Professional Documents

Culture Documents

Compliance Calendar For June 2020

Uploaded by

corporate partners0 ratings0% found this document useful (0 votes)

20 views8 pagesCompliance Calendar for June 2020

Original Title

Compliance Calendar for June 2020

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCompliance Calendar for June 2020

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views8 pagesCompliance Calendar For June 2020

Uploaded by

corporate partnersCompliance Calendar for June 2020

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

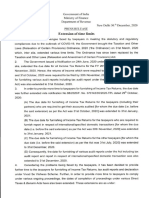

COMPLIANCE CALENDAR FOR THE MONTH OF MAY 2020

S. No Particulars of Compliance Forms/returns Due Date

Compliances Calendar for GST

1. Return of outward supplies of taxable goods and/or GSTR -1 30-06-2020

services for the Month of March, 2020 to May 2020 (for

Assesses having turnover exceeding 1.5 Cr.) Monthly

Return.

2. Return of outward supplies of taxable goods and/or GSTR -1 30-06-2020

services for the Month of January-March 2020 (for

Assesses having turnover exceeding 1.5 Cr.) Quaterly

Return.

3. Summary Return of Outward and Inward Supplies along GSTR -3B 30-06-2020

with payment of Tax where the Turnover of taxpayer is

upto Rs. 5 Crores for the Month of March, April and

May 2020.

4. Summary Return of Outward and Inward Supplies along GSTR -3B 30-06-2020

with payment of Tax where the Turnover of entity is

More than Rs. 5 Crores for the Month of March, April

and May 2020.

5. A taxable person who opts for cancellation of GST GSTR-10 30-06-2020

registration has to file a final return under GST law in

form GSTR-10 within three months.

6. GST Annual Return and Reconciliation Statement for FY GSTR-9 / 9A and 30-06-2020

2018-19. GSTR-9C

7. Summary of outward taxable supplies and tax payable GSTR-5 & 30-06-2020

by Non-Resident taxable person & OIDAR. GSTR – 5A

8. Return for Input Service Distributor. GSTR – 6 30-06-2020

9. Due date for filing GSTR-7 to be filed by the person GSTR – 7 30-06-2020

who is required to deduct TDS under GST for the

month of December,2019.

10. The due date for furnishing statement by e-commerce GSTR-8 30-06-2020

companies for the Month of December 2019.

11. Return filed by composition dealer statement-cum- 30-06-2020

challan to declare the details or summary of his/her

selfassessed tax payable for a quarter ending January

2020 to March 2020.

12. Payment under Sabka Vishwas Scheme. 30-06-2020

13. Intimation in respect of opting to pay tax under 30.06.2020

composition scheme for the FY 2020-21

14. Interest for delayed GST payment will be calculated 01-07-2020

on the net tax liability. This amendment will apply

retrospectively from 1st July 2017.

15. Registered person availing the benefit provided under Form GST CMP- 07.07.2020

Notification 2/2019 – Central Tax (Rate) shall be 08

required to furnish details of self-assessed tax for

quarter ending March 2020

16. The yearly return for 2019-20 shall be required to be Form GSTR 4 15.07.2020

filed by the Composition tax payers

17. Filed by a taxpayer who is liable to pay an amount 31.07.2020

that is equal to the input tax credit through cash

ledger or electronic credit

18. The implementation of the new GST return system 01-10-2020

has been postponed to 1st October 2020.

Compliances Calendar for ESI and PF Payments

1. PF Payment for March 2020 ECR 15-05-2020

2. ESIC Payment for March 2020 ESI Challan 15-05-2020

ESI contribution deposit due date extended to 45 days for Feb & March 2020 due to COVID 19

Compliances Calendar for Income Tax Act

1. Due date for deposit of Tax deducted by an office of the 30-06-2020

government for the month of March, 2020 to May 2020.

However, all sum deducted by an office of the

government shall be paid to the credit of the Central

Government on the same day where tax is paid without

production of an Income-tax Challan.

2. Due date for issue of TDS Certificate for tax deducted 30-06-2020

under section 194-IA in the month of March, 2020 to

May 2020.

3. Due date for issue of TDS Certificate for tax deducted 30-06-2020

under section 194-IB in the month of March, 2020 to

May 2020.

4. Due date for issue of TDS Certificate for tax deducted 30-06-2020

under section 194M in the month of March, 2020 to May

2020.

5. Quarterly statement in respect of foreign remittances (to Form No. 15CC 30-06-2020

be furnished by authorized dealers) for quarter ending

March, 2020.

6. Due date for furnishing by an office of the Government Form 24G 30-06-2020

where TDS/TCS for the month of April, 2020 has been

paid without the production of a challan

7. Quarterly statement of TCS deposited for the quarter 30-06-2020

ending March 31, 2020

8. Due date for furnishing statement by a stock exchange in Form no. 3BB 30-06-2020

respect of transactions in which client codes been

modified after registering in the system for the month of

March, 2020.

9. Submission of a statement by non-resident having a Form No. 49C 30-06-2020

liaison office in India for the financial year 2019-20

10. Due date for furnishing by an office of the Government 30-06-2020

where TDS/TCS for the month of March, 2020 has been

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

paid without the production of a challan.

11. Due date for furnishing of challan-cum-statement in 30-06-2020

respect of tax deducted under section 194-IA in the

month of March, 2020 to May 2020.

12. Due date for furnishing of challan-cum-statement in 30-06-2020

respect of tax deducted under section 194-IB in the

month of March, 2020 to May 2020.

13. Due date for furnishing of challan-cum-statement in 30-06-2020

respect of tax deducted under section 194M in the month

of March, 2020 to May 2020.

14. Quarterly statement of TDS deposited for the quarter 30-06-2020

ending March 31, 2020

15. Return of tax deduction from contributions paid by the 30-06-2020

trustees of an approved superannuation fund

16. Due date for furnishing of statement of financial 30-06-2020

transaction (in Form No. 61A) as required to be furnished

under sub-section (1) of section 285BA of the Act respect

of a financial year 2019-20

17. Due date for e-filing of annual statement of reportable Form No. 61B

accounts as required to be furnished under section

285BA(1)(k) for calendar year 2019 by reporting

financial institutions*

18. Due date for deposit of Tax deducted by an assessee 30-06-2020

other than an office of the Government for the month of

March, 2020.

19. Due date for e-filing of a declaration in Form No. 61 30-06-2020

containing particulars of Form No. 60 received during the

period October 1, 2019 to March 31, 2020.

20. Due date for uploading declarations received from Form. 15G/15H 30-06-2020

recipients in form during the quarter ending March, 2020.

21. Due date for deposit of TDS for the period January 2020 30-06-2020

to March 2020 when Assessing Officer has permitted

quarterly deposit of TDS under section 192, 194A, 194D

or 194H.

22. The due date for linking of PAN with Aadhaar as 30-06-2020

specified under sub-section 2 of Section 139AA of the

Income-tax Act,1961 has been extended from 31st

December, 2019 to 31st March, 2020 and further

extended to 30th June, 2020 due to COVID – 19

outbreaks.

23. The date for making investments & payments for 30-06-2020

claiming deduction under Section 80C (LIC, PPF, NSC

etc.), 80D (Mediclaim), 80G (Donations), extended to

30th June 2020 for FY 2019-20.

24. All delayed payments of advance tax, self assessment 30-06-2020

tax, TDS, TCS, equalization levy, STT, CTT made

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

between 20/03/2020 and 30/06/2020 will be charges at

reduced interest rate i.e., 9% p.a instead of 12% p.a.

25. The due date for issue of notice, intimation, order, 30-06-2020

investment in tax saving instruments, investments for

rollover benefit of capital gains under Income Tax has

been extended to 30th June 2020.

26. Application for allotment of PAN in case of non- 30-06-2020

individual resident person, which enters into a financial

transaction of Rs. 2,50,000 or more during FY 2019-20

and hasn't been allotted any PAN

27. Application for allotment of PAN in case of person being 30-06-2020

managing director, director, partner, trustee, author,

founder, karta, chief executive officer, principal officer

or office bearer of the person referred to in Rule 114(3)

(v) or any person competent to act on behalf of the

person referred to in Rule 114(3)(v) and who hasn't

allotted any PAN

28. Filing of revised return for the Assessment Year 2019-20 30-06-2020

29. Filing of belated return for the Assessment Year 2019-20 30-06-2020

Compliances Calendar for LODR/SEBI

1. Submission of Statement of Investor complaints Regulation 13(3) 15-05-2020

2. Submission of Submission of Corporate Governance Regulation 27(2) 15-05-2020

report

3. Submission of Shareholding Pattern Regulation 31 15-05-2020

4. SEBI has decided to exempt the requirement of - 15-05-2020

publication of advertisements in newspapers as required

under the LODR, for information such as notice of the

board meeting, financial results, etc., till 15th May, 2020.

5. Regulation 40(9) relating to Certificate from Practicing 31-05-2020

Company Secretary on timely issue of share certificates

6. Submission of Compliance certificate on share transfer Regulation 7(3) 31-05-2020

facility

7. Extension of the due date of filing disclosures, in terms 01-06-2020

of Regulations 30(1), 30(2) and 31(4) of the SAST

Regulations for the financial year ending March 31, 2020

8. Submission of Financial Results- 45 days from end of the Regulation 52 30-06-2020

Half year

9. Submission of Financial Results- 60 days from end of the Regulation 52 30-06-2020

financial year

10. Submission of Secretarial Compliance report Regulation 24A 30-06-2020

11. Submission of Financial Results Regulation 33 30-06-2020

12. The board of directors and Audit Committee of the listed Relaxation of -

entity are exempted from observing the maximum time gap between

stipulated time gap between two meetings for the two board / Audit

meetings held or proposed to be held between the period Committee

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

December 1, 2019 and June 30, 2020. meetings

However, the board of directors / Audit Committee shall

ensure that they meet atleast four times a year, as

stipulated under regulations 17(2) and 18(2)(a) of the

LODR

13. The Nomination and Remuneration Committee, 30-06-2020

Stakeholders Relationship Committee & The Risk

Management Committee shall meet at least once in a year

14. Regulation 44(5) relating to holding of AGM by top 100 30-09-2020

listed entities by market capitalization for FY 19-20

15. SEBI had issued Standard Operating Procedure (“SOP”)

dated 22ndJanuary, 2020, on imposition of fines and

other enforcement actions for non-compliances with

provisions of the LODR, the effective date of operation

of which was to be for compliance periods ending on or

after 31st March, 2020. The said SOP will now come into

force with effect from compliance periods ending on or

after 30th June, 2020.

Compliances Calendar for RBI (FEMA)

1. “The Company / reporting entity shall take approval from FLAIR -

the RBI in case of submission of FLA Return of 2019 /

revision of FLA Return of 2019 after due date i.e July 31,

2019.

Further, submission of FLA returns for previous years

will be activated only after September 01, 2019 (as per

FLAIR Portal)

2. Borrowers are required to report all ECB transactions to ECB 2 Return 07-04-2020

the RBI on a monthly basis through an AD Category – I

Bank in the form of ‘ECB 2 Return’.

Compliance Calendar for Companies Act, 2013

1. Funds may be spent for various activities related to Spending of CSR -

COVID-19 under item nos. (i) and (xii) of Schedule VII Funds for

relating to promotion of health care, including preventive COVID-19

health care and sanitation, and, disaster management. It

has clarified that spending of CSR funds for COVID-19

shall be considered as an eligible CSR activity.

2. LLP Settlement 01-04-2020 to

Modified LLP Settlement Scheme, 2020 Scheme, 2020 30-09-2020

The defaulting LLPs may themselves avail of the scheme

for filing documents which have not been filed or

registered in time on payment of fee as payable for filing

of such document /return.

This Scheme shall not apply to LLPs which has made an

application in Form 24 to the Registrar, for striking off

its name from the register as per provisions of Rule 37(1)

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

of the LLP Rules, 2009.

3. Companies Fresh Start Scheme, 2020 (CFSS-2020)

Any Eligible Company can file any form, statement or

return etc., which was required to be filed under the Act

but the Company has defaulted in filing the said form,

return etc. Such belated forms can be filed on payment of 01-04-2020 to

normal fees as prescribed under the Companies 30-09-2020

(Registration Offices and Fees) Rules, 2014.

No additional fee shall be payable. Thus, filing related

defaults can be made good irrespective of duration of

default.

4. DIN holders of DINs marked as ‘Deactivated’ due to

non-filing of DIR-3KYC/DIR-3 KYC-Web and those

Companies whose compliance status has been marked as

“ACTIVE non-compliant” due to non-filing of Active

Company Tagging Identities and Verification(ACTIVE)

eform are encouraged to become compliant once again in 01-04-2020 to

pursuance of the General Circular No. 11 dated 24th 30-09-2020

March, 2020 & General Circular No.12 dated 30th March

2020 and file DIR-3KYC/DIR-3KYC-Web/ACTIVE as

the case may be between 1st April, 2020 to 30th

September, 2020 without any filing fee of INR 5000/INR

10000 respectively.

5. MCA has notified the Companies (Appointment and Rules are

Qualification of Directors) Fifth Amendment Rules, effective from

2019, and the Companies (Accounts) Amendment Rules, December 01,

2019 with effective from December 01, 2019. 2019

If a person is already appointed as Independent Director

(ID) in a Company, on 01.12.2019 (the commencement &

of these rules) shall within period of five months from

such commencement i.e. 30th April, 2020 apply online to Registration

the institute for inclusion of his name in the data bank. on

Independent

After inclusion of the name in data bank shall pass an Directors’

online proficiency self-assessment test conducted by the Databank

institute within a period of one year from the date of commenced

inclusion of his name in the data bank, (i.e. 1 year from from 2nd

30th April, 2020 or any other date of inclusion of name in December,

data bank). Failing which, his name shall stand removed 2019 onwards.

from the databank of the institute.

Individuals who have served for a period of 10 years as

on date of inclusion of his name in databank as director

or Key Managerial Personnel (KMP) in listed public

company or unlisted public company having paid up

capital of Rs. 10 crore or more or Body Corporate listed

on the recognised Stock exchange shall not be required to

pass online proficiency self-assessment test.

The Databank, which was launched by the Ministry of

Corporate Affairs, can be accessed at www.mca.gov.in

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

or www.independentdirectorsdatabank.in.

6. The mandatory requirement of holding meetings of the

Board of the companies within the prescribed interval

provided in section 173 of the Companies Act, 2013

(i.e.120 days) stands extended by a period of 60 days till

next two quarters i.e. till 30th September.

Accordingly, as a one-time relaxation the gap between

two consecutive meetings of the Board may extend to

180 days till the next two quarters, instead of 120 days as

required in the Companies Act, 2013.

7. The Companies (Auditor’s Report) Order, 2020 shall be

made applicable from financial year 2020-21, instead of

being applicable from the financial year 2019-20 as

notified earlier. This will significantly ease the burden on

companies & their auditors for the financial year 2019-

20.

8. Newly incorporated companies are required to file a

declaration for Commencement of Business within 180

days of incorporation under section 10A of the

Companies Act, 2013.

An additional period of 180 more days is allowed for this

compliance.

9. Non-compliance of minimum residency in India for a

period of at least 182 days by at least one director of

every company, under Section 149 of the Companies

Act, 2013 shall not be treated as non-compliance for the

financial year 2019-20

10. Requirement under section 73(2)(c) of Companies Act 30-06-2020

2013, to create the deposit repayment reserve of 20% of

deposits maturing during the financial year 2020-21

before 30th April, 2020 shall be allowed to be complied

with till 30th June 2020.

11. Requirement under rule 18 of the Companies (Share 30-06-2020

Capital & Debentures) Rules, 2014 to invest or deposit at

least 15% of amount of debentures maturing in specified

methods of investments or deposits before 30th April

2020, may be complied with till 30th June 2020.

12. As per Para VII (1) of Schedule IV to the Companies

Act, 2013, the Independent Directors of the company are

required to hold at least one meeting in a financial year,

without the attendance of non-independent directors and

members of management. For the financial year 2019-20,

if the Independent Directors of a company have not been

able to hold such a meeting, the same shall not be viewed

as violation. The independent Directors, however, may

share their views amongst themselves through telephone

or e-mail or any other mode of communication, if they

deem it to be necessary.

Compliance Calendar for others

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

1. Issue of Diligence Report for Banks in case of ICSI 01-07-2020

Consortium Lending / Multiple Banking Arrangements

by Peer Reviewed Units.

2. The ICSI Auditing Standards is mandatorily applicable ICSI Auditing 01-10-2020

for Audit Engagements accepted by the Auditor on or Standards

after 1st October, 2020.

3. Debit card holders can now withdraw cash from any bank Banking Laws -

without any additional charges for next 3 months.

4. There will be a complete waiver of fees charged by the Banking Laws -

banks for not maintaining the minimum balance.

5. There will be reduction of bank charges for digital trade Banking Laws -

transactions for all trade finance consumers.

Compliance Calendar for June 2020 Contact us at pmkadvisors@gmail.com) - http://compliancedose.blogspot.com/

You might also like

- COVID-19 tax and statutory due date changesDocument20 pagesCOVID-19 tax and statutory due date changessandjkNo ratings yet

- Various Due DatesDocument21 pagesVarious Due DatesCA AravindNo ratings yet

- Notifications Gist Upto 30.09.2020Document2 pagesNotifications Gist Upto 30.09.2020NishthaNo ratings yet

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDocument9 pagesPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNo ratings yet

- Extended Due Dates Due To Covid-19Document4 pagesExtended Due Dates Due To Covid-19ParthNo ratings yet

- Compliance Calendar 2020-2021: Due Dates - After Covid-19Document21 pagesCompliance Calendar 2020-2021: Due Dates - After Covid-19ABC 123No ratings yet

- CBIC issues notifications providing COVID-19 relief for GST filingsDocument3 pagesCBIC issues notifications providing COVID-19 relief for GST filingssunshineNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- Government of India Ministry of Finance Department of RevenueDocument4 pagesGovernment of India Ministry of Finance Department of RevenueK PUNNA REDDYNo ratings yet

- Ordinance Issued 31 - 03 - 2020 PDFDocument4 pagesOrdinance Issued 31 - 03 - 2020 PDFMukund SarayanNo ratings yet

- Highlights of Relief Measures & Other Amendments Under GST: ASC Legal, Solicitors and Advocates April 2020Document4 pagesHighlights of Relief Measures & Other Amendments Under GST: ASC Legal, Solicitors and Advocates April 2020Pulkit AgarwalNo ratings yet

- January Compliance CalendarDocument24 pagesJanuary Compliance CalendarDsp VarmaNo ratings yet

- Relief Measures COVID 19Document10 pagesRelief Measures COVID 19Ajay ModiNo ratings yet

- Circular Refund 137 7 2020Document3 pagesCircular Refund 137 7 2020Shirish JainNo ratings yet

- Due Date Calendar June 22Document1 pageDue Date Calendar June 22HAKIMI MZNNo ratings yet

- Update - Government Announcements - Fight Against COVID 19Document53 pagesUpdate - Government Announcements - Fight Against COVID 19Vaibhav JainNo ratings yet

- FTCCI Webinar on GST Relief MeasuresDocument16 pagesFTCCI Webinar on GST Relief MeasuresRENISH VITHALANINo ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- Finance Minister announces tax, compliance relief measuresDocument2 pagesFinance Minister announces tax, compliance relief measuresajit jadhavNo ratings yet

- Compliance Chart FormatDocument2 pagesCompliance Chart FormatSmeet ShahNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- My Tax Espresso Jan 2023Document20 pagesMy Tax Espresso Jan 2023Claudine TanNo ratings yet

- COVID-19 Tax Implications and Filing ExtensionsDocument108 pagesCOVID-19 Tax Implications and Filing ExtensionsRichard CaneteNo ratings yet

- Reverse Charge Liability Under GST Not Paid in 2018-19Document3 pagesReverse Charge Liability Under GST Not Paid in 2018-19Finance KRIPPLNo ratings yet

- GST RCM liability paid late cannot avail ITCDocument3 pagesGST RCM liability paid late cannot avail ITCFinance KRIPPLNo ratings yet

- Measures by CBIC To Provide Relief To Taxpayers in View of COVID-19 PandemicDocument2 pagesMeasures by CBIC To Provide Relief To Taxpayers in View of COVID-19 PandemicABC 123No ratings yet

- Due Date Calendar Oct 22Document1 pageDue Date Calendar Oct 22Kushal DabhadkarNo ratings yet

- GST Times - Vol.1, Issue-4Document34 pagesGST Times - Vol.1, Issue-4Milna JosephNo ratings yet

- Finance Minister Announces Several Relief Measures Relating To Statutory and Regulatory Compliance Matters Across Sectors in View of COVIDDocument3 pagesFinance Minister Announces Several Relief Measures Relating To Statutory and Regulatory Compliance Matters Across Sectors in View of COVIDVenkataNo ratings yet

- Changes to Income Tax, GST & Customs Due DatesDocument2 pagesChanges to Income Tax, GST & Customs Due DatesMass DiCaprioNo ratings yet

- GST Guide on Tax Invoice AdjustmentsDocument14 pagesGST Guide on Tax Invoice AdjustmentsVictoria ChNo ratings yet

- Aino Communique 108th EditionDocument12 pagesAino Communique 108th EditionSwathi JainNo ratings yet

- Compendium of Steps Taken by Government of India To Support Msme Sector in Fight Against Covid-19 PandemicDocument13 pagesCompendium of Steps Taken by Government of India To Support Msme Sector in Fight Against Covid-19 PandemicSantoshNo ratings yet

- GST Circular clarifies ITC rules for Feb-Aug 2020Document3 pagesGST Circular clarifies ITC rules for Feb-Aug 2020Gulrana AlamNo ratings yet

- AINO Management InsightsDocument12 pagesAINO Management InsightsSwathi JainNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Paper-18 Supplementary 180221Document109 pagesPaper-18 Supplementary 180221Srihari SrinivasNo ratings yet

- GST Times - Vol.1, Issue-3Document22 pagesGST Times - Vol.1, Issue-3Milna JosephNo ratings yet

- Executive Programme (New Syllabus) Supplement FOR Tax LawsDocument14 pagesExecutive Programme (New Syllabus) Supplement FOR Tax Lawsgopika mundraNo ratings yet

- Taxguru - In-Updated Extended GST Due Date ChartDocument3 pagesTaxguru - In-Updated Extended GST Due Date ChartsureshNo ratings yet

- June 2020 SP 2Document27 pagesJune 2020 SP 2Avinash ShettyNo ratings yet

- Letter To FBR Extension of Time For E-Filing of Sales Tax Return Tax Period Jul.20Document1 pageLetter To FBR Extension of Time For E-Filing of Sales Tax Return Tax Period Jul.20Lahore TaxationsNo ratings yet

- MoF IT Extension PR 24.10.2020Document2 pagesMoF IT Extension PR 24.10.2020CA Poonam WaghNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Tax Laws Ns Ep June 2020Document29 pagesTax Laws Ns Ep June 2020sarvaniNo ratings yet

- Statutory Compliance Chart For Oct 18Document4 pagesStatutory Compliance Chart For Oct 18LeenaNo ratings yet

- 1 STP Q E, 0: MemorandumDocument1 page1 STP Q E, 0: MemorandumQuinciano MorilloNo ratings yet

- Compliance Calendar NovDocument23 pagesCompliance Calendar NovDsp VarmaNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Corporate Compliance Calendar For September, 2022 - Taxguru - inDocument25 pagesCorporate Compliance Calendar For September, 2022 - Taxguru - inSubhash VishwakarmaNo ratings yet

- Faq E-Invoice EnglishDocument57 pagesFaq E-Invoice English9155 Ashwini MetkariNo ratings yet

- Government of India extends tax filing deadlinesDocument2 pagesGovernment of India extends tax filing deadlinesSarang BondeNo ratings yet

- APEX EN Team Newsletter 7 2020 PDFDocument15 pagesAPEX EN Team Newsletter 7 2020 PDFMadalina LacatusuNo ratings yet

- 2020MCNo13 1 PDFDocument2 pages2020MCNo13 1 PDFMartinCroffsonNo ratings yet

- Pursuant To SEC Notice Dated 18 March 2020Document2 pagesPursuant To SEC Notice Dated 18 March 2020MartinCroffsonNo ratings yet

- 1 - BOI-Advisory - Dated March 20 20Document2 pages1 - BOI-Advisory - Dated March 20 20Nicole PTNo ratings yet

- Aino Communique 114th Edition Apr 23Document12 pagesAino Communique 114th Edition Apr 23Swathi JainNo ratings yet

- Advance Account: Accounting StandardsDocument49 pagesAdvance Account: Accounting StandardsgimNo ratings yet

- PressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFDocument2 pagesPressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFSaBoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MITSUBISHI CORPORATION ENTITLED TO REFUNDDocument5 pagesMITSUBISHI CORPORATION ENTITLED TO REFUNDDoogie ReynaldoNo ratings yet

- FASB ASC Topic 740: Income TaxesDocument42 pagesFASB ASC Topic 740: Income TaxesMo ZhuNo ratings yet

- Vat 7 CDocument3 pagesVat 7 CDylan Ramasamy67% (3)

- VOID : 7/12/2021 7/18/2021 XXX-XX-4525 Elite Hotline # 800 423-5595 Option 2Document1 pageVOID : 7/12/2021 7/18/2021 XXX-XX-4525 Elite Hotline # 800 423-5595 Option 2Ana Perone MenolascinaNo ratings yet

- Bitumen Prices Wef 01-02-11Document1 pageBitumen Prices Wef 01-02-11Vizag RoadsNo ratings yet

- Introduction to transfer taxes and succession conceptsDocument12 pagesIntroduction to transfer taxes and succession conceptsErica XaoNo ratings yet

- Medical PolicyDocument1 pageMedical PolicyAshok Dangwal100% (4)

- Tax Fraud Session with Eminent SpeakersDocument2 pagesTax Fraud Session with Eminent SpeakersSavyasachiNo ratings yet

- FNSTPB401 Student Assessment TasksDocument32 pagesFNSTPB401 Student Assessment Tasksdeathnote lNo ratings yet

- CIR vs. Aichi Forging Company of AsiaDocument27 pagesCIR vs. Aichi Forging Company of AsiaChristle CorpuzNo ratings yet

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023TARUN PRASADNo ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- First QuizDocument3 pagesFirst QuizMac Kerwin VisdaNo ratings yet

- Cambridge International AS & A Level: Economics 9708/23 October/November 2022Document15 pagesCambridge International AS & A Level: Economics 9708/23 October/November 2022Andrew BadgerNo ratings yet

- RTI Application Template For Income Tax RefundDocument2 pagesRTI Application Template For Income Tax Refundterrylibra81No ratings yet

- ABS CBN V CTADocument7 pagesABS CBN V CTAcaloytalaveraNo ratings yet

- Pay Stub Portal3Document1 pagePay Stub Portal3cwhite2150No ratings yet

- Solved Mrs Carr Made The Following Interest Payments Determine The ExtentDocument1 pageSolved Mrs Carr Made The Following Interest Payments Determine The ExtentAnbu jaromiaNo ratings yet

- Goods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLADocument30 pagesGoods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAKrishna ShuklaNo ratings yet

- Iesco Online Bill DecemberDocument1 pageIesco Online Bill Decembermuhammad awais IslamNo ratings yet

- Taxation CH 6Document2 pagesTaxation CH 6Kristel Nuyda LobasNo ratings yet

- Income Tax Fundamentals 2019 37th Edition Whittenburg Test BankDocument11 pagesIncome Tax Fundamentals 2019 37th Edition Whittenburg Test BankLindaBrownoaeg100% (58)

- Full Title SearchDocument41 pagesFull Title Searchagold73100% (2)

- Diluted EPS Excel TemplateDocument5 pagesDiluted EPS Excel Templateroneldo asasNo ratings yet

- CIR v. ArieteDocument4 pagesCIR v. ArieteMJ Cems100% (2)

- Salaries and WagesDocument14 pagesSalaries and WagesNicole FuderananNo ratings yet

- Income Tax 2nd PretestDocument3 pagesIncome Tax 2nd PretestEllaMay Delazerna0% (1)

- PILOT AgreementDocument4 pagesPILOT AgreementThe GazetteNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Prem KumarNo ratings yet

- Receipt CS-6686456Document1 pageReceipt CS-6686456Jean OrsayNo ratings yet