Professional Documents

Culture Documents

Table 1: Policy Roadmap

Uploaded by

Đỗ Viết Hà TXA2HNOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table 1: Policy Roadmap

Uploaded by

Đỗ Viết Hà TXA2HNCopyright:

Available Formats

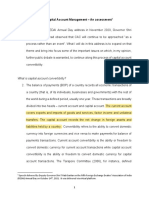

Table 1: Policy roadmap

Year Policy Roadmap

1991 Reduce state budget deficit to less than 5%, required reserves to less than 10%

1997 Apply a flexible exchange rate mechanism

2002 Establish Social and Policy Bank

2002 Apply a negotiable interest rate mechanism

2004 Allow the establishment of 100% foreign-owned financial companies

2007 Remove limitations on 100% foreign-owned insurance companies

2011 Remove limitations on 100% foreign-owned banks

Source: State Bank of Viet Nam, 2005

The nature of international integration in financial services can be observed in different ways. It is a

process by which countries and regions become open to the involvement of external elements in

financial areas, including capital (direct and indirect investment), technology, credit, and highly skilled

labor. International financial integration is also a process by which domestic factors enter other

countries2.

International financial integration may be pursued by nations in response to external factors.

International economic organizations or alliances (such as APEC, WTO, or ASEAN) can put pressure

on their member countries, or members may be obliged to follow organizational decisions governing

the opening of markets. As international financial integration is a process of adjusting business

operations, laws, financial policies, and regulations, processes must aim to harmonize and unify both

external and internal elements.

International integration of financial services is also a process of alignment of institutions, regulations,

policies, standards, principles, and laws that govern finance. The essence of the alignment process

lies with different countries commonly agreeing on financial treatments (tax, insurance and banking)

for the benefit of each other’s economic activities. The process is also the result of adjustments made

by the nation and its enterprises. The greater integration is the more practices and common

regulations aimed at uniformity and harmonization of financial policies are required.

International integration of finance is a continuous process, as the driving force behind it is the

development of the scientific, technological and economic powers of a given nation. As these factors

grow, financial integration is sooner realized and reflected in a wider range of aspects, such as the

extent of capital and labor exchanged. International practices increase and develop between the

financial relationships of organizations and institutions.

Finally, international financial integration is a cooperative process. Cooperation between nations

develops in accordance with the need to rely upon one another. However, some uncertainty remains

2

According to GATS, the corresponding “mode of supply” in which services are delivered: i) Mode 1 – “Cross Border” supply

occurs when a service supplier located in one country provide services to a customer in another country; ii) Mode 2 –

“Consumption abroad” occurs when a national of one country travels to another country, where it is then supplied with the

service; iii) Mode 3 – A service supplier is said to have a “Commercial Presence” when it sets up a branch or subsidiary in

another country in order to provide a service there; and iv) Mode 4 – “Presence of a natural person” refers to situations in

which a person travels from one country to another and there provides a service to a customer.

You might also like

- ADB International Investment Agreement Tool Kit: A Comparative AnalysisFrom EverandADB International Investment Agreement Tool Kit: A Comparative AnalysisNo ratings yet

- The Role of Financial System in The EconomyDocument15 pagesThe Role of Financial System in The Economymubarek100% (2)

- External Debt ManagementDocument55 pagesExternal Debt Managementajayajay83No ratings yet

- Assimil Brazilian Portuguese (Portuguese Edition)Document15 pagesAssimil Brazilian Portuguese (Portuguese Edition)robertocarmur43% (23)

- Guidelines For The Use of Digital Detector Arrays and Computed Radiology For Aerospace Casting Inspections PDFDocument32 pagesGuidelines For The Use of Digital Detector Arrays and Computed Radiology For Aerospace Casting Inspections PDFDagoberto AguilarNo ratings yet

- Presentation On International Financial ManagementDocument17 pagesPresentation On International Financial ManagementSukruth SNo ratings yet

- Sky & Telescope - February 2016 (Gnv64)Document82 pagesSky & Telescope - February 2016 (Gnv64)bogarguz100% (1)

- International Financial Management Notes Unit-1Document15 pagesInternational Financial Management Notes Unit-1Geetha aptdcNo ratings yet

- Eco International Monetary FundDocument34 pagesEco International Monetary FundAbbasNo ratings yet

- Effect of External Public Debt On The Exchange Rate in KenyaDocument22 pagesEffect of External Public Debt On The Exchange Rate in KenyaIJEBR100% (1)

- ABLSDocument86 pagesABLSRenée Alejandra100% (2)

- Boston Consultancy Group Matrix MM101Document8 pagesBoston Consultancy Group Matrix MM101Gift Simau100% (2)

- Applied Statistics in Business and Economics 5th Edition Doane Solutions ManualDocument26 pagesApplied Statistics in Business and Economics 5th Edition Doane Solutions ManualSharonMartinezfdzp100% (44)

- Financial Integration: Largely Adopted From Aziakpono, 2007Document22 pagesFinancial Integration: Largely Adopted From Aziakpono, 2007Fungai MukundiwaNo ratings yet

- SETHUDocument12 pagesSETHUMadhavi M KatakiaNo ratings yet

- Managing Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedDocument6 pagesManaging Foreign Debt and Liquidity: India's Experience: Payments Chaired by DR C Rangarajan. The Committee RecommendedSaurav SinghNo ratings yet

- TMIF Chapter ThreeDocument40 pagesTMIF Chapter ThreeYibeltal AssefaNo ratings yet

- Financial Globalisation.1Document7 pagesFinancial Globalisation.1Steeves DevaletNo ratings yet

- IRL 3109 - Lecture 6 (2020-12-10)Document26 pagesIRL 3109 - Lecture 6 (2020-12-10)nolissaNo ratings yet

- Economic Governance Watch 10-2022 - Illicit Financial FlowsDocument5 pagesEconomic Governance Watch 10-2022 - Illicit Financial FlowsTendai DubeNo ratings yet

- Module - 1: OF International Financial ManagementDocument37 pagesModule - 1: OF International Financial Management9832155922No ratings yet

- FM 603 Unit 1Document10 pagesFM 603 Unit 1Ritik SinghNo ratings yet

- 4.B IMF Lending and ConditionalityDocument12 pages4.B IMF Lending and Conditionalityarian.sajjadi7No ratings yet

- The Impact of International Corporate Law in EgyptDocument20 pagesThe Impact of International Corporate Law in EgyptshroukNo ratings yet

- 06 Banking CH 6Document8 pages06 Banking CH 6sabit hussenNo ratings yet

- Final Project CompDocument81 pagesFinal Project Compshahsam17No ratings yet

- Determinants of The Structure of Financial MarketsDocument3 pagesDeterminants of The Structure of Financial MarketsAbhishek MauryaNo ratings yet

- Ifs - Cia 1aDocument27 pagesIfs - Cia 1alakshitaNo ratings yet

- 001 Article A001 enDocument47 pages001 Article A001 enGustavoMamaniMamaniNo ratings yet

- Chapter 1 SolutionDocument2 pagesChapter 1 SolutionRicha Joshi100% (1)

- This Content Downloaded From 213.55.83.49 On Fri, 16 Dec 2022 11:03:41 UTCDocument34 pagesThis Content Downloaded From 213.55.83.49 On Fri, 16 Dec 2022 11:03:41 UTCabdiyooNo ratings yet

- ITB 7th SemDocument7 pagesITB 7th SemSweta BastiaNo ratings yet

- Ifm Assignment: - Babitha P Mba-B (121823602050)Document4 pagesIfm Assignment: - Babitha P Mba-B (121823602050)Hanuman PotluriNo ratings yet

- International Finance and Accounting: IMS-BOP-IprDocument29 pagesInternational Finance and Accounting: IMS-BOP-IprMD. MAHMUDUR RAHMAN FAHIMNo ratings yet

- Chapter One 1.1 Background To The StudyDocument19 pagesChapter One 1.1 Background To The StudyzubairNo ratings yet

- Chap 13Document5 pagesChap 13Jade Marie FerrolinoNo ratings yet

- Capital Mobility in Developing CountriesDocument41 pagesCapital Mobility in Developing CountriesEmir TermeNo ratings yet

- Iifm AssignmentDocument3 pagesIifm Assignmentashu1286No ratings yet

- FinancialDocument6 pagesFinancialJaalali A GudetaNo ratings yet

- Mid-Term Exam-International Financial ManagementDocument6 pagesMid-Term Exam-International Financial ManagementFIRDA SULAININo ratings yet

- Report On India's Balance of Payments Crisis and It's ImpactsDocument31 pagesReport On India's Balance of Payments Crisis and It's ImpactsRavi RockNo ratings yet

- Unit 1 IfmDocument19 pagesUnit 1 IfmMohammed HussainNo ratings yet

- Unit 2 IFM Final - MergedDocument30 pagesUnit 2 IFM Final - MergedTushar KhandelwalNo ratings yet

- RBI Speech On Capital Account ConvertibilityDocument12 pagesRBI Speech On Capital Account Convertibilitynisha vermaNo ratings yet

- 5 International Business Environment - 240126 - 220714Document33 pages5 International Business Environment - 240126 - 220714xonline022No ratings yet

- Abstract:: Main Job of IMF: 1) SurveillanceDocument10 pagesAbstract:: Main Job of IMF: 1) SurveillancePrafulla TekriwalNo ratings yet

- Indian Telco FDIDocument27 pagesIndian Telco FDISuraj Singh ChauhanNo ratings yet

- CH 1 - Scope of International FinanceDocument7 pagesCH 1 - Scope of International Financepritesh_baidya269100% (3)

- Chapter 7 Exchange ControlsDocument15 pagesChapter 7 Exchange ControlsMiko DimaandalNo ratings yet

- 421 IFM NotesDocument55 pages421 IFM NotesJ.M Sai TejaNo ratings yet

- Individual Assignments Section A - Short Answer Questions: 1) Summarize The Five Main Motives That Drive The Decision To Initiate FDIDocument15 pagesIndividual Assignments Section A - Short Answer Questions: 1) Summarize The Five Main Motives That Drive The Decision To Initiate FDIRogerchua5901No ratings yet

- International FinanceDocument39 pagesInternational FinancesrinivasNo ratings yet

- Unit VDocument9 pagesUnit VDr.P. Siva RamakrishnaNo ratings yet

- Naira Swap, Electioneering and Insecurity Menace in NigeriaDocument6 pagesNaira Swap, Electioneering and Insecurity Menace in NigeriaOlusegun Alaba Adebayo100% (1)

- g20 Background Brief Final Anti-Corruption 2-27-2012Document4 pagesg20 Background Brief Final Anti-Corruption 2-27-2012InterActionNo ratings yet

- Lessons From The South African ExperienceDocument15 pagesLessons From The South African ExperienceEmir TermeNo ratings yet

- Lecture 5 Internationalization Strategies For Financial ServicesDocument28 pagesLecture 5 Internationalization Strategies For Financial ServicesSalathiel OjageNo ratings yet

- Changing Landscape of Finance in India During Last Decade: Finance and The EconomyDocument9 pagesChanging Landscape of Finance in India During Last Decade: Finance and The EconomyVidhi BansalNo ratings yet

- Indian Financial SystemDocument4 pagesIndian Financial SystemLbsim-akash100% (2)

- FM 105 - Banking and Financial Institutions: Expanding BSP's Regulatory Power Under The New Central Bank ActDocument23 pagesFM 105 - Banking and Financial Institutions: Expanding BSP's Regulatory Power Under The New Central Bank ActKimberly Solomon JavierNo ratings yet

- Chapter SummaryDocument4 pagesChapter SummaryIndri FitriatunNo ratings yet

- Classens, K. and Van Horen, N. (2012) Foreign Banks: Trends, Impact and Financial Stability', IMF Working Paper, International Monetary FundDocument4 pagesClassens, K. and Van Horen, N. (2012) Foreign Banks: Trends, Impact and Financial Stability', IMF Working Paper, International Monetary FundMinh VănNo ratings yet

- Individual Assignment of IFM SOLUTIONDocument32 pagesIndividual Assignment of IFM SOLUTIONGETAHUN ASSEFA ALEMUNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Report of the Inter-agency Task Force on Financing for Development 2020: Financing for Sustainable Development ReportFrom EverandReport of the Inter-agency Task Force on Financing for Development 2020: Financing for Sustainable Development ReportNo ratings yet

- pathways_ls4_2e_u10_test_0Document7 pagespathways_ls4_2e_u10_test_0Đỗ Viết Hà TXA2HNNo ratings yet

- Views: ColumnistDocument1 pageViews: ColumnistĐỗ Viết Hà TXA2HNNo ratings yet

- Views: Your LettersDocument1 pageViews: Your LettersĐỗ Viết Hà TXA2HNNo ratings yet

- Extracted Pages From New Scientist - 04-01-2020Document1 pageExtracted Pages From New Scientist - 04-01-2020Đỗ Viết Hà TXA2HNNo ratings yet

- Views: From The ArchivesDocument1 pageViews: From The ArchivesĐỗ Viết Hà TXA2HNNo ratings yet

- Science of The Renaissance: Discovery ToursDocument1 pageScience of The Renaissance: Discovery ToursĐỗ Viết Hà TXA2HNNo ratings yet

- Wearing Shoes Can Weaken Ankle Bones: Potatoes Engineered To Kill Major PestDocument1 pageWearing Shoes Can Weaken Ankle Bones: Potatoes Engineered To Kill Major PestĐỗ Viết Hà TXA2HNNo ratings yet

- 7.1 Recommendations For The Legal and Policy FrameworkDocument1 page7.1 Recommendations For The Legal and Policy FrameworkĐỗ Viết Hà TXA2HNNo ratings yet

- There Is No Plan A: InsightDocument1 pageThere Is No Plan A: InsightĐỗ Viết Hà TXA2HNNo ratings yet

- Darwin's Galapagos With Jo Ruxton: Discovery ToursDocument1 pageDarwin's Galapagos With Jo Ruxton: Discovery ToursĐỗ Viết Hà TXA2HNNo ratings yet

- Nerves at Risk From Genital Surgery: An Increasing Understanding of Clitoral Anatomy Could Prevent Harm To PatientsDocument1 pageNerves at Risk From Genital Surgery: An Increasing Understanding of Clitoral Anatomy Could Prevent Harm To PatientsĐỗ Viết Hà TXA2HNNo ratings yet

- 7.2 Recommendations On A Development StrategyDocument1 page7.2 Recommendations On A Development StrategyĐỗ Viết Hà TXA2HNNo ratings yet

- Huge Optical Computer Could Outpace Quantum Computing: Tiny Bits of Graphene Help Reveal Secrets of Ice FormationDocument1 pageHuge Optical Computer Could Outpace Quantum Computing: Tiny Bits of Graphene Help Reveal Secrets of Ice FormationĐỗ Viết Hà TXA2HNNo ratings yet

- Bank ModernizationDocument1 pageBank ModernizationĐỗ Viết Hà TXA2HNNo ratings yet

- Vietnam Country Profile 2005Document1 pageVietnam Country Profile 2005Đỗ Viết Hà TXA2HNNo ratings yet

- Financial Risk: 5.4 ConclusionsDocument1 pageFinancial Risk: 5.4 ConclusionsĐỗ Viết Hà TXA2HNNo ratings yet

- 1 Appendix 1 - Summary of The Development and Reform Process of Viet Nam Banking Sector 1.1 Banking Sector Prior To 1989Document1 page1 Appendix 1 - Summary of The Development and Reform Process of Viet Nam Banking Sector 1.1 Banking Sector Prior To 1989Đỗ Viết Hà TXA2HNNo ratings yet

- Control and Evaluation: 7.4 Other RecommendationsDocument1 pageControl and Evaluation: 7.4 Other RecommendationsĐỗ Viết Hà TXA2HNNo ratings yet

- 6 Analysis of Impact of LiberalizationDocument1 page6 Analysis of Impact of LiberalizationĐỗ Viết Hà TXA2HNNo ratings yet

- 6.2.2 Demand SideDocument1 page6.2.2 Demand SideĐỗ Viết Hà TXA2HNNo ratings yet

- 7 RecommendationsDocument1 page7 RecommendationsĐỗ Viết Hà TXA2HNNo ratings yet

- StructuralDocument1 pageStructuralĐỗ Viết Hà TXA2HNNo ratings yet

- Extracted Pages From Ren Luyen Ky Nang Doc Hieu Tieng Anh 2Document2 pagesExtracted Pages From Ren Luyen Ky Nang Doc Hieu Tieng Anh 2Đỗ Viết Hà TXA2HNNo ratings yet

- 1.3 Limitation of The StudyDocument1 page1.3 Limitation of The StudyĐỗ Viết Hà TXA2HNNo ratings yet

- Foreword: Liberalization in Viet NamDocument1 pageForeword: Liberalization in Viet NamĐỗ Viết Hà TXA2HNNo ratings yet

- Tree (C)Document30 pagesTree (C)बानि तमिन्No ratings yet

- Verilog HDL: Special ClassesDocument11 pagesVerilog HDL: Special ClassesUnique ProNo ratings yet

- MGW Health CheckDocument2 pagesMGW Health Checkkaramdo0% (1)

- Lesson 1 Exploring Indian LiteratureDocument5 pagesLesson 1 Exploring Indian LiteratureAthan MensalvasNo ratings yet

- Noli and El FiliDocument2 pagesNoli and El FiliGeramei Vallarta TejadaNo ratings yet

- STP280 - 24Vd - UL (H4 Connector) - AZDocument2 pagesSTP280 - 24Vd - UL (H4 Connector) - AZkiranpandey87No ratings yet

- Penjelasan IMRAD StructureDocument2 pagesPenjelasan IMRAD Structureaji bondesNo ratings yet

- Time Value of MoneyDocument11 pagesTime Value of MoneyRajesh PatilNo ratings yet

- Conjunction and Exposition Text-2Document19 pagesConjunction and Exposition Text-2keyshalaokkiNo ratings yet

- Mathematics IDocument247 pagesMathematics IShreya PankajNo ratings yet

- Ernst Bloch Principle of Hope PDFDocument2 pagesErnst Bloch Principle of Hope PDFAdamNo ratings yet

- Cept FinalDocument14 pagesCept FinalVighnesh MalagiNo ratings yet

- 1.1.DeFacto Academy enDocument7 pages1.1.DeFacto Academy enYahya AçafNo ratings yet

- Structure Fires Caused by Hot Work: Marty AhrensDocument14 pagesStructure Fires Caused by Hot Work: Marty AhrensBurgosg ValeryNo ratings yet

- Program Orientation HandoutsDocument125 pagesProgram Orientation Handoutsapi-391214898No ratings yet

- PGCC 2022 HandbookDocument17 pagesPGCC 2022 HandbookhasnainNo ratings yet

- 1 Man Is The Crowning Glory of God's CreationDocument12 pages1 Man Is The Crowning Glory of God's CreationCaptainBreezy YeezyNo ratings yet

- AlerTox Sticks Soy PLUS ManualDocument8 pagesAlerTox Sticks Soy PLUS ManualLuis Miguel Matos OteroNo ratings yet

- ExcaDrill 45A DF560L DatasheetDocument2 pagesExcaDrill 45A DF560L DatasheetИгорь ИвановNo ratings yet

- DissertationDocument134 pagesDissertationAbbas AbbasiNo ratings yet

- Wilkins Excel SheetDocument9 pagesWilkins Excel SheetYuvraj Aayush Sisodia100% (1)

- 344W11MidTermExamI Solution PDFDocument22 pages344W11MidTermExamI Solution PDFTrường TùngNo ratings yet

- Review of The Householder's Guide To Community Defence Against Bureaucratic Aggression (1973)Document2 pagesReview of The Householder's Guide To Community Defence Against Bureaucratic Aggression (1973)Regular BookshelfNo ratings yet

- English Civic (Malaysia Unique)Document6 pagesEnglish Civic (Malaysia Unique)WAN MOHD HAFIZ BIN WAN ALI -No ratings yet