Professional Documents

Culture Documents

Boston Consultancy Group Matrix MM101

Uploaded by

Gift SimauCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boston Consultancy Group Matrix MM101

Uploaded by

Gift SimauCopyright:

Available Formats

MM101 ASSIGNMENT

Question 9

● Explain the BCG model

● With reference to Econet Wireless apply the BCG model clearly showing products in

each quadrant and the respective cash consumption and cash generation situation

● Examine the weaknesses associated with the BCG model as a product planning model

INTRODUCTION

The Ansoff and Porter models can help in deciding which strategy to adopt and are easy

models to use. However, marketers need more than these simple guidelines; they need to be

able to analyse their product offering and measure progress. Because of this the BCG model

have been developed . Boston Consultancy Group Matrix (BCG)- Using the variables of

market share and market growth rates, planners can plot their products/SBUs onto a grid

which will then suggest certain strategies that can be used. Because analysis is undertaken on

an individual basis (SBU/product) it means that firms can mix and match their efforts in order

to achieve optimum results at any given time.

The Boston Consulting Group Matrix (also known as the Boston Consulting Group analysis,

the Growth-Share Matrix, the Boston Box Matrix or Product Portfolio Matrix) was created by

Bruce D. Henderson for the Boston Consulting Group in 1970. It is a business planning tool that was

formulated to evaluate the strategic position of a firm’s brand portfolio and inform the long term

strategic planning for organisations with multiple business units or products. Its purpose is to inform

organisations consider growth opportunities by reviewing their brand portfolios to decide where to

invest, discontinue or develop products.

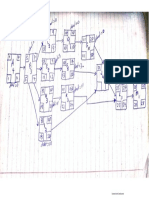

Figure 1 BCG Matrix

The BCG Matrix classifies a firm’s services or products into a 2-by-2 matrix. Each quadrant is

classified as low or high performance depending on relative market share and market growth. Once

the products/SBU’s are positioned on the matrix, strategies can be developed based on their relative

positions.

The matrix makes the following assumptions:

An increase in relative market share will result in increased cash flow

The firm benefits from utilising economies of scale and gains a cost advantage over

competitors

Growth rate above 10% is considered high and below 10% is considered low.

STARS

These are products in a high growth market and make up a sizeable portion of the market (potentially

market leaders). They generate large sums of money due to their high relative market share but also

require significant investment to fight off competition and maintain their rate of growth. Businesses

hope their Stars will become the next Cash Cows. When growth slows down

CASH COWS

These are products with high market share in a slow growing/mature industry. After years of

operating in the industry, market growth may decline and revenues stagnate. At these stage Stars

transform into Cash Cows. Given their large market share in a mature market, profits and cash flows

are high. However, because of the lower growth rate, investments should also be low. Cash Cows

typically generate cash in excess of the amount needed to maintain the business and the excess cash is

“milked” for investment in other business units i.e. Stars and Question Marks.

QUESTION MARKS (PROBLEM CHILD)

These are products with low market share in a rapidly growing market. Typically, these are

managerially intense and require significant investment and resources to increase their market share.

They are funded by products and in the Cash Cow quadrant. These products have potential to gain

market share and turn into Stars (with the right levels of support/investment) and eventually Cash

Cows when the market growth declines.

DOGS (CHARITABLY CALLED PETS)

These products have low market share in a mature slow growing market. While they are able to fund

themselves/break even and provide cash flows, they can never reach the Star quadrant. These are

typically phased out, depending on the amount already invested in them, unless they are

complimentary to an existing product or being used for a competitive purpose.

The matrix, simplified suggests that Question Marks and Stars should be funded by profits from the

Cash Cows and dogs should be divested or liquidated and the proceeds put to better use. This will

leave the business a balanced portfolio of Question Marks, Cash Cows and Stars and guarantee

positive cash flows in the future.

BCG Matrix: Cash Position for Products

Stars

Revenue + + +

Investment - - -

0

Question Marks

Revenue + +

Investment - - -_

+++

Dogs

Revenue +

Investment -

0

Cashcow

Revenue + + +

Investment -____

+ +_

Strategies suggested by the matrix are:

Build – for "Stars" to increase share, even if it means giving up short-term profits.

Hold – for "cash cows" which are strong, to preserve share.

Harvest – for weak "cash cows", where the future is poor, or for "question marks"

and "dogs" to increase short-term cash flow regardless of long-term effects.

Divest – to sell off, liquidate or delete an SBU which is a "dog" or "question mark"

draining resources.

BCG MATRIX FOR ECONET ZIMBABWE

QUESTION MARKS STARS

MARKET GROWTH

DOGS CASH COWS

MARKET SHARE

Figure 2BCG Matrix for Econet Wireless Zimbabwe

Question Marks – Econet Solar

This product has a relatively low market share in a rapidly growing market. The product has

yet to achieve a position of dominance in the market. Although it is generating funds, it still

requires a lot of investment and Econet Wireless Zimbabwe must decide if they want to

continue investing in it. Econet has the financial muscle and advantage of economies of scale

which it can utilise to give it a cost and price advantage over its competitors and to enable it

to provide solar solutions to the market on the requisite scale. While this product is

investment, management and skills intensive, Econet may opt to channel revenue from their

Cash Cows, Buddie and EcoCash towards this Question mark which could easily become a

star as consumers seek alternative energy sources going beyond the current power challenges

bedevilling the country.

Stars – Econet Broad Band

Econet Broad Band has relatively high market share in a high growth market. Statistics show

that there are more than 4.5 million (and growing) internet subscribers in the country. Econet

has firmly entrenched itself as the leader in this fast growing market through innovation –

they have the widest data coverage in the country, they were the first internet provider to

offer 4G Long Term Evolution (LTE) technology offering users download speeds of ten

times that of 3G, they are the only Apple certified LTE network in Zimbabwe and a Samsung

recommended data network of choice. The Internet has become part of everyone’s day to day

life and as such, Econet has developed solutions such as Connected Home, Connected

Lifestyle, OWNAI and Ruzivo that help consumers on a daily basis. All this product

development and investment is costly as is advertising to keep Econet’s product uppermost in

the consumers’ minds and reinforce the perception that theirs is the superior offering. Given

the market’s potential for growth the firm clearly feels this is money well spent. As the

market matures and growth declines the brand is likely to evolve into a cash cow which will

carry newly developed products into stardom.

Cash Cows – Buddy and EcoCash

Cash Cows are products with high market share in a mature/slow growing market. These

products have market dominance and require little expenditure as they have reached market

saturation point.

Buddie, Econet’s pre-paid mobile offering was launched in September 2011 now boasts over

13 million subscribers in Zimbabwe and continues to dominate the mobile voice market.

Profits and cash flows from this brand are high but because of the age of the market

investment has reduced significantly. The brand has adopted a monopoly like approach with

reluctance to promote or lower prices to retain market share and opted to ride on their country

wide coverage and reliability of their services as opposed to their 2 competitors Telecel and

NetOne who are willing to continue increasing promotional spend on their voice mobile

portfolios.

EcoCash has a high market share in the mobile money transfer market. EcoCash was

developed to generate a new recurring revenue stream to counter the decline in the mobile

voice revenue as the market stagnated. It was launched on 29 September 2011 and achieved

market dominance in the mobile money sector with products such as EcoCash Payroll,

EcoCash Diaspora, the EcoCash Debit Card and bill payments being developed to provide

unrivalled convenience and a holistic mobile money solution to the consumers. According

to POTRAZ’s Consumer Satisfaction Report the EcoCash platform is conducting almost 99%

of the total money transfer services while the other two main mobile money platforms

NetOne’s OneMoney and Telecel’s Telecash are struggling to gain traction. “EcoCash has a

94.5 percent market share of the sector, followed by OneMoney with a 4.7% stake and

Telecash with a mere 0.8 percent stake,” the report says.

Econet can milk these cash cows and use excess funds from their profits to develop Econet

Solar and supplement Econet Broad Band where necessary.

Dogs - Econet premium

Dogs have weak market share in low growth or stable markets these products include Econet

Premium, as implied buy its name is a niche product, targeting business executives and the

upper class clientele. It offers fast, efficient, reliable communication both at home and

abroad and is a revamped and rebranded version of the Business Partna brand. The size of the

market is limited, hence growth is limited too. The product will never make it into the Star or

Cash Cow quadrants. Dogs typically take up more time and money than they are worth -

consuming cash, even if it is just in the time taken to manage them. They usually produce

low profits and often incur losses. Econet must decide whether to do away with the

portfolio and use their savings on more profitable portfolios or nurse it for the benefit

of their elite clients.

The Boston Group suggests that investment should principally be channelled into stars and

those which could be promoted to star status. Investment in cash cows should be at the level

necessary to maintain market share. The profitability of dogs should be monitored closely and

the organisation should divest from unprofitable dogs. It should also withdraw from question

marks which do not have star potential.

Conclusion

The BCG model is a useful strategic planning tool as it enables firms to identify opportunities

and weaknesses in its various portfolios or brands. It has, however, been criticised as

follows:

It neglects the effects of synergies between business units

It is difficult to plot information accurately. The sizes of circles, unless done by

computer modelling, can only ever be estimated.

It is not fair to expect all SBUs to have the same rate of return or market share, etc.

The whole point of this method is to assess the position of each product, or SBU, and

different markets will have different growth rates. It is therefore really better to plot

only one product or SBU onto a BCG matrix.

If the model is used as a predictor of cash usage, valuable products may be left to

stagnate and die owing to lack of investment.

The model only uses market share and market growth as variables. Companies with

a small market share can be highly profitable and inversely, a high market share does

not necessarily lead to profitability.

The model ignores environmental factors which may have an impact on performance.

Positioning can encourage planners to develop bad habits, e.g. not allowing enough

funds to maintain the Cash Cows so that they grow weak. Planners can also

sometimes leave them too over-funded and fail to invest in other categories.

You might also like

- Account-Based Marketing: The CMO Blueprint ForDocument42 pagesAccount-Based Marketing: The CMO Blueprint ForRiddhimaNo ratings yet

- Leadership in Vodafone by Amin BDDocument5 pagesLeadership in Vodafone by Amin BDnalaminsNo ratings yet

- Business Strategy by Haroon AkramDocument23 pagesBusiness Strategy by Haroon Akramharoon0% (1)

- Marketview MoroccoDocument12 pagesMarketview MoroccoReda Hb100% (1)

- Group 15 Evaluate The Marketing Mix Strategies Employed by An Zimbabwean Organisation You Are Familiar WithDocument21 pagesGroup 15 Evaluate The Marketing Mix Strategies Employed by An Zimbabwean Organisation You Are Familiar WithMjay ZoeNo ratings yet

- Marketing Strategy of Rolls-Royce GhostDocument13 pagesMarketing Strategy of Rolls-Royce GhostKeshav ChoudharyNo ratings yet

- MGMT 493 Chap 4Document76 pagesMGMT 493 Chap 4Lily Van ElderenNo ratings yet

- HBSCTC_Question 3Document5 pagesHBSCTC_Question 3belindasithole965No ratings yet

- Growth Share Matrix - Boston Consulting Group's Strategic ToolDocument10 pagesGrowth Share Matrix - Boston Consulting Group's Strategic ToolMuhd Ridho BaihaqueNo ratings yet

- Assignment Human Resource Planning 086Document4 pagesAssignment Human Resource Planning 086Mani RayNo ratings yet

- Videcon FinalDocument26 pagesVidecon FinalvahidNo ratings yet

- CHAPTER 5 Strategic Analysis of Diversified CompaniesDocument40 pagesCHAPTER 5 Strategic Analysis of Diversified CompaniesBekam BekeeNo ratings yet

- BCG Notes FinalDocument10 pagesBCG Notes FinalHarsora UrvilNo ratings yet

- Marketing Strategy ModelsDocument58 pagesMarketing Strategy Modelsgaurav dixit100% (1)

- Business Strategy AssignmentDocument7 pagesBusiness Strategy AssignmentHaneen ShahidNo ratings yet

- The BCG GrowthDocument6 pagesThe BCG GrowthAkhilesh ShawNo ratings yet

- BCG Matrix: Product Life CycleDocument10 pagesBCG Matrix: Product Life CycleiamgyanuNo ratings yet

- Understanding The BCG Model Limitations / Problems of BCG ModelDocument13 pagesUnderstanding The BCG Model Limitations / Problems of BCG Modelshovit singhNo ratings yet

- Bcg-Matrix SVGDocument7 pagesBcg-Matrix SVGPriyanka KansaraNo ratings yet

- Assignment: Abid E A Rahim MGT1905003 Marketing Management 15-05-2020Document11 pagesAssignment: Abid E A Rahim MGT1905003 Marketing Management 15-05-2020EA AbidNo ratings yet

- BCG Matrix and Its Significance in Product Mix Analysis - NCK Pharma Solution Private Limited - Powered by Comm100 PDFDocument6 pagesBCG Matrix and Its Significance in Product Mix Analysis - NCK Pharma Solution Private Limited - Powered by Comm100 PDFAkhilesh MenonNo ratings yet

- BCG Matrix and GE 9 Cell PlaningDocument5 pagesBCG Matrix and GE 9 Cell PlaningAmit Vasantbhai50% (2)

- BCG, GE, 7s Doc 1.0Document21 pagesBCG, GE, 7s Doc 1.0Mohit Chaudhari.MPC.No ratings yet

- Assignment ON BCG Model and Ge9: Submitted To: Prof - Ratneshpal SinghDocument9 pagesAssignment ON BCG Model and Ge9: Submitted To: Prof - Ratneshpal SinghJaininder SharmaNo ratings yet

- Bmt1035-Strategic Management: FALL SEMESTER: 2021-22 Digital Assignment-07Document8 pagesBmt1035-Strategic Management: FALL SEMESTER: 2021-22 Digital Assignment-07Vasu Dev KanchetiNo ratings yet

- What Is The BCG GrowthDocument8 pagesWhat Is The BCG GrowthoyemaryNo ratings yet

- BCG Matrix: Kishor Kumar DekaDocument31 pagesBCG Matrix: Kishor Kumar DekaHansa SharmaNo ratings yet

- Analysing Strategy (BCG Matrix)Document6 pagesAnalysing Strategy (BCG Matrix)yadavpankaj1992No ratings yet

- BCG ItcDocument92 pagesBCG Itcprachii09No ratings yet

- BCG and GeDocument16 pagesBCG and GekaurmaanNo ratings yet

- BCG Matrix Explained - Product Fitment (Neelkamal Chair)Document12 pagesBCG Matrix Explained - Product Fitment (Neelkamal Chair)jaywilson3enNo ratings yet

- Black Book SMDocument37 pagesBlack Book SMamitpandey6592No ratings yet

- What Is The BCG MatrixDocument2 pagesWhat Is The BCG Matrixceenajhon327No ratings yet

- Strategic Direction of Husky 2020Document4 pagesStrategic Direction of Husky 2020RajNo ratings yet

- Boston Consulting Group MatrixDocument31 pagesBoston Consulting Group MatrixMic BaldevaronaNo ratings yet

- Implementation of BCG Matrix in Malaysia CompanyDocument21 pagesImplementation of BCG Matrix in Malaysia CompanyMisz Azzyati75% (4)

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixShreyaNo ratings yet

- Strategic Management (BCG Matrix)Document15 pagesStrategic Management (BCG Matrix)ERICK MLINGWANo ratings yet

- Lecture 2 BCG MatrixDocument26 pagesLecture 2 BCG MatrixAnant MishraNo ratings yet

- BCG Matrix Explained for Strategic Business AnalysisDocument31 pagesBCG Matrix Explained for Strategic Business AnalysisMifta Dian PratiwiNo ratings yet

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixVchair GuideNo ratings yet

- Usiness Policy AND Trategic Management: BCG MatrixDocument31 pagesUsiness Policy AND Trategic Management: BCG MatrixBijal DanichaNo ratings yet

- Strategic Portfolio AnalysisDocument27 pagesStrategic Portfolio Analysisgwyneth palatolonNo ratings yet

- BCG MatrixDocument30 pagesBCG MatrixmridulNo ratings yet

- BCG Matrix ExplainedDocument31 pagesBCG Matrix ExplainedUtkarsh SrivastavaNo ratings yet

- BCG Matrix Explained in 40 CharactersDocument6 pagesBCG Matrix Explained in 40 CharactersmussawirshahNo ratings yet

- BCG Growth MatrixDocument8 pagesBCG Growth MatrixPrashant RampuriaNo ratings yet

- Understanding The BCG Growth Share Matrix and How To Use ItDocument9 pagesUnderstanding The BCG Growth Share Matrix and How To Use ItRUCHIKA BAJAJNo ratings yet

- BCG Growth ReportDocument13 pagesBCG Growth ReportShaine MalunjaoNo ratings yet

- The BCG Matrix and GE McKinsey MatrixDocument5 pagesThe BCG Matrix and GE McKinsey MatrixAnshul MangalNo ratings yet

- BCG Growth-Share Matrix: Free StuffDocument6 pagesBCG Growth-Share Matrix: Free Stuffzafar_rezNo ratings yet

- Business Portfolio AnalysisDocument20 pagesBusiness Portfolio AnalysissoumitrabehuraNo ratings yet

- BCG Growth-Share MatrixDocument3 pagesBCG Growth-Share Matrixabhishek kunalNo ratings yet

- BCG Matrix PDFDocument0 pagesBCG Matrix PDFcrossculture123100% (1)

- Boston Consulting Group (BCG) Matrix Analysis of Mahindra & Mahindra (M&MDocument44 pagesBoston Consulting Group (BCG) Matrix Analysis of Mahindra & Mahindra (M&MManisha SinghNo ratings yet

- Group 3 ..StatergyDocument14 pagesGroup 3 ..StatergySwarnalata DashNo ratings yet

- Managing A Portfolio of Products: What Is Product Portfolio Management?Document5 pagesManaging A Portfolio of Products: What Is Product Portfolio Management?Vaibhav GuptaNo ratings yet

- BCG Matrix: A Concise Guide to the BCG MatrixDocument10 pagesBCG Matrix: A Concise Guide to the BCG MatrixNeeraj TripathiNo ratings yet

- BOSTON CONSULTING GROUP FinalDocument9 pagesBOSTON CONSULTING GROUP FinalpinnuuNo ratings yet

- Boston Consulting Group MatrixDocument19 pagesBoston Consulting Group MatrixDeepika ShinhNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Document1 pageThe Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Gift SimauNo ratings yet

- Model Framework For Achieving Gender Parity Combined With CoversDocument14 pagesModel Framework For Achieving Gender Parity Combined With CoversGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Importance of Good Design)Document7 pagesThe Practice of Market Research Ebook An Introduct... - (The Importance of Good Design)Gift SimauNo ratings yet

- Women's Experience in The 2018 Zimbabwe Election CycleDocument31 pagesWomen's Experience in The 2018 Zimbabwe Election CycleGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Contribution of Good Design)Document1 pageThe Practice of Market Research Ebook An Introduct... - (The Contribution of Good Design)Gift SimauNo ratings yet

- BOCR - Module 4 - Booklet - FinalDocument43 pagesBOCR - Module 4 - Booklet - FinalGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Document1 pageThe Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Gift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (Question Content)Document6 pagesThe Practice of Market Research Ebook An Introduct... - (Question Content)Gift SimauNo ratings yet

- Example: A Question of Roles: Pursuing The MeaningDocument10 pagesExample: A Question of Roles: Pursuing The MeaningGift SimauNo ratings yet

- Critical Path AnalysisDocument1 pageCritical Path AnalysisGift SimauNo ratings yet

- Final Assessment: How To GuideDocument8 pagesFinal Assessment: How To GuideGift SimauNo ratings yet

- Practical Guide To Market ResearchDocument200 pagesPractical Guide To Market Researchsarahmahdy50% (2)

- Comparing free trade areas and single marketsDocument12 pagesComparing free trade areas and single marketsGift SimauNo ratings yet

- N00784 PPM101DDocument8 pagesN00784 PPM101DGift SimauNo ratings yet

- L6 Dip in BM - Qual Spec - v3.1 - FinalDocument50 pagesL6 Dip in BM - Qual Spec - v3.1 - FinalRodrigues SambangoNo ratings yet

- Interlocking Soil Cement Blockmaking Machines & Accessories: 2019 Dollar PricelistDocument8 pagesInterlocking Soil Cement Blockmaking Machines & Accessories: 2019 Dollar PricelistGift SimauNo ratings yet

- Assessment One World of MarketingDocument10 pagesAssessment One World of MarketingGift SimauNo ratings yet

- SAM101B - S01328: by Gift SimauDocument11 pagesSAM101B - S01328: by Gift SimauGift SimauNo ratings yet

- Maths TestDocument13 pagesMaths TestGift SimauNo ratings yet

- Assessment 2Document9 pagesAssessment 2Gift SimauNo ratings yet

- Electricity and MagnetismDocument14 pagesElectricity and MagnetismGift SimauNo ratings yet

- Maths Test 1Document10 pagesMaths Test 1Gift SimauNo ratings yet

- Project Activity 1 Gift SimauDocument10 pagesProject Activity 1 Gift SimauGift SimauNo ratings yet

- Marketing MIx StrategyDocument8 pagesMarketing MIx StrategyGift SimauNo ratings yet

- Motivating Sales Teams Through Likert's Management ModelsDocument3 pagesMotivating Sales Teams Through Likert's Management ModelsGift SimauNo ratings yet

- FM101B S01328Document11 pagesFM101B S01328Gift SimauNo ratings yet

- DG2ECMDocument112 pagesDG2ECMGift SimauNo ratings yet

- Chapter 8 VatDocument7 pagesChapter 8 VatGift SimauNo ratings yet

- Social Media Marketing - IntroductionDocument17 pagesSocial Media Marketing - IntroductionGift SimauNo ratings yet

- Chapter 14 Standard Costing and Variance AnalysisDocument10 pagesChapter 14 Standard Costing and Variance AnalysisGift SimauNo ratings yet

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoNo ratings yet

- The Knowledge Company - Strategy Formulation in Knowledge-Intensive IndustriesDocument17 pagesThe Knowledge Company - Strategy Formulation in Knowledge-Intensive Industriesrmdeca0% (1)

- Tumkur Milk CoorporationDocument60 pagesTumkur Milk CoorporationValentineJoaoNo ratings yet

- Pangea Properties Hires Daniel Sobelman To Join Its Real Estate Investments and Lending PlatformsDocument2 pagesPangea Properties Hires Daniel Sobelman To Join Its Real Estate Investments and Lending PlatformsPR.comNo ratings yet

- The Master Budget - 1st QTRDocument41 pagesThe Master Budget - 1st QTRqueene50% (4)

- Chapter 6Document70 pagesChapter 6Allison StewartNo ratings yet

- James C. Corry ResumeDocument3 pagesJames C. Corry ResumeJC CorryNo ratings yet

- Indian Electricals Weighs Accepting Trial Order for Vending MachinesDocument8 pagesIndian Electricals Weighs Accepting Trial Order for Vending MachinesJoseph MathewNo ratings yet

- Five Common Investing Mistakes To AvoidDocument3 pagesFive Common Investing Mistakes To AvoidjanivarunNo ratings yet

- Midterm Exam Formulas CAPM Returns Dividends Stocks PortfoliosDocument4 pagesMidterm Exam Formulas CAPM Returns Dividends Stocks PortfoliosChristian Peralta ÜNo ratings yet

- Structured Warrants BrochureDocument30 pagesStructured Warrants BrochurefarazmasoodNo ratings yet

- Intern Report On Southeast Bank Bangladesh LimitedDocument33 pagesIntern Report On Southeast Bank Bangladesh LimitedA S M SalehNo ratings yet

- Ibd 092308Document24 pagesIbd 092308cphanhuy100% (1)

- Quiz exam practice foreign exchange rates forward premiumsDocument2 pagesQuiz exam practice foreign exchange rates forward premiumsanant_jain88114No ratings yet

- Philippine Deposit Insurance Corporation (Ra 3591)Document19 pagesPhilippine Deposit Insurance Corporation (Ra 3591)mtabcaoNo ratings yet

- Strategic Management Project of PEL PakistanDocument101 pagesStrategic Management Project of PEL PakistanBilawal Shabbir82% (11)

- ENRC - Annual Report 2010Document164 pagesENRC - Annual Report 2010user700700No ratings yet

- Cash and Cash Equivalents GuideDocument6 pagesCash and Cash Equivalents Guideanon_752939353100% (1)

- Financial Math SOA (12 Edition) - Ch.1: by Mr. Ghulam Nabi Lecturer College of Statistical and Actuarial Sciences, PUDocument14 pagesFinancial Math SOA (12 Edition) - Ch.1: by Mr. Ghulam Nabi Lecturer College of Statistical and Actuarial Sciences, PUGhulam NabiNo ratings yet

- Ultimate Income Blueprint PDFDocument37 pagesUltimate Income Blueprint PDFpai_ganes8002No ratings yet

- 9 - ch27 Money, Interest, Real GDP, and The Price LevelDocument48 pages9 - ch27 Money, Interest, Real GDP, and The Price Levelcool_mechNo ratings yet

- 100Document4 pages100agk123No ratings yet

- Portfolio Management IntroductionDocument46 pagesPortfolio Management IntroductionNurul AriffahNo ratings yet

- Starbucks Coffee SWOT AnalysisDocument11 pagesStarbucks Coffee SWOT AnalysisMuhammad Syaid DewantoroNo ratings yet

- Kempinski Presentation SchoolDocument14 pagesKempinski Presentation SchoolSanjay PatilNo ratings yet

- Introduction of A Financial Performance ProjectDocument15 pagesIntroduction of A Financial Performance ProjectNazir HussainNo ratings yet

- Ifsa Chapter14Document34 pagesIfsa Chapter14Nageswara KorrakutiNo ratings yet

- Click The Link To Go To The Relevant Section of Your Course PageDocument2 pagesClick The Link To Go To The Relevant Section of Your Course PageAmjad AliNo ratings yet

- McDonalds Risk Management StrategiesDocument10 pagesMcDonalds Risk Management StrategiesJustine Ocenada BaluyotNo ratings yet

- Primanila Plans, Inc. v. Securities and Exchange CommissionDocument1 pagePrimanila Plans, Inc. v. Securities and Exchange CommissionCheCheNo ratings yet