Professional Documents

Culture Documents

Jim Roppel Market Action 1

Jim Roppel Market Action 1

Uploaded by

L0 ratings0% found this document useful (0 votes)

115 views1 pageRoppel followed the upward momentum of the stock market in early 1997. In January and early February, the market continued to rise with the Dow crossing 7,000, though it began consolidating later in February. In March, an interest rate hike by the Federal Reserve sent the markets downward until mid-April. Roppel bought into Jabil Circuit when it broke out of a base and reached a new high in May 1997. The stock continued gaining as the company reported strong earnings and its CEO promoted its prospects. Roppel held the stock as it rose further on high volume and pulled back on weak volume. He sold when it showed selling signals like heavy down days on strong volume and breaking below its 50-day moving

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRoppel followed the upward momentum of the stock market in early 1997. In January and early February, the market continued to rise with the Dow crossing 7,000, though it began consolidating later in February. In March, an interest rate hike by the Federal Reserve sent the markets downward until mid-April. Roppel bought into Jabil Circuit when it broke out of a base and reached a new high in May 1997. The stock continued gaining as the company reported strong earnings and its CEO promoted its prospects. Roppel held the stock as it rose further on high volume and pulled back on weak volume. He sold when it showed selling signals like heavy down days on strong volume and breaking below its 50-day moving

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

115 views1 pageJim Roppel Market Action 1

Jim Roppel Market Action 1

Uploaded by

LRoppel followed the upward momentum of the stock market in early 1997. In January and early February, the market continued to rise with the Dow crossing 7,000, though it began consolidating later in February. In March, an interest rate hike by the Federal Reserve sent the markets downward until mid-April. Roppel bought into Jabil Circuit when it broke out of a base and reached a new high in May 1997. The stock continued gaining as the company reported strong earnings and its CEO promoted its prospects. Roppel held the stock as it rose further on high volume and pulled back on weak volume. He sold when it showed selling signals like heavy down days on strong volume and breaking below its 50-day moving

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

NEW TECHNOLOGIES PRODUCE UNPRECEDENTED OPPORTUNITIES 203

matched the S&P 500 with a solid 23% gain. Some of the best groups for

the year included semiconductors, which soared 80%; computer hardware,

which was up 41%; and software, which gained 36%.

Roppel Follows the Market’s Action

The upward momentum of the recent market action continued as 1997

began. January was another solid month as the markets continued higher.

Consolidation was dominant in February as the Dow traded sideways, though

it did cross the 7,000 mark, but the Nasdaq began to slip downward. In March

the Federal Reserve raised interest rates by a quarter of a point, which helped

send the markets downward. Sharp drops in the markets occurred until mid-

April. After some profit taking and a scare from the Fed, the markets would

again turn right around and resume their upward trends. Roppel was right

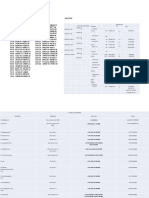

there, and he noticed a new leader taking shape. He bought into Jabil Circuit,

which was a technology leader from the electronics–contract manufacturing

group. Roppel bought this stock perfectly when it broke out of a base on

May 2, 1997, and made a new high at $25 per share, which can be seen in Fig-

ure 10-5 on p. 204. The market had also just turned back upward, and Roppel

was right in sync with the market and a strong stock. He held on to this stock

as it kept gaining in price. In mid-June 1997, the company reported outstand-

ing earnings and the CEO was featured on CNBC touting the bright future

that lay just ahead for the company. The stock really exploded upward after

that. Roppel still hung on, and the stock reacted perfectly by rising on heavy

volume and pulling back or pausing on weak volume, indicating that the big

investors were content to hold the stock. Roppel would go on to hold this stock

until it finally showed selling signals, which included heavy down days on very

strong volume. It also would slice through its 50-day moving average, which it

had never done all the way up on its rise. As we’ll see later, the market was set

for a major correction in the fall and Jabil Circuit would head lower with that

market correction. Roppel was out of his position when its action flashed sell

cues, and he acted correctly and retained another 100%+ gain. We are really

starting to see now how Roppel was beginning to turn things around and how

his profitable transactions would begin to mirror the same strategies of the

best stock traders who have already been featured.

You might also like

- Seasonal PatternsDocument14 pagesSeasonal PatternsHồng NgọcNo ratings yet

- Stock Trak ReportDocument5 pagesStock Trak Reportnhausaue100% (6)

- IBD Sell Buy Rules2 7Document22 pagesIBD Sell Buy Rules2 7Swami100% (1)

- Greenlight Capital Q4 2013 LetterDocument0 pagesGreenlight Capital Q4 2013 LetterCanadianValueNo ratings yet

- Exercises On GraphsDocument6 pagesExercises On GraphsDavid Gan50% (2)

- Jim Roppel Market Action 3Document1 pageJim Roppel Market Action 3LNo ratings yet

- Jim Roppel Market Action 2Document1 pageJim Roppel Market Action 2LNo ratings yet

- Jim Roppel Market Action 4Document1 pageJim Roppel Market Action 4LNo ratings yet

- Breakfast With Dave June 8Document17 pagesBreakfast With Dave June 8variantperception100% (1)

- Hedge Fund Industry Commentary: H1 2010Document6 pagesHedge Fund Industry Commentary: H1 2010mmitre2No ratings yet

- Market Tops BookletDocument16 pagesMarket Tops BookletDebarshi MajumdarNo ratings yet

- Dave Rosenberg Gluskin Sheff 01/07/2010Document12 pagesDave Rosenberg Gluskin Sheff 01/07/2010ETFDesk.comNo ratings yet

- Jim Roppel Market Action 5Document1 pageJim Roppel Market Action 5LNo ratings yet

- Breakfast With Dave June 2Document9 pagesBreakfast With Dave June 2variantperceptionNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Breakfast With Dave June 12Document7 pagesBreakfast With Dave June 12variantperception100% (1)

- Stock Newsletter Vol 1 Issue 2 1-15-14Document10 pagesStock Newsletter Vol 1 Issue 2 1-15-14Liam McMahonNo ratings yet

- Breakfast With Dave 010511Document15 pagesBreakfast With Dave 010511richardck50No ratings yet

- Einhorn - Q1 '12 Letter To PartnersDocument7 pagesEinhorn - Q1 '12 Letter To PartnersAAOI2No ratings yet

- General Market Update - July 2019Document7 pagesGeneral Market Update - July 2019Anonymous kOLTDa6No ratings yet

- The Years 1999/2000 Were A Time of ExtremesDocument9 pagesThe Years 1999/2000 Were A Time of ExtremesAlbert L. PeiaNo ratings yet

- Breakfast With Dave - 052709Document8 pagesBreakfast With Dave - 052709jobby jobNo ratings yet

- Shiller PE RatioDocument11 pagesShiller PE RatioAnthonyNo ratings yet

- Engleski 1Document6 pagesEngleski 1Ng Lay HoonNo ratings yet

- 06-10-10 Breakfast With DaveDocument8 pages06-10-10 Breakfast With DavefcamargoeNo ratings yet

- September 8, 2010 PostsDocument431 pagesSeptember 8, 2010 PostsAlbert L. PeiaNo ratings yet

- Q2 2021results For Cedar Creek Partners CorrectedDocument8 pagesQ2 2021results For Cedar Creek Partners Correctedl chanNo ratings yet

- Breakfast With Dave June 10Document9 pagesBreakfast With Dave June 10variantperceptionNo ratings yet

- August 182010 PostsDocument273 pagesAugust 182010 PostsAlbert L. PeiaNo ratings yet

- PivotDocument25 pagesPivotCan SlimNo ratings yet

- Markets Lose Early Bullish Momentum: Midnight Trader 4:17 PM, Jul 6, 2010 - Here's Where MarketsDocument48 pagesMarkets Lose Early Bullish Momentum: Midnight Trader 4:17 PM, Jul 6, 2010 - Here's Where MarketsAlbert L. PeiaNo ratings yet

- Rosenberg - What Would Happen Without QE3?Document7 pagesRosenberg - What Would Happen Without QE3?afonteveNo ratings yet

- Apple Conference Call Notes 3Q 2011Document6 pagesApple Conference Call Notes 3Q 2011andrewbloggerNo ratings yet

- Weekly UpdateDocument3 pagesWeekly UpdatefourjeNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument13 pagesBreakfast With Dave: David A. Rosenbergr_zuppardo7600No ratings yet

- Interpreting Market Internals in Context - Answer Key: Drill 1Document3 pagesInterpreting Market Internals in Context - Answer Key: Drill 1Cr HtNo ratings yet

- Variant Perception Outlook-Macrovoices May 2023Document14 pagesVariant Perception Outlook-Macrovoices May 2023David ScholtzNo ratings yet

- 2q 2015 International UpdateDocument8 pages2q 2015 International UpdateCanadianValueNo ratings yet

- Breakfast With Dave 082010Document15 pagesBreakfast With Dave 082010richardck50No ratings yet

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNo ratings yet

- Ross Haber TL Team: in This IssueDocument19 pagesRoss Haber TL Team: in This IssueJohnNo ratings yet

- Breakfast With Dave June 5Document8 pagesBreakfast With Dave June 5variantperception100% (2)

- Stepping Aside Because I Can Always Buy Back in Leigh Drogen I Sold OutDocument162 pagesStepping Aside Because I Can Always Buy Back in Leigh Drogen I Sold OutAlbert L. PeiaNo ratings yet

- 01-04-11 Breakfast With DaveDocument15 pages01-04-11 Breakfast With DavetngarrettNo ratings yet

- Weekly Call 4 Jul 21Document6 pagesWeekly Call 4 Jul 21jjaypowerNo ratings yet

- 1st Quarter 2005 CommentaryDocument2 pages1st Quarter 2005 CommentaryNelson Roberts Investment AdvisorsNo ratings yet

- AlphaClone's 2011 Year-End CommentaryDocument4 pagesAlphaClone's 2011 Year-End CommentaryAbsolute ReturnNo ratings yet

- Chalk STH Up To STH Chalk Up STHDocument32 pagesChalk STH Up To STH Chalk Up STHc_poh_leongNo ratings yet

- Weekly Macro Comment Hard To See Any NegativesDocument2 pagesWeekly Macro Comment Hard To See Any NegativesFlametreeNo ratings yet

- 2011 04 19 - Earnings Beats Pair With Strong Eurozone PMI & Canadian CPI Data To Lift Risk Back HigherDocument11 pages2011 04 19 - Earnings Beats Pair With Strong Eurozone PMI & Canadian CPI Data To Lift Risk Back HigherNaufal SanaullahNo ratings yet

- AssetClasses 2021Document7 pagesAssetClasses 2021Ankur Sharda100% (1)

- Breakfast With Dave: David A. RosenbergDocument7 pagesBreakfast With Dave: David A. RosenbergMitchell SchorrNo ratings yet

- Quantifiable Edges Special Report: Can Be Found HereDocument7 pagesQuantifiable Edges Special Report: Can Be Found HereDebashish GhoshNo ratings yet

- Edition 18 - Chartered 27th October 2010Document7 pagesEdition 18 - Chartered 27th October 2010Joel HewishNo ratings yet

- Breakfast With Dave - 052209Document8 pagesBreakfast With Dave - 052209jobby jobNo ratings yet

- Quarterly q217Document17 pagesQuarterly q217tantanNo ratings yet

- 06-14-10 Breakfast With DaveDocument7 pages06-14-10 Breakfast With DavefcamargoeNo ratings yet

- Seasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingFrom EverandSeasonal Stock Market Trends: The Definitive Guide to Calendar-Based Stock Market TradingNo ratings yet

- Summary of Gil Morales & Chris Kacher's In The Trading Cockpit with the O'Neil DisciplesFrom EverandSummary of Gil Morales & Chris Kacher's In The Trading Cockpit with the O'Neil DisciplesNo ratings yet

- Tier 1 Capital - All Banks1Document1 pageTier 1 Capital - All Banks1LNo ratings yet

- Tier 1 Capital - All BanksDocument1 pageTier 1 Capital - All BanksLNo ratings yet

- From Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdDocument1 pageFrom Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdLNo ratings yet

- 101 Things Everyone Should Know About Economics 1Document1 page101 Things Everyone Should Know About Economics 1LNo ratings yet

- Tier 1 Capital - All BanksDocument3 pagesTier 1 Capital - All BanksL100% (1)

- Mark Minervini Stage 2 Uptrend and Trend TemplateDocument1 pageMark Minervini Stage 2 Uptrend and Trend TemplateL100% (1)

- Hat-Trick-3 Easy-Entry-Exit Strategies9Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies9LNo ratings yet

- What Is An ATR Trailing Stop?: New Trader UDocument1 pageWhat Is An ATR Trailing Stop?: New Trader ULNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies8Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies8LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies6Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies6LNo ratings yet

- ATR Trailing Stop2Document1 pageATR Trailing Stop2LNo ratings yet

- Cat7 MT798 FAQs 2021 Draft 20210622Document29 pagesCat7 MT798 FAQs 2021 Draft 20210622Sarvendra SinghNo ratings yet

- PROBLEM 1 and 2Document3 pagesPROBLEM 1 and 2Thea MisolaNo ratings yet

- Balkans and Turkey Oriental Tobacco Crop ReportDocument7 pagesBalkans and Turkey Oriental Tobacco Crop ReportRoze GaleskaNo ratings yet

- Daily Programe ReportDocument5 pagesDaily Programe ReportBIKASHNo ratings yet

- Aviation Law ResearchDocument23 pagesAviation Law Researchvelan naveen natrajNo ratings yet

- Beretta T57 GeoDocument9 pagesBeretta T57 GeoIon IonescuNo ratings yet

- Advance SociologyDocument20 pagesAdvance SociologyAlabi IbrahimNo ratings yet

- Wa0028.Document22 pagesWa0028.Francois SlabbertNo ratings yet

- Primer: For Boi Registered CompaniesDocument13 pagesPrimer: For Boi Registered CompaniesSarah Jean TaliNo ratings yet

- Business Life Cycle Theory: Toyota IncorporationDocument13 pagesBusiness Life Cycle Theory: Toyota IncorporationAhsan JavaidNo ratings yet

- Industrial ArtsDocument11 pagesIndustrial ArtsSARAH JANE CAPSANo ratings yet

- Prequalified ListDocument387 pagesPrequalified Listherra husainNo ratings yet

- Building & Restructuring The CorporationDocument17 pagesBuilding & Restructuring The CorporationziaeceNo ratings yet

- 2018-12 ICMAB FL 001 PAC Year Question December 2018Document3 pages2018-12 ICMAB FL 001 PAC Year Question December 2018Mohammad ShahidNo ratings yet

- Indonesia: Selected IssuesDocument64 pagesIndonesia: Selected IssuesYusuf KusumaNo ratings yet

- Final Test Pad390 Question SetDocument2 pagesFinal Test Pad390 Question SetDvia Dhamirah100% (1)

- FMCG Industry AnalysisDocument16 pagesFMCG Industry AnalysisMeghna B RajNo ratings yet

- Nippon India Small CapDocument17 pagesNippon India Small CapArmstrong CapitalNo ratings yet

- Assignment # 1: Rabia Naeem D/O Naeem Uddin KhanDocument5 pagesAssignment # 1: Rabia Naeem D/O Naeem Uddin KhanAsad AhmedNo ratings yet

- SetcDocument3 pagesSetcsindhusmNo ratings yet

- Basic Accounting - ExerciseDocument20 pagesBasic Accounting - ExerciseRaaj Nishanth SNo ratings yet

- Espinosa&Gabijan - Export Pricing CostingDocument17 pagesEspinosa&Gabijan - Export Pricing CostingDulce Amor Margallo ValdescoNo ratings yet

- Project Report On Paper BagsDocument1 pageProject Report On Paper Bagsmr57863% (8)

- Cambridge O Level: Economics 2281/22Document23 pagesCambridge O Level: Economics 2281/22saeedaumar1954No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sahil YadavNo ratings yet

- ComputationDocument2 pagesComputationjoshua rodrigoNo ratings yet

- Risk Management - RM CHEAT SHEET MAYBEDocument9 pagesRisk Management - RM CHEAT SHEET MAYBEEdithNo ratings yet

- Partnership Formation and OperationDocument4 pagesPartnership Formation and Operationkat kaleNo ratings yet

- FFM 11ce SM Chapter09Document42 pagesFFM 11ce SM Chapter09Manish SadhuNo ratings yet

- Form 5 Business Studies Quiz 3 QuestionsDocument4 pagesForm 5 Business Studies Quiz 3 QuestionsPriyashini RajasegaranNo ratings yet