Professional Documents

Culture Documents

Principle of Insurance Group-G

Uploaded by

kjl;0 ratings0% found this document useful (0 votes)

8 views11 pagesThis document provides an overview of key concepts in insurance including:

1. Utmost good faith requires full disclosure of material information by both parties.

2. Indemnity means compensation to restore the insured to their original financial position.

3. Subrogation transfers rights from the insured to the insurer after indemnification for a loss.

4. Insurable interest requires the insured to suffer a financial loss from damage to the insured object.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of key concepts in insurance including:

1. Utmost good faith requires full disclosure of material information by both parties.

2. Indemnity means compensation to restore the insured to their original financial position.

3. Subrogation transfers rights from the insured to the insurer after indemnification for a loss.

4. Insurable interest requires the insured to suffer a financial loss from damage to the insured object.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views11 pagesPrinciple of Insurance Group-G

Uploaded by

kjl;This document provides an overview of key concepts in insurance including:

1. Utmost good faith requires full disclosure of material information by both parties.

2. Indemnity means compensation to restore the insured to their original financial position.

3. Subrogation transfers rights from the insured to the insurer after indemnification for a loss.

4. Insurable interest requires the insured to suffer a financial loss from damage to the insured object.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Course code: FIN 1205

Instructed by: This slide is Created By Group G:

Head of The Department List of members:

Dr. Md. Nur Alam Siddik 1. 1920051 Monirul Islam

2. 1920052 Md Shan Zid Hasan

Associate Professor of 3. 1920053 Jahirul Islam Joy

Begum Rokeya University of 4. 1920054 Munna Hossain

Rangpur. 5. 1920056 Md Abdullah-Al-Jiyad

6. 1920055 Md Khairul Isam

7. 1920057 MehediHasan(absent)

Insurance Definition

Insurance is a contract whereby, in return for the

payment of premium by the insured, the insurers pay the

financial losses suffered by the insured as a result of the

occurrence of unforeseen events.

Risk

• Risk is the chance something harmful or unexpected

could happen. For i.e. A factory catching fire, a ship

sinking etc.

Principles of Insurance

› Utmost Good Faith

› Indemnity

› Subrogation

› Contribution

› Insurable Interest

› Contribution

› Causa Proxima

Utmost Good Faith

Good faith- Let the buyer beware

Declaration of all material Information about

the subject mater of insurance

Material Information is that information which enables the insurer to

decide:

a. whether he will accept the risk and

b. if so, at what rate of premium and subject to what terms and

conditions.

Indemnity

Indemnity means security, protection and

compensation given against damage, loss or

injury.

According to the principle of indemnity, an insurance contract is signed

only for getting protection against unpredicted financial losses arising

due to future uncertainties. Insurance contract is not made for making

profit else its sole purpose is to give compensation in case of any

damage or loss.

• Applicability:

o When the losses suffered by the insured can be measured in terms of

money

o It is practicable to place the insured in the same financial position which

he occupied before the loss

Subrogation

Transfer of rights and remedies from the insured to the

insurer who has indemnified the insured in respect of the

loss.

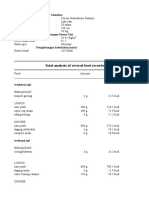

Contribution

It applies to all contracts of indemnity, if the

insured has taken out more than one policy on the

same subject matter.

• For example :- Mr. X insures his property worth

TK.100,000 with two insurers “Deltalife Ltd.” for TK.

90,000 and "MetLife BD Ltd." for TK. 60,000.

• Mr. X's actual property destroyed is worth TK. 60,000,

then Mr. X can claim the full loss of TK. 60,000 either

from Deltalife Ltd or MetLife BD Ltd., or he can claim

TK. 36,000 from Deltalife Ltd. and TK. 24,000 from

Metlife BD Ltd.

Insurable Interest

Insurable interest states that the person getting insured

must have insurable interest in the object of insurance. In

simple words, the insured person must suffer some financial loss by

the damage of the insured object.

Causa Proxima

… means when a loss is caused by For example :- A cargo ship's base was

more than one causes, the punctured due to rats and so sea water

proximate or the nearest or the entered and cargo was damaged.

closest cause should be taken into

consideration to decide the liability Here there are two causes for the damage

of the insurer. of the cargo ship - (i) The cargo ship

getting punctured because of rats, and (ii)

The sea water entering ship through

puncture. The risk of sea water is insured

but the first cause is not. The nearest

cause of damage is sea water which is

insured and therefore the insurer must pay

the compensation.

However, in case of life insurance, the

principle of Causa Proxima does not

apply. Whatever may be the reason of

death (whether a natural death or an

unnatural death) the insurer is liable to

pay the amount of insurance.

You might also like

- Principle of Non-Life InsuranceDocument18 pagesPrinciple of Non-Life InsuranceGlennGutay100% (1)

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- Insurance LawDocument52 pagesInsurance LawSenelwa Anaya100% (5)

- Wax Depilation ManualDocument17 pagesWax Depilation ManualAmit Sharma100% (1)

- Basics of InsuranceDocument26 pagesBasics of Insurancedranita@yahoo.comNo ratings yet

- GEC PE 3 ModuleDocument72 pagesGEC PE 3 ModuleMercy Anne EcatNo ratings yet

- Nursing Care Plan ConstipationDocument3 pagesNursing Care Plan Constipationbmrose3783% (12)

- Marine & Cargo InsuranceDocument53 pagesMarine & Cargo InsurancePrayank Khare100% (1)

- LLB Refresher Notes Insurance LawDocument43 pagesLLB Refresher Notes Insurance LawKriti Bhandari93% (14)

- Project Report On Chatam Saw MillDocument68 pagesProject Report On Chatam Saw MillThana Murugan100% (2)

- ZX 470Document13 pagesZX 470Mohammed Shaheeruddin100% (1)

- Principles of InsuranceDocument14 pagesPrinciples of Insurancevisualize2achieveNo ratings yet

- Home InsuranceDocument16 pagesHome InsuranceShashank TiwariNo ratings yet

- Insurance: A Bar Review OutlineDocument91 pagesInsurance: A Bar Review OutlineDi CanNo ratings yet

- Aplication Pipe and Tube - Nippon SteelDocument29 pagesAplication Pipe and Tube - Nippon Steelmatheus david100% (1)

- Art InsuranceDocument54 pagesArt InsuranceLove Aute100% (1)

- Lesson Law of InsuranceDocument6 pagesLesson Law of Insurancegaurav94163No ratings yet

- Marine InsuranceDocument201 pagesMarine Insurancejasmina.mushy22No ratings yet

- Ananay (16llb008)Document8 pagesAnanay (16llb008)Ananay ChopraNo ratings yet

- Insurance - 2013Document25 pagesInsurance - 2013Crazy KamaNo ratings yet

- Ambition Learning Solutions: General InsuranceDocument18 pagesAmbition Learning Solutions: General InsurancePratik RambhiaNo ratings yet

- THE RISK (Cl.8) : BY Dr. Y. Papa Rao Course TeacherDocument10 pagesTHE RISK (Cl.8) : BY Dr. Y. Papa Rao Course TeacherVarnika TayaNo ratings yet

- Business Studies InsuranceDocument7 pagesBusiness Studies InsuranceAdish JainNo ratings yet

- Insurance and Transportation Law Memory Aid 1Document24 pagesInsurance and Transportation Law Memory Aid 1angelica arnaizNo ratings yet

- Project WorkDocument75 pagesProject WorkShweta VijayNo ratings yet

- Law of Insurance VGSOM 16 1 2021Document31 pagesLaw of Insurance VGSOM 16 1 2021Aparna JRNo ratings yet

- Reliance Life Insurance Market Research1Document105 pagesReliance Life Insurance Market Research12014rajpointNo ratings yet

- Resume Group 2 Insurance and TaxesDocument14 pagesResume Group 2 Insurance and Taxeshilwa asaNo ratings yet

- Unit 20Document29 pagesUnit 20Rahul GurungNo ratings yet

- An Inchmaree Clause Is A Provision Common in Maritime Insurance Policies That Cover A Ship's Loss or Damage Due To Reasons Such AsDocument5 pagesAn Inchmaree Clause Is A Provision Common in Maritime Insurance Policies That Cover A Ship's Loss or Damage Due To Reasons Such AsSudhendra SoniNo ratings yet

- CH 1 Insurance and RiskDocument23 pagesCH 1 Insurance and Riskxingren010808No ratings yet

- Principle of InsuranceDocument3 pagesPrinciple of InsuranceShweta AgrawalNo ratings yet

- Marine InsuranceDocument75 pagesMarine InsuranceUmairah AzmanNo ratings yet

- Insurance Contracts: Insured Event OccursDocument7 pagesInsurance Contracts: Insured Event OccursDanielle MarundanNo ratings yet

- Marine Insurance Final ITL & PSMDocument31 pagesMarine Insurance Final ITL & PSMaeeeNo ratings yet

- Insurance Insure + AssuranceDocument19 pagesInsurance Insure + AssuranceTushar_Motwani_6363No ratings yet

- Insurance - Concept, Function and ImportanceDocument8 pagesInsurance - Concept, Function and ImportanceshreyaNo ratings yet

- CommRev Apr 3Document11 pagesCommRev Apr 3gongsilogNo ratings yet

- Risk Management and Insurance STUDENTDocument50 pagesRisk Management and Insurance STUDENTHạnh Nhân VănNo ratings yet

- Insurance: Its Evolution, Meaning & Tool in Risk Management: Prof Mahesh Kumar Amity Business SchoolDocument75 pagesInsurance: Its Evolution, Meaning & Tool in Risk Management: Prof Mahesh Kumar Amity Business Schoolasifanis100% (1)

- Introductionn: Chapter-1Document13 pagesIntroductionn: Chapter-1Anupriya ChuriNo ratings yet

- Principles of Insurance: Presented By: Chaithra.G Chaitra.M. Chandni.K. Devika.B.Z. Niveditha.CDocument18 pagesPrinciples of Insurance: Presented By: Chaithra.G Chaitra.M. Chandni.K. Devika.B.Z. Niveditha.CaashishNo ratings yet

- Accounting For Fire InsuranceDocument18 pagesAccounting For Fire InsuranceLorenz Samuel GomezNo ratings yet

- PrinciplesofinsuranceDocument14 pagesPrinciplesofinsuranceSenthil MN SNo ratings yet

- Insurance ManagementDocument27 pagesInsurance Managementzaks69No ratings yet

- The Seven Principles of InsuranceDocument8 pagesThe Seven Principles of InsurancesafiqulislamNo ratings yet

- 07 - Chapter 1 PDFDocument29 pages07 - Chapter 1 PDFPee KachuNo ratings yet

- Finanacial ManagementinsuranceDocument11 pagesFinanacial ManagementinsuranceallajunakiNo ratings yet

- Marine Insurance FinalDocument32 pagesMarine Insurance FinalSAJEDUR RAHAMANNo ratings yet

- INSURCONTRADocument7 pagesINSURCONTRAMark Dave YuNo ratings yet

- Principles of Insurance - Pham HaDocument157 pagesPrinciples of Insurance - Pham HaanonymousninjatNo ratings yet

- Insurance Law - FINALS: Intentional Acts Are Not CoveredDocument1 pageInsurance Law - FINALS: Intentional Acts Are Not CoveredJuliefer Ann GonzalesNo ratings yet

- Reliance Life InsuranceDocument101 pagesReliance Life InsuranceVicky Mishra100% (2)

- InsuranceDocument52 pagesInsuranceMercy NamboNo ratings yet

- Iura413 - Su 3.1.Document8 pagesIura413 - Su 3.1.Desiré PretoriusNo ratings yet

- Marine Insurance LTM 1Document45 pagesMarine Insurance LTM 1wirtzray41No ratings yet

- A Life Insurance Policy May Pass by Transfer, Will or Succession To Any Person, Whether He Has Insurable Interest or NotDocument2 pagesA Life Insurance Policy May Pass by Transfer, Will or Succession To Any Person, Whether He Has Insurable Interest or NotJan Kenrick SagumNo ratings yet

- InsuranceDocument2 pagesInsuranceJan Kenrick SagumNo ratings yet

- Principles of InsuranceDocument31 pagesPrinciples of Insuranceheenashelat1100% (1)

- Unit 3: Insurance: - Twesha ChhariaDocument53 pagesUnit 3: Insurance: - Twesha ChhariaRahul Kumar JainNo ratings yet

- Banking and Insurance (Unit 1)Document19 pagesBanking and Insurance (Unit 1)Mohit KumarNo ratings yet

- InsuranceDocument3 pagesInsuranceMonique McfarlaneNo ratings yet

- 00000477-Law of InsuranceDocument24 pages00000477-Law of Insuranceakshay yadavNo ratings yet

- Law of InsuranceDocument8 pagesLaw of InsuranceijujinuNo ratings yet

- Listes de Produits GAURAPADDocument1 pageListes de Produits GAURAPADBertrand KouamNo ratings yet

- Cdd161304-Manual Craftsman LT 1500Document40 pagesCdd161304-Manual Craftsman LT 1500franklin antonio RodriguezNo ratings yet

- Recognizing Fractures and Dislocations: Corpuz, Rachella Nicole PDocument46 pagesRecognizing Fractures and Dislocations: Corpuz, Rachella Nicole PRachella Nicole CorpuzNo ratings yet

- Water Quantity Estimation PDFDocument3 pagesWater Quantity Estimation PDFOladunni AfolabiNo ratings yet

- VSR 411 QB AnaesthesiaDocument7 pagesVSR 411 QB Anaesthesiavishnu dathNo ratings yet

- All About 304 Steel (Properties, Strength, and Uses)Document7 pagesAll About 304 Steel (Properties, Strength, and Uses)ZebNo ratings yet

- RA 9344 (Juvenile Justice and Welfare Act)Document10 pagesRA 9344 (Juvenile Justice and Welfare Act)Dan RamosNo ratings yet

- Diagnostic Test 12Document3 pagesDiagnostic Test 12Honorato BugayongNo ratings yet

- Tugas Gizi Caesar Nurhadiono RDocument2 pagesTugas Gizi Caesar Nurhadiono RCaesar 'nche' NurhadionoNo ratings yet

- CW Catalogue Cables and Wires A4 En-2Document1,156 pagesCW Catalogue Cables and Wires A4 En-2Ovidiu PuieNo ratings yet

- All Vaccinees Are Requested To Bring Certificate of Dose-II From COWIN Portal Alongwith Registered Mobile Number Before Proceeding For VaccinationDocument7 pagesAll Vaccinees Are Requested To Bring Certificate of Dose-II From COWIN Portal Alongwith Registered Mobile Number Before Proceeding For VaccinationRakesh KumarNo ratings yet

- PL 806aDocument45 pagesPL 806acesar luis gonzalez rodriguezNo ratings yet

- Industrial SpecialtiesDocument103 pagesIndustrial SpecialtiesRahul ThekkiniakathNo ratings yet

- Sim Medium 2 (English)Document2 pagesSim Medium 2 (English)TheLobitoNo ratings yet

- Meyer-Andersen - Buddhism and Death Brain Centered CriteriaDocument25 pagesMeyer-Andersen - Buddhism and Death Brain Centered Criteriautube forNo ratings yet

- Methods For The Assessment of Productivity of Small Hold FarmsDocument49 pagesMethods For The Assessment of Productivity of Small Hold FarmsMonaliz NagrampaNo ratings yet

- Stepanenko DermatologyDocument556 pagesStepanenko DermatologySanskar DeyNo ratings yet

- Lenovo TAB 2 A8-50: Hardware Maintenance ManualDocument69 pagesLenovo TAB 2 A8-50: Hardware Maintenance ManualGeorge KakoutNo ratings yet

- 01 Mono Channel BurnerDocument1 page01 Mono Channel BurnerSelwyn MunatsiNo ratings yet

- ECO-321 Development Economics: Instructor Name: Syeda Nida RazaDocument10 pagesECO-321 Development Economics: Instructor Name: Syeda Nida RazaLaiba MalikNo ratings yet

- .. - Bcsbi - .Document2 pages.. - Bcsbi - .Varun GopalNo ratings yet

- Center Di Kota Bandung : Inovasi Pemerintah Daerah Melalui Pembangunan AssessmentDocument12 pagesCenter Di Kota Bandung : Inovasi Pemerintah Daerah Melalui Pembangunan AssessmentDean ErhanNo ratings yet

- RA ELECTRONICSTECH CEBU Apr2019 PDFDocument12 pagesRA ELECTRONICSTECH CEBU Apr2019 PDFPhilBoardResultsNo ratings yet

- Complete Denture TechniquesDocument6 pagesComplete Denture TechniquesJohn Hyunuk ChoNo ratings yet