Professional Documents

Culture Documents

Module 5 - Prob 6 Valuation and Concepts Answer

Uploaded by

venice cambry0 ratings0% found this document useful (0 votes)

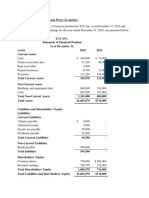

62 views1 pageThis document provides financial statements for Isaiah Company and its subsidiary Ezekiel Company for the year ended December 31, 2020. The consolidated statement of comprehensive income shows revenues of $180,000, net income of $60,000, and net income attributable to the parent company of $71,200. The consolidated statement of financial position indicates total assets of $480,000, total liabilities of $103,000, and shareholders' equity of $377,000, including non-controlling interest of $20,800.

Original Description:

valuation and concepts module 5 problem 6 answers

Original Title

MODULE 5 - PROB 6 VALUATION AND CONCEPTS ANSWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial statements for Isaiah Company and its subsidiary Ezekiel Company for the year ended December 31, 2020. The consolidated statement of comprehensive income shows revenues of $180,000, net income of $60,000, and net income attributable to the parent company of $71,200. The consolidated statement of financial position indicates total assets of $480,000, total liabilities of $103,000, and shareholders' equity of $377,000, including non-controlling interest of $20,800.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

62 views1 pageModule 5 - Prob 6 Valuation and Concepts Answer

Uploaded by

venice cambryThis document provides financial statements for Isaiah Company and its subsidiary Ezekiel Company for the year ended December 31, 2020. The consolidated statement of comprehensive income shows revenues of $180,000, net income of $60,000, and net income attributable to the parent company of $71,200. The consolidated statement of financial position indicates total assets of $480,000, total liabilities of $103,000, and shareholders' equity of $377,000, including non-controlling interest of $20,800.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

MODULE 5: SPECIAL TOPICS ON BUSINESS COMBINATION AND CONSOLIDATION

Problem 6 (Equity Method)

Prepare the summary of the December 31, 2020 Consolidated Financial Statements.

Consideration transferred 75,000

NCI 18,000

Fair Value of Net Assets (90,000)

Goodwill 3,000

Isaiah Company and Subsidiary Ezekiel

Company

Statement of Comprehensive Income

For the year ended December 31, 2020

Revenues 180,000

Cost of Sales (60,000)

Gross Profit 120,000

Expenses (60,000)

Net Income 60,000

Share in Profit of Investee 11,200

Net Income Attributable to Parent 71,200

Net Income Attributable to NCI 2,800

Isaiah Company and Subsidiary Ezekiel

Company

Statement of Financial Position

As of December 31, 2020

Other Assets 477,000

Goodwill 3,000

Total Assets 480,000

Total Liabilities 103,000

Share Capital 235,000

Retained Earnings 121,200

Controlling Interest 356,200

Non-controlling Interest 20,800

Total Equities 377,000

Total Liabilities and Equities 480,000

You might also like

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Chapter 8 - Financial AnalysisDocument4 pagesChapter 8 - Financial AnalysisLưu Ngọc Tường ViNo ratings yet

- FABMDocument3 pagesFABMAprodithe BoncolmoNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- Cash Flow Statement Illustration (IAS 7)Document2 pagesCash Flow Statement Illustration (IAS 7)amahaktNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Chapter 3-4 Lab Problems 9.14.2021Document1 pageChapter 3-4 Lab Problems 9.14.2021Abdullah alhamaadNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Computer Project 1Document5 pagesComputer Project 1Alex SmallzNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- For December 31Document4 pagesFor December 31Bopha vongNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- April20 BusinessFinanceDocument3 pagesApril20 BusinessFinanceADRIANO, Glecy C.75% (8)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Quiz 1 Final PeriodDocument10 pagesQuiz 1 Final PeriodCmNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- Financial Plann Blisspad. DocsDocument6 pagesFinancial Plann Blisspad. Docsshanemarcopadigos93No ratings yet

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- Financial Accounting: Tools For Business Decision Making: Ninth EditionDocument70 pagesFinancial Accounting: Tools For Business Decision Making: Ninth EditionJesussNo ratings yet

- Statement AnalysisDocument4 pagesStatement AnalysisrameelNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- 01 ELMS Activity 3Document2 pages01 ELMS Activity 3Gonzaga FamNo ratings yet

- PCOA007 - Exercise - Module 3 Part 2Document3 pagesPCOA007 - Exercise - Module 3 Part 2Eau Claire DomingoNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Installment Sales Preparartion of Financial StatementDocument2 pagesInstallment Sales Preparartion of Financial StatementRiza Mae AlceNo ratings yet

- Preparation of Financial Statements: Total 1,880,000 1,880,000Document2 pagesPreparation of Financial Statements: Total 1,880,000 1,880,000Riza Mae AlceNo ratings yet

- Financial Management: Case Study - Jaedan IndustriesDocument7 pagesFinancial Management: Case Study - Jaedan IndustriesAnkit GuptaNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Accounting For Managers ExerciseDocument34 pagesAccounting For Managers ExerciseJessica BernaciliaNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Group Activitity Bus FinDocument8 pagesGroup Activitity Bus FinDavon LopezNo ratings yet

- HW Chap 5Document9 pagesHW Chap 5uong huonglyNo ratings yet

- Test 1 - 2022 08 17Document3 pagesTest 1 - 2022 08 17MiclczeeNo ratings yet

- Activity 5 Non Current Assets Held For Sale and Discontinued OperationsDocument3 pagesActivity 5 Non Current Assets Held For Sale and Discontinued Operationsnglc srzNo ratings yet

- 40 MahtaDocument7 pages40 Mahtamahta yunitaNo ratings yet

- Problem 1: Cash Flow StatementDocument1 pageProblem 1: Cash Flow StatementNafisaRafaNo ratings yet

- FS Preparation 1Document4 pagesFS Preparation 1Bae Tashnimah Farina BaltNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Module 5 - Prob 1-3 Valuation and Concepts AnswersDocument1 pageModule 5 - Prob 1-3 Valuation and Concepts Answersvenice cambryNo ratings yet

- Mod 2 Valuation and ConceptsDocument1 pageMod 2 Valuation and Conceptsvenice cambryNo ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- Module 7 - Prob D-E Valuation and Concepts AnswersDocument3 pagesModule 7 - Prob D-E Valuation and Concepts Answersvenice cambryNo ratings yet

- This Study Resource Was: Correction of Errors - ProblemsDocument2 pagesThis Study Resource Was: Correction of Errors - Problemsvenice cambryNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource Wasvenice cambryNo ratings yet

- Questions 2Document12 pagesQuestions 2venice cambryNo ratings yet

- Mod 3 Valuation and ConceptsDocument2 pagesMod 3 Valuation and Conceptsvenice cambryNo ratings yet

- This Study Resource Was: MissionDocument5 pagesThis Study Resource Was: Missionvenice cambryNo ratings yet

- Module 7 - Prob A-C Valuation and Concepts AnswersDocument2 pagesModule 7 - Prob A-C Valuation and Concepts Answersvenice cambryNo ratings yet

- Mod 1 Valuation and ConceptswDocument2 pagesMod 1 Valuation and Conceptswvenice cambryNo ratings yet

- Gov Quiz 2Document3 pagesGov Quiz 2venice cambryNo ratings yet

- Government Accounting MODULE 1 - Part 2Document2 pagesGovernment Accounting MODULE 1 - Part 2venice cambryNo ratings yet

- Audprob Answer 13 and 14Document1 pageAudprob Answer 13 and 14venice cambryNo ratings yet

- Audprob Answer 3 and 4Document2 pagesAudprob Answer 3 and 4venice cambryNo ratings yet

- Audprob Answer 9 and 10Document2 pagesAudprob Answer 9 and 10venice cambryNo ratings yet

- Audprob Answer 7 and 8Document2 pagesAudprob Answer 7 and 8venice cambryNo ratings yet

- Accounting Research and MethodDocument1 pageAccounting Research and Methodvenice cambryNo ratings yet

- Audprob Answer 2Document2 pagesAudprob Answer 2venice cambryNo ratings yet

- Audprob Answer 15Document1 pageAudprob Answer 15venice cambryNo ratings yet

- Audprob Answer 5 and 6Document2 pagesAudprob Answer 5 and 6venice cambryNo ratings yet

- Audprob Answer 1Document1 pageAudprob Answer 1venice cambryNo ratings yet

- This Study Resource Was: Balance Sheet - ProblemsDocument3 pagesThis Study Resource Was: Balance Sheet - Problemsvenice cambryNo ratings yet

- This Study Resource Was: Operating Segments - TheoriesDocument1 pageThis Study Resource Was: Operating Segments - Theoriesvenice cambryNo ratings yet

- This Study Resource Was: Income Statement - TheoriesDocument1 pageThis Study Resource Was: Income Statement - Theoriesvenice cambryNo ratings yet

- This Study Resource Was: Cash Flow - TheoriesDocument1 pageThis Study Resource Was: Cash Flow - Theoriesvenice cambryNo ratings yet

- This Study Resource Was: Cash Flow - ProblemsDocument2 pagesThis Study Resource Was: Cash Flow - Problemsvenice cambryNo ratings yet

- CASH AND CASH EQUIVALENTS TheoDocument1 pageCASH AND CASH EQUIVALENTS Theovenice cambryNo ratings yet

- This Study Resource Was: Income Statement - ProblemsDocument3 pagesThis Study Resource Was: Income Statement - Problemsvenice cambryNo ratings yet

- Notes Payable - Theories: A. I OnlyDocument2 pagesNotes Payable - Theories: A. I Onlyvenice cambryNo ratings yet