Professional Documents

Culture Documents

Arbitrage Problem

Uploaded by

Shrikant0 ratings0% found this document useful (0 votes)

8 views8 pages1. Currency exchange rates are determined by interest rates and inflation rates between countries. Differences in these rates across currencies can be exploited through arbitrage.

2. The arbitrage process involves borrowing in one currency, converting it to another currency at the spot rate, investing it to earn interest, then converting it back and repaying the loan to realize a profit from favorable interest rate differences.

3. An example shows an Indian importer who needs to pay $100,000 in 3 months. By borrowing rupees, converting to dollars at the spot rate, investing dollars for 3 months, and converting back at the higher 3-month forward rate, a profit of Rs. 22,250 is realized

Original Description:

Original Title

arbitrage problem

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Currency exchange rates are determined by interest rates and inflation rates between countries. Differences in these rates across currencies can be exploited through arbitrage.

2. The arbitrage process involves borrowing in one currency, converting it to another currency at the spot rate, investing it to earn interest, then converting it back and repaying the loan to realize a profit from favorable interest rate differences.

3. An example shows an Indian importer who needs to pay $100,000 in 3 months. By borrowing rupees, converting to dollars at the spot rate, investing dollars for 3 months, and converting back at the higher 3-month forward rate, a profit of Rs. 22,250 is realized

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views8 pagesArbitrage Problem

Uploaded by

Shrikant1. Currency exchange rates are determined by interest rates and inflation rates between countries. Differences in these rates across currencies can be exploited through arbitrage.

2. The arbitrage process involves borrowing in one currency, converting it to another currency at the spot rate, investing it to earn interest, then converting it back and repaying the loan to realize a profit from favorable interest rate differences.

3. An example shows an Indian importer who needs to pay $100,000 in 3 months. By borrowing rupees, converting to dollars at the spot rate, investing dollars for 3 months, and converting back at the higher 3-month forward rate, a profit of Rs. 22,250 is realized

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

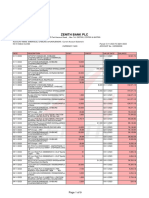

COVER IN MONEY MARKET

(COVERED INTEREST ARBITRAGE)

COVER IN MONEY MARKET

(COVERED INTEREST ARBITRAGE

Currency rate determined by the major factors

such as interest and inflation. Interest rates are

also influenced by inflation. Between 2

currencies there should not be difference in

interest rates and their spot and forward

exchange rates. If there are differences in

interest and exchange rates it can be exploited

to one’s advantage. Receiver or payer in a

foreign currency can take benefits in these

differences through arbitrage process.

Arbitrage Process

1. Borrow in 1 currency and pay interest on

that.

2. Convert that currency in another currency at

spot rate.

3. Invest in converted currency to earn interest.

4. Receive invested money on maturity with

interest.

5. Subsequently convert the currency on to a

forward date and rate and repay the loan

with interest.

example

An Indian importer has to pay $100000 after 3

months.

ER spot Rs. 61. Forward Rate (3 months) Rs.61.5.

Interest Rate- Ruppes 8% and Dollar 6%

Calculate arbitrage profits or loss?

Solution:

Interest rate differential= 8%-6% = 2%

Spread = Forward rate- Spot Rate 12 100

Spot Rate Months

= 61.5- 61.0 12 100 = 3.28%

61.0 3

Spread percentage of 3.28% is higher compared

interest rate differential of 2%.

Forward rate of Dollar is higher compared to higher

interest rate of india.

Person who is exposed in foreign currency (dollars)

can borrow in rupees and invest in dollar forward

market and there by can benefit from operation

Arbitrage process

• Indian has to pay $100000 in 3 months

i.e 61*100000 = Rs 6100000

• Importer borrows Rs 6100000 at 8% for 3 months

Interest for 3 months- 6100000*8/100*3/12 = 122000

A) Money repayable after 3 months with interest

6100000+122000 = 6220000

• He Converts Rs6100000 in dollars at spot rate Rs 61 and gets

$100000

• He deposits these dollars for 3 months to earn interest a 6%

= 100000*6/100*3/12 = $1500

• Refund of dollars deposit with interest $101500

B) Conversion of dollar into rupees at forward rate $101500

101500*61.5 = 6242250

less return of loan with interest = 6220000

Profit on arbitrage (B-A) 22250

• Difference between spot rate and forward rate

of dollar is 0.50 (Rs61.50-61.0)

• Exposure of importer in Rs = 0.50*100000

= 50000

less: profit on arbitrage = 22250

uncovered balance of exposure 27750

Importers Loss is covered to the extent of Rs.

22250 due to money market operation.

Problem

An Indian has to receive Euro 100000 after 90

days. Present rate of Euro 80.00 and forward

rate 79.00.

Exporter in order to cover the loss or exposure

decides to enter into money market. Interest

rate on Euro is 6% and Rupees is 8%

Work out arbitrage profit or loss?

You might also like

- Swap Transactions: Types of Swaps - Swaps & Deposit Markets - IllustrationsDocument18 pagesSwap Transactions: Types of Swaps - Swaps & Deposit Markets - IllustrationsManisha MishraNo ratings yet

- Problem Solving questions-IFTDocument18 pagesProblem Solving questions-IFTPiyush KothariNo ratings yet

- Time Value of MoneyDocument30 pagesTime Value of MoneyAshia12No ratings yet

- INSURANCE BROKER POLICIES Erna SuryawatiDocument7 pagesINSURANCE BROKER POLICIES Erna SuryawatiKehidupan DuniawiNo ratings yet

- Forex Solutions RevisionDocument20 pagesForex Solutions RevisionGAURAV MALLA 2122053No ratings yet

- Unit - 3 Forex MarketDocument4 pagesUnit - 3 Forex MarketRavi SistaNo ratings yet

- Covered Interest ArbitrageDocument9 pagesCovered Interest ArbitrageIndeevar SarkarNo ratings yet

- Module 1 - Time Value of Money Handout For LMS 2020Document8 pagesModule 1 - Time Value of Money Handout For LMS 2020sandeshNo ratings yet

- Problem ForexDocument8 pagesProblem ForexKushal SharmaNo ratings yet

- 4) - Are Shares of A Single Foreign Company Issued in The U.S. (ADR or American Depository Receipt)Document8 pages4) - Are Shares of A Single Foreign Company Issued in The U.S. (ADR or American Depository Receipt)mohanraokp2279No ratings yet

- BBA VI Sem. - International Finance - Practical ProblemsDocument16 pagesBBA VI Sem. - International Finance - Practical ProblemsdeepeshmahajanNo ratings yet

- Time Value of MoneyDocument78 pagesTime Value of Moneyneha_baid_167% (3)

- FIN672, Exam I (Part 2)Document5 pagesFIN672, Exam I (Part 2)Nguyễn Trung KiênNo ratings yet

- Power Notes: Bonds Payable and Investments in BondsDocument38 pagesPower Notes: Bonds Payable and Investments in BondsiVONo ratings yet

- Corporate Finance Session-3Document3 pagesCorporate Finance Session-3Pandy PeriasamyNo ratings yet

- Contoh Kasus Instrumen KeuanganDocument31 pagesContoh Kasus Instrumen KeuanganDedy SiburianNo ratings yet

- TVM 2021Document58 pagesTVM 2021mahendra pratap singhNo ratings yet

- Chapter 2 TVMDocument45 pagesChapter 2 TVMGupta AashiyaNo ratings yet

- IFM ProblemsDocument107 pagesIFM ProblemsRammohanreddy RajidiNo ratings yet

- MF Tutorial 6Document29 pagesMF Tutorial 6Hueg Hsien0% (1)

- CASE STUDY ON MODULE A - UnlockedDocument16 pagesCASE STUDY ON MODULE A - UnlockedRitesh UpadhyayNo ratings yet

- Arbitrage Without Transaction Cost: Available CapitalDocument15 pagesArbitrage Without Transaction Cost: Available CapitalBigbi KumarNo ratings yet

- Caiib Fmmoda Nov08Document100 pagesCaiib Fmmoda Nov08nellaimathivel4489No ratings yet

- Fixed Income SecuritiesDocument19 pagesFixed Income SecuritiesShailendraNo ratings yet

- Forex ArithmeticsDocument3 pagesForex Arithmeticsphenix0723No ratings yet

- Foreign Exchange Intensive Understanding of The Concept and Few Numericals Based On ForexDocument12 pagesForeign Exchange Intensive Understanding of The Concept and Few Numericals Based On ForexAIJAZ TURREYNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- PPI ExercisesDocument20 pagesPPI ExercisesJuan Pablo GarciaNo ratings yet

- Techniques of Asset/liability Management: Futures, Options, and SwapsDocument43 pagesTechniques of Asset/liability Management: Futures, Options, and SwapsSushmita BarlaNo ratings yet

- Fixed Income SecuritiesDocument59 pagesFixed Income SecuritiesSudhir Kumar AgarwalNo ratings yet

- Covered Interest ArbitrageDocument3 pagesCovered Interest ArbitrageKamrul HasanNo ratings yet

- Speculating On Anticipated Exchange RateDocument9 pagesSpeculating On Anticipated Exchange RatefaisalharaNo ratings yet

- PPA ExcercisesDocument10 pagesPPA ExcercisesJuan Pablo GarciaNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of Moneyansary75No ratings yet

- Time Value of MoneyDocument76 pagesTime Value of Moneyrhea agnesNo ratings yet

- MF 6Document29 pagesMF 6Hueg HsienNo ratings yet

- Time Value of Money MPFDocument6 pagesTime Value of Money MPFSaloni AgrawalNo ratings yet

- Case Study Revision - BFMDocument8 pagesCase Study Revision - BFMMOHAMED FAROOKNo ratings yet

- Accounting Chapter 10Document11 pagesAccounting Chapter 10Andrew ChouNo ratings yet

- Numerical Questions - IfMDocument3 pagesNumerical Questions - IfMKamal AnchaliaNo ratings yet

- Forex Pages 42 90Document49 pagesForex Pages 42 90RITZ BROWN100% (1)

- Review For Exam 1Document4 pagesReview For Exam 1Mahina NozirovaNo ratings yet

- Bonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument49 pagesBonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessCOURAGEOUSNo ratings yet

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANNo ratings yet

- Financial Management FM 1: Introduction & Time Value of MoneyDocument20 pagesFinancial Management FM 1: Introduction & Time Value of MoneyharryworldNo ratings yet

- Intuition Behind The Present Value RuleDocument34 pagesIntuition Behind The Present Value RuleAbhishek MishraNo ratings yet

- Chapter 12 Solutions 7eDocument6 pagesChapter 12 Solutions 7eMuhammad Mubashir56% (9)

- PracticematerialDocument3 pagesPracticematerialAyush SharmaNo ratings yet

- Assignment of Financial Management 2Document31 pagesAssignment of Financial Management 2Hafizur RahmanNo ratings yet

- FM03 Debt MKT 0208Document73 pagesFM03 Debt MKT 0208Derek LowNo ratings yet

- Foreign Exchange Market, Exchange Rate Determination & Currency DerivativesDocument28 pagesForeign Exchange Market, Exchange Rate Determination & Currency DerivativesParomita SarkarNo ratings yet

- Midterm Exam 1 Practice - SolutionDocument6 pagesMidterm Exam 1 Practice - SolutionbobtanlaNo ratings yet

- Lesson 3. TVM 2020Document25 pagesLesson 3. TVM 2020Vĩ NguyễnNo ratings yet

- Transaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMDocument32 pagesTransaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMNishant RaghuwanshiNo ratings yet

- Practice Worksheet Solutions - IBFDocument13 pagesPractice Worksheet Solutions - IBFsusheel kumarNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of MoneyDarrell PhilipNo ratings yet

- Chapter 008 SolutionsDocument6 pagesChapter 008 SolutionsAnton VelkovNo ratings yet

- Time Value of Money:: "Money Is An Arm or Leg. You Either Use It or Lose It." - Henry FordDocument33 pagesTime Value of Money:: "Money Is An Arm or Leg. You Either Use It or Lose It." - Henry FordramunagatiNo ratings yet

- Traslation 1Document3 pagesTraslation 1ShrikantNo ratings yet

- Put Option ProblemDocument5 pagesPut Option ProblemShrikantNo ratings yet

- Option Market TheoryDocument5 pagesOption Market TheoryShrikantNo ratings yet

- Call Option ProblemDocument5 pagesCall Option ProblemShrikantNo ratings yet

- A Study On Exemplary Role Played by Teachers in Quality Enhancement For The Improvement of Educational Scenario in Higher EducationDocument5 pagesA Study On Exemplary Role Played by Teachers in Quality Enhancement For The Improvement of Educational Scenario in Higher EducationShrikantNo ratings yet

- International Business CIA 1.1Document7 pagesInternational Business CIA 1.1Kanika BothraNo ratings yet

- Types of TotalitarianismDocument2 pagesTypes of TotalitarianismTabathaAldermanNo ratings yet

- Dpds Template-1st QuarterDocument61 pagesDpds Template-1st QuarterJhoice AnanayoNo ratings yet

- Statements PDFDocument4 pagesStatements PDFSami Ullah Khan Larhi78% (9)

- Zen 20231101 20240126 405 Aaaaa 226 - 1211217083 1706256506406Document9 pagesZen 20231101 20240126 405 Aaaaa 226 - 1211217083 17062565064067qv49rn925No ratings yet

- Medicine WellnessDocument1 pageMedicine WellnessAyushiSrivastavaNo ratings yet

- Invoice LetterDocument1 pageInvoice LetterResianing Marita100% (1)

- Banking and Insurance Law AssignmentDocument2 pagesBanking and Insurance Law AssignmentKoushiki RoyNo ratings yet

- International BusinessDocument29 pagesInternational Businesselias LubengoNo ratings yet

- Resolution LetterDocument1 pageResolution LetterJohnrey LatigayNo ratings yet

- Forest School 11 English Sample Paper 5Document7 pagesForest School 11 English Sample Paper 5微信:London-001No ratings yet

- Chapter 3Document21 pagesChapter 3saudafmNo ratings yet

- Canadian Dollar: People Also AskDocument1 pageCanadian Dollar: People Also AskLordoc DoctorsaabNo ratings yet

- 4110093927 (7)Document2 pages4110093927 (7)Mulriyanto TegarNo ratings yet

- Local Studies About Coin Sorter MachineDocument4 pagesLocal Studies About Coin Sorter Machineshaneamaro79No ratings yet

- Mutual Funds Price ListDocument6 pagesMutual Funds Price ListMohammad Nowaiser MaruhomNo ratings yet

- BMGC L6 2022-2023Document59 pagesBMGC L6 2022-2023Bianca KangNo ratings yet

- Rick Steves' German: Phrase Book & DictionaryDocument656 pagesRick Steves' German: Phrase Book & DictionaryGlorija MarkovicNo ratings yet

- Create Customer Statements Execution ReportDocument11 pagesCreate Customer Statements Execution ReportShakhir MohunNo ratings yet

- ECONOMICS The Creation of Money in The Banking System-WorksheetDocument2 pagesECONOMICS The Creation of Money in The Banking System-WorksheetKeii blackhoodNo ratings yet

- 2017 Annual ReportDocument160 pages2017 Annual ReportRr.Annisa BudiutamiNo ratings yet

- New Economic PolicyDocument24 pagesNew Economic Policynagesh dash100% (1)

- ACB System Installation ManualDocument12 pagesACB System Installation ManualAngNo ratings yet

- Andhra Court-Fees and Suits Valuation (Andhra Pradesh Second Amendment) Act, 1958Document3 pagesAndhra Court-Fees and Suits Valuation (Andhra Pradesh Second Amendment) Act, 1958KushNo ratings yet

- Read MeDocument1 pageRead Merachad5No ratings yet

- Test Bank For International Economics 17th Edition Robert Carbaugh Isbn 10 1337558931 Isbn 13 9781337558938Document2 pagesTest Bank For International Economics 17th Edition Robert Carbaugh Isbn 10 1337558931 Isbn 13 9781337558938Jennifer Vega100% (36)

- Pa Aaaaa SssDocument34 pagesPa Aaaaa Ssspeter NHNo ratings yet

- Ehi 4 emDocument16 pagesEhi 4 emamazonpoint24No ratings yet

- CHAPTER 1 Revisison of Macroeconomics 1Document27 pagesCHAPTER 1 Revisison of Macroeconomics 1Nguyễn Khoa NamNo ratings yet

- Doorprize IDX Mobile Kegiatan Kunjungan ASM Kencana Bandung Ke IDXDocument6 pagesDoorprize IDX Mobile Kegiatan Kunjungan ASM Kencana Bandung Ke IDXAulia NisaNo ratings yet