Professional Documents

Culture Documents

Local Government Taxation Short Cases Explained

Uploaded by

Richard Rhamil Carganillo Garcia Jr.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Local Government Taxation Short Cases Explained

Uploaded by

Richard Rhamil Carganillo Garcia Jr.Copyright:

Available Formats

Local Government Taxation Short Cases

1. Congress, after much public hearing and consultations with various sectors of society, came to the

conclusion that it will be good for the country to have only one system of taxation by centralizing the

imposition and collection of all taxes in the national government. Accordingly, it is thinking of passing a

law that would abolish the taxing power of all local government units. In your opinion, would such a law

be valid under the present Constitution? Explain your answer. (5 points)

- No. Changing the current tax system and policy into one system of taxation by centralizing the

imposition and collection of all taxes in the national government is not an efficient move. Because the

national government needed subsidiaries or subsystems like local government to make the tax system be

organized and the process of tax imposition and collection will be easier and it will not be mix-up.

2. In order to raise revenue for the repair and maintenance of the newly constructed City Hall of Makati,

the City Mayor ordered the collection of P1.00, called “elevator tax", every time a person rides any of the

high-tech elevators in the city hall during the hours of 8:00 a.m. to 10:00 a.m. and 4:00 p.m. to 6:00 p.m.

Is the “elevator tax" a valid imposition? Explain. (5 points)

- The imposition of “Elevator Tax” is not valid. Because City Mayors has no power to imposed taxes.

Thus, tax imposition in city or municipality shall exercise by the local legislative council called

“Sanggunian” which is the one who is responsible for tax imposition.

3. Mr. Fermin, a resident of Quezon City, is a Certified Public Accountant- Lawyer engaged in the

Practice of his two professions. He has his main office in Makati City and maintains a branch office in

Pasig City. Mr. Fermin pays his professional tax as a CPA in Makati City and his professional tax as a

lawyer in Pasig City. May Makati City, where he has his main office, require him to pay his professional

tax as a lawyer? Explain. (5 points)

- No. Mr Fermin has given the option where to pay his professional tax as a lawyer. It is either where he

practice his profession or where his principal office is located. May Quezon City, where he has his

residence and where he also practices his two professions, go after him for the payment of his

professional tax as a CPA and a lawyer? Explain. (5 points)- No. The City of Quezon has no right to

mandate and has no privilege to collect for his professional tax. Because Mr Fermin’s professional taxes

shall only be paid in the city where he practices his profession or where he maintain his principal office.

Question City is not the proper situs for Mr Fermin to pay his professional taxes.

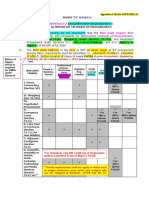

4. Ferremaro, Inc., a manufacturer of handcrafted shoes, maintains its principal office in Cubao, Quezon

City. It has branches/sales offices in Cebu and Davao. Its factory is located in Marikina City where most

of its workers live. Its principal office in Quezon City is also a sales office. Sales of finished products for

calendar year 2009 in the amount of P10 million were made at the following locations: Cebu branch 25%

Davao branch 15% Quezon City branch 60% Total 100% Where should the applicable local taxes on the

shoes be paid? Explain. (5 points)

- It is applicable to pay the local taxes and record the sale in the city or municipality where the branch or

sales office is located. Since Ferremaro, Inc. maintains one factory, the sale shall be recorded in the

principal office. The 25% of the sales shall be taxed in Cebu branch and the 15% of the sales shall be

taxed in Davao branch. The remaining 60% shall be recorded in the principal office. Whereas, the 30% of

the 60% remaining sales is taxable where the principal office is located and the 70% of the 60%

remaining sales is taxable where the factory is located

You might also like

- Quiz4-Responsibilityacctg TP BalscoreDocument5 pagesQuiz4-Responsibilityacctg TP BalscoreRambell John RodriguezNo ratings yet

- Master Budget Case Study for Earrings UnlimitedDocument2 pagesMaster Budget Case Study for Earrings UnlimitedCindy Tran20% (5)

- DLSL CPA Board Operation - Business LawDocument12 pagesDLSL CPA Board Operation - Business LawPrincessAngelaDeLeonNo ratings yet

- AMPOONDocument28 pagesAMPOONMelanie AmpoonNo ratings yet

- Income Taxation GuideDocument543 pagesIncome Taxation Guidemae annNo ratings yet

- LCRC Calamba Review Center Audit ProceduresDocument4 pagesLCRC Calamba Review Center Audit ProceduresjeromyNo ratings yet

- Conditions foreign CPAs practice accountancy PhilippinesDocument3 pagesConditions foreign CPAs practice accountancy PhilippinesANGELU RANE BAGARES INTOLNo ratings yet

- (Tax) CPAR PreweekDocument4 pages(Tax) CPAR PreweekNor-janisah PundaodayaNo ratings yet

- Regulatory Framework For Business TransactionsDocument13 pagesRegulatory Framework For Business TransactionsNash VelisanoNo ratings yet

- CPA review school Philippines tax questionsDocument9 pagesCPA review school Philippines tax questionsNah HamzaNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- Mastery in Management Advisory ServicesDocument12 pagesMastery in Management Advisory ServicesPrincess Claris Araucto0% (1)

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Document85 pagesAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- Threats To Compliance With The Fundamental PrinciplesDocument5 pagesThreats To Compliance With The Fundamental PrinciplesAbigail SubaNo ratings yet

- TAX - 001 - MC Questions - For PostingDocument5 pagesTAX - 001 - MC Questions - For PostingAnonymous YtNo ratings yet

- Fria QuizDocument2 pagesFria QuizdavidgollaNo ratings yet

- Philippine Christian University Income Taxation QuizDocument4 pagesPhilippine Christian University Income Taxation QuizRenalyn ParasNo ratings yet

- True or False Chapter 4 and 5 QuestionsDocument2 pagesTrue or False Chapter 4 and 5 Questionswaiting4y100% (1)

- RFBT 34new-3Document1 pageRFBT 34new-3CPANo ratings yet

- 68125672575bdf96fc857f403531f1c9-copyDocument9 pages68125672575bdf96fc857f403531f1c9-copyyour unreal0% (1)

- CTDI Final Pre-Board Special Laws Only PDFDocument4 pagesCTDI Final Pre-Board Special Laws Only PDFPatricia Marie MercaderNo ratings yet

- CorporationDocument6 pagesCorporationJane TuazonNo ratings yet

- CMA Exam Review - Part 2 AssessmentDocument66 pagesCMA Exam Review - Part 2 AssessmentAlyssa PilapilNo ratings yet

- FINALS - Theory of AccountsDocument8 pagesFINALS - Theory of AccountsAngela ViernesNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankDAN NGUYEN THE100% (1)

- ToaDocument5 pagesToaGelyn CruzNo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- MODADV3 Handouts 1 of 2Document23 pagesMODADV3 Handouts 1 of 2Dennis ChuaNo ratings yet

- Chapter 19Document9 pagesChapter 19Marc Siblag IIINo ratings yet

- Chapter On CVP 2015 - Acc 2Document16 pagesChapter On CVP 2015 - Acc 2nur aqilah ridzuanNo ratings yet

- 10 X08 BudgetingDocument13 pages10 X08 Budgetingjenna hannahNo ratings yet

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- FAR 2 Finals Cheat SheetDocument8 pagesFAR 2 Finals Cheat SheetILOVE MATURED FANSNo ratings yet

- Ch03 MCDocument117 pagesCh03 MCRock RoseNo ratings yet

- Solution Chapter 12Document19 pagesSolution Chapter 12ClarisaJoy SyNo ratings yet

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

- Notes in Preferential TaxationDocument57 pagesNotes in Preferential TaxationJeremae Ann Ceriaco100% (1)

- Management Accounting Information For Activity and Process DecisionsDocument30 pagesManagement Accounting Information For Activity and Process DecisionsCarmelie CumigadNo ratings yet

- COST ACCOUNTING STANDARDS AND METHODSDocument35 pagesCOST ACCOUNTING STANDARDS AND METHODSDea Lyn Bacula100% (1)

- BL AnswerKeyDocument4 pagesBL AnswerKeyRosalie E. BalhagNo ratings yet

- Finals Handout TaxDocument3 pagesFinals Handout TaxFlorenz AmbasNo ratings yet

- BLT 2012 Final Pre-Board April 21Document17 pagesBLT 2012 Final Pre-Board April 21Lester AguinaldoNo ratings yet

- Sales Agency Accounting SystemDocument1 pageSales Agency Accounting Systemalmira garciaNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Donor's TaxDocument25 pagesDonor's TaxMark Erick Acojido RetonelNo ratings yet

- SALES (Answer Key)Document2 pagesSALES (Answer Key)Vannesa Ronquillo Compasivo100% (1)

- Taxation - Fisrt Pre-Board - 2016NDocument11 pagesTaxation - Fisrt Pre-Board - 2016NKenneth Bryan Tegerero Tegio100% (2)

- REGULATORY FRAMEWORK MCQDocument17 pagesREGULATORY FRAMEWORK MCQabcdefgNo ratings yet

- To Manage Financial Risk: Purpose of A DerivativeDocument4 pagesTo Manage Financial Risk: Purpose of A DerivativeVillaruz Shereen MaeNo ratings yet

- AC19 MODULE 5 - UpdatedDocument14 pagesAC19 MODULE 5 - UpdatedMaricar PinedaNo ratings yet

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsHazel Joy GaboNo ratings yet

- Tax Breaks for SeniorsDocument10 pagesTax Breaks for SeniorsAlex OngNo ratings yet

- Mockboard (Mas)Document3 pagesMockboard (Mas)Nezhreen MaruhomNo ratings yet

- MAS Quiz 3Document3 pagesMAS Quiz 3Zyrelle DelgadoNo ratings yet

- Consolidated Net Income and NCII CaseDocument9 pagesConsolidated Net Income and NCII CaseJeth MahusayNo ratings yet

- AT-07 (FS Audit Process - Audit Planning)Document4 pagesAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNo ratings yet

- Cpa Review School of The Philippines: ManilaDocument24 pagesCpa Review School of The Philippines: ManilaRalph Joshua JavierNo ratings yet

- The Level of Literacy Rate and Tax Education Both Are Different in The Case of Small Cities and TownsDocument4 pagesThe Level of Literacy Rate and Tax Education Both Are Different in The Case of Small Cities and TownsshabywarriachNo ratings yet

- Finalstax1samplex 20 21Document16 pagesFinalstax1samplex 20 21Abigael SeverinoNo ratings yet

- Reporting and analytics overview for QuickBooks OnlineDocument6 pagesReporting and analytics overview for QuickBooks OnlineRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Manage clients and work in one placeDocument9 pagesManage clients and work in one placeRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Special Client Onboarding TasksDocument11 pagesSpecial Client Onboarding TasksRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Onboarding Workflow: The Story So FarDocument12 pagesOnboarding Workflow: The Story So FarRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Banking and ToolsDocument10 pagesBanking and ToolsRichard Rhamil Carganillo Garcia Jr.0% (1)

- Fast-track month-end close with QuickBooks OnlineDocument7 pagesFast-track month-end close with QuickBooks OnlineRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Christian P. Gavina Tax Assessment DeadlinesDocument5 pagesChristian P. Gavina Tax Assessment DeadlinesRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Research Design:: D. Proposed MethodologyDocument2 pagesResearch Design:: D. Proposed MethodologyRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Supporting Your Small Business ClientsDocument13 pagesSupporting Your Small Business ClientsRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Fs RatiosDocument1 pageFs RatiosRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Suggested QuestionnaireDocument2 pagesSuggested QuestionnaireRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Fs RatiosDocument1 pageFs RatiosRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Order Entered Diskettes Copied Invoice SentDocument2 pagesOrder Entered Diskettes Copied Invoice SentRichard Rhamil Carganillo Garcia Jr.No ratings yet

- AE119 Group-2Document7 pagesAE119 Group-2Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Research Design:: D. Proposed MethodologyDocument2 pagesResearch Design:: D. Proposed MethodologyRichard Rhamil Carganillo Garcia Jr.No ratings yet

- 'ElectivesDocument2 pages'ElectivesRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Contribution of Nursing TheoristDocument9 pagesContribution of Nursing TheoristRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Marketing StrategiesDocument1 pageMarketing StrategiesRichard Rhamil Carganillo Garcia Jr.No ratings yet

- MARKETING STUDY EditedDocument48 pagesMARKETING STUDY EditedRichard Rhamil Carganillo Garcia Jr.No ratings yet

- WorldCom ScandalDocument1 pageWorldCom ScandalRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Grow PH: We Build A Better Future With YouDocument24 pagesGrow PH: We Build A Better Future With YouRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Law On Partnership and Corporation by Hector de LeonDocument113 pagesLaw On Partnership and Corporation by Hector de LeonShiela Marie Vics75% (12)

- SampleDocument5 pagesSampleJolina AynganNo ratings yet

- General Ledger TemplateDocument1 pageGeneral Ledger TemplateRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Types of IndustriesDocument6 pagesTypes of IndustriesRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Employee EngagementDocument75 pagesEmployee EngagementDurgesh Agrawal88% (25)

- 2019 - Sample Articles of Incorporation Natural PersonDocument3 pages2019 - Sample Articles of Incorporation Natural PersonRichard Rhamil Carganillo Garcia Jr.No ratings yet

- 26 - KantDocument3 pages26 - KantRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Reflecting on an ABM Immersion ActivityDocument2 pagesReflecting on an ABM Immersion ActivityRichard Rhamil Carganillo Garcia Jr.No ratings yet

- City of Cleveland Shaker Square Housing ComplaintDocument99 pagesCity of Cleveland Shaker Square Housing ComplaintWKYC.comNo ratings yet

- Service Request For Quotation: M/S: - PO. Box: - Postal CodeDocument6 pagesService Request For Quotation: M/S: - PO. Box: - Postal CodeMirsoNo ratings yet

- AsterDM Annual Report FY 2019-20Document280 pagesAsterDM Annual Report FY 2019-20Jayaprakash MuthuvatNo ratings yet

- Process Costing Example for Lakeland ChemicalDocument233 pagesProcess Costing Example for Lakeland ChemicalAishwarya Raju0% (1)

- Tax ReturnDocument16 pagesTax ReturnHasan MahmoodNo ratings yet

- LangfieldSmith7e PPT Ch13Document33 pagesLangfieldSmith7e PPT Ch13Bành Đức HảiNo ratings yet

- Seminar 2 Presentation QuestionsDocument17 pagesSeminar 2 Presentation QuestionsJennifer YoshuaraNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableRoka Unichu CamachoNo ratings yet

- Financial Distress Thesis-1Document80 pagesFinancial Distress Thesis-1Asaminew DesalegnNo ratings yet

- Case StudyDocument5 pagesCase StudyTrân LêNo ratings yet

- Handbook - Intellectual Capital ManagementDocument62 pagesHandbook - Intellectual Capital ManagementKarmen JelcicNo ratings yet

- Applied Economics Module 1Document23 pagesApplied Economics Module 1Sachi UncianoNo ratings yet

- Multistate Complaint PRC 1Document44 pagesMultistate Complaint PRC 1Michael JamesNo ratings yet

- Annex "H" Documentary Requirement Alternative Methods of ProcurementDocument2 pagesAnnex "H" Documentary Requirement Alternative Methods of ProcurementAdonis BarraquiasNo ratings yet

- Wood Chipper Machinery Proforma InvoiceDocument2 pagesWood Chipper Machinery Proforma InvoiceAlvaro Espino RodriguezNo ratings yet

- 10 Point Socioeconomic Agenda of Duterte AdministrationDocument5 pages10 Point Socioeconomic Agenda of Duterte AdministrationGlaiza Cabahug ImbuidoNo ratings yet

- Calculating Enterprise ValueDocument8 pagesCalculating Enterprise ValueMerleNo ratings yet

- Zenith Steel BrochureDocument4 pagesZenith Steel BrochurefebousNo ratings yet

- Fundamentals of Marketing Chapter 5Document6 pagesFundamentals of Marketing Chapter 5Tracy Mason MediaNo ratings yet

- Fm-Ii Assignment Fm-Ii Assignment: Neha Singh Neha SinghDocument62 pagesFm-Ii Assignment Fm-Ii Assignment: Neha Singh Neha SinghNeha SinghNo ratings yet

- PA Induction Ready ReckonerDocument173 pagesPA Induction Ready Reckonersushant guptaNo ratings yet

- BUDGETING - Exercises: UnitsDocument2 pagesBUDGETING - Exercises: UnitsLeo Sandy Ambe CuisNo ratings yet

- Sex Toys Market - NewDocument9 pagesSex Toys Market - NewPrasun RaiNo ratings yet

- BATA Blackbook AkshitDocument76 pagesBATA Blackbook AkshitKhan YasinNo ratings yet

- EXXONMOBIL Strategic Marketing PlanDocument19 pagesEXXONMOBIL Strategic Marketing PlanSaad MalikNo ratings yet

- A Study On Responsibility Accounts On StakeholdersDocument6 pagesA Study On Responsibility Accounts On StakeholdersresearchparksNo ratings yet

- Muller PhippsDocument2 pagesMuller PhippsIqra SameerNo ratings yet

- SIP FileDocument62 pagesSIP FileswetaNo ratings yet

- Sajjan Precision Castings: Terms & ConditionsDocument1 pageSajjan Precision Castings: Terms & ConditionsHarpal SinghNo ratings yet

- Legal Chart Prabhu231082010Document18 pagesLegal Chart Prabhu231082010vakilarunNo ratings yet