Professional Documents

Culture Documents

Tutorial 1

Uploaded by

nur izzatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 1

Uploaded by

nur izzatiCopyright:

Available Formats

1) Discuss any two (2) unethical behavior done by Bernie Madoff

Lacked honesty.

Bernie Madoff is a biggest financial scam. He was caught wind that hedge fund

manager of one of their partners was consistently retaining a 1 to 2 percent profit per

month. Madoff’s return was too consistent when market went up, Madoff made a

profit. When market went down, he still made a profit. Madoff returns weren’t real.

The return to be unfazed by the market conditions. There was a little to no fluctuation

despite the market movements. He provided investors with solid and steady returns

even in down markets. He claimed that his strategies were too difficult for investor to

understand.

Running business that there was no fairness and lacking integrity.

Bernie Madoff also running the largest Ponzi scheme in which he would take funds

from new investors and pay dividend and redemption request to older investor,

pocketing a large portion for himself. To keep the scam going, the masterminds

behind the plan convince numerous victims that they’re investing in a legitimate fund

that promises great returns. Madoff set up his portfolios to look like he was matching

the returns of the S&P 500. This strategy prevented him from needing to pay too

much to existing investors, but it still made his purported holdings appeal to new

targets. And he remained under the radar by doing everything he could to keep his

scheme low key. He targeted specific, elite groups of investors, keeping his victims

close and the SEC off his back. He also stayed off the grid by keeping his paperwork

up to date and consistent. While most other Ponzi schemes operate by giving out large

returns and then collapsing, Madoff was able to tread water with his smaller returns

and keep his scam going for years.

2) Two (2) impacts of these behavior toward society and economy

The impact of these behavior toward economy is majority of investors rushed to

redeem their investment that made the firm bankrupt. Most of the hedge fund

companies and financial institutions that invested in the Madoff funds either faced

a financial crisis or failed when the business went bankrupt.

This has made a major contribution to the recent crash of the stock markets, which

has adversely affected the economy. This scam and others from risky investments

contributed to many economic problems that even spilled to social level including

jobs losses, auctioning of land, inflation and declining house prices, which also

spilled to the social level or depression. In Madoff case, his wife, Ruth needs to

settle with the feds for $205million. She also revealed that she and Bernie made a

suicide but didn’t go through with it.

These are in addition to family finances being extremely strained, economic stress

and depression setting in and the investment environment was largely curtailed,

hence the financial crisis hitting the economy.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Ultimate Guide For City PhotographyDocument48 pagesThe Ultimate Guide For City Photographygbhat62No ratings yet

- History of Madre de DiosDocument3 pagesHistory of Madre de DiosMisterJanNo ratings yet

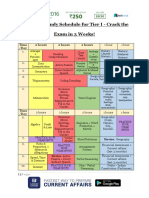

- SSC CHSL Study Schedule For Tier I - Crack The Exam in 3 Weeks!Document3 pagesSSC CHSL Study Schedule For Tier I - Crack The Exam in 3 Weeks!Tushita80% (15)

- Nanotechnology in Civil EngineeringDocument22 pagesNanotechnology in Civil EngineeringNehad AhmedNo ratings yet

- Business Law Syllabus (BLT)Document4 pagesBusiness Law Syllabus (BLT)Glene NallaNo ratings yet

- 1.0 Technical Analysis 1.1 Crude Palm Oil Futures (FCPO)Document6 pages1.0 Technical Analysis 1.1 Crude Palm Oil Futures (FCPO)nur izzatiNo ratings yet

- Past Year Question Chapter 6Document6 pagesPast Year Question Chapter 6nur izzatiNo ratings yet

- Tutorial Chapter 7Document5 pagesTutorial Chapter 7nur izzatiNo ratings yet

- CSC 413: Introduction To Interactive Multimedia Universiti Teknologi Mara (Melaka)Document1 pageCSC 413: Introduction To Interactive Multimedia Universiti Teknologi Mara (Melaka)nur izzatiNo ratings yet

- CSC 413: Introduction To Interactive Multimedia Universiti Teknologi Mara (Melaka)Document2 pagesCSC 413: Introduction To Interactive Multimedia Universiti Teknologi Mara (Melaka)nur izzatiNo ratings yet

- Profit Loss Account TemplateDocument4 pagesProfit Loss Account TemplatesnehaNo ratings yet

- Unit 19-20Document10 pagesUnit 19-20Wulan AnggreaniNo ratings yet

- Genmath Q2 Week4Document36 pagesGenmath Q2 Week4ShennieNo ratings yet

- Candi MerakDocument2 pagesCandi MerakEdi YantoNo ratings yet

- 1 Programming Model (Algorithms 1.1)Document10 pages1 Programming Model (Algorithms 1.1)HarshaSharmaNo ratings yet

- Workplace Health Promotion at Eska Rafinerska (Oil Refinery) 1. Organisations Involved 2. Description of The CaseDocument2 pagesWorkplace Health Promotion at Eska Rafinerska (Oil Refinery) 1. Organisations Involved 2. Description of The CaseDiana Vanessa GuerreroNo ratings yet

- Understanding: Sexual HarassmentDocument8 pagesUnderstanding: Sexual HarassmentAlex TwahirwaNo ratings yet

- 312 Listening List III FinalDocument2 pages312 Listening List III FinalJakeNo ratings yet

- Say's Law of Market and Quantity Theory of MoneyDocument19 pagesSay's Law of Market and Quantity Theory of MoneyBHANU TYAGINo ratings yet

- Book Review - 1: Reviewer: Devajyoti BiswasDocument3 pagesBook Review - 1: Reviewer: Devajyoti BiswassaemoonNo ratings yet

- Please DocuSign Youssef ADMISSIONS FORM W ATDocument5 pagesPlease DocuSign Youssef ADMISSIONS FORM W ATyoussefkhalfaoui30No ratings yet

- Fforde Economic StrategyDocument29 pagesFforde Economic StrategyDinhThuyNo ratings yet

- 850 SQ MM AAC Conductor PDFDocument1 page850 SQ MM AAC Conductor PDFSamyak DeoraNo ratings yet

- Bernardo Carpio - Mark Bryan NatontonDocument18 pagesBernardo Carpio - Mark Bryan NatontonMark Bryan NatontonNo ratings yet

- Normalization ExercisesDocument2 pagesNormalization ExercisesAnh DiệuNo ratings yet

- Writing Task 2 - Discussion - Opinion EssayDocument7 pagesWriting Task 2 - Discussion - Opinion EssayTonNo ratings yet

- Dead Poets SocietyDocument1 pageDead Poets SocietyNagy ZenteNo ratings yet

- Syllabus (Economic Analysis For Business)Document5 pagesSyllabus (Economic Analysis For Business)S TMNo ratings yet

- Walt Disney BiographyDocument8 pagesWalt Disney BiographyIsaacRodríguezNo ratings yet

- Biology-Activity-3 - Growth and Development of PlantDocument3 pagesBiology-Activity-3 - Growth and Development of PlantnelleoNo ratings yet

- Technical Support Questions and Answers: How Do I Access Commseciress?Document3 pagesTechnical Support Questions and Answers: How Do I Access Commseciress?goviperumal_33237245No ratings yet

- Modernism Revisited Five Fascist ModernismDocument25 pagesModernism Revisited Five Fascist ModernismUdrea FanicaNo ratings yet

- Drugs: Samkox Productions 0774852021Document2 pagesDrugs: Samkox Productions 0774852021MichaelNo ratings yet

- Pre-Intermediate Tests Audio Script: Track 1Document25 pagesPre-Intermediate Tests Audio Script: Track 1arifsahidNo ratings yet

- The Wise Old WomenDocument2 pagesThe Wise Old WomenLycoris FernandoNo ratings yet