Professional Documents

Culture Documents

202 Part 1 2 Assignment Template - Financial Statements Ratios

Uploaded by

Ahmed Mahmoud0 ratings0% found this document useful (0 votes)

25 views1 pageOriginal Title

Copy of 202 Part 1 2 Assignment Template - Financial Statements Ratios

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 page202 Part 1 2 Assignment Template - Financial Statements Ratios

Uploaded by

Ahmed MahmoudCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

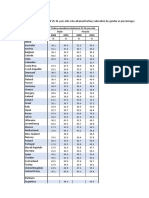

Acme Corporation Acme Corportation

Balance Sheet Income Statement Financial Ratios

December 31, 2019 For the Year Ended December 31, 2109 (1-1) (1-1) (1-2) (1-3)

Industry Ratios Acme Corp's Ratios Calculation Compare Explain

Assets Liabilities Sales $4,290,000 Quick ratio 1

Current Assets Current Liabilities COGS 3,580,000 Current ratio 2.7

Cash $72,000 Accts & Notes Pay. $432,000 Gross Profit 710,000 Inventory turnover 5.8

A/R 439,000 Accruals 170,000 Days sales outstanding 32 days

Inventory 894,000 Total Current Liabilities 602,000 Operating Expenses Fixed assets turnover 13

Total current assets 1,405,000 Long-term debt 404,290 Selling Expenses 121,320 Total assets turnover 2.6

Total Liabilities 1,006,290 Administrative Expenses 115,000 Return on assets 9.10%

Long-term Assets Depreciation 159,000 Return on equity 18.20%

Land and bldg 238,000 Owner's Equity Misc. Expenses 134,000 Debt ratio 50%

Machinery 132,000 Retained earnings 254,710 Operating Profit (EBIT) 180,680 Profit margin on sales 3.50%

Other Fixed Assets 61,000 Common stock 575,000

Total Long-term Assets 431,000 Total Owner's Equity 829,710 Taxes 72,272 *Industry average ratios have been constant for the past four years. (1-4) How is Acme doing compared to the rest of the industry? What are their strengths/what can they do to improve?

*Based on year-end balance sheet figures.

Total Liabilities &

Total Assets $1,836,000 $1,836,000 Net income $108,408

Owner's Equity

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Financial Report For IntramuralsDocument2 pagesFinancial Report For IntramuralsRosa Palconit0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Q&A-Accounts & Finance (Optional Included)Document109 pagesQ&A-Accounts & Finance (Optional Included)Madan G Koushik100% (1)

- Question 1: Completing The Accounting Cycle, Worksheet and FinancialDocument9 pagesQuestion 1: Completing The Accounting Cycle, Worksheet and FinancialĐanNguyễnNo ratings yet

- Account CodesDocument35 pagesAccount CodesKarenNo ratings yet

- Chapter 18 Cost Accounting.Document19 pagesChapter 18 Cost Accounting.Kheng BinuyaNo ratings yet

- PRACTICAL Assignment No. 1Document3 pagesPRACTICAL Assignment No. 1Ahmed MahmoudNo ratings yet

- Homework-8: Problem 3: Webwork Math-1601-01-Spring-2021 Homework-8 3Document1 pageHomework-8: Problem 3: Webwork Math-1601-01-Spring-2021 Homework-8 3Ahmed MahmoudNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasAhmed MahmoudNo ratings yet

- Week11-UPDATED DATA-Application AssignmentDocument2 pagesWeek11-UPDATED DATA-Application AssignmentAhmed MahmoudNo ratings yet

- 04-8 Submit 20201205Document3 pages04-8 Submit 20201205Ahmed MahmoudNo ratings yet

- Instructions - Managerial Capstone-KeaneDocument4 pagesInstructions - Managerial Capstone-KeaneAhmed MahmoudNo ratings yet

- This Study Resource Was: Prep QuestionsDocument3 pagesThis Study Resource Was: Prep QuestionsAhmed MahmoudNo ratings yet

- Problem 26 (12) - 2A: InstructionsDocument6 pagesProblem 26 (12) - 2A: InstructionsAhmed MahmoudNo ratings yet

- This Study Resource Was: Roller Coaster CrewDocument3 pagesThis Study Resource Was: Roller Coaster CrewAhmed MahmoudNo ratings yet

- This Study Resource Was: in Class AssignmentDocument3 pagesThis Study Resource Was: in Class AssignmentAhmed MahmoudNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasAhmed MahmoudNo ratings yet

- Charges Than The Original Structures. Use Curved Arrows To Show The Flow of Electrons FromDocument3 pagesCharges Than The Original Structures. Use Curved Arrows To Show The Flow of Electrons FromAhmed MahmoudNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument8 pagesNumbers Sheet Name Numbers Table NameAhmed MahmoudNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAhmed MahmoudNo ratings yet

- This Study Resource Was: Running Head: Should The U.S. Offer A Path To Citizenship/legal Residency For Illegal 1Document7 pagesThis Study Resource Was: Running Head: Should The U.S. Offer A Path To Citizenship/legal Residency For Illegal 1Ahmed MahmoudNo ratings yet

- Applying Psychology To My Life - (Tyreke Simmons)Document3 pagesApplying Psychology To My Life - (Tyreke Simmons)Ahmed MahmoudNo ratings yet

- Chapter 3 Homework Template 7.6 21Document27 pagesChapter 3 Homework Template 7.6 21Ahmed Mahmoud100% (1)

- Male Female 2009 2019 2009 2019 % % % %: Tertiary Educational Attainment 25-34 Year-OldsDocument7 pagesMale Female 2009 2019 2009 2019 % % % %: Tertiary Educational Attainment 25-34 Year-OldsAhmed MahmoudNo ratings yet

- Advanced Accounting TemplateDocument2 pagesAdvanced Accounting TemplateAhmed MahmoudNo ratings yet

- Interest 100 0.10 Par Value Bond 1000: Yield-To-MaturityDocument8 pagesInterest 100 0.10 Par Value Bond 1000: Yield-To-MaturityAhmed MahmoudNo ratings yet

- Excel Project 1 - Pizza Case StudyDocument5 pagesExcel Project 1 - Pizza Case StudyAhmed MahmoudNo ratings yet

- What I Know .Use Separate Paper For Your AnswerDocument7 pagesWhat I Know .Use Separate Paper For Your AnswerWhyljyne GlasanayNo ratings yet

- Week 3 - Chapter 3Document68 pagesWeek 3 - Chapter 3Dre ThathipNo ratings yet

- E4 - 17Document1 pageE4 - 17Mary BellezaNo ratings yet

- 2012 Dec QCF QDocument3 pages2012 Dec QCF QMohamedNo ratings yet

- Trident ACC 201 All Modules Case and SLP - LatestDocument17 pagesTrident ACC 201 All Modules Case and SLP - LatestamybrownNo ratings yet

- Redington India Condensed Consolidated Interim Financial StatementsDocument20 pagesRedington India Condensed Consolidated Interim Financial StatementsraxenNo ratings yet

- Icbp FRDocument131 pagesIcbp FREnggar Shafira AgriskaNo ratings yet

- Kalbe Farma TBK 31 Des 2020Document173 pagesKalbe Farma TBK 31 Des 2020A. A Gede Wimanta Wari Bawantu32 DarmaNo ratings yet

- Accruals Accounting: A Brief Guide ToDocument4 pagesAccruals Accounting: A Brief Guide Tosrihari44188No ratings yet

- SUEZ 2020 Consolidated Financial Statements ENDocument6 pagesSUEZ 2020 Consolidated Financial Statements ENchemicalchouhan9303No ratings yet

- MIB, Semester 1 Accounting and Finance Navneet Saxena: Amity International Business SchoolDocument12 pagesMIB, Semester 1 Accounting and Finance Navneet Saxena: Amity International Business SchoolDiptayan BaidyaNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- CH 08Document68 pagesCH 08nastassya ruhukailNo ratings yet

- Jollibee Food Corporation Statement of Financial PositionDocument12 pagesJollibee Food Corporation Statement of Financial PositionNeil Rey De SagunNo ratings yet

- Sarana Meditama Metropolitan (Q4 - 2014)Document72 pagesSarana Meditama Metropolitan (Q4 - 2014)Wihelmina DeaNo ratings yet

- Chapter 3 The Financial StatementDocument11 pagesChapter 3 The Financial StatementKhorchnoi Abaja CalimlimNo ratings yet

- Modern Advanced Accounting - Assignment 3Document12 pagesModern Advanced Accounting - Assignment 3Anita Kharod ChaudharyNo ratings yet

- MbssDocument3 pagesMbssErvin KhouwNo ratings yet

- FI504 Case Study 1Document17 pagesFI504 Case Study 1Scott SmithNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- Tea Plant Financial StatementsDocument41 pagesTea Plant Financial StatementsHassaan AhmadNo ratings yet

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- Basic Financial StatementsDocument12 pagesBasic Financial StatementsChriszel Dianne DamasingNo ratings yet

- Mayora Indah TBK PDFDocument84 pagesMayora Indah TBK PDFsherlijulianiNo ratings yet