Professional Documents

Culture Documents

CFS Class Problems

Uploaded by

Pranav Mishra0 ratings0% found this document useful (0 votes)

21 views2 pagesDelta Corporation's cash flow statement for 2011 shows:

1) Net cash provided by operating activities was $130,300 due to operating income of $130,000 adjusted for non-cash expenses.

2) Net cash used in investing activities was $35,750 due to purchases of long-term investments and land, offset by sales of long-term investments and equipment.

3) Net cash used in financing activities was $174,500 due to repayments of notes payable and dividends paid, offset by new notes payable and stock issued.

Original Description:

Original Title

CFS class problems

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDelta Corporation's cash flow statement for 2011 shows:

1) Net cash provided by operating activities was $130,300 due to operating income of $130,000 adjusted for non-cash expenses.

2) Net cash used in investing activities was $35,750 due to purchases of long-term investments and land, offset by sales of long-term investments and equipment.

3) Net cash used in financing activities was $174,500 due to repayments of notes payable and dividends paid, offset by new notes payable and stock issued.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views2 pagesCFS Class Problems

Uploaded by

Pranav MishraDelta Corporation's cash flow statement for 2011 shows:

1) Net cash provided by operating activities was $130,300 due to operating income of $130,000 adjusted for non-cash expenses.

2) Net cash used in investing activities was $35,750 due to purchases of long-term investments and land, offset by sales of long-term investments and equipment.

3) Net cash used in financing activities was $174,500 due to repayments of notes payable and dividends paid, offset by new notes payable and stock issued.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Problems on Cash Flow Statement

1. Delta Corporation’s income statement for 2011 and its comparative balance sheets for 2011 and 2010 are

presented below. Income statement for the year ending December 31, 2011 is as follows:

Net Sales 825000

Cost of goods sold 460000

Gross Margin 365000

Operating Expenses (including depreciation

expense of $6000 on buildings and $11550 on

equipment and amortization of $2400) 235000

Operating Income 130000

Other Income

Interest expense (27500)

Dividend Income 1700

Gain on sale of investment 6250

Loss on disposal of equipment (1150) (20700)

Income before income taxes 109300

Income tax expense 26100

Net Income 83200

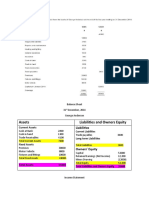

Comparative Balance Sheets are as follows:

Assets 2011 2010

Cash 52925 60925

Accounts Receivable (Net) 148000 157250

Inventory 161000 150500

Prepaid Expenses 3900 2900

Long-Term Investments 18000 43000

Land 75000 62500

Buildings 231000 231000

Accumulated Depreciation, buildings (45500) (39500)

Equipment 79865 83615

Accumulated depreciation, equipment (21700) (22800)

Intangible assets 9600 12000

Total Assets 712090 741390

Liabilities and Stockholders' Equity

Accounts payable 66875 116875

Notes payable 37850 72850

Accrued liabilities 2500 0

Income taxes payable 10000 0

Bonds payable 105000 155000

Mortgage payable 165000 175000

Common Stock, 10 par value 200000 170000

Additional paid-in capital 45000 25000

Retained Earnings 104865 46665

Treasury stock (25000) (20000)

Total liabilities and stockholders' equity 712090 741390

The company’s records for 2011 provide this additional information:

a. Sold long-term investments that cost 35,000 for a gain of 6,250; made other long-term investments in

the amount of 10,000.

b. Purchased five acres of land to build a parking lot for 12,500.

c. Sold equipment that cost 18,750 and that had accumulated depreciation of 12,650 at a loss of 1,150;

purchased new equipment for 15,000.

d. Repaid notes payable in the amount of 50,000; borrowed 15,000 by signing new notes payable.

e. Converted 50,000 of bonds payable into 3,000 shares of common stock.

f. Reduced the Mortgage Payable account by 10,000.

g. Declared and paid cash dividends of 25,000.

h. Purchased treasury stock for 5,000.

Prepare Cash Flow Statement for the year ending December 31, 2011.

2. Gamma Corporation’s income statement for the year ended June 30, 2010 and its comparative balance sheets

for June 30, 2010 and 2009 follow:

Income Statement for the year ending on June 30, 2010

Net Sales 244000

Cost of goods sold 148100

Gross Margin 95900

Operating Expenses 45000

Operating Income 50900

Interest expense 2800

Income before income taxes 48100

Income tax expense 12300

Net Income 35800

Comparative Balance Sheets are as follows:

Assets 2010 2009

Cash 139800 25000

Accounts Receivable (Net) 42000 52000

Inventory 86800 96800

Prepaid Expenses 6400 5200

Furniture 110000 120000

Accumulated depreciation, furniture (18000) (10000)

Total Assets 367000 289000

Liabilities and Stockholders' Equity

Accounts payable 26000 28000

Income taxes payable 2400 3600

Notes payable 74000 70000

Common Stock, 10 par value 230000 180000

Retained Earnings 34600 7400

Total liabilities and stockholders' equity 367000 289000

The company issued a 44000 note payable for purchased of furniture; sold furniture that cost 54000 with

accumulated depreciation of 30,600 at carrying value; recorded depreciation on furniture for the year, 38,600;

repaid a note in the amount of 40,000; issued 50,000 of common stock at par value; and paid dividends of 8,600.

Prepare Gamma’s Cash Flow Statement for the year ending June 30, 2010.

You might also like

- Principles of Information Security 4th Edition Whitman Test BankDocument5 pagesPrinciples of Information Security 4th Edition Whitman Test Bankxasuhymu100% (3)

- Test of Controls and Substantive ProceduresDocument16 pagesTest of Controls and Substantive ProceduresAdeel Sajjad100% (5)

- 199 Your SPKG VoiceDocument22 pages199 Your SPKG VoiceJimmy PaulNo ratings yet

- Moodys Approach To Rating The Petroleum Industry PDFDocument32 pagesMoodys Approach To Rating The Petroleum Industry PDFMujtabaNo ratings yet

- SEC +by Laws PDFDocument8 pagesSEC +by Laws PDFal bentulanNo ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- Accounting Unit 1Document75 pagesAccounting Unit 1Huzaifa Abdullah50% (2)

- CASE 6 Tufstuff Inc.Document8 pagesCASE 6 Tufstuff Inc.Karen QuiachonNo ratings yet

- 2016 Tax Consulting Engagement LetterDocument9 pages2016 Tax Consulting Engagement LettersarahvillalonNo ratings yet

- HRM CoursesDocument241 pagesHRM CoursesAparajita LohaniNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Republic V KerDocument3 pagesRepublic V KerCinNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- Delivery orders report from Ashok Vihar outletDocument41 pagesDelivery orders report from Ashok Vihar outletPranav MishraNo ratings yet

- Elbow MechanismDocument61 pagesElbow MechanismSourav Kotgund100% (2)

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- DFNDFNDFNDFNDFDocument6 pagesDFNDFNDFNDFNDFMohammad Ibnu LapaolaNo ratings yet

- Sujan Sir Assignment (MBA)Document18 pagesSujan Sir Assignment (MBA)Habibur RahmanNo ratings yet

- Financial Accounting AssignmentsDocument3 pagesFinancial Accounting AssignmentsMemes CreatorNo ratings yet

- Cash Flow QN 3Document4 pagesCash Flow QN 3Takudzwa LanceNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- HO and Branches Combined StatmentDocument5 pagesHO and Branches Combined Statmentmmh771984No ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- Multiple Step Income Statement BreakdownDocument5 pagesMultiple Step Income Statement BreakdownNavinNo ratings yet

- Direct MethodDocument3 pagesDirect Methodانا و البحرNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash Flowsuske.uchiha2000No ratings yet

- Income Statement and Balance Sheet for Xeta LtdDocument6 pagesIncome Statement and Balance Sheet for Xeta LtdNeelu AggrawalNo ratings yet

- IAS 7 Cash Flow StatementDocument5 pagesIAS 7 Cash Flow Statementchalah DeriNo ratings yet

- 0422 Topic 1 Single EntryDocument22 pages0422 Topic 1 Single Entryانيس AnisNo ratings yet

- PGDM (2021-23) Exercise On Final AccountsDocument9 pagesPGDM (2021-23) Exercise On Final Accountspriyanshu guptaNo ratings yet

- Assignment1 HWDocument10 pagesAssignment1 HWRUPIKA R GNo ratings yet

- The Financial Statements of CF LTDDocument4 pagesThe Financial Statements of CF LTDKIMBERLY MUKAMBANo ratings yet

- Problem 1.5ADocument5 pagesProblem 1.5ANavinNo ratings yet

- SVS Ltd. trial balance analysisDocument6 pagesSVS Ltd. trial balance analysisVigneswar SundaramurthyNo ratings yet

- North Mountain NurseryDocument1 pageNorth Mountain Nurserychandel08No ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- EVA ProblemDocument1 pageEVA ProblemAshutosh BiswalNo ratings yet

- Financial Statement ExerciseDocument7 pagesFinancial Statement ExerciseĐạt PhạmNo ratings yet

- Tgs Minggu 3 (Problem 3-2,3-5,3-7)Document7 pagesTgs Minggu 3 (Problem 3-2,3-5,3-7)Ca AdaNo ratings yet

- Solve accounting problems and prepare financial statementsDocument5 pagesSolve accounting problems and prepare financial statementsUmer NawazNo ratings yet

- California Dispensers Financial StatementsDocument9 pagesCalifornia Dispensers Financial StatementsHarsh MaheshwariNo ratings yet

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow Questiondanielkithome38No ratings yet

- Insurance Statements Sec AFGHDocument5 pagesInsurance Statements Sec AFGHKARAN KAPOOR PGP 2021-23 BatchNo ratings yet

- Assets Liabilities and Owners EquityDocument9 pagesAssets Liabilities and Owners EquityNouman MujahidNo ratings yet

- 2017 Sec 4E5N Prelim Paper 2 - AnsDocument7 pages2017 Sec 4E5N Prelim Paper 2 - AnsDamien SeowNo ratings yet

- Financial statements overviewDocument20 pagesFinancial statements overviewParas VohraNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Management AccountingDocument13 pagesManagement AccountingbhushspatilNo ratings yet

- Practice - Cash Flows Statement - Hale CompanyDocument1 pagePractice - Cash Flows Statement - Hale CompanyRaaj Nishanth SNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- Mock Exam 2 Suggested SolutionsDocument10 pagesMock Exam 2 Suggested SolutionsAna-Maria GhNo ratings yet

- 15 Sole Trader - 2020Document34 pages15 Sole Trader - 2020Philile NkwanyanaNo ratings yet

- Dax CorporationsDocument1 pageDax CorporationsNazri YusofNo ratings yet

- Answer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Document9 pagesAnswer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Abul Ala Daniyal QaziNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Cash Flow Statement: Performa and ProblemsDocument52 pagesCash Flow Statement: Performa and Problems727822TPMB005 ARAVINTHAN.SNo ratings yet

- Swan Textile 2010 Cash Flow StatementDocument5 pagesSwan Textile 2010 Cash Flow Statementসানজিদা সাঈদNo ratings yet

- CashflowDocument8 pagesCashflowShubhankar GuptaNo ratings yet

- Birla Institute of Technology and Science, PilaniDocument3 pagesBirla Institute of Technology and Science, PilaniArjun Jaideep BhatnagarNo ratings yet

- Trister Company FileDocument11 pagesTrister Company FilehljuristsinternationalNo ratings yet

- Prepare Financial StatementsDocument16 pagesPrepare Financial StatementsDayaan ANo ratings yet

- Shiksha: Gross Profit 5200 5330 Total Liabilities 16000Document2 pagesShiksha: Gross Profit 5200 5330 Total Liabilities 16000chinmayaa reddyNo ratings yet

- Wip C.Document9 pagesWip C.Never GonondoNo ratings yet

- Pioma Plastics Cash Flow Statement Year Ended July 31Document4 pagesPioma Plastics Cash Flow Statement Year Ended July 31Prajwal PaiNo ratings yet

- Microsoft Interview Experience 20-22Document1 pageMicrosoft Interview Experience 20-22Pranav MishraNo ratings yet

- Systemix DatasetDocument3,423 pagesSystemix DatasetPranav MishraNo ratings yet

- Application Form: Submitted ToDocument3 pagesApplication Form: Submitted ToPranav MishraNo ratings yet

- JPM PanelChallenges v13-532FDocument1 pageJPM PanelChallenges v13-532FPranav MishraNo ratings yet

- IIFT ResponsibilitiesDocument1 pageIIFT ResponsibilitiesPranav MishraNo ratings yet

- Problems On Cash Flow Statement: (Solutions Are at The End)Document20 pagesProblems On Cash Flow Statement: (Solutions Are at The End)Pranav MishraNo ratings yet

- CFS Class ProblemsDocument2 pagesCFS Class ProblemsPranav MishraNo ratings yet

- Systemix: The It-Consulting, Prodman and E-Commerce ClubDocument1 pageSystemix: The It-Consulting, Prodman and E-Commerce ClubPranav MishraNo ratings yet

- CASH FLOW STATEMENT ANALYSISDocument32 pagesCASH FLOW STATEMENT ANALYSISPranav MishraNo ratings yet

- CASH FLOW STATEMENT ANALYSISDocument32 pagesCASH FLOW STATEMENT ANALYSISPranav MishraNo ratings yet

- Analysis of FSDocument42 pagesAnalysis of FSPranav MishraNo ratings yet

- Omni-Channel Focus for Customer CentricityDocument6 pagesOmni-Channel Focus for Customer CentricityPranav MishraNo ratings yet

- Analysis of FSDocument42 pagesAnalysis of FSPranav MishraNo ratings yet

- Impactful Introductions: Presenters: Rohan Chadha Dipen GuptaDocument7 pagesImpactful Introductions: Presenters: Rohan Chadha Dipen GuptaPranav MishraNo ratings yet

- GEP Gameplan 2021 BschoolDocument12 pagesGEP Gameplan 2021 Bschooljai kunwarNo ratings yet

- Additional Problems On CFSDocument20 pagesAdditional Problems On CFSPranav MishraNo ratings yet

- Case Study - ServiceMaxDocument2 pagesCase Study - ServiceMaxPranav MishraNo ratings yet

- Bitwise IIFTDocument1 pageBitwise IIFTPranav MishraNo ratings yet

- L'Oréal India Campus Event Guide Discover Beauty-Tech CareersDocument1 pageL'Oréal India Campus Event Guide Discover Beauty-Tech CareersPranav MishraNo ratings yet

- Channe Partner Digital EcosystemDocument3 pagesChanne Partner Digital EcosystemPranav MishraNo ratings yet

- Task - 1Document35 pagesTask - 1Pranav MishraNo ratings yet

- BM PDFDocument307 pagesBM PDFPulkit SharmaNo ratings yet

- Grace Under PressureDocument1 pageGrace Under PressurePranav MishraNo ratings yet

- CertificationsDocument1 pageCertificationsPranav MishraNo ratings yet

- WAT-PI Kit PDFDocument32 pagesWAT-PI Kit PDFAdvaith JayakumarNo ratings yet

- ACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersDocument7 pagesACCA Financial Reporting (FR) Further Question Practice Practice & Apply Questions & AnswersMr.XworldNo ratings yet

- Muchael - Challenges of Cross Border Mergers and Acquisition A Case Study of Tiger Brands Limited (HACO Industries Limited)Document64 pagesMuchael - Challenges of Cross Border Mergers and Acquisition A Case Study of Tiger Brands Limited (HACO Industries Limited)Denis Deno RotichNo ratings yet

- Ig CommerceDocument159 pagesIg CommerceRouful RasoolNo ratings yet

- Module A (June 2013) - AnswerDocument16 pagesModule A (June 2013) - Answer徐滢No ratings yet

- Project Taxation Law NewDocument20 pagesProject Taxation Law NewmanasaNo ratings yet

- Group 1 Section A PDFDocument14 pagesGroup 1 Section A PDFNayeem Md Sakib100% (1)

- ACCCOB3 - K81 - GWBC - Group 3Document14 pagesACCCOB3 - K81 - GWBC - Group 3Mannix Richard DelRosarioNo ratings yet

- MSU College of Business Administration and Accountancy Operating Leases StudyDocument4 pagesMSU College of Business Administration and Accountancy Operating Leases StudyJayr BVNo ratings yet

- Case DiscussionsDocument4 pagesCase Discussionsshebin_abdsajNo ratings yet

- Income Taxation Reviewer Final 1Document121 pagesIncome Taxation Reviewer Final 1Stanley Renz Obaña Dela CruzNo ratings yet

- 12th Accountancy - Public Exam Model Question Paper - English Medium PDF DownloadDocument6 pages12th Accountancy - Public Exam Model Question Paper - English Medium PDF DownloadMohamed Jamil IrfanNo ratings yet

- T3 EmployeeDocument4 pagesT3 EmployeeLe YenNo ratings yet

- Chapter 4 - Tax Schemes, Periods, Methods and ReportingDocument2 pagesChapter 4 - Tax Schemes, Periods, Methods and ReportingRoshel RombaoaNo ratings yet

- Basic Accounting - Midterm 2010Document6 pagesBasic Accounting - Midterm 2010Trixia Floie GalimbaNo ratings yet

- Solutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210Document36 pagesSolutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210detachedcoped.f863i3100% (44)

- Part 1 - Decision Tree For Addressing Surplus Cash in A CorporationDocument4 pagesPart 1 - Decision Tree For Addressing Surplus Cash in A CorporationbaxterNo ratings yet

- 03 Musgrave Thin (1948)Document18 pages03 Musgrave Thin (1948)Alvaro ArroyoNo ratings yet

- Three-Statement Modeling Case GuideDocument15 pagesThree-Statement Modeling Case Guidetanmay agnaniNo ratings yet

- MaithanDocument201 pagesMaithanSivaNo ratings yet

- Morton E. Cole v. Commissioner of Internal Revenue, 481 F.2d 872, 2d Cir. (1973)Document8 pagesMorton E. Cole v. Commissioner of Internal Revenue, 481 F.2d 872, 2d Cir. (1973)Scribd Government DocsNo ratings yet

- Entr 122 ExamDocument5 pagesEntr 122 ExamSophia Ysabelle BernasolNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument59 pagesChapter 4 - Completing The Accounting CycleTâm Lê Hồ HồngNo ratings yet