Professional Documents

Culture Documents

Risk-Based Audit Process Overview

Uploaded by

Pam IntruzoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk-Based Audit Process Overview

Uploaded by

Pam IntruzoCopyright:

Available Formats

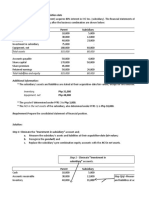

Seatwork: OVERVIEW OF RISK-BASED AUIT PROCESS

1. What are the three phases of the audit process? Give specific activities to be undertaken by the auditor for each

phases.

- The three phases of the audit process are risk assessment, risk response and reporting.

- Risk assessment :

Performance engagement activities to decide whether to accept or continue audit engagement

Planning the audit to develop an overall audit strategy and audit plan

- Risk response :

Designing overall responses and further audit procedures to develop appropriate responses to the

assessed risk of material misstatement

Implementing responses to assessed risk of material misstatement to reduce audit risk to an

acceptably low level

- Reporting :

Evaluating the audit evidence obtained to determine what additional audit work is required

Forming an opinion based on audit findings and preparing the auditor’s report

2. Explain Risk-Based Approach under the context of courting (for gentlemen) or accepting/rejecting the proposal

of the gentlemen (for ladies)

- Accepting/Rejecting the proposal of the gentlemen

3. What is the difference between Risk-Based and Account-Based audit?

- Auditors first obtain an understanding of control and assess control risk for particular type of errors and

frauds in specific accounts and cycle for account-based audit while risk-based audit is that the auditors

obtain an understanding of the client’s objectives.

4. What are the four critical components of risk that are relevant to the conduct of the audit. Explain each.

- The four critical components of risk that are relevant to the conduct of the audit are audit risk, engagement

risk, financial reporting risk and business risk.

- Audit risk : the risk that an auditor may give an unqualified opinion on financial statements

- Engagement risk : the risk that a CPA firm is exposed to because it is associated with a particular client

including loss of reputation

- Financial Reporting Risk : risk that relate directly to the recording of transactions

- Business Risk : risk that affect the operations and potential outcomes of organizational activities

5. State the purpose and nature of the Engagement Letter.

- Purpose : An engagement letter is sent to the client by the auditors to make clear the nature of the

engagement, any limitations on the scope of the audit, work to be performed by the client's staff, and the

basis for computing the auditors' fee.

- Nature : The engagement letter represents the written contract for the engagement, and its primary

objective is to prevent possible misunderstandings between the client and the auditors. It constitutes an

executory contract between the auditors and the client.

You might also like

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- Psa 315 (Part 1)Document47 pagesPsa 315 (Part 1)LisaNo ratings yet

- Unit 1 Audit of Property PLant and EquipmentDocument5 pagesUnit 1 Audit of Property PLant and EquipmentJustin SolanoNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Accounting For Special Transaction C8 Prob 5Document2 pagesAccounting For Special Transaction C8 Prob 5skilled legilimenceNo ratings yet

- Ass 2 in AuditingDocument5 pagesAss 2 in Auditingarnel gallarteNo ratings yet

- CPA Firm's Liability for Creditors' Losses Due to Reliance on Erroneous Financial StatementsDocument7 pagesCPA Firm's Liability for Creditors' Losses Due to Reliance on Erroneous Financial StatementsLeslie Mae Vargas ZafeNo ratings yet

- Define Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudDocument3 pagesDefine Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudSomething ChicNo ratings yet

- PSA 540: Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures ScopeDocument2 pagesPSA 540: Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures ScopeRam100% (1)

- Applied Auditing Preliminary Examination Multiple ChoiceDocument7 pagesApplied Auditing Preliminary Examination Multiple ChoicestillwinmsNo ratings yet

- Assurance Principles MT Quiz 1 and 2 FinalDocument13 pagesAssurance Principles MT Quiz 1 and 2 FinalSunshineNo ratings yet

- Audit Theory Chapter 7 Overview of FS Audit ProcessDocument13 pagesAudit Theory Chapter 7 Overview of FS Audit ProcessAdam SmithNo ratings yet

- Alce - 4,9,14,19Document2 pagesAlce - 4,9,14,19Riza Mae AlceNo ratings yet

- AT7Document8 pagesAT7gazer beamNo ratings yet

- Chapter11 CorgovDocument2 pagesChapter11 CorgovEANNA15No ratings yet

- Practice Set PSA 200Document5 pagesPractice Set PSA 200Krystalah CañizaresNo ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Acc110p2quiz 2answers Construction Contracts 1 PDF FreeDocument10 pagesAcc110p2quiz 2answers Construction Contracts 1 PDF FreeMichael Brian TorresNo ratings yet

- Psa 330Document25 pagesPsa 330xxxxxxxxx50% (2)

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- Chapter 10Document6 pagesChapter 10Melissa Kayla ManiulitNo ratings yet

- ACT 1202 Quiz No. 1 - AUDITING AND ASSURANCE PRINCIPLESDocument21 pagesACT 1202 Quiz No. 1 - AUDITING AND ASSURANCE PRINCIPLESJimbo ManalastasNo ratings yet

- Accounting policies, estimates and errors quizDocument2 pagesAccounting policies, estimates and errors quizkim cheNo ratings yet

- QuizDocument26 pagesQuizJan YasaNo ratings yet

- Advac Solmal Chapter 13Document16 pagesAdvac Solmal Chapter 13john paul100% (1)

- Pre 12 QuizDocument9 pagesPre 12 QuizCJ GranadaNo ratings yet

- Audit Theory Case AnalysisDocument2 pagesAudit Theory Case AnalysisSheila Mary GregorioNo ratings yet

- Tugas GSLC: No. Audit Procedures Audit Objective and Assertion Type of Test 1Document2 pagesTugas GSLC: No. Audit Procedures Audit Objective and Assertion Type of Test 1JSKyungNo ratings yet

- Chapter 2 - The Second Big Question - What Options Are Open To The OrganizationDocument8 pagesChapter 2 - The Second Big Question - What Options Are Open To The OrganizationSteffany RoqueNo ratings yet

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- Chapter 12 - Assurance & Other Related ServicesDocument5 pagesChapter 12 - Assurance & Other Related ServicesellieNo ratings yet

- National College Business Combination ExamsDocument9 pagesNational College Business Combination ExamsheyNo ratings yet

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDocument7 pagesPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaNo ratings yet

- Ra 9298Document6 pagesRa 9298Jane Michelle EmanNo ratings yet

- Assurance Services FundamentalsDocument10 pagesAssurance Services FundamentalsLysss EpssssNo ratings yet

- Sol. Man. - Chapter 12 - Insurance Contracts - Acctg. For Special TransactionsDocument1 pageSol. Man. - Chapter 12 - Insurance Contracts - Acctg. For Special TransactionsanjNo ratings yet

- Security Part Ii: Auditing Database SystemsDocument53 pagesSecurity Part Ii: Auditing Database SystemsJohn Carlo D MedallaNo ratings yet

- Operations Auditing - Midterm Exam: Input Process OutputDocument7 pagesOperations Auditing - Midterm Exam: Input Process OutputMaurice AgbayaniNo ratings yet

- ACC223 - Strategic AnalysisDocument16 pagesACC223 - Strategic Analysiswil markNo ratings yet

- Accounting For Government and Not-For-Profit OrganizationsDocument30 pagesAccounting For Government and Not-For-Profit OrganizationsPatricia ReyesNo ratings yet

- Risk-Based Auditing ProcessDocument10 pagesRisk-Based Auditing ProcessJwyneth Royce DenolanNo ratings yet

- Keme Chap 4Document5 pagesKeme Chap 4Melissa Kayla Maniulit100% (1)

- Summary Notes - PSA 120Document2 pagesSummary Notes - PSA 120Laila ContadoNo ratings yet

- Corporation Liquidation Notes PDFDocument4 pagesCorporation Liquidation Notes PDFTk KimNo ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- Bcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)Document5 pagesBcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)nickoloco100% (1)

- Problem 7-1: True or False False: Fact PatternDocument23 pagesProblem 7-1: True or False False: Fact PatternMichael Brian TorresNo ratings yet

- Chapter 2 4 For Law On Sales by Domingo Rex Bookstore Summarized VersionDocument15 pagesChapter 2 4 For Law On Sales by Domingo Rex Bookstore Summarized Versionsoyoung kim100% (1)

- Final Examination: Total Points EcodevDocument14 pagesFinal Examination: Total Points EcodevEllen BuenafeNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial StatementsAngelica Joy ManaoisNo ratings yet

- Consideration of Internal Control in A Financial Statements AuditDocument9 pagesConsideration of Internal Control in A Financial Statements AuditJan Danielle AgaloNo ratings yet

- Overview of Risk-Based AuditDocument8 pagesOverview of Risk-Based AuditMay Grethel Joy PeranteNo ratings yet

- Test of Control And/or Substantive Procedure, Developed To Assess The Efficacy of Controls inDocument4 pagesTest of Control And/or Substantive Procedure, Developed To Assess The Efficacy of Controls inIsabell CastroNo ratings yet

- The Risk-Based Audit ModelDocument2 pagesThe Risk-Based Audit ModelJoshel MaeNo ratings yet

- Auditing Book EditedDocument72 pagesAuditing Book EditedJE SingianNo ratings yet

- Practical AuditingDocument61 pagesPractical Auditinglloyd100% (1)

- Business Combinations QuizzerDocument9 pagesBusiness Combinations QuizzerjaysonNo ratings yet

- AuditDocument2 pagesAuditPam IntruzoNo ratings yet

- Weather is great todayDocument1 pageWeather is great todayPam IntruzoNo ratings yet

- Prelect 2A:: Human Resource ManagerDocument26 pagesPrelect 2A:: Human Resource ManagerPam IntruzoNo ratings yet

- ABC Company Sales Performance Report Q1-Q4Document3 pagesABC Company Sales Performance Report Q1-Q4Pam IntruzoNo ratings yet

- PrismDocument1 pagePrismPam IntruzoNo ratings yet

- Regional Director, Acting Provincial Director Showdown InspectionDocument2 pagesRegional Director, Acting Provincial Director Showdown InspectionPam IntruzoNo ratings yet

- Financial Accounting 1 Unit 12Document24 pagesFinancial Accounting 1 Unit 12Pam IntruzoNo ratings yet

- Beginning Word Practice 1 - PamelaDocument1 pageBeginning Word Practice 1 - PamelaPam IntruzoNo ratings yet

- FX AC 13 Transfer and Business Taxes - INTRUZO ANSWERDocument6 pagesFX AC 13 Transfer and Business Taxes - INTRUZO ANSWERPam IntruzoNo ratings yet

- Research Draft1Document4 pagesResearch Draft1Pam IntruzoNo ratings yet

- Econ H200 L7Document11 pagesEcon H200 L7Pam IntruzoNo ratings yet

- Religions 12 00247 v2Document12 pagesReligions 12 00247 v2Pam IntruzoNo ratings yet

- Research - Def of TermsDocument3 pagesResearch - Def of TermsPam IntruzoNo ratings yet

- 7 Podiotan - Beat Inspection ReportDocument1 page7 Podiotan - Beat Inspection ReportPam Intruzo60% (5)

- Online Class Student GuidelinesDocument12 pagesOnline Class Student GuidelinesElaine Fiona Villafuerte100% (1)

- Shooting Incident Report in Dumaguete CityDocument1 pageShooting Incident Report in Dumaguete CityPam IntruzoNo ratings yet

- Basic Audit Sampling ConceptsDocument2 pagesBasic Audit Sampling ConceptsPam IntruzoNo ratings yet

- Initial Investigation ReportDocument2 pagesInitial Investigation ReportJordan Tumayan71% (109)

- HK Government Works Contract Technical Audit ManualDocument73 pagesHK Government Works Contract Technical Audit ManualFawad SaeedNo ratings yet

- Progress ReportDocument1 pageProgress ReportPam Intruzo100% (9)

- Forming An Opinion and Reporting On Financial StatementsDocument2 pagesForming An Opinion and Reporting On Financial StatementsPam IntruzoNo ratings yet

- Course Introduction & Chapter 1Document24 pagesCourse Introduction & Chapter 1Pam IntruzoNo ratings yet

- Modifying the Independent Auditor's ReportDocument2 pagesModifying the Independent Auditor's ReportPam IntruzoNo ratings yet

- Lessons From Enron: Mark GoyderDocument11 pagesLessons From Enron: Mark GoyderPam IntruzoNo ratings yet

- Risk-Based Audit Process OverviewDocument1 pageRisk-Based Audit Process OverviewPam IntruzoNo ratings yet

- A036 2010 Iaasb Handbook Isa 700Document29 pagesA036 2010 Iaasb Handbook Isa 700afb99No ratings yet

- CPA Requirements & Professional Practice of AccountancyDocument1 pageCPA Requirements & Professional Practice of AccountancyPam IntruzoNo ratings yet

- Nonaudit Engagements - Procedures and Reports-1Document1 pageNonaudit Engagements - Procedures and Reports-1Pam IntruzoNo ratings yet

- My Answers Mock1 FreeDocument19 pagesMy Answers Mock1 FreeCamiNo ratings yet

- 3 Types Stock Verification Ordnance FactoriesDocument3 pages3 Types Stock Verification Ordnance FactoriesAnand DubeyNo ratings yet

- 6+ Years Accounting Experience Seeking New OpportunityDocument2 pages6+ Years Accounting Experience Seeking New OpportunitySanjay RathiNo ratings yet

- BBM 222 Cooperative and Microfinance Management ModuleDocument99 pagesBBM 222 Cooperative and Microfinance Management Modulesteve100% (6)

- TROS Terms and Conditions PDFDocument16 pagesTROS Terms and Conditions PDFCandice MillerNo ratings yet

- CPA BEC Cheat Sheet 2015Document2 pagesCPA BEC Cheat Sheet 2015GabrielNo ratings yet

- Total Assets 335,000 80,000: Additional InformationDocument8 pagesTotal Assets 335,000 80,000: Additional InformationHohohoNo ratings yet

- Set Off and Carry Forward of Losses 1218288118076384 8Document26 pagesSet Off and Carry Forward of Losses 1218288118076384 8jui999No ratings yet

- TM Ar2015Document409 pagesTM Ar2015Lavenyaa TharmamurthyNo ratings yet

- The Role of Different Departments in A Shipping CompanyDocument63 pagesThe Role of Different Departments in A Shipping CompanyHomer OdysseusNo ratings yet

- Baltimore County Public Schools - AuditDocument56 pagesBaltimore County Public Schools - AuditParents' Coalition of Montgomery County, MarylandNo ratings yet

- Cmo 39 2015 Guidelines On The Pilot Implementation of The Electronic Application and Issuance of Preferential and Non Preferential Certificate of Origin e CODocument6 pagesCmo 39 2015 Guidelines On The Pilot Implementation of The Electronic Application and Issuance of Preferential and Non Preferential Certificate of Origin e COmick_15No ratings yet

- New Financial Approaches for KMML's Economic SustainabilityDocument104 pagesNew Financial Approaches for KMML's Economic SustainabilityAmeen Mt100% (1)

- MIA Audit and Assurance Practice Guide AAPG 2 PDFDocument37 pagesMIA Audit and Assurance Practice Guide AAPG 2 PDFSyah MuhammadNo ratings yet

- Ifrs Usgaap NotesDocument38 pagesIfrs Usgaap Notesaum_thai100% (1)

- Big Data Management and Data AnalyticsDocument6 pagesBig Data Management and Data AnalyticsLelaki Pertama TamboenNo ratings yet

- Analysis of Financial Statements and Fund Accounting Methods for Atlanta County GovernmentDocument6 pagesAnalysis of Financial Statements and Fund Accounting Methods for Atlanta County GovernmentDawna Lee BerryNo ratings yet

- Auditing Theory Review Notes PDFDocument136 pagesAuditing Theory Review Notes PDFTricia Mae Fernandez100% (1)

- Ecolex 1 EkDocument109 pagesEcolex 1 Ekapi-29229615No ratings yet

- Activity Based Costing and Activity Based Management - ProblemDocument3 pagesActivity Based Costing and Activity Based Management - Problemkiara kiesh FosterNo ratings yet

- HRM 3Document14 pagesHRM 3Engr Nargis HussainNo ratings yet

- Southwest Medical Center internal controls auditDocument9 pagesSouthwest Medical Center internal controls auditRauliser VerdeciaNo ratings yet

- AUDIT SAMPLING METHODSDocument9 pagesAUDIT SAMPLING METHODSemc2_mcv100% (3)

- Clause 9 Performance EvaluationDocument8 pagesClause 9 Performance EvaluationAdil AbdulkhaderNo ratings yet

- Auditing Past Papers Short Question and AnswersDocument5 pagesAuditing Past Papers Short Question and AnswersMalika HaiderNo ratings yet

- 2009 Revised Rules of Procedure of The CoaDocument21 pages2009 Revised Rules of Procedure of The Coaedzn55100% (3)

- Auditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocument9 pagesAuditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashMarjorie PonceNo ratings yet

- Advance AccountingDocument7 pagesAdvance AccountingPutri anjjarwatiNo ratings yet

- Ch. 15 Internal AuditDocument3 pagesCh. 15 Internal Auditmayday101No ratings yet

- SB 236Document234 pagesSB 236IkramNo ratings yet