Professional Documents

Culture Documents

Questions: Required

Uploaded by

ritz meshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions: Required

Uploaded by

ritz meshCopyright:

Available Formats

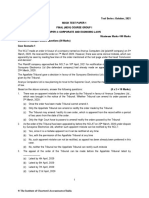

QUESTIONS D.

Question

Y-Connections, China based firm, has just developed ultra-thintablet S-5 with few features like the

ability to open two apps at the same time. This tablet cost ` 5,00,000 to develop; it has undergone

extensive research and is ready for production. Currently, the firm is deciding on plant capacity,

which could cost either ` 35,00,000 or ` 52,00,000. The additional outlay would allow the plant to

increase capacity from 500 units to 750 units. The relevant data for the life cycle of the tablet at

different capacity level are as under:

Expected Sales 500 units 750 units

Sale Price ` 79,600 per unit ` 69,600 per unit

Variable Selling Costs 10% of Selling Price 10% of Selling Price

Salvage Value - Plant ` 6,25,000 ` 9,00,000

Profit Volume Ratio 40%

Required

Advise Y-Connections, regarding the ‘Optimal Plant Capacity’ to install. The tablet’s life cycle is two

years.

Note: Ignore the time value of money.

Solution

Workings

Statement Showing “Variable Manufacturing Cost per unit”

Particulars of Costs ` / unit

Sales 79,600

Less: Contribution (40%) 31,840

Variable Cost 47,760

Less: Variable Selling Costs (` 79,600 × 0.1) 7,960

Variable Manufacturing Cost 39,800

Statement Showing “Expected Profit”

(‘000) ` / unit

Particulars of Costs

500 units 750 units

Sales 39,800 52,200

(`79,600 500) (`69,600 750)

Less: Variable Mfg. Cost 19,900 29,850

(`39,800 500) (`39,800 750)

Less: Variable Selling Cost 3,980 5,220

(`39,800 0.1) (`52,200 0.1)

© The Institute of Chartered Accountants of India

D.3 STRATEGIC COST MANAGEMENT AND PERFORMANCE EVALUATION

Add: Salvage Value 625 900

Less: Cost of Plant 3,500 5,200

Net Profit 13,045 12,830

Development cost is sunk and is not relevant.

Advice

Based on the above ‘Expected Profit’ statement which is purely based on financial considerations

firm may go for high price – low volume i.e. 500 units level. However, non-financial considerations

are also given due importance as they account for actions that may not contribute directly to profits

in the short run but may contribute significantly to profits in long run. Here, it is important to note

that life cycle of product is two years and there is no significant difference between the profits at

both levels. In this scenario firm may opt the plant having high capacity not only to increase its

market share but also to establish a long term brand image.

© The Institute of Chartered Accountants of India

You might also like

- Fima Week 2 ActivitiesDocument9 pagesFima Week 2 ActivitiesKatrina PaquizNo ratings yet

- Business Plan of Manufacturing Air PurifiersDocument7 pagesBusiness Plan of Manufacturing Air PurifiersSakshi BaiwalNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- CMA JUNE 2021 EXAM P1 PROCESS COSTING SOLUTIONSDocument5 pagesCMA JUNE 2021 EXAM P1 PROCESS COSTING SOLUTIONSTameemmahmud rokibNo ratings yet

- Paper - 5: Advanced Management Accounting Questions Limiting FactorDocument24 pagesPaper - 5: Advanced Management Accounting Questions Limiting FactorSrihariNo ratings yet

- Paper - 5: Advanced Management Accounting Questions Limiting FactorDocument24 pagesPaper - 5: Advanced Management Accounting Questions Limiting FactorMohit MaheshwariNo ratings yet

- Spreadsheet budgeting and cash flow analysisDocument3 pagesSpreadsheet budgeting and cash flow analysisBình LêNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Module 5 - Factory Overhead VarianceDocument73 pagesModule 5 - Factory Overhead VarianceCristineNo ratings yet

- Absorption Costing vs. Marginal CostingDocument4 pagesAbsorption Costing vs. Marginal CostingprasannamrudulaNo ratings yet

- MTP 12 16 Answers 1696782053Document14 pagesMTP 12 16 Answers 1696782053harshallahotNo ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTUsran Ali BubinNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- 7Document8 pages7Indu DahalNo ratings yet

- EE Financial ProjectionsDocument2 pagesEE Financial Projectionsnishatmridula06No ratings yet

- 11 Flexible Budgets and Overhead AnalysisDocument73 pages11 Flexible Budgets and Overhead AnalysisAnne PilapilNo ratings yet

- Solutionmmaf 635 Jan 2013Document10 pagesSolutionmmaf 635 Jan 2013anis izzati100% (1)

- Trial Essay Questions V3 DoneDocument5 pagesTrial Essay Questions V3 DoneNguyễn Huỳnh ĐứcNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Model Solution - Assessment 2Document12 pagesModel Solution - Assessment 2rajeshkinger_1994100% (2)

- Flexible BudgetsDocument23 pagesFlexible BudgetsscienceplexNo ratings yet

- Solutions For CH 9 2-26-14Document15 pagesSolutions For CH 9 2-26-14Rafael Ricardo VilleroNo ratings yet

- Managerial Accounting 14Th Edition Warren Solutions Manual Full Chapter PDFDocument67 pagesManagerial Accounting 14Th Edition Warren Solutions Manual Full Chapter PDFykydxnjk4100% (9)

- Answer Key To Test #3 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #3 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Chap 4 Activity Answer KeyDocument4 pagesChap 4 Activity Answer KeycykablyatNo ratings yet

- Calculate profit using absorption and marginal costingDocument21 pagesCalculate profit using absorption and marginal costingSelena ReidNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Exercise 2Document3 pagesExercise 2Kathy LaiNo ratings yet

- SD17 Hybrid F5 Section C Answers Clean Proof PDFDocument12 pagesSD17 Hybrid F5 Section C Answers Clean Proof PDFShaksham SharmaNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- MTP 3 16 Answers 1681098469Document13 pagesMTP 3 16 Answers 1681098469Umar MalikNo ratings yet

- Business Accounting and Finance: QUESTION 1 (P17-2A)Document9 pagesBusiness Accounting and Finance: QUESTION 1 (P17-2A)sang_ratu_1No ratings yet

- CH07sDocument13 pagesCH07sTricia DazaNo ratings yet

- Alternative Costing Systems ExplainedDocument21 pagesAlternative Costing Systems ExplainedSaad KhanNo ratings yet

- FINMAN Decision AnalysisDocument5 pagesFINMAN Decision AnalysisTrish GarridoNo ratings yet

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument34 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsGuinevereNo ratings yet

- Required: ( ) Average Time Per BatchDocument23 pagesRequired: ( ) Average Time Per BatchAmol TambeNo ratings yet

- Classifying Costs: Kristelle Joyce L. SoteroDocument26 pagesClassifying Costs: Kristelle Joyce L. SoteroRujean Salar AltejarNo ratings yet

- Chapter 5 CostiiDocument8 pagesChapter 5 CostiiTammy 27No ratings yet

- 22 - Mtest - Management Accounting Morning 1st HalfDocument4 pages22 - Mtest - Management Accounting Morning 1st HalfZohaib NasirNo ratings yet

- b5 Special Solving Set 5Document6 pagesb5 Special Solving Set 5MSHANA ALLYNo ratings yet

- ACT202 - Chapter 6Document38 pagesACT202 - Chapter 6arafkhan1623No ratings yet

- Formula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductDocument6 pagesFormula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductChris MarasiganNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- 5 Contribution Margin DecisionsDocument21 pages5 Contribution Margin Decisionsabeer alfalehNo ratings yet

- Break-Even Point and Cost-Volume-Profit Analysis: QuestionsDocument39 pagesBreak-Even Point and Cost-Volume-Profit Analysis: QuestionsElijah MontefalcoNo ratings yet

- Chapter 7 Relevant CostsDocument55 pagesChapter 7 Relevant CostsnathalieroseNo ratings yet

- Paper - 5: Advanced Management Accounting Questions CVP AnalysisDocument20 pagesPaper - 5: Advanced Management Accounting Questions CVP AnalysisRohit KasbeNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Objectives of Cost-Volume-Profit AnalysisDocument7 pagesObjectives of Cost-Volume-Profit AnalysisAnonNo ratings yet

- Inventory Costing & Capacity AnalysisDocument18 pagesInventory Costing & Capacity AnalysisReshu BediaNo ratings yet

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- Marginal Costing Decision MakingDocument3 pagesMarginal Costing Decision MakingDhanesh PatilNo ratings yet

- Assignment# 3 Magic TimberDocument5 pagesAssignment# 3 Magic TimberASAD ULLAH0% (2)

- Cost-Management-Accounting-System 3Document89 pagesCost-Management-Accounting-System 3MollaNo ratings yet

- Class Test Dec 10Document6 pagesClass Test Dec 10trudes100No ratings yet

- Rebuilding the Corporate Genome: Unlocking the Real Value of Your BusinessFrom EverandRebuilding the Corporate Genome: Unlocking the Real Value of Your BusinessNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Jurnal Internasional CBDocument9 pagesJurnal Internasional CBindirapradnyaDNo ratings yet

- Introduction Feminist Values in ResearchDocument12 pagesIntroduction Feminist Values in ResearchJoana Emmerick SeabraNo ratings yet

- Pi Is 0140673619302399Document1 pagePi Is 0140673619302399ritz meshNo ratings yet

- The Feminist ViewsDocument19 pagesThe Feminist Viewsritz meshNo ratings yet

- 120-122Dr RAJIVARANJANDocument4 pages120-122Dr RAJIVARANJANritz meshNo ratings yet

- Analysis of Customer Satisfaction on Internet Banking Service Quality in Andheri to Bandra AreaDocument57 pagesAnalysis of Customer Satisfaction on Internet Banking Service Quality in Andheri to Bandra Arearitz meshNo ratings yet

- Jurnal Internasional CBDocument9 pagesJurnal Internasional CBindirapradnyaDNo ratings yet

- The Feminist ViewsDocument19 pagesThe Feminist Viewsritz meshNo ratings yet

- Your Project (1) - Converted-Pages-1-14,16-35,37Document53 pagesYour Project (1) - Converted-Pages-1-14,16-35,37ritz meshNo ratings yet

- Introduction Feminist Values in ResearchDocument12 pagesIntroduction Feminist Values in ResearchJoana Emmerick SeabraNo ratings yet

- Pi Is 0140673619302399Document1 pagePi Is 0140673619302399ritz meshNo ratings yet

- Questionnaire - ItcDocument4 pagesQuestionnaire - Itcritz meshNo ratings yet

- The Role of Social Media Marketing Strategies for Mumbai BusinessesDocument7 pagesThe Role of Social Media Marketing Strategies for Mumbai Businessesritz meshNo ratings yet

- 120-122Dr RAJIVARANJANDocument4 pages120-122Dr RAJIVARANJANritz meshNo ratings yet

- MCom Sem4 Retail ManagementDocument28 pagesMCom Sem4 Retail ManagementLIBIN JOSENo ratings yet

- Resume Format 1 (Prime)Document2 pagesResume Format 1 (Prime)ritz meshNo ratings yet

- MCom Sem4 Retail ManagementDocument28 pagesMCom Sem4 Retail ManagementLIBIN JOSENo ratings yet

- Itc Project 2Document67 pagesItc Project 2ritz meshNo ratings yet

- U Frequency: Will Go To Another Outlet 75 Will Buy Another Product 25Document4 pagesU Frequency: Will Go To Another Outlet 75 Will Buy Another Product 25ritz meshNo ratings yet

- Ashish S Consumer Behavior Project Report On Classmate NotebooksDocument160 pagesAshish S Consumer Behavior Project Report On Classmate Notebooksritz meshNo ratings yet

- TH TH: © The Institute of Chartered Accountants of IndiaDocument9 pagesTH TH: © The Institute of Chartered Accountants of Indiaritz meshNo ratings yet

- Quant AlgebraDocument11 pagesQuant Algebraritz meshNo ratings yet

- Analysis of Customer Satisfaction on Internet Banking Service Quality in Andheri to Bandra AreaDocument57 pagesAnalysis of Customer Satisfaction on Internet Banking Service Quality in Andheri to Bandra Arearitz meshNo ratings yet

- ADocument34 pagesAritz meshNo ratings yet

- Probability Extra Practice ANSWERSDocument3 pagesProbability Extra Practice ANSWERSAnto WillNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument16 pages© The Institute of Chartered Accountants of Indiaritz meshNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument11 pages© The Institute of Chartered Accountants of Indiaritz meshNo ratings yet

- hardPROB PDFDocument2 pageshardPROB PDFklausfuchsNo ratings yet

- Less: Exchange Margin at 0.10%: © The Institute of Chartered Accountants of IndiaDocument11 pagesLess: Exchange Margin at 0.10%: © The Institute of Chartered Accountants of Indiaritz meshNo ratings yet

- Bangladesh Army University of Science &technology: Supervised byDocument42 pagesBangladesh Army University of Science &technology: Supervised byAsef MubarratNo ratings yet

- Chapter 4 Internal ControlDocument55 pagesChapter 4 Internal ControlHussien AdemNo ratings yet

- Siebel Systems: Anatomy of A Sale: Case Analysis: Vaibhav Gupta, IIM SambalpurDocument2 pagesSiebel Systems: Anatomy of A Sale: Case Analysis: Vaibhav Gupta, IIM SambalpurRajeev RastogiNo ratings yet

- AssetAdditions - Asset Additions ReportDocument434 pagesAssetAdditions - Asset Additions ReportNabeel RashidNo ratings yet

- International FinanceDocument68 pagesInternational FinanceVenkata Raman RedrowtuNo ratings yet

- The Promotion MixDocument5 pagesThe Promotion Mixkeshavrathi175% (4)

- Tru EarthDocument5 pagesTru EarthSiddharthNo ratings yet

- Advance AssignmnentDocument2 pagesAdvance Assignmnentሔርሞን ይድነቃቸውNo ratings yet

- Bayer CropScience Limited 2021-22 - Web Upload (17 MB) - IndiaDocument192 pagesBayer CropScience Limited 2021-22 - Web Upload (17 MB) - IndiaAadarsh jainNo ratings yet

- GGU MBA - FoB - M1 S2 - Summary DocDocument6 pagesGGU MBA - FoB - M1 S2 - Summary Docjay pNo ratings yet

- De Beer by PatelDocument12 pagesDe Beer by Patelgunnidheepatel100% (1)

- The 2011 Focus Experts' Guide To Enterprise Resource PlanningDocument24 pagesThe 2011 Focus Experts' Guide To Enterprise Resource PlanningRahul KapoorNo ratings yet

- Post Test - Tin BeltDocument7 pagesPost Test - Tin BeltSatria Ami WibowoNo ratings yet

- Choose A Company at Your Locality and Do PresentatDocument3 pagesChoose A Company at Your Locality and Do PresentatPadua CdyNo ratings yet

- NBFC-2 BCGDocument34 pagesNBFC-2 BCGvamsi.iitkNo ratings yet

- Consumer Perception Towards Coffee Houses in India: Marketing ResearchDocument51 pagesConsumer Perception Towards Coffee Houses in India: Marketing ResearchgarimaamityNo ratings yet

- Epic Feature UserStory TaskDocument15 pagesEpic Feature UserStory TaskJean Pierre SO100% (1)

- Barlow-Just in Time Implementation Within The Hotel IndustryDocument13 pagesBarlow-Just in Time Implementation Within The Hotel Industryanglescr5100% (1)

- Accounts Questions Compiler PDFDocument187 pagesAccounts Questions Compiler PDFBrinda RNo ratings yet

- Entrepreneurship roles in quality of lifeDocument2 pagesEntrepreneurship roles in quality of lifeMarianne Grace YrinNo ratings yet

- SLT Research Methods - First 3 ChaptersDocument5 pagesSLT Research Methods - First 3 ChaptersHaneesha TeenuNo ratings yet

- TestDocument5 pagesTestashup260% (1)

- R12 Month End Close ChecklistDocument15 pagesR12 Month End Close ChecklistHaslina Hasan100% (2)

- Module 7Document35 pagesModule 7Mishti Ritz MukherjeeNo ratings yet

- Coffee Shop Financial Plan Template (2023 Guide)Document2 pagesCoffee Shop Financial Plan Template (2023 Guide)mokinyui emmanuelNo ratings yet

- Citymall Promoting Patronage Among Locals PreviewDocument7 pagesCitymall Promoting Patronage Among Locals PreviewSamael LightbringerNo ratings yet

- JIT For Lean Manufacturing FinalDocument83 pagesJIT For Lean Manufacturing FinalMusical CorruptionNo ratings yet

- FY14 IRS Form 990Document33 pagesFY14 IRS Form 990National Association of the DeafNo ratings yet

- Antique'S Morning Presentation: ABB India Muthoot Finance Cadila Healthcare Bharat Heavy Electricals Mahanagar GasDocument38 pagesAntique'S Morning Presentation: ABB India Muthoot Finance Cadila Healthcare Bharat Heavy Electricals Mahanagar Gasvatsal shahNo ratings yet

- 1.2 Defining Merchant BankingDocument6 pages1.2 Defining Merchant BankingGuru SwarupNo ratings yet