Professional Documents

Culture Documents

Cost II

Uploaded by

Shimelis TesemaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost II

Uploaded by

Shimelis TesemaCopyright:

Available Formats

RIFT VALLEY UNIVERSITY, COLLEGE OF BUSINESS AND ECONOMICS, DEPARTMENT OF

ACCOUNTING AND FINANCE

COMPREHENSIVE BUDGETING ILLUSTRATION

Royal Company is preparing budgets for the second quarter ending June 30.

Budgeted sales of the company’s only product for the next five months are;

April………………..... 20,000 units

May ………………….50,000 units

June…………………. 30,000 units

July………………….. 25,000 units

August ………………15,000 units

Additional data:

• Royal Company sets an expected selling price of Br.10 per unit. All sales are on account. The

company collects 70% of these credit sales in the month of the sale; 25% are collected in the

month following sale; and the remaining 5% are uncollectible. The accounts receivable balance

on March 31 was $30,000. All of this balance was collectible.

• The company desires to have inventory on hand at the end of each month equal to 20% of the

following month’s budgeted unit sales. On March 31, 4,000 units were on hand.

• 5 pounds of material are required per unit of product. Management desires to have materials

on hand at the end of each month equal to 10% of the following month’s production needs. The

beginning materials inventory was 13,000 pounds. The material costs $0.40 per pound.

• Half of a month’s purchases are paid for in the month of purchase; the other half is paid for in

the following month. No discounts are given for early payment. The accounts payable balance

on March 31 was $12,000.

• Each unit produced requires 0.05 hour of direct labor. Each hour of direct labor costs the

company $10. Management fully adjusts the workforce to the workload each month.

• Variable manufacturing overhead is $20 per direct labor-hour. Fixed manufacturing

overhead is $50,500 per month. This includes $20,500 in depreciation, which is not a cash

outflow. Royal Company uses absorption costing in its budgeted income statement and balance

sheet. Manufacturing overhead is applied to units of product on the basis of direct labor-hours.

The company has no work in process inventories.

Cost and Management Accounting II worksheet

By- Muridu.S

RIFT VALLEY UNIVERSITY, COLLEGE OF BUSINESS AND ECONOMICS, DEPARTMENT OF

ACCOUNTING AND FINANCE

• Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and

administrative expenses are $70,000 per month and include $10,000 in depreciation.

A line of credit is available at a local bank that allows the company to borrow up to $75,000.All

borrowing occurs at the beginning of the month, and all repayments occur at the end of the

month. The interest rate is 1% per month. The company does not have to make any payments

until the end of the quarter. Royal Company desires a cash balance of at least $30,000 at the

end of each month. The cash balance at the beginning of April was $40,000. Cash dividends of

$51,000 are to be paid to stockholders in April. Equipment purchases of $143,700 are

scheduled for May and $48,800 for June. This equipment will be installed and tested during

the second quarter and will not become operational until July, when depreciation charges will

commence.

Based on the above information prepare the following budgets;

A. Sales budget

B. Cash collection budget

C. Production budget

D. Direct material budget

E. Expected cash disbursement for direct material

F. Direct labor budget

G. Manufacturing overhead budget

H. Ending finished goods inventory budget

I. Selling and administrative expense budget

J. Cost of goods sold budget

K. Cash budget

L. Budgeted income statement

M. Budgeted balance sheet

Cost and Management Accounting II worksheet

By- Muridu.S

You might also like

- Chapter Two 2. Probability Distribution 2.1. Meaning and Concept of ProbabilityDocument11 pagesChapter Two 2. Probability Distribution 2.1. Meaning and Concept of ProbabilityShimelis Tesema100% (1)

- Chapter 1Document22 pagesChapter 1Shimelis TesemaNo ratings yet

- IAS Vs IFRSDocument1 pageIAS Vs IFRSShimelis TesemaNo ratings yet

- Chapter 3Document19 pagesChapter 3Shimelis TesemaNo ratings yet

- Cost CH 2Document16 pagesCost CH 2Shimelis TesemaNo ratings yet

- Unit Three Flexible Budget and StandardsDocument17 pagesUnit Three Flexible Budget and StandardsShimelis TesemaNo ratings yet

- Cost - CH-1 Cma-IiDocument14 pagesCost - CH-1 Cma-IiShimelis TesemaNo ratings yet

- Interpersonal Category: The Ten Managerial RolesDocument2 pagesInterpersonal Category: The Ten Managerial RolesShimelis Tesema100% (1)

- Depreciation Types and ExamplesDocument7 pagesDepreciation Types and ExamplesShimelis Tesema100% (2)

- Background: Strategic Plan of The BankDocument6 pagesBackground: Strategic Plan of The BankShimelis Tesema100% (9)

- PPM 542 - Shimelis Tessema - GSR-2453-13Document4 pagesPPM 542 - Shimelis Tessema - GSR-2453-13Shimelis TesemaNo ratings yet

- Case Analysis - Ass 2Document1 pageCase Analysis - Ass 2Shimelis Tesema100% (1)

- Background Vision MissionDocument6 pagesBackground Vision MissionShimelis Tesema83% (6)

- Chapter 5 Regulations of Financial Market S and InstitutionsDocument7 pagesChapter 5 Regulations of Financial Market S and InstitutionsShimelis Tesema100% (1)

- Financial Institutions Ch-1Document28 pagesFinancial Institutions Ch-1Shimelis Tesema100% (1)

- FIM Group AssignmentDocument1 pageFIM Group AssignmentShimelis TesemaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Job CostingDocument11 pagesJob Costingbellado0% (1)

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Document2 pagesAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- Korina Power Plant ProjectDocument19 pagesKorina Power Plant ProjectNugroho CWNo ratings yet

- Arielle Martin - IRS LetterDocument2 pagesArielle Martin - IRS LetterArielle MartinNo ratings yet

- Supply Chain Management in Banking Sector PDFDocument37 pagesSupply Chain Management in Banking Sector PDFAdv Sunil JoshiNo ratings yet

- Sky City Accounting and Financialy AnalysisDocument6 pagesSky City Accounting and Financialy AnalysisElenaWang1111No ratings yet

- MyobDocument1 pageMyobAgnes WeaNo ratings yet

- Building Blocks For Community InvestmentsDocument5 pagesBuilding Blocks For Community Investmentsnatasha mukukaNo ratings yet

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesDocument2 pagesThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaNo ratings yet

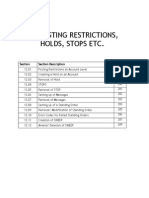

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- The Role and Scope of Management AccountingDocument16 pagesThe Role and Scope of Management AccountingNassir CeellaabeNo ratings yet

- KSA Amiantit Annual ReportDocument56 pagesKSA Amiantit Annual ReportShyam_Nair_9667No ratings yet

- W07 Case Study Loan AssignmentDocument66 pagesW07 Case Study Loan AssignmentArmando Aroni BacaNo ratings yet

- Chapter-14 Accounting For Not For Profit Organization PDFDocument6 pagesChapter-14 Accounting For Not For Profit Organization PDFTarushi Yadav , 51BNo ratings yet

- Blaw Review QuizDocument34 pagesBlaw Review QuizRichard de Leon100% (1)

- BFIN525 - Chapter 9 ProblemsDocument6 pagesBFIN525 - Chapter 9 Problemsmohamad yazbeckNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- Latsol Abc Ujian 2 InterDocument9 pagesLatsol Abc Ujian 2 InterABIMANTRANANo ratings yet

- Vanguard Assurance Corporation, Petitioner, vs. Hon. Court of Appeals and Jalwindor Manufacturing, Inc.Document6 pagesVanguard Assurance Corporation, Petitioner, vs. Hon. Court of Appeals and Jalwindor Manufacturing, Inc.Kier Christian Montuerto InventoNo ratings yet

- Geopacific Resources NL - ASX Quarterly Report Dec 2011 - Nabila Gold ProjectDocument11 pagesGeopacific Resources NL - ASX Quarterly Report Dec 2011 - Nabila Gold ProjectIntelligentsiya HqNo ratings yet

- Financial Econometrics and Empirical Finance - Module 2 General Exam Solutions - July 2012Document25 pagesFinancial Econometrics and Empirical Finance - Module 2 General Exam Solutions - July 2012Sunny DeolNo ratings yet

- 10.7 Mechanical Theories of The Money SupplyDocument7 pages10.7 Mechanical Theories of The Money SupplyHashifaGemelliaNo ratings yet

- Portfolio Managers DataDocument3 pagesPortfolio Managers DataSaurav SundaramNo ratings yet

- All Fiori ApplicationDocument49 pagesAll Fiori ApplicationRehan KhanNo ratings yet

- Lilac Flour Mills - FinalDocument9 pagesLilac Flour Mills - Finalrahulchohan2108No ratings yet

- 12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadDocument6 pages12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadAřúń .jřNo ratings yet

- Mahindra Case StudyDocument10 pagesMahindra Case StudySahil AroraNo ratings yet

- Theories of Exchange RateDocument47 pagesTheories of Exchange RateRajesh SwainNo ratings yet

- Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Document111 pagesHorngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Sally MillerNo ratings yet