Professional Documents

Culture Documents

Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)

Uploaded by

mrthilagamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)

Uploaded by

mrthilagamCopyright:

Available Formats

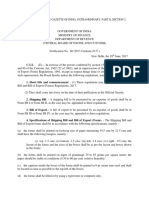

FORM-II

(see regulation 4)

Postal Bill of Export – II

(To be submitted in duplicate)

Bill of Foreign Post office code Name of Exporter Address of Exporter IEC State GSTIN or as AD code (if Details of Customs Broker

Export code applicable applicable)

No. License Name and

and No. address

date.

Yes/No as

Declarations applicable

1 We declare that we intend to claim rewards under Merchandise Exports from India Scheme (MEIS)(for export through Chennai / Mumbai / Delhi FPO only).

2 We declare that we intend to zero rate our exports under Section 16 of IGST Act.

3 We declare that the goods are exempted under CGST/SGST/UTGST/IGST Acts.

We hereby declare that the contents of this postal bill of export are true and correct in every respect.

(Signature of the Exporter/ Authorised agent)

Examination order and report

Let Export Order: Signature of officer of Customs along with stamp and date.

Details of parcel

Consignee details Product details Details of Parcel Postal tracking Assessable value under section 14 of the Customs Act

number

Name and Country of destination Description CTH Quantity Invoice no. Weight FOB Currency Exchange rate Amount in INR

Address Unit number and date Gross net

(pieces, liters,

kgs., meters)

9

Details of Tax invoice or commercial invoice Details of duty/ tax

(whichever applicable)

H.S Invoice details value Customs duties GST details total

code invoice no. Sl. No. of Export duty Cess IGST (if applicable) Compensation cess (if LUT/ bond details duty cess

and date item in applicable) (if applicable)

invoice rate amount rate amount rate amount rate amount

You might also like

- Notes-RJ Speed Seduction Gold WalkupsDocument7 pagesNotes-RJ Speed Seduction Gold Walkupsdulixuexi100% (1)

- IAS Compass - Current Affairs Compilation For Prelims 2024 - EconomyDocument90 pagesIAS Compass - Current Affairs Compilation For Prelims 2024 - EconomyPRAFUL BHARDWAJNo ratings yet

- Checklist of Construction SiteDocument7 pagesChecklist of Construction SiteSurya PNo ratings yet

- Hydraulic Troubleshoot - DynapacDocument37 pagesHydraulic Troubleshoot - DynapacMoazzam Ali0% (1)

- Tupad Orientation Presentation 2017Document54 pagesTupad Orientation Presentation 2017Anonymous EvbW4o1U7100% (5)

- Uncommon GST TopicsDocument36 pagesUncommon GST TopicsEugeniePaxtonNo ratings yet

- Chargeble GSTDocument87 pagesChargeble GSTgopaljha84No ratings yet

- 6.case Study On Input Tax Credit Under GSTDocument17 pages6.case Study On Input Tax Credit Under GSTSUNIL PUJARINo ratings yet

- GST Assessment, Audit and ComplianceDocument33 pagesGST Assessment, Audit and ComplianceSuresh Kumar YathirajuNo ratings yet

- All About GST REFUNDS - Refrence ManualDocument451 pagesAll About GST REFUNDS - Refrence ManualSwarnadevi GanesanNo ratings yet

- RBI Grade B 2022 Phase 1 Previous Year Paper Shift 2Document142 pagesRBI Grade B 2022 Phase 1 Previous Year Paper Shift 2Ashok Singh PatelNo ratings yet

- Inflammatory Bowel DiseaseDocument27 pagesInflammatory Bowel DiseaseMihai VladescuNo ratings yet

- 1839 - Apex Ultima Protek Shade Card - 01 - Mobile Version-2Document12 pages1839 - Apex Ultima Protek Shade Card - 01 - Mobile Version-2mrthilagamNo ratings yet

- (Studyplan) CSIR Combined Administrative Service Exam (CASE) - Booklist, Strategy, Studymaterial Download PDFs MrunalDocument12 pages(Studyplan) CSIR Combined Administrative Service Exam (CASE) - Booklist, Strategy, Studymaterial Download PDFs Mrunalguru1241987babuNo ratings yet

- Eastridge Golf Club, Inc V Eastridge Labor Union-SUPERDocument3 pagesEastridge Golf Club, Inc V Eastridge Labor Union-SUPERJames Evan I. ObnamiaNo ratings yet

- CA Inter GST Marathon NotesDocument133 pagesCA Inter GST Marathon NotesNandan Gambhir100% (1)

- Registration TermsDocument6 pagesRegistration Termsmrthilagam100% (1)

- Registration TermsDocument6 pagesRegistration Termsmrthilagam100% (1)

- UntitledDocument612 pagesUntitledSanidhya Patil100% (1)

- GST Annual Return and AuditDocument10 pagesGST Annual Return and AuditRachit ChhedaNo ratings yet

- Perfume Notes & FamiliesDocument24 pagesPerfume Notes & Familiesmohamed tharwatNo ratings yet

- Supply GSTDocument16 pagesSupply GSTMehak Kaushikk100% (1)

- Periodontal IndicesDocument29 pagesPeriodontal IndicesFachrul Latif DentistNo ratings yet

- KalasarpaDosha RemedyDocument28 pagesKalasarpaDosha RemedyAnita Kadavergu100% (1)

- Pbe Form 1Document3 pagesPbe Form 1sam yadavNo ratings yet

- GST Flyers: Central Board of Excise & Customs New DelhiDocument468 pagesGST Flyers: Central Board of Excise & Customs New DelhiPrerna YadavNo ratings yet

- GST Pranav Chandak QUESTION BankDocument85 pagesGST Pranav Chandak QUESTION Bankgvramani51233No ratings yet

- Monthly Current Affairs: Ibps, SSC, Sbi, Railways & Rbi Exams in One PlaceDocument76 pagesMonthly Current Affairs: Ibps, SSC, Sbi, Railways & Rbi Exams in One PlacePushpendra Singh ChouhanNo ratings yet

- GST NotesDocument282 pagesGST NotesMRUNALI KUMBHARNo ratings yet

- Tax Structure in IndiaDocument17 pagesTax Structure in IndiaDepika MenghaniNo ratings yet

- March 2017 - Competition PowerDocument142 pagesMarch 2017 - Competition PowerHariniDevi100% (1)

- Electronic Dealer Financing Scheme (e-DFS) in Sambalpur Region for IOCL DealersDocument9 pagesElectronic Dealer Financing Scheme (e-DFS) in Sambalpur Region for IOCL DealersmonikaNo ratings yet

- RBI Study Material for Assistants and Grade B Officers ExamDocument13 pagesRBI Study Material for Assistants and Grade B Officers ExamAnudeep KumarNo ratings yet

- CA Pitam Goel CA Tushar AggarwalDocument110 pagesCA Pitam Goel CA Tushar AggarwalLokesh SethiNo ratings yet

- GST User ManuelDocument195 pagesGST User Manuelsakthi raoNo ratings yet

- Goods & Services Act FinalDocument78 pagesGoods & Services Act FinalParvesh AghiNo ratings yet

- Narrate The History of GST in IndiaDocument6 pagesNarrate The History of GST in IndiaHari KrishnanNo ratings yet

- Shriram City Union Finance Personal LoanDocument3 pagesShriram City Union Finance Personal LoanRavikumar Toorupu100% (1)

- Application Form for IIM ProgrammesDocument7 pagesApplication Form for IIM ProgrammesBipro HabisyasiNo ratings yet

- PreliminaryDocument30 pagesPreliminaryADYASA CHOUDHURY100% (1)

- Comedk PDFDocument42 pagesComedk PDFdisha_33495952No ratings yet

- GST STeps To File ReturnDocument22 pagesGST STeps To File ReturnAnnu KashyapNo ratings yet

- MSME HelpDocument10 pagesMSME HelpAjay MehtaNo ratings yet

- GST BookDocument100 pagesGST BookNaman ChopraNo ratings yet

- MCQ Assessment ProcedureDocument13 pagesMCQ Assessment ProcedureDeepsikha maitiNo ratings yet

- CA RAJ KUMAR PROCEDURAL ASPECTS OF GSTDocument1 pageCA RAJ KUMAR PROCEDURAL ASPECTS OF GSTDeepak SinghNo ratings yet

- Financial Dynamics of Major Indian States: Satbir Singh & Vinay MehalaDocument16 pagesFinancial Dynamics of Major Indian States: Satbir Singh & Vinay MehalaTJPRC PublicationsNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet

- BRM Assignment # 02Document7 pagesBRM Assignment # 02Muneer HussainNo ratings yet

- Demystifying Economic Terms With Maggu-Bhai Volume 22 (June)Document10 pagesDemystifying Economic Terms With Maggu-Bhai Volume 22 (June)Mana Planet100% (1)

- Matrimonial Market Analysis PDFDocument27 pagesMatrimonial Market Analysis PDFRajat JaatNo ratings yet

- GST Debit Note Format in ExcelDocument4 pagesGST Debit Note Format in ExcelVivek PadoleNo ratings yet

- Punjab Rent (Amendment) Act, 2013Document10 pagesPunjab Rent (Amendment) Act, 2013Latest Laws TeamNo ratings yet

- Champaran Gurukul: Banking Made EasyDocument5 pagesChamparan Gurukul: Banking Made EasybiplabmajumderNo ratings yet

- Free Download Indirect Tax Book For Ca Final Bangar PDFDocument4 pagesFree Download Indirect Tax Book For Ca Final Bangar PDFNikhil Agrawal0% (3)

- BCom Income Tax Procedure and PracticeDocument61 pagesBCom Income Tax Procedure and PracticeUjjwal KandhaweNo ratings yet

- Business - Presentation - With - Carreer - Plan-1 WEI FAST PAYDocument32 pagesBusiness - Presentation - With - Carreer - Plan-1 WEI FAST PAYangelNo ratings yet

- E-Auction BSNLDocument4 pagesE-Auction BSNLritz1238_ras1245No ratings yet

- SchemesTap - May 2022 - Part 1 Lyst2546Document20 pagesSchemesTap - May 2022 - Part 1 Lyst2546minalNo ratings yet

- Memoirs of Cgda: Sh. Sanjiv Mittal, IDASDocument21 pagesMemoirs of Cgda: Sh. Sanjiv Mittal, IDASAmit kumarNo ratings yet

- What Is GST?: AdditionDocument16 pagesWhat Is GST?: AdditionPalanisami DuraisamiNo ratings yet

- 206 PFP MCQDocument18 pages206 PFP MCQPratik DixitNo ratings yet

- Presentation ON: Goods and Service Tax: Applicability, Itc and ReturnsDocument31 pagesPresentation ON: Goods and Service Tax: Applicability, Itc and ReturnsSonal AggarwalNo ratings yet

- Chapter 6 ValueofTaxableSupplyDocument21 pagesChapter 6 ValueofTaxableSupplyDR. PREETI JINDALNo ratings yet

- GST Guidance on Input Tax CreditDocument21 pagesGST Guidance on Input Tax CreditSUNIL PUJARINo ratings yet

- National Workshop On DBTDocument12 pagesNational Workshop On DBTSushubhNo ratings yet

- Sample Questions T. Y. B. Com. (SEM V) Banking Law & - PracticeDocument7 pagesSample Questions T. Y. B. Com. (SEM V) Banking Law & - PracticeHarish ShuklaNo ratings yet

- Explained - Companies Act 2013, Types of CompaniesDocument36 pagesExplained - Companies Act 2013, Types of CompaniesAbhay SinghNo ratings yet

- Final Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Document31 pagesFinal Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Sanket Mhetre100% (1)

- (To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )Document47 pages(To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )HimanshuKaushikNo ratings yet

- Draft Formats Under Goods and Services Tax - Invoice Rules, 20Document4 pagesDraft Formats Under Goods and Services Tax - Invoice Rules, 20Anoop krishnanNo ratings yet

- Draft Shipping Bill and Bill Export Regulations 2017 Sb1Document19 pagesDraft Shipping Bill and Bill Export Regulations 2017 Sb1Anand Jay100% (1)

- Scan 20 Dec 2020Document25 pagesScan 20 Dec 2020mrthilagamNo ratings yet

- Writings Near The End of The Human Erastories and Book Reviews ObookoDocument157 pagesWritings Near The End of The Human Erastories and Book Reviews Obookoعمر الصران أبويعربNo ratings yet

- Vannangal CDocument41 pagesVannangal CmrthilagamNo ratings yet

- Scan 20 Dec 2020Document10 pagesScan 20 Dec 2020mrthilagamNo ratings yet

- Scan 20 Dec 2020Document10 pagesScan 20 Dec 2020mrthilagamNo ratings yet

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Document1 pageForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamNo ratings yet

- NOC for business address useDocument1 pageNOC for business address usemrthilagamNo ratings yet

- Astrology 3Document23 pagesAstrology 3mrthilagamNo ratings yet

- Astrology 3Document23 pagesAstrology 3mrthilagamNo ratings yet

- EFMA Info Guide PDFDocument3 pagesEFMA Info Guide PDFmrthilagamNo ratings yet

- WelcomeDocument5 pagesWelcomeCatNo ratings yet

- Scan 7 Sep 18 PDFDocument1 pageScan 7 Sep 18 PDFmrthilagamNo ratings yet

- Depreciation Schedule for Mis Just Click as of March 31, 2017Document1 pageDepreciation Schedule for Mis Just Click as of March 31, 2017mrthilagamNo ratings yet

- 00563Document2 pages00563Thilagam Manie Rathina100% (1)

- Recruitment Proposal: Created byDocument9 pagesRecruitment Proposal: Created byIPS SolutionsNo ratings yet

- Checklist for business loan documentsDocument1 pageChecklist for business loan documentsTanpreet SinghNo ratings yet

- MolesDocument15 pagesMolesGunjan KaulNo ratings yet

- Root-Knot and Root-Lesion Nematode SuppressionDocument6 pagesRoot-Knot and Root-Lesion Nematode SuppressionRAMIRO H.S.No ratings yet

- Diagnosis in OncologyDocument22 pagesDiagnosis in OncologyAndi SuryajayaNo ratings yet

- BDHCH 13Document40 pagesBDHCH 13tzsyxxwhtNo ratings yet

- Learn English for Free at thichtienganh.comDocument30 pagesLearn English for Free at thichtienganh.comNhân Đăng NguyễnNo ratings yet

- Can Capitalism Bring Inclusive Growth?: - Suneel SheoranDocument4 pagesCan Capitalism Bring Inclusive Growth?: - Suneel SheoranSandeepkumar SgNo ratings yet

- IJST - Vol (7) - No (4) December 2012Document153 pagesIJST - Vol (7) - No (4) December 2012Taghreed hashim AlnoorNo ratings yet

- KT 470Document4 pagesKT 470Fabian PzvNo ratings yet

- Journal No. 3 "Specialized Leaves"Document10 pagesJournal No. 3 "Specialized Leaves"Ej AgsaldaNo ratings yet

- Pharmacy Service VA Design Guide: Final DraftDocument75 pagesPharmacy Service VA Design Guide: Final DraftAhmad Gamal Elden MAhanyNo ratings yet

- Calculation of The Reorder Point For Items With Exponential and Poisson Distribution of Lead Time DemandDocument10 pagesCalculation of The Reorder Point For Items With Exponential and Poisson Distribution of Lead Time DemandRaj ChauhanNo ratings yet

- Praying in The Spirit Series-Conceiving in The SpiritDocument11 pagesPraying in The Spirit Series-Conceiving in The SpiritPrecious O. OkaforNo ratings yet

- Class 7 Chapter 5 WaterDocument10 pagesClass 7 Chapter 5 WaterANIRBAN DAMNo ratings yet

- Hubungan Antara Aktivitas Fisik Dan Screen Time Dengan Status Gizi Pada Siswa-Siswa SMP Kristen Eben Haezar 2 ManadoDocument11 pagesHubungan Antara Aktivitas Fisik Dan Screen Time Dengan Status Gizi Pada Siswa-Siswa SMP Kristen Eben Haezar 2 ManadorezkaNo ratings yet

- DesignGyan17150517Seating System Components-Seating Terminology - FOR - TRAININGDocument42 pagesDesignGyan17150517Seating System Components-Seating Terminology - FOR - TRAININGK S RANJITH ランジットNo ratings yet

- Molykote: 111 CompoundDocument2 pagesMolykote: 111 CompoundEcosuministros ColombiaNo ratings yet

- Production of Non Ferrous MetalsDocument68 pagesProduction of Non Ferrous MetalsDrTrinath TalapaneniNo ratings yet

- Lwtech HR Management FlyerDocument2 pagesLwtech HR Management FlyerAshlee RouseyNo ratings yet

- Madeline Reitman Capstone Proposal 2Document6 pagesMadeline Reitman Capstone Proposal 2api-446158134No ratings yet

- Full Floating Clapper Assembly: Swing Check ValveDocument2 pagesFull Floating Clapper Assembly: Swing Check Valvemubarak aliNo ratings yet

- 19 - Kyocera Milling - Endmill - Radius - Ball-Nose 2010-2011 (ENG)Document24 pages19 - Kyocera Milling - Endmill - Radius - Ball-Nose 2010-2011 (ENG)karadimasNo ratings yet

- Dr. P S Adhya 7186Document1 pageDr. P S Adhya 7186Partha AdhyaNo ratings yet