Professional Documents

Culture Documents

st.0 234

Uploaded by

Sbmtab12Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

st.0 234

Uploaded by

Sbmtab12Copyright:

Available Formats

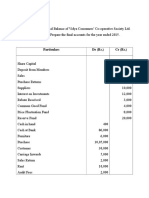

Chapter 1 Financial Statements of Not-for-Profit 1.

37 Organisations

Step 4.

Items not existing in Receipts and Payments Account: Following items do not exist in

Receipts and Payments Accunt but are shown in Income and Expenditure Account:

(a) Depreciation on fixed assets as an expense, i.e., in the debit side.

(b) Outstanding Expenses as expenses, i.e., in the debit side.

(c) Accrued or outstanding incomes as an income, i.e., in the credit side.

(d) Loss on sale of fixed assets, if any, as expense (loss), ie., in the debit side.

(e) Gain (Profit) on sale of fixed assets, if any, as income, i.e., in the credit side.

Deduct the amount of depreciation from fixed assets in the Balance Sheet after

adjusting purchase and sale of fixed assets.

Step 5. Detertine Surplus or Deficit in Income and Expenditure Account: By comparing total

of debit side and total of credit side of Income and Expenditure Account. If total of

credit side is more than the total of debit side, it is surplus (i.e., excess of income

over expenditure). And if, total of debit side is more than the total of credit side, it

is deficit (i.e., excess of expenditure over income). Surplus or deficit is transferred to

the Capital Fund and shown in the Balance Sheet.

Step 6. Closing Balance Sheet: Prepare Balance Sheet as at the end of the year after taking into

account opening balances of assets, liabilities and opening Capital Fund, surplus or deficit,

purchase and sale of assets during the year and charging depreciation on the fixed assets.

Illustration 25.

From the following items of Receipts and Payments Acount of Young Club, prepare Income

and Expenditure Account for the year ended 31st March, 2020:

Salaries Paid 5,00,000

50,000

Electricity Expenses

35,000

Printing and Stationery (including 5,000 for the previous year)

Subscriptions received (including 20,000 received in advance and

4,00,000

50,000 for the previous year)

4,50,000

Net proceeds from Refreshment Roomn

1,60,000

Miscellaneous expenses

12,000

Interest paid on Loan for half year

75,000

Rent and Rates (including 10,000 prepaid)

45,000

Lockers rent received

31st March, 2020 were 80,000 and half year's

Additional Information: Subscriptions in

arrears on

interest on loan was also outstanding.

Young Club

Solution: ACCOUNT for the year ended 31st March,

2020 Cr.

Dr. INCOME AND EXPENDITURE

Income

Expenditure 4,00,000

To Salaries 5,00,000 By Subscriptions

To Electricity Expenses 50,000 Less: Advance Received 20,000

lo

Arrears (Prev. Year) 50,000 70,000

Printing and Stationery 35,000 3,30,000

Less: Outstanding for

30,000 Add: Subscriptions in Arrears

Previous Year 5,000 (31st March, 2020) 80,000 4,10,000

fo Miscellaneous Expenses 1,60,000

to Interest on By Net Proceeds from

Loan 12,000 Refreshment Room 450,000

Add: Outstanding 12,000 24,000 45,000

7r 00

By Lockers Rent

You might also like

- Statement of Cash Flows: RequiredDocument50 pagesStatement of Cash Flows: RequiredLouise91% (22)

- Financial Statements Answers FFFFFFFFFFF PDFDocument27 pagesFinancial Statements Answers FFFFFFFFFFF PDFJHEYNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Algorithms (Complete Course) :-Btech CSE: TopicsDocument4 pagesAlgorithms (Complete Course) :-Btech CSE: TopicsRahul SinghNo ratings yet

- Bringing Words To LifeDocument23 pagesBringing Words To LifeKatarina Mijatovic100% (3)

- C10 - PAS 7 Statement of Cash FlowsDocument15 pagesC10 - PAS 7 Statement of Cash FlowsAllaine Elfa100% (2)

- Solution Manual For Oracle 12c SQL 3rd Edition CasteelDocument6 pagesSolution Manual For Oracle 12c SQL 3rd Edition CasteelHeatherRobertstwopa100% (35)

- Perfect Rigor - A Genius and The Mathematical Breakthrough of The CenturyDocument217 pagesPerfect Rigor - A Genius and The Mathematical Breakthrough of The CenturyChin Mun LoyNo ratings yet

- Defender 90 110 Workshop Manual 2Document190 pagesDefender 90 110 Workshop Manual 2Jim Brint100% (1)

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- Vikash Kumar: Career ObjectiveDocument2 pagesVikash Kumar: Career ObjectiveAnikesh SinghNo ratings yet

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- Schofield1998 - The Mohr-Coulomb Error CorrectionDocument3 pagesSchofield1998 - The Mohr-Coulomb Error CorrectionandresmelodNo ratings yet

- Probability Distributions Summary - Exam PDocument1 pageProbability Distributions Summary - Exam Proy_gettyNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Exam 3Document22 pagesExam 3Darynn F. Linggon100% (2)

- Not-for-Profit Organisations: PurchaseDocument1 pageNot-for-Profit Organisations: PurchaseSbmtab12No ratings yet

- 4.6 Final AcoountsDocument2 pages4.6 Final AcoountsSarath kumar CNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Cash Flow NewDocument4 pagesCash Flow NewAnkur GoyalNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Guideline Answers For Accounting Group - IDocument14 pagesGuideline Answers For Accounting Group - ITrisha IyerNo ratings yet

- Accounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Document3 pagesAccounting Class Test 1.: DATE:10 APRIL, 2020 TIME: 1:hours MARKS: 30 Total No. of Questions: 3 Total No. of Pages: 03Mandeep KaurNo ratings yet

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and Compliancelc100% (1)

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- Insurance QuestionsDocument2 pagesInsurance Questionsmarkobare2019No ratings yet

- NPO and Partnership TestsDocument20 pagesNPO and Partnership Testskartik aggarwalNo ratings yet

- SEMI-FINAL EXAM QUESTIONNAIRE (Edited)Document17 pagesSEMI-FINAL EXAM QUESTIONNAIRE (Edited)Pia De LaraNo ratings yet

- Ma AssigmentDocument32 pagesMa AssigmentAashayNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- Ex of Cash Flow AnalysisDocument7 pagesEx of Cash Flow AnalysisS. Chakrabarty MeconNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- CF Statement Solutions 1Document4 pagesCF Statement Solutions 1Joy MukhiNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush MalaniNo ratings yet

- Adjusting Entries From The Desk F JASDocument3 pagesAdjusting Entries From The Desk F JASMalik of ChakwalNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Adv Acc Prep 2024Document3 pagesAdv Acc Prep 2024Suhail AhmedNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Barnabas Assignment - JRTBDocument7 pagesBarnabas Assignment - JRTBJose Rey BuenavistaNo ratings yet

- Trial BalDocument1 pageTrial BalNikhil SharmaNo ratings yet

- BAC4023 W10 - Preparation of Financial Statements EXAMPLEDocument4 pagesBAC4023 W10 - Preparation of Financial Statements EXAMPLEPhí Phương ThảoNo ratings yet

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevNo ratings yet

- Kamini NarasimhanDocument1 pageKamini NarasimhanSbmtab12No ratings yet

- GR 568Document1 pageGR 568Sbmtab12No ratings yet

- GR 567Document1 pageGR 567Sbmtab12No ratings yet

- GR 567Document1 pageGR 567Sbmtab12No ratings yet

- In-The of The Year's: AppropriateDocument1 pageIn-The of The Year's: AppropriateSbmtab12No ratings yet

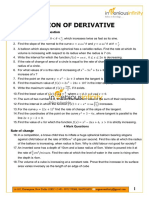

- Application of Derivative: Very Short Answer Type QuestionDocument6 pagesApplication of Derivative: Very Short Answer Type QuestionSbmtab12No ratings yet

- AOD Part-1Document2 pagesAOD Part-1Sbmtab12No ratings yet

- Principles of Health EducationDocument3 pagesPrinciples of Health EducationJunah DayaganonNo ratings yet

- Constructing The Spatial Weights Matrix Using A Local StatisticDocument15 pagesConstructing The Spatial Weights Matrix Using A Local StatisticbwcastilloNo ratings yet

- MLAHomeworkDocument4 pagesMLAHomeworkVANESSA SALDANANo ratings yet

- Algorithm Exam HelpDocument9 pagesAlgorithm Exam HelpProgramming Exam HelpNo ratings yet

- Astm A 101Document3 pagesAstm A 101RECEP ÇETİNKAYANo ratings yet

- WPI PharmaceuticalsDocument23 pagesWPI PharmaceuticalsKyle Millar-CorlissNo ratings yet

- OD329422999281816100Document1 pageOD329422999281816100sanjeev kumarNo ratings yet

- Tele BRANCHES 01.06.2021Document23 pagesTele BRANCHES 01.06.2021Abhishek BarwalNo ratings yet

- Acc CH2Document4 pagesAcc CH2Trickster TwelveNo ratings yet

- Chapter 4 IR ModelsDocument34 pagesChapter 4 IR ModelsYohannes KefaleNo ratings yet

- Choose The Best Answer From The Four Options (Marked A, B, C, or D) To Complete The Sentences. Exercise 1Document6 pagesChoose The Best Answer From The Four Options (Marked A, B, C, or D) To Complete The Sentences. Exercise 1Van AnhNo ratings yet

- AkbarDocument13 pagesAkbarNihar HarinkhedeNo ratings yet

- Fon Iv Ass1Document2 pagesFon Iv Ass1HemanthNo ratings yet

- 3.1 Mitosis Ans PDFDocument7 pages3.1 Mitosis Ans PDFtess_15No ratings yet

- TVL IACSS9 12ICCS Ia E28 MNHS SHS CAMALIGDocument4 pagesTVL IACSS9 12ICCS Ia E28 MNHS SHS CAMALIGKattie Alison Lumio MacatuggalNo ratings yet

- Sales Order Demo PolicyDocument4 pagesSales Order Demo Policysindhura2258No ratings yet

- Irfan Byna Nur Akbar MT PresentationDocument14 pagesIrfan Byna Nur Akbar MT PresentationirfanNo ratings yet

- Higher Education Loans Board: Loan Disbursement ReportDocument2 pagesHigher Education Loans Board: Loan Disbursement ReportEdward KalvisNo ratings yet

- Ebook PDF Consumer Behaviour Asia Pacific Edition by Wayne D Hoyer PDFDocument41 pagesEbook PDF Consumer Behaviour Asia Pacific Edition by Wayne D Hoyer PDFmarvin.tappen826100% (35)

- Multi Car ParkingDocument33 pagesMulti Car ParkingTanvi KhuranaNo ratings yet

- Recovery in Credit GrantedDocument21 pagesRecovery in Credit GrantedMaria Ysabella Yee80% (5)

- KUC Students Handbook Rvsd3 AKA (1750)Document155 pagesKUC Students Handbook Rvsd3 AKA (1750)Robert DansoNo ratings yet