Professional Documents

Culture Documents

LL.B., Sem.-III 203: Principles of Taxation Law: Seat No.

Uploaded by

Pooja ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LL.B., Sem.-III 203: Principles of Taxation Law: Seat No.

Uploaded by

Pooja ShahCopyright:

Available Formats

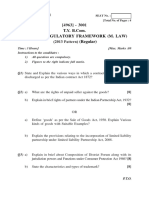

Seat No.

: _______________

MC-105

March-2018

LL.B., Sem.-III

203 : Principles of Taxation Law

Time : 3 Hours] [Max. Marks : 100

.

.

om

1.

.

.c

.

er

2. .

3.

ap

“ ” “ ” .

. (GST)

sp

.

m

, 2017

? .

xa

4. “ ” ? , 2017

ye

.

.m

, 2017

.

w

5.

w

(1) - - .

(2) “ ” “ ” .

w

(3) , 2017

.

(4) , 2017 .

(5) , 2017 .

(6) .

___________

MC-105 1 P.T.O.

This Question Paper is downloaded from www.myexamspaper.com

Seat No. : _______________

MC-105

March-2018

LL.B., Sem.-III

203 : Principles of Taxation Law

Time : 3 Hours] [Max. Marks : 100

Instruction : Each question carries equal marks.

1. Explain in detail about the annual income from House Property. How the income of

om

House Property rented by owner can be derived ?

OR

Explain in detail the various Heads of Income under the Income Tax Act.

.c

2. Explain the provisions relating to Exempted Income under the Income Tax Act.

er

OR

Discuss in detail about "Agricultural Income" and "Incidental Income" under the

Income Tax Act.

3.

ap

Explain the concept of the Goods and Services Tax. Discuss briefly the objects and

reasons of the introduction of Goods and Services Tax Act and its advantages.

sp

OR

Who is liable for Registration and who is not liable for Registration under the Gujarat

m

Goods and Services Tax Act, 2017 ? Explain the process of Registration under the

above legislation.

xa

4. What do you mean by Input Credit Tax ? Discuss the provisions relating to Input Credit

Tax under the Central Goods and Services Tax Act, 2017.

ye

OR

Explain the process of collection and levy of GST under the Gujarat Goods and

.m

Services Tax Act, 2017.

5. Explain in detail any two from the following :

w

(1) The provisions relating to depreciation allowance while computing profit and gain

of business or profession under the Income Tax Act

w

(2) Provisions relating to payment of Advance Tax deductible at Source (TDS) under

the Income Tax Act

w

(3) Provisions relating to filing of Returns in general for Goods and Services Tax

under the Central Goods and Services Tax Act, 2017

(4) Zero Rated Supply under the Integrated Goods and Services Tax Act, 2017

(5) Transfer of Input Credit under the Integrated Goods and Services Tax Act, 2017

(6) Constitutional provisions relating to GST Council

___________

MC-105 2

This Question Paper is downloaded from www.myexamspaper.com

You might also like

- LL.B, Sem.-III 203: Principles of Taxation Laws (Core Course)Document2 pagesLL.B, Sem.-III 203: Principles of Taxation Laws (Core Course)Pooja ShahNo ratings yet

- Question On Goods and Services Tax (GST) Set - 1Document5 pagesQuestion On Goods and Services Tax (GST) Set - 1Amar SinghNo ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- Civil Procedure CodeDocument3 pagesCivil Procedure CodeVansh SharmaNo ratings yet

- II B. Tech I Semester Model Question Paper, Sept - 2017 Managerial EconomicsDocument5 pagesII B. Tech I Semester Model Question Paper, Sept - 2017 Managerial EconomicsRashmi SharmaNo ratings yet

- Fin 303 PDFDocument4 pagesFin 303 PDFSimanta KalitaNo ratings yet

- Cbic 3rd Edition Faq December 15 2018 PDFDocument561 pagesCbic 3rd Edition Faq December 15 2018 PDFGiri SukumarNo ratings yet

- Model Answer ScriptDocument9 pagesModel Answer ScriptPresidency UniversityNo ratings yet

- Background Materia On GST Vol 2 Feb 2024Document560 pagesBackground Materia On GST Vol 2 Feb 2024ravi.pansuriya07No ratings yet

- TaxationDocument4 pagesTaxationshreya chhajerNo ratings yet

- MBA Accounting Exam PaperDocument4 pagesMBA Accounting Exam Paperrgcsm88No ratings yet

- Volume I (BGM 16 04 2019) PDFDocument870 pagesVolume I (BGM 16 04 2019) PDFManoj GuptaNo ratings yet

- Class PPT Economy Current Affairs Lecture 3 17 Sept 22Document23 pagesClass PPT Economy Current Affairs Lecture 3 17 Sept 22Tanay BansalNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- GST Import Po ProcessDocument12 pagesGST Import Po Processdeepika_Rejish100% (1)

- gstreturnandtallyDocument49 pagesgstreturnandtallyManikant VNo ratings yet

- Question Paper Code:: Reg. No.Document3 pagesQuestion Paper Code:: Reg. No.KathiravanNo ratings yet

- Knowledge Assessment - I: Exercise Questions Short Answer QuestionsDocument2 pagesKnowledge Assessment - I: Exercise Questions Short Answer Questionsvinodjoshi22No ratings yet

- gstreturnandtally-240201101504-8032c8ca (1)Document49 pagesgstreturnandtally-240201101504-8032c8ca (1)gangotrikaviriNo ratings yet

- Befa Regular 22019Document2 pagesBefa Regular 22019reddy reddyNo ratings yet

- GST Update Weekly BriefingDocument39 pagesGST Update Weekly BriefingsridharanNo ratings yet

- IDT 2 New Question PaperDocument13 pagesIDT 2 New Question PaperSagar Deep MsdNo ratings yet

- IDT Past Exam CA Saumil Manglani For CS Exe Jun 22 & Dec 22Document38 pagesIDT Past Exam CA Saumil Manglani For CS Exe Jun 22 & Dec 22RahulNo ratings yet

- CS Professional DT IDT Most Expected Questions For DECEMBER 2023Document285 pagesCS Professional DT IDT Most Expected Questions For DECEMBER 2023Dhanush GunisettyNo ratings yet

- Guidebook For Expats in All Sectors in MalaysiaDocument39 pagesGuidebook For Expats in All Sectors in MalaysiajoeNo ratings yet

- CA Inter Compact Books For May 21Document216 pagesCA Inter Compact Books For May 21Rahul AgrawalNo ratings yet

- Complete GST Book PDFDocument351 pagesComplete GST Book PDFAGNIHOTRAM RAM NARAYANANo ratings yet

- GST Update130620Document23 pagesGST Update130620Raju SomaniNo ratings yet

- 2023 Ballb End Term Sem 6Document8 pages2023 Ballb End Term Sem 6VISHAKHA SHAKYANo ratings yet

- gst_bcomph_4th sem_2019Document2 pagesgst_bcomph_4th sem_2019singhdharamreetpreetNo ratings yet

- Kratzke FedIncTax Fall 2010Document51 pagesKratzke FedIncTax Fall 2010dezraty14088No ratings yet

- Megacard CorporationDocument6 pagesMegacard CorporationrahulsinhadpsNo ratings yet

- 2022 PDFDocument8 pages2022 PDFRiya NitharwalNo ratings yet

- Minimum Alternative TaxDocument27 pagesMinimum Alternative TaxYash TiwariNo ratings yet

- G S T MaterialDocument20 pagesG S T MaterialGonella NagamallikaNo ratings yet

- (2013 Pattern) April 2018Document128 pages(2013 Pattern) April 2018Pranab BordoloiNo ratings yet

- GSTDocument11 pagesGSTvamshi9686No ratings yet

- TX Zwe Examiner's Report June 2022Document10 pagesTX Zwe Examiner's Report June 2022Sean ChigagaNo ratings yet

- Model Papers: (C B E - T R A)Document23 pagesModel Papers: (C B E - T R A)Asal IslamNo ratings yet

- Background Materia On GST Vol 1 Feb 2024Document1,117 pagesBackground Materia On GST Vol 1 Feb 2024Sejal GuptaNo ratings yet

- ICAB Certificate Level Taxation Nov 17Document9 pagesICAB Certificate Level Taxation Nov 17Prithvi PrasadNo ratings yet

- Rr310106 Managerial Economics and Financial AnalysisDocument9 pagesRr310106 Managerial Economics and Financial AnalysisSRINIVASA RAO GANTANo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Assignment-I_Specialized Accounting_F010102T(A)-1Document1 pageAssignment-I_Specialized Accounting_F010102T(A)-1upadhyaypriyam.50No ratings yet

- UU-4th Semester Questions 2022Document13 pagesUU-4th Semester Questions 2022swainananta336No ratings yet

- OFI GST Process Claim Functional DocumentDocument22 pagesOFI GST Process Claim Functional Documentlkalidas1998No ratings yet

- Trade Notice No 09-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Document6 pagesTrade Notice No 09-CGST & CX-MUMBAI Zone-2021 Dated 22september2021Gautam jainNo ratings yet

- SP 25-12-2022Document4 pagesSP 25-12-2022Niranjan JadhavNo ratings yet

- CPA Advanced Taxation GuideDocument6 pagesCPA Advanced Taxation GuideEmmaNo ratings yet

- NR 310106 MepaDocument8 pagesNR 310106 MepaSrinivasa Rao GNo ratings yet

- Capital Budgeting 2Document92 pagesCapital Budgeting 2moydozukkuNo ratings yet

- Month BillDocument1 pageMonth Billapi-19500872No ratings yet

- Extra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Document4 pagesExtra Reading Time: 15 Minutes Writing Time: 03 Hours Maximum Marks: 100 Roll No.Dj BravoNo ratings yet

- GST Law (Set 2)Document4 pagesGST Law (Set 2)studywagishaNo ratings yet

- Business Regulatory Framework (M. Law) (Regular)Document127 pagesBusiness Regulatory Framework (M. Law) (Regular)Yogesh SaindaneNo ratings yet

- Annexure Viii Neon Cable - 26!04!2021Document12 pagesAnnexure Viii Neon Cable - 26!04!2021group3 cgstauditNo ratings yet

- Tax Law - IIDocument19 pagesTax Law - IIAniket SharmaNo ratings yet

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Indirect Taxation (Section B) : The Institute of Cost Accountants of IndiaDocument344 pagesIndirect Taxation (Section B) : The Institute of Cost Accountants of IndiaSagar Verma100% (1)

- Ultra Life ER14250 DatasheetDocument2 pagesUltra Life ER14250 DatasheetArslan AwanNo ratings yet

- Spare Parts Catalog - Scooptram ST1030Document956 pagesSpare Parts Catalog - Scooptram ST1030Elvis RianNo ratings yet

- Government of West Bengal Ration Card DetailsDocument1 pageGovernment of West Bengal Ration Card DetailsGopal SarkarNo ratings yet

- SatconDocument18 pagesSatconBADRI VENKATESHNo ratings yet

- Zodiac Working Boat MK6HDDocument4 pagesZodiac Working Boat MK6HDdan antonNo ratings yet

- Consideration PropDocument2 pagesConsideration PropQasim GorayaNo ratings yet

- Genetic Modified FoodDocument16 pagesGenetic Modified FoodKishoNo ratings yet

- Workday Studio - Complex Integration Tool OverviewDocument3 pagesWorkday Studio - Complex Integration Tool OverviewHarithaNo ratings yet

- Governor's Pleasure and Dismissal of Council of MinistersDocument10 pagesGovernor's Pleasure and Dismissal of Council of MinistersUditanshu MisraNo ratings yet

- Corbin Technical Bulletin Volume 4Document149 pagesCorbin Technical Bulletin Volume 4aikidomoysesNo ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- To Register Your IGP Please Visit or Scan The QR Code Below To Register Your IGP Please Visit or Scan The QR Code BelowDocument1 pageTo Register Your IGP Please Visit or Scan The QR Code Below To Register Your IGP Please Visit or Scan The QR Code BelowLester Jao SegubanNo ratings yet

- New Product Development ProcessDocument29 pagesNew Product Development ProcessGAURAV SHARMA100% (1)

- Mode D'emploi 2-43 Operating Instructions 44-85 Manual de Instrucciones 86-127Document43 pagesMode D'emploi 2-43 Operating Instructions 44-85 Manual de Instrucciones 86-127Oleksii_ServiceNo ratings yet

- Normalization Castuera BSCS2CDocument8 pagesNormalization Castuera BSCS2CRichard, Jr. CastueraNo ratings yet

- Tata Consulting Engineers Design Guide For Auxiliary Steam HeaderDocument10 pagesTata Consulting Engineers Design Guide For Auxiliary Steam HeadervijayanmksNo ratings yet

- Proposed Rule: Employment: Adverse ActionsDocument4 pagesProposed Rule: Employment: Adverse ActionsJustia.comNo ratings yet

- Instruction Manual For Spider S3 and Spider S4Document6 pagesInstruction Manual For Spider S3 and Spider S4Syah KamalNo ratings yet

- Toaz - Info Module in Ergonomics and Planning Facilities For The Hospitality Industry PRDocument33 pagesToaz - Info Module in Ergonomics and Planning Facilities For The Hospitality Industry PRma celine villoNo ratings yet

- International Journal of Plasticity: Dong Phill Jang, Piemaan Fazily, Jeong Whan YoonDocument17 pagesInternational Journal of Plasticity: Dong Phill Jang, Piemaan Fazily, Jeong Whan YoonGURUDAS KARNo ratings yet

- An Improved TS Algorithm For Loss-Minimum Reconfiguration in Large-Scale Distribution SystemsDocument10 pagesAn Improved TS Algorithm For Loss-Minimum Reconfiguration in Large-Scale Distribution Systemsapi-3697505No ratings yet

- DES-3611.prepaway - Premium.exam.65q: Number: DES-3611 Passing Score: 800 Time Limit: 120 Min File Version: 1.1Document22 pagesDES-3611.prepaway - Premium.exam.65q: Number: DES-3611 Passing Score: 800 Time Limit: 120 Min File Version: 1.1Emre Halit POLATNo ratings yet

- Shrimp Aquaculture in Sarangani BayDocument5 pagesShrimp Aquaculture in Sarangani BayronanvillagonzaloNo ratings yet

- What Is A Human Resources Strategy?Document8 pagesWhat Is A Human Resources Strategy?abdallah abdNo ratings yet

- Tipster Job AdvertDocument3 pagesTipster Job AdvertDatateq ConsultancyNo ratings yet

- The King's Avatar - A Compilatio - Butterfly BlueDocument8,647 pagesThe King's Avatar - A Compilatio - Butterfly BlueDarka gamesNo ratings yet

- Fatigue Analysis of Sundry I.C Engine Connecting Rods: SciencedirectDocument7 pagesFatigue Analysis of Sundry I.C Engine Connecting Rods: SciencedirectAshwin MisraNo ratings yet

- OriginalDocument4 pagesOriginalJob ValleNo ratings yet

- Serena Berman PW Res - 2020Document2 pagesSerena Berman PW Res - 2020Serena BermanNo ratings yet

- Year Overview 2012 FinalDocument65 pagesYear Overview 2012 FinalArjenvanLinNo ratings yet