Professional Documents

Culture Documents

Zahurak Company: Group Assignment 4 Anurag Priyadarshi 380 Fiza Azmi 390 Sarthak Agrawal 415 3-19)

Zahurak Company: Group Assignment 4 Anurag Priyadarshi 380 Fiza Azmi 390 Sarthak Agrawal 415 3-19)

Uploaded by

diveshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zahurak Company: Group Assignment 4 Anurag Priyadarshi 380 Fiza Azmi 390 Sarthak Agrawal 415 3-19)

Zahurak Company: Group Assignment 4 Anurag Priyadarshi 380 Fiza Azmi 390 Sarthak Agrawal 415 3-19)

Uploaded by

diveshCopyright:

Available Formats

Group Assignment 4

Anurag Priyadarshi 380

Fiza Azmi 390

Sarthak Agrawal 415

3-19)

Zahurak Company

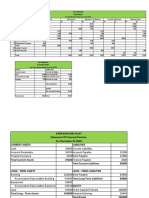

Income Statement for the year ended 31 Dec 2018 Balance Sheet of Chiara Co as on 31 Dec 2018

Particulars (Expense) Amt Particulars (Income)Amt Assets: Amt

Depreciation Expense 6500 Plumbing fees 84000 Current Assets:

Salaries Expense 46700 Cash 7000

Rent Expense 13000 Account Receivable 27200

N on-current Assets:

Trucks (42000-17500) 24500

Profit (Balancing Figure & Other

Equity) 17800 Land 32000

84000 84000

Total Assets 90700

Liabilities and Equity:

Current Liabilites:

Accounts Payable 15000

Salaries Payable 4200

Unearned Fees 3600

N on-current liabilities:

Equity:

Common Stock 20000

Other Equity (45500 + 17800 - 15400) 47900

Total of Liabilities and Equity 90700

3-8)

Wilson Trucking Company

Income Statement for the year ended 31 Dec 2018 Balance Sheet of Chiara Co as on 31 Dec 2018

Particulars (Expense) Amt Particulars (Income) Amt Assets: Amt

Depreciation Expense 23500 Trucking Fees 130000 Current Assets:

Salaries Expense 61000 Cash 8000

Office Supplies Expense 8000 Account Receivable 17500

Repairs Expense 12000 Office Supplies 3000

Loss (Balancing Figure & Other

Equity) 25500

130000 130000 N on-current Assets:

Trucks (172000 - 36000) 136000

Land 85000

Total Assets 249500

Liabilities and Equity:

Current Liabilites:

Accounts Payable 12000

Interest Payable 4000

N on-current liabilities:

Long Term Notes Payable 53000

Equity:

Common Stock 20000

Other Equity (155000 +25500 - 20000) 160500

Total of Liabilities and Equity 249500

3-8 A)

Taybalt Construction

Income Statement for the year ended 31 Dec 2018 Balance Sheet of Chiara Co as on 31 Dec 2018

Particulars (Expense) Amt Particulars (Income) Amt Assets: Amt

Depreciation Expense-Building 11000 Professional fees earned 97000 Current Assets:

Depreciation Expense-Equipment 6000 Rent earned 14000 Cash 5000

Wages Expense 32000 Dividends earned 2000 Short Term Investment 23000

Interest Expense 5100 Interest Earned 2100 Supplies 8100

Inusrance Expense 10000 Prepaid Insurance 7000

Rent Expense 13400

Supplies Expense 7400 N on-current Assets:

Postage Expense 4200 Equipment (40000-20000) 20000

Property taxes Expense 5000 Building (150000-50000) 100000

Repairs Expense 8900 Land 55000

Telephone Expense 3200

Utilities Expense 4600

Total Assets 218100

Profit (Balancing Figure & Other Equity) 4300 Liabilities and Equity

115100 115100 Current Liability

Accounts Payable 16500

Interest Payable 2500

Rent Payable 3500

Wages Payable 2500

Property Tax Payable 900

Unearned Professional Fees 7500

Non Current Liability

Long Term Notes Payables 67000

Equity

Common Stock 5000

Other Equity (121400 + 4300 - 13000) 112700

Total of Liabilities and Equity 218100

3-5 B)

Income Statement for the year ended 31 Dec 2018 Balance Sheet of Chiara Co as on 31 Dec 2018

Particulars (Expense) Amt Particulars (Income) Amt Assets: Amt

Depreciation Expense(Trucks) 29000 Delivery Fee earned 611800 Current Assets:

Depreciation Expense(Equipments) 48000 Interest earned 34000 Cash 58000

Salaries Expense 74000 Account Receivable 120000

Wages Expense 300000 Interest Receviable 7000

Interest Expense 15000 Notes Receivable 210000

office supplies expense 31000 office supplies 22000

Advertising Expense 27200

Repairs Expense-Trucks 35600

Profit (Balancing Figure & Other

Equity) 86000

645800 645800 N on-current Assets:

Trucks(134000-58000) 76000

Equipment(270000-200000) 70000

Land 100000

Total Assets 663000

Liabilities and Equity:

Current Liabilites:

Accounts Payable 134000

Interest Payable 20000

Salaries Payable 28000

Unearned delivery fees 120000

N on-current liabilities:

Long term notes 200000

Equity:

Common stocks 15000

Other Equities( Retained earnings+ Profit-

Dividend) 146000

Total of Liabilities and Equity 663000

3-8 B)

Anara Company

Income Statement for the year ended 31 Dec 2018 Balance Sheet of Chiara Co as on 31 Dec 2018

Particulars (Expense) Amt Particulars (Income) Amt Assets: Amt

Depreciation Expense-Building 2000 Professional fees earned 59600 Current Assets:

Depreciation Expense-Equipment 1000 Rent earned 4500 Cash 7400

Wages Expense 18500 Dividends earned 1000 Short-term investments 11200

Interest Expense 1550 Interest Earned 1320 Supplies 4600

Inusrance Expense 1525 Prepaid Insurance 1000

Rent Expense 3600

Supplies Expense 1000

Postage Expense 410 N on-current Assets:

Property taxes Expense 4825 Equipment (24000-4000) 20000

Repairs Expense 679 Building(100000 - 10000) 90000

Telephone Expense 521 Land 30500

Utilities Expense 1920

Total Assets 164700

Profit (Balancing Figure &

Other Equity) 28890

Liabilities and Equity:

66420 66420 Current Liabilites:

Accounts Payable 3500

Interest Payable 1750

Rent Payable 400

Wages payable 1280

Property taxes payable 3330

Unearned professional fees 750

N on-current liabilities:

Long-term notes payable 40000

Equity

Common Stock 30000

Other Equity( 62800 + 28890 - 8000) 83690

Total of Liabilities and Equity 164700

You might also like

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- 3 Beethoven Schubert Bach Text 2018Document11 pages3 Beethoven Schubert Bach Text 2018djaaaamNo ratings yet

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A Partnershipstudentone60% (15)

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- Due Diligence ReportDocument9 pagesDue Diligence ReportBhogadi Bharadwaja100% (3)

- Tally Practical QuestionDocument18 pagesTally Practical QuestionBarani Dharan78% (326)

- Depreciation Is $3700 (Furniture and Equipment) + $28800 (Vehicles) $32 500Document4 pagesDepreciation Is $3700 (Furniture and Equipment) + $28800 (Vehicles) $32 500David ChungNo ratings yet

- Management AccountingDocument13 pagesManagement AccountingbhushspatilNo ratings yet

- Tgs Minggu 3 (Problem 3-2,3-5,3-7)Document7 pagesTgs Minggu 3 (Problem 3-2,3-5,3-7)Ca AdaNo ratings yet

- 0422 Topic 1 Single EntryDocument22 pages0422 Topic 1 Single Entryانيس AnisNo ratings yet

- CFS Class ProblemsDocument2 pagesCFS Class ProblemsPranav MishraNo ratings yet

- Ex. E10-20Document5 pagesEx. E10-20Emily PolancoNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow Questiondanielkithome38No ratings yet

- HO and Branches Combined StatmentDocument5 pagesHO and Branches Combined Statmentmmh771984No ratings yet

- Schutz Building Services Is A FastDocument2 pagesSchutz Building Services Is A FastShih an TsaiNo ratings yet

- Template 2.7Document1 pageTemplate 2.7Vaishnav VIPANCHIKANo ratings yet

- Financial Accounting-I Assignment 2: InstructionsDocument3 pagesFinancial Accounting-I Assignment 2: InstructionsMemes CreatorNo ratings yet

- Income Statement Balance Sheet For The Year Ended 31 July 2012 As at 31 July 2012 Sales Non Current AssetsDocument1 pageIncome Statement Balance Sheet For The Year Ended 31 July 2012 As at 31 July 2012 Sales Non Current Assetshananiqbal1999No ratings yet

- Girdharilal Case StudyDocument1 pageGirdharilal Case StudySandipan DawnNo ratings yet

- Svs Ltd. Trial Balance, January 31, 2013 Amount in Rs. Particulars Debit CreditDocument6 pagesSvs Ltd. Trial Balance, January 31, 2013 Amount in Rs. Particulars Debit CreditVigneswar SundaramurthyNo ratings yet

- SFP SolutionDocument1 pageSFP SolutionAejaz MohamedNo ratings yet

- SFP SolutionDocument1 pageSFP SolutionAejaz MohamedNo ratings yet

- Journal Entry For Atkin AgencyDocument4 pagesJournal Entry For Atkin AgencySamarth LahotiNo ratings yet

- Prob 5 UnsolvedDocument3 pagesProb 5 UnsolvedBhushan ShirsathNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- 2017 BGSS 4E5N Prelim P2 AnsDocument6 pages2017 BGSS 4E5N Prelim P2 AnsDamien SeowNo ratings yet

- Accounting Unit 1Document75 pagesAccounting Unit 1Huzaifa Abdullah50% (2)

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Balance Statement Assets Liabilities and Stockholder's EquityDocument5 pagesBalance Statement Assets Liabilities and Stockholder's EquityNavinNo ratings yet

- ANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsDocument11 pagesANSWER KEY - CHARLOTTE SERVICES - Classification of Account and Balances of The AccountsAnne MiguelNo ratings yet

- Work Sheet 1 PDFDocument9 pagesWork Sheet 1 PDFProtik SarkarNo ratings yet

- Book 2Document4 pagesBook 2Trinh Duc Manh (k15 HL)No ratings yet

- Financial Statement 1st PaperDocument24 pagesFinancial Statement 1st PaperMtNo ratings yet

- Akuntansi NadhipDocument9 pagesAkuntansi NadhipGeordhan AlexanderNo ratings yet

- Final AccountsDocument15 pagesFinal AccountsHammadNo ratings yet

- Sujan Sir Assignment (MBA)Document18 pagesSujan Sir Assignment (MBA)Habibur RahmanNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentMedha SinghNo ratings yet

- Pizaanut Balance Sheet As On 30 April 2020 AssetsDocument6 pagesPizaanut Balance Sheet As On 30 April 2020 AssetsAnindya BasuNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash Flowsuske.uchiha2000No ratings yet

- 12 Accountancy 2018 Sample Paper 2Document23 pages12 Accountancy 2018 Sample Paper 2Sukhjinder SinghNo ratings yet

- Cash Flow Statement Problems-1Document5 pagesCash Flow Statement Problems-1Chandan ArunNo ratings yet

- Solutions of Practice Q2 & Q3Document2 pagesSolutions of Practice Q2 & Q3Kashan AzizNo ratings yet

- Maria Case SolutionDocument5 pagesMaria Case SolutionNavneet SharmaNo ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- Akm Assignment 5Document7 pagesAkm Assignment 5Annisa Dwi RizkafianiNo ratings yet

- Class Test 3: SFX Greenherald Int'L School As Level Accounting (9706)Document4 pagesClass Test 3: SFX Greenherald Int'L School As Level Accounting (9706)Abid AhmedNo ratings yet

- Dargent Co. AnswerDocument4 pagesDargent Co. AnswerAbishek GuptaNo ratings yet

- Chapter 1 - Ex SolutionDocument9 pagesChapter 1 - Ex SolutionNguyễn Đức MinhNo ratings yet

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A PartnershipNiño Rey LopezNo ratings yet

- PR InterDocument12 pagesPR InterNicholas AyeNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- Problem 1.5ADocument5 pagesProblem 1.5ANavinNo ratings yet

- Additional Self-Test ProblemsDocument80 pagesAdditional Self-Test Problemsnsrivastav1No ratings yet

- DFNDFNDFNDFNDFDocument6 pagesDFNDFNDFNDFNDFMohammad Ibnu LapaolaNo ratings yet

- Problem 1-6 Transaction Statement Cash Boats: AssetsDocument7 pagesProblem 1-6 Transaction Statement Cash Boats: AssetsSamarth LahotiNo ratings yet

- Dispenser of California - Rahul - MattaDocument9 pagesDispenser of California - Rahul - MattaHarsh MaheshwariNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- The Balance Sheet of Bharat LTD As at 31st MarchDocument4 pagesThe Balance Sheet of Bharat LTD As at 31st Marchsunny_masand1990No ratings yet

- PGP 387 Divesh Paper ManufacturingDocument3 pagesPGP 387 Divesh Paper ManufacturingdiveshNo ratings yet

- Managing Business Markets: Case AnalysisDocument2 pagesManaging Business Markets: Case AnalysisdiveshNo ratings yet

- Cost and Management Accounting in Practise: An Industry Specific PerspectiveDocument16 pagesCost and Management Accounting in Practise: An Industry Specific PerspectivediveshNo ratings yet

- Managing Business Markets - A: R5: A Roadmap For Branding in Industrial MarketsDocument9 pagesManaging Business Markets - A: R5: A Roadmap For Branding in Industrial MarketsdiveshNo ratings yet

- Group 7 - Assignment 2Document2 pagesGroup 7 - Assignment 2diveshNo ratings yet

- Roll No Preference 1 Preference 2 Preference 3 CourseDocument2 pagesRoll No Preference 1 Preference 2 Preference 3 CoursediveshNo ratings yet

- Cost and Management Accounting in Practise: An Industryspecific PerspectiveDocument16 pagesCost and Management Accounting in Practise: An Industryspecific PerspectivediveshNo ratings yet

- Exercise Assignment Qstns FADocument3 pagesExercise Assignment Qstns FAdiveshNo ratings yet

- CMA Project Shivam GroudDocument18 pagesCMA Project Shivam GrouddiveshNo ratings yet

- Consumer Behaviour Pre-Exercise: New Smartphone PurchaseDocument2 pagesConsumer Behaviour Pre-Exercise: New Smartphone PurchasediveshNo ratings yet

- Lakhs Lakhs Lakhs Lakhs Urban Rural Urban Rural Urban RuralDocument5 pagesLakhs Lakhs Lakhs Lakhs Urban Rural Urban Rural Urban RuraldiveshNo ratings yet

- Divesh - 387 - Edinburgh Tram SystemxDocument27 pagesDivesh - 387 - Edinburgh Tram SystemxdiveshNo ratings yet

- Roll Name 380 Anurag Priyadarshi 390 Fiza Azmi 415 Sarthak AgrawalDocument12 pagesRoll Name 380 Anurag Priyadarshi 390 Fiza Azmi 415 Sarthak AgrawaldiveshNo ratings yet

- Information About The Focus GroupDocument4 pagesInformation About The Focus GroupdiveshNo ratings yet

- Financial Accounting Group Assignment 2Document2 pagesFinancial Accounting Group Assignment 2diveshNo ratings yet

- Case Study For Round 1 of HCCB Case Challenge Season 1Document4 pagesCase Study For Round 1 of HCCB Case Challenge Season 1diveshNo ratings yet

- Group 1 - CodingdfDocument10 pagesGroup 1 - CodingdfdiveshNo ratings yet

- Focus Group Moderator Guide - Gfdfdfdroup 2Document5 pagesFocus Group Moderator Guide - Gfdfdfdroup 2diveshNo ratings yet

- 02 Lembar Jawaban (Filled In)Document21 pages02 Lembar Jawaban (Filled In)Epon NopiantiNo ratings yet

- CH 4Document6 pagesCH 4pfz8nqrybpNo ratings yet

- Module 3 - Accounting For Business TransactionsDocument10 pagesModule 3 - Accounting For Business TransactionsMJ San PedroNo ratings yet

- S 2 Accounting Paper 1 (Final)Document15 pagesS 2 Accounting Paper 1 (Final)Muhammad Salim Ullah KhanNo ratings yet

- 1 Installment SalesDocument26 pages1 Installment SalesSameer Hussain100% (2)

- Pacific Grove Spice Company Case CalculationsDocument11 pagesPacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- Matahari Department StoreDocument59 pagesMatahari Department StoreResti0805_DyoNo ratings yet

- Statement of Income: P&L Account Can Also Be Named AsDocument5 pagesStatement of Income: P&L Account Can Also Be Named Asanand sanilNo ratings yet

- Assinment 3Document8 pagesAssinment 3Anshul SinghNo ratings yet

- AP 9502 - LiabilitiesDocument12 pagesAP 9502 - Liabilitiesrandel10caneteNo ratings yet

- Tata Motors LTD: Q4FY19 Result UpdateDocument4 pagesTata Motors LTD: Q4FY19 Result Updatekapil bahetiNo ratings yet

- Review of Financial Statement Preparation Analysis and Interpretation Pt.8Document6 pagesReview of Financial Statement Preparation Analysis and Interpretation Pt.8ADRIANO, Glecy C.No ratings yet

- Exercises Short ProblemsDocument6 pagesExercises Short ProblemsKlaire SwswswsNo ratings yet

- MFRS101 Presentation of Financial StatemntsDocument8 pagesMFRS101 Presentation of Financial StatemntsIsmahani HaniNo ratings yet

- Lalit Ji Huf 22Document6 pagesLalit Ji Huf 22sunil jadhavNo ratings yet

- Asset: Financial Accounting Economic Value Ownership CashDocument5 pagesAsset: Financial Accounting Economic Value Ownership CashPhillip DominguezNo ratings yet

- US GAAP Vs IFRS TelecommDocument52 pagesUS GAAP Vs IFRS Telecommludin00100% (1)

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelNo ratings yet

- Module 1B - PFRS For Medium Entities NotesDocument25 pagesModule 1B - PFRS For Medium Entities NotesLee SuarezNo ratings yet

- Voli Motors D.O.O Bulevar Josipa Broza BB 81000 Podgorica MontenegroDocument1 pageVoli Motors D.O.O Bulevar Josipa Broza BB 81000 Podgorica MontenegromilanNo ratings yet

- Accounting Warren 23rd Edition Solutions ManualDocument54 pagesAccounting Warren 23rd Edition Solutions Manualbrennadrusillas7zNo ratings yet

- Intermediate Accounting 3Document105 pagesIntermediate Accounting 3Lehnard Delos Reyes GellorNo ratings yet

- AP1: Cash and AccrualsDocument3 pagesAP1: Cash and AccrualsJelwin Enchong BautistaNo ratings yet

- Small Business & Entrepreneurship - Chapter 8Document36 pagesSmall Business & Entrepreneurship - Chapter 8Muhammad Zulhilmi Wak JongNo ratings yet

- DELL LBO Model Part 1 CompletedDocument21 pagesDELL LBO Model Part 1 CompletedMohd IzwanNo ratings yet

- AFR - Question BankDocument31 pagesAFR - Question BankDownloder UwambajimanaNo ratings yet

- M 202Document2 pagesM 202Rafael Capunpon VallejosNo ratings yet