Professional Documents

Culture Documents

Deriving Actual Cost Actually

Uploaded by

Madhusudhan Reddy VangaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deriving Actual Cost Actually

Uploaded by

Madhusudhan Reddy VangaCopyright:

Available Formats

DERIVING ACTUAL COST, ACTUALLY!

ORACLE COST ACCOUNTING

WHITE PAPER

Contents

Introduction .................................................................................................................................................. 2

Build-Up ........................................................................................................................................................ 3

Case-1: Cost Layer Generation ................................................................................................................. 4

Case-2: WO creation, completion, and the checking the cost layer consumption ................................ 6

Closing Notes .............................................................................................................................................. 11

About the Author ....................................................................................................................................... 11

1 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Introduction

Cost Accounting is the Cost Accountants’ tool to calculate

inventory transaction costs, maintain inventory valuation,

generate accounting distributions for inventory and WIP VALUATION STRUCTURE

transactions, analyze product costs, analyze usage of working

capital for inventory and analyze gross margins. Cost Accounting Oracle Cloud Cost

empowers you with flexible cost setup features, including Accounting empowers

multiple cost elements, resources, overheads, and activities. Cost customers to evaluate

planning also provides involves robust planning, costing and their costing at a much

analysis of manufacturing costs. more granular level than

ever by introducing

Oracle Cloud supports three costing methods- Standard Costing, Valuation Structure to

Average (Perpetual) Costing and Actual (FIFO) Costing. Currently, maintain the item cost at

LIFO is not supported. Cost Accounting is enabled by Valuation desired atomic level.

Structure and Valuation Unit, which define the granularity at Cost Accountants can

which the cost of an item is maintained. This empowers enjoy their life more

businesses to maintain cost at the desired level such as at lot than ever in an Actual

level or serial number level or at an item level. Cost method

environment. This paper

Valuation Structure states the level at which the item cost for a highlights the

business will be maintained. Oracle Cloud enables the business significance of deploying

to maintain cost at various granular levels in order to derive the valuation structure in

best and accurate costing. This significance of the valuation Cost Accounting to reap

structure is realized even more in the case of Actual Cost larger and sustainable

method. This document will talk about the importance of benefits.

implementing Actual Costing while maintaining cost at a granular

level of VIN (serial number) in case of the automobile industry

and will differentiate it from Actual Costing at a higher level.

This paper will demonstrate the significance of using Valuation Structure in Actual Cost method

environment with a use case.

2 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Build-Up

A bus manufacturer is implementing Actual Cost method to derive its costing. The decision has

to be made on valuation structure. The requirement is to track the cost of the bus based on

Vehicle Identification Number (VIN). Currently, the business is using costing at ‘Cost

Organization – Inventory Organization’ level and thus, they find it challenging to track the bus

manufacturing cost by VIN.

The following use cases will discuss and depict the significant benefits and shortcomings of

using the valuation structure functionality in Oracle cloud. For the stated requirement, the

valuation structure is changed to ‘Cost Organization – Inventory Organization – Sub inventory –

Serial Number’. Here in this discussion, we will focus on two parts- 1000-1660 (non-serial

controlled) and BCI_BUS (Serial Controlled). The hypothesis is that the new valuation structure

shall generate the cost layer and shall calculate the final cost of the finished good based on the

actual components utilized in manufacturing it.

For this purpose, we will discuss the details under following two cases-

1. Cost Layer Generation

2. Cost Layer Consumption

In the first case, we will analyze the differences when the cost processors generate the cost

layers. While in the second case, we will discuss the exhaustion of the cost layers under two

stated cost valuation structures.

3 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Case-1: Cost Layer Generation

With the previous setup, no matter how many transactions for different VIN Bus items were

made, Cost Accounting will generate just one cost layer based on the Item code. However, with

the new valuation structure, with every transaction, the system generates a new valuation unit

based on serial number (or VIN in this case). In the absence of serial number, valuation unit is

generated based on the sub-inventory for which transaction is being done. Thus, every bus with

a unique VIN is considered as a new valuation unit and hence a new cost layer is generated in

the system.

The below screenshot depicts the cost layer for the non-serial controlled item. In the absence

of serial number, valuation unit is limited up to sub-inventory. Hence based on transaction in

various sub-inventories, valuation unit has been generated. In this case, 2 cost layers can be

seen based on transaction in two different sub-inventories.

Below screenshot depicts the cost layers for serial controlled item, which creates the valuation

unit by considering the serial number in the respective sub-inventory.

4 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Noticeably, the system has generated a cost layer for each bus with a unique VIN, which is

apparently the valuation structure and the newly created valuation unit based on the profile

option. Every cost layer details out the cost of the unique VIN Bus.

While in case of previous valuation structure, the system would have generated just one cost layer with

multiple costs for the Bus item, irrespective of the VINs. This would pose to be a problem to the

accountant when distributions are generated. Any VIN bus is being issued to the shop floor, costing

would have considered the bus cost based on FIFO. This is likely to mess up the bus cost and generate

huge variance at the period end. We will be discovering the same in the next test case.

5 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

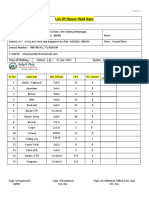

Case-2: WO creation, completion, and the checking the cost layer consumption

A non-standard work order has been created and the required bus components have been attached for

the execution of work order. In the current example, work order consumes one serial controlled Bus and

one non-serial controlled component to produce the final sellable bus.

In the old scenario, irrespective of which VIN bus (and associated cost) was received in inventory first,

the bus was issued to the current work order in order to complete and receive the finished bus in final

sub-inventory. In the screenshot below, VIN-333333 is being issued to the WO which costs 100 000

bucks (check Case-1 screenshot)

6 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Post completing the work order, all the cost processes are run and distributions get generated.

Item 1000-1660 consumed from Spares sub-inventory, which has cost $10 (refer to screenshot). It has

exhausted the respective layer as the cost generated at Sub inventory level. Note that this item is not

serial controlled and the serial number is non-mandatory in valuation structure. Hence, it will not

mandate the serial number for generating the valuation unit.

The screenshot below demonstrates the case with old valuation structure. Item 1000-1660 is received

in Production sub inventory before the Spares sub-inventory. However, as the control is maintained only

up to Inventory Organization, it consumed the cost layer created for Production sub-inventory, even

7 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

though we issued material from Spares sub inventory at a different cost.

While with the new valuation structure in place, in absence of the serial number, cost is maintained at

sub inventory level and hence the item and the item cost gets picked up from the corresponding cost

layer, which actually has been issued to work order. In the below screenshot, if the component item

would have been issued from Production sub-inventory then the corresponding cost would be used in

the work order.

8 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Similarly, VIN bus issued in accordance with the VIN issued to the work order i.e. serial number 333333

at the cost of $100000.

Below is the screenshot referencing the old valuation structure. It does not consider the VIN and the

sub-inventory. Hence it issues the BCI bus based on FIFO at a different cost $263952. In this case, only

one cost layer is available for BCI bus with multiple costs listed based on the transaction date. Thus, the

system picks up the first available cost from the list.

9 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Now when the same work order cost is compared based on two valuation structure methods, it

amounts to a significant difference as depicted below

Work order cost as per the new valuation structure-

Work order cost as per the old valuation structure-

10 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

Closing Notes

This paper has specifically highlighted the significance of intelligent use of the valuation unit. From the

above two test cases, it is inferred that with the judicious use of Valuation Unit and Valuation Structure,

business can derive the cost accurately. A business can reap the benefits of costing largely in a

sustainable manner. This will not only make it easier during period end but will also facilitate the

reconciliation and audit process.

About the Author

Ashutosh Sahu

With almost 6 years of experience in Oracle VCP and Cloud applications, Ashutosh is a qualified MBA in

Industrial and Supply Chain Management. His focus areas are advisory and solutions consulting for range

of Supply Chain organizations.

Copyright © 2018, Trinamix Inc. All rights reserved. This document is provided for information purposes

only and the contents hereof are subject to change without notice. This document is not warranted

error-free, nor subject to any other warranties or conditions, whether expressed orally or implied in law,

did including implying warranties and conditions of merchantability or fitness for a particular purpose

11 White Paper | Deriving Actual Cost, Actually!

www.trinamix.com

You might also like

- DBM Process Flow ChartDocument5 pagesDBM Process Flow ChartGobi NagarajanNo ratings yet

- Split Valuation - Phantom - Mixed CostingDocument33 pagesSplit Valuation - Phantom - Mixed Costingmannoj2001No ratings yet

- Chapter 4 Solutions Comm 305Document159 pagesChapter 4 Solutions Comm 305mike67% (3)

- Cost Object Mapping ConfigurationDocument4 pagesCost Object Mapping ConfigurationGK SKNo ratings yet

- Introduction to Activity Based Costing (ABCDocument4 pagesIntroduction to Activity Based Costing (ABCDANIELANo ratings yet

- Activity-Based Costing and Activity-Based ManagementDocument30 pagesActivity-Based Costing and Activity-Based ManagementNitin RajotiaNo ratings yet

- Elemental Cost Analysis User ManualDocument7 pagesElemental Cost Analysis User ManualAlexander DomoulinNo ratings yet

- BPCS Costing1Document5 pagesBPCS Costing1Satya BobbaNo ratings yet

- Demystifying The Usage of Sub-Items in is-OIL TSWDocument21 pagesDemystifying The Usage of Sub-Items in is-OIL TSWmagforuNo ratings yet

- Configure Loss Accrual Using Project Process ConfiguratorDocument9 pagesConfigure Loss Accrual Using Project Process ConfiguratorabhijitNo ratings yet

- ABC CostingDocument10 pagesABC CostingJerilyn EscañoNo ratings yet

- Accounting 2Document7 pagesAccounting 2vietthuiNo ratings yet

- 2015 03 17costmgmtwhitepaperDocument37 pages2015 03 17costmgmtwhitepaperkrishanu1013No ratings yet

- Traditional vs ABC CostingDocument7 pagesTraditional vs ABC Costingsandesh tamrakarNo ratings yet

- Introduction To Activity Based CostingDocument3 pagesIntroduction To Activity Based CostingAnonymous qbVaMYIIZNo ratings yet

- Overhead Cost Planning Using Costing SheetDocument15 pagesOverhead Cost Planning Using Costing SheetBalanathan Virupasan100% (1)

- CH 14Document4 pagesCH 14sweetescape1100% (3)

- ABC problems and costing systemsDocument17 pagesABC problems and costing systemsKathryn TeoNo ratings yet

- Sap & Finance - Sap Fico Interview Questions - Product CostingDocument8 pagesSap & Finance - Sap Fico Interview Questions - Product CostingA KNo ratings yet

- Chapter 5 (Activity-Based Costing) Video: Overhead To Products Based On Direct Labor, With Labor Being A Measure ofDocument8 pagesChapter 5 (Activity-Based Costing) Video: Overhead To Products Based On Direct Labor, With Labor Being A Measure ofMhekai SuarezNo ratings yet

- Seminar 3 - QDocument3 pagesSeminar 3 - QanalsluttyNo ratings yet

- Job-Process Costing SystemsDocument25 pagesJob-Process Costing Systemsliyneh mebrahituNo ratings yet

- Activity-Based Costing PPT SummaryDocument43 pagesActivity-Based Costing PPT SummaryHannah Mae VestilNo ratings yet

- Costing Sheet CalculDocument16 pagesCosting Sheet CalculSudhakar PatnamNo ratings yet

- Sap Standard Product Costing 1701037406Document130 pagesSap Standard Product Costing 1701037406Nessma MohamedNo ratings yet

- San FS SD P004 1.0Document10 pagesSan FS SD P004 1.0Amarnath ReddyNo ratings yet

- Cost Rollup BasicsDocument9 pagesCost Rollup BasicssdhrubuNo ratings yet

- Job Order Costing FINALDocument11 pagesJob Order Costing FINALmannu.abhimanyu3098No ratings yet

- Job Monitoring Setup With SAP Solution Manager 7.1 SP 10Document5 pagesJob Monitoring Setup With SAP Solution Manager 7.1 SP 10Wikendro DjuminNo ratings yet

- Understanding Results Analysis For WIP: Introduction and Configuration GuideDocument3 pagesUnderstanding Results Analysis For WIP: Introduction and Configuration GuidegildlreiNo ratings yet

- Oracle Flow Manufacturing - Process FlowDocument31 pagesOracle Flow Manufacturing - Process FlowPritesh MoganeNo ratings yet

- KKS5 Variance Calculation Product Cost Collectors - CollectiDocument7 pagesKKS5 Variance Calculation Product Cost Collectors - Collecticinek777No ratings yet

- Oracle WIP WhitepaperDocument23 pagesOracle WIP WhitepapertsurendarNo ratings yet

- Manufacturing AccountingDocument9 pagesManufacturing AccountingKui MangusNo ratings yet

- EAM CostDocument43 pagesEAM CostAymen HamdounNo ratings yet

- اسئلهIMA الهامهDocument31 pagesاسئلهIMA الهامهhmza_6No ratings yet

- SAP CO PC Product Costing Q & ADocument14 pagesSAP CO PC Product Costing Q & AJit GhoshNo ratings yet

- AccountingDocument20 pagesAccountingAbdul AyoubNo ratings yet

- Reposting and Analysing Controlling Profitability Analysis DocumentsDocument14 pagesReposting and Analysing Controlling Profitability Analysis Documentsakbarthwal1977No ratings yet

- Soal Tugas Problem Product CostingDocument2 pagesSoal Tugas Problem Product CostingMaria DiajengNo ratings yet

- Activity Based CostingDocument4 pagesActivity Based CostingprashantNo ratings yet

- How Value Stream Costing WorksDocument4 pagesHow Value Stream Costing Workstanpreet_makkadNo ratings yet

- Asset Capitalization ThresholdDocument5 pagesAsset Capitalization ThresholdSohail AkhtarNo ratings yet

- KKS6 Variance Calculation Product Cost CollectorDocument4 pagesKKS6 Variance Calculation Product Cost Collectorcinek777No ratings yet

- Repitive Man-Sap LibraryDocument15 pagesRepitive Man-Sap LibraryPrateek SehgalNo ratings yet

- Retrobilling 11.5.10Document9 pagesRetrobilling 11.5.10Muhammad Daniyal KhurshidiNo ratings yet

- Ch4 - Cost Accounting - UpdatedDocument21 pagesCh4 - Cost Accounting - UpdatedrasmimoqbelNo ratings yet

- Cost 1 Chapt-3Document43 pagesCost 1 Chapt-3Tesfaye Megiso BegajoNo ratings yet

- Product Cost by Order CycleDocument10 pagesProduct Cost by Order CycleSunando Narayan BiswasNo ratings yet

- Backflush Accounting 1Document9 pagesBackflush Accounting 1Ai Lin ChenNo ratings yet

- FIFO CostingDocument13 pagesFIFO Costingangra11100% (1)

- ERP Article - Lean Manufacturing Using MS DynamicsDocument11 pagesERP Article - Lean Manufacturing Using MS Dynamicsanushag2211No ratings yet

- MIGRATION TO PERIOD COSTDocument9 pagesMIGRATION TO PERIOD COSTChandrababu Naidu BoyapatiNo ratings yet

- Batch Costing - Meaning, Need and Types (With Calculations)Document9 pagesBatch Costing - Meaning, Need and Types (With Calculations)Namrita GuptaNo ratings yet

- Unit Three Activity-Based CostingDocument9 pagesUnit Three Activity-Based CostingDzukanji SimfukweNo ratings yet

- MICROSOFT AZURE ADMINISTRATOR EXAM PREP(AZ-104) Part-4: AZ 104 EXAM STUDY GUIDEFrom EverandMICROSOFT AZURE ADMINISTRATOR EXAM PREP(AZ-104) Part-4: AZ 104 EXAM STUDY GUIDENo ratings yet

- SAP Variant Configuration: Your Successful Guide to ModelingFrom EverandSAP Variant Configuration: Your Successful Guide to ModelingRating: 5 out of 5 stars5/5 (2)

- Oracle SCM Functional Guide - Oracle Inventory - Defining Organization AccessDocument4 pagesOracle SCM Functional Guide - Oracle Inventory - Defining Organization AccessMadhusudhan Reddy VangaNo ratings yet

- The Oracle Prodigy - Changing The Home Page Layout in Oracle Fusion ApplicationsDocument4 pagesThe Oracle Prodigy - Changing The Home Page Layout in Oracle Fusion ApplicationsMadhusudhan Reddy VangaNo ratings yet

- ASL Sourcing in Procurement PDFDocument27 pagesASL Sourcing in Procurement PDFStacey BrooksNo ratings yet

- The Oracle Prodigy - Changing The Home Page Layout in Oracle Fusion ApplicationsDocument4 pagesThe Oracle Prodigy - Changing The Home Page Layout in Oracle Fusion ApplicationsMadhusudhan Reddy VangaNo ratings yet

- SLA and Cost AcctgDocument57 pagesSLA and Cost AcctgcadigvijayNo ratings yet

- Oracle Applications - Oracle R12 Order Management and Purchase Orders Data Fix Patches and ScriptsDocument5 pagesOracle Applications - Oracle R12 Order Management and Purchase Orders Data Fix Patches and ScriptsMadhusudhan Reddy VangaNo ratings yet

- Fetch Order Transaction Type Details in Oracle Order ManagementDocument17 pagesFetch Order Transaction Type Details in Oracle Order ManagementMadhusudhan Reddy VangaNo ratings yet

- CostingDocument34 pagesCostingTito247No ratings yet

- Oracle SCM Shipping Parameters GuideDocument4 pagesOracle SCM Shipping Parameters GuideMadhusudhan Reddy VangaNo ratings yet

- Applies To:: Amr (Available) Contact Us HelpDocument1 pageApplies To:: Amr (Available) Contact Us HelpMadhusudhan Reddy VangaNo ratings yet

- Te040 Iprocurement Test Script On Oracle Iprocurement 101018161903 Phpapp01Document48 pagesTe040 Iprocurement Test Script On Oracle Iprocurement 101018161903 Phpapp01Madhusudhan Reddy VangaNo ratings yet

- Datafix Script To Clear The RCV Stuck Pending TransactionsDocument2 pagesDatafix Script To Clear The RCV Stuck Pending TransactionsMadhusudhan Reddy VangaNo ratings yet

- ASL Sourcing in Procurement PDFDocument27 pagesASL Sourcing in Procurement PDFStacey BrooksNo ratings yet

- Oracle Applications - ITEMSDocument4 pagesOracle Applications - ITEMSMadhusudhan Reddy VangaNo ratings yet

- Due To Security Profile Issue Has RaisedDocument1 pageDue To Security Profile Issue Has RaisedMadhusudhan Reddy VangaNo ratings yet

- Oracle Iexpenses Process FlowDocument17 pagesOracle Iexpenses Process FlowMadhusudhan Reddy VangaNo ratings yet

- Work Confirmation DeleteDocument3 pagesWork Confirmation DeleteMadhusudhan Reddy VangaNo ratings yet

- AME Setup - Oracle Apps ReferenceDocument16 pagesAME Setup - Oracle Apps ReferenceMadhusudhan Reddy VangaNo ratings yet

- I Supplier KeyfeaturesDocument7 pagesI Supplier KeyfeaturesMadhusudhan Reddy VangaNo ratings yet

- HoldsDocument1 pageHoldsMadhusudhan Reddy VangaNo ratings yet

- OFI GST – Assets IntegrationDocument19 pagesOFI GST – Assets IntegrationMadhusudhan Reddy VangaNo ratings yet

- Procure To Pay (p2p) R12 - ErpSchoolsDocument20 pagesProcure To Pay (p2p) R12 - ErpSchoolsMadhusudhan Reddy VangaNo ratings yet

- Optimize profile option namesDocument453 pagesOptimize profile option namesMadhusudhan Reddy VangaNo ratings yet

- Consigned Process in Oracle InventoryDocument10 pagesConsigned Process in Oracle InventoryMadhusudhan Reddy VangaNo ratings yet

- El Shaye B Expense Sub Inventory and ItDocument27 pagesEl Shaye B Expense Sub Inventory and ItMadhusudhan Reddy VangaNo ratings yet

- Work Confirmation Correction Qty WrongDocument1 pageWork Confirmation Correction Qty WrongMadhusudhan Reddy VangaNo ratings yet

- Daily Assessment RecordDocument4 pagesDaily Assessment Recordapi-342236522100% (2)

- 3.1 C 4.5 Algorithm-19Document10 pages3.1 C 4.5 Algorithm-19nayan jainNo ratings yet

- Pharma TestDocument2 pagesPharma TestMuhammad AdilNo ratings yet

- Eportfile 4Document6 pagesEportfile 4api-353164003No ratings yet

- Plastic Welding: We Know HowDocument125 pagesPlastic Welding: We Know Howprabal rayNo ratings yet

- Types of NumbersDocument11 pagesTypes of NumbersbrajanosmaniNo ratings yet

- List of household items for relocationDocument4 pagesList of household items for relocationMADDYNo ratings yet

- Reference - Unit-V PDFDocument128 pagesReference - Unit-V PDFRamesh BalakrishnanNo ratings yet

- Advanced Presentation Skills: Creating Effective Presentations with Visuals, Simplicity and ClarityDocument15 pagesAdvanced Presentation Skills: Creating Effective Presentations with Visuals, Simplicity and ClarityGilbert TamayoNo ratings yet

- Sonigra Manav Report Finle-Converted EDITEDDocument50 pagesSonigra Manav Report Finle-Converted EDITEDDABHI PARTHNo ratings yet

- Phaseo Abl7 Abl8 Abl8rps24100Document9 pagesPhaseo Abl7 Abl8 Abl8rps24100Magda DiazNo ratings yet

- I Button Proper TDocument4 pagesI Button Proper TmariammariaNo ratings yet

- Admission Procedure For International StudentsDocument8 pagesAdmission Procedure For International StudentsAndreea Anghel-DissanayakaNo ratings yet

- Medicinal PlantDocument13 pagesMedicinal PlantNeelum iqbalNo ratings yet

- Quick Reference - HVAC (Part-1) : DECEMBER 1, 2019Document18 pagesQuick Reference - HVAC (Part-1) : DECEMBER 1, 2019shrawan kumarNo ratings yet

- (PDF) Biochemistry and Molecular Biology of Plants: Book DetailsDocument1 page(PDF) Biochemistry and Molecular Biology of Plants: Book DetailsArchana PatraNo ratings yet

- Hisar CFC - Approved DPRDocument126 pagesHisar CFC - Approved DPRSATYAM KUMARNo ratings yet

- Vincent Ira B. Perez: Barangay Gulod, Calatagan, BatangasDocument3 pagesVincent Ira B. Perez: Barangay Gulod, Calatagan, BatangasJohn Ramsel Boter IINo ratings yet

- Presepsi Khalayak Terhadap Program Acara Televise Reality Show "Jika Aku Menjadi" Di Trans TVDocument128 pagesPresepsi Khalayak Terhadap Program Acara Televise Reality Show "Jika Aku Menjadi" Di Trans TVAngga DianNo ratings yet

- Building Primitive Traps & SnaresDocument101 pagesBuilding Primitive Traps & SnaresJoseph Madr90% (10)

- DNA Affirmative - MSDI 2015Document146 pagesDNA Affirmative - MSDI 2015Michael TangNo ratings yet

- Boala Cronica Obstructive: BpocDocument21 pagesBoala Cronica Obstructive: BpocNicoleta IliescuNo ratings yet

- Ek Pardesi Mera Dil Le Gaya Lyrics English Translation - Lyrics GemDocument1 pageEk Pardesi Mera Dil Le Gaya Lyrics English Translation - Lyrics Gemmahsa.molaiepanahNo ratings yet

- More Than Moore: by M. Mitchell WaldropDocument4 pagesMore Than Moore: by M. Mitchell WaldropJuanjo ThepresisNo ratings yet

- SolarBright MaxBreeze Solar Roof Fan Brochure Web 1022Document4 pagesSolarBright MaxBreeze Solar Roof Fan Brochure Web 1022kewiso7811No ratings yet

- 13Document47 pages13Rohan TirmakheNo ratings yet

- Grace Lipsini1 2 3Document4 pagesGrace Lipsini1 2 3api-548923370No ratings yet

- City MSJDocument50 pagesCity MSJHilary LedwellNo ratings yet

- C11 Strategy DevelopmentDocument30 pagesC11 Strategy DevelopmentPARTI KEADILAN RAKYAT NIBONG TEBALNo ratings yet

- 2010-12 600 800 Rush Switchback RMK Service Manual PDFDocument430 pages2010-12 600 800 Rush Switchback RMK Service Manual PDFBrianCook73% (11)