Professional Documents

Culture Documents

CN23

Uploaded by

Rajeev KhullarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CN23

Uploaded by

Rajeev KhullarCopyright:

Available Formats

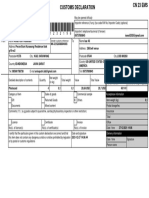

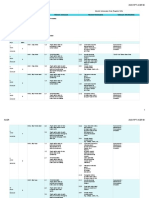

(Designated operator) CUSTOMS DECLARATION CN 23

From Name

Sender’s customs

reference (if any)

No. of item (barcode, if any) May be opened officially Important!

See instructions

on the back

Business

Street Tel. No.

Postcode City

Country

To Name

Business

Importer/addressee reference (if any) (tax code/VAT No./importer code) (optional)

Street Tel. No.

Postcode City Importer/addressee fax/e-mail (if known)

Country

For commercial items only

Net weight

Detailed description of contents (1) Quantity (2) Value (5)

(in kg) (3) HS tariff number (7) Country of origin of goods (8)

Total gross weight (4) Total value (6) Postal charges/Fees (9)

Category of item (10) Commercial sample Other (please specify): Office of origin/Date of posting

Gift Returned goods Explanation:

Documents Sale of goods

Comments (11): (e.g.: goods subject to quarantine, sanitary/phytosanitary inspection or other restrictions)

I certify that the particulars given in this customs decla-

ration are correct and that this item does not contain any

dangerous article or articles prohibited by legislation or

by postal or customs regulations

Licence (12) Certificate (13) Invoice (14) Date and sender’s signature (15)

No(s). of licence(s) No(s). of certificate(s) No. of invoice

Size 210 x 148 mm

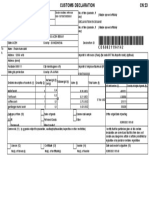

CN 23 (back)

Instructions

You should attach this customs declaration and accompanying documents securely to the outside of the item, preferably in an adhesive transparent envelope.

If the declaration is not clearly visible on the outside, or if you prefer to enclose it inside the item, you must fix a label to the outside indicating the presence of a

customs declaration.

To accelerate customs clearance, complete this declaration in English, French or in a language accepted in the destination country. If available, add importer/

addressee telephone number and e-mail address, and sender telephone number.

To clear your item, the Customs in the country of destination need to know exactly what the contents are. You must therefore complete your declaration fully and

legibly; otherwise, delay and inconvenience may result for the addressee. A false or misleading declaration may lead to a fine or to seizure of the item.

Your goods may be subject to restrictions. It is your responsibility to enquire into import and export regulations (prohibitions, restrictions such as quarantine,

pharmaceutical restrictions, etc.) and to find out what documents, if any (commercial invoice, certificate of origin, health certificate, licence, authorization for goods

subject to quarantine (plant, animal, food products, etc.) are required in the destination country.

Commercial item means any goods exported/imported in the course of a business transaction, whether or not they are sold for money or exchanged.

(1) Give a detailed description of each article in the item, e.g. “men’s cotton shirts”. General descriptions, e.g. “spare parts”, “samples” or “food products” are not

permitted.

(2) Give the quantity of each article and the unit of measurement used.

(3) and (4) Give the net weight of each article (in kg). Give the total weight of the item (in kg), including packaging, which corresponds to the weight used to

calculate the postage.

(5) and (6) Give the value of each article and the total, indicating the currency used (e.g. CHF for Swiss francs).

(7) and (8) The HS tariff number (6-digit) must be based on the Harmonized Commodity Description and Coding System developed by the World Customs

Organization. “Country of origin” means the country where the goods originated, e.g. were produced/manufactured or assembled. Senders of commercial items

are advised to supply this information as it will assist Customs in processing the items.

(9) Give the amount of postage paid to the Post for the item. Specify separately any other charges, e.g. insurance.

(10) Tick the box or boxes specifying the category of item.

(11) Provide details if the contents are subject to quarantine (plant, animal, food products, etc.) or other restrictions.

(12), (13) and (14) If your item is accompanied by a licence or a certificate, tick the appropriate box and state the number. You should attach an invoice for all

commercial items.

(15) Your signature and the date confirm your liability for the item.

You might also like

- HM Revenue & Customs - Form CN23 - 2012Document2 pagesHM Revenue & Customs - Form CN23 - 2012alain_oregioniNo ratings yet

- Commercial Invoice TemplateDocument2 pagesCommercial Invoice TemplatedukuhwaruNo ratings yet

- CN23Document2 pagesCN23Rajeev KhullarNo ratings yet

- CN23Document2 pagesCN23DMCC chennaiNo ratings yet

- CN23 PDFDocument2 pagesCN23 PDFRajeev KhullarNo ratings yet

- CN 23 enDocument2 pagesCN 23 enAbhishek TiwariNo ratings yet

- CN 23 enDocument2 pagesCN 23 enVENU42908No ratings yet

- CN23 PDFDocument2 pagesCN23 PDFRajeev KhullarNo ratings yet

- CN23Document1 pageCN23Kamil MaskNo ratings yet

- Peut-Être Ouvert D'o Ce Gift/Cadeau Commercial Sample/echantillon Commercial Documents Other/AutreDocument4 pagesPeut-Être Ouvert D'o Ce Gift/Cadeau Commercial Sample/echantillon Commercial Documents Other/AutreJefNo ratings yet

- Receipt Booking1Document1 pageReceipt Booking1Triono HandokoNo ratings yet

- Receipt BookingDocument1 pageReceipt BookingPelayananNo ratings yet

- Xavier PaguayDocument1 pageXavier Paguaymarco christopherNo ratings yet

- Receipt BookingDocument1 pageReceipt BookingFR ChannelNo ratings yet

- PT POS INDONESIA Customs Declaration FormDocument1 pagePT POS INDONESIA Customs Declaration FormRoni -No ratings yet

- Receipt Booking United StateDocument1 pageReceipt Booking United StateMoch. Arif Bayu Setia BudiNo ratings yet

- Receipt BookingDocument1 pageReceipt BookingFairuz FaaNo ratings yet

- India Post Customs FormDocument2 pagesIndia Post Customs FormSunny KumarNo ratings yet

- Receipt - Booking - 2023-03-30T160201.352Document1 pageReceipt - Booking - 2023-03-30T160201.352Ir AwNo ratings yet

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Document1 pageForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamNo ratings yet

- Receipt BookingDocument1 pageReceipt BookingB12 NkNo ratings yet

- Receipt BookingDocument1 pageReceipt Bookingleonitaria officialNo ratings yet

- Declaration en Douane: Sender Customs Reference (If Any)Document1 pageDeclaration en Douane: Sender Customs Reference (If Any)NUR SAIDNo ratings yet

- PT POS INDONESIA Customs Declaration FormDocument1 pagePT POS INDONESIA Customs Declaration FormNUR SAIDNo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- Declaration en Douane: Sender Customs Reference (If Any)Document1 pageDeclaration en Douane: Sender Customs Reference (If Any)NUR SAIDNo ratings yet

- Declaration en Douane: Sender Customs Reference (If Any)Document1 pageDeclaration en Douane: Sender Customs Reference (If Any)lexa darmawanNo ratings yet

- Form VN-CUDocument2 pagesForm VN-CUkatacumiNo ratings yet

- Chile Cert Origen ChinaDocument2 pagesChile Cert Origen ChinamiNo ratings yet

- LeonDocument1 pageLeonRoni -No ratings yet

- Proforma Invoice With General ConditionsDocument6 pagesProforma Invoice With General ConditionsambrosialnectarNo ratings yet

- Certificate of Origin - FORM ADocument2 pagesCertificate of Origin - FORM ARivanda MilaNo ratings yet

- Bawang Buleleng Bali Declaration en Douane: Passport-PE2121621Document1 pageBawang Buleleng Bali Declaration en Douane: Passport-PE2121621Paradise CHNo ratings yet

- Eur 1Document4 pagesEur 1Sarah FetahNo ratings yet

- Certificate of Origin Form F For China-Chile FTADocument2 pagesCertificate of Origin Form F For China-Chile FTAinspectormetNo ratings yet

- Development specifications for CN 23 customs declarationDocument11 pagesDevelopment specifications for CN 23 customs declarationMaddison Charles JoNo ratings yet

- Receipt Booking ItalyDocument1 pageReceipt Booking ItalyMoch. Arif Bayu Setia BudiNo ratings yet

- Declaration en Douane: Sender Customs Reference (If Any)Document1 pageDeclaration en Douane: Sender Customs Reference (If Any)skullterrongNo ratings yet

- Form EDocument1 pageForm EHarenNo ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- Obrasci Uverenja o Kretanju Tekst Izjave Na FakturiDocument14 pagesObrasci Uverenja o Kretanju Tekst Izjave Na FakturiVladimir StojanovicNo ratings yet

- Certificado FORM-A PDFDocument2 pagesCertificado FORM-A PDFAnonymous xtfIrUNo ratings yet

- Certificate of Free SaleDocument1 pageCertificate of Free SaleJhayd ManlapazNo ratings yet

- CDS Liu KeDocument1 pageCDS Liu KeMohammad Khairul UmamNo ratings yet

- For All Articles Value Less Than Rs.23000Document1 pageFor All Articles Value Less Than Rs.23000realrakhiNo ratings yet

- ASEAN Trade Certificate DetailsDocument2 pagesASEAN Trade Certificate DetailsDustin SangNo ratings yet

- Certificate of Origining Feb WR PDFDocument3 pagesCertificate of Origining Feb WR PDFLucero GonzalesNo ratings yet

- Goods consigned from exporter's businessDocument1 pageGoods consigned from exporter's businessLim DongseopNo ratings yet

- Att. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDocument2 pagesAtt. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDINI KUSUMAWATINo ratings yet

- Goods consigned certificate of originDocument1 pageGoods consigned certificate of originLim DongseopNo ratings yet

- Proforma Invoice DetailsDocument15 pagesProforma Invoice DetailsdarapuNo ratings yet

- Commercial FedexDocument2 pagesCommercial FedexDODI HARIYANTONo ratings yet

- Global System of Trade Preferences Certificate of Origin (Combined Declaration and Certificate)Document1 pageGlobal System of Trade Preferences Certificate of Origin (Combined Declaration and Certificate)Lim DongseopNo ratings yet

- Receipt Booking EmsDocument1 pageReceipt Booking Emsanisa putriNo ratings yet

- Draft Shipping Bill and Bill Export Regulations 2017 Sb1Document19 pagesDraft Shipping Bill and Bill Export Regulations 2017 Sb1Anand Jay100% (1)

- PT POS Indonesia customs declaration formDocument1 pagePT POS Indonesia customs declaration formPutri WulandariNo ratings yet

- Form 2 (See Rules 10, 14, 17 and 18) : Appl No:1051462220 Dt:12-03-2020Document5 pagesForm 2 (See Rules 10, 14, 17 and 18) : Appl No:1051462220 Dt:12-03-2020Śŗíķańt MáhaŕaňàNo ratings yet

- MarsDocument2 pagesMarsRajeev KhullarNo ratings yet

- 2,6,10 TrineDocument2 pages2,6,10 TrineRajeev KhullarNo ratings yet

- Cpsup PDFDocument1 pageCpsup PDFRajeev KhullarNo ratings yet

- Stagnation NegationDocument2 pagesStagnation NegationRajeev KhullarNo ratings yet

- Govt JobDocument1 pageGovt JobRajeev KhullarNo ratings yet

- Puducherry-Abroad & Govt JobDocument1 pagePuducherry-Abroad & Govt JobRajeev KhullarNo ratings yet

- Tamilnadu-Rahu DashaDocument2 pagesTamilnadu-Rahu DashaRajeev KhullarNo ratings yet

- Rahu+venus in 5th HDocument1 pageRahu+venus in 5th HRajeev KhullarNo ratings yet

- Akola ChartDocument56 pagesAkola ChartRajeev KhullarNo ratings yet

- Scan Doc with CamScanner AppDocument1 pageScan Doc with CamScanner AppRajeev KhullarNo ratings yet

- First 12th H-4 PDFDocument1 pageFirst 12th H-4 PDFRajeev KhullarNo ratings yet

- 12th H-Aries PDFDocument1 page12th H-Aries PDFRajeev KhullarNo ratings yet

- 12th H-Aries PDFDocument1 page12th H-Aries PDFRajeev KhullarNo ratings yet

- Angul-Govt Job PDFDocument1 pageAngul-Govt Job PDFRajeev KhullarNo ratings yet

- Scan Doc by CamScannerDocument1 pageScan Doc by CamScannerRajeev KhullarNo ratings yet

- Job ChangeDocument1 pageJob ChangeRajeev KhullarNo ratings yet

- Angul-Govt Job PDFDocument1 pageAngul-Govt Job PDFRajeev KhullarNo ratings yet

- HoroscopesDocument56 pagesHoroscopesRajeev KhullarNo ratings yet

- AllahabadDocument2 pagesAllahabadRajeev KhullarNo ratings yet

- 12th H-AriesDocument1 page12th H-AriesRajeev KhullarNo ratings yet

- 12th H-4 PDFDocument1 page12th H-4 PDFRajeev KhullarNo ratings yet

- Akola ProfessionDocument3 pagesAkola ProfessionRajeev KhullarNo ratings yet

- HoroscopesDocument56 pagesHoroscopesRajeev KhullarNo ratings yet

- Twelfth House SignificantDocument2 pagesTwelfth House SignificantRajeev KhullarNo ratings yet

- HoroscopesDocument56 pagesHoroscopesRajeev KhullarNo ratings yet

- CN23 PDFDocument2 pagesCN23 PDFRajeev KhullarNo ratings yet

- The Schematic Structure of Computer Science Research ArticlesDocument11 pagesThe Schematic Structure of Computer Science Research ArticlesAlfin KarimahNo ratings yet

- ABOO DIL HOSSAIN V MR SHEIK FAROOK BOODHOO and ANOR 2017 SCJ 142Document7 pagesABOO DIL HOSSAIN V MR SHEIK FAROOK BOODHOO and ANOR 2017 SCJ 142Jonathan BruneauNo ratings yet

- Organizational Culture Views of ExcellenceDocument25 pagesOrganizational Culture Views of ExcellenceElia Kim FababeirNo ratings yet

- Lessons Learned From Board Members of ColorDocument12 pagesLessons Learned From Board Members of Color3BL Media StaffNo ratings yet

- West Side Story Study Guide PDFDocument21 pagesWest Side Story Study Guide PDFSharon Ann100% (2)

- MGT 209 - CH 12 NotesDocument5 pagesMGT 209 - CH 12 NotesAmiel Christian MendozaNo ratings yet

- Organizational Behavior: Conflict and NegotiationDocument33 pagesOrganizational Behavior: Conflict and Negotiationshubham singhNo ratings yet

- A Trip To New York: Was/were/wasn't/weren'tDocument1 pageA Trip To New York: Was/were/wasn't/weren'talexander33% (3)

- Multiple Choice Scoring Methods - Which is Best for Higher Ed AssessmentDocument16 pagesMultiple Choice Scoring Methods - Which is Best for Higher Ed AssessmentPremier BrandsNo ratings yet

- SAftex Company ProfileDocument5 pagesSAftex Company ProfileLeulNo ratings yet

- Flowering vs Non-Flowering Plants LessonDocument3 pagesFlowering vs Non-Flowering Plants LessonMariel AronNo ratings yet

- COURSE of Interior DesignDocument235 pagesCOURSE of Interior DesignAhmed MohmmedNo ratings yet

- Community and Environmental HealthDocument26 pagesCommunity and Environmental HealthMary Grace AgueteNo ratings yet

- (SHRM) Corporate CampaignsDocument2 pages(SHRM) Corporate CampaignsNewThorHinoNo ratings yet

- Concrete Construction Article PDF - Understanding Specifications For Superflat FloorsDocument3 pagesConcrete Construction Article PDF - Understanding Specifications For Superflat Floorskimura takuyaNo ratings yet

- 1 PDFDocument25 pages1 PDFjsadachiNo ratings yet

- Salvosa Vs IACDocument2 pagesSalvosa Vs IACRia Kriselle Francia PabaleNo ratings yet

- Mock 8Document75 pagesMock 8satyajitadrijaNo ratings yet

- Home Theater Magazine March 2006Document123 pagesHome Theater Magazine March 2006linhbeoNo ratings yet

- Dear Stund I Found An InformationDocument9 pagesDear Stund I Found An InformationAbelito NahasonNo ratings yet

- End of Year 1 Higher TestDocument3 pagesEnd of Year 1 Higher TestRoyJJNo ratings yet

- The Nature of OperationsDocument21 pagesThe Nature of OperationsDeKabayanNo ratings yet

- Rancangan Pengajaran Tahunan Bahasa Inggeris Tahun 1 Semakan 2017Document9 pagesRancangan Pengajaran Tahunan Bahasa Inggeris Tahun 1 Semakan 2017sitinorhidayahazmeeNo ratings yet

- Differentiated Lesson PlanDocument18 pagesDifferentiated Lesson PlanAnne Mooney100% (1)

- Impact of Perceived Stress On General Health: A Study On Engineering StudentsDocument17 pagesImpact of Perceived Stress On General Health: A Study On Engineering StudentsGlobal Research and Development ServicesNo ratings yet

- CJR Language Studies Group 5Document6 pagesCJR Language Studies Group 5CahyaltiNo ratings yet

- Lesson Plan 21Document2 pagesLesson Plan 21Robertson Sondoh JrNo ratings yet

- Survey QuestionnaireDocument4 pagesSurvey QuestionnaireCatherine Nur KomaraNo ratings yet

- Summary District 1 CoopsDocument13 pagesSummary District 1 CoopsCarlo Villanueva BeltranNo ratings yet

- Autobiographical Essay 1 Autobiographical Essay Tricia M. Cook Professor Damaris Wight EDUC 120 Foundations of Education Fall 2020Document7 pagesAutobiographical Essay 1 Autobiographical Essay Tricia M. Cook Professor Damaris Wight EDUC 120 Foundations of Education Fall 2020api-517602393No ratings yet