Professional Documents

Culture Documents

Practice 6

Practice 6

Uploaded by

RENIEEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice 6

Practice 6

Uploaded by

RENIEECopyright:

Available Formats

LCNRV of inventory is always

a) either the net realizable value or cost.

b) equal to net realizable value.

c) the greater of net realizable value or cost.

d) equal to net realizable value less costs to complete.

Lower-of-cost-or-net realizable value as it applies to inventory is best described as

a) the reporting of a loss when there is a decrease in the future utility below the

original cost.

b) a method of determining cost of goods sold.

c) the reporting of a gain or loss when there is a decrease in the future utility below

the original cost.

d) a change in inventory value to net realizable value.

The replacement cost of a FIFO cost inventory item is $75. Net realizable value is

$82.50. The cost of the item is $76.50. The inventory item would be valued at

a) $0.

b) $75.

c) $76.50.

d) $82.50.

The replacement cost of an inventory item is ₤90. Net realizable value is ₤87.50. The

cost of the item is ₤93. The inventory would be valued at

a) ₤91.50.

b) ₤90.

c) ₤93.

d) ₤87.50.

You might also like

- Chap 4 - CVP AnalysisDocument47 pagesChap 4 - CVP Analysiszyra liam styles93% (14)

- Chap 4 CVP AnalysisDocument47 pagesChap 4 CVP Analysisyanachii22100% (2)

- Reviewer - MaDocument6 pagesReviewer - Magelsk50% (2)

- Inventories - TOADocument19 pagesInventories - TOAYen86% (7)

- Test Bank CHP 9Document52 pagesTest Bank CHP 9candratriutariNo ratings yet

- Inventory Management FAQDocument5 pagesInventory Management FAQsurenNo ratings yet

- Valuation of Inventories: A Cost-Basis Approach: True-FalseDocument5 pagesValuation of Inventories: A Cost-Basis Approach: True-FalseCarlo ParasNo ratings yet

- Test Bank For Intermediate Accounting 17th by Kieso DownloadDocument56 pagesTest Bank For Intermediate Accounting 17th by Kieso Downloadjasondaviskpegzdosmt100% (24)

- Chapter 8 ACCT 1Document56 pagesChapter 8 ACCT 1John PickleNo ratings yet

- Test Bank For Intermediate Accounting 16th Edition by KiesoDocument56 pagesTest Bank For Intermediate Accounting 16th Edition by Kiesosarahreedddsqrtmjycsax100% (22)

- Test Bank For Intermediate Accounting 17th Edition Donald e Kieso DownloadDocument56 pagesTest Bank For Intermediate Accounting 17th Edition Donald e Kieso DownloadTeresaMoorecsrby100% (40)

- CHP 6 Eko 2Document10 pagesCHP 6 Eko 2Golden Ting Chiong SiiNo ratings yet

- Inventories ThoeryDocument10 pagesInventories ThoeryAltessa Lyn ContigaNo ratings yet

- 5 6235268602178568335Document45 pages5 6235268602178568335Maristella Gaton100% (1)

- Chap 4 CVP AnalysisDocument45 pagesChap 4 CVP AnalysisJessaNo ratings yet

- CH 08Document52 pagesCH 08kareem_batista20860% (5)

- Intermediate Accounting 17th Edition Kieso Test BankDocument56 pagesIntermediate Accounting 17th Edition Kieso Test Bankesperanzatrinhybziv100% (28)

- Intermediate Accounting 17Th Edition Kieso Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting 17Th Edition Kieso Test Bank Full Chapter PDFDebraWhitecxgn100% (9)

- ch08 PDFDocument52 pagesch08 PDFKyle Lee UyNo ratings yet

- Intermediate Accounting 14th Edition Kieso Test Bank DownloadDocument52 pagesIntermediate Accounting 14th Edition Kieso Test Bank Downloadodiletoanhyx2p3100% (33)

- Chapter3 - Solved AssignementDocument5 pagesChapter3 - Solved Assignementcumar maxamuud samatarNo ratings yet

- Variance Quizzer 1Document2 pagesVariance Quizzer 1Kang GaellyNo ratings yet

- Exercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueDocument9 pagesExercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueManuel Magadatu100% (1)

- Quizzer-Cost-Behavior - Docx Regression Analysis Least SquaresDocument1 pageQuizzer-Cost-Behavior - Docx Regression Analysis Least SquareslastjohnNo ratings yet

- CVP - Quiz 1Document7 pagesCVP - Quiz 1Jane ValenciaNo ratings yet

- 2.MATERIAL With New EOQDocument6 pages2.MATERIAL With New EOQMuhammad EjazNo ratings yet

- Microeconomic Theory Basic Principles and Extensions 10th Edition Nicholson Test BankDocument39 pagesMicroeconomic Theory Basic Principles and Extensions 10th Edition Nicholson Test Bankmasonpowellkp28100% (14)

- Inventories Cost ApproachDocument56 pagesInventories Cost ApproachJD DLNo ratings yet

- Assuming An Increase in Price Levels Over TimeDocument1 pageAssuming An Increase in Price Levels Over TimeElliot RichardNo ratings yet

- Kieso IFRS TestBank Ch08Document55 pagesKieso IFRS TestBank Ch08aapNo ratings yet

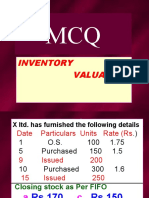

- MCQ Inventory Valuation LBSIMDocument49 pagesMCQ Inventory Valuation LBSIMSumit SharmaNo ratings yet

- Chap 007Document50 pagesChap 007saud1411100% (7)

- Chapter 7 - Test BankDocument52 pagesChapter 7 - Test BankFa Nyanya50% (4)

- Inventory: 1. IAS 2 InventoriesDocument7 pagesInventory: 1. IAS 2 InventoriesHikmət RüstəmovNo ratings yet

- Temitope Acc220 ObjDocument6 pagesTemitope Acc220 Objmuyi kunleNo ratings yet

- Assigment Accounting Meeting 11Document22 pagesAssigment Accounting Meeting 11cecilia angelNo ratings yet

- All Economics Practise MCQsDocument82 pagesAll Economics Practise MCQsRohan KhuranaNo ratings yet

- PAS 2 and 41Document28 pagesPAS 2 and 41Renz NgohoNo ratings yet

- ch09 Invenories AddtlDocument12 pagesch09 Invenories AddtlSalverika TorecampoNo ratings yet

- ESSAY. Write Your Answer in The Space Provided or On A Separate Sheet of PaperDocument5 pagesESSAY. Write Your Answer in The Space Provided or On A Separate Sheet of PaperSandhya1No ratings yet

- Chapter 9: Inventories: Additional Valuation Issues: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldDocument23 pagesChapter 9: Inventories: Additional Valuation Issues: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldArifin ArifinNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- CH 09Document54 pagesCH 09jidaNo ratings yet

- Kieso IFRS TestBank Ch09Document47 pagesKieso IFRS TestBank Ch09Ivern BautistaNo ratings yet

- Cost Behavior: True / False QuestionsDocument13 pagesCost Behavior: True / False QuestionsNaddieNo ratings yet

- Tutorial 3 Answer EconomicsDocument9 pagesTutorial 3 Answer EconomicsDanial IswandiNo ratings yet

- Chapter 8 Testbank Act310Document52 pagesChapter 8 Testbank Act310Md Al Alif Hossain 2121155630No ratings yet

- اسئلة ادارية 5+6+7+8+9+1Document17 pagesاسئلة ادارية 5+6+7+8+9+1Maysaa AlhusbanNo ratings yet

- ACTG240 - Ch07 Prac QuizDocument12 pagesACTG240 - Ch07 Prac QuizxxmbetaNo ratings yet

- (Lecture 2 W2) Tuto Answer-Cost Classification - QADocument6 pages(Lecture 2 W2) Tuto Answer-Cost Classification - QAMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- tb11 1Document10 pagestb11 1PeterNo ratings yet

- OPERATIONS MANAGEMENT-Inventory Models For Independent DemandDocument20 pagesOPERATIONS MANAGEMENT-Inventory Models For Independent DemandNina Oaip100% (1)

- Question #1: Inventory ItemDocument7 pagesQuestion #1: Inventory ItemAngelo TipaneroNo ratings yet

- Marginal Costing and Cost-Volume-Profit (CVP) Analysis: Hammad Javed Vohra, FCCADocument25 pagesMarginal Costing and Cost-Volume-Profit (CVP) Analysis: Hammad Javed Vohra, FCCAUrooj MustafaNo ratings yet

- The First Step in The Integrative Framework For The Implementation of Task Redesign IsDocument1 pageThe First Step in The Integrative Framework For The Implementation of Task Redesign IsRENIEENo ratings yet

- Segunda KatigbakDocument1 pageSegunda KatigbakRENIEENo ratings yet

- The Fifth Step in The Integrative Framework For The Implementation of Task Redesign IsDocument1 pageThe Fifth Step in The Integrative Framework For The Implementation of Task Redesign IsRENIEENo ratings yet

- The Eighth Step in The Integrative Framework For The Implementation of Task Redesign IsDocument2 pagesThe Eighth Step in The Integrative Framework For The Implementation of Task Redesign IsRENIEENo ratings yet

- The Matching ConceptDocument2 pagesThe Matching ConceptRENIEENo ratings yet

- Accompanying The Bank Statement Was A Credit Memo For A ShortDocument2 pagesAccompanying The Bank Statement Was A Credit Memo For A ShortRENIEENo ratings yet

- Vanilla Co. A Wholesale Company, Had The Following Information in Its General Ledger For The Year 2019?Document1 pageVanilla Co. A Wholesale Company, Had The Following Information in Its General Ledger For The Year 2019?RENIEENo ratings yet

- On The BankDocument1 pageOn The BankRENIEENo ratings yet

- Practice 3Document1 pagePractice 3RENIEENo ratings yet