Professional Documents

Culture Documents

Monthly

Uploaded by

nasirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly

Uploaded by

nasirCopyright:

Available Formats

Banking Industry of Bangladesh was adversely affected by the covid-19

pandemic during the FY2020. The internal and external affairs of the

financial market caused significant pressure on the sector as a whole. To

assist the banks to survive in this critical situation Bangladesh Bank (BB) has

declared a series of policies and prudential measures from the inception of

the pandemic. ➢ Repo Rate lowered to

5.25%.

As a part of initiative to support the economy from the negative fallout due ➢ Fall in CRR to 3.50%

to the pandemic, BB took several measures. The central bank lowered the (daily basis) & 4.00%

repo from 6.00% to 5.25%, followed by a reduction of the cash reserve (bi-weekly basis).

requirement (CRR) from 5.00% to 3.50% on a daily basis, and 5.50% to

4.00% in bi-weekly basis. Moreover, BB eminent the advance/investment

deposit ratio (ADR/IDR) by 2.00%, increasing ADR to 87.00% for

conventional banks and IDR to 92.00% for Shariah-based Islamic Banks. In

addition, BB stated several schemes for refinancing to aid in the credit flow

to businesses and households.

350

300

250

200

Through Banks

150

Through BB Refinance

100

Schemes

50

0

Industries and Service Sector Cottage, Micro, Small and Medium *Figure in BDT Billion

Enterprises

Exhibit 1: Government initiatives to support businesses & strengthening banks’ liquidity

As shown in the graph above, the government initiated interest payment

subsidies for working capital loans by banks to the businesses, with BDT 330

billion to industries and service sectors plagued by the coronavirus pandemic

and BDT 200 billion loans provided to Cottage, Micro, Small and Medium

Enterprises (CMSMEs). In this regard, BB introduced refinance schemes of

BDT 150 billion and BDT 100 billion respectively to ensure sufficient liquidity

of banks.

Bangladesh Bank has taken measures like relaxation over non-performing

loan classification, waiver of credit card interests & penalties for delay in

repayment, postponing loan payments with no additional penalties; imposing

restrictions on bank dividend payments etc. Classification of loans has not

changed since January 1 till December 31 of 2020 even during failure to pay

back the loan. BB also instructed the banks to extend the repayment tenure

of existing term loans by up to two years. Bangladesh Bank has also provide

relaxation on loan installment and as per Bangladesh Bank Circular financial

institutions can rearrange the numbers of installments for the short and long

term borrowers who are unable to pay the due installments between January

1 to December 31 of 2020 against their loans, lease and advances.

Bank deposits (excluding inter-bank items) increased by BDT 1,217,840.00 Comparison to June

million or 10.61% at the end of June 2020 as compared to June 2019 when 2019:

the growth rate was 9.89% compared to December 2018. The rise in total • Bank deposits

bank deposits was shared by all kinds of deposits. Demand deposits increased by 10.61%

increased by BDT 173,110.00 million or 14.64% to BDT 1,355,280.00 million in June 2020

in at the end of June 2020 against 4.42% increase at the end of June 2019. • Demand deposits

Besides, time deposits increased by 10.48% in June 2020 against 10.67% increased by 14.64%

increase as compared to June 2019. Government deposits increased by BDT in June 2020

5,320.00 million or 6.43% to BDT 880,990.00 million in June 2020 against • time deposits

9.20% increase compare to the data of June 2019. increased by 10.48%

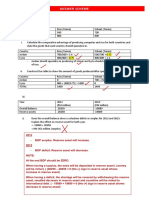

Exhibit 2: Credit and Deposit of Banking Industry in June 2020

Particulars June 2020 June 2019 2019 2018 2017 2016

Deposits (BDT in Millions) 12,690,990 11,473,150 12,219,640 10,440,950 9,874,890 8,933,920

Credit (BDT in Millions) 10,940,070 10,041,810 10,520,930 8,994,930 8,050,850 6,787,940

Deposit Growth (%) 10.61 9.89 17.04 5.73 10.53 12.10

Credit Growth (%) 8.95 11.64 16.97 11.73 18.61 13.58

Source: Monetary Policy Department and Statistics Department, Bangladesh Bank

On the other hand, outstanding bank credit (excluding foreign bills and Rise in the bank

inter-bank items) in FY2020 rose by 8.95% at the end of June 2020 as credit by 8.95%

compared to previous year’s same period and the growth rate was Advances increased

11.64% in FY2019 (June) as opposed to the December 2018. The rise in by 9.91%

the bank credit occurred due to increasing of advances by banks while

bills purchased and discounted by banks slightly decreased in June 2020.

Advances increased by BDT 964,390.00 million or 9.91% in June 2020

against the increase of 11.74% compare to June 2019. Bills purchased

and discounted decreased by BDT 66,130.00 million or 21.63% in at the

end of June 2020 against the increase of 8.40% which was at the end of

June 2019.

Exhibit 3: Gross NPL Ratio of Banking Industry (in percentage)

Particulars 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020*

State Owned

11.3 23.9 19.8 22.2 21.5 25.1 26.5 30.0 23.9 22.7

Commercial Banks

Specialized Banks

14.6 26.8 26.8 32.8 23.2 26.0 23.4 19.5 15.1 15.9

(DFI)

Private

2.9 4.6 4.5 4.9 4.9 4.6 4.9 5.5 5.8 5.9

Commercial Banks

Foreign

3.0 3.5 5.5 7.3 7.8 9.6 7.0 6.5 5.7 5.5

Commercial Banks

Total 6.1 10.0 8.9 9.7 8.8 9.2 9.3 10.3 9.32 9.2

Source: Banking Regulation and Policy Department (BRPD), Bangladesh Bank

*June 2020

The overall NPL of the banking industry stood at 9.32% as on

December 31, 2019. The NPL fell further to 9.2% as on June 2020.

The reduction of NPLs was affiliated with “One Time Exit Policy” for NPL fell

bad loan rescheduling offered by Bangladesh Bank at the beginning further to

of FY2020 and scaled up efforts for loan recovery by banks. Gross 9.2%

NPL for both SCBs and FCBs went down to 22.70% and 5.50% as on Net NPL

June 30, 2020. Overall provisioning against classified loans further ratio fell

to 0.15%

improved at the end of second quarter of FY2020, however, SCBs

witnessed deterioration. The system-wide net NPLs of the banking

industry witnessed an improvement, Net NPL ratio of the banking

sector was 1.02% in December 2019 which fell to 0.15% at the end

of June 2020.

Industry

Highlights RMG Sector

Bangladesh being the second largest apparel exporter in the world

fetching more than 84% of the country’s export earnings had been facing • Contribution to GDP

a tremendous challenge after the coronavirus outbreak. Over the last around 11.2%.

three decades, the RMG exports have registered a cumulative average

• 36% of manufacturing

growth of 14.8% per annum reaching USD34.2 billion in FY2019 which is

employment engaging 4.1

84.2% of the country’s total exports and dropped by more than 18% to

million workers

around USD27.95 billion in FY2020 according to EPB data.

60000

40000

20000

0

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20

Source: EPB (*FY2019-20 July-Sep)

Total Export RMG Export

Exhibit 4: RMG Export in Comparison to Total Export

Orders Cancelled or

Many international buyers had been cancelling or postponing confirmed Suspended: USD 3.16

procurement orders as their retail outlets were substantially closed in billion worth of

Europe, North America, Asia and elsewhere. shipments involving

1,142 factories affecting

Moreover, the country has been facing tough competition from its close 2.26 million workers

contender, Vietnam, in the global market. Vietnam has comparatively (April 18, 2020)

done better than Bangladesh during the lockdown as it started its

operations early and has advantage in lower raw material prices, higher

production capacity, lower lead time, productive employees, product

diversification, etc. The sector is looking forward for government support

and policies to overcome the challenges of Bangladesh.

Nonetheless, the government announced a stimulus package of BDT50

billion for RMG and other export-oriented industries for paying salaries-

allowances to workers & employees with fund of USD5.0 billion facilitating

short-term obligations for importing raw materials for export-oriented

industries. However, it will only meet a fraction of the massive

requirements of the sector, which needs at least USD470 million to pay

wages every month.

3,500.00

3,000.00

2,500.00

2,000.00

1,500.00

1,000.00

500.00

-

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

Woven 1,625. 1,505. 1,200. 194.55 622.16 1,075. 1,494. 1,103. 1,064. 985.50 1,110.

Knit 1,414. 1,278. 1,055. 180.12 608.38 1,164. 1,750. 1,364. 1,348. 1,338. 1,334.

Total 3,039. 2,784. 2,256. 374.67 1,230. 2,240. 3,244. 2,468. 2,413. 2,323. 2,444.

Woven Knit Total Source: EPB (USD Million)

Exhibit 5: Month wise Woven & Knit export till December

Insights from

Industry Expert’s Perspective

Economic and

Business Indicators

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BUSM4186 AssignmentDocument4 pagesBUSM4186 AssignmentKhánh LyNo ratings yet

- Automobile Industry in BangladeshDocument7 pagesAutomobile Industry in BangladeshnasirNo ratings yet

- Shanta Holdings Limited-PtdDocument13 pagesShanta Holdings Limited-PtdnasirNo ratings yet

- Linde Bangladesh Limited-PtdDocument14 pagesLinde Bangladesh Limited-PtdnasirNo ratings yet

- What Do You Mean by PreventionDocument8 pagesWhat Do You Mean by PreventionnasirNo ratings yet

- Khulna Power Company LTD-PTDDocument10 pagesKhulna Power Company LTD-PTDnasirNo ratings yet

- Berger Paints Bangladesh Limited-PtdDocument15 pagesBerger Paints Bangladesh Limited-PtdnasirNo ratings yet

- Eskayef Pharmaceuticals Limited-PtdDocument25 pagesEskayef Pharmaceuticals Limited-PtdnasirNo ratings yet

- Acme Laboratories Ltd. - Unsolicited-PtdDocument13 pagesAcme Laboratories Ltd. - Unsolicited-PtdnasirNo ratings yet

- M/S Print Point Galaxy: Credit AnalysisDocument3 pagesM/S Print Point Galaxy: Credit AnalysisnasirNo ratings yet

- Performance of Banking Industry: Exhibit 1: Government Initiatives To Support Businesses & Strengthening Banks' LiquidityDocument2 pagesPerformance of Banking Industry: Exhibit 1: Government Initiatives To Support Businesses & Strengthening Banks' LiquiditynasirNo ratings yet

- Impact of Covid 19 On Poultry-FinalDocument6 pagesImpact of Covid 19 On Poultry-FinalnasirNo ratings yet

- The Philippine Financial System FullDocument35 pagesThe Philippine Financial System FullFe ValenciaNo ratings yet

- Managerial Accounting Quiz.1992012172610Document4 pagesManagerial Accounting Quiz.1992012172610Go Turpin0% (1)

- (GLOBAL MKT - GROUP 1) Economic Factors Affecting FPT SoftwareDocument3 pages(GLOBAL MKT - GROUP 1) Economic Factors Affecting FPT SoftwareRCS Nguyễn Tuệ MẫnNo ratings yet

- Emerging Senegal - Dangote New PlantDocument8 pagesEmerging Senegal - Dangote New PlantRohit MotapartiNo ratings yet

- 03 Task Performance 2Document4 pages03 Task Performance 2Ash kaliNo ratings yet

- Balance of Payments WorksheetDocument4 pagesBalance of Payments Worksheetansh yadavNo ratings yet

- HTML 000001Document1 pageHTML 000001NILLOINo ratings yet

- 281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerDocument1 page281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerMichael MotanNo ratings yet

- Presentation 1Document24 pagesPresentation 1waseemniazjatoi100% (1)

- Service Sector Contribution in GDP Country WiseDocument4 pagesService Sector Contribution in GDP Country WisenumlumairNo ratings yet

- Corporate Governance in Real Estate Sector in India Under The Supervision of Prof J.P. SHARMA SONAL NAGPAL (Mcom, Mphil, D.U)Document1 pageCorporate Governance in Real Estate Sector in India Under The Supervision of Prof J.P. SHARMA SONAL NAGPAL (Mcom, Mphil, D.U)Sonal KhuranaNo ratings yet

- Economic Survey 2002-03Document240 pagesEconomic Survey 2002-03raza9871No ratings yet

- Ocean Carriers PresentationDocument12 pagesOcean Carriers PresentationIvaylo VasilevNo ratings yet

- WORLD BANK PresentationDocument30 pagesWORLD BANK PresentationAmna FarooquiNo ratings yet

- Marketing PlanDocument4 pagesMarketing PlanRence Terrado0% (1)

- Topic - China's Push For The Next World Superpower Lit ReviewDocument4 pagesTopic - China's Push For The Next World Superpower Lit Reviewumang tyagiNo ratings yet

- World Bank (IBRD & IDA)Document5 pagesWorld Bank (IBRD & IDA)prankyaquariusNo ratings yet

- Bemis Co Check Date Check Number: VOID - This Is Not A CheckDocument1 pageBemis Co Check Date Check Number: VOID - This Is Not A Checkfreeman p. donNo ratings yet

- International Financial Management PDFDocument134 pagesInternational Financial Management PDFRomelyn PagulayanNo ratings yet

- T7 - Answer Scheme BopDocument5 pagesT7 - Answer Scheme BopAkai GunnerNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument35 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancevaraprasadNo ratings yet

- LÊ NGUYỄN ANH THƠ - preclass 2Document3 pagesLÊ NGUYỄN ANH THƠ - preclass 2Lê Nguyễn Anh ThơNo ratings yet

- Indian Financial System - CIADocument12 pagesIndian Financial System - CIASamar GhorpadeNo ratings yet

- Sino-ASEAN Relations in The Early 21th CenturyDocument16 pagesSino-ASEAN Relations in The Early 21th CenturyKha KhaNo ratings yet

- South Asian Free Trade AgreementDocument44 pagesSouth Asian Free Trade AgreementZeeshan Adeel100% (3)

- Trade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamDocument14 pagesTrade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamTRn JasonNo ratings yet

- United Kingdom Salary Survey 2010Document64 pagesUnited Kingdom Salary Survey 2010Mohsin MunirNo ratings yet

- Alpesh Raut FINANCIAL CONSULTANT-1-2Document2 pagesAlpesh Raut FINANCIAL CONSULTANT-1-2Alpesh RautNo ratings yet

- Cotton: World Markets and Trade: Record World Consumption Helps Lower Stocks in 2019/20Document29 pagesCotton: World Markets and Trade: Record World Consumption Helps Lower Stocks in 2019/20JigneshSaradavaNo ratings yet