Professional Documents

Culture Documents

Manage Bank Statement

Uploaded by

Prophet paschal LambOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manage Bank Statement

Uploaded by

Prophet paschal LambCopyright:

Available Formats

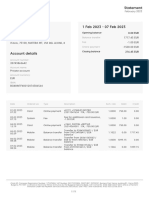

Statement Ending

09/21/2018

RETURN SERVICE REQUESTED Managing Your Accounts

Primary BranchCanton Phone Number443-573-4800

Online BankingHowardBank.com

John Doe

123 Main Street

Baltimore, MD 21224

Telephone

1-877-527-2703

Banking

Mailing Address3301 Boston Street

Baltimore, MD 21224

Summary of Accounts

Account Type Account Number Ending Balance

HOWARD RELATIONSHIP CHECKING XXXXXXXX4101 $5,684.22

HOWARD RELATIONSHIP CHECKING-XXXXXXXX4101

Primary Checking

Account Summary

Date Description Amount

09/01/2018 Beginning Balance $18,805.47

3 Credit(s) This Period $4,293.20

20 Debit(s) This Period $17,414.45

09/21/2018 Ending Balance $5,684.22

Account Activity

Post Date Description Debits Credits Balance

09/01/2018 Beginning Balance $18,805.47

09/04/2018 Signature POS Debit 09/02 MD BALTIMORE GIANT FOOD $57.48 $18,747.99

INC SEQ# 071582

09/04/2018 Nationstar dba Mr Cooper XXXXXX6179 $1,989.60 $16,758.39

09/05/2018 HMS WARRANTY 8002473680 5829389 $42.99 $16,715.40

09/05/2018 SAMS CLUB MC ONLINE PMT CKF426104254POS $4,671.42 $12,043.98

09/05/2018 DISCOVER BANK ETRANSFER $8,212.00 $3,831.98

09/06/2018 BLTMORE GAS ELEC ONLINE PMT $160.75 $3,671.23

09/06/2018 AMAZON $170.00 $3,501.23

09/06/2018 DEVONSHIRE II CO CONS CP BC5198 $195.00 $3,306.23

09/07/2018 DEPOSIT $653.25 $3,959.48

09/07/2018 TARGET ONLINE PMT $88.59 $3,870.89

09/10/2018 ATM Withdrawal 09/07 MD BALTIMORE 10101 $180.00 $3,690.89

PHILDELPHIA RD SEQ# 008838

09/10/2018 Signature POS Debit 09/08 MD BALTIMORE GIANT FOOD $70.11 $3,620.78

I

09/10/2018 L A FITNESS $12.98 $3,607.80

09/11/2018 AT&T MOBILITY ONLINE PMT $116.22 $3,491.58

09/14/2018 DEPOSIT $606.62 $4,098.20

09/14/2018 DIRECT DEP $3,033.33 $7,131.53

09/14/2018 Signature POS Debit 09/13 MD BALTIMORE GIANT $19.86 $7,111.67

09/17/2018 ATM Withdrawal 09/15 WV INWOOD $400.00 $6,711.67

MARTINSBURG-INWOOD

09/17/2018 Signature POS Debit 09/16 MD BALTIMORE GIANT $14.06 $6,697.61

BILLING RIGHTS SUMMARY

In case of errors or questions about loans on your statement

If you think your statement is wrong, or if you need more information about a transaction on your statement, write us on a separate sheet of paper at the address on the reverse side of this

form as soon as possible. We must hear from you no later than sixty (60) days after we sent you the first statement on which the error or problem appeared. You can telephone us, but doing so will not preser e

your rights. In your letter, give us the following information:

• Your name and account number.

• The dollar amount of the suspected error.

• !escribe the error or item you are unsure about, and explain as clearly as you can why you belie e it is an error or why you need more information. You don"t ha e to pay any amount in #uestion

while we are in estigating, but you are still obligated to pay the parts of your outstanding balance that are not in #uestion. While we in estigate your #uestion, we cannot report you as delin#uent or

ta$e any action to collect the amount you #uestion. We can apply any unpaid amount against your credit limit.

TO REPORT A LOST OR STOLEN ATM OR VISA ® DEBIT CARD

To report a lost or stolen Howard Bank Visa Debit Card or ATM Card call 410-750-0020 OR after hours call 1-800-472-3272.

IN CASE OF ERROR OR QUESTIONS ABOUT YOUR ELECTRONIC TRANSFERS

Call us at 410-750-0020 or write us at 3301 Boston Street, Baltimore, MD 21224

If you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt, you must contact us by phone or mail. We must hear from you no later

than sixty (60) days after we sent you the first statement on which the error or problem appeared. %n your letter, gi e us the following information&

• Your name and account number.

• The dollar amount of the suspected error.

• Describe the error or item you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

%f you tell us erbally we may re#uire that you send us your complaint or #uestion in writing within ten ('0) business days. We will tell you the results of our in estigation within ten ('0) calendar days ((

business days for VISA® !ebit )ard point of sale transactions) after we hear from you and will correct any error promptly. %f we need more time, howe er, we may ta$e up to forty fi e (*() days to

in estigate your complaint or #uestion. %f we decide to do this, we will credit your account within ten ('0) calendar days (( business days for +%,- ® Debit Card point of sale transactions) for the amount

you thin$ is in error so that you will ha e the use of the money during the time it ta$es us to complete our in estigation. %f we as$ you to put your complaint or #uestion in writing and we do not

recei e it within ten ('0) business days, we may not credit your account. %f we decide that there was not error, we will send you a written explanation within three (.) business days after we finish our

in estigation. You may as$ for copies of the documents that we used in our in estigation and we must ma$e these a ailable to you for your inspection.

If your alleged error concerns a transfer to or from a third party (for example, a social security payment) our investigation may be limited to a review of our own records. If we decide that there was no

error, you may want to contact such third party to pursue the matter further.

IF THIS STATEMENT IS FOR A CHECKING ACCOUNT OR A N.O.W. ACCOUNT THIS FORM IS

/01+%!2! 31 425/ Y16 7-5-8)2 Y160 )42)97119 W%34 Y160 ,3-32:283

CHECKS OUTSTANDING

NUMBER AMOUNT

1. In your checkbook, enter the interest earned on your

account as it appears on the front of this statement.

2. Verify that checks are charged on the statement for

amount drawn.

3. Be sure that service charges (if any) or other

authorized deductions shown on this statement have

been deducted from your checkbook balance.

4. Verify that all deposits have been credited for the

same amount as on your records.

5. Be sure that all checks outstanding on your previous

statement have been included in this statement

(otherwise, they are still outstanding).

6. )hec$ o= on the stubs of your chec$boo$, each of

the checks paid by us.

7. Make a list of the numbers and amounts of those

checks still outstanding in the space provided at

the left.

ENTER FINAL

BALANCE AS PER

8. STATEMENT

WHENEVER A STATEMENT SHALL ADD

BE UNCLAIMED OR UNDELIVERED, -8Y !2/1,%3,

EITHER BE CAUSE OF THE TOTAL 9. NOT CREDITED

OVER

!2/1,%310", ;-%5602 31 /01+%!2 OUTSTANDING

ADEQUATE INSTRUCTIONS OR

BECAUSE OF HIS OR HER FAILURE

10. TOTAL

TO 813%;Y 342 7-89 1; - )4-8<2

SUBTRACT

1; 11.

-!!02,,, 342 7-89 :-Y CHECKS

DISCONTINUE SENDING STATEMENTS )- OUTSTANDING

00Y

683%5 13420W%,2 %8,306)32! 7Y

BALANCE SHOULD

THE DEPOSITOR. AGREE WITH

12. CHECKBOOK

HOWARD RELATIONSHIP CHECKING-XXXXXXXX4101 (continued)

Primary Checking

Account Activity (continued)

Post Date Description Debits Credits Balance

SEQ# 0087

09/17/2018 Signature POS Debit 09/15 MD BALTIMORE GIANT FOOD $44.90 $6,652.71

09/18/2018 THE HOME DEPOT ONLINE PMT POS $9.51 $6,643.20

09/18/2018 00RETIRE2020 TRAN000141 000001018370220 $541.66 $6,101.54

09/20/2018 ".";0/ 71557915 $417.32 $5,684.22

09/21/2018 Ending Balance $5,684.22

Daily Balances

Date Amount Date Amount Date Amount

09/04/2018 $16,758.39 09/10/2018 $3,607.80 09/18/2018 $6,101.54

09/05/2018 $3,831.98 09/11/2018 $3,491.58 09/20/2018 $5,684.22

09/06/2018 $3,306.23 09/14/2018 $7,111.67

09/07/2018 $3,870.89 09/17/2018 $6,652.71

Overdraft and Returned Item Fees

Total for this period Total year-to-date

Total Overdraft Fees $0.00 $0.00

Total Returned Item Fees $0.00 $0.00

This page left intentionally blank

You might also like

- Amount EnclosedDocument4 pagesAmount EnclosedVicki HillNo ratings yet

- Stanley Chinedu Nwafor 1422102310 20210130092323Document1 pageStanley Chinedu Nwafor 1422102310 20210130092323Юлия ПNo ratings yet

- Bay First Bank, N.A Account Statement For Jan 1 To Jan 31, 2021Document1 pageBay First Bank, N.A Account Statement For Jan 1 To Jan 31, 2021Jordany brNo ratings yet

- 01 AB 0.428 000638740261156 P Y R&R Atms Rentals and Vending LLC UNIT 61054 2478 E Desert Inn RD LAS VEGAS NV 89160-8044Document4 pages01 AB 0.428 000638740261156 P Y R&R Atms Rentals and Vending LLC UNIT 61054 2478 E Desert Inn RD LAS VEGAS NV 89160-8044Madison BlackNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- ICBC Credit Card: HKD Payment Autopay Authorization FormDocument2 pagesICBC Credit Card: HKD Payment Autopay Authorization FormGladys TseNo ratings yet

- Account Summary Portfolio AllocationDocument13 pagesAccount Summary Portfolio AllocationCourtney JohnsonNo ratings yet

- Statement Ending 000111/111999/222000222111: Summary of AccountsDocument4 pagesStatement Ending 000111/111999/222000222111: Summary of AccountsNiao PjNo ratings yet

- Spending Account StatementDocument2 pagesSpending Account StatementTaylor LynnNo ratings yet

- PDFDocument4 pagesPDFMark Christian CruzNo ratings yet

- BBAV Bank StatementDocument1 pageBBAV Bank StatementTommy CliftonNo ratings yet

- Cesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203Document4 pagesCesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203CESAR ABREUNo ratings yet

- Estatement20160515 - 000057601Document3 pagesEstatement20160515 - 000057601Swamy KurnoolNo ratings yet

- Covid-19 PCR Swab Lab ResultsDocument1 pageCovid-19 PCR Swab Lab ResultsJN AdingraNo ratings yet

- Reach Us 1-866-775-0556 Customer Service BOX 6062 SIOUX FALLSDocument5 pagesReach Us 1-866-775-0556 Customer Service BOX 6062 SIOUX FALLSScott HeatwoleNo ratings yet

- Iesha Indi June Statement 2021Document1 pageIesha Indi June Statement 2021Sharon JonesNo ratings yet

- Trust - Bank Statement 2017Document49 pagesTrust - Bank Statement 2017Emalyn SimanganNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- Retail XXX6651 Statement 10 - 19 - 2015Document2 pagesRetail XXX6651 Statement 10 - 19 - 2015alfonso loboNo ratings yet

- Collection Summary Demand Summary: Loan Details Insurance DetailsDocument2 pagesCollection Summary Demand Summary: Loan Details Insurance DetailsDURGAPUR-BOLPURNo ratings yet

- Statement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRDocument1 pageStatement of Account: Product: Ca-Gen-Pub-Metro/Urban-Inr Currency: INRAottry MukherjeeNo ratings yet

- Summary of Account Activity Payment InformationDocument4 pagesSummary of Account Activity Payment InformationAnonymous 7DmNfQeSQNo ratings yet

- Lyndsie Barnes BankDocument4 pagesLyndsie Barnes BankJaram JohnsonNo ratings yet

- February 01, 2020 Through February 29, 2020Document4 pagesFebruary 01, 2020 Through February 29, 2020Jimario SullivanNo ratings yet

- 164152336-Aug-30-2013 (чейз)Document4 pages164152336-Aug-30-2013 (чейз)Юлия ПNo ratings yet

- Statement Oct2015Document9 pagesStatement Oct2015Banerjee SuvranilNo ratings yet

- Discover Statement 20130323 0818Document6 pagesDiscover Statement 20130323 0818Rebekah PerkinsNo ratings yet

- Financial Summary Account# Balance Financial Summary Account# BalanceDocument3 pagesFinancial Summary Account# Balance Financial Summary Account# BalanceShelvya ReeseNo ratings yet

- My Statements ControlDocument6 pagesMy Statements ControlDaniel KentNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Your RBC Personal Banking Account StatementDocument2 pagesYour RBC Personal Banking Account Statementdrgt ggNo ratings yet

- Bickslow Bank Statement Template - TemplateLabDocument1 pageBickslow Bank Statement Template - TemplateLabbaga ibakNo ratings yet

- John Henry CFSB Card ActivitiesDocument1 pageJohn Henry CFSB Card ActivitiesSolomon100% (1)

- Secure Documents Download Fileloan Id 0000305572&object Id 42773697Document1 pageSecure Documents Download Fileloan Id 0000305572&object Id 42773697lorrieNo ratings yet

- Aliyu STTMNTDocument2 pagesAliyu STTMNTShelvya ReeseNo ratings yet

- Bank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweDocument2 pagesBank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweWierd SpecieNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument3 pagesBank Statement Template 1 - TemplateLabMakel AlqadaffiNo ratings yet

- Service Tax Registration No. credit card statement summaryDocument4 pagesService Tax Registration No. credit card statement summarySamNo ratings yet

- Viaions of The EndDocument5 pagesViaions of The EndDon PayneNo ratings yet

- Nicholas Indi July Statement 2021Document1 pageNicholas Indi July Statement 2021Sharon JonesNo ratings yet

- 7 D 6341 D 9Document6 pages7 D 6341 D 9Saul IpanaqueNo ratings yet

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTDocument1 pageConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriNo ratings yet

- E-Bill# 003045008 Dated June 2020 For Account# 00000693168Document2 pagesE-Bill# 003045008 Dated June 2020 For Account# 00000693168Keisha MussingtonNo ratings yet

- EstatementDocument2 pagesEstatementIKEOKOLIE HOMEPCNo ratings yet

- EversourceDocument2 pagesEversourceAlicjaVictoriaMucha100% (1)

- TD Simple Checking: Chauncy Lucion Cooper 10515 SW 170 TER Miami FL 3315Document6 pagesTD Simple Checking: Chauncy Lucion Cooper 10515 SW 170 TER Miami FL 3315James FranklinNo ratings yet

- Bill To: Ship To:: Thank You For Your Business!Document1 pageBill To: Ship To:: Thank You For Your Business!Jaram JohnsonNo ratings yet

- StatementDocument4 pagesStatementjoan manuel100% (1)

- ACE BANK CUSTOMER STATEMENTDocument1 pageACE BANK CUSTOMER STATEMENTsantiago ospinaNo ratings yet

- Account StatementDocument39 pagesAccount StatementSun SivathaNo ratings yet

- Deanna STTMNTDocument2 pagesDeanna STTMNTShelvya ReeseNo ratings yet

- Account StatementDocument3 pagesAccount StatementJamesNo ratings yet

- Monthly Report 2023 06 enDocument7 pagesMonthly Report 2023 06 enDustin Knechtel-wickertNo ratings yet

- PNC Access Checking Account SummaryDocument2 pagesPNC Access Checking Account SummaryNiao PjNo ratings yet

- Jerry CoDocument4 pagesJerry CogarrettloehrNo ratings yet

- Statement - 2021 08 01 - 2021 08 12 - ENDocument1 pageStatement - 2021 08 01 - 2021 08 12 - ENRichard GriffinNo ratings yet

- Estmt - 2019 07 25Document8 pagesEstmt - 2019 07 25Sandra RíosNo ratings yet

- Dario JunioDocument6 pagesDario JunioManuela Granda VallejoNo ratings yet

- Estmt - 2019 08 26Document8 pagesEstmt - 2019 08 26Sandra RíosNo ratings yet

- Estmt - 2022 08 18Document4 pagesEstmt - 2022 08 18CHRIS100% (1)

- Advertising and Sales Promotion AssignmentDocument26 pagesAdvertising and Sales Promotion AssignmentMiniMohnishPuriNo ratings yet

- Estilita RnvioDocument1 pageEstilita RnvioAna MartinezNo ratings yet

- Invoice #22676: Diana Host LTDDocument1 pageInvoice #22676: Diana Host LTDHitlar MamaNo ratings yet

- Blockchain Programming in CDocument6 pagesBlockchain Programming in CFarjana Akter EityNo ratings yet

- Current & Saving Account StatementDocument35 pagesCurrent & Saving Account Statementmadhu kumarNo ratings yet

- The Future of Payment in AfricaDocument17 pagesThe Future of Payment in AfricaNegera AbetuNo ratings yet

- Intra-EEA Fallback POS Interchange FeesDocument4 pagesIntra-EEA Fallback POS Interchange FeesStefano Micautolalaner GrgićNo ratings yet

- Check Disbursement Voucher: Mancarmel TradingDocument1 pageCheck Disbursement Voucher: Mancarmel TradingCarlo GarciaNo ratings yet

- What Are The Different Types of Banking TransactionsDocument5 pagesWhat Are The Different Types of Banking Transactionsbackupsanthosh21 dataNo ratings yet

- DBBL StatementDocument1 pageDBBL StatementKazi Foyez Ahmed75% (16)

- Green Dot Bank StatementDocument3 pagesGreen Dot Bank StatementDavid Thompson100% (1)

- Essentials of Bank Computerization Payment Systems and Electronic BankingDocument7 pagesEssentials of Bank Computerization Payment Systems and Electronic Bankingvijayadarshini vNo ratings yet

- IRCTC Next Generation Eticketing SystemDocument2 pagesIRCTC Next Generation Eticketing SystemTushar SinghNo ratings yet

- Master Card Card Identification FeaturesDocument2 pagesMaster Card Card Identification FeaturesNoufal Babu0% (1)

- Tax Invoice Signature Not VerifiedDocument1 pageTax Invoice Signature Not VerifiedSatender Kumar0% (1)

- Industry Study - Fintech in Indonesia and How Kredivo Boosts Conversions by 40%Document6 pagesIndustry Study - Fintech in Indonesia and How Kredivo Boosts Conversions by 40%Thang LeNo ratings yet

- Formular Antrag Entschaedigung Englisch - 09 2018Document2 pagesFormular Antrag Entschaedigung Englisch - 09 2018Philip BNo ratings yet

- MT 199 Free Format Message: Click Here To Get FileDocument2 pagesMT 199 Free Format Message: Click Here To Get FileFaNToMツNailNo ratings yet

- SRIKANTH REDDY BANK ACCOUNT STATEMENTDocument8 pagesSRIKANTH REDDY BANK ACCOUNT STATEMENTSrikanth reddyNo ratings yet

- Ilac Wire Transfer Form-UpdatedDocument1 pageIlac Wire Transfer Form-Updatedmirins265No ratings yet

- Canara Bank Statement-1Document9 pagesCanara Bank Statement-1Er Md AamirNo ratings yet

- DAY258403358 Auth LetterDocument3 pagesDAY258403358 Auth LetterDanish InamNo ratings yet

- Foodpanda Invoice (Orders Summary) April 1-30, 2021Document43 pagesFoodpanda Invoice (Orders Summary) April 1-30, 2021JL DulanaNo ratings yet

- Arjun Desai 2 St. Vincent Street West Dublin Dublin Co. DublinDocument3 pagesArjun Desai 2 St. Vincent Street West Dublin Dublin Co. DublinarjunNo ratings yet

- FNB Pricing GuideDocument14 pagesFNB Pricing Guidemovali2No ratings yet

- State Bank of India savings account statement for Mr. Rachaprolu AtchaiahDocument12 pagesState Bank of India savings account statement for Mr. Rachaprolu AtchaiahRajesh pvkNo ratings yet

- Icard Statement 01.2023Document1 pageIcard Statement 01.2023anastasiya DubininaNo ratings yet

- POS Order Report PDFDocument5 pagesPOS Order Report PDFEriko Indra Teknik Informatika 091No ratings yet

- May 2019 account statement for Shree TradersDocument1 pageMay 2019 account statement for Shree TradersSunil KumarNo ratings yet

- Towards A Cashless Society - A Design Science Research On Mobile WalletsDocument145 pagesTowards A Cashless Society - A Design Science Research On Mobile Walletshar.san0% (1)