Professional Documents

Culture Documents

New Partnership Faqs

Uploaded by

Speedy Pinoy DenmarkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Partnership Faqs

Uploaded by

Speedy Pinoy DenmarkCopyright:

Available Formats

NEW PARTNERSHIP: KEY POINTS FOR CONSIDERATION

1. GENERAL

1.1 Should the partnership have a minimum duration so that no Partner can retire during this

period? Yes

Or should any Partner be able to leave on an agreed notice period? If yes, what period? 1

month.

Are there to be specific conditions for leaving the partnership? Yes. If yes, [provide details].

1.2 Changes in the business such as the introduction of a new Partner or the opening of new

offices should be agreed by all partners.

1.3 When one Partner leaves the partnership should end.

1.4 Expulsion of a partner can be effected by the agreement of all partners.

What are the grounds for expulsion? [provide details].

2. FINANCIAL

2. 1 In what proportions are the net profits of the business to be shared? [provide details].

2. 2 Are particular Partners to be entitled to the profits of particular offices or are the profits of the

offices to be pooled before divided? [provide details].

Similarly, what is the position concerning the out-goings of particular offices? [provide

details].

2. 3 Should some of the Partners be paid a "salary" as a first charge on profits before they are

divided? [provide details].

2. 4 Should the Partners be allowed to make drawings from the firm's account on account of

profits. Yes.

If so, what should the maximum amount of drawings be for each partner? [provide details].

2. 5 Is the signature of more than one Partner to be needed for cheques? Yes. Is there to be any

maximum amount above which the signatures of more than one Partner are needed? [provide

details].

3. PARTNERSHIP PROPERTY

3. 1 The offices to be treated as the property of the partnership .

3. 2 What are to be the amount of the contributions of the Partners to the capital of the firm?

[provide details].

3. 3 If the capital of the firm is increased in what proportion should the Partners advance the

additional capital? [provide details].

3. 4 Should the Partners be entitled to interest on the capital contributed by them as a first charge

on profits? Yes. If so what should the rate of interest be? [provide details].

4. PROVISION FOR A PARTNER LEAVING

© Signform (UK) Ltd. - Partnership FAQs Page 1

4. 1 Is a Partner to be entitled to sell his share of the business to an outsider? Yes.

If the remaining Partners are to have a right of first refusal how is the share of the outgoing

Partner to be apportioned between them [provide details].

How is the price of the share to be fixed? [provide details].

Is the price of the share of the outgoing Partner to include goodwill? Yes.

4. 2 In the event of a Partner dying or leaving the business, his share is to be payable by the

remaining partners in a lump sum. If instalments, over what period are they to be paid

[provide details], and what provisions for interest on unpaid instalments should there be

[provide details]?

4. 3 Should a Partner leaving the Partnership be prevented from competing with the business or

soliciting customers? If so, for how long are these restrictions to apply and how large should

the area be within which the outgoing Partner will not be allowed to complete?

4. 4 Should the remaining Partners provide a pension or annuity for an outgoing Partner and his

dependants? Alternatively, should the Partners be required to take out a personal pension, and

if so what should his minimum contribution be?

4. 5 Should the Partners take out Life Insurance Policies on each others lives as a way of ensuring

that a deceased Partner’s personal representatives can be paid his share of the business

immediately?

5. RUNNING A BUSINESS

5. 1 Should all Partners be required to divert the whole of their time to the Partnership business or

should/are some or all of them be allowed to carry on other activities as well?

5. 2 Should any income derived by a Partner from activities outside the firm be treated as

Partnership money or as his personal income?

5. 3 What should be the holiday entitlement of each Partner?

5. 4 Should the other Partners have the right to retire a Partner suffering from ill health or an

accident? If so, how long should the Partner be incapacitated before the other Partners can

retire him?

5. 5 How much power should particular Partners have in running the offices? For instance, should

the particular Partner running an individual Office be entitled to hire and dismiss staff without

needing the consent of the other Partners? In what areas will the agreement of the other

Partners be necessary?

5. 6 How should disputes be resolved concerning, say the account of the Partnership? Should there

be provision for reference of such disputes to arbitration?

5. 7 Should there be provision for sick pay?

© Signform (UK) Ltd. - Partnership FAQs Page 2

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

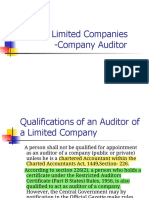

- Audit of Limited Companies - Company AuditorDocument8 pagesAudit of Limited Companies - Company AuditorAshiqul HaqueNo ratings yet

- Easement of Light and ViewDocument13 pagesEasement of Light and Viewkook0% (1)

- Judicial AffidavitDocument5 pagesJudicial AffidavitChe PuebloNo ratings yet

- Research Methodology and Research Ethics FinalDocument28 pagesResearch Methodology and Research Ethics FinalAnkita100% (1)

- Tax 86-12Document5 pagesTax 86-12Marinel FelipeNo ratings yet

- Quisumbing vs. GumbanDocument2 pagesQuisumbing vs. GumbanXyra Krezel Gajete100% (1)

- Ra 7166Document2 pagesRa 7166Ronz RoganNo ratings yet

- 31PDocument28 pages31PSathvik AmarnathNo ratings yet

- Meralco V QuisumbingDocument35 pagesMeralco V Quisumbingjoan dlcNo ratings yet

- Al KafalahDocument19 pagesAl KafalahMahyuddin KhalidNo ratings yet

- CSS International Relations Solved MCQs With Explanation (Set-II)Document10 pagesCSS International Relations Solved MCQs With Explanation (Set-II)ToobaNo ratings yet

- App-202-2014-Charles Nyambe and 82 Others and Buks Haulage Ltd-Sep 2017-Kajimanga JSDocument29 pagesApp-202-2014-Charles Nyambe and 82 Others and Buks Haulage Ltd-Sep 2017-Kajimanga JSAngelina mwakamuiNo ratings yet

- MCRO - 27-CR-23-14518 - E-Filed Comp-Order For Detention - 2023-07-12 - 20230712121221 (Redacted)Document8 pagesMCRO - 27-CR-23-14518 - E-Filed Comp-Order For Detention - 2023-07-12 - 20230712121221 (Redacted)WCCO - CBS MinnesotaNo ratings yet

- Family TrustsDocument2 pagesFamily Trustsvsimas11No ratings yet

- Decision On Confirmation of Charges - Muthaura, Uhuru and AliDocument193 pagesDecision On Confirmation of Charges - Muthaura, Uhuru and AliEric KitetuNo ratings yet

- Buy Side Representation AgreementDocument6 pagesBuy Side Representation AgreementArif ShaikhNo ratings yet

- Pro-Troll v. Shortbus Flashers - ComplaintDocument13 pagesPro-Troll v. Shortbus Flashers - ComplaintSarah BursteinNo ratings yet

- NO Maintenance - Adultery - Punjab & Haryana High CoutDocument7 pagesNO Maintenance - Adultery - Punjab & Haryana High CoutKAPIL DEVNo ratings yet

- Concept of Minimum Wage, Fair Wage, Living Wage and Need Based Minimum WageDocument10 pagesConcept of Minimum Wage, Fair Wage, Living Wage and Need Based Minimum Wagefxmn001No ratings yet

- Consumer Affairs Authority Act No. 9Document53 pagesConsumer Affairs Authority Act No. 9Padmavati KarthicNo ratings yet

- MCQs On Indian Partnership Act, 1932 Part 1Document11 pagesMCQs On Indian Partnership Act, 1932 Part 1Piyush KandoiNo ratings yet

- Explanatory StatementDocument1 pageExplanatory StatementanantNo ratings yet

- Article 32 FinalDocument18 pagesArticle 32 FinalShubham Jain Modi100% (1)

- How To Do MLC Inspection ?: Regulation 1.1 - Minimum AgeDocument15 pagesHow To Do MLC Inspection ?: Regulation 1.1 - Minimum AgegunturNo ratings yet

- Lacson vs. PeopleDocument3 pagesLacson vs. Peopletingcangmy15No ratings yet

- Plunder Law Ra 7080Document9 pagesPlunder Law Ra 7080Sebastian M.VNo ratings yet

- Modes of Acquiring OwnershipDocument5 pagesModes of Acquiring OwnershipCyril Dave LimNo ratings yet

- Paige Thompson Memorandum 8-13-19Document13 pagesPaige Thompson Memorandum 8-13-19Neal McNamaraNo ratings yet

- Jimmy Co Vs CADocument2 pagesJimmy Co Vs CAPatrick Ramos100% (1)

- Jehan Mutin Contract GAD AgendaDocument4 pagesJehan Mutin Contract GAD AgendaLyns EnriquezNo ratings yet