Professional Documents

Culture Documents

JK Tyre One Page Profile

Uploaded by

p9688822Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JK Tyre One Page Profile

Uploaded by

p9688822Copyright:

Available Formats

Academic Project – No recommendation Made by

Pratyush Kumar

JK TYRE & INDUSTRIES LTD - One Page Profile

The flagship company of JK Organisation, JK Tyre & Industries Ltd is one of India’s foremost tyre manufacturers

and is also amongst the top 25 manufacturers in the world.

It is the only Indian tyre manufacturer to be included in the list of Superbrands India in 2019 for the seventh

consecutive year.

INR (Crs)

Key Financial Metrics Mar-19 Mar-20 Mar-21 Mar-22 Mar-23Trailing Share Price - 5Y

Total Sales 10,367.76 8,722.70 9,102.20 11,982.96 14,644.94

Sales Growth (Y-o-Y) 25.33% -15.87% 4.35% 31.65% 22.21% 600

Gross Proft Margin (%) 15.60% 20.56% 25.59% 11.61% 16.25% 500

EBITDA Margins (%) 14.73% 8.91% 10.72% 11.30% 14.35% 400

EBIT Margins (%) 9.00% 3.28% 5.70% 5.01% 9.23%

300

Net Profit Margins (%) 4.88% 0.80% 1.70% 1.73% 3.51%

200

Earnings Per Share (in Rs) 7.16 6.12 12.97 8.53 10.66

EPS Growth (%) 145.98% -14.51% 111.82% -34.23% 24.98% 100

Dividend Per Share 1.50 0.70 2.00 1.50 2.00 0

Dividend Per Share Growth Y-O-Y (%) 0.03% -53.33% 185.67% -24.99% 33.32% 20192019202020212021202220222023

Key Financial Ratios Mar-19 Mar-20 Mar-21 Mar-22 Mar-23Trailing Volume - 5Y

Price to Earnings 12.82 6.63 8.40 13.76 14.54 400L

EV/EBITDA 9.96x 9.89x 8.25x 11.20x 9.63x

EV/Sales 1.45x 1.47x 1.07x 1.12x 1.18x 200L

Price to Book Value 4.02% 1.74% 4.08% 4.12% 4.56%

0L

Return on Equity 8% 6% 12% 7% 8%

2019

2019

2020

2020

2021

2021

2022

2022

2023

2023

Return on Capital Employed 10% 7% 13% 9% 11%

Top 10 Shareholders No. Shares in Lakhs % Holdings Mkt Value Shareholding Pattern

BENGAL & ASSAM COMPANY LTD. 1300.03 49.86 21589.38

SACHIN BANSAL 63.50 2.44 1056.52 Shareholding Pattern

TASHA INVESTMENT ADVISORS LLP 48.59 1.86 805.38

EDGEFIELD SECURITIES LIMITED 47.38 1.82 788.06 Promoter

SACHIN BANSAL 47.00 1.80 779.40 Public &…

DEEPAK BHAGNANI 35.99 1.38 597.54 FII

HDFC MUTUAL FUND - HDFC HYBRID EQUITY FUND & HDFC TRANSPORTATION33.33

AND LOGISTICS

1.28FUND 554.24

DII

CASSINI PARTNERS L.P. MANAGED BY HABROK CAPITAL MANAGEMENT LLP 28.86 1.11 480.63

RAGHUPATI SINGHANIA 16.44 0.63 272.79 0% 20% 40% 60%

ANSHUMAN SINGHANIA (Karta of Shripati Singhania HUF) 15.13 0.58 251.14

Designation Number Remuneration/Median Salary Capital Structure

Board of Directors (BoD) - Executive Directors (ED) 3 ₹ 10,73,37,270 Current Price as on 14th Mar 433.15

BOD - Non-Executive Directors (NED) 7 ₹ 16,00,000 No. of Shares o/s 26.07

Key Managerial Personnel 5 ₹ 2,11,79,876 Market Capitalization 11,293.24

Employees other than BoD and KMP 1908 ₹ 9,42,307 Less:Cash & Equivalents (265.80)

Workers 3859 ₹ 5,21,692 Add:Total Debt 8,942.88

Add:Miniority Interest 0

Enterprise Value 19,970.32

Average Remuneration of Top Level Management with Worker = 442x

Recent Updates

You might also like

- Entrepreneurship: Quarter 2 - Module 10Document56 pagesEntrepreneurship: Quarter 2 - Module 10Rutchel83% (6)

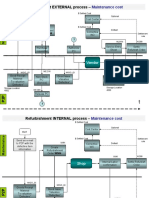

- Refurbishment Diagrams Include WS05Document6 pagesRefurbishment Diagrams Include WS05Apolinar Arrieta RomeroNo ratings yet

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocument10 pagesTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssNo ratings yet

- Pelan Induk Dan Pelaksanaan ECER - En. Azmi YahyaDocument130 pagesPelan Induk Dan Pelaksanaan ECER - En. Azmi Yahyanurmee100% (1)

- Q1 2022 ColliersQuarterly JakartaDocument28 pagesQ1 2022 ColliersQuarterly Jakartanur mawaddah100% (1)

- Financial Management Exam March 2019Document7 pagesFinancial Management Exam March 2019IQBAL MAHMUDNo ratings yet

- Post Closing Trial BalanceDocument25 pagesPost Closing Trial Balancelala100% (1)

- Bangkok Expressway and Metro Public Company Limited (BEM) Opportunity Day Ye2022Document25 pagesBangkok Expressway and Metro Public Company Limited (BEM) Opportunity Day Ye2022sozodaaaNo ratings yet

- Financial Deepening For Stronger Growth and Sustainable RecoveryDocument14 pagesFinancial Deepening For Stronger Growth and Sustainable Recoverysapi sapiapaNo ratings yet

- Kirpal MotorsDocument9 pagesKirpal MotorsakhilNo ratings yet

- Kirk Fulford - AASB PresentationDocument33 pagesKirk Fulford - AASB PresentationTrisha Powell CrainNo ratings yet

- Chemical Enhanced Oil Recovery (EOR)Document7 pagesChemical Enhanced Oil Recovery (EOR)NIRAJ DUBEYNo ratings yet

- RR Immediate Reform Agenda Imf and BeyondDocument122 pagesRR Immediate Reform Agenda Imf and BeyondSidra GhafoorNo ratings yet

- 7E IntepretationDocument4 pages7E IntepretationNurin SyazarinNo ratings yet

- Shantanu FadmDocument12 pagesShantanu FadmHimanshuNo ratings yet

- Quarterly Update Q4FY20: Visaka Industries LTDDocument10 pagesQuarterly Update Q4FY20: Visaka Industries LTDsherwinmitraNo ratings yet

- Acb - HSCDocument10 pagesAcb - HSCSeoNaYoungNo ratings yet

- HKTDC MzU3OTAyNjA4 enDocument10 pagesHKTDC MzU3OTAyNjA4 enweiqin chenNo ratings yet

- Annual Report 202021Document128 pagesAnnual Report 202021fddNo ratings yet

- DHOMEDocument23 pagesDHOMEsozodaaaNo ratings yet

- Screener - in TempleteDocument11 pagesScreener - in TempleteSumantha SahaNo ratings yet

- Non Alcoholic Wine in Asia Pacific DatagraphicsDocument3 pagesNon Alcoholic Wine in Asia Pacific DatagraphicsSaloni GawdeNo ratings yet

- Retail Industry Retail Industry Retail IndustryDocument8 pagesRetail Industry Retail Industry Retail IndustryTanmay PokaleNo ratings yet

- Investor Conference 2023Q2 en - tcm33 86078Document27 pagesInvestor Conference 2023Q2 en - tcm33 86078潘祈睿No ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Document5 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Namrata ShahNo ratings yet

- PWC Ghana 2023 Budget DigestDocument49 pagesPWC Ghana 2023 Budget DigestAl SwanzyNo ratings yet

- Nominal & Real GDP (2003-2022) in Bangladesh Over The YearsDocument2 pagesNominal & Real GDP (2003-2022) in Bangladesh Over The Yearssadia TFNo ratings yet

- 通膨是什麼?通膨升息有關係?該怎麼進行通膨投資?|天下雜誌Document1 page通膨是什麼?通膨升息有關係?該怎麼進行通膨投資?|天下雜誌賴峻德No ratings yet

- FIN201 Termpaper SubmissionDocument19 pagesFIN201 Termpaper Submissionsohan hossainNo ratings yet

- Annual Report 202021Document128 pagesAnnual Report 202021AiswaryaNo ratings yet

- FRA Group 1 Mahindra and Mahindra LTDDocument25 pagesFRA Group 1 Mahindra and Mahindra LTDakshay iyerNo ratings yet

- Project Indium Discussion Material - VFDocument11 pagesProject Indium Discussion Material - VFApoorva ChandraNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Store Factsheet: Nama Store: Number of Store: Opening DateDocument8 pagesStore Factsheet: Nama Store: Number of Store: Opening DateNikita Dara AmeliaNo ratings yet

- 大众汽车2024年战略规划报告Document44 pages大众汽车2024年战略规划报告Gordon FreemanNo ratings yet

- PEST AnalysisDocument8 pagesPEST AnalysisPratham ThakurNo ratings yet

- 3.0 Financial Analysis 3.1 Gross MarginDocument7 pages3.0 Financial Analysis 3.1 Gross MarginhanisNo ratings yet

- Brac BankDocument14 pagesBrac BankShurovi UrmiNo ratings yet

- Glaxosmithkline Consumer Healthcare: Group MembersDocument19 pagesGlaxosmithkline Consumer Healthcare: Group MembersBilal AfzalNo ratings yet

- Prashant Sharma BudgetDocument24 pagesPrashant Sharma BudgetPrashant SharmaNo ratings yet

- ChartsDocument4 pagesChartsVijendra Kumar DubeyNo ratings yet

- DuPont AnalysingDocument2 pagesDuPont AnalysingNiharika GuptaNo ratings yet

- Balkrishna Ind - Ratio Analysis - Altman Z ScoreDocument4 pagesBalkrishna Ind - Ratio Analysis - Altman Z ScoredhruvNo ratings yet

- Decision Science (Assignment) Chandigarh UniversityDocument7 pagesDecision Science (Assignment) Chandigarh UniversityShubham DwivediNo ratings yet

- 1Q21 Profit in Line With Estimates: SM Investments CorporationDocument8 pages1Q21 Profit in Line With Estimates: SM Investments CorporationJajahinaNo ratings yet

- Q4 2020 Property Briefing - All SectorsDocument127 pagesQ4 2020 Property Briefing - All SectorsRen SensonNo ratings yet

- MM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIDocument8 pagesMM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIcatatankotakkuningNo ratings yet

- Contoh DCF ValuationDocument17 pagesContoh DCF ValuationArie Yetti NuramiNo ratings yet

- Sub: Investor Presentation On Financial Results For The Quarter and Nine Months Ended 31 December, 2021Document39 pagesSub: Investor Presentation On Financial Results For The Quarter and Nine Months Ended 31 December, 2021Dasari PrabodhNo ratings yet

- Financial Modelling Mid Term: Do Not Hard Code Any Solution Hard Coded Solution Will Not Be Awarded Any MarksDocument7 pagesFinancial Modelling Mid Term: Do Not Hard Code Any Solution Hard Coded Solution Will Not Be Awarded Any MarksSAMBUDDHA ROYNo ratings yet

- Dubai Property Market 2023: Demand Should Hold Up Against Global Economic PressuresDocument15 pagesDubai Property Market 2023: Demand Should Hold Up Against Global Economic Pressuresnidish.sNo ratings yet

- Berger 1Document8 pagesBerger 1Nikesh PandeyNo ratings yet

- Q3 2022 ID ColliersQuarterly JakartaDocument27 pagesQ3 2022 ID ColliersQuarterly JakartaGeraldy Dearma PradhanaNo ratings yet

- Musical Muesuem AssignmentDocument12 pagesMusical Muesuem AssignmentiopasdcNo ratings yet

- FullReport AES2021Document108 pagesFullReport AES2021clement3176No ratings yet

- Africa Day Presentation VDefDocument30 pagesAfrica Day Presentation VDefBernard BiboumNo ratings yet

- BOIPPTNew 06112020Document36 pagesBOIPPTNew 06112020Rohit AggarwalNo ratings yet

- Task 3 by Aditya GuptaDocument7 pagesTask 3 by Aditya GuptaADITYA GUPTANo ratings yet

- Exide IndustriesDocument55 pagesExide IndustriesSALONI JaiswalNo ratings yet

- ALLIDocument16 pagesALLIAbdullah KhanNo ratings yet

- Automotive Monthly Report Ratio V2Document11 pagesAutomotive Monthly Report Ratio V2Pathquest SolutionsNo ratings yet

- School RatesDocument7 pagesSchool RatesFeb RaynNo ratings yet

- Vietnam Market Trend Q3 - 2020Document22 pagesVietnam Market Trend Q3 - 2020cosmosmediavnNo ratings yet

- Revenue Stream: Advisory and Project Management 35%Document4 pagesRevenue Stream: Advisory and Project Management 35%razNo ratings yet

- Transforming Bangladesh’s Participation in Trade and Global Value ChainFrom EverandTransforming Bangladesh’s Participation in Trade and Global Value ChainNo ratings yet

- Table of Contents - Section & Sheet Titles: Model NameDocument89 pagesTable of Contents - Section & Sheet Titles: Model NameGee BeemNo ratings yet

- Nisha Verma, BEM/809 Assignment - Project Procurement Management BEM 3.1 Topic: Material Management Session: Aug 21-Dec 21Document5 pagesNisha Verma, BEM/809 Assignment - Project Procurement Management BEM 3.1 Topic: Material Management Session: Aug 21-Dec 21Nisha VermaNo ratings yet

- Practice Problem in General Accounting Ytac, Bacalso, MajaduconDocument25 pagesPractice Problem in General Accounting Ytac, Bacalso, Majaduconeunice demaclid100% (1)

- A222 - Individual Assignment #2 - Topic 1-4Document9 pagesA222 - Individual Assignment #2 - Topic 1-4IzadNo ratings yet

- 2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which IncludeDocument8 pages2.03 - Notes: Trial Balance Is Prepared. Only The Accounts That Have A Balance, Which Includeapi-262218593No ratings yet

- CH 3Document94 pagesCH 3api-3088239320% (1)

- Accounting PrinciplesDocument1 pageAccounting PrinciplesShyama ThekkumvadanNo ratings yet

- Quiz 2Document2 pagesQuiz 2hrshtkatwala100% (1)

- Managerial and Cost Accounting Exercises IDocument20 pagesManagerial and Cost Accounting Exercises IRithik VisuNo ratings yet

- NCPAR Sample Review QuestionsDocument7 pagesNCPAR Sample Review QuestionsJonathan Tumamao FernandezNo ratings yet

- Financial Statement Modeling Course Manual - 647883d6d91e8Document121 pagesFinancial Statement Modeling Course Manual - 647883d6d91e8brandkNo ratings yet

- Measuring LiquidityDocument3 pagesMeasuring LiquiditySteven PangNo ratings yet

- MergerDocument38 pagesMergerJatin PandeNo ratings yet

- Lembar Jawaban BlankDocument17 pagesLembar Jawaban Blankmaisaroh dwi oktavianingtyasNo ratings yet

- 002 Topic 2b (Set A) Q_98212a37f76c2aeb76f391122e9_202405051917_02377Document9 pages002 Topic 2b (Set A) Q_98212a37f76c2aeb76f391122e9_202405051917_02377vooyinyin6No ratings yet

- Mba 104 PDFDocument2 pagesMba 104 PDFSimanta KalitaNo ratings yet

- Toaz - Info Multiple Choice QuestionsDocument136 pagesToaz - Info Multiple Choice QuestionsMohammed AttaNo ratings yet

- After-Tax Weighted Average Cost of Capital (WACC)Document6 pagesAfter-Tax Weighted Average Cost of Capital (WACC)Kenny HoNo ratings yet

- Fin2001 Pset4Document10 pagesFin2001 Pset4Valeria MartinezNo ratings yet

- Final Assignment No 3 Acctg 121Document4 pagesFinal Assignment No 3 Acctg 121Pler WiezNo ratings yet

- Accountancy: Accounting ConceptsDocument12 pagesAccountancy: Accounting ConceptsarfankafNo ratings yet

- Afm Module 3 - IDocument26 pagesAfm Module 3 - IABOOBAKKERNo ratings yet

- Shreeji Kosh Overseas Pte. Ltd. FS 31 March 23Document19 pagesShreeji Kosh Overseas Pte. Ltd. FS 31 March 23primestuff09No ratings yet

- Exer 10 1Document14 pagesExer 10 1AbhishekKumar0% (2)

- Lec3 Capital BudgetingDocument35 pagesLec3 Capital BudgetingThato HollaufNo ratings yet