Professional Documents

Culture Documents

Financial Risk: 5.4 Conclusions

Uploaded by

Đỗ Viết Hà TXA2HNOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Risk: 5.4 Conclusions

Uploaded by

Đỗ Viết Hà TXA2HNCopyright:

Available Formats

Consequently, insufficient IAS implementation shelters Vietnamese banks from foreign competition as

non performing loans are systematically understated. At the same time, systematic risk in the banking

sector is accelerating. An example is the most recent use of derivatives, while no Vietnamese

accounting standards exist or are in the drafting stage.

Financial risk

Capital adequacy ratios (CAR) for Vietnamese banks are, according to international standards, very

low. A proper valuation of recent recapitalization by means of Treasury bonds (non-tradable) and

NPL, including directed lending would give an even worse picture. Vietnamese banks, especially

SOCBs, are extremely leveraged. In addition the maturity mismatch of liabilities and assets is

administrated and unhealthy large. A significant increase of sources of funds would cause a severe

margin crunch and might jeopardize survivability of banks.

5.4 Conclusions

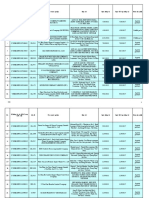

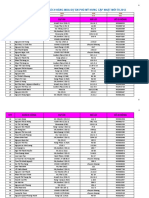

The following table illustrates Vietnam’s banking sector competitiveness in comparison with other

countries in the region:

Table 11: Competitiveness of Viet nam’s banking and finance sector

# Countries General finance ranking General finance ranking for

for 2001 2003

1 Viet Nam 47 43

2 China 20 21

3 Singapore 3 3

4 Malaysia 21 22

5 Thailand 26 24

6 Indonesia 50 46

7 Philippines 36 34

Source: IMF 2003; WEF

Beside the banking system itself, the following issues will arise during the integration process:

Exogenous risks from international and regional banking systems: opening the domestic

financial market will increase risks within the market due to external impacts, and will erase the

probability of exploiting the gap between domestic and international interest rates;

Economy of scale and customer distribution channels will be lost. At present, advantages in

market share, customers and distribution channels lie in the hands of domestic banks. However,

limitation and discriminatory treatment are expected to be abandoned after 2010. The scale of

operation and approaches to the market, customer segments, and the types of services provided

by foreign banks will therefore increase. At that point, Vietnamese banks will have to relinquish a

chunk of their market share to foreign banks;

Investment in modern technology. With their limited financial and operational capacity, the

modernization challenge has turned into a large pressure. If new banking technology is not

planned for and adopted, banks will continue to take unnecessary risks and an inefficient use of

resources;

42

You might also like

- The COVID-19 Crisis and Banking System Resilience: Simulation of Losses On Non-Performing Loans and Policy ImplicationsDocument52 pagesThe COVID-19 Crisis and Banking System Resilience: Simulation of Losses On Non-Performing Loans and Policy ImplicationsFungsional PenilaiNo ratings yet

- Experience in Managing Passive Operations by Banks in Developed CountriesDocument4 pagesExperience in Managing Passive Operations by Banks in Developed CountriesAcademic JournalNo ratings yet

- Banking Operations & Credit Analysis: Challenges & Issues Faced by Icici Bank and Banks in GeneralDocument3 pagesBanking Operations & Credit Analysis: Challenges & Issues Faced by Icici Bank and Banks in GeneralMonal DeyNo ratings yet

- Experience in Managing Passive Operations by Banks in Developed CountriesDocument5 pagesExperience in Managing Passive Operations by Banks in Developed CountriesAcademic JournalNo ratings yet

- Case Study Report - Group 4Document9 pagesCase Study Report - Group 4Tavleen KaurNo ratings yet

- Fintech and the Future of Finance: Market and Policy ImplicationsFrom EverandFintech and the Future of Finance: Market and Policy ImplicationsNo ratings yet

- Predictive Analysis of Borrower Charge Off: CAL CourseDocument45 pagesPredictive Analysis of Borrower Charge Off: CAL CourseSakshi PandyaNo ratings yet

- Part 3: Proposal of Recommendation For Credit Card Service Development at Vietinbank 3.1 Vietinbank Achivements in 2019Document3 pagesPart 3: Proposal of Recommendation For Credit Card Service Development at Vietinbank 3.1 Vietinbank Achivements in 2019Sữa ChuaNo ratings yet

- 1 s2.0 S1544612323000314 MainDocument8 pages1 s2.0 S1544612323000314 MainAakash DebnathNo ratings yet

- To Minh ThongDocument63 pagesTo Minh ThongDeependra Singh ShekhawatNo ratings yet

- Assignment 1 CB Vishal Vangwad FinalDocument4 pagesAssignment 1 CB Vishal Vangwad FinalVishal VangwadNo ratings yet

- TRM Report ViettinbankDocument22 pagesTRM Report ViettinbankNinh Thị Ánh NgọcNo ratings yet

- Fintech and The Future of FinanceDocument108 pagesFintech and The Future of FinanceBekele Guta GemeneNo ratings yet

- Working Paper: The Banking System of Vietnam After The Accession To WTO: Transition and Its ChallengesDocument26 pagesWorking Paper: The Banking System of Vietnam After The Accession To WTO: Transition and Its ChallengeserickaNo ratings yet

- Stateof Fin Techin ASEANDocument37 pagesStateof Fin Techin ASEANHòa TrầnNo ratings yet

- Improving The Loaning Process in Commercial BanksDocument6 pagesImproving The Loaning Process in Commercial BanksCentral Asian StudiesNo ratings yet

- K20404C Final-TestDocument34 pagesK20404C Final-TestNgọc Hoàng Thị BảoNo ratings yet

- FinTech and Banking DisruptionDocument13 pagesFinTech and Banking DisruptionMaru MasNo ratings yet

- Road Map for Developing an Online Platform to Trade Nonperforming Loans in Asia and the PacificFrom EverandRoad Map for Developing an Online Platform to Trade Nonperforming Loans in Asia and the PacificNo ratings yet

- Digital Disruption in Banking and Its Impact On CompetitionDocument50 pagesDigital Disruption in Banking and Its Impact On CompetitioneffulgentflameNo ratings yet

- RiskmanagementchapterDocument16 pagesRiskmanagementchapterDeva BeharaNo ratings yet

- No Theme Time: Banking and Finance Sector Prioritises Cyber SecurityDocument4 pagesNo Theme Time: Banking and Finance Sector Prioritises Cyber SecurityHarmoniousMUSICNo ratings yet

- Paolaf 1Document123 pagesPaolaf 1ثقتي بك ياربNo ratings yet

- Challenges Faced by Banking Industry: AssignmentDocument7 pagesChallenges Faced by Banking Industry: Assignmentkirtan patelNo ratings yet

- BouteraaDocument12 pagesBouteraavasu guptaNo ratings yet

- Modelo de Evaluación de Deudas Vencidas en Un Banco Comercial Utilizando Tecnologías Neuro-FuzzyDocument20 pagesModelo de Evaluación de Deudas Vencidas en Un Banco Comercial Utilizando Tecnologías Neuro-FuzzyjoseNo ratings yet

- Batten, J., & Vo, X. V. (2019) .Document13 pagesBatten, J., & Vo, X. V. (2019) .ShinyeNo ratings yet

- Session 8-4: Financial Education in The Digital Age Experience From Viet Nam by Dinh Thi Thanh VanDocument21 pagesSession 8-4: Financial Education in The Digital Age Experience From Viet Nam by Dinh Thi Thanh VanADBI EventsNo ratings yet

- 2020 Ccaf Fintech Innovation Western BalkansDocument94 pages2020 Ccaf Fintech Innovation Western BalkansKate LowNo ratings yet

- Managing the Development of Digital Marketplaces in AsiaFrom EverandManaging the Development of Digital Marketplaces in AsiaNo ratings yet

- Sloboda Contemporary Challenges and Risks of Retail BankingDocument11 pagesSloboda Contemporary Challenges and Risks of Retail BankingAngelina NahakNo ratings yet

- Bispap76c PDFDocument18 pagesBispap76c PDFAbdou SoumahNo ratings yet

- Overview of The Greek Financial System: January 2017 B GDocument53 pagesOverview of The Greek Financial System: January 2017 B GVenture ConsultancyNo ratings yet

- Case Analysis of Philippine National Bank: Ramon Magsaysay Technological University Masinloc Campus Masinloc, ZambalesDocument14 pagesCase Analysis of Philippine National Bank: Ramon Magsaysay Technological University Masinloc Campus Masinloc, Zambalesphejnosaj_23No ratings yet

- Banking in Crisis: How strategic trends will change the banking business of the futureFrom EverandBanking in Crisis: How strategic trends will change the banking business of the futureNo ratings yet

- NHTM Group 8 Report 1Document14 pagesNHTM Group 8 Report 1Huyen TranNo ratings yet

- Proposal Sajjan - Final 5-11Document12 pagesProposal Sajjan - Final 5-11yazeed mohailanNo ratings yet

- 8 e Banking Challenges Status Trends Policy Issues 21-12-2007Document18 pages8 e Banking Challenges Status Trends Policy Issues 21-12-2007phuong_mkNo ratings yet

- Consumer Banking in PakistanDocument77 pagesConsumer Banking in Pakistannumair1989No ratings yet

- Group Assignment - Group 2Document48 pagesGroup Assignment - Group 2Đình MinhNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- The Increased Role of Foreign Bank Entry in Emerging MarketsDocument8 pagesThe Increased Role of Foreign Bank Entry in Emerging MarketsMihai NegoiţescuNo ratings yet

- International Debt Report 2023Document214 pagesInternational Debt Report 2023bpdaoudaNo ratings yet

- Opportunities and Challenges Facing The Financial Sector in Pakistan: HypothesisDocument2 pagesOpportunities and Challenges Facing The Financial Sector in Pakistan: HypothesisSohailuddin AlaviNo ratings yet

- 5 Russian+LawDocument10 pages5 Russian+Lawavicenna.deskartian.margani-2020No ratings yet

- Research Proposal Sample 1Document12 pagesResearch Proposal Sample 1Quang Minh Le100% (1)

- FinalDocument24 pagesFinalNgọc Hoàng Thị BảoNo ratings yet

- Analysis of Frauds in Indian Banking SectorDocument4 pagesAnalysis of Frauds in Indian Banking SectorEditor IJTSRD100% (1)

- CIS EffectivenessDocument36 pagesCIS EffectivenesspeterdawhizNo ratings yet

- Report TrangDocument22 pagesReport TrangThanh Kim Phuc NguyenNo ratings yet

- Online Banking FinalDocument34 pagesOnline Banking FinalSuman Hazra100% (1)

- 3218 Uyen Nguyen My 10210652 BS A1.1 12612 1050291616Document29 pages3218 Uyen Nguyen My 10210652 BS A1.1 12612 1050291616Uyên Nguyễn MỹNo ratings yet

- The Impact of Internet Finance On The Systemic Risk of China's Listed Commercial BanksDocument11 pagesThe Impact of Internet Finance On The Systemic Risk of China's Listed Commercial BanksKhoa BùiNo ratings yet

- Banking Challenges 09AC31 PsgimDocument10 pagesBanking Challenges 09AC31 Psgimscribd09ac31No ratings yet

- Emfrm+2023 903 913Document11 pagesEmfrm+2023 903 913DonaldNo ratings yet

- Thet Oo Maung (MBF - 70)Document68 pagesThet Oo Maung (MBF - 70)Yar LayNo ratings yet

- Financial Services Focus ReportDocument24 pagesFinancial Services Focus ReportDarj K.No ratings yet

- E BankingDocument64 pagesE BankingmaarzzbNo ratings yet

- Krishna GosaviDocument16 pagesKrishna Gosavikrishna gosaviNo ratings yet

- pathways_ls4_2e_u10_test_0Document7 pagespathways_ls4_2e_u10_test_0Đỗ Viết Hà TXA2HNNo ratings yet

- Views: ColumnistDocument1 pageViews: ColumnistĐỗ Viết Hà TXA2HNNo ratings yet

- Views: Your LettersDocument1 pageViews: Your LettersĐỗ Viết Hà TXA2HNNo ratings yet

- Extracted Pages From New Scientist - 04-01-2020Document1 pageExtracted Pages From New Scientist - 04-01-2020Đỗ Viết Hà TXA2HNNo ratings yet

- Views: From The ArchivesDocument1 pageViews: From The ArchivesĐỗ Viết Hà TXA2HNNo ratings yet

- Science of The Renaissance: Discovery ToursDocument1 pageScience of The Renaissance: Discovery ToursĐỗ Viết Hà TXA2HNNo ratings yet

- Wearing Shoes Can Weaken Ankle Bones: Potatoes Engineered To Kill Major PestDocument1 pageWearing Shoes Can Weaken Ankle Bones: Potatoes Engineered To Kill Major PestĐỗ Viết Hà TXA2HNNo ratings yet

- 7.1 Recommendations For The Legal and Policy FrameworkDocument1 page7.1 Recommendations For The Legal and Policy FrameworkĐỗ Viết Hà TXA2HNNo ratings yet

- There Is No Plan A: InsightDocument1 pageThere Is No Plan A: InsightĐỗ Viết Hà TXA2HNNo ratings yet

- Darwin's Galapagos With Jo Ruxton: Discovery ToursDocument1 pageDarwin's Galapagos With Jo Ruxton: Discovery ToursĐỗ Viết Hà TXA2HNNo ratings yet

- Nerves at Risk From Genital Surgery: An Increasing Understanding of Clitoral Anatomy Could Prevent Harm To PatientsDocument1 pageNerves at Risk From Genital Surgery: An Increasing Understanding of Clitoral Anatomy Could Prevent Harm To PatientsĐỗ Viết Hà TXA2HNNo ratings yet

- 7.2 Recommendations On A Development StrategyDocument1 page7.2 Recommendations On A Development StrategyĐỗ Viết Hà TXA2HNNo ratings yet

- Huge Optical Computer Could Outpace Quantum Computing: Tiny Bits of Graphene Help Reveal Secrets of Ice FormationDocument1 pageHuge Optical Computer Could Outpace Quantum Computing: Tiny Bits of Graphene Help Reveal Secrets of Ice FormationĐỗ Viết Hà TXA2HNNo ratings yet

- StructuralDocument1 pageStructuralĐỗ Viết Hà TXA2HNNo ratings yet

- Vietnam Country Profile 2005Document1 pageVietnam Country Profile 2005Đỗ Viết Hà TXA2HNNo ratings yet

- Bank ModernizationDocument1 pageBank ModernizationĐỗ Viết Hà TXA2HNNo ratings yet

- 1 Appendix 1 - Summary of The Development and Reform Process of Viet Nam Banking Sector 1.1 Banking Sector Prior To 1989Document1 page1 Appendix 1 - Summary of The Development and Reform Process of Viet Nam Banking Sector 1.1 Banking Sector Prior To 1989Đỗ Viết Hà TXA2HNNo ratings yet

- 7 RecommendationsDocument1 page7 RecommendationsĐỗ Viết Hà TXA2HNNo ratings yet

- 6 Analysis of Impact of LiberalizationDocument1 page6 Analysis of Impact of LiberalizationĐỗ Viết Hà TXA2HNNo ratings yet

- Table 1: Policy RoadmapDocument1 pageTable 1: Policy RoadmapĐỗ Viết Hà TXA2HNNo ratings yet

- 6.2.2 Demand SideDocument1 page6.2.2 Demand SideĐỗ Viết Hà TXA2HNNo ratings yet

- Control and Evaluation: 7.4 Other RecommendationsDocument1 pageControl and Evaluation: 7.4 Other RecommendationsĐỗ Viết Hà TXA2HNNo ratings yet

- Extracted Pages From Ren Luyen Ky Nang Doc Hieu Tieng Anh 2Document2 pagesExtracted Pages From Ren Luyen Ky Nang Doc Hieu Tieng Anh 2Đỗ Viết Hà TXA2HNNo ratings yet

- 1.3 Limitation of The StudyDocument1 page1.3 Limitation of The StudyĐỗ Viết Hà TXA2HNNo ratings yet

- Foreword: Liberalization in Viet NamDocument1 pageForeword: Liberalization in Viet NamĐỗ Viết Hà TXA2HNNo ratings yet

- B 12 Có Đáp Án Năm 2020 - 2021Document52 pagesB 12 Có Đáp Án Năm 2020 - 2021Hà LêNo ratings yet

- M e m o r I es: (n) Nghề nghiệp (a) Quan trọngDocument42 pagesM e m o r I es: (n) Nghề nghiệp (a) Quan trọngTrangNo ratings yet

- Data Hay Bán Hàng Live StreamDocument160 pagesData Hay Bán Hàng Live StreamBảo hộ lao động Vĩnh PhúcNo ratings yet

- Garment Manufacturing /mattress Animal Feed (Thuc An Gia Suc/thuy Hai San)Document18 pagesGarment Manufacturing /mattress Animal Feed (Thuc An Gia Suc/thuy Hai San)Alina PhanNo ratings yet

- Danh sách tổng hợp (cập nhật ngày 06.7.2023)Document5 pagesDanh sách tổng hợp (cập nhật ngày 06.7.2023)Thuy Linh NguyenNo ratings yet

- Sap - WRP - 2022 - W03 - 17-23.01.2022 - To Revise and ResubmitDocument46 pagesSap - WRP - 2022 - W03 - 17-23.01.2022 - To Revise and ResubmitMinh ThuậnNo ratings yet

- Vovinam - File Thuyet Tring Bang WordDocument4 pagesVovinam - File Thuyet Tring Bang Wordlee hoangNo ratings yet

- Stratigic Managemen - SIM336Document21 pagesStratigic Managemen - SIM336Tít Thò Lò100% (1)

- Hoc Vien Ngan Hang: de Thi Ket Thuc Hoc Phan Kinh Te Hoc Moi Tru NG Eco11A Khoa Kinh TeDocument2 pagesHoc Vien Ngan Hang: de Thi Ket Thuc Hoc Phan Kinh Te Hoc Moi Tru NG Eco11A Khoa Kinh TeTrịnh Việt ĐứcNo ratings yet

- FBS Duty RosterDocument16 pagesFBS Duty RosterQuy TranxuanNo ratings yet

- Vietnam Political Risk - NewsDocument4 pagesVietnam Political Risk - NewshuongleloveNo ratings yet

- 86f4be500e7cac40b5b214de9577dd2eDocument31 pages86f4be500e7cac40b5b214de9577dd2e10-Gia KhôiNo ratings yet

- Robocon 2007 ThemeDocument15 pagesRobocon 2007 ThemeRAGHAV MAHAJAN BTechNo ratings yet

- Solutions Manual For Calculus For Business Economics and The Social and Life Scienc Brief Edition 11th Edition by HoffmannDocument10 pagesSolutions Manual For Calculus For Business Economics and The Social and Life Scienc Brief Edition 11th Edition by Hoffmannhuyhue11220% (1)

- 466 - DS KH Dat Nen Phu My HungDocument92 pages466 - DS KH Dat Nen Phu My Hungsơn trầnNo ratings yet

- Marketing Management 1Document19 pagesMarketing Management 1Mỹ TiênNo ratings yet

- Đề thi Lam Sơn - Thanh Hoá - 13 - 3Document5 pagesĐề thi Lam Sơn - Thanh Hoá - 13 - 3Đỗ LinhNo ratings yet

- JPS-router Jig Handle Cover SED PDFDocument1 pageJPS-router Jig Handle Cover SED PDFMiriam JonesNo ratings yet

- I/ Thêm am, is, hoặc are vào những câu sau đâyDocument2 pagesI/ Thêm am, is, hoặc are vào những câu sau đâyPhúc NguyễnNo ratings yet

- Stop AI ProposalDocument22 pagesStop AI ProposalBeo ThaiNo ratings yet

- Electrosteel CaseDocument4 pagesElectrosteel CaseSumit SrivastavaNo ratings yet

- This Study Resource Was: Vietnam AirlinesDocument9 pagesThis Study Resource Was: Vietnam AirlinesNgọcc Lann100% (2)

- Zal TVDocument35 pagesZal TVTUENo ratings yet

- Ôn tập sau TếtDocument6 pagesÔn tập sau TếtMinh ThưNo ratings yet

- 993 1984 1 SMDocument12 pages993 1984 1 SMAnh Trần QuỳnhNo ratings yet

- 8b7a06d13b285552e9cf244a44f1537cDocument12 pages8b7a06d13b285552e9cf244a44f1537cTo Vinh BangNo ratings yet

- 180 Bài Tập Viết Lại Câu Tiếng Anh - KhoaDocument17 pages180 Bài Tập Viết Lại Câu Tiếng Anh - Khoaquynguyenn0405No ratings yet

- Vietnam Paint MarketDocument3 pagesVietnam Paint Marketmeocon124No ratings yet

- IMC BrandDocument12 pagesIMC BrandMinh Thuận Nguyễn HàNo ratings yet

- Vietnam Rice Supplier Audit RFQ (1) 7Document2 pagesVietnam Rice Supplier Audit RFQ (1) 7Tam Van LêNo ratings yet