Professional Documents

Culture Documents

UNIT7

UNIT7

Uploaded by

Loan Nguyễn0 ratings0% found this document useful (0 votes)

9 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesUNIT7

UNIT7

Uploaded by

Loan NguyễnCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Terms:

1. Depository: Biên nhận ký gửi

2. Nondepository: phi lưu ký

3. deficit units: Đơn vị thâm hụt

4. commercial banks: Ngân hàng thương mại

5. savings institutions: tổ chức tiết kiệm

6. credit unions: Tổ chức tín dụng

7. finance companies: Công ty tài chính

8. mutual funds: Quỹ tương hỗ

9. pension funds: Quỹ hưu trí

10. insurance companies: Công ty bảo hiểm

11. financial conglomerates: tập đoàn tài chính

12. Consolidation: sự hợp nhất

13. credit rationing: hạn mức tín dụng

14. credit risk: Rủi ro tín dụng

15. deposit outflows: Dòng vốn ra

16. discount loans: Vay giảm

17. discount rate: Lãi suất chiết khấu

18. duration analysis: Phân tích khoảng thời gian

19. equity multiplier: Hệ số vốn chủ sở hữu

Question:

1. Marketability: Commercial banks use some funds to purchase securities

and other funds to make loans. Why are the securities more marketable

than loans in the secondary market?

Securities are more standardized than loans and therefore can be more easily

sold in the secondary market. The excessive documentation on commercial

loans limits a bank's ability to sell loans in the secondary market.

2. Depository Institutions: Explain the primary use of funds by commercial

banks versus savings institutions.

Savings institutions have traditionally concentrated in mortgage lending,

while commercial banks have concentrated in commercial lending. Savings

institutions are now allowed to diversify their asset portfolio to a greater

degree and will likely increase their concentration in commercial loans (but

not to the same degree as commercial banks).

3. Credit Unions With regard to the profit motive, how are credit unions

different from other financial institutions?

Credit unions are non-profit financial institutions.

4. NondepositoryInstitutions: Compare the main sources and uses of funds

for finance companies, insurance companies, and pension funds.

Finance companies sell securities to obtain funds, while insurance

companies receive insurance premiums and pension funds receive

employee/employer contributions. Finance companies use funds to provide

direct loans to consumers and businesses. Insurance companies and pension

funds purchase securities.

5. Mutual Funds: What is the function of a mutual fund? Why are mutual

funds popular among investors? How does a money market mutual fund

differ from a stock or bond mutual fund?

A mutual fund sells shares to investors, pools the funds, and invests the

funds in a portfolio of securities. Mutual Funds are popular because they

can help individuals diversify while using professional expertise to make

investment decisions.

A money market mutual fund invests in money market securities, whereas

other mutual funds normally invest in stocks or bonds.

6. Comparing Financial Institutions: Classify the types of financial

institutions mentioned in this chapter as either depository or

nondepository. Explain the general difference between depository and

nondepository institution sources of funds. It is often said that all types of

financial institutions have begun to offer services that were previously

offered only by certain types. Consequently, the operations of many

financial institutions are becoming more similar. Nevertheless,

performance levels still differ significantly among types of financial

institutions. Why?

Depository institutions include commercial banks, savings and loan

associations, and credit unions. These institutions differ from nondepository

institutions in that they accept deposits. Nondepository institutions include

finance companies, insurance companies, pension funds, mutual funds, and

money market funds.

Even Though financial institutions are becoming more similar, they often

differ distinctly from each other in terms of sources and uses of funds.

Therefore, their performance levels differ as well.

7. Why are financial intermediaries willing to engage in information

collection activities when investors in financial instruments may be

unwilling to do so?

Banks make private loans; their conclusions on who is creditworthy are not

made public. Therefore, money spent on investigating the creditworthiness

of another party can be used to benefit the bank and not others, avoiding the

free-rider problem. This does not mean that financial intermediaries such as

banks do not deal with asymmetric information problems, but it does give

them an edge in reducing that asymmetry.

8. Financial Intermediation: Look in a business periodical for news about a

recent financial transaction involving two financial institutions. For this

transaction, determine the following:

a. How will each institution’s balance sheet be affected?

b. Will either institution receive immediate income from the transaction?

c. Who is the ultimate user of funds?

d. Who is the ultimate source of funds?

Assume a financial transaction that involves two financial institutions,

company A and company B. Company A invested $3 million in the bond

issued by Company B and maturing in 5 years.

a.(Company A's or Company B's) cash and long-term debt will increase.

(Company A's or Company B's) cash will decrease and long-term assets will

increase.

b.(Company A or Company B or None of the companies) will receive

immediate income derived from the transaction.

c.(Company A or Company B) is the ultimate user of funds.

d.(Company A or Company B) is the ultimate source of funds.

9. Impact of Credit Crisis on Institutions: Explain why mortgage defaults

during the credit crisis adversely affected financial institutions that did not

originate the mortgages. What role did these institutions play in financing

the mortgages?

Some financial institutions participated by issuing mortgage-backed

securities that represented mortgages originated by mortgage companies.

- Mortgage-backed securities performed poorly during the credit crisis in

2008 because of the high default rate on mortgages.

- Some financial institutions that held a large amount of mortgage-backed

securities suffered major losses at this time

10. Regulation of Financial Institutions: Financial institutions are subject to

regulation to ensure that they do not take excessive risk and can safely

facilitate the flow of funds through financial markets. Nevertheless, during

the credit crisis, individuals were concerned about using financial

institutions to facilitate their financial transactions. Why do you think the

existing regulations were ineffective at ensuring a safe financial system?

During the credit crisis in 2008, the failure of some financial institutions

caused concerns that others might fail, and disrupted the flow of funds in

financial markets. The primary cause was that financial institutions

experienced massive mortgage defaults. They should have recognized that

subprime mortgages (unqualified borrowers, low down payment) may

default. In addition, regulators should have recognized that subprime

mortgages may default and could have imposed regulations to limit an

institution's exposure to subprime mortgages.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

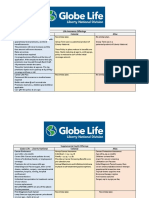

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina Hughes0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business Plan For Palm Oil ProductionDocument16 pagesBusiness Plan For Palm Oil ProductionAsan Godwin Jnr100% (2)

- Coles and WoolworthDocument12 pagesColes and WoolworthAnkit AgarwalNo ratings yet

- Willow Inn, Inc., A Pennsylvania Corporation v. Public Service Mutual Insurance Company, A New York Corporation, 399 F.3d 224, 3rd Cir. (2005)Document16 pagesWillow Inn, Inc., A Pennsylvania Corporation v. Public Service Mutual Insurance Company, A New York Corporation, 399 F.3d 224, 3rd Cir. (2005)Scribd Government DocsNo ratings yet

- Consolidation Notes: Freeholds: Investigation of Title To Registered Freehold Land Property RegisterDocument23 pagesConsolidation Notes: Freeholds: Investigation of Title To Registered Freehold Land Property RegisterHedley Horler (scribd)No ratings yet

- Overcoming The Pilot Shortage PDFDocument16 pagesOvercoming The Pilot Shortage PDFTim ChongNo ratings yet

- Summary Mortgage Markets With ClimateDocument4 pagesSummary Mortgage Markets With ClimateJoe MoretNo ratings yet

- Exemptions From GST: "It Is Not The End But The Start of The Journey"-Arun JaitleyDocument24 pagesExemptions From GST: "It Is Not The End But The Start of The Journey"-Arun JaitleyRadhika AggarwalNo ratings yet

- Intro2Insurance IndustryDocument94 pagesIntro2Insurance IndustryRajMrRajNo ratings yet

- 255cc 275cc 295cc 325cc ManualDocument150 pages255cc 275cc 295cc 325cc ManualPETERNo ratings yet

- Commercial Insurance Manager or Program Underwriting Manager orDocument2 pagesCommercial Insurance Manager or Program Underwriting Manager orapi-121458038No ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Dishtvlof PDFDocument343 pagesDishtvlof PDFle sageNo ratings yet

- Universal Basic IncomeDocument31 pagesUniversal Basic IncomeumairahmedbaigNo ratings yet

- Insurable InterestDocument31 pagesInsurable InterestMargaret Hidaya100% (1)

- ABBRDocument2 pagesABBRRuijia ZengNo ratings yet

- Londres vs. National Life InsuranceDocument2 pagesLondres vs. National Life InsuranceAnny YanongNo ratings yet

- GMC Policy 2019 20Document5 pagesGMC Policy 2019 20Rohit LambaNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument7 pagesBajaj Allianz General Insurance Company LTDraman kumarNo ratings yet

- Google Chrome KjTe7XDocument4 pagesGoogle Chrome KjTe7XShyamsundar PNo ratings yet

- data - Docs/nsw-Risk - Management - Guide - Small - Business - Pdf&Ei 0Dk2Tim0Jmecomcxkfqe&Usg Afqjcne - Jko92Pmixrru 2Fna4Rbdzz-TqwDocument9 pagesdata - Docs/nsw-Risk - Management - Guide - Small - Business - Pdf&Ei 0Dk2Tim0Jmecomcxkfqe&Usg Afqjcne - Jko92Pmixrru 2Fna4Rbdzz-TqwRushi NaikNo ratings yet

- Questions For CEO ExamDocument8 pagesQuestions For CEO ExamShihab ReturnsNo ratings yet

- Objectives:: Define The Information Needed:-This First Step States That What Is The InformationDocument44 pagesObjectives:: Define The Information Needed:-This First Step States That What Is The InformationKrishna Prasad GaddeNo ratings yet

- Ucc Chattel N Notice Asn Colb MwmsDocument13 pagesUcc Chattel N Notice Asn Colb MwmsMicheal100% (4)

- Construction Disputes and SettlementDocument14 pagesConstruction Disputes and SettlementHashir PNo ratings yet

- Not An Insurer Against All Risks Case DigestDocument3 pagesNot An Insurer Against All Risks Case DigestHenio PajaritoNo ratings yet

- Basics of Business Insurance - NotesDocument41 pagesBasics of Business Insurance - Notesjeganrajraj100% (1)

- BALIC Annual Report10 11Document144 pagesBALIC Annual Report10 11Manuj KinraNo ratings yet

- HCM Embedded Learning: Enterprise and Workforce StructuresDocument32 pagesHCM Embedded Learning: Enterprise and Workforce Structuresknani9090No ratings yet

- Farm Chart of Accounts Example UpdatedDocument5 pagesFarm Chart of Accounts Example UpdatedBarkhad MohamudNo ratings yet