Professional Documents

Culture Documents

2

Uploaded by

Jam Mua Macalanggan0 ratings0% found this document useful (0 votes)

7 views1 pagePhil Crim Law

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPhil Crim Law

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 page2

Uploaded by

Jam Mua MacalangganPhil Crim Law

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

7/17/2021 G.R. No. L-10666 September 24, 1958 - LIM HOA TING v.

TING v. CENTRAL BANK OF THE PHILIPPINES<br /><br />104 Phil 573 : Septembe…

has in the past been consistently classified and considered as a

flavor and flavoring extract, not only by the Import Control

Commission but also by its successor, the defendant Bank itself, to

say nothing of the fact that the law itself seems to have favored

this interpretation, this, in addition to the same opinion rendered

by the Director of Science and Technology, the importation of said

substance is exempt from the exchange tax. Refund of the

exchange taxes previously paid by importers of mono-sodium

glutamate is in order since Section 2, Republic Act No. 601,

authorizes refund of exchange taxes on commodities and

substances listed and classified as flavors.

2. ID.; ID.; POWER OF CENTRAL BANK TO RECLASSIFY

COMMODITIES SO AS TO IMPOSE TAX. — If the Government

desires to make a reclassification so as to impose the exchange tax

on the importation of this substances for revenue purposes, the

Legislature can easily do so in the form of an amendment to the

law. The subsequent interpretation given by the defendant Bank

not to consider mono-sodium glutamate as a flavor or flavoring

extract, is rather arbitrary, if not beyond the scope of its powers

and authority.

3. STATUTES; PUBLICATION IN THE OFFICIAL GAZETTE;

ESSENTIAL REQUISITE FOR EFFECTIVELY OF STATUTES. — Both

Section 11 of the Revised Administrative Code and Article 2 of the

new Civil Code provide that the laws shall take effect after fifteen

days following the completion of their publication in the Official

Gazette, unless it is otherwise provided. While a circular of the

Central Bank is not a statute or law, however, where it is issued for

the implementation of the law authorizing its issuance, it has the

force and effect of law. (See U. S. v. Tupasi Molina, 20 Phil. 119

and authorities cited therein.) Moreover, as a rule, circulars and

regulations, like the one at bar, which prescribes a penalty for its

violation should be published before becoming effective, this, on

the general principle and theory that before the public is bound by

its contents, especially its penal provisions, a law, regulation or

circular must first be published and the people officially and

specifically informed of said contents and its penalties. (People v.

Que Po Lay, 50 Off. Gaz. [10] 4850; 94 Phil., 640.) In the present

case, since Resolution No. 756 of the Monetary Board under which

mono-sodium glutamate was no longer considered a flavor and so

not exempted from the exchange tax, was not published in the

Official Gazette, it could not bind the plaintiff importer.

4. ID.; STATUTORY CONSTRUCTION; CONTEMPORANEOUS

CONSTRUCTION; WEIGHT OF. — The contemporaneous

https://www.chanrobles.com/cralaw/1958septemberdecisions.php?id=299 2/17

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Please Accept ThisDocument1 pagePlease Accept ThisJam Mua MacalangganNo ratings yet

- Montelibano vs. Severino (Civil Case No. 902 of The Court of First Instance of Occidental Negros and Which Forms ADocument1 pageMontelibano vs. Severino (Civil Case No. 902 of The Court of First Instance of Occidental Negros and Which Forms AJam Mua MacalangganNo ratings yet

- Supreme Court: Gaston V. Taquio For Petitioner. Marcos S. Pagaspas For Private RespondentDocument1 pageSupreme Court: Gaston V. Taquio For Petitioner. Marcos S. Pagaspas For Private RespondentJam Mua MacalangganNo ratings yet

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDocument1 pagePhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceJam Mua MacalangganNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument1 pageConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveJam Mua MacalangganNo ratings yet

- Handicraft v. National Labor Relations Commission, Et AlDocument1 pageHandicraft v. National Labor Relations Commission, Et AlJam Mua MacalangganNo ratings yet

- Araullo, C. J., Johnson, Street, Avanceña, Villamor, Ostrand, Johns, and Romualdez, JJ., ConcurDocument1 pageAraullo, C. J., Johnson, Street, Avanceña, Villamor, Ostrand, Johns, and Romualdez, JJ., ConcurJam Mua MacalangganNo ratings yet

- Philippine Supreme Court JurisprudenceDocument1 pagePhilippine Supreme Court JurisprudenceJam Mua MacalangganNo ratings yet

- Supreme CourtDocument1 pageSupreme CourtJam Mua MacalangganNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FBI Anti-Recruitment FlyerDocument2 pagesFBI Anti-Recruitment FlyerAnonymous iDI36msvkHNo ratings yet

- 2hours Training ModuleDocument24 pages2hours Training ModuleMacky Paul Masong AmoresNo ratings yet

- 194 GSIS v. Province of TarlacDocument2 pages194 GSIS v. Province of TarlacMiggy CardenasNo ratings yet

- R277-328 Equal Opportunity in EducationDocument5 pagesR277-328 Equal Opportunity in EducationThe Salt Lake TribuneNo ratings yet

- Skylar Schuth Assignment 2 RewriteDocument4 pagesSkylar Schuth Assignment 2 Rewriteapi-302722965No ratings yet

- Writ, OS & ServicesDocument20 pagesWrit, OS & ServicesJoannePriyaNo ratings yet

- He Showed Us The Way - Cesar ChavezDocument2 pagesHe Showed Us The Way - Cesar Chavezapi-232728249No ratings yet

- Cultural Self Awareness EssayDocument4 pagesCultural Self Awareness EssayRayvonne Brown100% (1)

- Philippine CitizenshipDocument4 pagesPhilippine CitizenshipJenny AbilleroNo ratings yet

- Karm V NypaDocument9 pagesKarm V NyparkarlinNo ratings yet

- Misfortunes in MadridDocument23 pagesMisfortunes in MadridLUREY JAMES A. VACALARESNo ratings yet

- Individualism and CollectivismDocument12 pagesIndividualism and CollectivismSwastik AgarwalNo ratings yet

- LPO Letter Re Li-CycleDocument4 pagesLPO Letter Re Li-CycleNick PopeNo ratings yet

- Government Lawyers CESO RankDocument3 pagesGovernment Lawyers CESO RankErwin E NadNo ratings yet

- Trends, Network & Critical Thinking: Quarter 2Document23 pagesTrends, Network & Critical Thinking: Quarter 2Jhunella Mae Collera Sapinoso100% (4)

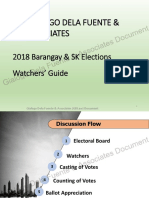

- Brgy. & SK Elections Watchers' GuideDocument103 pagesBrgy. & SK Elections Watchers' GuideuntayaoNo ratings yet

- Ingroup Vs OutgroupDocument5 pagesIngroup Vs Outgroupparadisearth100% (1)

- Ground Water Recharge 2023Document4 pagesGround Water Recharge 2023Rima MisaNo ratings yet

- Water Conflict ScenarioDocument8 pagesWater Conflict ScenarioMan DjunNo ratings yet

- 179 X Mega CasesDocument51 pages179 X Mega CaseszacybernautNo ratings yet

- Niryat Bandhu SchemeDocument3 pagesNiryat Bandhu Scheme2005vrindaNo ratings yet

- Tilted Arc: Arts Policy As Populist CensorshipDocument23 pagesTilted Arc: Arts Policy As Populist CensorshipLisa Temple-Cox100% (1)

- Statement For Min..Heroes 2019Document4 pagesStatement For Min..Heroes 2019GCICNo ratings yet

- Chapter 5 Congress: The Legislative BranchDocument40 pagesChapter 5 Congress: The Legislative BranchlightbeatleNo ratings yet

- 450 California History IntroductionDocument25 pages450 California History IntroductionJay JaberNo ratings yet

- Problem StatementDocument2 pagesProblem StatementShahid Javaid67% (3)

- Doty Serpo PDFDocument3 pagesDoty Serpo PDFMoises Gomez Hernandez100% (1)

- Feasibility Study and Detail Design of Adama Town Water Supply ProjectDocument93 pagesFeasibility Study and Detail Design of Adama Town Water Supply ProjectEphrem Gizachew100% (3)

- Minimum Wage RaisesDocument2 pagesMinimum Wage Raisesdave_jamieson1222100% (1)

- Supreme Court Judgments-Disciplinary ActionDocument25 pagesSupreme Court Judgments-Disciplinary Actionmmnamboothiri0% (1)