Professional Documents

Culture Documents

IHSM Poussin AcrlyicAcidValueChain March22

IHSM Poussin AcrlyicAcidValueChain March22

Uploaded by

Yang SunmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IHSM Poussin AcrlyicAcidValueChain March22

IHSM Poussin AcrlyicAcidValueChain March22

Uploaded by

Yang SunmanCopyright:

Available Formats

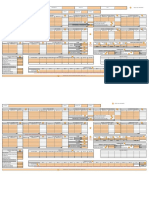

Acrylic acid value chain

Has the tide turned?

Denis Poussin, Director Global Acrylates and SAP,

IHS Markit

22 March 2018

Hilton Americas | Houston, TX, US

2018 IHS MarkitTM. All Rights Reserved.

Confidential. © 2017

Babies and contractors have a lot in common….

Don’t make deadlines

Like to eat…a lot

Expensive!

but mainly…

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

…they are big consumers of acrylic acid derivatives

49% Acrylic Acid 51%

Super Absorbent

Polymers (SAP)

5.6M Acrylate

Esters

tons

But their market dynamics

are very different

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Has the tide turned on the industry?

What drives demand for each side of value chain?

Isn’t there overcapacity?

Which side is more attractive to producers?

What price movements can we anticipate?

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Consumers of acrylic acid derivatives

Super absorbent polymers Acrylate esters

Glacial Acrylic Acid Oxo Alcohols

Acrylic Acid

Propylene

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

They are influenced by different drivers

Acrylic acid

Acrylate esters Sap

Paints and Absorbent

coatings hygiene products Socio-cultural

factors

Construction Disposable

and automotive income

Macro economics/GDP

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Acrylates demand follows GDP

US Architectural coatings production vs. residential construction

Paints, 4000 200

GDP trends coatings

and 160

3000

adhesives

Real 2010 Dollars

Millions of Litres

demand 120

• Economic cycles

2000

80

• Construction industry 1000

40

0 0

2000 2003 2006 2009 2012 2015

• Automotive Industry Architectural Coatings Produced

Residential US Construction Market Value

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Whereas SAP demand grew very quickly based on societal factors

Baby diaper penetration

100

Societal and

Penetration %

economic factors Diaper 50

adoption

0

0 5000 10000 15000 20000 25000 30000

Source: IHS Markit GDP per Capita in USD per annum © 2018 IHS Markit

• Disposable income

• Demographics Middle Class

400

Million Households

• Degree of urbanization Forecast

• Working mothers 200

• Preconception / disposable product adoption

0

2000 2005 2010 2015 2020 2025 2030

China India

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Acrylates are commodities, whereas SAPs are more of a specialty product

SAP X SAP premium grades 40% of global market.

Premium grades Mature and maturing markets.

Requirements for Innovation

1,067kt

X SAP standard grades: 40% of global

SAP SAP

Performance grades Standard grades

market. Developing economies.

535kt 1,075kt

X

SAP Performance grades: 20% of global

market. Versatile and high growth.

X Butyl acrylate: low differentiation

2-EHA BA

641 kt 2,826kt

X

2 Ethylhexyl acrylate: low differentiation

Global demand

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Has the tide turned on the industry?

What drives demand for each side of value chain?

Isn’t there overcapacity?

Which side is more attractive to producers?

What price movements can we anticipate?

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

But let’s first look back…

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Acrylic acid capacity is dominated by NEA

N. America

1,283

16% EMEA & CIS N.E. Asia

1,640 4,621

20% 57%

Region

S. S.E. Asia

Capacity thousand America

metric tons

375

160 5%

2%

% world capacity

2017 total capacity = 8.1 million metric tons

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Due to breakneck speed China capacity addition in 2010 to 2015

Acrylic Acid capacity

10

8

Million Metric Tons

0

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

China Capacity Rest of NEA Rest of the World

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Resulting in global overcapacity but unequal regional operating rates

Regional Acrylic Acid operating rates

100%

90%

Operating Rate

80%

70%

60%

50%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

NAM WEP NEA

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

But all is not well…

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Recent volatility masking long term trends

Regional Glacial Acrylic Acid prices

2,500 Nov-Dec 2016

Multiple TARs and April 2017

incidents in China Unexpected

shutdown at

Dollars Per Metric Ton

2,100 Oct 2016

BASF Arkema, US

Jan 2018

Ludwigshafen Propylene price rockets in the

1,700 US

1,300

900 Environmental inspections

in China

500

Dec-15 Sep-16 Jun-17 Mar-18 Dec-18

North America, Contract West Europe, Contract China, Spot

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Is there more trouble ahead?

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

What are those long term trends?

Rebalancing of the market:

• Demand growing faster than new capacity

• Global producers integrating downstream

• North America has cost advantage but no

investment planned

• China has spare capacity, but also issues:

– Cost position

– Environmental issues

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

SAP is pulling acrylic acid from acrylates value chain

2017-2027

2017 -2027Growth Rates

growth rates (%)

6.5

SAP 3.4

3.4

4.3

2-EHA 2.5

2.1

5.3

BA 2.1

2.5

5.3

Acrylic Acid 3.2

0.9

0 1 2 3 4 5 6 7

Growth Rate (%)

NEA WEP NAM

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

SAP has historically offered better margins

SAP Margins

NBA Margins

Regional margins – Butyl Acrylate to SAP

400

US Dollars per Metric Ton

200

0

-200

-400

-600

-800

-1000

Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17

NAM Contract WEP (Contract) China (Spot)

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Global supply of acrylic acid is tightening

Demand is growing faster than capacity addition

5,000

4,000

Thousand Tons

3,000

2,000

1,000

0

2012 2014 2016 2018 2020 2022 2024 2026

Capacity addition Demand

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Global producers are increasing captive use

Capacity (kmt) % Captive use

in WEP

CAA Derivatives

50

50

DowDuPont 100 Acrylates

72 70

50 50

Arkema 250 Acrylates

54 48

50

50

BASF 480 Acrylates

92 62

50

Evonik 250 SAP

68

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Which is worrying for North America

North America: Acrylic Acid Supply & Demand North America: Butyl Acrylate Supply & Demand

2,000 100% 700 100%

Thousand Metric Tons

Thousand Metric Tons

Operating Rate

Operating Rate

0 0% 0 0%

12 13 14 15 16 17 18 19 20 21 22 27 12 13 14 15 16 17 18 19 20 21 22 27

Domestic Demand Production Domestic Demand Production

Total Capacity Operating Rate Total Capacity Operating Rate

Source: IHS Markit © 2018 IHS Markit Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Can China help?

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

China Butyl Acrylate Producers ~ 600 Mt BA

~ 200 Mt BA

~ 100 Mt BA

4

1

13

1

5 31%

Non Integrated

36

12

69%

Integrated into Propylene

5

4

8

Traditional Propylene units 3 44%

PDH

13

On Purpose Propylene units 56%

Conventional

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

At a disadvantaged feedstock position

Propylene 2017 Cost Curve

• High feedstock costs

1200 Demand

• Expensive logistics to Europe and

Americas

Dollars per Metric Ton

1000 China Steam Cracker

Avg

PD

800

H

Splitter • Fast growing domestic demand

WEP

600

Avg • Chequered reliability record

NEA Avg

NAM Avg

400

• China remains to prove itself as

200

global exporter…

0

0.0 20.0 40.0 60.0 80.0 100.0 120.0

Cumulative Production - Million Metric Tons

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

China Environmental Inspections Number of

Provinces

Impact on Butyl Acrylate

Involved % of BA Capacity affected

BA Capacity

Price comparison

1st

2,000 600 25%

Round 8

Pilot

Dollars Per Metric Ton

2nd 420

1,000 17%

Round 7

2nd

3rd

4th

1st

3rd

0 140 6%

Round 7

China NBA (Spot) 4th

Source: IHS Markit © 2018 IHS Markit 1,270 52%

Round

8

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Trends combine to support underlying price rises

Global weighted average prices

2,100

US Dollars per Metric Ton

1,900

1,700

1,500

1,300

1,100

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

Global BA Global 2-EHA Global GAA Global SAP

Source: IHS Markit © 2018 IHS Markit

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Conclusions: Has the tide turned on acrylic acid value chain?

SAP vs Acrylates Markets

• Distinct drivers • China is only competitive within limits

• Faster growing demand from SAP • Limited investment

• SAP is a more attractive outlet for acrylic • Uncertainties and volatility

acid

Trends Prices

• Vertical integration • Global prices poised for progressive uplift

• Shrinking merchant market

• Channeling of acrylic acid towards SAP

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

Contact details

Denis Poussin

Director \ Acrylates

+44 203 253 2623 tel

Denis.Poussin@ihsmarkit.com

London

Confidential. © 2018 IHS MarkitTM. All Rights Reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Gejjo Design Business Planner With GuidesDocument50 pagesGejjo Design Business Planner With GuidesKim Reyes100% (2)

- Factors That Affect The Setting Up of An Integrated Steel Mill in KenyaDocument8 pagesFactors That Affect The Setting Up of An Integrated Steel Mill in KenyaLuigi BoardNo ratings yet

- I Mech E Big Ben PDFDocument22 pagesI Mech E Big Ben PDFBharat GouripurNo ratings yet

- Project Status Summary SheetDocument1 pageProject Status Summary SheetYang SunmanNo ratings yet

- Contract Summary SheetDocument1 pageContract Summary SheetYang SunmanNo ratings yet

- Gsi Concept Preliminary Cost Estimate TemplateDocument198 pagesGsi Concept Preliminary Cost Estimate TemplateYang SunmanNo ratings yet

- Water Quantities TemplateDocument21 pagesWater Quantities TemplateYang SunmanNo ratings yet

- Independent Quantity Verification FormDocument1 pageIndependent Quantity Verification FormYang SunmanNo ratings yet

- Penndot Pre Eps Submission ChecklistDocument4 pagesPenndot Pre Eps Submission ChecklistYang SunmanNo ratings yet

- NH 42 So 4Document1 pageNH 42 So 4Yang SunmanNo ratings yet

- Green Quantities TemplateDocument21 pagesGreen Quantities TemplateYang SunmanNo ratings yet

- Treatment of Industrial EffluentsDocument2 pagesTreatment of Industrial EffluentsYang SunmanNo ratings yet

- ERI PX Standard P&IDDocument2 pagesERI PX Standard P&IDYang SunmanNo ratings yet

- Na 2 So 4Document1 pageNa 2 So 4Yang SunmanNo ratings yet

- 2012-Fiche Ifc Indirect Force enDocument2 pages2012-Fiche Ifc Indirect Force enYang SunmanNo ratings yet

- Potassium Sulfate Crystallization K SO K SO: FranceDocument1 pagePotassium Sulfate Crystallization K SO K SO: FranceYang SunmanNo ratings yet

- CaseStudies PharmezZLDDocument2 pagesCaseStudies PharmezZLDYang SunmanNo ratings yet

- Evonik Company Presentation (January 2018)Document94 pagesEvonik Company Presentation (January 2018)Yang Sunman100% (1)

- IHSM Palmer MobilityImpact March22Document35 pagesIHSM Palmer MobilityImpact March22Yang SunmanNo ratings yet

- Solvay 2019 - StrategyReview - Presentation - 0Document47 pagesSolvay 2019 - StrategyReview - Presentation - 0Yang SunmanNo ratings yet

- Engineering - Principles - For - Assured - Potable - WaterDocument16 pagesEngineering - Principles - For - Assured - Potable - WaterYang SunmanNo ratings yet

- Configurations and Smart Optimisation Make The Difference in AdvancingDocument6 pagesConfigurations and Smart Optimisation Make The Difference in AdvancingYang SunmanNo ratings yet

- Transformation Kinetics of Burnt Lime in Freshwater and Sea WaterDocument28 pagesTransformation Kinetics of Burnt Lime in Freshwater and Sea WaterYang SunmanNo ratings yet

- Iwaresa Medywat Session: Medywat: How To Keep Youth Success Going?Document10 pagesIwaresa Medywat Session: Medywat: How To Keep Youth Success Going?Yang SunmanNo ratings yet

- IHSM Byrne GlobalStyrene March22Document29 pagesIHSM Byrne GlobalStyrene March22Yang SunmanNo ratings yet

- Acrylonitrile & Derivatives: Demand Growth But Balance UncertainDocument39 pagesAcrylonitrile & Derivatives: Demand Growth But Balance UncertainYang SunmanNo ratings yet

- Fluorocarbons: Are We Still Warming Towards Them?: Adam Bland, Director Specialty Chemicals, IHS MarkitDocument32 pagesFluorocarbons: Are We Still Warming Towards Them?: Adam Bland, Director Specialty Chemicals, IHS MarkitYang SunmanNo ratings yet

- Benzene - The Calm Before The Storm: Peter Feng, Executive Director, AromaticsDocument25 pagesBenzene - The Calm Before The Storm: Peter Feng, Executive Director, AromaticsYang SunmanNo ratings yet

- Algeria The Case of AlgeriDocument17 pagesAlgeria The Case of AlgeriYang SunmanNo ratings yet

- Friday Paddle - Friday Pickleball PaddlesDocument1 pageFriday Paddle - Friday Pickleball PaddlesgloriasuNo ratings yet

- MBA (Full-Time) II IV: INSTRUCTIONS: The Question Paper Seven Questions in Any Five Questions. All Questions Carry EqualDocument4 pagesMBA (Full-Time) II IV: INSTRUCTIONS: The Question Paper Seven Questions in Any Five Questions. All Questions Carry EqualAkshay MehtaNo ratings yet

- Advanced Noble Impulse Strategy Ichimoku Cloud SystemDocument10 pagesAdvanced Noble Impulse Strategy Ichimoku Cloud SystemmathaNo ratings yet

- The Consumer's Optimal Choice: Pen PalDocument5 pagesThe Consumer's Optimal Choice: Pen Palnyass thomsonNo ratings yet

- CIPS Level 2 - Certificate in Procurement and Supply Operations Module 2 - Procurement and Supply OperationsDocument4 pagesCIPS Level 2 - Certificate in Procurement and Supply Operations Module 2 - Procurement and Supply OperationsEng. Abdulaziz A. Al-Massabi100% (2)

- Amazon MotionDocument11 pagesAmazon MotionGeekWireNo ratings yet

- Quiz - Individual Assignment 5 FuadDocument4 pagesQuiz - Individual Assignment 5 FuadMd. Shahariar KoushikNo ratings yet

- Problem Set 1 SolutionsDocument16 pagesProblem Set 1 SolutionsAhmed SamadNo ratings yet

- IMC NumberDocument3 pagesIMC Numberpdn525z6twNo ratings yet

- Project BlackbookDocument19 pagesProject BlackbookJugal PatelNo ratings yet

- Waterous Drug Corporation Vs NLRC, G.R. 113271, October 16, 1997Document3 pagesWaterous Drug Corporation Vs NLRC, G.R. 113271, October 16, 1997eunice demaclidNo ratings yet

- Autority To Sell of Real PropertyDocument2 pagesAutority To Sell of Real PropertyBblabsLlamera100% (1)

- Palepu 3e - TB - Ch02 Class Exercise Chapter 2Document6 pagesPalepu 3e - TB - Ch02 Class Exercise Chapter 2nur zakirahNo ratings yet

- Mathematics-Ppt With HyperlinkDocument26 pagesMathematics-Ppt With Hyperlinkfarina kimNo ratings yet

- $6,975.36 Total Assets: Balances and HoldingsDocument2 pages$6,975.36 Total Assets: Balances and Holdingsnnenna26No ratings yet

- 8th Maths Question BankDocument44 pages8th Maths Question Bankds0909@gmailNo ratings yet

- Investment Risk and Portfolio ManagementDocument20 pagesInvestment Risk and Portfolio ManagementJUNENo ratings yet

- How To Outsmart Your Smart MeterDocument28 pagesHow To Outsmart Your Smart MeterAlienUFONo ratings yet

- Shareholders EquityDocument30 pagesShareholders EquityEmmanuelNo ratings yet

- Chpter 5 International Trade and Economic DevelopmentditedDocument11 pagesChpter 5 International Trade and Economic DevelopmentditedkasuNo ratings yet

- Managerial Economics NotesDocument35 pagesManagerial Economics Notessubhash_9280% (5)

- Pakistan Market StrategyDocument51 pagesPakistan Market StrategyWolf Gaming & tech TipsNo ratings yet

- Assignment 1 Student'S Name: IdDocument6 pagesAssignment 1 Student'S Name: IdHAFIZ MUHAMMAD ARSLAN MUNIRNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Busn 233 CH 06Document81 pagesBusn 233 CH 06Pramod VasudevNo ratings yet

- Pindyck PPT CH11Document69 pagesPindyck PPT CH11Muthia KhairaniNo ratings yet

- Proforma Invoice: Nabaki Afrika LTDDocument1 pageProforma Invoice: Nabaki Afrika LTDmariaNo ratings yet