Professional Documents

Culture Documents

GST notes: Key concepts and benefits

Uploaded by

swetha shree chavan mOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST notes: Key concepts and benefits

Uploaded by

swetha shree chavan mCopyright:

Available Formats

lOMoARcPSD|6469575

GST notes

Llb 3 years (Karnataka State Law University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

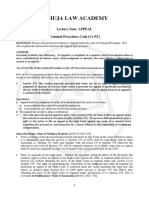

Goods and Services Tax (GST)

KSLU Past Examination Questions:

1.An assessee was an authorized dealer of Sony electronics products which were sold to

different customers in Karnataka under the Direct billing from Sony Ltd in Delhi. Is there a

sale in the course of inter – state trade or commerce? Give reasons [D,15] [D,17]

2.What is Dual GST Model? Explain its features? [Dec 17]

Meaning of Goods and Services Tax (GST)

“GST is a tax on supply of Goods, or Services or both except on supply of the

Alcoholic Liquor for Human Consumption”. [ Article 366 (12a) ]

It is implemented from 01.07.2017

It extends to whole of India including Jammu and Kashmir.

Set –off of taxes

The Supplier at each stage is permitted to avail credit of GST paid on purchase of Goods and/

or Services which can be set-off against taxes paid on supply of Goods and Services made by

him.

Accrual of tax

The tax would accrue to the taxing authority which has the jurisdiction over the place of

consumption which is also termed as place of supply. Hence, GST is a destination based

consumption tax.

Existing taxes that are subsumed under GST:

GST would replace the following taxes levied and collected by the

Central Government State Government

a. central Excise Duty a. State VAT

b. Duties of Excise (Medicinal & Toilet b. Central Sales Tax

preparation) c. Luxury Tax

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

c. Additional Duties of Excise (Goods of d. Entry Tax (all forms)

Special Importance) e. Entertainment & Amusement Tax (except

d. Additional Duties of Excise (Textiles & when levied by the local bodies)

Textiles Product) f. Taxes on advertisements

e. Additional Duties of Customs (commonly g. Purchase Tax

known as CVD) h. Taxes on lotteries, betting & gambling

f. Special Additional Duty of Customs i. State Surcharges & Cesses so far as they

(SAD) relate to supply of goods and services

g. Service Tax, Central Surcharges &

Cesses so far as they relate to supply of

goods and services a.

How GST would work ?

A being the “Manufacturer” of soap, sold the soap for ₹100 to B being the “Wholesaler”. A

used services of E for manufacturing of goods of ₹20 and paid tax of ₹1.

B sold the soap for ₹150 to C who was the “Retailer”. C sold the soap to D being

“Consumer” for ₹200.

If in this case tax rate in GST is 5% then,

Transaction Particulars Transaction Tax Tax Input Tax

value rate Tax payable

Credit

Service E to A 20 5% 1.00 0.00 1.00

Sale A to B 100 5% 5.00 1.00 4.00

Sale B to C 150 5% 7.50 5.00 2.50

Sale C to D 200 5% 10.00 7.50 2.50

(a.) E would be collecting ₹1 i.e. 5% of ₹20 on services provided to A. E would be

depositing ₹1 to the Government. For the sake of simplicity, it has been assumed that E does

not have any claim of Input Tax Credit against the output tax liability of ₹1.

(b). A would be collecting ₹5 i.e. 5% of ₹100 on sales made to B. A would be depositing ₹4

to thegovernment after taking credit of the tax of ₹1 paid to E. Credit of taxes paid on service

is allowed to be set off in GST. However, if it would have been earlier taxes, than service tax

was not allowed as set off against Sales Tax.

(c). B would be collecting ₹7.5 i.e. 5% of 150 on sales made to C and he would be depositing

₹2.5 to the Government after deducting ₹5 paid on purchases made from A out of ₹7.5.

(d) C would be collecting ₹10 i.e. 5% of 200 on sales made to D and he would be depositing

₹2.5 to the government after deducting ₹7.5 out of ₹10 paid on Purchases made from B.

Therefore, in GST, total revenue collected from the entire chain of transaction would be ₹10

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

at a tax rate of 5% after allowing set-off of entire taxes paid earlier in the supply chain and

not having any cascading effect of levy of tax on tax.

Coverage of GST on Transactions:

Central GST will replace the existing Central Excise Duty and Service Tax. CGST

would also cover sale transactions

State GST will replace State VAT, Entry Tax, Octroi, Luxury Tax, Entertainment tax

etc. SGST would be levied on services as well

Integrated GST (equal to CGST + SGST ) will be levied on all supplies of goods and/

or services in the course of Inter State Trade or Commerce. IGST would be applicable

to import of goods or services also.

Deficiencies in the earlier indirect tax regime

No set-off:

Certain taxes levied by State Government were not allowed as set-off for payment of

other taxes levied by them. Eg: when goods are manufactured and sold, both excise

duty (CENVAT) and State VAT were levied. Though CENVAT and State level VAT

are essentially Value Added Taxes, Set-off of one against the credit of another was

not possible as CENVAT was a Central Government Levy and State VAT was a State

Government levy.

Variety of Taxes and Rates:

The variety of Value Added Tax laws in the country with disparate tax rates and

dissimilar tax practices divides the country into separate economic spheres.

Double Taxation :

Earlier some items are treated both as a commodity as well as a service. Eg: software.

This resulted in double taxation of a transaction as both goods and services.

High Compliance Cost:

The creation of tariff and non tariff barriers such as Octroi, Entry Tax, Check Posts,

etc. hindered the free flow of trade throughout the country. Besides that, the large

number of taxes created high compliance cost for the tax payers in the form of

number of returns, payments etc.

Others:

a) Non inclusion of several local levies in State VAT such as luxury tax, entertainment tax

etc.

b) No CENVAT after manufacturing stage

c) Non integration of VAT and Service Tax

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Existing taxes that will continue even after the introduction of GST

1. Central Excise Duty levied on manufacture / production of Tobacco, Petroleum

Crude, Diesel, Petrol, ATF and Natural Gas.

2. State Excise Duty levied on manufacture / production of Alcoholic Liquor, Opium,

Indian Hemp and Narcotics.

3. VAT levied on Intra-State sale of Petroleum Crude, Diesel, Petrol, ATF, Natural and

Alcoholic Liquor

Benefits of GST:

GST is a win – win situation for the entire country.

It brings benefits to all the stakeholders of industry, Government and the consumer.

It will lower the cost of goods and services, give a boost to the economy and make

the products and services globally competitive.

Other significant benefits of GST

1. Creation of unified national market:

GST aims to make India a common market with common tax rates and

procedures and remove the economic barriers thus paving the way for an

integrated economy at the national level.

2. Mitigation of ill effects of cascading:

By subsuming most of the Central and State taxes into a single tax and by

allowing a set – off of prior – stage taxes for the transactions across the entire

value chain, it would mitigate the ill effects of cascading, improving

competitiveness and improve liquidity of the businesses.

3. Elimination of multiple taxes and double taxation:

GST will subsume majority of existing indirect tax levies both at Central and

State level into one tax i.e., GST which will be leviable uniformly on goods and

services.

This will make doing business easier and will also tackle the highly disputed

issues relating to double taxation of a transaction as both goods and services.

4. Boost to ‘Make in India’ initiative:

GST will give a major boost to the ‘Make in India’ initiative of the Government

of India by making goods and services produced in India competitive in the

national as well as international market.

5. Buoyancy to the Government Revenue:

GST is expected to bring buoyancy to the Government Revenue by widening the

tax base and improving the taxpayer compliance.

GST shall be implemented in India on a dual structure basis i.e., the Centre and

the States shall have concurrent powers to levy, collect and administer GST.

The proposed GST system shall have two components – Central GST and State

GST / UTGST.

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Conceptual framework (Dual Model of GST)

The significant features of Dual GST in India, are as under

1. CGST is to be administered by the Central Government and SGST is to be administered

by State Governments. UTGST is to be administered by Administrator appointed by the

Central Government for the Union Territory.

2. CGST has replaced existing Central Excise, Service Tax, Additional Excise Duty,

Special Additional Duty of Customs, etc. whereas SGST has replaced State VAT, CST,

Luxury Tax, Octroi and Entry Tax, Purchase Tax, etc.

3. Taxable Event under GST shall be supply of goods or services or both. It is an event the

occurrence of which attracts the liability to tax.

Under earlier system of indirect taxes there were different taxable event in each of the

indirect taxes. “Manufacture” was a taxable event under Central Excise, “Transfer of property

in goods” under VAT/CST, and services “Provided or agreed to be provided” in Service Tax.

4. GST is based on destination based consumption tax principle. On the contrary, erstwhile

Central Sales Tax was origin based tax.

5 . Supplies of goods or services or both as specified in Schedule – I is to be treated as Supply

of goods or services or both and subject to tax under GST even if such supplies are made

without consideration.

What is Schedule - I?

ACTIVITIES TO BE TREATED AS SUPPLY EVEN IF MADE WITHOUT

CONSIDERATION

1. Permanent transfer or disposal of business assets where input tax credit has been availed on

such assets.

2. Supply of goods or services or both between related persons or between distinct persons as

specified in section 25, when made in the course or furtherance of business:

Provided that gifts not exceeding fifty thousand rupees in value in a financial year by an

employer to an employee shall not be treated as supply of goods or services or both.

3. Supply of goods—

(a) by a principal to his agent where the agent undertakes to supply such goods on behalf of

the principal; or

(b) by an agent to his principal where the agent undertakes to receive such goods on behalf of

the principal.

4. Import of services by a taxable person from a related person or from any of his other

establishments outside India, in the course or furtherance of business.

Conceptual framework:

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

GST shall be implemented in India on a dual structure basis i.e. the Centre and the States

shall have concurrent powers to levy, collect and administer GST.

The proposed GST system shall have two components – Central GST and State GST /

UTGST.

The Central GST and the State GST / UTGST would be levied simultaneously on every

transaction of supply of goods or services or both except the exempt supply and the

transactions which are upto the prescribed threshold limits.

Conceptual framework:

1. CGST:

GST levied by the Centre on intra – State supply of goods or services or both would

be called the Central GST (CGST)

2. SGST:

GST levied by the states on intra – State supply of goods or services or both would be

called the State GST (SGST). State under the GST Law is defined to include a Union

Territory with Legislature.

2. SGST:

GST levied by the states on intra – State supply of goods or services or both would be

called the State GST (SGST). State under the GST Law is defined to include a Union

Territory with Legislature.

Thus, on every supply of goods or services or both within the Union territories of

Delhi and Pondicherry, State GST (SGST) will be levied.

In Uttar Pradesh SGST is named as UP GST. In Rajasthan, it is named as Rajasthan

GST and the same way in all other states.

3. UTGST:

On every supply of goods or services or both within the Union territories of Andaman

and Nicobar Islands, Lakshadweep, Dadra and Nagar Haveli, Daman and Diu,

Chandigarh, Union Territory GST (UTGST) will be levied.

4. IGST:

On every inter – State supply of goods or services or both, integrated GST (IGST)

will be levied and collected by Centre. IGST shall be apportioned between the centre

and the states in the manner as may be provided in due course by the GST Council.

5. Import of goods or services or both:

Import of goods or services or both shall be treated as inter – state supply and would

be liable to IGST.

Since GST is a destination based consumption tax, IGST on import shall be levied

and collected by the state in which goods or services or both are finally consumed /

used.

IGST on goods imported into India shall be levied and collected in accordance with

the provisions of section 3 of the Customs Tariff Act, 1975 at the point when duties of

custom are levied on the said goods under section 12 of the Customs Act, 1962.

6. Export of goods or services or both:

Exports will be treated as ‘Zero rated supplies’.

No tax will be payable on export of goods or services or both, however credit of input

tax credit will be available and exporters can claim refund of the same

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Persons liable for Registration under GST (Sec23)

Every supplier shall be liable to be registered under the Act in the State from which

he makes a taxable supply of Goods or Services or both.

Registration is required if his aggregate turnover in a financial year exceeds ₹ 20

Lakhs.

This threshold limit will be ₹ 10 Lakhs if a taxable person conducts his business in

any of the special category states i.e. Arunachal Pradesh, Assam, Jammu and

Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal

Pradesh and Uttarakhand.

Persons not liable for Registration under (Sec 22)

1. The following persons shall not be liable to registration, namely:

Any person engaged exclusively in the business of supplying goods or services or

both that are not liable to tax or wholly exempt from tax;

An agriculturist, to the extent of supply of produce out of cultivation of land.

2. The Government may, on the recommendation of the Council, by notification, specify the

category of persons who may be exempted from obtaining registration under this Act.

E-Commerce Operator: sec 2(45) of GST Act

“Electronic commerce operator” means any person who owns, operates or manages

digital or electronic facility or platform for electronic commerce.

It includes every person who, directly or indirectly, owns, operates or manages a

digital/ electronic facility or platform for supply of goods or services or both.

While an aggregator (Ola, Swiggy, etc.) only connects the customer with the

supplier / service provider, an e – commerce operator (Flipkart) facilitates the entire

process of the supply of goods / provision of service. Under the GST law, even

aggregators would be covered under the definition of ‘electronic commerce operator’.

The following aspects need to be noted:

The threshold limits of registration would not apply and he would be required

to obtain registration irrespective of his turnover.

He is required to deduct an amount as tax out of the consideration paid or

payable by him to the actual supplier of goods or services or both made

through such operator.

The law requires the operator to collect tax at source in respect of supplies

where the consideration is collected by the electronic commerce operator.

However, these provisions would not apply to a transaction where monies are

received by the supplier on delivery (COD basis) and the delivery is made

directly by the supplier.

Classification system under GST

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Classification of Goods Classification of

Service

Classification of Goods:

Classification of goods under the GST regime shall be made according to the

Harmonised System of Nomenclature (HSN). A code shall be allotted to each

commodity and such code shall be mentioned on the invoice issued by the taxable

person:

Taxable person having a turnover of less than ₹ 1.5 crores shall not be required to

mention the HSN code in their invoice.

Taxable person whose turnover is above ₹ 1.5 crores but below ₹ 5 crores shall use

two digit HSN code, and

The taxpayers whose turnover is ₹ 5 crores and above shall use four digit HSN code

in their invoice.

In case of imports / exports, HSN code of 8 digits shall be compulsory.

Classification of Service

Services under the GST regime shall be classified as per Services Accounting Code (SAC). It

is 8 digit code of which first 2 digit is zero.

Goods and Services Tax (compensation to States Act 2017)

The Goods and Services Tax (Compensation to States) Act, 2017 provides for a mechanism

to compensate the States on account of loss of revenue which may arise due to

implementation of the Goods and Services Tax read together with the Constitutional (101st

Amendment) Act, 2016, for a period of 5 years.

This Act, inter alia provides:

That the base year during the transition period shall be reckoned as the

financial year 2015-16 for the purpose of calculating compensation amount

payable to the states;

That the revenue proposed to be compensated would consist of revenues from

all taxes that stands subsumed into GST law, as audited by the CAG;

Levy of a cess over and above the GST (named as GST Compensation Cess)

on certain notified goods to compensate States for 5 years on account of

revenue loss suffered by them.

Notified Goods are:

Pan Masala (60% to 204%)

Aerated Water (12%)

Tobacco & Tobacco Product (71%)

Cigarettes, Cigar, Hookah (21%)

Motor vehicle ( Nil to 15%)

Coal, Lignite (₹ 400 / tonne)

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

That the proceeds of the cess will be utilized to compensate States that warrant

payment of compensation;

That 50% of the amount remaining unutilized in the fund at the end of the fifth year

will be transferred to the Centre and the balance 50% would be distributed amongst

the State and Union Territories in the ratio of total revenues from SGST / UTGST of

the fifth year;

GST Compensation Cess (under section 8 of the Act) will be levied on all intra-State

and inter-State supplies of goods or services or both, including import of goods;

The Cess would not be leviable on supplies made by a person who has opted for

composition levy;

What is Composition Levy (sec 10(1) of CGST Act 2017

Composition scheme under the GST Law is for small taxpayers. The objective of

composition scheme is to bring simplicity and give relief to small taxpayers so that

they need not be burdened with the compliance provisions under the GST Law.

Moreover, it is an optional scheme and the eligible person can opt to pay a fixed

percentage of turnover as fees every quarter instead of paying at normal rate.

A registered person, whose aggregate turnover in the preceding financial year did not

exceed ₹ 1.5 crore, may opt to pay, in lieu of the normal tax payable by him, an

amount calculated at such rate as may be prescribed, but not exceeding,-

a. 1 % of the turnover in State or turnover in Union territory in case of a manufacturer

(CGST rate),

b. 2.5 % of the turnover in State or turnover in Union territory in case of persons engaged in

making supplies referred to in clause (b) of paragraph 6 of schedule II, [i.e. supply, by way of

or as part of any service or in any other manner whatsoever, of goods, being food or any other

article for human consumption or any drink (other than alcoholic liquor for human

consumption), where such supply or services is for cash, deferred payment or other valuable

consideration] (CGST rate), and

c. 0.5 % of the turnover in State or turnover in Union territory in case of other suppliers

(CGST rate)

Note:

Like CGST rate, there shall be equivalent rate of SGST / UTGST payable in case of

composition levy. As a result, total GST payable shall be double of the above mentioned

CGST rates. Thus, the maximum total GST rate shall be 2 % or 5 % or 1 %, as the case may

be instead of 1 % or 2.5 % or 0.5%.

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Composite and Mixed Supplies (sec8)

Composite supply means a supply made by a taxable person to a recipient and:

• Comprises two or more taxable supplies of goods or services or both, or any

combination thereof.

• Are naturally bundled and supplied in conjunction with each other, in the ordinary

course of business.

This means that in a composite supply, goods or services or both are bundled owing to

natural necessities. The elements in a composite supply are dependent on the principal

supply.

How to determine the tax liability on composite supplies?

A composite supply comprising of two or more supplies, one of which is a principal supply,

shall be treated as a supply of such principal supply.

Example: Elite Manufacturers entered into a contract with XYZ Ltd. for supply of Ready

made shirts packed in designer boxes at XYZ Ltd.’s outlet. Further, Elite Manufacturers

would also get them insured during transit. In this case, packing materials, transport &

insurance is a composite supply, wherein supply of goods is principal supply.

Example: When a consumer buys a television set and he also gets warranty and a

maintenance contract with the TV, this supply is a composite supply. In this example, supply

of TV is the principal supply, warranty and maintenance services are ancillary.

What is principal supply (sec 2(90) of CGSTAct)

“Principal supply” means the supply of goods or services which constitutes the predominant

element of a composite supply and to which any other supply forming part of that composite

supply is ancillary;

The concept of ‘a principal supply’ emerges only for determining whether a supply is a

composite supply or not, and where it is a composite supply, the rate of tax applicable for the

composite supply.

Principal supply recognizes two or more supplies, and arranges them in a two – step

hierarchy – a single predominant supply and the ancillary supply(ies).

a. Supply of a laptop and a carry case – In this case, the case only adds value to the

supply of laptop and therefore, the case would be ancillary while the laptop comprises

the predominant element of the supply. Even where the brand of the case is not the

same as that of the laptop, and the supplier can establish that the case is naturally

bundled with the laptop in the ordinary course of his business, the supply can be

treated as a composite supply.

b. Supply of equipment and installation / commissioning of the same – While the

recipient actually purchases the equipment, making the equipment the principal

supply, the installation makes the equipment usable by the recipient. Even if there is a

separate charge for the installation of the equipment, since the service is naturally

bundled and Provided in the ordinary course of business, the supply would be a

composite supply.

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Mixed supplies

Mixed supplies means:

Two or more individual supplies of goods or services, or any combination thereof,

made in conjunction with each other by a taxable person.

For a single price where such supply does not constitute a composite supply.

The individual supplies are independent of each other and are not naturally bundled.

How to determine the tax liability on mixed supplies?

A mixed supply comprising of two or more supplies shall be treated as supply of that

particular supply that attracts highest rate of tax.

Example: A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry

fruits, aerated drink and fruit juices when supplied for a single price is a mixed supply.

Each of these items can be supplied separately and is not dependant on any other. It shall not

be a mixed supply if these items are supplied separately.

Example: A shopkeeper selling storage water bottles along with refrigerator. Bottles and the

refrigerator can easily be priced and sold separately. So, such supplies are mixed supplies

Procedure for Registration (sec25)

1. Every person who is liable to be registered under section 22 or section 24 shall apply for

registration in every such State or Union territory in which he is so liable within 30 days

from the date on which he becomes liable for registration, in such manner and subject to

such conditions as may be prescribed;

2. A person seeking registration under this Act shall be granted a single registration in a

State or Union territory;

3. A person, though not liable to be registered under section 22 or section 24 may get

himself registered voluntarily, and all provisions of this Act, as are applicable to a

registered person, shall apply to such person.

4. Where a person who has obtained, or is required to obtain registration in a State or Union

territory in respect of an establishment, has an establishment in another State or Union

territory, then such establishments shall be treated as establishments of distinct persons

for the purposes of this Act.

5. Every person shall have a Permanent Account Number issued under the Income-tax Act,

1961 in order to be eligible for grant of registration:

Provided, that a person required to deduct tax under section 51 may have, in lieu of

Permanent Account Number, a Tax Deduction and Collection Account Number issued under

the said Act in order to be eligible for grant of registration.

6. Where a person who is liable to be registered under this Act fails to obtain registration,

the proper officer may, without prejudice to any action which may be taken under this

Act or under any other law for the time being in force, proceed to register such person in

such manner as may be prescribed.

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

7. Notwithstanding anything contained in sub-section (1),-

Any specialized agency of the United Nations Organization or any Multilateral

Financial Institution and Organization notified under the United Nations (Privileges

and Immunities) Act, 1947, Consulate or Embassy of foreign countries; and

Any other person or class of persons, as may be notified by the Commissioner, shall

be granted a Unique Identity Number in such manner and for such purposes, including

refund of taxes on the notified supplies of goods or services or both received by them,

as may be prescribed.

8. The registration or the Unique Identity Number shall be granted or rejected after due

verification in such manner and within such period as may be prescribed.

9. A certificate of registration shall be issued in such form and with effect from such date as

may be prescribed.

Cancellation of Registration (29)

Any Registration granted under this Act may be cancelled by the Proper Officer when –

The business is discontinued, transferred fully for any reason including death of

proprietor, amalgamate with other legal entity, demerged or otherwise disposed of; or

There is any change in the constitution of the business; or

The taxable person is no longer liable to be registered under section 22.

This is possible after the persons is afforded an opportunity of being heard (except no such

opportunity need to be provided in case the application is filed by the registered taxable

person or his legal heirs, in the case of death of such person, for cancellation of registration)

when –

The registered taxable person has contravened such provisions of the Act or the rules

made there under as may be prescribed; or

A person paying tax under Composition Scheme has not furnished returns for three

consecutive tax periods; or

Any taxable person who has not furnished returns for a continuous period of six

months; or

Any person who has taken voluntary registration and has not commenced business

within six months from the date of registration;

Where registration has been obtained by means of fraud, wilful misstatement or

suppression of facts.

As such, cancellation of registration, shall not affect the liability of the taxable person to pay

tax and other dues under the Act for any period prior to the date of cancellation whether or

not such tax and other dues are determined before or after the date of cancellation.

PLACE OF SUPPLY

The ‘location of the supplier’ and ‘place of supply’ is principally essential to determine

whether the supply is an inter – State or an intra – State supply (i.e., where location of

supplier and place of supply are in the same State or Union Territory, the supply would be an

intra – State, and will be an inter – State supply in any other case).

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

Location of Supplier of Goods

Location of supplier of goods is the term not defined in law.

The word ‘location’ in this phrase refers to the site or premises (geographical point) where

the supplier is situated with the goods in his control ready to be supplied or in other words it

is the physical point where the goods are situated under the control of the person wherever

incorporated or registered, ready to be supplied.

Location of the supplier of services” Sec2 (15) of IGST Act)

“Location of the supplier of services” means,-

a) Where a supply is made from a place of business for which the registration has been

obtained, the location of such place of business;

b) Where a supply is made from a place other than the place of business for which

registration has been obtained (a fixed establishment elsewhere), the location of such

fixed establishment;

“Location of the supplier of services” means,-

c) Where a supply is made from more than one establishment, whether the place of

business or fixed establishment, the location of the establishment most directly

concerned with the provisions of the supply; and

d) In absence of such places, the location of the usual place of residence of the supplier.

Place of supply of goods- supplies within India (sec 10 of IGST Act)

i. Where ‘supply involves movement’, the place of supply will be the place where

the goods are located at the time at which the movement terminates for delivery to

the recipient.

ii. Where the goods are assembled or installed at site, the place of supply will be the

location of such installation or assembly.

iii. Where goods are supplied on – board a conveyance, the place of supply will be

the location at which the goods are taken on – board.

Place of supply of goods –imported or Exported (sec 11 of IGST Act)

Import of Goods [ Sec. 2 (10) of IGST Act]

Means bringing goods into India from a place outside India.

Export of Goods [Sec 2(5) of IGST Act]

Means taking goods out of India to a place outside India.

With these definitions which are with reference to the movement of goods and not the

location of the supplier or recipient. The place of supply will be:

i.In the case of import of goods, the location of the importer and

ii. In the case of export of goods, the location outside India where the goods are exported

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

lOMoARcPSD|6469575

KSLU Past Examination Questions:

1. An assessee was an authorized dealer of Sony electronics products which were sold to

different customers in Karnataka under the Direct billing from Sony Ltd in Delhi. Is

there a sale in the course of inter – state trade or commerce? Give reasons [D,15]

[D,17]

Downloaded by Vyshu Sonu (swevyshu846@gmail.com)

You might also like

- Human Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsFrom EverandHuman Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsNo ratings yet

- India's Constitutional Framework for Taxation PowersDocument13 pagesIndia's Constitutional Framework for Taxation PowersDeepesh SinghNo ratings yet

- Taxguru - In-Power of Commissioner To Reduce or Waive Income Tax PenaltyDocument9 pagesTaxguru - In-Power of Commissioner To Reduce or Waive Income Tax PenaltyRakesh Kumar SinghalNo ratings yet

- Topic:-Definition, Scope and Objective of Maternity Benifit Act 1961Document9 pagesTopic:-Definition, Scope and Objective of Maternity Benifit Act 1961ANURAG100% (1)

- Income Tax AuthoritiesDocument3 pagesIncome Tax AuthoritiesANUP KUMAR100% (1)

- Making of Arbitral Award and Termination of ProceedingsDocument15 pagesMaking of Arbitral Award and Termination of ProceedingsAshutosh BagchiNo ratings yet

- Aids To InterpretationDocument68 pagesAids To InterpretationWWWEEEENo ratings yet

- Basis of Charge and Scope of TotalDocument24 pagesBasis of Charge and Scope of TotalSujithNo ratings yet

- Inter State Migrant Workmen Act 1979Document10 pagesInter State Migrant Workmen Act 1979Akhil NautiyalNo ratings yet

- Appeals and Revision: After Studying This Chapter, You Will Be Able ToDocument25 pagesAppeals and Revision: After Studying This Chapter, You Will Be Able TofirastiNo ratings yet

- Administrative Law OverviewDocument37 pagesAdministrative Law OverviewBharath YJNo ratings yet

- Intervention Meaning and Kinds of InterventionDocument1 pageIntervention Meaning and Kinds of InterventionBilal akbarNo ratings yet

- Appointment-of-Receiver SAIF ALIDocument16 pagesAppointment-of-Receiver SAIF ALISaif AliNo ratings yet

- 15831b - Income Tax AuthoritiesDocument23 pages15831b - Income Tax AuthoritiesanmoldeepsinghNo ratings yet

- Registration Under GSTDocument19 pagesRegistration Under GSTHappyNo ratings yet

- Professional Ethics And Duties Of AdvocatesDocument9 pagesProfessional Ethics And Duties Of Advocatesbhawini100% (1)

- SHARE CAPITAL AND DEBENTURESDocument75 pagesSHARE CAPITAL AND DEBENTURESNandita AgarwalNo ratings yet

- Income Tax Authorities Powers and DutiesDocument16 pagesIncome Tax Authorities Powers and Dutiesnandan velankarNo ratings yet

- Interim Orders.: (A) Commissions (Secs. 75-78, Order 26)Document5 pagesInterim Orders.: (A) Commissions (Secs. 75-78, Order 26)guneet0911No ratings yet

- Women & Law - Research PaperDocument54 pagesWomen & Law - Research Papers100% (2)

- Jatin Project (Lok Adalat)Document20 pagesJatin Project (Lok Adalat)tarun choudhary100% (1)

- Unit 6 - Probation BY - Pankaj S. Meena Assistant Professor, Ucl, MlsuDocument18 pagesUnit 6 - Probation BY - Pankaj S. Meena Assistant Professor, Ucl, MlsuTushar SaxenaNo ratings yet

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDocument23 pagesPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaNo ratings yet

- Capital Gains Taxation in IndiaDocument3 pagesCapital Gains Taxation in IndiavikramkukrejaNo ratings yet

- The State of Rajasthan Vs Mst. Vidhyawati and Another On 2 February, 1962Document21 pagesThe State of Rajasthan Vs Mst. Vidhyawati and Another On 2 February, 1962Anuraag JassalNo ratings yet

- Fiscal Statutes (Strict Construction LLB Notes)Document4 pagesFiscal Statutes (Strict Construction LLB Notes)Amogh PareekNo ratings yet

- Enforcement of Foreign Awards in IndiaDocument12 pagesEnforcement of Foreign Awards in IndiaTanveer100% (1)

- Hierarchy and Powers of Criminal CourtsDocument4 pagesHierarchy and Powers of Criminal CourtsRohit kumar SharmaNo ratings yet

- Interpretation of Fiscal StatutesDocument6 pagesInterpretation of Fiscal StatutessubramonianNo ratings yet

- Power AND Function OF Securitie S Appelate Tribunal: Sandeep ChawdaDocument19 pagesPower AND Function OF Securitie S Appelate Tribunal: Sandeep ChawdaSandeep ChawdaNo ratings yet

- Appeal CR PC Additionla Notes 26.09.2022Document6 pagesAppeal CR PC Additionla Notes 26.09.2022Garvish DosiNo ratings yet

- Authorities Under The Industrial Disputes ActDocument4 pagesAuthorities Under The Industrial Disputes ActLakshmi Narayan RNo ratings yet

- Air AcT NOTES PDFDocument3 pagesAir AcT NOTES PDFaswin donNo ratings yet

- Bar Counsil of IndiaDocument8 pagesBar Counsil of IndiaAmitpal SINGHNo ratings yet

- Incomes Exempt from Tax Under Section 10Document47 pagesIncomes Exempt from Tax Under Section 10CA Rishabh DaiyaNo ratings yet

- Exemption From Custom DutyDocument13 pagesExemption From Custom DutyAbhinav PrasadNo ratings yet

- A Critical Analysis of Professional Misconduct by Advocates in IndiaDocument13 pagesA Critical Analysis of Professional Misconduct by Advocates in IndiaArushi Bisht100% (1)

- Remedies Against The Order of PunishmentDocument6 pagesRemedies Against The Order of Punishmentkunal_kapoor404No ratings yet

- Cic Decisons ExemptnsDocument35 pagesCic Decisons ExemptnsManuNo ratings yet

- Powers and Functions of BCI PDFDocument3 pagesPowers and Functions of BCI PDFVishal AnandNo ratings yet

- Wealth TaxDocument5 pagesWealth TaxsadathnooriNo ratings yet

- Labour Laws GuideDocument14 pagesLabour Laws Guidesohel alamNo ratings yet

- ADRDocument9 pagesADRAvtar singhNo ratings yet

- Residential Status Tax RulesDocument4 pagesResidential Status Tax RulesSimran Kaur Khurana100% (1)

- Concept of Juvenile DeliquencyDocument8 pagesConcept of Juvenile DeliquencyTanuNo ratings yet

- Legal AidsDocument144 pagesLegal AidsAnonymous tOgAKZ8No ratings yet

- NATIONAL COMPANY LAW TRIBUNAL: QUASI-JUDICIAL AUTHORITY FOR CORPORATE DISPUTESDocument4 pagesNATIONAL COMPANY LAW TRIBUNAL: QUASI-JUDICIAL AUTHORITY FOR CORPORATE DISPUTESSrishti GoelNo ratings yet

- Offender Failing To Observe Conditions of BondDocument3 pagesOffender Failing To Observe Conditions of BondveerNo ratings yet

- GST AssignmentDocument7 pagesGST Assignmentshivam tiwariNo ratings yet

- In Re - Vinay Chandra MishraDocument2 pagesIn Re - Vinay Chandra MishraSumisha P RNo ratings yet

- Offences and Prosecution Under Income Tax ActDocument8 pagesOffences and Prosecution Under Income Tax Actnahar_sv1366No ratings yet

- Meaning of Misstatement of ProspectusDocument15 pagesMeaning of Misstatement of ProspectusShobha MohandasNo ratings yet

- Forms of Delegated Legislation ClassificationDocument4 pagesForms of Delegated Legislation ClassificationShrujan SinhaNo ratings yet

- Workmen's Compensation Act OverviewDocument4 pagesWorkmen's Compensation Act OverviewAshwin RacerNo ratings yet

- U.P Land Law Test: Board of Revenue PowersDocument10 pagesU.P Land Law Test: Board of Revenue PowersSadhvi SinghNo ratings yet

- Form of Dresses or Robes To Be Worn by AdvocatesDocument2 pagesForm of Dresses or Robes To Be Worn by AdvocatesNagaraja ReddyNo ratings yet

- ACC 223: Understanding the Difference Between Tax and FeeDocument2 pagesACC 223: Understanding the Difference Between Tax and FeePrachi Tripathi 42No ratings yet

- AssignmentDocument8 pagesAssignmentbharat singhNo ratings yet

- Analysis of India's Banking Regulation Act 1949Document3 pagesAnalysis of India's Banking Regulation Act 1949Anugrah JoyNo ratings yet

- Tribunalisation of Justice: Application of Droit Administratif in IndiaDocument9 pagesTribunalisation of Justice: Application of Droit Administratif in IndiaAkash AgarwalNo ratings yet

- Criminal Law I Exam GuideDocument2 pagesCriminal Law I Exam Guideswetha shree chavan mNo ratings yet

- 4 Constutitional Law IIDocument282 pages4 Constutitional Law IIswetha shree chavan mNo ratings yet

- Arbitration Project Team RolesDocument1 pageArbitration Project Team Rolesswetha shree chavan mNo ratings yet

- 2018 Batch 2019d IpcDocument2 pages2018 Batch 2019d Ipcswetha shree chavan mNo ratings yet

- Final Report West Bengal NUJSDocument224 pagesFinal Report West Bengal NUJSMaaz AlamNo ratings yet

- Public International LawDocument41 pagesPublic International Lawswetha shree chavan mNo ratings yet

- VTU notes on balancing of reciprocating massesDocument43 pagesVTU notes on balancing of reciprocating massesswetha shree chavan mNo ratings yet

- Unit 2 DYNAMIC FORCE ANALYSISDocument39 pagesUnit 2 DYNAMIC FORCE ANALYSISswetha shree chavan mNo ratings yet

- Contempt of Court 2Document10 pagesContempt of Court 2swetha shree chavan mNo ratings yet

- HMT M4 Ktunotes - inDocument54 pagesHMT M4 Ktunotes - inswetha shree chavan mNo ratings yet

- VTU NOTES ON BALANCING OF ROTATING MASSESDocument46 pagesVTU NOTES ON BALANCING OF ROTATING MASSESRichard Mortimer100% (2)

- Mechanical Vibrations (10me72)Document167 pagesMechanical Vibrations (10me72)swetha shree chavan mNo ratings yet

- Heat transfer document titleDocument3 pagesHeat transfer document titleMuwaizNo ratings yet

- Unit 1 Dynamics of MachineryDocument17 pagesUnit 1 Dynamics of Machineryswetha shree chavan mNo ratings yet

- Ktunotes Download Notes PDF FreeDocument31 pagesKtunotes Download Notes PDF FreeFor MoreNo ratings yet

- HMT M1 Ktunotes - inDocument29 pagesHMT M1 Ktunotes - inshubhamNo ratings yet

- Design of Machine Elements - II (10me62)Document271 pagesDesign of Machine Elements - II (10me62)swetha shree chavan m100% (1)

- Heat transfer document titleDocument3 pagesHeat transfer document titleMuwaizNo ratings yet

- 15ME631Document3 pages15ME631Pradeep ShivaNo ratings yet

- KTU Students Study Materials WebsiteDocument9 pagesKTU Students Study Materials Websiteswetha shree chavan mNo ratings yet

- HMT M3 Ktunotes - inDocument25 pagesHMT M3 Ktunotes - inswetha shree chavan mNo ratings yet

- 2017 Batch 2015j JurisprudenceDocument2 pages2017 Batch 2015j Jurisprudenceswetha shree chavan mNo ratings yet

- 15ME631Document3 pages15ME631Pradeep ShivaNo ratings yet

- Page No. 40) : JUNE - 2014 Duration: 3 Hours Max - Marks:100 Unit - IDocument3 pagesPage No. 40) : JUNE - 2014 Duration: 3 Hours Max - Marks:100 Unit - Iswetha shree chavan mNo ratings yet

- Muhammadan Law Notes on Family Law and SuccessionDocument133 pagesMuhammadan Law Notes on Family Law and Successionswetha shree chavan mNo ratings yet

- Jurisprudence Notes LLB PDFDocument53 pagesJurisprudence Notes LLB PDFbikash78% (9)

- III Semester of 3 Yr. LL.B./VII Semester of 5 Yr. B.A./ B.B.A. LL.B Examination, December 2016 JurisprudenceDocument2 pagesIII Semester of 3 Yr. LL.B./VII Semester of 5 Yr. B.A./ B.B.A. LL.B Examination, December 2016 JurisprudenceRichardNo ratings yet

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- C9 (MC) - Cost Accounting by Carter (Part1)Document2 pagesC9 (MC) - Cost Accounting by Carter (Part1)AkiNo ratings yet

- Relaxo Footwear's Pandemic PerformanceDocument2 pagesRelaxo Footwear's Pandemic Performancevighnesh varmaNo ratings yet

- Ch09: Break-Even Point & Cost-Volume-Profit Analysis: Presented byDocument49 pagesCh09: Break-Even Point & Cost-Volume-Profit Analysis: Presented byJason Vi LucasNo ratings yet

- VAT Invoice - 2023-02-28 - 00000006062065-2302-9647607Document2 pagesVAT Invoice - 2023-02-28 - 00000006062065-2302-9647607falparslan5265No ratings yet

- G12 ABM Marketing Lesson 1 (Part 3)Document12 pagesG12 ABM Marketing Lesson 1 (Part 3)Leo SuingNo ratings yet

- LG Electronics India PVT LTD Rural MarketingDocument4 pagesLG Electronics India PVT LTD Rural MarketingAnmol LamaNo ratings yet

- CVP Cost For IEDocument1 pageCVP Cost For IEValerie Aubrey Luna BeatrizNo ratings yet

- BM DLP Week 5Document5 pagesBM DLP Week 5Gift Anne ClarionNo ratings yet

- Tax Invoice TitleDocument1 pageTax Invoice TitlebiswaNo ratings yet

- Vinay Ford MotorsDocument71 pagesVinay Ford MotorshjanagamaNo ratings yet

- Q # 1. Explain How Budgetary Systems Fit Within The Performance Hierarchy?Document5 pagesQ # 1. Explain How Budgetary Systems Fit Within The Performance Hierarchy?Hammad AnwarNo ratings yet

- How sales drives business successDocument3 pagesHow sales drives business successPriyanka ReddyNo ratings yet

- Questions 11 and 12 Are Based On The Following InformationDocument2 pagesQuestions 11 and 12 Are Based On The Following InformationBella AyabNo ratings yet

- Midterm SalesDocument3 pagesMidterm SalesArzaga Dessa BCNo ratings yet

- Company Profile @MRF TyresDocument8 pagesCompany Profile @MRF TyresAnkur Dubey40% (5)

- Class Activity 1Document2 pagesClass Activity 1awaz0% (1)

- Consignment and Franchise Assignment ILAGANDocument4 pagesConsignment and Franchise Assignment ILAGANAsdfghjkl LkjhgfdsaNo ratings yet

- Drivers of Globalization: Market Cost Government CompetitiveDocument6 pagesDrivers of Globalization: Market Cost Government CompetitiveraghavelluruNo ratings yet

- Result Paper - 11 (ITX) : 2: LogoutDocument11 pagesResult Paper - 11 (ITX) : 2: LogoutbavithraNo ratings yet

- Roles of Managerial Economist in BusinessDocument3 pagesRoles of Managerial Economist in BusinessvarinderksranNo ratings yet

- Auditing Problem 1Document1 pageAuditing Problem 1jhobsNo ratings yet

- Mahendra & MahendraDocument111 pagesMahendra & MahendrasiddiqrehanNo ratings yet

- GST Compensation Cess Fund detailsDocument2 pagesGST Compensation Cess Fund detailsPalak JioNo ratings yet

- Partnership Operation Learning ExercisesDocument26 pagesPartnership Operation Learning ExercisesAndrea Beverly TanNo ratings yet

- Activity 1: Right StepsDocument63 pagesActivity 1: Right StepsGem N AquarianNo ratings yet

- Channel Distribution at P & GDocument2 pagesChannel Distribution at P & GStuti MaheshwariNo ratings yet

- CH 6 Strategic Market Planning 6.3.2019Document39 pagesCH 6 Strategic Market Planning 6.3.2019XinniKuanNo ratings yet

- Markup and Margin ExplainedDocument4 pagesMarkup and Margin ExplainedRafael RiveraNo ratings yet

- Kem ChicksDocument7 pagesKem ChicksYayette Barimbad0% (1)