Professional Documents

Culture Documents

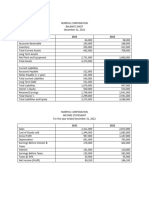

Assignment #5 (Graded) 3.33%: Prepaid Interest 54,500 Short Term Investments 60,500 Prepaid Advertising 117,000

Uploaded by

AP Password0 ratings0% found this document useful (0 votes)

17 views4 pagesThe document contains calculations of various financial ratios for a company:

1. The working capital ratio is -305,500, indicating the company has more current liabilities than current assets.

2. The current ratio is 1.35, meaning the company has $1.35 in current assets for every $1 in current liabilities.

3. The acid-test ratio is 0.45, showing the company has $0.45 in quick assets for every $1 in current liabilities.

4. The accounts receivable collection period is 58.54 days, indicating on average it takes 58 days to collect on credit sales.

5. The number of days sales in inventory ratio is

Original Description:

Accounting sample problem

Original Title

Assignment #5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains calculations of various financial ratios for a company:

1. The working capital ratio is -305,500, indicating the company has more current liabilities than current assets.

2. The current ratio is 1.35, meaning the company has $1.35 in current assets for every $1 in current liabilities.

3. The acid-test ratio is 0.45, showing the company has $0.45 in quick assets for every $1 in current liabilities.

4. The accounts receivable collection period is 58.54 days, indicating on average it takes 58 days to collect on credit sales.

5. The number of days sales in inventory ratio is

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views4 pagesAssignment #5 (Graded) 3.33%: Prepaid Interest 54,500 Short Term Investments 60,500 Prepaid Advertising 117,000

Uploaded by

AP PasswordThe document contains calculations of various financial ratios for a company:

1. The working capital ratio is -305,500, indicating the company has more current liabilities than current assets.

2. The current ratio is 1.35, meaning the company has $1.35 in current assets for every $1 in current liabilities.

3. The acid-test ratio is 0.45, showing the company has $0.45 in quick assets for every $1 in current liabilities.

4. The accounts receivable collection period is 58.54 days, indicating on average it takes 58 days to collect on credit sales.

5. The number of days sales in inventory ratio is

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Assignment #5 (graded) 3.

33%

1.) Working Capital Ratio

Item Amount

Prepaid interest 54,500

Short term investments 60,500

Prepaid advertising 117,000

Total current assets 232,000

Unearned revenue 174,500

Rent payable 199,500

Interest payable 163,500

Total current liabilities 537,500

Current assets – current liabilities = working capital

232,000 – 537500 = -305,500

2.) Current Ratio

Item Amount

Prepaid rent 115,500

Accounts receivable 14,900

Merchandise Inventory 192,500

Prepaid Advertising 182,000

Total current assets 504,900

Unearned revenue 177,000

Salaries Payable 197,000

Total current liabilities 374,000

Current Asset 504,900

Current Liabilities 374,000

Current ratio 1.35

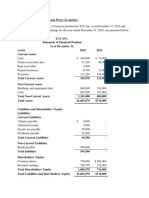

3.) Acid-test Ratio

Item Amount

Cash 146,000

Short-term investments 22,000

Accounts receivable 156,500

Prepaid rent 133,000

Total current assets 457,500

Salaries payable 63,000

Accounts payable 167,500

Interest payable 171,500

Rent payable 162,000

Mortgage payable 153,500

Total current liabilities 717,500

Current Asset less prepaid rent 324,500

Current liabilities 717,500

Acid Test Ratio 0.45

4.) Accounts Receivable Collection Period

Item Amount (2022)

Ave. Accounts Receivable 17,000

/Sales 106,000

0.160 x 365 days

Accounts Receivable Collection Period 58.54

5.) Number of days Sales in Inventory Ratio

Item Amount (2022)

Ave. Merchandise Inventory 21,500

/Cost of Goods Sold 47,500

0.452 x 365 days

Number of days sales in inventory ratio 165.21

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- ACC10007 Sample Exam 1Document9 pagesACC10007 Sample Exam 1dannielNo ratings yet

- International Financial Management 9th Edition Jeff Madura Solutions Manual 1Document15 pagesInternational Financial Management 9th Edition Jeff Madura Solutions Manual 1eleanor100% (39)

- The 2022 Mckinsey Global Payments ReportDocument53 pagesThe 2022 Mckinsey Global Payments ReportIrene SkorlifeNo ratings yet

- Macroeconomics SimulationDocument11 pagesMacroeconomics SimulationH. AlhemeiriNo ratings yet

- Determinants of EVADocument19 pagesDeterminants of EVAAbdulAzeemNo ratings yet

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 14Document28 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 14jasperkennedy091% (11)

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Balance Sheet (All Numbers in Thousands) : Break Down 7/30/2020Document16 pagesBalance Sheet (All Numbers in Thousands) : Break Down 7/30/2020Shubham ThakurNo ratings yet

- 02 Arus Kas SoalDocument5 pages02 Arus Kas SoalRafif Gayuh IslamiNo ratings yet

- Name of The Student: Student ID: Course: CRN: Instructor's Name: DateDocument14 pagesName of The Student: Student ID: Course: CRN: Instructor's Name: DateM shayan JavedNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Activity 2 Financial RatiosDocument2 pagesActivity 2 Financial RatioscontactitsshunNo ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- Group 8-SW Income Statement & Balance SheetDocument2 pagesGroup 8-SW Income Statement & Balance SheetDiễm Quỳnh QuáchNo ratings yet

- 40 MahtaDocument7 pages40 Mahtamahta yunitaNo ratings yet

- Layto CashtoaccrualDocument6 pagesLayto CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Neale Corporation Financial StatementDocument4 pagesNeale Corporation Financial StatementkerryNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Crash Landing On You Company Financial StatementsDocument6 pagesCrash Landing On You Company Financial StatementsEmar KimNo ratings yet

- BusFin PT 4Document2 pagesBusFin PT 4Nadjmeah AbdillahNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- Pro Forma Statement of Financial Position: Warner CompanyDocument6 pagesPro Forma Statement of Financial Position: Warner CompanysunflowerNo ratings yet

- FS Financial StudyDocument6 pagesFS Financial StudyMarina AbanNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- PSB Tk.2 d3 Pajak 2018Document93 pagesPSB Tk.2 d3 Pajak 2018Ardi PribadiNo ratings yet

- XYZ Corp PresentationDocument4 pagesXYZ Corp PresentationIna Patricia ErjasNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDocument7 pagesSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNo ratings yet

- AkuntansuDocument36 pagesAkuntansusuryati hungNo ratings yet

- Buscom-Asset AcquisitionDocument7 pagesBuscom-Asset AcquisitionRenelyn DavidNo ratings yet

- Evidencia 2 ANALISIS E INTERPRETACION DE ESTADOS FINANCIEROSDocument5 pagesEvidencia 2 ANALISIS E INTERPRETACION DE ESTADOS FINANCIEROSRegina De LeónNo ratings yet

- Akn p5 3a Pa1Document10 pagesAkn p5 3a Pa1Alche MistNo ratings yet

- Annual Income Statement (Values in 000's $) : Current AssetsDocument6 pagesAnnual Income Statement (Values in 000's $) : Current AssetsVikash ChauhanNo ratings yet

- FM (Bal Sheet Final Real)Document2 pagesFM (Bal Sheet Final Real)Lysss EpssssNo ratings yet

- AssignmentDocument5 pagesAssignmentOur Beatiful Waziristan OfficialNo ratings yet

- Financial Sttement PreparationDocument3 pagesFinancial Sttement PreparationMIEL CAÑETENo ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- Scarry CompanyDocument3 pagesScarry CompanyBuenaventura, Elijah B.No ratings yet

- Problem 1: Cash Flow StatementDocument1 pageProblem 1: Cash Flow StatementNafisaRafaNo ratings yet

- Maf5102 Fa Cat 2 2018Document4 pagesMaf5102 Fa Cat 2 2018Muya KihumbaNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Exam 2Document7 pagesExam 2Saima ArshadNo ratings yet

- Assigment 4Document3 pagesAssigment 4Syakil AhmedNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- SOLUTION TO SCHEDULE 3gDocument4 pagesSOLUTION TO SCHEDULE 3gKrushna Omprakash MundadaNo ratings yet

- 6-4B SolutionDocument3 pages6-4B SolutionAnish AdhikariNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Advanced Financial Accounting Assignment: QuestionDocument2 pagesAdvanced Financial Accounting Assignment: QuestionAyyan AzeemNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- FMA AssignmentDocument2 pagesFMA AssignmentGetahun MulatNo ratings yet

- Forecasted Financial StatementsDocument8 pagesForecasted Financial StatementsAmeer hamzaNo ratings yet

- Chapter 3. Exercises Income StatementDocument6 pagesChapter 3. Exercises Income StatementHECTOR ORTEGANo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Assignment#2Document7 pagesAssignment#2AP PasswordNo ratings yet

- Human Resource Selection ProcessDocument3 pagesHuman Resource Selection ProcessAP PasswordNo ratings yet

- Human Resource Performance ManagementDocument2 pagesHuman Resource Performance ManagementAP PasswordNo ratings yet

- Assessing A Tutorial VideoDocument2 pagesAssessing A Tutorial VideoAP PasswordNo ratings yet

- Excel ExamDocument78 pagesExcel ExamAP PasswordNo ratings yet

- Ass. 1Document2 pagesAss. 1Tamer MohamedNo ratings yet

- Sample Position PaperDocument4 pagesSample Position PaperThird YearNo ratings yet

- HOSPEX - Adlux Exhibition Estimate Ver 2Document6 pagesHOSPEX - Adlux Exhibition Estimate Ver 2mangeoNo ratings yet

- Economist Alfred MarshallDocument13 pagesEconomist Alfred MarshallSEEMAL JAMILNo ratings yet

- International Accounting Standard CommitteeDocument2 pagesInternational Accounting Standard Committeeshamrat ronyNo ratings yet

- (DHT) Core CriteriaDocument3 pages(DHT) Core CriteriaKeith McCannNo ratings yet

- B. Inggris XII PAT Genap 2023Document4 pagesB. Inggris XII PAT Genap 2023AriH213 LNo ratings yet

- Ffa2 3 Alloc FDTDocument8 pagesFfa2 3 Alloc FDTbrocodebymindsNo ratings yet

- WhatsApp Chat With CitibankDocument5 pagesWhatsApp Chat With CitibankAbhijeet PatilNo ratings yet

- cl-12 Economics Lesson Plan 2023-24Document30 pagescl-12 Economics Lesson Plan 2023-24kuldeepbhatt0786No ratings yet

- Breaking Through Ingrained Beliefs Revisiting The Impact of The Digital Economy On Carbon EmissionsDocument13 pagesBreaking Through Ingrained Beliefs Revisiting The Impact of The Digital Economy On Carbon Emissionsivory11136999No ratings yet

- Final File General Awareness Capsule Ibps Po Clerk Mains 2022 Gopal Sir 2Document119 pagesFinal File General Awareness Capsule Ibps Po Clerk Mains 2022 Gopal Sir 2JugnuNo ratings yet

- Measuring The Cost of LivingDocument5 pagesMeasuring The Cost of LivingEdmar OducayenNo ratings yet

- DEFINITION of 'Trading Floor'Document3 pagesDEFINITION of 'Trading Floor'chethanNo ratings yet

- Finmar ReviewerDocument5 pagesFinmar ReviewerGelly Dominique GuijoNo ratings yet

- 9 - 29 - M&aDocument2 pages9 - 29 - M&aPham Ngoc VanNo ratings yet

- 10-Steps To Improve Public Transport For The Whole Malaysia - Penang WatchDocument3 pages10-Steps To Improve Public Transport For The Whole Malaysia - Penang WatchZulhilmi Harman0% (1)

- Pemanfaatan Teknologi Pascapanen Untuk Pengembanga PDFDocument15 pagesPemanfaatan Teknologi Pascapanen Untuk Pengembanga PDFKhairil HarahapNo ratings yet

- Liberalization, Privatisation and Globalisation!Document37 pagesLiberalization, Privatisation and Globalisation!Nivesh GuptaNo ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- Trade and Commerce During The Vijayanagara Period With Special Reference To The Western Coastal Areas of Karnataka With The Portuguese: A StudyDocument5 pagesTrade and Commerce During The Vijayanagara Period With Special Reference To The Western Coastal Areas of Karnataka With The Portuguese: A StudyBianca CastaphioreNo ratings yet

- Bill Statement: (Invoice)Document1 pageBill Statement: (Invoice)Terrence LimNo ratings yet

- Proforma Invoice: Total Amount To Be Paid Bank DetailsDocument1 pageProforma Invoice: Total Amount To Be Paid Bank Detailsrajend thakurNo ratings yet

- MEFA Questions and AnswersDocument15 pagesMEFA Questions and AnswersG. Somasekhar SomuNo ratings yet

- MSB ATM GuidanceDocument3 pagesMSB ATM GuidanceJay CaplanNo ratings yet