Professional Documents

Culture Documents

Weekly Market & Stock Report

Uploaded by

Dharmesh MistryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Market & Stock Report

Uploaded by

Dharmesh MistryCopyright:

Available Formats

Weekly & Daily Morning Report

15th JUL 2021

EQUITYMARKET ANALYSIS

Technical Out Look NIFTY

Nifty Index closed at the level of 15854 with a change of (+0.26%) Yesterday a flat

opening was seen but after opening nifty hold above 20 EMA levels and almost tested

15877 levels, we have already mentioned a strong bullish move will be seen once

15925 levels will be crossed. The bulls need to cross this barrier on a closing basis in

order to confirm the next leg-up, which will then take the index to 16400 in the short

term. Nifty range for today is 15800 – 16000 as nifty 15800 Put holds 59.02 lacs open

positions, On the other hand nifty 16000 Call holds 59.95 lacs open positions.

Holding 15800 target 15900 15930… thereafter it will show real power on screen.

Index Trend Support Level Resistance level

Nifty Short Term DOWNTREND 15700 – 15750 15900 – 16000

Nifty Long Term CONSOLIDATION 15300 – 15500 16000 – 16500

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

STOCKS DETAILS: -

Result Calendar: -

1. INFY ON 14TH July 2021

2. LTTS ON 14TH July 2021

3. LTI ON 15TH July 2021

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

4. WIPRO ON 15TH July 2021

5. HDFCAMC ON 16TH July 2021

6. L&TFH ON 16TH July 2021

7. HDFCBANK ON 17TH July 2021

8. BAJFINANCE ON 20TH July 2021

FII / DII DATA: -

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

INTRADAY STOCKS: -

1. SHYAMCENT: - As we can see in the Daily chart of SHYAMCENT yesterday a strong

bullish candle was formed which almost moved above a strong level of 10.85 now if it

holds above 11 than further upside will be seen.

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

2. GAYAPROJ: - As we can see in Daily chart of GAYAPROJ yesterday a big bullish

move was visible and also crossed 38 levels has been closed above which is a very

good sign for GAYAPROJ. Now we can expect 48 levels in coming days.

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

3. JMFINANCIAL: - As we can see in JMFINANCIAL Daily chart a clear breakout is visible

above 101 levels and also a strong volume was seen yesterday now on below chart

indicates a strong move which will test 123 levels in coming days.

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

Bank Nifty View

Bank Nifty Index Closed at level of 35668 with change of (-0.01%) yesterday again

35800 acted as a strong resistance to have already mentioned as long as bank nifty

holds below 35800 a strong upside move will be seen and once that levels crossed we

can expect 36500 levels.

Trading Range 35000 to 35850, lower level to buy side.

Index Trend Support Level Resistance level

Bank Nifty Short Term DOWNTREND 35300 – 35400 35800 – 36000

Bank Nifty Long Term DOWNTREND 34900 – 35000 36000 – 37000

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

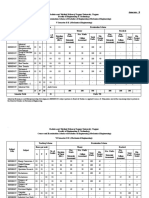

Technical Updates 15.07.2021

Date Name Script Buy/Sell Entry Target Stop Duration Status

Price Loss

15.07.2021 Shyam Cent Buy 11.15 12.45 – 10.50 Positional call

13.20

15.07.2021 Gaya Proj Buy Above 42 – 48 35 Positional

38

15.07.2021 Jm Financial Buy 104 115 – 98 Positional

123

14.07.2021 HDFC Bank Buy 1500 + 1550 1480 Positional HOT

13.07.2021 Gujalkali Buy 460 490 – 451 Positional

505

13.07.2021 AsterDM Sell 164 171 – 156 Intra day

176

14.07.2021 JaiCorp Buy 165 175 – 160 Positional call

179

14.07.2021 MindaCorp Buy 136 142 – 130 Positional

145

14.07.2021 PenInd Buy 35 37 – 40 32 Positional

Future Calls

Date Script Name Calls Details

15.07.2021 Nifty Future Buy on decline at 15810-15820 stop loss 15750 target

15900 +

15.07.2021 Bank Nifty Buy around 35500 + stop loss 35300 target 35900

36000

Option Trading:

Nifty is one of the best underlines for Option Trading.

Bank Nifty – Option Trading – It is Wild Animal – will never control.

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

Nifty Option Trading - Earn regular 2 to 5 percent per month as trade

with lending business, instead of Speculation. (More details calls)

All options traders are advised to trade with small capital on

Wednesday and Thursday. (Rs. 25000 to 50000)

Risk Reward Ratio likely 1: 9

Date Scrip Call/Put Buy/Sell

Name

15.07.2021 Nifty Buy Sell 15900 call at 20-25 stop loss 33 target 1

15.07.2021 Nifty Expiry Sell 35800 call at 90-100 stop loss 200 trget 10

Strategy Sell 36000 call at 70 stop loss 110 target 5

Intraday Daily Bank Nifty Option strategy

Buy Weekly expiry call and put whereas premium 4 to 5

Sell Call and put whereas premium 20-25 range stop loss 2 times i.e. 50 points

Stop loss in system not in mind.

Maintain trailing stop loss after 1.30 pm

Square up position at 3.15 pm.

Back Tested Strategy – Success Ratio 75 %

Daily trading Strategy.

Past Performance

Date Name Script Buy/S Entry Target Stop Duration Status

ell Price s Loss

24.06.2021 TWL BUY 64 67 – 70 62 Intraday + Book Profit

Positional

22.06.2021 SYNGENE BUY 580 591 – 570 Intraday + Book Profit

600 Positional

25.06.2021 KRBL BUY 254 260 – 246 Intraday + Book Profit

270 Positional

25.06.2021 Bajaj Fin Buy 6060 6150 6000 Intra day Book Profit

25.06.2021 IBREALEST BUY Above 130 – 121 Intraday + NOT

125 135 Positional ACTIVATED

23.06.2021 Ashok Leyland BUY 118 125 115 Two to Book Profit

three days

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

30.06.2021 HUL Buy 2500 2540- 2475 Intraday + Stop Loss

2570 Positional

30.06.2021 Power Grid Sell 240 235- 244 Intra day NOT

231 ACTIVATED

30.06.2021 TWL BUY 73 77 70 Intraday + Stop Loss

Positional

01.07.2021 Apex BUY Above 309 – 285 Intraday + Book Profit

290 315 Positional

01.07.2021 Escorts Buy 1200 1300 1170 Positional Not Activated

call

01.07.2021 Genuspower BUY 67 70 – 73 63 Intraday + Closed at 66

Positional

01.07.2021 Exideind Sell Below 175 – 183 Intraday + Not Activated

180 170 Positional

30.06.2021 IGL BUY 545 575 540 Intraday + BOOK

Positional PROFIT

30.06.2021 SEQUENT BUY 315 340 308 Intraday + Stop Loss

Positional

30.06.2021 Dr Readdy Buy 5400 5500- 5300 Positional BOOK

5600 PROFIT

02.07.2021 TIRUMALCH Buy 150 158 – 145 Positional Not Activated

M 163 call

02.07.2021 DABUR Buy 585 597 575 Positional Exit At 590

call

02.07.2021 NOCIL Buy 223 230 – 218 Intra day Not Activated

235

01.07.2021 Lal Path Buy 3260 3350 3200 Intra + Posi. Book Profit

23.06.2021 SBILIFE BUY 1011 1030 – 1005 Intraday + Stop Loss

1045 Positional

25.06.2021 TCS BUY 3345 3411 – 3310 Intraday + Book Profit

3440 Positional

07.07.2021 HAL Buy 1110 1140 – 1061 Positional BOOK

1180 call PROFIT

07.07.2021 Indus Bank Buy 1025 1050 1000 Intra Day BOOK

PROFIT

07.07.2021 Kotak Bank Buy 1745 1770 1730 INTRADAY BOOK

PROFIT

07.07.2021 Mangalam Buy 166 173 – 160 Positional BOOK

179 call PROFIT

07.07.2021 HDFCBANK Buy 1523 1551 1507 Positional Not Activated

call

06.07.2021 MHRIL Buy Above 293 – 274 Positional BOOK

280 300 call PROFIT

06.07.2021 Bajaj Fin Buy 6100 6250 6050 Intra day BOOK

PROFIT

06.07.2021 Infosys Buy 1591 1620 1575 Not Activated

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

06.07.2021 Gujalkali Buy Above 470 – 435 Positional Stop Loss

450 500 call

05.07.2021 INDOCO Buy 461 500 450 Positional Stop Loss

call

05.07.2021 Jyothlab Buy 166 172 – 162 Intra day BOOK

176 PROFIT

01.07.2021 Kotak Bank Buy 1700 1750 1690 Intra day BOOK

PROFIT

09.07.2021 JUSTDIAL Buy 1055 1109 1040 Positional BOOK

call PROFIT

09.07.2021 Tata Steel Buy 1170 1200=1 1150 Positional Not Activated

220

09.07.2021 Tata Motor Sell 313 305 316 Intra day Not activated

05.07.2021 Welspunind Buy Above 115 – 97 Positional Book Profit

105 130 call

13.07.2021 Shilamed Buy 590 620 – 575 Positional Not Activated

636 call

09.07.2021 GABRIAL Buy 126 130 – 122 Intra Day Book Profit

135

13.07.2021 HDFC Buy 2485 2550 2450 Heavy BOOK

Delivery PROFIT

seen

13.07.2021 Shila med Buy 590 620 – 575 Positional Exit

636 call

13.07.2021 Kitex Garm Buy 165 200 130 Positional Book Profit

Long Term Portfolio:

Invest Rs. 1 Lacs + become a 1 Crore in next 20 years +

Invest Rs. 1 Lacs in Mutual Fund for 50 years become 50 crores +

Laksh Jain

Independent Research Analyst

CMT Candidate

This is for Educational Purpose

Only and trade accordingly

Ph & WhatsApp: - 8962532207---7067688818

Note:

1. In trading follow 2% Rule of your capital in any trade. i.e., if you have a capital of Rs. 1

Lacs so your stop loss will come only Rs. 2 percent i.e., Rs. 2000/- only

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

2. Trade accordingly your risk appetite.

3. Before good trading, time to invest in Learning. First Learn than earn instead of first lose

money and thereafter learn how to stop losses thereafter how to Earn from the market.

4. Always follow stop loss order and two trade simultaneously i.e. if buy side also, stop loss

order also punch in system and vice versa.

5. If your loss in one trade, do no afraid and trade again in double qty, if loss have a

confidence and again trade with 4 times qty on intraday basis with confidence only.

6. Trade with confidence and conviction and do not afraid in the market.

7. Above calls and guidance are only for education purposes only and trade accordingly, no

one responsible of your trade.

8. Stock Market is a GAME of SYSTAMATIC Money Transfer from Indiscipline Traders to

Discipline Traders.

9. If you are traders, do not trade without stop loss and stop loss should be in system (not

in mind) and both the order should be punch simultaneously.

Laksh Jain | ONLY FOR EDUCATIONAL PURPOSE & TRADE ACCORDINGLY.

You might also like

- WeeklyTechnicalPicks 05august2022Document9 pagesWeeklyTechnicalPicks 05august2022AJayNo ratings yet

- MOStMarketOutlook19thMarch2024Document10 pagesMOStMarketOutlook19thMarch2024Sandeep JaiswalNo ratings yet

- MOStMarketOutlook20thMarch2024Document10 pagesMOStMarketOutlook20thMarch2024Sandeep JaiswalNo ratings yet

- MOStMarketOutlook27thMarch2024Document10 pagesMOStMarketOutlook27thMarch2024Sandeep JaiswalNo ratings yet

- Money Trend: CNX Nifty CMP 10761Document4 pagesMoney Trend: CNX Nifty CMP 10761Maruthee SharmaNo ratings yet

- MOStMarketOutlook4thApril2024Document10 pagesMOStMarketOutlook4thApril2024Sandeep JaiswalNo ratings yet

- Axis Top - PicksDocument9 pagesAxis Top - Picksravi kumarNo ratings yet

- MOStMarketOutlook26thMarch2024Document10 pagesMOStMarketOutlook26thMarch2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- Most Market Out Look 27 Th February 24Document12 pagesMost Market Out Look 27 Th February 24Realm PhangchoNo ratings yet

- Daily Technical Report - 28 June 2022 - 27-06-2022 - 22Document5 pagesDaily Technical Report - 28 June 2022 - 27-06-2022 - 22Tejas KothariNo ratings yet

- Money Trend: CNX Nifty CMP 10761Document4 pagesMoney Trend: CNX Nifty CMP 10761Maruthee SharmaNo ratings yet

- Weekly: Join in Our Telegram Channel - T.Me/Equity99Document9 pagesWeekly: Join in Our Telegram Channel - T.Me/Equity99Lingesh SivaNo ratings yet

- Technical Picks for Samvat 2078Document16 pagesTechnical Picks for Samvat 2078Swasthyasudha AyurvedNo ratings yet

- KOTAK Diwali Technical Picks 2021Document16 pagesKOTAK Diwali Technical Picks 2021Aditya MehtaNo ratings yet

- Money Trend: CNX Nifty CMP 10603Document4 pagesMoney Trend: CNX Nifty CMP 10603Maruthee SharmaNo ratings yet

- MOStMarketOutlook1stApril2024Document10 pagesMOStMarketOutlook1stApril2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- Technical & Derivatives: September 2018Document8 pagesTechnical & Derivatives: September 2018VinodNo ratings yet

- Motilal Oswal Diwali Picks 2021Document8 pagesMotilal Oswal Diwali Picks 2021Aditya MehtaNo ratings yet

- Derivatives Weekly View: Positive Bias Remains Intact Till Nifty Holds Above 15900Document13 pagesDerivatives Weekly View: Positive Bias Remains Intact Till Nifty Holds Above 15900Porus Saranjit SinghNo ratings yet

- MOStMarketOutlook21stMarch2024Document10 pagesMOStMarketOutlook21stMarch2024Sandeep JaiswalNo ratings yet

- Sernet Retail Research-Daily 13-02-2024Document13 pagesSernet Retail Research-Daily 13-02-2024Mayank ShahNo ratings yet

- MOSt Market Outlook 14 TH February 2024Document10 pagesMOSt Market Outlook 14 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Weekly Sector Watch-April 01,'24Document14 pagesWeekly Sector Watch-April 01,'24advik porwalNo ratings yet

- Nifty Nearing Crucial Hurdles, Still Better To Take Some Money Off The TableDocument3 pagesNifty Nearing Crucial Hurdles, Still Better To Take Some Money Off The TablebbaalluuNo ratings yet

- Daily Technical Report - 29 March 2022 - 28-03-2022 - 23Document4 pagesDaily Technical Report - 29 March 2022 - 28-03-2022 - 23MkNo ratings yet

- TQU 21st April 2017Document12 pagesTQU 21st April 2017narnoliaNo ratings yet

- Nifty Ends Higher Despite ChecksDocument3 pagesNifty Ends Higher Despite ChecksbbaalluuNo ratings yet

- Money Trend: CNX Nifty CMP 10739Document4 pagesMoney Trend: CNX Nifty CMP 10739Maruthee SharmaNo ratings yet

- MOSt Market Outlook 7 TH February 2024Document10 pagesMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNo ratings yet

- Most Market Outlook: Morning UpdateDocument5 pagesMost Market Outlook: Morning UpdateVinayak ChennuriNo ratings yet

- MOStMarketOutlook2ndApril2024Document10 pagesMOStMarketOutlook2ndApril2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 5 TH February 2024Document10 pagesMOSt Market Outlook 5 TH February 2024Sandeep JaiswalNo ratings yet

- MOStMarketOutlook13thApril2023 PDFDocument10 pagesMOStMarketOutlook13thApril2023 PDFLakhan SharmaNo ratings yet

- Daily Technical Report - 13 July 2022 - 13-07-2022 - 09Document5 pagesDaily Technical Report - 13 July 2022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- MOStMarketOutlook28thMarch2024Document10 pagesMOStMarketOutlook28thMarch2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- Money Trend: CNX Nifty CMP 10602Document4 pagesMoney Trend: CNX Nifty CMP 10602Maruthee SharmaNo ratings yet

- Nifty and Bank Nifty trend analysisDocument4 pagesNifty and Bank Nifty trend analysisMaruthee SharmaNo ratings yet

- Technical and Derivatives Review |July 18, 2020Document3 pagesTechnical and Derivatives Review |July 18, 2020bbaalluuNo ratings yet

- 9th Nov, 2023Document11 pages9th Nov, 2023Pushpendra KushwahaNo ratings yet

- MOStMarketOutlook3rdApril2024Document10 pagesMOStMarketOutlook3rdApril2024Sandeep JaiswalNo ratings yet

- Indsec Daily Technical Report For 27th May 2011Document2 pagesIndsec Daily Technical Report For 27th May 2011Hima DaniNo ratings yet

- Technical Weekly Picks - 01 JUN 2020 - 01-06-2020 - 09Document7 pagesTechnical Weekly Picks - 01 JUN 2020 - 01-06-2020 - 09NehaKarunyaNo ratings yet

- Money Trend: CNX Nifty CMP 10431Document4 pagesMoney Trend: CNX Nifty CMP 10431Maruthee SharmaNo ratings yet

- Morning Market Outlook and Investment IdeasDocument10 pagesMorning Market Outlook and Investment IdeasLakhan SharmaNo ratings yet

- MOSt Market Outlook 16 TH May 2023Document10 pagesMOSt Market Outlook 16 TH May 2023Smit ParekhNo ratings yet

- Market Morning 00412 25-05-2021Document3 pagesMarket Morning 00412 25-05-2021Dhiren DesaiNo ratings yet

- TQR 13th FebruaryDocument10 pagesTQR 13th FebruarynarnoliaNo ratings yet

- Deepak Nitrite Is FallingDocument83 pagesDeepak Nitrite Is FallingPankaj SharmaNo ratings yet

- Capstocks (Daily Reports) 14 Mar 2024Document13 pagesCapstocks (Daily Reports) 14 Mar 2024Sashil ReddyNo ratings yet

- MOSt Market Outlook 15 TH February 2024Document10 pagesMOSt Market Outlook 15 TH February 2024Sandeep JaiswalNo ratings yet

- MOStMarketOutlook4thMay2023 PDFDocument10 pagesMOStMarketOutlook4thMay2023 PDFLakhan SharmaNo ratings yet

- SSJ Diwali Picks - 2023Document20 pagesSSJ Diwali Picks - 2023Jignesh MistryNo ratings yet

- MOSt Market Outlook 24 TH March 2023Document10 pagesMOSt Market Outlook 24 TH March 2023Hola GamerNo ratings yet

- WeeklyTechnicalPicks 01092023Document9 pagesWeeklyTechnicalPicks 01092023Debabrata DasNo ratings yet

- Weekly market outlook and recommendations from ICICI SecuritiesDocument14 pagesWeekly market outlook and recommendations from ICICI SecuritiesRaya DuraiNo ratings yet

- Best Intraday Strategy For Beginners - : 1. Basic KnowledgeDocument3 pagesBest Intraday Strategy For Beginners - : 1. Basic KnowledgeDharmesh MistryNo ratings yet

- BSNL Receipt - 888904243339Document1 pageBSNL Receipt - 888904243339Dharmesh MistryNo ratings yet

- BSNL Receipt - 888900823117Document1 pageBSNL Receipt - 888900823117Dharmesh MistryNo ratings yet

- Mxkufðuð: Elðumx (UlxmkDocument8 pagesMxkufðuð: Elðumx (UlxmkDharmesh MistryNo ratings yet

- Financial Weekly Published in English & GujaratiDocument53 pagesFinancial Weekly Published in English & GujaratiDevashish SahasrabudheNo ratings yet

- PrintReceipt BSNL 19 Feb 2015Document1 pagePrintReceipt BSNL 19 Feb 2015GirishNairNo ratings yet

- PrintReceipt BSNL 19 Feb 2015Document1 pagePrintReceipt BSNL 19 Feb 2015GirishNairNo ratings yet

- BSNL Payment Receipt Rs. 128 SuccessfulDocument1 pageBSNL Payment Receipt Rs. 128 SuccessfulDharmesh MistryNo ratings yet

- Shoe Rack 1 - 2Document1 pageShoe Rack 1 - 2Dharmesh MistryNo ratings yet

- Summer Camp Students: Football Cookery Tennise Vollyball Basketball CricketDocument2 pagesSummer Camp Students: Football Cookery Tennise Vollyball Basketball CricketDharmesh MistryNo ratings yet

- GenGS InteriorDesignPicturesDocument24 pagesGenGS InteriorDesignPicturesDharmesh MistryNo ratings yet

- Summer Camp Students: Football Cookery Tennise Vollyball Basketball CricketDocument2 pagesSummer Camp Students: Football Cookery Tennise Vollyball Basketball CricketDharmesh MistryNo ratings yet

- PrintReceipt BSNL 19 Feb 2015Document1 pagePrintReceipt BSNL 19 Feb 2015GirishNairNo ratings yet

- BSNL Receipt 881605221167044Document1 pageBSNL Receipt 881605221167044Dharmesh MistryNo ratings yet

- Amardadam AshtakDocument1 pageAmardadam AshtakDharmesh Mistry100% (1)

- BSNL Receipt 11-10-2015Document1 pageBSNL Receipt 11-10-2015Dharmesh MistryNo ratings yet

- Balkuver Ashtak EnglishDocument1 pageBalkuver Ashtak EnglishDharmesh Mistry100% (1)

- TicketDocument2 pagesTicketDharmesh MistryNo ratings yet

- TestDocument1 pageTestRobincrusoeNo ratings yet

- Evening UpasanaDocument8 pagesEvening UpasanaDharmesh Mistry50% (2)

- TestDocument1 pageTestRobincrusoeNo ratings yet

- Salt Water Battery Science Project GuideDocument3 pagesSalt Water Battery Science Project GuideDharmesh MistryNo ratings yet

- Science Project 2014-15: On Salt Water BatteryDocument3 pagesScience Project 2014-15: On Salt Water BatteryDharmesh MistryNo ratings yet

- Science Project 2014-15Document4 pagesScience Project 2014-15Dharmesh MistryNo ratings yet

- Science Project 2014-15Document2 pagesScience Project 2014-15Dharmesh MistryNo ratings yet

- Science Project 2014-15: Divine Public SchoolDocument4 pagesScience Project 2014-15: Divine Public SchoolDharmesh MistryNo ratings yet

- Iso Neo Sec TertDocument1 pageIso Neo Sec TertDharmesh MistryNo ratings yet

- Cover Page DMDocument4 pagesCover Page DMDharmesh MistryNo ratings yet

- Divine Public School 2014-15 Science Project on Salt Water BatteryDocument4 pagesDivine Public School 2014-15 Science Project on Salt Water BatteryDharmesh MistryNo ratings yet

- Title Page - Super King Air C90CGTi FusionDocument2 pagesTitle Page - Super King Air C90CGTi Fusionsergio0% (1)

- 4 - ASR9K XR Intro Routing and RPL PDFDocument42 pages4 - ASR9K XR Intro Routing and RPL PDFhem777No ratings yet

- RELATED STUDIES AND LITERATURE ON EGGSHELL POWDER USE IN CONCRETEDocument5 pagesRELATED STUDIES AND LITERATURE ON EGGSHELL POWDER USE IN CONCRETEReiBañez100% (2)

- MB1 - The Australian Economy PA 7092016Document8 pagesMB1 - The Australian Economy PA 7092016ninja980117No ratings yet

- Nevada Reports 1882-1883 (17 Nev.) PDFDocument334 pagesNevada Reports 1882-1883 (17 Nev.) PDFthadzigsNo ratings yet

- No or Islamic Bank OurStory EnglishDocument45 pagesNo or Islamic Bank OurStory EnglishTalib ZaidiNo ratings yet

- Ssnt Question BankDocument32 pagesSsnt Question Bankhowise9476No ratings yet

- EN - Ultrasonic Sensor Spec SheetDocument1 pageEN - Ultrasonic Sensor Spec Sheettito_matrixNo ratings yet

- Thermodynamics d201Document185 pagesThermodynamics d201Rentu PhiliposeNo ratings yet

- Kami Export - Exercise Lab - Mini-2Document3 pagesKami Export - Exercise Lab - Mini-2Ryan FungNo ratings yet

- Standards in Nursing Education ProgrammeDocument13 pagesStandards in Nursing Education ProgrammeSupriya chhetryNo ratings yet

- Anand FDocument76 pagesAnand FSunil BharadwajNo ratings yet

- Cis Bin Haider GRP LTD - HSBC BankDocument5 pagesCis Bin Haider GRP LTD - HSBC BankEllerNo ratings yet

- People V VillanuevaDocument2 pagesPeople V VillanuevaLavernaNo ratings yet

- 20-Sdms-02 (Overhead Line Accessories) Rev01Document15 pages20-Sdms-02 (Overhead Line Accessories) Rev01Haytham BafoNo ratings yet

- 2003 June Calc Paper 6 (H)Document20 pages2003 June Calc Paper 6 (H)abbasfazilNo ratings yet

- Kathmandu University: Q.No. Marks Obtained Q.No. Marks Ob-Tained 1. 6. 2. 7. 3. 8. 4. 9. 5. 10Document12 pagesKathmandu University: Q.No. Marks Obtained Q.No. Marks Ob-Tained 1. 6. 2. 7. 3. 8. 4. 9. 5. 10Snehaja RL ThapaNo ratings yet

- JohnsonJohnson 2006 PDFDocument84 pagesJohnsonJohnson 2006 PDFakfar b417No ratings yet

- ClassifiedrecordsDocument23 pagesClassifiedrecordsChetana SJadigerNo ratings yet

- Mechanical Engineering Semester SchemeDocument35 pagesMechanical Engineering Semester Schemesantvan jagtapNo ratings yet

- ACL Reconstruction BookDocument18 pagesACL Reconstruction BookSergejs JaunzemsNo ratings yet

- RAN15.0 Feature ListDocument34 pagesRAN15.0 Feature ListmyososNo ratings yet

- Tax2win's Growth Strategy Through Comprehensive Tax SolutionsDocument6 pagesTax2win's Growth Strategy Through Comprehensive Tax SolutionsAhmar AyubNo ratings yet

- Execution and Documentation Requirements For Life Cycle Cost AnalysesDocument20 pagesExecution and Documentation Requirements For Life Cycle Cost AnalysessmetNo ratings yet

- Key Benefits of Cloud-Based Internet of Vehicle (IoV) - Enabled Fleet Weight Management SystemDocument5 pagesKey Benefits of Cloud-Based Internet of Vehicle (IoV) - Enabled Fleet Weight Management SystemVelumani sNo ratings yet

- The Role of Business in Social and Economic Development Chapter 1Document18 pagesThe Role of Business in Social and Economic Development Chapter 1Emil EscasinasNo ratings yet

- Pantangco DigestDocument2 pagesPantangco DigestChristine ZaldivarNo ratings yet

- Order From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedDocument9 pagesOrder From U.S. Disctrict Judge Jesus G. Bernal To Chino Valley UnifiedBeau YarbroughNo ratings yet

- JBNBNBNBNBNBDocument4 pagesJBNBNBNBNBNBmaheshNo ratings yet

- Strengthening RC Structures with Steel Plate Bonding MethodsDocument29 pagesStrengthening RC Structures with Steel Plate Bonding MethodsSiti Rohani Isdris100% (1)