Professional Documents

Culture Documents

Advantages of DCF: Business Valuation Is A Process and A Set of Procedures Used To Estimate The

Uploaded by

Nikunj WaliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advantages of DCF: Business Valuation Is A Process and A Set of Procedures Used To Estimate The

Uploaded by

Nikunj WaliaCopyright:

Available Formats

Business valuation

is a process and a set of procedures used to estimate the economic value of an

owner’s interest in a business. Valuation is used by financial market participants to determine the price

they are willing to pay or receive to consummate a sale of a business. In addition to estimating the selling

price of a business, the same valuation tools are often used by business appraisers to resolve disputes

related to estate and gift taxation, divorce litigation, allocate business purchase price among business

assets, establish a formula for estimating the value of partners' ownership interest for buy-sell

agreements, and many other business and legal purposes.

DCF

A valuation method used to estimate the attractiveness of an investment opportunity. Discounted cash

flow (DCF) analysis uses future free cash flow projections and discounts them (most often using the

weighted average cost of capital) to arrive at a present value, which is used to evaluate the potential for

investment.

ADVANTAGES OF DCF

Arguably the best reason to like DCF is that it produces the closest thing to an intrinsic stock value. The alternatives

to DCF are relative valuation measures, which use multiples to compare stocks within a sector. While relative

valuation metrics such as price-earnings (P/E), EV/EBITDA and price-to-sales ratios are fairly simple to calculate,

they aren't very useful if an entire sector or market is over or undervalued. A carefully designed DCF, by contrast,

should help investors steer clear of companies that look inexpensive against expensive peers.

Unlike standard valuation tools such as the P/E ratio, DCF relies on free cash flows. For the most part, free cash flow

is a trustworthy measure that cuts through much of the arbitrariness and "guesstimates" involved in reported

earnings. Regardless of whether a cash outlay is counted as an expense or turned into an asset on the balance

sheet, free cash flow tracks the money left over for investors.

DISADVANTAGES OF DCF

Although DCF analysis certainly has its merits, it also has its share of shortcomings. For starters, the DCF model is

only as good as its input assumptions. Depending on what you believe about how a company will operate and how

the market will unfold, DCF valuations can fluctuate wildly. If your inputs - free cash flow forecasts, discount rates and

perpetuity growth rates - are wide of the mark, the fair value generated for the company won't be accurate, and it

won't be useful when assessing stock prices. Following the "garbage in, garbage out" principle, if the inputs into the

model are "garbage", then the output will be similar.

DCF works best when there is a high degree of confidence about future cash flows. But things can get tricky when a

company's operations lack what analysts call "visibility" - that is, when it's difficult to predict sales and cost trends with

much certainty. While forecasting cash flows a few years into the future is hard enough, pushing results into eternity

(which is a necessary input) is nearly impossible. The investor's ability to make good forward-looking projections is

critical - and that's why DCF is susceptible to error.

You might also like

- Investment Bankers Private Equity Equity Research "Buy Side" InvestorsDocument14 pagesInvestment Bankers Private Equity Equity Research "Buy Side" InvestorsRonove GamingNo ratings yet

- Answers SssssssDocument9 pagesAnswers SssssssfibiNo ratings yet

- Presented By: Muhammad Taimoor Baig Uzair-ul-Atiq Kashif Bashir Salman Zafar Syed Ali RazaDocument40 pagesPresented By: Muhammad Taimoor Baig Uzair-ul-Atiq Kashif Bashir Salman Zafar Syed Ali RazaSalman ZafarNo ratings yet

- Bav Unit 4th DCFDocument57 pagesBav Unit 4th DCFRahul GuptaNo ratings yet

- The DCF Model ArticlesDocument8 pagesThe DCF Model ArticlesJames H SingletaryNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- Valuing Startup VenturesDocument4 pagesValuing Startup VenturesJonhmark AniñonNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Bav Notes Unit 3rdDocument10 pagesBav Notes Unit 3rdMrSURYAA pandeyNo ratings yet

- Merrill Lynch 2007 Analyst Valuation TrainingDocument74 pagesMerrill Lynch 2007 Analyst Valuation Trainingmehtarahul999No ratings yet

- ValuationDocument3 pagesValuationvaibhavi DhordaNo ratings yet

- Intro To ValuationDocument6 pagesIntro To ValuationDEVERLYN SAQUIDONo ratings yet

- 11 - Business Valuation: Prof. S. Satya MoorthiDocument13 pages11 - Business Valuation: Prof. S. Satya MoorthiVandana Kuntal ChaharNo ratings yet

- Valuing Startup Ventures PDFDocument2 pagesValuing Startup Ventures PDFA2ANo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- CV Valuation Approaches InfographicDocument4 pagesCV Valuation Approaches InfographicNAZREEN SHAHAL 2227536No ratings yet

- Merrill Lynch 2007 Analyst Valuation TrainingDocument74 pagesMerrill Lynch 2007 Analyst Valuation TrainingJose Garcia100% (21)

- Valuation Matters The Complete Guide to Company Valuation TechniquesFrom EverandValuation Matters The Complete Guide to Company Valuation TechniquesNo ratings yet

- Where Do You See This?: What Does Leverage Mean?Document6 pagesWhere Do You See This?: What Does Leverage Mean?abhijeet1828No ratings yet

- DCF and NPV - WallstreetDocument1 pageDCF and NPV - WallstreetSijanPokharelNo ratings yet

- Discounted Cash Flow AnalysisDocument13 pagesDiscounted Cash Flow AnalysisJack Jacinto67% (3)

- Group 1 Relative Valuation PDFDocument4 pagesGroup 1 Relative Valuation PDFGiddel Ann Kristine VelasquezNo ratings yet

- DCF Model Training - 4Document10 pagesDCF Model Training - 4mohd shariqNo ratings yet

- Research Paper On Company ValuationDocument8 pagesResearch Paper On Company Valuationfys374dr100% (1)

- ICAI Corporate ValuationDocument47 pagesICAI Corporate Valuationqamaraleem1_25038318No ratings yet

- Cost of CapitalDocument8 pagesCost of Capitalpetut zipagangNo ratings yet

- Valuation 101: How To Do A Discounted Cashflow AnalysisDocument3 pagesValuation 101: How To Do A Discounted Cashflow AnalysisdevNo ratings yet

- Sos ReportDocument6 pagesSos ReportTushaar JhamtaniNo ratings yet

- GROUP 4 - Relative Valuation Model ResearchDocument8 pagesGROUP 4 - Relative Valuation Model ResearchGiddel Ann Kristine VelasquezNo ratings yet

- Company Valuation ThesisDocument4 pagesCompany Valuation Thesisangelaweberolathe100% (1)

- IRR Vs WACCDocument4 pagesIRR Vs WACC04071990100% (1)

- Module 4 Corporate ValuationDocument6 pagesModule 4 Corporate ValuationYounus ahmedNo ratings yet

- FinanceDocument8 pagesFinancepiyush kumarNo ratings yet

- Prospective Analysis Theory and ConceptDocument32 pagesProspective Analysis Theory and ConceptEster Sabatini100% (1)

- The Guide To Private Company ValuationDocument15 pagesThe Guide To Private Company ValuationShay BhatterNo ratings yet

- Value-based financial management: Towards a Systematic Process for Financial Decision - MakingFrom EverandValue-based financial management: Towards a Systematic Process for Financial Decision - MakingNo ratings yet

- Siti Maisarah Share Valuation AssignmentDocument20 pagesSiti Maisarah Share Valuation AssignmentmiaNo ratings yet

- Corporatre ValuationDocument46 pagesCorporatre ValuationVipin MehtaNo ratings yet

- Final CaDocument64 pagesFinal Cap Jhaveri100% (1)

- Valuation Crash Course Simplest Explanation 1689925455Document9 pagesValuation Crash Course Simplest Explanation 1689925455Sarthak TomarNo ratings yet

- Blue Line ManagementDocument15 pagesBlue Line Managementmarivas2388No ratings yet

- 46377bosfinal p2 cp13Document30 pages46377bosfinal p2 cp13Shashank gunnerNo ratings yet

- DCF PrimerDocument30 pagesDCF PrimerAnkit_modi2000No ratings yet

- RELATIVE VALUATION Theory PDFDocument5 pagesRELATIVE VALUATION Theory PDFPrateek SidharNo ratings yet

- Module 2.3 - Cash Flow TechniqueDocument11 pagesModule 2.3 - Cash Flow TechniqueGerald RamiloNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 5Document6 pagesBUS 5111 - Financial Management - Written Assignment Unit 5LaVida LocaNo ratings yet

- Discounted Cash FlowDocument50 pagesDiscounted Cash Flowgangster91No ratings yet

- 4-Chp 4 - Finance in Planning & Decision MakingDocument17 pages4-Chp 4 - Finance in Planning & Decision MakingAsad MuhammadNo ratings yet

- Business Valuation IIDocument30 pagesBusiness Valuation IIsuneshdeviNo ratings yet

- New-Venture ValuationDocument7 pagesNew-Venture ValuationBurhan Al MessiNo ratings yet

- Financial Modelling and ValuationDocument5 pagesFinancial Modelling and Valuationibshyd1100% (1)

- @@@valuation 5-15-2021Document39 pages@@@valuation 5-15-2021Mark LesterNo ratings yet

- A Brief Introduction To Valuation PDFDocument2 pagesA Brief Introduction To Valuation PDFsumanta maitiNo ratings yet

- Presented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshDocument11 pagesPresented By:-Pankaj Smit Ojas Sayali Ishaan Dattaji Ashutosh Omkar MaheshOjas LeoNo ratings yet

- How Do You Value A Company?Document3 pagesHow Do You Value A Company?Sumit DaniNo ratings yet

- Discounted Cash Flow (DCF) AnalysisDocument2 pagesDiscounted Cash Flow (DCF) AnalysisgyanelexNo ratings yet

- Common DCF Errors - LeggMasonDocument12 pagesCommon DCF Errors - LeggMasonBob JonesNo ratings yet

- Common Errors in DCF ModelsDocument12 pagesCommon Errors in DCF Modelsrslamba1100% (2)

- 6th MKT Sp.Document8 pages6th MKT Sp.Nikunj WaliaNo ratings yet

- Buying Behaviour of Car ReportDocument36 pagesBuying Behaviour of Car ReportNikunj WaliaNo ratings yet

- 98 5Document22 pages98 5palashdon6No ratings yet

- The New E-Class With 14 Centimetres More Rear Leg RoomDocument2 pagesThe New E-Class With 14 Centimetres More Rear Leg RoomNikunj WaliaNo ratings yet

- Successful Turnaround of TVS SuzukiDocument21 pagesSuccessful Turnaround of TVS SuzukiJitendra Pal SinghNo ratings yet

- Dell Vs AcerDocument2 pagesDell Vs AcerNikunj WaliaNo ratings yet

- Shivani ResumeDocument2 pagesShivani ResumeNikunj WaliaNo ratings yet

- For Horizontal LineDocument5 pagesFor Horizontal LineNikunj WaliaNo ratings yet

- RLA-Grade 6 2023Document4 pagesRLA-Grade 6 2023Catherine Mabini BeatoNo ratings yet

- B737 AutothrottleDocument103 pagesB737 AutothrottleZaw100% (1)

- Research ProposalDocument2 pagesResearch Proposalsmh9662No ratings yet

- Mesa Quirurgica Opt 70 Ec 02 PDFDocument36 pagesMesa Quirurgica Opt 70 Ec 02 PDFTEYLER BARBOZANo ratings yet

- Qatar OM PART C PDFDocument796 pagesQatar OM PART C PDFBobi Guau100% (3)

- Mum LatecityDocument14 pagesMum LatecityGkiniNo ratings yet

- Renaissance RapierDocument66 pagesRenaissance Rapierrshpr100% (1)

- EPB2.4 + V3f20 Installation - Start-Up ProcDocument30 pagesEPB2.4 + V3f20 Installation - Start-Up ProcBeltran Héctor75% (4)

- Eating Well: Snacks For 1-4 Year OldsDocument42 pagesEating Well: Snacks For 1-4 Year OldsAndreea AndreiNo ratings yet

- Reflective EssayDocument4 pagesReflective Essayapi-385380366No ratings yet

- Case Study - of Chapel of San Pedro CalungsodDocument5 pagesCase Study - of Chapel of San Pedro CalungsodJosielynNo ratings yet

- A 268 - A 268M - 01 Qti2oc0wmq - PDFDocument6 pagesA 268 - A 268M - 01 Qti2oc0wmq - PDFMan98No ratings yet

- Tutorial 2 EtherchannelDocument3 pagesTutorial 2 EtherchannelOng CHNo ratings yet

- Make - Volume 13 - Volume 13Document212 pagesMake - Volume 13 - Volume 13Pedernal Lisiao100% (2)

- Securing Your Organization From Modern Ransomware: Ransomware Attacks Are Now A Team EffortDocument11 pagesSecuring Your Organization From Modern Ransomware: Ransomware Attacks Are Now A Team EfforttiagouebemoraisNo ratings yet

- Wireless Cellular and LTE 4g Broadband PDFDocument26 pagesWireless Cellular and LTE 4g Broadband PDFAE videosNo ratings yet

- Armenotech PCIDSS AOCDocument13 pagesArmenotech PCIDSS AOCHakob ArakelyanNo ratings yet

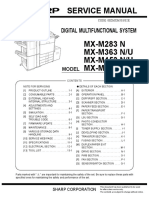

- Sharp MX M283 363 453 503 PDFDocument404 pagesSharp MX M283 363 453 503 PDFAlejandro Barraza100% (2)

- Exercise 3 - Wireframe Geometry Creation and Editing - Rev ADocument33 pagesExercise 3 - Wireframe Geometry Creation and Editing - Rev AdevNo ratings yet

- Guru Stotram-1Document5 pagesGuru Stotram-1Green WattNo ratings yet

- Artificial Intelligence in Power System OperationsDocument8 pagesArtificial Intelligence in Power System OperationsDummyofindiaIndiaNo ratings yet

- Henry's Bench: Keyes Ky-040 Arduino Rotary Encoder User ManualDocument4 pagesHenry's Bench: Keyes Ky-040 Arduino Rotary Encoder User ManualIsrael ZavalaNo ratings yet

- Sheet - PDF 3Document4 pagesSheet - PDF 3Nazar JabbarNo ratings yet

- Aurora National High School: Report On AttendanceDocument2 pagesAurora National High School: Report On AttendanceLimuel CaringalNo ratings yet

- Roy B. Kantuna, MPRM, CESE: (For Midterm) (Instructor)Document8 pagesRoy B. Kantuna, MPRM, CESE: (For Midterm) (Instructor)Athena Mae DitchonNo ratings yet

- SN Quick Reference 2018Document6 pagesSN Quick Reference 2018pinakin4uNo ratings yet

- Richard Feynman - The Hierarchy of ComplexityDocument3 pagesRichard Feynman - The Hierarchy of ComplexityjacquesyvescaruanaNo ratings yet

- h4 History of India Ad 1526 - Ad 1707Document2 pagesh4 History of India Ad 1526 - Ad 1707Baddela ReddyNo ratings yet

- Can We Define Ecosystems - On The Confusion Between Definition and Description of Ecological ConceptsDocument15 pagesCan We Define Ecosystems - On The Confusion Between Definition and Description of Ecological ConceptsKionara SarabellaNo ratings yet

- Bubbles in Transformer Oil Dynamic Behavior Internal Discharge and Triggered Liquid BreakdownDocument9 pagesBubbles in Transformer Oil Dynamic Behavior Internal Discharge and Triggered Liquid BreakdownMuhammad Irfan NazhmiNo ratings yet