Professional Documents

Culture Documents

Double Entry System Test

Uploaded by

Huma EssaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Double Entry System Test

Uploaded by

Huma EssaCopyright:

Available Formats

A business is started with the injection of 10,000 in cash. In which account

is the credit entry made?

Cash

Capital

2. A business purchases equipment cash. In which account is the debit

entry made?

Equipment

Supplies

3.Insurance of 2,000 is paid in advance. In which account is the debit entry

made?

Insurance prepayments

Insurance expense

A business purchases supplies on account for 2,000. On which account is

the credit entry made?

Supplies

Accounts payable

5. A business collects fees from a customer in cash for work done. In

which account is the credit entry made?

Accounts Receivable

Fee Income

6. A business owner withdraws cash of 1,000 from the business. In which

account is the debit entry made?

Drawings account

Cash

7. Net wages of 24,000 are paid to employees. Which account is debited?

Cash

Net wages control

8. A business invoices customers for fees, giving credit of 30 days. Which

account is the debit entry posted to?

Accounts receivable

Accounts payable

9. A telephone bill is received by the business for 500. Which account is the

debit entry posted to?

Telephone expense

Accounts payable

10. A deposit of 1,500 is received from a customer for work to be started

next month. Which account is credited?

Deferred income

Fee income

11. Howard Company had a transaction that caused a $5,000 increase in

both assets and total liabilities. This transaction could have been a(n)

a. Investment of $5,000 cash in the business by the stockholders.

b. Repayment of a $5,000 bank loan.

c. Purchase of office equipment for $5,000 cash.

d. Purchase of office equipment for $12,000, paying $7,000 cash and issuing a note payable for

the balance.

Juan de la Cruz began professional practice as a system analyst on July 1. He plans to prepare a

monthly financial statement. During July, the owner completed these transactions (PHP = Philippine

Peso, currency of Philippines):

July 1. Owner invested PHp 500,000 cash along with computer equipment that had a market value of

php. 120,000 two years ago but was now worth Php. 100,000 only.

July 2. Paid php. 15,000 cash for the rent of office space for the month.

July 4. Purchased php. 12,000 of additional equipment on credit (due within 30 days).

July 8. Completed awork for a client and immediately collected the php. 32,000 cash.

July 10. Completed work for a client and sent a bill for php. 27,000 to be paid within 30 days.

July 12. Purchased additional equipment for php. 8,000 in cash.

July 15. Paid an assistant php. 6,200 cash as wages for 15 days.

July 18. Collected php. 15,000 on the amount owed by the client.

July 25. Paid php. 12,000 cash to settle the liability on the equipment purchased.

July 28. Owner withdrew php. 500 cash for personal use.

July 30. Completed work for another client who paid only php. 40,000 for 50% of the system design.

July 31. Paid salary of assistant php. 700.

July 31. Received PLDT bill, php. 1,800 and Meralco bill php. 3,800.

Required:

Prepare the journal entries, T accounts and trial balance for this business.

You might also like

- Accounts For Manufacturing FirmsDocument17 pagesAccounts For Manufacturing FirmsZegera Mgendi100% (2)

- Form 5 Accounting: Transaction Analysis ExerciseDocument33 pagesForm 5 Accounting: Transaction Analysis ExerciseCahyani Prastuti100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Finacle Friendly A Handbook On CbsDocument289 pagesFinacle Friendly A Handbook On CbsS. Allen78% (23)

- Self Test Questions - Chap - 4 - AnswersDocument4 pagesSelf Test Questions - Chap - 4 - AnswersFahad MushtaqNo ratings yet

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocument12 pagesLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- When Goods Are Purchased:: Journal Entries in A Perpetual Inventory SystemDocument27 pagesWhen Goods Are Purchased:: Journal Entries in A Perpetual Inventory SystemFami FamzNo ratings yet

- Comprehensive Accounting Cycle Review Problem Copy 2Document12 pagesComprehensive Accounting Cycle Review Problem Copy 2api-252183085No ratings yet

- Journal Entry To Post Closing Trial BalanceDocument5 pagesJournal Entry To Post Closing Trial BalanceRaez Rodillado100% (1)

- 14 AdjustmentsssDocument7 pages14 AdjustmentsssZaheer Ahmed SwatiNo ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- Larry Jones Laundry Shop New FormatDocument18 pagesLarry Jones Laundry Shop New FormatVincent Madrid100% (1)

- Hobbit ComprehensionDocument2 pagesHobbit ComprehensionHuma EssaNo ratings yet

- Preparing Financial Stat. Cemba 560Document172 pagesPreparing Financial Stat. Cemba 560nanapet80No ratings yet

- Part I: Organizational Profile: Name of Individual/AssociationDocument2 pagesPart I: Organizational Profile: Name of Individual/AssociationKristy Dela PeñaNo ratings yet

- Basic AccountingDocument6 pagesBasic AccountingViolet Gomez RedNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Comprehensive ProblemDocument11 pagesComprehensive Problemapi-295660192No ratings yet

- Ch04 Completing The Accounting CycleDocument68 pagesCh04 Completing The Accounting CycleGelyn CruzNo ratings yet

- Assignment 2Document6 pagesAssignment 2Edna Ming0% (1)

- Exercises AccountingDocument3 pagesExercises AccountingAmalia BejenariuNo ratings yet

- Module 1 Review of The Accounting Cycle For A Service Business by Marivic ManaloDocument28 pagesModule 1 Review of The Accounting Cycle For A Service Business by Marivic ManaloChing ChongNo ratings yet

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- CHAPTER 6 - Adjusting EntriesDocument25 pagesCHAPTER 6 - Adjusting EntriesMuhammad AdibNo ratings yet

- Journal-Entry AssignmentsDocument2 pagesJournal-Entry AssignmentsRieven BaracinasNo ratings yet

- Test Question For Exam Chapter 1 To 6Document4 pagesTest Question For Exam Chapter 1 To 6Cherryl ValmoresNo ratings yet

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualDocument9 pages(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualRENZ ALFRED ASTRERONo ratings yet

- ADocument57 pagesAAliaJustineIlagan100% (1)

- C. Identification, Recording, Communication.: ExceptDocument9 pagesC. Identification, Recording, Communication.: ExceptSylvia Al-a'maNo ratings yet

- Assignment Qs 1 - Journalization and PostingDocument2 pagesAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- Handout 6 Accounting For Service Merchandising and Manufacturing BusinessesDocument8 pagesHandout 6 Accounting For Service Merchandising and Manufacturing BusinessesSevi MendezNo ratings yet

- Simple Interest and Maturity ValueDocument2 pagesSimple Interest and Maturity ValueMary100% (6)

- Comprehensive Accounting Cycle Review ProblemDocument11 pagesComprehensive Accounting Cycle Review Problemapi-253984155No ratings yet

- Simple and Compound EntryDocument4 pagesSimple and Compound EntryJezeil DimasNo ratings yet

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDocument19 pagesSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The Philippinesareum100% (1)

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Book Answers BalanceDocument9 pagesBook Answers BalanceIza Valdez100% (1)

- Chapter 7 The Accounting EquationDocument57 pagesChapter 7 The Accounting EquationCarmelaNo ratings yet

- Name: Date: Score: Course/Year/Section: Professor: Practice Activity 3: Journal Entries Problem 1Document1 pageName: Date: Score: Course/Year/Section: Professor: Practice Activity 3: Journal Entries Problem 1BathalaNo ratings yet

- Adjusting Entry - LectureDocument9 pagesAdjusting Entry - LectureMaDine 19100% (2)

- Perpetual Transactions: Journal EntriesDocument71 pagesPerpetual Transactions: Journal EntriesRona Mae AnteroNo ratings yet

- Prefinal Exam Set B (Fabm1)Document4 pagesPrefinal Exam Set B (Fabm1)Zybel RosalesNo ratings yet

- Module 2 - Completing The Accounting Cycle DiscussionDocument62 pagesModule 2 - Completing The Accounting Cycle Discussioncdlchristopher04100% (1)

- I. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1Document3 pagesI. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1HLeigh Nietes-GabutanNo ratings yet

- Recording Merchandising TransactionsDocument4 pagesRecording Merchandising Transactionsacidreign50% (2)

- Exam Type With Answer KeyDocument7 pagesExam Type With Answer KeyAngelieNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesJon PangilinanNo ratings yet

- Module 5 - Correcting EntriesDocument2 pagesModule 5 - Correcting EntriesFeiya LiuNo ratings yet

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- Chapter 2 Accounting For The Service BusinessDocument37 pagesChapter 2 Accounting For The Service BusinessKristel100% (1)

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Adjusting Entries Chapter $Document56 pagesAdjusting Entries Chapter $Arzan AliNo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- Jesse Taylor Comprehensive Accounting ProblemDocument9 pagesJesse Taylor Comprehensive Accounting Problemapi-311367219No ratings yet

- PRACTICE QUESTIONS FOR ACC1003 1st ASSESSMENTDocument6 pagesPRACTICE QUESTIONS FOR ACC1003 1st ASSESSMENTmeera abdullahNo ratings yet

- Reviewer in AccountingDocument6 pagesReviewer in AccountingJoseph AndrewsNo ratings yet

- Adjusting Entries QuizDocument2 pagesAdjusting Entries QuizOfelia YanosNo ratings yet

- Journalizing Closing Entries For A Merchandising EnterpriseDocument36 pagesJournalizing Closing Entries For A Merchandising EnterpriseRodolfo CorpuzNo ratings yet

- ACCT101 - Prelim - THEORY (25 PTS)Document3 pagesACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

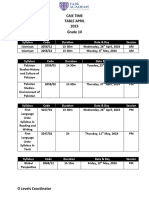

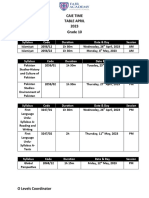

- Caie Time Table 2023Document3 pagesCaie Time Table 2023Huma Essa0% (1)

- HamnaDocument3 pagesHamnaHuma EssaNo ratings yet

- 2nd TermDocument2 pages2nd TermHuma EssaNo ratings yet

- Caie Time Table 2022Document1 pageCaie Time Table 2022Huma EssaNo ratings yet

- Faaz Short3Document2 pagesFaaz Short3Huma EssaNo ratings yet

- Life Without ElectricityDocument1 pageLife Without ElectricityHuma EssaNo ratings yet

- Setting The SceneDocument4 pagesSetting The SceneHuma EssaNo ratings yet

- Caie Time Table 2022Document3 pagesCaie Time Table 2022Huma EssaNo ratings yet

- CAIE TIME TABLE 2023 Grade 11Document2 pagesCAIE TIME TABLE 2023 Grade 11Huma EssaNo ratings yet

- Write A Story Where A Text Message Plays An Important Part. (528 Words)Document6 pagesWrite A Story Where A Text Message Plays An Important Part. (528 Words)Huma EssaNo ratings yet

- Y7 Week 3Document1 pageY7 Week 3Huma EssaNo ratings yet

- Tips For Composition: o o o o oDocument2 pagesTips For Composition: o o o o oHuma EssaNo ratings yet

- Question and Paper Tips EconomicsDocument3 pagesQuestion and Paper Tips EconomicsHuma EssaNo ratings yet

- Artice Writing Presentation29th AprilDocument34 pagesArtice Writing Presentation29th AprilHuma EssaNo ratings yet

- Newspaper Report Writing PresentationDocument37 pagesNewspaper Report Writing PresentationHuma EssaNo ratings yet

- Economics 2281: Introductory Class Huma EssaDocument11 pagesEconomics 2281: Introductory Class Huma EssaHuma EssaNo ratings yet

- Rev Test 0-III Eco Unit 1.1-1.4Document1 pageRev Test 0-III Eco Unit 1.1-1.4Huma EssaNo ratings yet

- Descriptive Writing Train StationDocument2 pagesDescriptive Writing Train StationHuma Essa0% (2)

- Formal Letter: by Huma EssaDocument13 pagesFormal Letter: by Huma EssaHuma EssaNo ratings yet

- Narrative Writing GlossaryDocument46 pagesNarrative Writing GlossaryHuma EssaNo ratings yet

- Past Paper Questions Paper 1Document6 pagesPast Paper Questions Paper 1Huma EssaNo ratings yet

- Ratio Analysis TestDocument3 pagesRatio Analysis TestHuma EssaNo ratings yet

- Read The Following Case Study and Answer The Questions Given Below. Gulf CafeDocument1 pageRead The Following Case Study and Answer The Questions Given Below. Gulf CafeHuma EssaNo ratings yet

- Aug Test 0-I BSDocument1 pageAug Test 0-I BSHuma EssaNo ratings yet

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- Individual Car Loan Agreement SampleDocument32 pagesIndividual Car Loan Agreement Sampleey019.aaNo ratings yet

- U.S. Hegemony Today - Peter GowanDocument12 pagesU.S. Hegemony Today - Peter GowanpeterVoterNo ratings yet

- Tax Invoice: Mudassi R Syed ZaidiDocument2 pagesTax Invoice: Mudassi R Syed ZaidiManoj KumarNo ratings yet

- RBI Preparation StrategyDocument21 pagesRBI Preparation StrategybinayNo ratings yet

- Test Bank Ques - 5Document4 pagesTest Bank Ques - 5MahfuzulNo ratings yet

- Financial-Accounting-2-Summary-Valix PDFDocument20 pagesFinancial-Accounting-2-Summary-Valix PDFRheu ReyesNo ratings yet

- Rich Dad Poor Dad Book Review 2.0Document3 pagesRich Dad Poor Dad Book Review 2.0Sakshi IyerNo ratings yet

- VII Giverny Capital August 2010Document9 pagesVII Giverny Capital August 2010globalaviNo ratings yet

- Electronic Document Preparation and ManagementDocument14 pagesElectronic Document Preparation and ManagementTorrain TVNo ratings yet

- Afs (2021)Document46 pagesAfs (2021)Marc Darryl GuevarraNo ratings yet

- Financial Management Project Fall 2023Document2 pagesFinancial Management Project Fall 2023singhamsingha1974No ratings yet

- Puget Sound State Bank v. Washington Paving CoDocument2 pagesPuget Sound State Bank v. Washington Paving CoTicia Co SoNo ratings yet

- JISEv29n3p131 PDFDocument10 pagesJISEv29n3p131 PDFRenzo RamosNo ratings yet

- Contract Costing PPT FinalDocument15 pagesContract Costing PPT FinalShivamNo ratings yet

- Module 3 CFAS PDFDocument7 pagesModule 3 CFAS PDFErmelyn GayoNo ratings yet

- Notes - Conso FS (Subsequent To Acquisition Date)Document35 pagesNotes - Conso FS (Subsequent To Acquisition Date)Joana TrinidadNo ratings yet

- Ch02 Financial Statements, Taxes, and Cash FlowsDocument34 pagesCh02 Financial Statements, Taxes, and Cash FlowsAndrew BruceNo ratings yet

- FORM24Document3 pagesFORM24Fayaz KhanNo ratings yet

- EmployersLiabilityInsurance UK1 PDFDocument1,781 pagesEmployersLiabilityInsurance UK1 PDFAmine AïdiNo ratings yet

- Branches of AccountingDocument3 pagesBranches of AccountingMie HuntersNo ratings yet

- RaymondDocument3 pagesRaymondAkankshaNo ratings yet

- Tutorial 2 - StudsDocument8 pagesTutorial 2 - StudsAmalMdIsaNo ratings yet

- Mcit and CWTDocument5 pagesMcit and CWTOlan Dave LachicaNo ratings yet

- StateStreet RDPDocument3 pagesStateStreet RDPKOTHAPALLI VENKATA JAYA HARIKA PGP 2019-21 BatchNo ratings yet

- Surrender of LeaseDocument3 pagesSurrender of LeaseLegal Forms83% (6)

- Quicknotes On Revised Corporation CodeDocument11 pagesQuicknotes On Revised Corporation CodeMichaelangelo MacabeeNo ratings yet