Professional Documents

Culture Documents

Retail Industry 1624655310

Retail Industry 1624655310

Uploaded by

saurav_kumar_32Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail Industry 1624655310

Retail Industry 1624655310

Uploaded by

saurav_kumar_32Copyright:

Available Formats

Market SizeSize

Market 2021 57,15,700Cr(P)

57,15,700 (F)

Retail Industry

Retail Industry Growth RateRate

2021 -7.47%(E)

(E)

Growth -7.47%

All figures based

on 2020-21data

in INR Crores

Revenue 23,996.1 2,251.78 5,253.78 1,096.5 20,201.92

Net Profit 1,165.31 -51.01 -649.64 -6.20 33.84

Founded 2002 1998 1997 2002 2007

Market Cap 2,07,009.36 30,294.64 18,203.57 5,421.64 2,985.27

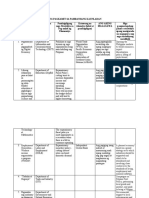

Cost break-up of organized retailers Multi-brand retailers profitability Single brand retailers profitability

11.2% 15.5%

5-10% Material

Cost 8.0% 7.9% 11.8% 11.7%

10.9%

Power and 7.2% 7.2% 10.1%10.5%

10-15% 6.1% 9.4%

Fuel 5.4%

Employee 4.3% 7.1%

Costs

3.7%

3.0% 5.7% 5.5% 5.7% 6.1% 6.6%

5-10% 2.6%

Other 4.6%

1-2% 1.6%

expenses 0.6% 0.9%

70-75%

FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY14 FY15 FY16 FY17 FY18 FY19 FY20

Operating margins Net margins Operating margins Net margins

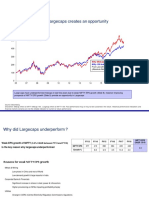

e-Retail growth (in ₹ Tn) News and Facts Other Major Players

1. Retail sales slowdown by 49% in

April of this year against pre-

4.8

pandemic level of April 2019.

2. Retail Inflation(CPI) moderated to

4.29% in April from a four-month

high of 5.52% in March. RBI projects

1.723 retail inflation at 5.1% in 2021-22.

0.381 3. Reliance Retail buys Future Group's

businesses for ₹24,713 crore and

FY15 FY20 FY25P provides operational support.

www.phnxglobal.com /phnxglobal 2021 by

© 2021

© by Phoenix Global

Market SizeSize

Market 2021 57,15,700Cr(P)

57,15,700 (F)

Retail Industry

Retail Industry Growth RateRate

2021 -7.47%(E)

(E)

Growth -7.47%

All figures based

on 2020-21data

in INR Crores

Revenue 23,996.1 2,251.78 5,253.78 1,096.5 20,201.92

Net Profit 1,165.31 -51.01 -649.64 -6.20 33.84

Founded 2002 1998 1997 2002 2007

Market Cap 2,07,009.36 30,294.64 18,203.57 5,421.64 2,985.27

Total Retail Market (in ₹ Tn) Organized Retail Market (in ₹ Tn)

91-95

11.5-12

62 66-67

57-58 7.4 7.1-7.3

39 5.9-6

3.24

FY15 FY20 FY21P FY22P FY25P FY15 FY20 FY21P FY22P FY25P

Organizedretail

Organized retail segment

segment composition

composition Organized Retail segments revenue (in ₹ Tn)

7.40 7.20

25.25% 20.61% 5.95

5.68

0.68%

21.86% 4.85

24.18% 3.24 4.00

2.86 2.40

1.72 1.90

0.38

1.38%

2.01% 4.03%

Food & grocery Apparel

Footwear Furniture & Furnishing

FY15 FY20 FY21E FY22P

Pharmacy Consumer durables, mobile and IT

Books & music Others E-retail B&M Retail Organized Retail

www.phnxglobal.com /phnxglobal © 2021 by Phoenix Global

GrowthGrowth

rate of rate

Retailofsector

Retail sector

• Retail market grew at 10% CAGR Total Retail Market (in ₹ Tn)

for FY15-FY20 and 7.5% for FY20.

100 91-95

• Expected FY21 is predicted to 90

degrow at 7-8% due to national 80

lockdowns where store operations 70 62

66-67

and sale of non-essential 60

57-58

commodity were halted 50

temporarily. 40

39

• Essential commodities (food and 30

pharma) accounted for 56% of total 20

and still grew at 8-9% while non- 10

essential commodities suffered 0

greatly and fell by 25-28%. FY15 FY20 FY21P FY22P FY25P

• FY20-25 is predicted to grow at 8-

9% and FY22 to grow at 15-17% of Total Retail breakup FY19

which essential segment will grow 5.7%

1.4%

7.7%

at 8-10% and non-essential at 26-

28%. 28.0%

10.6%

• However, these projections were

dependent on market sentiments

being positive which will not occur 20.3%

as there will be pressure on retail 26.3%

again as second wave of Covid has

again led to lockdowns which will

deeply hurt the non-essential Apparel & Footwear Consumer Durables & IT

segment. Jewellery & Accessories Health & Entertainment

Home Décor & Furnishings Beauty & Personal Care

Others

www.phnxglobal.com /phnxglobal © 2021 by Phoenix Global

Organized

Organized Retail Retail

• Organized Retail Penetration (ORP) is Organized Retail Market (in ₹ Tn)

estimated to be 10-12% of total 11.5-12

retail for FY21.

• Grew at 18% CAGR for FY15-20 and

7.4

expected to degrow by 19-21% in 7.1-7.3

5.9-6

FY21 as organized retail is 80%

comprised of non-essential goods

3.24

which fell by 25-27%.

• FY22 is expected to grow at 20-25%

as consumer confidence was back

and there was increase in store FY15 FY20 FY21P FY22P FY25P

footfall even seen by increase of

consumer durable, mobile and ORGANIZED RETAIL SEGMENT

furniture during festive season COMPOSITION

accompanied by economic factor of

low base year and high discretionary Others, Food &

spending. Books & 25.25% grocery,

music, 20.61%

• Non-essential segment has been 0.68%

expected to grow more in the future

as there is plan for more stores

spread across tier 2 & 3 cities with

increase in disposable income.

Apparel,

• Organized sector is expected to grow 21.86%

at 9-11% CAGR from FY20-25. Consumer Footwear,

durables, Pharmacy, Furniture & 4.03%

mobile and 1.38% Furnishing,

IT, 24.18% 2.01%

www.phnxglobal.com /phnxglobal 2021 by

© 2021

© by Phoenix Global

VerticalVertical

segments of Organized

segments Retail Retail

of Organized

• Implementation of GST, allowing 51% Organized Retail Market Size & Penetration FY20

FDI in multi-brand retail, and 100% in 2000

1800

1766 1844 70.00%

single-brand retail through automatic 1600 1505 1597 57.30%

60.00%

1400 50.00%

route will further contribute to 1200 40.00%

1000

reaching 13% ORP by 2025. 800 30.00%

600 26.60%

18.40% 13.60%20.00%

• Food & grocery account for 20% of 400

200

294 147 101

50 5.20% 10.00%

4.60%

organized retail and is one of the fastest 0 7.60% 8.10% 0.00%

Food & grocery

Pharmacy

Others

Consumer durables,

Apparel

Footwear

Furniture & Furnishing

Books & music

growing sector with added advantage

mobile and IT

of growing even in pandemic but still

ORP is just 4.6% showing huge

opportunity for growth but hindered by

unique services by unorganized sector

Market Size (in ₹ Bn) Organised Retail (% of total Retail)

and supply chain challenges. Sector

grew by 1-4% in FY21 and expected to

grow at 13-18% CAGR. Organized Retail Market Size & Penetration FY23P

• Apparel, footwear, consumer durables, 2500 2266

2087

80.00%

70.00%

1883

mobiles, IT, jewelry and watches are 2000

1688 70.20% 60.00%

other major contributors to the 1500 50.00%

40.00%

organized retail sector which are 1000 31.80% 30.00%

expected to increase ORP as the 22.20%

500 321 11.70%20.00%

younger generation with their 5.10%

153 141

9.80% 8.60% 26 10.00%

2.30%

disposable income are becoming more 0 0.00% Pharmacy

Food & grocery

Others

Apparel

Consumer durables,

Footwear

Furniture & Furnishing

Books & music

brand conscious.

mobile and IT

• Stringent lockdowns due to second

wave will hurt FY22 growth projections

as Q1 has suffered like in case of 49%

fall in apparel sales in April. Market Size (in ₹ Bn) Organised Retail (% of total Retail)

www.phnxglobal.com /phnxglobal 2021 by

© 2021

© by Phoenix Global

E-RetailE-retail

& B&M&Retail

B&Msector

Retail sector

• E-retail segment of organized retail E-Retail growth (in ₹ Tn)

grew at estimated 10-15% in FY21

even though 90% of it comprises of

non-essential commodity sales as 4.8

people started preferring online

purchase due to social distancing

norms.

• It has been increasing its share

within the organized retail as it 1.723

went from 12% in FY15 to 23% in

FY20 and is now projected to reach 0.381

38-40% by FY25 of organized retail

sector. FY15 FY20 FY25P

• Expected Increase in demand after

the restrictions have lifted has

shown FY22 projections to be 25- Organized Retail segments revenue (in Tn)

30% growth rate.

• On the other hand, Brick & Mortar 7.40 7.20

(B&M) retailers saw an estimated

decline in FY21 of 30% which reset 5.68 5.95

it to 3-year-old levels. 4.85

• Even now, B&M retail is estimated 4.00

to grow at 20% in FY22 which still 2.86

3.24

leave its revenue to be lower than 2.40

FY20s and are going to be even 1.72 1.90

lower in reality due second wave

Covid lockdowns. 0.38

• B&M retail CAGR for next 5 years is FY15 FY20 FY21E FY22P

estimated to be 4-6%. E-retail B&M Retail Organized Retail

www.phnxglobal.com /phnxglobal 2021 by

© 2021

© by Phoenix Global

Profitability

Profitability

• Single brand retailers’ margins fell more Single brand retailers profitability

than the multi-brand retailers’ in FY21 as 20.0%

they had a higher concentration of non- 18.0%

essential goods. 16.0%

15.5%

12.5-14%

• Margins are expected to jump back up to 14.0%

11.8% 11.7%

12.5-14% in FY22 but further increase will 12.0% 10.9%

10.1%10.5% 9.5-10%

9.4%

be tough due to fall in revenue and 10.0%

increased raw material and even these 8.0% 6.1% 6.6% 7.1%

5.7% 5.5% 5.7%

estimates will be higher than reality as 6.0% 4.6%

second Covid wave has caused lockdowns 4.0%

of these retailers throughout India. 2.0%

0.0%

• Multi-brand retailers catering to essential

commodities along with non-essential

items will soften the blow on margins.

They have expectedly fallen to 7-7.5% in Operating margins Net margins

FY21 due to their not being

commensurate fall in revenue and fixed Multi-brand retailers profitability

cost. 14.0%

• Increase in revenue with decrease in raw 12.0% 11.2%

materials costs will be necessary for

expansion of margins. 10.0%

8-9.5%

8.0% 7.9%

• Organized retailers will need to focus on 8.0% 7.2% 7.2% 7-7.5%

food and grocery sector as even though it 6.1%

6.0% 5.4%

is a challenge due to supply chain and low

4.3%

margins, it is far to big and is still growing 4.0%

3.7%

at the highest rate among all verticals. 2.6% 3.0%

2.0% 1.6%

• Apparels having the highest margin among 0.6% 0.9%

top verticals with brands ability to 0.0%

distinguish itself making it an attractive FY14 FY15 FY16 FY17 FY18 FY19 FY20FY21PFY22P

market for organized retailers. Operating margins Net margins

www.phnxglobal.com /phnxglobal 2021 by

© 2021

© by Phoenix Global

References

References

• Moneycontrol

• Mint

• The Economic Times

• Business Standard

• The Hindu BusinessLine

• IBEF

• CRISIL Research

Editors : Lakshya Bansal, Indian Institute of Management, Tiruchirappalli

www.phnxglobal.com /phnxglobal 2021 by

© 2021

© by Phoenix Global

You might also like

- Pestle Analysis of Saudi ArabiaDocument11 pagesPestle Analysis of Saudi ArabiaBaadshah KingNo ratings yet

- Unit 2 Case Study Guidelines - Lady M Confections Revised 10.4.18Document11 pagesUnit 2 Case Study Guidelines - Lady M Confections Revised 10.4.18Neel PatelNo ratings yet

- FullReport AES2021Document108 pagesFullReport AES2021clement3176No ratings yet

- Lombard Fy19Document21 pagesLombard Fy19Sriram RajaramNo ratings yet

- GLOBUSSPR - Investor Presentation - 16-Jun-21 - TickertapeDocument29 pagesGLOBUSSPR - Investor Presentation - 16-Jun-21 - Tickertapepiyush rohiraNo ratings yet

- 2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFDocument20 pages2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFRAHUL PANDEYNo ratings yet

- Raising Estimates On Higher Earnings Contribution From Power BusinessDocument4 pagesRaising Estimates On Higher Earnings Contribution From Power BusinessJNo ratings yet

- Africa Day Presentation VDefDocument30 pagesAfrica Day Presentation VDefBernard BiboumNo ratings yet

- Quarterly Update Q4FY20: Visaka Industries LTDDocument10 pagesQuarterly Update Q4FY20: Visaka Industries LTDsherwinmitraNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Integrated Report 2018Document86 pagesIntegrated Report 2018Sumiya Brinty Barkat UllahNo ratings yet

- SiemensDocument9 pagesSiemensCam SNo ratings yet

- Gabriel IndiaDocument137 pagesGabriel IndiaIshaan MakkerNo ratings yet

- Chevron Lubricants Lanka PLC: Hold For Dividends Lack of Long Term Growth Prospects Limit Price UpsideDocument3 pagesChevron Lubricants Lanka PLC: Hold For Dividends Lack of Long Term Growth Prospects Limit Price UpsidejdNo ratings yet

- Divi's Laboratories: CMP: INR4,117 TP: INR4,850 (+18%) On A Stellar Growth Trajectory BUYDocument10 pagesDivi's Laboratories: CMP: INR4,117 TP: INR4,850 (+18%) On A Stellar Growth Trajectory BUYLive NIftyNo ratings yet

- 1Q21 Operating EBITDA Below COL Estimates On Lower-Than-Expected RevenuesDocument8 pages1Q21 Operating EBITDA Below COL Estimates On Lower-Than-Expected RevenuesJajahinaNo ratings yet

- Tsel2021 AR Webversion FINALDocument162 pagesTsel2021 AR Webversion FINALr dNo ratings yet

- PT Semen Indonesia, TBK: 1H 2015 Update - Weak MarginDocument7 pagesPT Semen Indonesia, TBK: 1H 2015 Update - Weak MarginRendy SentosaNo ratings yet

- Equity Markets Review Underperformance of Largecaps Creates An OpportunityDocument8 pagesEquity Markets Review Underperformance of Largecaps Creates An OpportunitysumeetNo ratings yet

- BMP Bav ValuationDocument4 pagesBMP Bav ValuationThu ThuNo ratings yet

- JK Tyre One Page ProfileDocument1 pageJK Tyre One Page Profilep9688822No ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- Aptus Housing Finance LTD: SubscribeDocument5 pagesAptus Housing Finance LTD: SubscribeupsahuNo ratings yet

- Madhuvanthi Raja-Accounts Minor 2Document11 pagesMadhuvanthi Raja-Accounts Minor 2madhuvanthi.rajaaNo ratings yet

- Monthly Bulletin July 2023 EnglishDocument13 pagesMonthly Bulletin July 2023 EnglishNirmal MenonNo ratings yet

- FullReport AES2022Document100 pagesFullReport AES2022Slimey DogiesNo ratings yet

- Cushman & Wakefield Global Cities Retail GuideDocument9 pagesCushman & Wakefield Global Cities Retail GuideFiolenzaNo ratings yet

- Korn Ferry Salary Movement and Forecast Survey ReportDocument17 pagesKorn Ferry Salary Movement and Forecast Survey ReportTulshidasNo ratings yet

- FY 2017 PresentationDocument30 pagesFY 2017 PresentationtheredcornerNo ratings yet

- Highlights of The Union Budget 2023 1675419647Document103 pagesHighlights of The Union Budget 2023 1675419647harsh437kashyapNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Prashant Sharma BudgetDocument24 pagesPrashant Sharma BudgetPrashant SharmaNo ratings yet

- Q1FY23 - Result Update: Future Growth IntactDocument10 pagesQ1FY23 - Result Update: Future Growth IntactResearch ReportsNo ratings yet

- Results-Presentation 2019Document32 pagesResults-Presentation 2019Shahin AlamNo ratings yet

- 1Q21 Earnings Rise On Higher Selling Prices, in Line To Meet Full Year ForecastDocument7 pages1Q21 Earnings Rise On Higher Selling Prices, in Line To Meet Full Year ForecastJajahinaNo ratings yet

- Kirk Fulford - AASB PresentationDocument33 pagesKirk Fulford - AASB PresentationTrisha Powell CrainNo ratings yet

- 1Q21 Profit in Line With Estimates: SM Investments CorporationDocument8 pages1Q21 Profit in Line With Estimates: SM Investments CorporationJajahinaNo ratings yet

- India International Trade Investment Website June 2022Document18 pagesIndia International Trade Investment Website June 2022vinay jodNo ratings yet

- Q3 & 9M FY21 - Results Presentation: February 2021Document29 pagesQ3 & 9M FY21 - Results Presentation: February 2021Richa CNo ratings yet

- IDirect EicherMotors Q2FY20Document10 pagesIDirect EicherMotors Q2FY20Dushyant ChaturvediNo ratings yet

- On The Path To Recovery: Mold-Tek PackagingDocument7 pagesOn The Path To Recovery: Mold-Tek PackagingSumangalNo ratings yet

- 1Q21 Core Earnings Lag Forecasts: Metro Pacific Investments CorporationDocument8 pages1Q21 Core Earnings Lag Forecasts: Metro Pacific Investments CorporationJajahinaNo ratings yet

- BNIS Short Notes: Proxy To Indonesia's DigitalizationDocument5 pagesBNIS Short Notes: Proxy To Indonesia's DigitalizationAgus SuwarnoNo ratings yet

- Volume 5 - March 2022: Descriptions FY2021 FY2020 %Document5 pagesVolume 5 - March 2022: Descriptions FY2021 FY2020 %fielimkarelNo ratings yet

- 2017 11 28 PH e EeiDocument8 pages2017 11 28 PH e EeiKurt YuNo ratings yet

- Project Indium Discussion Material - VFDocument11 pagesProject Indium Discussion Material - VFApoorva ChandraNo ratings yet

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocument10 pagesQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsNo ratings yet

- Capa CiteDocument29 pagesCapa CiteParas ChhedaNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Document5 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Namrata ShahNo ratings yet

- Seya-Industries-Result-Presentation - Q1FY201 Seya IndustriesDocument24 pagesSeya-Industries-Result-Presentation - Q1FY201 Seya Industriesabhishek kalbaliaNo ratings yet

- Investor Conference 2023Q2 en - tcm33 86078Document27 pagesInvestor Conference 2023Q2 en - tcm33 86078潘祈睿No ratings yet

- Ultratech Cement: CMP: Inr6,485 TP: Inr8,050 (+24%) Market Share Gains Con Nue BuyDocument10 pagesUltratech Cement: CMP: Inr6,485 TP: Inr8,050 (+24%) Market Share Gains Con Nue BuyLive NIftyNo ratings yet

- 2020 06 24 PH S Mpi PDFDocument5 pages2020 06 24 PH S Mpi PDFJNo ratings yet

- EricssonDocument47 pagesEricssonRafa Borges100% (1)

- Quarterly Update Q1FY22: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q1FY22: Century Plyboards (India) LTDhackmaverickNo ratings yet

- 2020 08 06 PH e Mpi PDFDocument8 pages2020 08 06 PH e Mpi PDFJNo ratings yet

- Annual Report 2021Document100 pagesAnnual Report 2021pranshukd25No ratings yet

- ICICI Prudential Life - 2QFY20 - HDFC Sec-201910231337147517634Document15 pagesICICI Prudential Life - 2QFY20 - HDFC Sec-201910231337147517634sandeeptirukotiNo ratings yet

- BAJAJ AUTO LTD - Quantamental Equity Research ReportDocument1 pageBAJAJ AUTO LTD - Quantamental Equity Research ReportVivek NambiarNo ratings yet

- Analyst Presentation Q2 2017 FinalDocument13 pagesAnalyst Presentation Q2 2017 FinalRamakanth GiriNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- IES EE C 1993 (Electrical Guru - Blogspot.in)Document11 pagesIES EE C 1993 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1995 (Electrical Guru - Blogspot.in)Document9 pagesIES EE C 1995 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1994 (Electrical Guru - Blogspot.in)Document9 pagesIES EE C 1994 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1992 (Electrical Guru - Blogspot.in)Document10 pagesIES EE C 1992 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1991 (Electrical Guru - Blogspot.in)Document8 pagesIES EE C 1991 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1989 (Electrical Guru - Blogspot.in)Document9 pagesIES EE C 1989 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1990 (Electrical Guru - Blogspot.in)Document10 pagesIES EE C 1990 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- IES EE C 1987 (Electrical Guru - Blogspot.in)Document6 pagesIES EE C 1987 (Electrical Guru - Blogspot.in)Tanmay PokaleNo ratings yet

- Insurance Industry ReportDocument13 pagesInsurance Industry ReportTanmay PokaleNo ratings yet

- Section 2 - CH 1 - Part 2Document11 pagesSection 2 - CH 1 - Part 2Jehan OsamaNo ratings yet

- Pengeluaran Kajian Sabtu-Ahad: A B C D eDocument7 pagesPengeluaran Kajian Sabtu-Ahad: A B C D eLukmanNo ratings yet

- International Trade Theory PracticeDocument2 pagesInternational Trade Theory Practiceak100% (1)

- Eff CHP 4 Mvsir Charts May 23Document35 pagesEff CHP 4 Mvsir Charts May 23Abhinav AgarwalNo ratings yet

- Monetary Policy and Central Banking PDFDocument2 pagesMonetary Policy and Central Banking PDFTrisia Corinne JaringNo ratings yet

- Korean Case StudyDocument2 pagesKorean Case Studytaisha100% (1)

- 12.4 Calculating Exchange Rates ExerciseDocument3 pages12.4 Calculating Exchange Rates Exerciseprakhyat reddyNo ratings yet

- Pambansang KaunlaranDocument3 pagesPambansang KaunlaranTria LagustanNo ratings yet

- Black Money Act 2015Document16 pagesBlack Money Act 2015Dharshini AravamudhanNo ratings yet

- JP MORGAN - David FernandezDocument32 pagesJP MORGAN - David FernandezAsian Development BankNo ratings yet

- Isphan Yar M Bhandara S/O M P Bhandara Bangal No 24-B-2 Sarwar Road LHR CanttDocument1 pageIsphan Yar M Bhandara S/O M P Bhandara Bangal No 24-B-2 Sarwar Road LHR CanttZeeshan AjmalNo ratings yet

- Municipal Corporation of Delhi Tax Payment Checklist For The Year (2022-2023)Document1 pageMunicipal Corporation of Delhi Tax Payment Checklist For The Year (2022-2023)Zinnia SharmaNo ratings yet

- E-Way Bill SystemDocument1 pageE-Way Bill SystemManoj RacerNo ratings yet

- BNIS Macroeconomic Outlook 2023 Threading The Global Slowdown NeedleDocument36 pagesBNIS Macroeconomic Outlook 2023 Threading The Global Slowdown NeedleBrainNo ratings yet

- APEC-by-Corazon-C.-Blanes APECDocument4 pagesAPEC-by-Corazon-C.-Blanes APECChristopher PilotinNo ratings yet

- Truearth 2Document11 pagesTruearth 2Mathan Anto MarshineNo ratings yet

- 5.2 - Inflation, GDP Practice Questions AKDocument6 pages5.2 - Inflation, GDP Practice Questions AKKathryn BourneNo ratings yet

- Answers To Textbook Problems: Chapter 16 (5) Price Levels and The Exchange Rate in The Long Run 93Document4 pagesAnswers To Textbook Problems: Chapter 16 (5) Price Levels and The Exchange Rate in The Long Run 93anaNo ratings yet

- Cash Flow Statement and AnalysisDocument2 pagesCash Flow Statement and Analysisaashidua15gmailcomNo ratings yet

- FILE - 20220513 - 151826 - Chapter 5 Protection - DoneDocument40 pagesFILE - 20220513 - 151826 - Chapter 5 Protection - DoneHuyền TràNo ratings yet

- Indian Economy 2 NotesDocument5 pagesIndian Economy 2 NotesMuskan YadavNo ratings yet

- An Overview of The Spatial Policy On Asian and European CountriesDocument7 pagesAn Overview of The Spatial Policy On Asian and European CountriesJay SeaNo ratings yet

- APPLICATION LETTER Copy - Docx (Ashar Alo)Document6 pagesAPPLICATION LETTER Copy - Docx (Ashar Alo)Md akibNo ratings yet

- Covid Debts PayoffDocument20 pagesCovid Debts PayoffChi VũNo ratings yet

- Relationship Between THE National Aggregates of National IncomeDocument17 pagesRelationship Between THE National Aggregates of National Incomeeeshani MalhotraNo ratings yet

- Forex MarketDocument4 pagesForex MarketShreya MathurNo ratings yet

- All Keen To Grab Private Chinese LoanDocument6 pagesAll Keen To Grab Private Chinese LoanEmdad YusufNo ratings yet

- Disinvestment Objectives: 9 Objectives of Disinvestment in IndiaDocument4 pagesDisinvestment Objectives: 9 Objectives of Disinvestment in IndiakanishkNo ratings yet

- Role of World Bank in International Business ScenarioDocument1 pageRole of World Bank in International Business ScenarioRANOBIR DEY100% (2)