Professional Documents

Culture Documents

Closing Disclosure: NO NO NO

Uploaded by

Meagan W.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Closing Disclosure: NO NO NO

Uploaded by

Meagan W.Copyright:

Available Formats

This form is a statement of final loan terms and closing costs.

Compare this

Closing Disclosure document with your Loan Estimate.

Closing Information Transaction Information Loan Information

Date Issued {esign.Fill:CDDateIssued}

5/21/2021 Borrower JAVIER SALINAS and MEAGAN WOOD Loan Term 30 years

Closing Date 5/25/2021 See attached page for additional borrower Purpose Purchase

Disbursement Date 5/25/2021 information Product Fixed Rate

Settlement Agent REPUBLIC TITLE OF TEXAS Seller GUY N. GRAY and ELIZABETH T. GRAY

File # 1010-336062-RTT 23 S HIGHLAND DR Loan Type Conventional X FHA

Property 23 S HIGHLAND DR SANGER, TX 76266 VA

SANGER, TX 76266 Lender FIRST UNITED BANK & TRUST COMPANY Loan ID # 3371821

Sale Price $295,900 MIC # 513-2239484-703

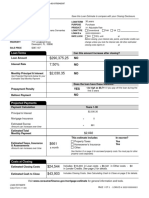

Loan Terms Can this amount increase after closing?

Loan Amount $290,540 NO

Interest Rate 3% NO

Monthly Principal & Interest $1,224.93 NO

See Projected Payments below for your

Estimated Total Monthly Payment

Does the loan have these features?

Prepayment Penalty NO

Balloon Payment NO

Projected Payments

Payment Calculation Years 1-30

Principal & Interest $1,224.93

Mortgage Insurance + 200.34

Estimated Escrow + 579.65

Amount can increase over time

Estimated Total

Monthly Payment $2,004.92

This estimate includes In escrow?

Estimated Taxes, Insurance X Property Taxes YES

& Assessments $594.23 X Homeowner's Insurance YES

Amount can increase over time a month X Other: HOA DUES NO

See page 4 for details See Escrow Account on page 4 for details. You must pay for other property

costs separately.

Costs at Closing

Closing Costs $14,846.61 Includes $9,470.25 in Loan Costs + $5,376.36 in Other Costs – $0.00 in

Lender Credits. See page 2 for details.

Cash to Close $10,382.30 Includes Closing Costs. See Calculating Cash to Close on page 3 for details.

CLOSING DISCLOSURE PAGE 1 OF 5 • LOAN ID # 3371821

IDS, Inc. - 67658

Closing Cost Details

Borrower-Paid Seller-Paid Paid by

Loan Costs At Closing Before Closing At Closing Before Closing Others

A. Origination Charges $995.00

01 % of Loan Amount (Points)

02 ADMINISTRATION FEE $995.00

03

04

05

06

B. Services Borrower Did Not Shop For $5,805.25

01 APPRAISAL FEE to FUB FBO FIRST UNITED BANK - COOLEY APPRAISALS, LLC $585.00

02 APPRAISAL OCA FEE to FUB FBO APPRAISAL SHIELD $29.00

03 ATTORNEY DOC PREP FEE to SLG $125.00

04 CREDIT REPORT to FUB FBO CREDIT PLUS $62.75

05 FINAL INSPECTION to FUB FBO FIRST UNITED BANK - COOLEY APPRAISALS, LLC

06 FLOOD CERTIFICATION to FUB FBO SERVICELINK NATIONAL FLOOD $6.50

07 LAND SURVEY to HALFF ASSOCIATES, INC.

08 MORTGAGE INSURANCE PREMIUM to DEPT OF HUD-UFMIP $4,997.00

09 PEST INSPECTION to ACTION PEST SERVICES

10 TAX SERVICE to FUB FBO LERETA $105.00

11 VERIFICATION OF ASSETS to FUB FBO EQUIFAX VERIFICATION SERVICES

12 VERIFICATION OF EMPLOYMENT/INCOME to FUB FBO EQUIFAX VERIFICATION

SERVICES

C. Services Borrower Did Shop For $2,670.00

01 TITLE - COURIER MESSENGER FEES to REPUBLIC TITLE OF TEXAS $20.00

02 TITLE - ENDORSEMENTS to REPUBLIC TITLE OF TEXAS $310.00

03 TITLE - LENDERS TITLE INSURANCE to REPUBLIC TITLE OF TEXAS $1,836.00

04 TITLE - SETTLEMENT FEE to REPUBLIC TITLE OF TEXAS $500.00

05 TITLE - TEXAS GUARANTEE FEE to REPUBLIC TITLE OF TEXAS $4.00

06

07

08

D. TOTAL LOAN COSTS (Borrower-Paid) $9,470.25

Loan Costs Subtotals (A + B + C) $9,470.25

Other Costs

E. Taxes and Other Government Fees $144.00

01 Recording Fees Deed: Mortgage: $144.00

02

F. Prepaids $1,986.12

01 Homeowner's Insurance Premium (12 mo.) to JACOBS INSURANCE SOLUTIONS $1,818.96

02 Mortgage Insurance Premium ( mo.)

03 Prepaid Interest ($23.8800 per day from 5/25/2021 to 6/1/2021) $167.16

04 Property Taxes ( mo.)

05

G. Initial Escrow Payment at Closing $2,818.24

01 Homeowner's Insurance $151.58 per month for 3 mo. $454.74

02 Mortgage Insurance per month for mo.

03 Property Taxes $428.07 per month for 8 mo. $3,424.56

04

05

06

07

08 Aggregate Adjustment – $1,061.06

H. Other $428.00

01 DIVISION OF COMMISSION to VALEN REALTY LLC $8,877.00

02 DIVISION OF COMMISSION to THE MICHAEL GROUP $8,877.00

03 TITLE - OWNERS TITLE INSURANCE to REPUBLIC TITLE OF TEXAS $128.00

04 TRANSFER FEE to JUNCTION PROPERTY $300.00

05

06

07

08

I. TOTAL OTHER COSTS (Borrower-Paid) $5,376.36

Other Costs Subtotals (E + F + G + H) $5,376.36

J. TOTAL CLOSING COSTS (Borrower-Paid) $14,846.61

Closing Costs Subtotals (D + I) $14,846.61 $17,859.00

Lender Credits

CLOSING DISCLOSURE PAGE 2 OF 5 • LOAN ID # 3371821

IDS, Inc. - 67658

Calculating Cash to Close Use this table to see what has changed from your Loan Estimate.

Loan Estimate Final Did this change?

Total Closing Costs (J) $14,200 $14,846.61 YES • See Total Loan Costs (D) and Total Other Costs (I)

Closing Costs Paid Before Closing $0 $0 NO

Closing Costs Financed

(Paid from your Loan Amount) $0 $0 NO

Down Payment/Funds from Borrower $5,360 $5,360.00 NO

Deposit – $2,610 – $5,918.00 YES • You increased the deposit. See details in Section L

Funds for Borrower $0 $0 NO

Seller Credits $0 $0 NO

Adjustments and Other Credits $0 – $3,906.31 YES • See details in Section L

Cash to Close $16,950 $10,382.30

Summaries of Transactions Use this table to see a summary of your transaction.

BORROWER'S TRANSACTION SELLER'S TRANSACTION

K. Due from Borrower at Closing $310,746.61 M. Due to Seller at Closing

01 Sale Price of Property $295,900.00 01 Sale Price of Property

02 Sale Price of Any Personal Property Included in Sale 02 Sale Price of Any Personal Property Included in Sale

03 Closing Costs Paid at Closing (J) $14,846.61 03

04 04

Adjustments 05

05 06

06 07

07 08

Adjustments for Items Paid by Seller in Advance Adjustments for Items Paid by Seller in Advance

08 City/Town Taxes to 09 City/Town Taxes to

09 County Taxes to 10 County Taxes to

10 Assessments to 11 Assessments to

11 12

12 13

13 14

14 15

15 16

L. Paid Already by or on Behalf of Borrower at Closing $300,364.31 N. Due from Seller at Closing

01 Deposit $5,918.00 01 Excess Deposit

02 Loan Amount $290,540.00 02 Closing Costs Paid at Closing (J)

03 Existing Loan(s) Assumed or Taken Subject to 03 Existing Loan(s) Assumed or Taken Subject to

04 04 Payoff of First Mortgage Loan

05 Seller Credit 05 Payoff of Second Mortgage Loan

Other Credits 06

06 OPTION FEE $200.00 07

07 08 Seller Credit

Adjustments 09

08 TITLE PREMIUM ADJUSTMENT $1,736.00 10

09 11

10 12

11 13

Adjustments for Items Unpaid by Seller Adjustments for Items Unpaid by Seller

12 City/Town Taxes to 14 City/Town Taxes to

13 County Taxes to 15 County Taxes to

14 Assessments to 16 Assessments to

15 TAX PRORATIONS 1/1/21 to 5/21/21 $1,970.31 17

16 18

17 19

CALCULATION CALCULATION

Total Due from Borrower at Closing (K) $310,746.61 Total Due to Seller at Closing (M)

Total Paid Already by or on Behalf of Borrower at Closing (L) – $300,364.31 Total Due from Seller at Closing (N)

Cash to Close X From To Borrower $10,382.30 Cash From To Seller

CLOSING DISCLOSURE PAGE 3 OF 5 • LOAN ID # 3371821

IDS, Inc. - 67658

Additional Information About This Loan

Loan Disclosures

Assumption Escrow Account

If you sell or transfer this property to another person, your lender For now, your loan

X will allow, under certain conditions, this person to assume this loan X will have an escrow account (also called an “impound” or “trust”

on the original terms. account) to pay the property costs listed below. Without an escrow

will not allow assumption of this loan on the original terms. account, you would pay them directly, possibly in one or two large

payments a year. Your lender may be liable for penalties and interest

Demand Feature

for failing to make a payment.

Your loan

has a demand feature, which permits your lender to require early Escrow

repayment of the loan. You should review your note for details. $9,359.88 Estimated total amount over year 1 for

X does not have a demand feature. Escrowed

your escrowed property costs:

Property Costs

Property Taxes

Late Payment over Year 1

Homeowner's Insurance

If your payment is more than 15 days late, your lender will charge a late MORTGAGE INSURANCE

fee of 4% of the overdue principal and interest payment. Non-Escrowed $174.96 Estimated total amount over year 1 for

Property Costs your non-escrowed property costs:

over Year 1 HOA DUES

Negative Amortization (Increase in Loan Amount)

Under your loan terms, you You may have other property costs.

are scheduled to make monthly payments that do not pay all of the Initial Escrow $2,818.24 A cushion for the escrow account you pay

interest due that month. As a result, your loan amount will increase Payment at closing. See Section G on page 2.

(negatively amortize), and your loan amount will likely become larger

Monthly Escrow $779.99 The amount included in your total monthly

than your original loan amount. Increases in your loan amount lower Payment payment.

the equity you have in this property.

may have monthly payments that do not pay all of the interest due will not have an escrow account because you declined it your

that month. If you do, your loan amount will increase (negatively lender does not offer one. You must directly pay your property costs,

amortize), and, as a result, your loan amount may become larger such as taxes and homeowner’s insurance. Contact your lender to

than your original loan amount. Increases in your loan amount lower

ask if your loan can have an escrow account.

the equity you have in this property.

X do not have a negative amortization feature. No Escrow

Partial Payments Estimated Estimated total amount over year 1. You

Property Costs must pay these costs directly, possibly in

Your lender over Year 1 one or two large payments a year.

X may accept payments that are less than the full amount due (partial Escrow Waiver Fee

payments) and apply them to your loan.

may hold them in a separate account until you pay the rest of the In the future,

payment, and then apply the full payment to your loan. Your property costs may change and, as a result, your escrow payment

does not accept any partial payments. may change. You may be able to cancel your escrow account, but if you

If this loan is sold, your new lender may have a different policy. do, you must pay your property costs directly. If you fail to pay your

Security Interest property taxes, your state or local government may (1) impose fines

You are granting a security interest in and penalties or (2) place a tax lien on this property. If you fail to pay

23 S HIGHLAND DR, SANGER, TX 76266 any of your property costs, your lender may (1) add the amounts to

your loan balance, (2) add an escrow account to your loan, or (3)

require you to pay for property insurance that the lender buys on your

You may lose this property if you do not make your payments or satisfy behalf, which likely would cost more and provide fewer benefits than

other obligations for this loan. what you could buy on your own.

CLOSING DISCLOSURE PAGE 4 OF 5 • LOAN ID # 3371821

IDS, Inc. - 67658

Loan Calculations Other Disclosures

Total of Payments. Total you will have paid after Appraisal

you make all payments of principal, interest, If the property was appraised for your loan, your lender is required to

mortgage insurance, and loan costs, as scheduled. $492,501.68 give you a copy at no additional cost at least 3 days before closing. If

you have not yet received it, please contact your lender at the

Finance Charge. The dollar amount the loan will information listed below.

cost you. $199,038.93

Contract Details

See your note and security instrument for information about

Amount Financed. The loan amount available after

• what happens if you fail to make your payments,

paying your upfront finance charge. $283,825.34

• what is a default on the loan,

• situations in which your lender can require early repayment of the

Annual Percentage Rate (APR). Your costs over the loan, and

loan term expressed as a rate. This is not your • the rules for making payments before they are due.

interest rate. 4.034%

Liability after Foreclosure

Total Interest Percentage (TIP). The total amount If your lender forecloses on this property and the foreclosure does not

of interest that you will pay over the loan term as a cover the amount of unpaid balance on this loan,

percentage of your loan amount. 51.835% state law may protect you from liability for the unpaid balance. If you

refinance or take on any additional debt on this property, you may

lose this protection and have to pay any debt remaining even after

foreclosure. You may want to consult a lawyer for more information.

X state law does not protect you from liability for the unpaid balance.

Questions? If you have questions about the loan Refinance

terms or costs on this form, use the contact Refinancing this loan will depend on your future financial situation, the

information below. To get more information or property value, and market conditions. You may not be able to

make a complaint, contact the Consumer refinance this loan.

Financial Protection Bureau at

Tax Deductions

www.consumerfinance.gov/mortgage-closing

If you borrow more than this property is worth, the interest on the loan

amount above this property’s fair market value is not deductible from

your federal income taxes. You should consult a tax advisor for more

information.

Contact Information

Lender Mortgage Broker Real Estate Broker (B) Real Estate Broker (S) Settlement Agent

Name FIRST UNITED BANK & THE MICHAEL GROUP REAL VALEN REALTY LLC REPUBLIC TITLE OF TEXAS

TRUST COMPANY ESTATE

Address 1400 WEST MAIN STREET 1845 PRECINCT LINE RD. 261 820 S. MACARTHUR 8920 COIT RD STE 200

DURANT, OK 74701 SUITE 206 BLVD, STE 105 PLANO, TX 75025

HURST, TX 76054 COPPELL, TX 75019

NMLS ID 400025

TX License ID 0520106 0619929 1877347 92770

Contact BILL WINTER JONATHAN HARRIS MARIA ORTUNO TRACY HORNE

Contact NMLS ID 469225

Contact 1882560

TX License ID

Email bwinter@firstunitedbank.c jonathanharrisrealtor@gma maria@drhomesolutions.ne Thorne@republictitle.com

om il.com t

Phone 214-502-3813 817-577-9000 469-647-8729 972-618-4711

Confirm Receipt

By signing, you are only confirming that you have received this form. You do not have to accept this loan because you have signed or

received this form.

{eSign.B1Sig$1} {eSign.B1SigDate$1} {eSign.B2Sig$2} {eSign.B2SigDate$2}

JAVIER SALINAS Date MEAGAN WOOD Date

CLOSING DISCLOSURE PAGE 5 OF 5 • LOAN ID # 3371821

IDS, Inc. - 67658

Closing Disclosure Addendum

Date Issued {esign.Fill:CDDateIssued}

5/21/2021

Additional Borrower JAVIER SALINAS

Information 3307 HUISACHE ST.

DENTON, TX 76209

MEAGAN WOOD

3307 HUISACHE ST

DENTON, TX 76209

Borrower-Paid Seller-Paid Paid by

At Closing Before Closing At Closing Before Closing Others

Itemization of Recording Fees (From E01) $144.00

RECORDING FEES to DEED $44.00;MORTGAGE $100.00;RELEASES $0.00 $144.00

Confirm Receipt - Addendum

By signing, you are only confirming that you have received the Closing Disclosure and this Closing Disclosure Addendum. You do not

have to accept this loan because you have signed or received these forms.

{eSign.B1Sig$11} {eSign.B1SigDate$11} {eSign.B2Sig$22} {eSign.B2SigDate$22}

JAVIER SALINAS Date MEAGAN WOOD Date

CLOSING DISCLOSURE ADDENDUM PAGE 1 OF 1 • LOAN ID # 3371821

IDS, Inc. - 67658

You might also like

- Statement of Account BBVADocument7 pagesStatement of Account BBVAchistopher freundNo ratings yet

- Fax Cover Page 6 Pages: Attention: Robert GouletDocument6 pagesFax Cover Page 6 Pages: Attention: Robert Gouletrobert gouletNo ratings yet

- Loan Agreement PDFDocument8 pagesLoan Agreement PDFWilletta KincaidNo ratings yet

- Buy A Home 1000 Down 1sthomenetworkDocument1 pageBuy A Home 1000 Down 1sthomenetworkapi-526198652No ratings yet

- Mar-2021, Apr-2021, May-2021, Jun-2021, Aug-2021Document4 pagesMar-2021, Apr-2021, May-2021, Jun-2021, Aug-2021James Franklin100% (3)

- Banco Filipino PPT PresentationDocument20 pagesBanco Filipino PPT PresentationKirsten Ann de AsisNo ratings yet

- E PassbookDocument9 pagesE PassbookAdnan QureshiNo ratings yet

- The Euro Currency and Euro Bond MarketsDocument26 pagesThe Euro Currency and Euro Bond MarketsRutvik PanditNo ratings yet

- Loan DocumentsDocument49 pagesLoan DocumentsBrendaNo ratings yet

- 0 - Loan EstimateDocument3 pages0 - Loan EstimateSophia AlvaradNo ratings yet

- CDDocument6 pagesCDAnonymous HrsuLZUYNo ratings yet

- Enclosed Documents List: United Wholesale Mortgage, LLCDocument79 pagesEnclosed Documents List: United Wholesale Mortgage, LLCHoang NguyenNo ratings yet

- SinglesignerDocument7 pagesSinglesignermatthewknapp81.mkNo ratings yet

- Closing Disclosure: Loan TermsDocument3 pagesClosing Disclosure: Loan TermsSupreet KaurNo ratings yet

- Characteristics ListDocument9 pagesCharacteristics ListStephanie BrightNo ratings yet

- Sample Loan EstimateDocument4 pagesSample Loan EstimateSusmita SapkotaNo ratings yet

- Loan EstimateDocument6 pagesLoan EstimateirenenjoNo ratings yet

- Changed Circumstance Detail Form: Melissa Marie JonesDocument11 pagesChanged Circumstance Detail Form: Melissa Marie JonesMelissa JonesNo ratings yet

- SANDOVAL 8030228962 Loan EstimateDocument3 pagesSANDOVAL 8030228962 Loan EstimateRic PerezNo ratings yet

- Pre-Application WorksheetDocument2 pagesPre-Application WorksheetBrettKingNo ratings yet

- 1102 Green Pine #G-1 ALTA - Settlement - Statement - CombinedDocument3 pages1102 Green Pine #G-1 ALTA - Settlement - Statement - CombinedAmanda ALEXNo ratings yet

- Loan EstimateDocument10 pagesLoan Estimatevaibhav_M_123No ratings yet

- PackageAsPdf ClickDocument9 pagesPackageAsPdf ClickAnthony ReedNo ratings yet

- Estimated Cash To Close Worksheet: Estimate Prepared For You By: David StarlingDocument2 pagesEstimated Cash To Close Worksheet: Estimate Prepared For You By: David StarlingA.k SaidiNo ratings yet

- CFPB Loan-EstimateDocument3 pagesCFPB Loan-EstimateRichard VetsteinNo ratings yet

- CFPB Loan EstimateDocument3 pagesCFPB Loan EstimateRichard VetsteinNo ratings yet

- Good Faith Estimate (GFE) : PurposeDocument3 pagesGood Faith Estimate (GFE) : PurposeEdwin RajNo ratings yet

- Prev 165896547003461209Document19 pagesPrev 165896547003461209sososolalalaiiNo ratings yet

- MOA Sample AuditDocument49 pagesMOA Sample AuditUrban SmithNo ratings yet

- Agreement 2Document11 pagesAgreement 2Ramona SowersNo ratings yet

- Loan Rates & Estimated Total Costs: Private Education Loan Approval DisclosureDocument2 pagesLoan Rates & Estimated Total Costs: Private Education Loan Approval DisclosureKeith GruberNo ratings yet

- Nm1-Cash Advance ContractDocument3 pagesNm1-Cash Advance Contractjohndoe6t9No ratings yet

- ClosingDocument18 pagesClosingrobert kingNo ratings yet

- SPENJE3 - Policy PackageDocument11 pagesSPENJE3 - Policy Packagejennyspenner24No ratings yet

- Original: Your Credit Score and The Price You Pay For CreditDocument26 pagesOriginal: Your Credit Score and The Price You Pay For CreditMaritza CardonaNo ratings yet

- Vzbill 5-22-2022 GalkinDocument4 pagesVzbill 5-22-2022 GalkinmambaNo ratings yet

- Loan AgreementDocument2 pagesLoan Agreementjeffrey bandoquilloNo ratings yet

- Chap 008Document5 pagesChap 008hasnat sakibNo ratings yet

- Your Reverse Mortgage Summary: You Could GetDocument11 pagesYour Reverse Mortgage Summary: You Could GetPete Santilli100% (1)

- DocumentDocument15 pagesDocumentElijah Aziz'ElNo ratings yet

- CMG Home Ownership Accelerator Example Doc Set CA050207Document94 pagesCMG Home Ownership Accelerator Example Doc Set CA050207Robert Emmett McAuliffeNo ratings yet

- Trust Notification LetterDocument2 pagesTrust Notification Letterbs9951193No ratings yet

- Read, Sign and Return.: October 29, 2019Document31 pagesRead, Sign and Return.: October 29, 2019MIGUEL GOMEZNo ratings yet

- Payplan TaylorDocument2 pagesPayplan TayloraaronulloaeNo ratings yet

- NJ Forensic Analysis SampleDocument77 pagesNJ Forensic Analysis Sampleagold73No ratings yet

- Mortgage Key Facts SheetDocument2 pagesMortgage Key Facts Sheetpeter_martin9335No ratings yet

- SignedDocument14 pagesSignedtrumpu01No ratings yet

- Streamline CompareDocument1 pageStreamline Comparejoe@josephhummel.comNo ratings yet

- Hola Mi Amor PorDocument3 pagesHola Mi Amor PorEstudiante AstralNo ratings yet

- MN Updated Bank Contract 9.36Document5 pagesMN Updated Bank Contract 9.36vqcheslav.karaNo ratings yet

- Loan AgreementDocument2 pagesLoan AgreementJohn Bradley GomezNo ratings yet

- KWP/ADV/2022/ Date: 14/04/2022: REF NO: BOB/KAWEMPE/ADV/2022-65 Dated 14/04/2022Document2 pagesKWP/ADV/2022/ Date: 14/04/2022: REF NO: BOB/KAWEMPE/ADV/2022-65 Dated 14/04/2022BalavinayakNo ratings yet

- Loan Estimate Form: Date Issued Loan ID Loan Type Loan Term Purpose PropertyDocument2 pagesLoan Estimate Form: Date Issued Loan ID Loan Type Loan Term Purpose Propertys.bello1141No ratings yet

- The Golden Legacy Financing Corporation: Disclosure Statement of Loan/Credit TransactionDocument1 pageThe Golden Legacy Financing Corporation: Disclosure Statement of Loan/Credit TransactionAbenser RegalarioNo ratings yet

- Sdlkfjasd LFKDocument66 pagesSdlkfjasd LFKTerryLasutNo ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- TD Mortgage Affordability Calculator - TD Canada TrustDocument5 pagesTD Mortgage Affordability Calculator - TD Canada TrustTomura ShigarakiNo ratings yet

- Loan Documentation - 20210905100946Document13 pagesLoan Documentation - 20210905100946598dqczrn6No ratings yet

- Es Consumer Financing AgreeDocument2 pagesEs Consumer Financing Agreecatherinecastillo914No ratings yet

- CFPB Closing DisclosureDocument5 pagesCFPB Closing DisclosureRichard VetsteinNo ratings yet

- Title Condition ReportDocument5 pagesTitle Condition ReportTanisJamNo ratings yet

- Land Settlement Statement FormDocument3 pagesLand Settlement Statement FormASDFGHJKNo ratings yet

- Loan Documentation - 20231215065004Document13 pagesLoan Documentation - 20231215065004souljarsmile7No ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- Estimate For 2015 Fiat 500 Pop: Estimate of Work Inspection ResultsDocument1 pageEstimate For 2015 Fiat 500 Pop: Estimate of Work Inspection ResultsMeagan W.No ratings yet

- Things To DoDocument1 pageThings To DoMeagan W.No ratings yet

- PJÄTTERYD Picture, Fairytale, 22x22 - IKEADocument1 pagePJÄTTERYD Picture, Fairytale, 22x22 - IKEAMeagan W.No ratings yet

- PJÄTTERYD Picture, Fairytale, 22x22 - IKEADocument1 pagePJÄTTERYD Picture, Fairytale, 22x22 - IKEAMeagan W.No ratings yet

- Individual or Joint Specimen Signature Card 07-31-2014Document1 pageIndividual or Joint Specimen Signature Card 07-31-2014Dialife Medical Equipment and SuppliesNo ratings yet

- Section 1 PDFDocument2 pagesSection 1 PDFRobert FergustoNo ratings yet

- NLA Tenant Check Form JULY 2016Document3 pagesNLA Tenant Check Form JULY 2016La SaNo ratings yet

- International Payment InstrumentsDocument48 pagesInternational Payment InstrumentsSimona StancioiuNo ratings yet

- Challan FormDocument1 pageChallan FormAsad IshaqNo ratings yet

- Mock Test JAIIBDocument73 pagesMock Test JAIIBrkpo97100% (6)

- Guru Kirpa ArtsDocument8 pagesGuru Kirpa ArtsMeenu MittalNo ratings yet

- Simple and Compound Interest - M9Document24 pagesSimple and Compound Interest - M9Sage Juniper'Ashe V. EinsofNo ratings yet

- Spiel 4 Kinds of ProductDocument6 pagesSpiel 4 Kinds of ProductEman OlympiaNo ratings yet

- Customer Interface Specification: 14 April 2016Document1,049 pagesCustomer Interface Specification: 14 April 2016Prabin ShresthaNo ratings yet

- Account Statement - Mar 31, 2021Document7 pagesAccount Statement - Mar 31, 2021Clifton WilsonNo ratings yet

- Banking Laws (Digest)Document14 pagesBanking Laws (Digest)Karen Gina DupraNo ratings yet

- Comparative Analysis of Financial Statement of ICICI Bank and Kotak Mahindra BankDocument14 pagesComparative Analysis of Financial Statement of ICICI Bank and Kotak Mahindra Bankchandni dhanwaniNo ratings yet

- 04 Subjective / Subjektif 2: Format Latihan: Subjektif. Tiada Sistem Pemarkahan, Contoh Jawapan DiberikanDocument16 pages04 Subjective / Subjektif 2: Format Latihan: Subjektif. Tiada Sistem Pemarkahan, Contoh Jawapan Diberikanforyourhonour wongNo ratings yet

- Account Statement As of 23-03-2021 08:50:12 GMT +0530Document2 pagesAccount Statement As of 23-03-2021 08:50:12 GMT +0530ShivaNo ratings yet

- SEBI Regulations For Merchant BankersDocument3 pagesSEBI Regulations For Merchant Bankerspraveena DNo ratings yet

- Mutasi Transaksi - PermataME6574 - 81202124819Document4 pagesMutasi Transaksi - PermataME6574 - 81202124819jainulNo ratings yet

- Fatture (Vendite)Document2 pagesFatture (Vendite)Muhammad ArifNo ratings yet

- La Casa Interiors Deposits All Cash Receipts Each Wednesday andDocument1 pageLa Casa Interiors Deposits All Cash Receipts Each Wednesday andAmit PandeyNo ratings yet

- CITIBANK Statements MarchDocument4 pagesCITIBANK Statements MarchamatobertrumNo ratings yet

- Course Module 1 Mathematics of InvestmentDocument18 pagesCourse Module 1 Mathematics of InvestmentAnne Maerick Jersey OteroNo ratings yet

- Secondary Mortgage Market: Government-Sponsored Enterprise Fannie Mae Freddie Mac Ginnie MaeDocument1 pageSecondary Mortgage Market: Government-Sponsored Enterprise Fannie Mae Freddie Mac Ginnie Maefrancis dungcaNo ratings yet

- Account Statement PDFDocument2 pagesAccount Statement PDFKhan SubhanNo ratings yet

- Frequently Asked Questions ON Finacle Core Banking SolutionDocument76 pagesFrequently Asked Questions ON Finacle Core Banking Solutionbalraj0% (1)

- Proforma Inv 155678: MR Maric DamirDocument1 pageProforma Inv 155678: MR Maric DamirDamir MaricNo ratings yet

- Analysis On Electronic Money Transactions On Velocity of Money in Asean-5 CountriesDocument16 pagesAnalysis On Electronic Money Transactions On Velocity of Money in Asean-5 CountriesAmelia Wahyuni DewiNo ratings yet