Professional Documents

Culture Documents

Jim Roppel Market Action 3

Jim Roppel Market Action 3

Uploaded by

LOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jim Roppel Market Action 3

Jim Roppel Market Action 3

Uploaded by

LCopyright:

Available Formats

NEW TECHNOLOGIES PRODUCE UNPRECEDENTED OPPORTUNITIES 205

the next 30 months. When the market moves up strongly like it was doing

in the first part of 1997, there are many opportunities to latch onto big lead-

ing stocks that are being accumulated by big money funds. And that was

exactly what was happening, just as we’ve seen in past upward-trending mar-

kets. One mistake that Roppel made in 1997 was when he took a position in

Siebel Systems, Inc., in June. Roppel knew the company well, and it had impres-

sive fundamentals and was in a major leading group — software enterprise.

Its customer-relationship management software program was being adopted

by many large organizations, and Seibel was reaping the benefits of strong

revenues and earnings. As it broke out of a cup-with-handle pattern he

bought in at $27 to $30 per share (adjusted for a three-for-one stock split).

He went in with a huge position and was leveraged on full margin. Having

taken his biggest position yet he was too nervous when the stock quickly

pulled back in what turned out to be a normal minor fluctuation. He then

quickly unloaded his full position and ended up losing about one point on

the transaction. Seibel went on to be a huge winner. Roppel would learn from

this, as we’ll see later, but that is one of the traits of the best traders — they

always remember their mistakes so in the future they try not to repeat them.

As we get back to the markets’ action, recall that when the markets rise

very fast over an extended period of time it usually means that a top may be

just around the corner. In 1997 the Nasdaq was leading all indexes as it raced

up to hit over 1,700 in early October. The Dow had slowed down somewhat

and traded in a choppy fashion during August and September. After normal

pullbacks in mid-October, the markets were hit with some international

issues that sent them down hard. During the summer of 1997 overbuilding

in Asia caused excess capacity, and the Thai Baht declined 12% against the

dollar. Other devaluations soon followed, and as the “Asian flu” spread, it

was feared that U.S. companies doing business in Asia would get hurt. This

expansion of globalization to the Pacific Rim would then begin to stumble

as the fast growth track that it had been on began slowing down. A near

panic ensued as the U.S. markets then reacted to this crisis. On Monday,

October 27, the Dow would fall 554 points, or over 7%. It would be the

largest point loss in the Dow’s history, surpassing the crash in 1987. But the

markets soon recovered, as the crisis did not have as much of an impact as

most had feared, and the U.S. economy was still very strong and for the most

part unaffected. As many also looked to the U.S. for growth, they would find

You might also like

- 1929 Annual Stock Market ForecastDocument19 pages1929 Annual Stock Market Forecastniky186No ratings yet

- Bristol Port PESTEL and SWOT AnalysisDocument4 pagesBristol Port PESTEL and SWOT AnalysisLynne Farrugia100% (1)

- Jim Roppel Market Action 5Document1 pageJim Roppel Market Action 5LNo ratings yet

- Jim Roppel Market Action 1Document1 pageJim Roppel Market Action 1LNo ratings yet

- Market Tops BookletDocument16 pagesMarket Tops BookletDebarshi MajumdarNo ratings yet

- Quantifiable Edges Special Report: Can Be Found HereDocument7 pagesQuantifiable Edges Special Report: Can Be Found HereDebashish GhoshNo ratings yet

- Breakfast With Dave 010511Document15 pagesBreakfast With Dave 010511richardck50No ratings yet

- Market Haven Monthly 2011 FebruaryDocument10 pagesMarket Haven Monthly 2011 FebruaryMarketHavenNo ratings yet

- Investment Strategy 30 NovembreDocument6 pagesInvestment Strategy 30 NovembreZerohedgeNo ratings yet

- Hussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011Document6 pagesHussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011KoalaCapitalSICAVNo ratings yet

- The Years 1999/2000 Were A Time of ExtremesDocument9 pagesThe Years 1999/2000 Were A Time of ExtremesAlbert L. PeiaNo ratings yet

- First Quarter 2009 - NewsletterDocument6 pagesFirst Quarter 2009 - NewsletterEricNo ratings yet

- The Causes of The 1929 CrashDocument10 pagesThe Causes of The 1929 CrashSalah KhalifaNo ratings yet

- Investment Strategy: Turning Point?Document5 pagesInvestment Strategy: Turning Point?marketfolly.comNo ratings yet

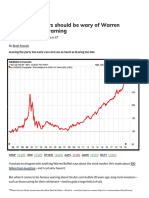

- Opinion:: Investors Should Be Wary of Warren Buffett's Crash WarningDocument5 pagesOpinion:: Investors Should Be Wary of Warren Buffett's Crash WarningNayeem RajaNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument7 pagesBreakfast With Dave: David A. RosenbergMitchell SchorrNo ratings yet

- Breakfast With Dave June 12Document7 pagesBreakfast With Dave June 12variantperception100% (1)

- Amazing Stock Market SeasonalityDocument5 pagesAmazing Stock Market SeasonalityBrook Rene JohnsonNo ratings yet

- Dave Rosenberg Gluskin Sheff 01/07/2010Document12 pagesDave Rosenberg Gluskin Sheff 01/07/2010ETFDesk.comNo ratings yet

- 01-31-11 Breakfast With DaveDocument8 pages01-31-11 Breakfast With DavetngarrettNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument13 pagesBreakfast With Dave: David A. Rosenbergr_zuppardo7600No ratings yet

- Smarte Trader February 11 2016 PDFDocument10 pagesSmarte Trader February 11 2016 PDFThinh DoNo ratings yet

- Impact of Overseas Market: Foreign Institutional Investors)Document7 pagesImpact of Overseas Market: Foreign Institutional Investors)Garvita SrivastavaNo ratings yet

- RJ StoutDocument7 pagesRJ StoutacegacegnikNo ratings yet

- 2009-04 Miller CommentaryDocument5 pages2009-04 Miller CommentaryTheBusinessInsider100% (1)

- Breakfast With Dave - 052709Document8 pagesBreakfast With Dave - 052709jobby jobNo ratings yet

- Marc Faber May 5Document3 pagesMarc Faber May 5variantperception100% (1)

- Wealthbuilder Stock Market Brief 2nd May 2019Document6 pagesWealthbuilder Stock Market Brief 2nd May 2019Christopher Michael QuigleyNo ratings yet

- Mauldin August 8Document10 pagesMauldin August 8richardck61No ratings yet

- Nervous About The Market It Might Be Time For This StrategyDocument6 pagesNervous About The Market It Might Be Time For This StrategyAndrey YablonskiyNo ratings yet

- 1987 Zero HedgeDocument9 pages1987 Zero Hedgeeliforu100% (1)

- Barings BankDocument8 pagesBarings Bankishan696969100% (1)

- Selector September 2007 Quarterly NewsletterDocument12 pagesSelector September 2007 Quarterly Newsletterapi-237451731No ratings yet

- Asian Financial Crisis 1997Document37 pagesAsian Financial Crisis 1997eexeeNo ratings yet

- Hedgefolios Strategy Advisory "The Fake Bull Market of 2018"Document6 pagesHedgefolios Strategy Advisory "The Fake Bull Market of 2018"Thinh DoNo ratings yet

- AssetClasses 2021Document7 pagesAssetClasses 2021Ankur Sharda100% (1)

- August 022010 PostsDocument150 pagesAugust 022010 PostsAlbert L. PeiaNo ratings yet

- 2018 10 IceCap Global Market Outlook 1Document21 pages2018 10 IceCap Global Market Outlook 1Smeet GopaniNo ratings yet

- Stock Market Research Paper 5Document13 pagesStock Market Research Paper 5api-549214190No ratings yet

- Breakfast With Dave June 2Document9 pagesBreakfast With Dave June 2variantperceptionNo ratings yet

- Vital Signs: Tipping Point?!Document4 pagesVital Signs: Tipping Point?!trade100No ratings yet

- Don't Wait For May SAUT 041910Document5 pagesDon't Wait For May SAUT 041910careyescapitalNo ratings yet

- Investment Strategy: 'Tis The Season?Document5 pagesInvestment Strategy: 'Tis The Season?marketfolly.comNo ratings yet

- Market Analysis Nov 2022Document12 pagesMarket Analysis Nov 2022Muhammad SatrioNo ratings yet

- PivotDocument25 pagesPivotCan SlimNo ratings yet

- October 2018 - "The Devil's Slide": Our View On Global Investment MarketsDocument21 pagesOctober 2018 - "The Devil's Slide": Our View On Global Investment MarketsSunil ParikhNo ratings yet

- Information Bite 15mar8Document4 pagesInformation Bite 15mar8information.biteNo ratings yet

- q.1 FMDocument15 pagesq.1 FMJhanvi Pankaj PandyaNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument8 pagesBreakfast With Dave: David A. RosenbergeconomicburnNo ratings yet

- RecessionDocument6 pagesRecessionWilly RaoulNo ratings yet

- An Easy Way To Own 1,300 of America's Fastest-Growing CompaniesDocument15 pagesAn Easy Way To Own 1,300 of America's Fastest-Growing CompaniesjesssamuelNo ratings yet

- Our Favorite Financials FundsDocument2 pagesOur Favorite Financials Fundsnicole_yang_100No ratings yet

- BMAN33000 Lehman Brothers Case PackDocument9 pagesBMAN33000 Lehman Brothers Case Packpouria11No ratings yet

- Emp2Document8 pagesEmp2dpbasicNo ratings yet

- Capital FlowDocument4 pagesCapital FlowStelu Olar100% (1)

- May 122010 PostsDocument13 pagesMay 122010 PostsAlbert L. PeiaNo ratings yet

- Great Easter ToysDocument9 pagesGreat Easter ToysAnwesha Samal0% (1)

- An End To Currency Manipulation - 03.26.08 - FEER - by Bret SwansonDocument1 pageAn End To Currency Manipulation - 03.26.08 - FEER - by Bret SwansonBret SwansonNo ratings yet

- Seasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingFrom EverandSeasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingNo ratings yet

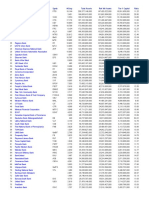

- Tier 1 Capital - All Banks1Document1 pageTier 1 Capital - All Banks1LNo ratings yet

- 101 Things Everyone Should Know About Economics 1Document1 page101 Things Everyone Should Know About Economics 1LNo ratings yet

- Tier 1 Capital - All BanksDocument1 pageTier 1 Capital - All BanksLNo ratings yet

- From Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdDocument1 pageFrom Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdLNo ratings yet

- Mark Minervini Stage 2 Uptrend and Trend TemplateDocument1 pageMark Minervini Stage 2 Uptrend and Trend TemplateL100% (1)

- Hat-Trick-3 Easy-Entry-Exit Strategies8Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies8LNo ratings yet

- Tier 1 Capital - All BanksDocument3 pagesTier 1 Capital - All BanksL100% (1)

- Hat-Trick-3 Easy-Entry-Exit Strategies9Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies9LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies6Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies6LNo ratings yet

- ATR Trailing Stop2Document1 pageATR Trailing Stop2LNo ratings yet

- What Is An ATR Trailing Stop?: New Trader UDocument1 pageWhat Is An ATR Trailing Stop?: New Trader ULNo ratings yet

- 3M Packaging Solutions Guide: Right Tapes. Right System. Right PartnerDocument52 pages3M Packaging Solutions Guide: Right Tapes. Right System. Right PartnerTheodora StefanNo ratings yet

- The Routledge Companion To Theatre of The Oppressed CompressDocument463 pagesThe Routledge Companion To Theatre of The Oppressed CompressRobert ShermanNo ratings yet

- M.G. Motor: by Raunak Botke, Mba, MarketingDocument16 pagesM.G. Motor: by Raunak Botke, Mba, MarketingRaunak BotkeNo ratings yet

- Chapter 7Document60 pagesChapter 7Sunil KumarNo ratings yet

- CONTENT 1 Jones11e PPT Ch01 Accessible FinalDocument40 pagesCONTENT 1 Jones11e PPT Ch01 Accessible FinalAmir HafiyNo ratings yet

- Overview Diversity ProjectDocument13 pagesOverview Diversity Projectapi-349463576No ratings yet

- Parmley Graham LTDDocument17 pagesParmley Graham LTDAdilov MNo ratings yet

- Time Conversion and Gha-Declination-Lha Calculation: Assoc - Prof.Dr. Ali Cemal TOZDocument15 pagesTime Conversion and Gha-Declination-Lha Calculation: Assoc - Prof.Dr. Ali Cemal TOZsami kayakıranNo ratings yet

- Mr. Marlone J. Arevalo: Grade 12Document23 pagesMr. Marlone J. Arevalo: Grade 12kohanaprudigiNo ratings yet

- Chapter 2. Portland CementDocument14 pagesChapter 2. Portland CementKhaled Al-SwairkiNo ratings yet

- Radical Acceptance (DBT) WorksheetDocument3 pagesRadical Acceptance (DBT) Worksheetchizoba enwerejiNo ratings yet

- Teachings of Juan MatusDocument30 pagesTeachings of Juan MatusitounosNo ratings yet

- 11521i PDFDocument1 page11521i PDFNisa Javadd0% (1)

- Capitol Steel Corporation-RSB PDFDocument1 pageCapitol Steel Corporation-RSB PDFeg choloNo ratings yet

- Best-Kept Secret Executive Leadership: The inDocument9 pagesBest-Kept Secret Executive Leadership: The intaapNo ratings yet

- CVT / TCM Calibration Data "Write" Procedure: Applied VehiclesDocument24 pagesCVT / TCM Calibration Data "Write" Procedure: Applied VehiclesАндрей ЛозовойNo ratings yet

- Art App - LM01 FinalDocument124 pagesArt App - LM01 FinalSamNo ratings yet

- Fluid Transients in Complex Systems With Air Entrainment: B.Eng., HCMUT)Document161 pagesFluid Transients in Complex Systems With Air Entrainment: B.Eng., HCMUT)Srinivasan DeviNo ratings yet

- PWC - Understanding Internal AuditDocument20 pagesPWC - Understanding Internal AuditISabella ARndorferNo ratings yet

- PAC7 (UF1) : Comparatives & Superlatives: Historial de IntentosDocument11 pagesPAC7 (UF1) : Comparatives & Superlatives: Historial de IntentospemirubioNo ratings yet

- I. Objectives: Fort Pilar ST., Zamboanga CityDocument10 pagesI. Objectives: Fort Pilar ST., Zamboanga CityDanizelle Kaye Cadocoy BernardoNo ratings yet

- Nivel 2-Unit 4Document16 pagesNivel 2-Unit 4Jonathan Alberto Peñaranda PaezNo ratings yet

- Interest Survey - GardeningDocument1 pageInterest Survey - Gardeningnorasmith8272No ratings yet

- 30 Questions of Procedure Text: Playing A Cassette On The Tape RecorderDocument12 pages30 Questions of Procedure Text: Playing A Cassette On The Tape RecorderCeha KartikaNo ratings yet

- Pressman 7 CH 26Document28 pagesPressman 7 CH 26kyuuNo ratings yet

- OWG007101 IGWB Hardware and Principle ISSUE 1.0Document35 pagesOWG007101 IGWB Hardware and Principle ISSUE 1.0anujgujjarNo ratings yet

- Sylllabus of 4th Semester - 25062022Document26 pagesSylllabus of 4th Semester - 25062022Suman GhoshNo ratings yet

- Betamate 2090Document4 pagesBetamate 2090José Antonio CuberoNo ratings yet

- JFK OCM3 Masterclass PDFDocument35 pagesJFK OCM3 Masterclass PDFMauro BianchiniNo ratings yet