Dimensions of Indian Culture, Core Cultural Values and Marketing ImplicationsDocument2 pagesDimensions of Indian Culture, Core Cultural Values and Marketing ImplicationsAninda DuttaNo ratings yet

- Impact of Tata-Corus Merger on Shareholder WealthDocument82 pagesImpact of Tata-Corus Merger on Shareholder WealthDevNo ratings yet

- Mechanize Hand Winding of Yarn for Traditional WeavingDocument10 pagesMechanize Hand Winding of Yarn for Traditional WeavingRupangi VatsNo ratings yet

- Growth of Entrepreneurship in IndiaDocument6 pagesGrowth of Entrepreneurship in IndiaammuajayNo ratings yet

- Group 2 BRM ProjectDocument20 pagesGroup 2 BRM ProjectAbhi_The_RockstarNo ratings yet

- BhishmaDocument6 pagesBhishmaHarsh SoniNo ratings yet

- Case StudyDocument10 pagesCase StudyArpit KulshreshthaNo ratings yet

- Robin Hood - Case StudyDocument3 pagesRobin Hood - Case StudyvsmittalNo ratings yet

- Product Mix DaburDocument29 pagesProduct Mix DaburgetgauravsbestNo ratings yet

- HUL's Business Strategies and Marketing AnalysisDocument50 pagesHUL's Business Strategies and Marketing AnalysisMohammed Aadil100% (1)

- National Publishing CaseDocument10 pagesNational Publishing CaseJay ZatakiaNo ratings yet

- Jumbo King: India's Fastest Growing Vada Pav ChainDocument9 pagesJumbo King: India's Fastest Growing Vada Pav ChainRahul GiddeNo ratings yet

- SEWA Trade Facilitation Centre ReportDocument7 pagesSEWA Trade Facilitation Centre ReportHimanshu PatelNo ratings yet

- Company Insights - HenkelDocument12 pagesCompany Insights - Henkelmohit negiNo ratings yet

- VAT Act 2052Document8 pagesVAT Act 2052Nirmal Shrestha100% (1)

- Lindenlab 160131143912Document9 pagesLindenlab 160131143912Tripti GuptaNo ratings yet

- Liberalisation Privatisation N GlobalisationDocument3 pagesLiberalisation Privatisation N GlobalisationPunya SinglaNo ratings yet

- Canada & India: An International Business ComparisonDocument19 pagesCanada & India: An International Business Comparisonagreen89No ratings yet

- Mutual Fund vs. Hedge FundDocument10 pagesMutual Fund vs. Hedge FundSachin YadavNo ratings yet

- Ethics in Business GuideDocument25 pagesEthics in Business Guidebhatiachetan2075No ratings yet

- Cox Communications XLS372 XLS ENGDocument13 pagesCox Communications XLS372 XLS ENGPriyank BoobNo ratings yet

- Case Study On SBIDocument18 pagesCase Study On SBIRashika SaxenaNo ratings yet

- Understanding Consumer Behavior Through Ethnographic ResearchDocument5 pagesUnderstanding Consumer Behavior Through Ethnographic ResearchMohammad Ali KazanNo ratings yet

- Monetary and Fiscal Policies in IndiaDocument5 pagesMonetary and Fiscal Policies in Indiarakeshgopinath4999No ratings yet

- Research ProjectDocument8 pagesResearch ProjectNivruti TagotraNo ratings yet

- L&T Market Information and StrategiesDocument10 pagesL&T Market Information and StrategiesGuna NethasNo ratings yet

- Large-Scale Investments in Agriculture in India: R. RamakumarDocument12 pagesLarge-Scale Investments in Agriculture in India: R. RamakumarramakumarrNo ratings yet

- Saatchi&SaatchiDocument5 pagesSaatchi&SaatchiAbhinandan SinghNo ratings yet

- Ruralmarketing - Haats and MealsDocument11 pagesRuralmarketing - Haats and MealssauravkumbhNo ratings yet

- Pink - Abstract GD Topic - Group Discussion Ideas PDFDocument5 pagesPink - Abstract GD Topic - Group Discussion Ideas PDFAshutosh SharmaNo ratings yet

- BRM Group Project - Group 3Document11 pagesBRM Group Project - Group 3Yawar Ali KhanNo ratings yet

- Project Report - ESGDocument23 pagesProject Report - ESGdeepakasopaNo ratings yet

- Chapter 4 Behavioural FinanceDocument51 pagesChapter 4 Behavioural FinanceYohana RayNo ratings yet

- Income Inequality in IndiaDocument77 pagesIncome Inequality in IndiaKinjal GalaNo ratings yet

- Women Entrepreneurship in India: Growth, Challenges and SupportDocument26 pagesWomen Entrepreneurship in India: Growth, Challenges and SupportAshik ReddyNo ratings yet

- Economic Project Praveen Patil 1Document38 pagesEconomic Project Praveen Patil 1Rahul AgarwalNo ratings yet

- Strategic Management AssignmentDocument5 pagesStrategic Management AssignmentRahul BaggaNo ratings yet

- Walmart's Departure from India JVDocument2 pagesWalmart's Departure from India JVAbhishek SuranaNo ratings yet

- ITC Ltd. Economic-Industry-Company Analysis ReportDocument14 pagesITC Ltd. Economic-Industry-Company Analysis Reportkirti sabranNo ratings yet

- Harvey v. Facey - Case Brief: Download Free SoftwareDocument1 pageHarvey v. Facey - Case Brief: Download Free SoftwareshaherawafiNo ratings yet

- Distressed Debt Investing: Baupost's Annual Shareholder LettersDocument6 pagesDistressed Debt Investing: Baupost's Annual Shareholder Lettersjt322No ratings yet

- Bruce Greenwald On Value Investing - US News - 11-7-2008Document4 pagesBruce Greenwald On Value Investing - US News - 11-7-2008Luiz SobrinhoNo ratings yet

- What Three Types of Information Provided by Case Study 2 Are Most Important and Influential in Your Conclusions and RecommendationsDocument2 pagesWhat Three Types of Information Provided by Case Study 2 Are Most Important and Influential in Your Conclusions and RecommendationsOjas GuptaNo ratings yet

- Budgets Are The Primary Control Mechanism For Companies To Monitor Their Performance by Analyzing Favourable and Unfavourable VariancesDocument2 pagesBudgets Are The Primary Control Mechanism For Companies To Monitor Their Performance by Analyzing Favourable and Unfavourable VariancesOjas GuptaNo ratings yet

- Case Study 4Document8 pagesCase Study 4Ojas GuptaNo ratings yet

- American Apparel. Drowning in Debt?Document7 pagesAmerican Apparel. Drowning in Debt?Ojas GuptaNo ratings yet

- American Apparel. Drowning in Debt?Document7 pagesAmerican Apparel. Drowning in Debt?Ojas GuptaNo ratings yet

- Finance Through DebtDocument1 pageFinance Through DebtOjas GuptaNo ratings yet

- American Apparel. Drowning in Debt?Document7 pagesAmerican Apparel. Drowning in Debt?Ojas GuptaNo ratings yet

- Case Study 4Document8 pagesCase Study 4Ojas GuptaNo ratings yet

- Problem Set 2.1Document1 pageProblem Set 2.1Ojas GuptaNo ratings yet

- Financing Through Debt and FPDocument1 pageFinancing Through Debt and FPOjas GuptaNo ratings yet

- Anan University case study examines IT infrastructure relationshipsDocument3 pagesAnan University case study examines IT infrastructure relationshipsSam PatriceNo ratings yet

- Statistic For ManagementDocument20 pagesStatistic For ManagementHương GiangNo ratings yet

- 14 Sustainable TourismDocument17 pages14 Sustainable TourismIwan Firman WidiyantoNo ratings yet

- Syllabus B7345-001 Entrepreneurial FinanceDocument7 pagesSyllabus B7345-001 Entrepreneurial FinanceTrang TranNo ratings yet

- MO QuestionDocument2 pagesMO Questionlingly justNo ratings yet

- Acctg180 W02 Problems Accounting CycleDocument9 pagesAcctg180 W02 Problems Accounting CycleAniNo ratings yet

- Prevention Appraisal Internal Failure External Failure: Iona CompanyDocument5 pagesPrevention Appraisal Internal Failure External Failure: Iona CompanyFrans KristianNo ratings yet

- Chapter 11 Snell ManagingHumanResources 19e PPT CH11Document43 pagesChapter 11 Snell ManagingHumanResources 19e PPT CH11J Manuel BuenoNo ratings yet

- Jasper Gifford Economics DraftDocument10 pagesJasper Gifford Economics DraftHiNo ratings yet

- Experiemental Marketing Notes by Ankit and AshneeDocument3 pagesExperiemental Marketing Notes by Ankit and AshneeDeepakshi GargNo ratings yet

- Audit 2023Document18 pagesAudit 2023queenmutheu01No ratings yet

- Pei201509 DLDocument46 pagesPei201509 DLanjangandak2932No ratings yet

- International Trade 3rd Edition Feenstra Test BankDocument47 pagesInternational Trade 3rd Edition Feenstra Test BankMichaelRothpdytk100% (16)

- JBIMS M.SC - Finance Placement Report 2019 20Document10 pagesJBIMS M.SC - Finance Placement Report 2019 205vipinappuNo ratings yet

- Barangay Annual Gender and Development (Gad) Plan and Budget FY 2021Document8 pagesBarangay Annual Gender and Development (Gad) Plan and Budget FY 2021HELEN CASIANONo ratings yet

- F6zwe 2016 Jun Q PDFDocument11 pagesF6zwe 2016 Jun Q PDFGamuchirai KarisinjeNo ratings yet

- Profile of The Aerospace Industry in Greater MontrealDocument48 pagesProfile of The Aerospace Industry in Greater Montrealvigneshkumar rajanNo ratings yet

- Tracxn Startup Research Global SaaS India Landscape May 2016 1Document125 pagesTracxn Startup Research Global SaaS India Landscape May 2016 1Shikha GuptaNo ratings yet

- Presentation On Internship Program Done at The Enq: Subhankar BhattacharjeeDocument28 pagesPresentation On Internship Program Done at The Enq: Subhankar BhattacharjeeSubhankar BhattacharjeeNo ratings yet

- Unit III - Application of Theory of ProductionDocument16 pagesUnit III - Application of Theory of ProductionPushpavalli MohanNo ratings yet

- Module 6 - Project Closure and TerminationDocument29 pagesModule 6 - Project Closure and TerminationAnthonyNo ratings yet

- Responsibility accounting problems and solutionsDocument5 pagesResponsibility accounting problems and solutionsAsnarizah PakinsonNo ratings yet

- Bangladesh Steel Industry - December 2019 PDFDocument19 pagesBangladesh Steel Industry - December 2019 PDFMahmudul Hasan SajibNo ratings yet

- CLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1Document7 pagesCLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1kdcngan162No ratings yet