Professional Documents

Culture Documents

Fundamentals of Accountancy Business and Management 1 (Lehnard D. Gellor, CPA) Page 1 of 4

Uploaded by

Lehnard Delos Reyes GellorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Accountancy Business and Management 1 (Lehnard D. Gellor, CPA) Page 1 of 4

Uploaded by

Lehnard Delos Reyes GellorCopyright:

Available Formats

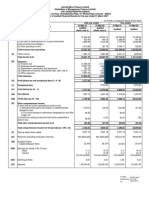

FINAL EXAMINATION

Second Semester, SY 2020-2021

May 17-19, 2021

Student Number: _________

Name: ______Alfea Mae M. Bercero

_____________________________________________

Grade and Section: _________11- Score

ABM_______________________________

------------------------------------------------------------------------------------------------------------------------------------------------

General Instructions: Read and analyze each item carefully. Answer the given items by providing the

necessary information asked for.

------------------------------------------------------------------------------------------------------------------------------------------------

Test I. Provided below is the Unadjusted Trial Balance of “Cardo General Merchandise” for the year

ended Dec. 31, 2020.

Cardo General Merchandise

Unadjusted Trial Balance

December 31, 2020

Debit Credit

Cash 100,123

Accounts Receivable 512,698

Merchandise Inventory 278,691

Prepaid Insurance 146,100

Accounts Payable 241,386

Dalisay, Capital 547,854

Dalisay, Withdrawals 100,000

Sales 819,313

Sales Discounts 57,410

Sales Returns and Allowances 5,000

Purchases 249,772

Purchases Discounts 6,193

Purchases Returns and Allowances 8,460

Freight-in 100,258

Utilities Expense 23,154

Insurance Expense 50,000

Total 1,623,20 1,623,206

6

Additional Information:

a Insurance in the amount of P60,875 has expired during the year.

b The December 31 merchandise inventory amounted to P289,636.00.

Required: Prepare worksheet. Use the template provided below. (40 pts.)

Fundamentals of Accountancy Business and Management 1 [Lehnard D. Gellor, CPA] Page 1 of 4

Cardo General Merchandise

Worksheet

December 31, 2020

Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Account Titles

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash 100,123

Accounts Receivable 512,698

Merchandise Inventory 278,691

Prepaid Insurance 146,100

Accounts Payable 241,386

Dalisay, Capital 547,854

Dalisay, Withdrawals 100,000

Sales 819,313

Sales Discounts 57,410

Sales Ret. and Allow. 5,000

Purchases 249,772

Purchases Discounts 6,193

Purchases Ret. And Allow. 8,460

Freight-in 100,258

Utilities Expense 23,154

Insurance Expense 50,000

Total 1,623,206 1,623,206

Profit/Loss

Total

additional

INsurace 60,875

Fundamentals of Accountancy Business and Management 1 [Lehnard D. Gellor, CPA] Page 2 of 4

merchandise inventory 289,636.00

Fundamentals of Accountancy Business and Management 1 [Lehnard D. Gellor, CPA] Page 3 of 4

Fundamentals of Accountancy Business and Management 1 [Lehnard D. Gellor, CPA] Page 4 of 4

Test II. Provided below are income statement accounts taken from the Dec. 31, 2020 worksheet of

Edgardo Banay-banay.

Banay-banay General Merchandise

Debit Credit

Sales 978,000

Sales Discounts 64,150

Sales Returns and Allowances 5,000

Purchases 651,009

Purchases Discounts 10,459

Purchases Returns and Allowances 6,200

Freight-in 100,500

Salaries Expense 124,000

Miscellaneous Expense 50,000

Total 994,659 994,659

Additional Information:

a The beginning and ending merchandise inventory are 400,000 and 678,450 respectively.

Required: Prepare income statement (10 pts). Use the template provided below.

Fundamentals of Accountancy Business and Management 1 [Lehnard D. Gellor, CPA] Page 5 of 4

Banay-banay General Merchandise

Income Statement

For the Year Ended December 31, 2020

Net Sales

Sales 978,000

Less: Sales returns and Allowances 5,000

Sales Discounts 64,150 69,150

Net sales 908

Cost of goods sold

Merchandise Inventory, January1 400,000

Purchases

Less: Purchase Returns & Allowances

Purchase Discounts

Net purchases

Add: Freight-in

Cost of goods purchased

Cost of goods available for sale

Less: Merchandise Inventory, December 31

Cost of goods sold

Gross Profit

Operating expenses

Salaries Expense

Miscellaneous Expense

Total operating expense

Net Profit

Fundamentals of Accountancy Business and Management 1 [Lehnard D. Gellor, CPA] Page 6 of 4

You might also like

- Financial Transaction WorksheetDocument6 pagesFinancial Transaction WorksheetAnya DaniellaNo ratings yet

- Module 4 Packet: AE 111 - Financial Accounting & ReportingDocument28 pagesModule 4 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- Fundamentals of Accountancy, Business and Management 1: Quarter 4 - Week 7Document6 pagesFundamentals of Accountancy, Business and Management 1: Quarter 4 - Week 7nicss bonaobraNo ratings yet

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument17 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditPrecious NosaNo ratings yet

- Balance Sheet Only-Agatha TradingDocument1 pageBalance Sheet Only-Agatha TradingJasmine Acta0% (1)

- Financial Statement Analysis Part 2Document10 pagesFinancial Statement Analysis Part 2Kim Patrick VictoriaNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Quiz 4 - Statement of Cash FlowsDocument2 pagesQuiz 4 - Statement of Cash FlowsFrancez Anne Guanzon33% (3)

- Castro-Merchandising 20211124 0001Document2 pagesCastro-Merchandising 20211124 0001Chelsea TengcoNo ratings yet

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- Module 1: Statement Of: Financial Position (SFP)Document20 pagesModule 1: Statement Of: Financial Position (SFP)Alyssa Nikki VersozaNo ratings yet

- Journal Entries TradingDocument79 pagesJournal Entries TradingAvox EverdeenNo ratings yet

- FABM 1 LAS Quarter 4 Week 3..Document14 pagesFABM 1 LAS Quarter 4 Week 3..Jonalyn DicdicanNo ratings yet

- LESSON 10 Business TransactionsDocument8 pagesLESSON 10 Business TransactionsUnamadable UnleomarableNo ratings yet

- Shs Abm Gr12 Fabm2 q1 m4-Statement-Of-cash-flow FinalDocument12 pagesShs Abm Gr12 Fabm2 q1 m4-Statement-Of-cash-flow FinalKye RauleNo ratings yet

- Unit 8 Adjusting EntriesDocument8 pagesUnit 8 Adjusting EntriesRey ViloriaNo ratings yet

- Abm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaDocument22 pagesAbm - 12 - Fabm2 - q1 - Clas2 - Prep of Sci - v8 - Rhea Ann NavillaKim Yessamin MadarcosNo ratings yet

- Fundamental of Accounting, Business, and Management 2 PDFDocument15 pagesFundamental of Accounting, Business, and Management 2 PDFElijah AramburoNo ratings yet

- Cash Flow Statement (CFS) : Fabm IiDocument11 pagesCash Flow Statement (CFS) : Fabm IiAlyssa Nikki VersozaNo ratings yet

- Luyong - 4TH Q - Fabm1Document3 pagesLuyong - 4TH Q - Fabm1Jonavi LuyongNo ratings yet

- Practice Problem 11.0: Name Date Course/Year ScoreDocument5 pagesPractice Problem 11.0: Name Date Course/Year ScoreCatherine GonzalesNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document30 pagesFundamentals of Accountancy, Business and Management 1KISHANo ratings yet

- Accounting 2 Week 1-2Document6 pagesAccounting 2 Week 1-2Ace LincolnNo ratings yet

- General Journal, GeveraDocument2 pagesGeneral Journal, GeveraFeiya LiuNo ratings yet

- Module 9 - Fabm 1: Fundamentals of Accountancy, Business and Management 1Document12 pagesModule 9 - Fabm 1: Fundamentals of Accountancy, Business and Management 1Richard Rhamil Carganillo Garcia Jr.No ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Math 11 Fabm1 Abm q2 Week 7Document14 pagesMath 11 Fabm1 Abm q2 Week 7Marchyrella Uoiea Olin JovenirNo ratings yet

- Test Question For Exam Chapter 1 To 6Document4 pagesTest Question For Exam Chapter 1 To 6Cherryl ValmoresNo ratings yet

- Final Exam - ABM 2Document2 pagesFinal Exam - ABM 2Charry VonNo ratings yet

- Cost of Goods Sold WorksheetDocument2 pagesCost of Goods Sold Worksheetbutch listangcoNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesHuskyNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (Q4W5-7)Document6 pagesFundamentals of Accountancy, Business and Management 1 (Q4W5-7)tsuki100% (1)

- ACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsDocument1 pageACTIVITY. On February 1, 20A4, Mira Delamar Opened A Store That SellsMiguel Lulab100% (1)

- Accounting Cycle of A Service BusinessDocument17 pagesAccounting Cycle of A Service BusinessAmie Jane Miranda100% (1)

- FABM1 Q4 Module 13Document12 pagesFABM1 Q4 Module 13Earl Christian BonaobraNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document37 pagesFundamentals of Accountancy, Business and Management 1Mylene CandidoNo ratings yet

- Case 2-4 - SceDocument3 pagesCase 2-4 - SceNica CabradillaNo ratings yet

- Page 75Document3 pagesPage 75Aya AlayonNo ratings yet

- Bus.-Finance LAS Qtr1Document36 pagesBus.-Finance LAS Qtr1Matt Yu EspirituNo ratings yet

- FABM 1-Answer Sheet-Q1-W8Document1 pageFABM 1-Answer Sheet-Q1-W8Florante De LeonNo ratings yet

- Learning Objectives:: in This Lesson, You Will Be Able To: A) Explain Tools in Managing Cash, Receivables and InventoryDocument30 pagesLearning Objectives:: in This Lesson, You Will Be Able To: A) Explain Tools in Managing Cash, Receivables and InventoryAlecs ContiNo ratings yet

- Special Journals - Quiz 38Document7 pagesSpecial Journals - Quiz 38Joana TrinidadNo ratings yet

- Fabm 1 Lesson 3 ContDocument30 pagesFabm 1 Lesson 3 ContCyrene MedianaNo ratings yet

- Fabm2 - Se (2) Answer KeyDocument2 pagesFabm2 - Se (2) Answer Keyl m100% (1)

- Business Finance 1st Quarter Examination 22-23Document3 pagesBusiness Finance 1st Quarter Examination 22-23Phegiel Honculada MagamayNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- General Ledger - Adrianne, Mendoza-BSBA-1 BLK BDocument6 pagesGeneral Ledger - Adrianne, Mendoza-BSBA-1 BLK BJaks ExplorerNo ratings yet

- PretestDocument4 pagesPretestRaul Soriano CabantingNo ratings yet

- Types of Business According To ActivitiesDocument16 pagesTypes of Business According To ActivitiesAdrianChrisArciagaArevaloNo ratings yet

- Summative Test in Fabm 2 Name: - Grade/Section: - ScoreDocument5 pagesSummative Test in Fabm 2 Name: - Grade/Section: - ScorebethNo ratings yet

- Cash FlowDocument35 pagesCash FlowsiriusNo ratings yet

- Republic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorDocument7 pagesRepublic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorJessie Mark AnapadaNo ratings yet

- Answer Keys - Test Bank - Fabm2Document10 pagesAnswer Keys - Test Bank - Fabm2Kevin Pereña GuinsisanaNo ratings yet

- FABM 2 Reviewer PrelimsDocument2 pagesFABM 2 Reviewer Prelimssushi nakiriNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document19 pagesFundamentals of Accountancy, Business and Management 1Shiellai Mae Polintang0% (1)

- Bhulero Merchandise Periodic 11 25Document10 pagesBhulero Merchandise Periodic 11 25Mary Jane PalermoNo ratings yet

- Business Simulation Letter To PrincipalDocument8 pagesBusiness Simulation Letter To Principalwilhelmina romanNo ratings yet

- Neo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleDocument17 pagesNeo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleGina Calling Danao100% (1)

- Module 3 Chapter 7Document8 pagesModule 3 Chapter 7Angelie Bocala CatalanNo ratings yet

- Consolidated CasesDocument91 pagesConsolidated CasesJames Jake ParkerNo ratings yet

- Varun's Technology Blog - AX 2012 Fixed Asset Set UpDocument7 pagesVarun's Technology Blog - AX 2012 Fixed Asset Set UpSrini Vasan100% (1)

- Wai-Sum Chan - Yiu-Kuen Tse - Financial Mathematics For Actuaries-World Scientific Publishing Company (2018) PDFDocument372 pagesWai-Sum Chan - Yiu-Kuen Tse - Financial Mathematics For Actuaries-World Scientific Publishing Company (2018) PDFDaniela Bernal Abella100% (1)

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiNo ratings yet

- CaseDocument37 pagesCaseNingClaudioNo ratings yet

- CCB DeveloperDocument7 pagesCCB DeveloperHaneef Ali SadiqNo ratings yet

- Janine Mae Serpa Msme Engr. John N. Celeste, Msme, DpaDocument2 pagesJanine Mae Serpa Msme Engr. John N. Celeste, Msme, Dpajaninemaeserpa14No ratings yet

- Journal Entries: Date Account Title and Explanation P.R. Debit CreditDocument9 pagesJournal Entries: Date Account Title and Explanation P.R. Debit CreditMarii M.No ratings yet

- Kangra Central Cooperative Bank Report 2016-17 Pankajrana209@Document54 pagesKangra Central Cooperative Bank Report 2016-17 Pankajrana209@pankaj91% (11)

- English - Grade VIII - My Lost Dollar - Chapter - 1Document4 pagesEnglish - Grade VIII - My Lost Dollar - Chapter - 1Vishvavenkat K SNo ratings yet

- Class Exercises - Stock ValuationDocument15 pagesClass Exercises - Stock ValuationDua hussainNo ratings yet

- Joanne Chen - Michael D'Orazio - Victor Ho - AlanDocument16 pagesJoanne Chen - Michael D'Orazio - Victor Ho - Alanapi-26156903No ratings yet

- Proceedings To Annul Transaction: Suspect PeriodDocument19 pagesProceedings To Annul Transaction: Suspect PeriodGigiRuizTicarNo ratings yet

- Indent Formats 2014Document8 pagesIndent Formats 2014Ramakrishna Rao ReddyNo ratings yet

- Bidding Document - Cold Storage For Meat and Associated Facilities Final-1Document184 pagesBidding Document - Cold Storage For Meat and Associated Facilities Final-1dmugalloy100% (1)

- 13 - Tax Law - Customs Law - 271219Document25 pages13 - Tax Law - Customs Law - 271219Sushil BansalNo ratings yet

- Ara ReportDocument60 pagesAra Reportvineeth singhNo ratings yet

- Basics of Ichimoku Kinko Hyo by Zaw FXDocument16 pagesBasics of Ichimoku Kinko Hyo by Zaw FXAh JiaoNo ratings yet

- VWAPDocument8 pagesVWAPKarthick Annamalai50% (2)

- Fundamental Analysis of Axis and ICICI BankDocument18 pagesFundamental Analysis of Axis and ICICI BankAnu100% (2)

- Business Activity and Influences On Businesses: Sole Traders, Partnerships, Social Enterprises, and FranchisesDocument21 pagesBusiness Activity and Influences On Businesses: Sole Traders, Partnerships, Social Enterprises, and FranchisesKo Nay Min AyeNo ratings yet

- Salary Dost Credit Policy: Loan Limit and TenureDocument11 pagesSalary Dost Credit Policy: Loan Limit and TenureAlpesh KuleNo ratings yet

- Swing Trading SimplifiedDocument115 pagesSwing Trading Simplified李蘇民79% (34)

- Ebook PDF Corporate Finance A Focused Approach 7th Edition PDFDocument41 pagesEbook PDF Corporate Finance A Focused Approach 7th Edition PDFjennifer.browne345100% (36)

- Hul FravDocument8 pagesHul FravAnmol YadavNo ratings yet

- Merak Fiscal Model Library: Bahrain PSC (1998)Document2 pagesMerak Fiscal Model Library: Bahrain PSC (1998)Libya TripoliNo ratings yet

- Insurance Industry in BangladeshDocument17 pagesInsurance Industry in BangladeshArifuzzaman khan100% (5)

- Accounting Abm 12Document9 pagesAccounting Abm 12veronica aban0% (1)

- Act 110 Activity 8Document8 pagesAct 110 Activity 8Norkan DimalawangNo ratings yet