Professional Documents

Culture Documents

Format For Course Curriculum: Annexure CD - 01'

Uploaded by

Akash Singh RajputOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Format For Course Curriculum: Annexure CD - 01'

Uploaded by

Akash Singh RajputCopyright:

Available Formats

Annexure ‘CD – 01’

FORMAT FOR COURSE CURRICULUM

Course Title: Principle & Practice of Banking L T P/S SW/F TOTAL

Course Code: W CREDIT

Credit Units: 3 UNITS

3 - - - 3

Course Contents/Syllabus:

Weightage %

Course Objectives: The objective of this course is to facilititate study of theory and practise of banking and finance. The course is

intented to introduce Indian banking and touches on almost every aspect, from the Indian financial system to contemporary issues

and developments in the industry.

Pre-requisites: Students are expected to take note of all the latest developments relating to the subject covered in the syllabus by

referring to Financial Papers, Economic Journals, Latest Books and Publications in the subject concerned.

Student Learning Outcomes: On the successful completion of this module the student will be able to acquire an in-depth knowledge

of the following:

Various functions associated with banking.

Practise and procedures relating to deposit and credit,documentation,monitoring and control

An insight into marketing of banking services and banking technology.

Module I : Indian Financial System 25% Weightage

Descriptors/Topics

Recent developments in Indian Financial System, Market Structure and Financial Innovation, RBI, SEBI, IRDA and their major functions;Role & Function

of banks;Regulatory provisions;Enactments Governing Banks( Banking Regulation Act 1949, RBI Act 1935 etc.);Basic concepts of Retail

banking,Wholesale banking,International Banking;Role and function of Money Market-CP ; -Bancassurance;Importance of Risk Management in

Banks(credit, market, liquidity, operational and Interest rate risk);Basic concept of VaR Analysis; Banking Codes, Impact of Basel I, II & III & Capital

Adequacy Ratio.

Module II: Functions of Banks(Deposit) 15% Weightage

Descriptors/Topics

Banker-customer relationship( As per Indian contract Act) ; Know Your Customer (KYC) guidelines; Different deposit products, services rendered by banks(

locker etc..);Mandate & Power of Attorney;Paying & Collecting Banker( remittance, drafts etc.);Protection available under Negotiable Instruments Act;

Endorsements;Forged Instruments;Bouncing of cheques and their implications, Ancillary services: Remittances, Safe Deposit Lockers, etc.

Module III : Functions of Banks(Credit) 25% Weightage

Descriptors/Topics

Recommendations of Tandon Committee, Chore Committee & Nayak Committee;Principles of lending; Working Capital & term loans;Appraisal

techniques(for loans);Credit Monitoring;NPA Management( DRT/DRAT, SARFAESI Act 2002, Competition Act 2005);Priority sector lending( credit

appraisal mechanism);Financial Inclusion- PMJDY Agriculture,SMEs,SHGs,SSIs;Tiny sector financing(i.e. Microfinance);New product & Services- Credit

cards/ Personal loans/Consumer loans-brief outlining of Procedures and Practices; Nachiket Mor committee Report, Payment Banks and Small Banks,

Business Correspodence, Concept of Base Rate and its calculation & Prime Lending Rate, Treasury Management

Module IV : Banking Technology 20% Weightage

Descriptors/Topics

Banking Technology;Core Banking(CBS); Electronic Products;Banking Technology; Distribution Channels, Teller Machines at the bank counters;Cash

dispensers;ATMs, Home banking;Electronic Payment System;Online Banking-Personal Identification Numbers and their Use in Conjunction with magnetic

cards of both credit and debit cards, Smart Cards;Signature storage and Display by Electronic Means;Cheque Truncation;Microfiche;Note and Coin counting

devices;Electronic Funds Tranfer-SWIFTS,RTGS,NEFT;Information Technology-RBI NET, Datanet, Nicnet,I-NET, Internet, Email; Global developments &

Banking Technology; Impact of Technology on banks;Cyber security-protecting the confidentiality and secrecy of data;Phising attack;Cloud Computing;

Moble Phone Banking

Module V: Support Services-Marketing of Banking Services/Products 15% Weightage

Descriptors/Topics

Marketing Management; Product Research & Development, Test Marketing of Bank Products,;Cross selling,Upselling;Product life cycle; Product

Modification, New Product Development;Packaging & Branding of Bank Products( Re-engineering);Diversification;Importance of

Pricing;Distribution;Factors influencing Direct & Indirect Channels of Bank Products;Physical distribution;Promotion;Promotion Mix, Role of Promotion in

Marketing;Marketing Information System- Role of DSA/DMA in bank Marketing;;Channel Management;Selling Functions of a Bank;Portfolio & Wealth

Management; Portfolio & Wealth Management; Telemarketing , Bancassurrance,

Pedagogy for Course Delivery: The course is covered by adopting a combination of lecture methods, class presentation by groups

of students, self study sessions. Each student is required to do the back ground reading from the specified chapters of the prescribed

book before coming to class. Cases are also to be analyzed, discussed in groups (teams) outside the class as preparatory work.

Assessment/ Examination Scheme:

Theory L/T (%) Special Project End Term Examination

25% 5% 70%

Theory Assessment (L&T):

Continuous Assessment/Internal Assessment End Term

Examination

Components (Drop CT CP Group Presentation Attendence

down)

Weightage (%) 10 5 10 05 70

Text & References:

Indian Institute of Banking & Finance,Principles & Practices of Banking, Macmillan Publishers Ltd.,2013

Paul ,Suresh, Management of Banking and Financial Services, second edition (Pearson)

Berry, Leonard L., Donnelly , Jr, James H., Marketing for bankers, American Institute of banking, American Bankers Association, 1975

Patodiya, S.N.,, Bank Marketing Management, Macmillan Publishers Ltd.,1984

Kaptan, S.S. and Choubey, N.S., Indian Banking in Electronic Era, Sarup & Sons, NewDelhi,2003

Agarwal O.P. Practices & Law of Banking CAIIB-Guide, Skylark Publications

Sobti, Renu, Banking and Financial Services in India- marketing Redefined, New Century Publications,2003

Soni S. and V. Aggarwal, Computers and Banking, Sultan Chand & Sons, New Delhi

Verma ,J.C., Negotiable Instruments Act, Bharat Law House Private Ltd., New Delhi

Jain, Alok K. Marketing, Challenges for Commercial Banks of India, Swajay Publishers,1997

Any other Study Material:

Articles from Journal of Finance

Articles from International Journal -Finance India

Business newspapers

Yahoo finance (http://finance.yahoo.com/)

Investopedia (www.investopedia.com) - Investing 101 ,Stock Basics ,Basic Financial Concepts, Bond & Debt Basics ,IPO Basics, Brokers and

Online Trading, Economics Basics, Reading Financial Tables, Understanding the P/E Ratio

Google Finance (www.google.com/finance)

Remarks & Suggestions:

Date: Name & Designation

Organization

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Statement PDFDocument3 pagesStatement PDFRodney PattersonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Reading and Use of English-Paper 1-Part5-H-5Document2 pagesReading and Use of English-Paper 1-Part5-H-5Punky Brewster0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Supply Chain Management of Big BazaarDocument48 pagesSupply Chain Management of Big BazaarAkash Singh RajputNo ratings yet

- Lioyds Bank Statment 3Document4 pagesLioyds Bank Statment 3zainabNo ratings yet

- Initiating Process Group: ABS ABSDocument8 pagesInitiating Process Group: ABS ABSAkash Singh RajputNo ratings yet

- 3.5 Changing Dynamics of Strategic Growth - Technology Driven Aggregation and Large Scale ConsolidationDocument15 pages3.5 Changing Dynamics of Strategic Growth - Technology Driven Aggregation and Large Scale ConsolidationAkash Singh Rajput100% (1)

- II. Income Under The House Properties :: Basis of Charge Section 22Document4 pagesII. Income Under The House Properties :: Basis of Charge Section 22Akash Singh RajputNo ratings yet

- Numericals Module 1 & 2Document7 pagesNumericals Module 1 & 2Akash Singh RajputNo ratings yet

- Amity Business School: Process OverviewDocument5 pagesAmity Business School: Process OverviewAkash Singh RajputNo ratings yet

- Regression DataDocument1 pageRegression DataAkash Singh RajputNo ratings yet

- Session 1-2Document4 pagesSession 1-2Akash Singh RajputNo ratings yet

- 3.4 Porter's Model of Generic Business StrategiesDocument8 pages3.4 Porter's Model of Generic Business StrategiesAkash Singh RajputNo ratings yet

- Amity Business School: Program Management OfficeDocument4 pagesAmity Business School: Program Management OfficeAkash Singh RajputNo ratings yet

- Technical FormulaesDocument3 pagesTechnical FormulaesRajatSharmaNo ratings yet

- Course Learning Outcomes: Students Will Be Able: 1 2 3 4 5Document5 pagesCourse Learning Outcomes: Students Will Be Able: 1 2 3 4 5Akash Singh RajputNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsAkash Singh RajputNo ratings yet

- SP Logical AbilityDocument4 pagesSP Logical AbilitysidNo ratings yet

- Akash TestDocument3 pagesAkash TestAkash Singh RajputNo ratings yet

- Class Summary - 9th March 2021Document1 pageClass Summary - 9th March 2021Akash Singh RajputNo ratings yet

- Sample Questions: English ComprehensionDocument4 pagesSample Questions: English ComprehensionAkash Singh RajputNo ratings yet

- Traning Need AnalysisDocument5 pagesTraning Need AnalysisAkash Singh RajputNo ratings yet

- Documents - 16ad0highlights of Campus Placement Handbook 2020-2022.Document5 pagesDocuments - 16ad0highlights of Campus Placement Handbook 2020-2022.Akash Singh RajputNo ratings yet

- Format For Course Curriculum: Course Level: PG Course Objectives: Course ObjectivesDocument5 pagesFormat For Course Curriculum: Course Level: PG Course Objectives: Course ObjectivesAkash Singh RajputNo ratings yet

- Course Objectives: The Objective of This Course Is To: L T P/S SW/F W Total Credit UnitsDocument3 pagesCourse Objectives: The Objective of This Course Is To: L T P/S SW/F W Total Credit UnitsShubham AgarwalNo ratings yet

- Course Title: Corporate Tax Planning & Management Course Code: ACCT801 Credit Units:03 Level: PGDocument5 pagesCourse Title: Corporate Tax Planning & Management Course Code: ACCT801 Credit Units:03 Level: PGAkash Singh RajputNo ratings yet

- FM InterpretationDocument5 pagesFM InterpretationAKASHNo ratings yet

- Project Planning, Appraisal and ControlDocument4 pagesProject Planning, Appraisal and ControlAkash Singh RajputNo ratings yet

- NoteworthyExercise 1556814574514Document2 pagesNoteworthyExercise 1556814574514Akash Singh RajputNo ratings yet

- NTCC Project 2Document28 pagesNTCC Project 2Akash Singh RajputNo ratings yet

- Strengths: Become A Data AnalystDocument1 pageStrengths: Become A Data AnalystAkash Singh RajputNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- Conflict Style QuestionnaireDocument5 pagesConflict Style QuestionnaireAKASHNo ratings yet

- Afsar Raza CVDocument2 pagesAfsar Raza CVWaqas Malook KhattakNo ratings yet

- (G.r. No. 115324. February 19, 2003) Producers Bank of The Philippines (Now First International Bank), Petitioner, vs. Hon. Court of Appeals and Franklin Vives, RespondentsDocument2 pages(G.r. No. 115324. February 19, 2003) Producers Bank of The Philippines (Now First International Bank), Petitioner, vs. Hon. Court of Appeals and Franklin Vives, RespondentsQueenie SabladaNo ratings yet

- Thoughts About FTPDocument10 pagesThoughts About FTPJaphyNo ratings yet

- Monthly BeePedia June 2021Document100 pagesMonthly BeePedia June 2021convey2rohit2190No ratings yet

- Exchange Rate 1: The Monetary Approach in The Long-RunDocument26 pagesExchange Rate 1: The Monetary Approach in The Long-RunTrần Hoàn Hạnh NgânNo ratings yet

- Check ReportsDocument3 pagesCheck ReportsM RAMAKRISHNA RAONo ratings yet

- A Comparative Study of Non-Performing Assets of Canara Bank & Icici BankDocument42 pagesA Comparative Study of Non-Performing Assets of Canara Bank & Icici BankASWATHYNo ratings yet

- Emilio Final Updated - Docx 1Document33 pagesEmilio Final Updated - Docx 1Joel C. BaccayNo ratings yet

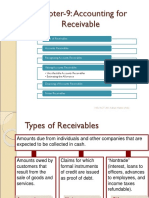

- Chapter-9: Accounting For Receivable: Types of ReceivablesDocument24 pagesChapter-9: Accounting For Receivable: Types of ReceivablesMohammed Merajul IslamNo ratings yet

- Gerald Canton Palma: Statement of AccountDocument4 pagesGerald Canton Palma: Statement of AccountGerald PalmaNo ratings yet

- Name: Muhammad Azeem Shoukat Name: Muhammad Azeem Shoukat Name: Muhammad Azeem Shoukat Name: Muhammad Azeem ShoukatDocument1 pageName: Muhammad Azeem Shoukat Name: Muhammad Azeem Shoukat Name: Muhammad Azeem Shoukat Name: Muhammad Azeem ShoukatمحمدعظیمچوھدریNo ratings yet

- Activities Undertaken by Banks Include Personal Banking, Corporate BankingDocument7 pagesActivities Undertaken by Banks Include Personal Banking, Corporate BankingPrince Isaiah JacobNo ratings yet

- Annex G-Recon Statement of AccountabilityDocument11 pagesAnnex G-Recon Statement of AccountabilityAllyssa GabaldonNo ratings yet

- Wa0097 PDFDocument57 pagesWa0097 PDFPooja PhadatareNo ratings yet

- Doc1544 9849Document1 pageDoc1544 9849georgebates1979No ratings yet

- Swift Mashreeq Bank-1Document2 pagesSwift Mashreeq Bank-1Wallet Leo100% (1)

- Mfi AssignmentDocument5 pagesMfi Assignmentdeepika singhNo ratings yet

- For Goaml: Data Processing and CleaningDocument14 pagesFor Goaml: Data Processing and CleaningrashedNo ratings yet

- 35 T PGLDocument14 pages35 T PGLemmanuelnwankwoNo ratings yet

- challanform9TH BIODocument1 pagechallanform9TH BIOferozabad schoolNo ratings yet

- List of Conditions Effective From 01-04-2017Document13 pagesList of Conditions Effective From 01-04-2017omidreza tabrizianNo ratings yet

- Receivable Financing Sample ProblemDocument3 pagesReceivable Financing Sample ProblemKathleen FrondozoNo ratings yet

- S Poddar and Co ProfileDocument35 pagesS Poddar and Co ProfileasassasaaNo ratings yet

- Black Slip Deutsche Bank Ag-99euroDocument3 pagesBlack Slip Deutsche Bank Ag-99eurohaleighcrissy49387No ratings yet

- Summer Internship Presentation On Bank Finance Effective Post Sanction Monitoring, Problems & SolutionsDocument24 pagesSummer Internship Presentation On Bank Finance Effective Post Sanction Monitoring, Problems & SolutionsHemant YadavNo ratings yet

- Islamic BankingDocument11 pagesIslamic BankingAmara Ajmal100% (5)

- Jaysasuman ResumeDocument5 pagesJaysasuman ResumeJay SasumanNo ratings yet