Professional Documents

Culture Documents

CA51025 - Module 4.1 - Special Banking Laws

Uploaded by

Drehfcie0 ratings0% found this document useful (0 votes)

20 views4 pagesThis document summarizes special banking laws in the Philippines related to secrecy of bank deposits and unclaimed balances.

The key points are:

1) Bank deposits in the Philippines are considered absolutely confidential, but there are exceptions allowing examination of deposits in cases of court orders, impeachment, bribery, or money laundering investigations.

2) Foreign currency deposits have additional exceptions, such as when the depositor provides written consent or if related to a money laundering offense.

3) Unclaimed balances that have gone untouched for 10 years or more must be deposited with the Treasurer of the Philippines and may be subject to escheat proceedings where a court determines the property has no heirs. Violations

Original Description:

Original Title

CA51025_Module 4.1_Special Banking Laws

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes special banking laws in the Philippines related to secrecy of bank deposits and unclaimed balances.

The key points are:

1) Bank deposits in the Philippines are considered absolutely confidential, but there are exceptions allowing examination of deposits in cases of court orders, impeachment, bribery, or money laundering investigations.

2) Foreign currency deposits have additional exceptions, such as when the depositor provides written consent or if related to a money laundering offense.

3) Unclaimed balances that have gone untouched for 10 years or more must be deposited with the Treasurer of the Philippines and may be subject to escheat proceedings where a court determines the property has no heirs. Violations

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views4 pagesCA51025 - Module 4.1 - Special Banking Laws

Uploaded by

DrehfcieThis document summarizes special banking laws in the Philippines related to secrecy of bank deposits and unclaimed balances.

The key points are:

1) Bank deposits in the Philippines are considered absolutely confidential, but there are exceptions allowing examination of deposits in cases of court orders, impeachment, bribery, or money laundering investigations.

2) Foreign currency deposits have additional exceptions, such as when the depositor provides written consent or if related to a money laundering offense.

3) Unclaimed balances that have gone untouched for 10 years or more must be deposited with the Treasurer of the Philippines and may be subject to escheat proceedings where a court determines the property has no heirs. Violations

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

SPECIAL BANKING LAWS j.

Report of banks to AMLC of covered and/or

suspicious transactions under Sec. 9 of R.A. No.

SECRECY OF BANK DEPOSITS 9160; and

R.A. No. 1405, as amended k. Upon the issuance by the court of a preliminary

order of proscription OR in case of designation of

I. Purposes terrorist individual, groups of persons,

a. To encourage people to deposit in banking organizations or associations, the AMLC may,

institutions; and without a need of a court order, either on its own

b. To discourage private hoarding of money and other or upon the request of the Anti-Terrorism Council,

financial instruments so that the same may be inquire into the property or funds:

properly utilized by banks in authorized loans to i. that are in any way related to financing of

assist in the economic development of the country. terrorism as defined and penalized under R.A.

No. 10168 (The Terrorism Financing Prevention

II. Coverage and Suppression Act of 2012), and

All deposits of whatever nature with banks or banking ii. of any person or persons in relation to whom

institutions in the Philippines including investments in there is probable cause to believe that such

bonds issued by the Government of the Philippines, its person or persons are committing or attempting

political subdivisions and its instrumentalities, are or conspiring to commit, or participating in or

hereby considered as of an absolutely confidential facilitating the financing of the acts punished

nature and may not be examined, inquired or looked under R.A. No. 11479 (The Anti-Terrorism Act of

into by any person, government official, bureau or 2020).1

office.

IV. Exceptions to Secrecy of Foreign Currency Deposits

III. Exceptions to Secrecy of Peso Deposits a. When there is written consent of depositor under

a. When there is written permission of the depositor Section 8 of the Foreign Currency Deposits Act (R.A.

or investor; No. 6426);

b. In cases of impeachment; b. Upon the order of a competent court, the AMLC

c. Upon order of a competent court in cases of bribery may inquire into or examine any particular deposit

or dereliction of duty of public officials; or investment with any banking institution or non-

d. Upon order of a competent court in cases where bank financial institution when it has been

the money deposited or invested is the subject established that there is probable cause that the

matter of the litigation; deposits or investments involved are in any way

e. Upon order of the competent court or tribunal in related to a money laundering offense; and

cases involving unexplained wealth under Sec. 8 of c. Upon the issuance by the court of a preliminary

the Anti-Graft and Corrupt Practices Act (R.A. No. order of proscription OR in case of designation of

3019); terrorist individual, groups of persons,

f. Upon the order of a competent court, or in proper organizations or associations, the AMLC may,

cases by the Anti-Money Laundering Council without a need of a court order, either on its own

(AMLC), where there is probable cause of money or upon the request of the Anti-Terrorism Council,

laundering (and in instances related to kidnapping, inquire into the property or funds:

violation of the Dangerous Drugs Act, hijacking, i. that are in any way related to financing of

destructive arson and murder, including those terrorism as defined and penalized under R.A.

perpetrated by terrorists, even without court No. 10168 (The Terrorism Financing Prevention

order); and Suppression Act of 2012), and

g. Upon inquiry by the Commissioner of Internal ii. of any person or persons in relation to whom

Revenue for the purpose of determining the net there is probable cause to believe that such

estate of a deceased depositor; person or persons are committing or attempting

h. Upon inquiry by the Commissioner of Internal or conspiring to commit, or participating in or

Revenue for the purpose of determining the facilitating the financing of the acts punished

financial incapacity of a taxpayer who has filed an under R.A. No. 11479 (The Anti-Terrorism Act of

application for compromise settlement of his tax 2020).2

liability by reason of financial incapacity under Sec.

204 (A) (2) of the Tax Code; V. Penalties for Violation

i. Disclosure of the Treasurer of the Philippines for Imprisonment of not more than five (5) years or a fine

dormant deposits for at least 10 years under the of not more than twenty thousand pesos (P20,000.00)

Unclaimed Balances Act (R.A. No. 3936); or both, in the discretion of the court.

1 See Sec. 35 of R.A. No. 11479, otherwise known as The Anti-Terrorism of 24 August 2020, there are at least 29 Petitions filed before the

Act of 2020. R.A. No. 11479 was signed into law on 03 July 2020, Supreme Court challenging its constitutionality.

2

published on 06 July 2020, and took effect on 21 July 2020. However, as Ibid.

CA51025: Regulatory Framework and Legal Issues in Business

Module 4.1: Special Banking Laws

Page 1 of 4

UNCLAIMED BALANCES III. Escheat under the Rules of Court

Act No. 3936, as amended The rules on Escheat, as a special proceeding, are laid

down in Rule 91 of the Rules of Court.

I. Coverage a. Petition for Escheat must be filed by the Solicitor

Unclaimed balances include credits or deposits of General in the Regional Trial Court (RTC) of the

money, bullion, security or other evidence of province where the deceased last resided or where

indebtedness of any kind, and interest thereon with he had estate (Sec. 1).

banks, loan associations, and trust corporations, in favor b. The court shall release an order of hearing that shall

of any person: fix the date and place of hearing, which date shall

a. known to be dead; or not be more than 6 months after the entry of order,

b. who has not made further deposits or withdrawals and shall direct publication of the order once a

during the preceding ten (10) years or more. week for 6 consecutive weeks in a newspaper of

general circulation published in the province (Sec.

Such unclaimed balances, together with the increase 2).

and proceeds thereof, shall be deposited with the c. Upon arrival of the date fixed and no sufficient

Treasurer of the Philippines to the credit of the cause shown to the contrary, the court shall

Government of the Republic of the Philippines to be adjudge that the estate of the deceased in the

used as the National Assembly (now Congress) may Philippines, after the payment of just debts and

direct. charges, escheat (Sec. 3).

d. If a devisee, legatee, heir, widow, widower, or other

II. Procedure person entitled to such estate appears and files a

a. Within the month of January of every odd year, all claim thereto with the court within 5 years from the

banks, loan associations, and trust corporations date of such judgment, such person shall have

shall forward to the Treasurer of the Philippines a possession of and title to the same, but a claim not

statement, under oath, of all credits and deposits made within the said time shall be forever barred

held by them in favor of persons known to be dead, (Sec. 4).

or who have not made further deposits or

withdrawals during the preceding 10 years or more,

arranged in alphabetical order according to the

names of creditors and depositors, and showing:

(1) The names and last known place of residence;

(2) The amount and the date of the outstanding

unclaimed balance;

(3) The date when the person in whose favor the

unclaimed balance stands died, if known, or

the date when he made his last deposit or

withdrawal; and

(4) The interest due on such unclaimed balance.

b. A copy of the sworn statement shall be posted in a

conspicuous place in the premises of the bank, loan

association, or trust corporation concerned for at

least sixty (60) days from the date of filing thereof.

c. Immediately before filing the sworn statement, the

bank, loan association, and trust corporation shall

communicate with the person in whose favor the

unclaimed balance stands at his last known place of

residence or post office address.

d. The Treasurer of the Philippines shall inform the

Solicitor General of the existence of unclaimed

balances held by banks, building and loan

associations, and trust corporations.

e. The Solicitor General will then initiate the proper

escheat proceedings in court.

Escheat - the reversion of property to a government

entity in the absence of legal claimants or heirs.

CA51025: Regulatory Framework and Legal Issues in Business

Module 4.1: Special Banking Laws

Page 2 of 4

PHILIPPINE DEPOSIT INSURANCE CORPORATION V. Exclusions

R.A. No. 3591, as amended PDIC shall not pay deposit insurance for the following

accounts or transactions, whether denominated,

I. PDIC documented, recorded or booked as deposit by the

a. PDIC is a government-owned corporation created bank:

under R.A. No. 3591; a. Investment products such as bonds and securities,

b. Powers and functions are exercised by a Board of trust accounts, and other similar instruments;

Directors composed of seven (7) members as b. Deposit accounts or transactions which are

follows: unfunded, or that are fictitious or fraudulent;

1. Secretary of Finance who shall be the ex officio c. Deposits accounts or transactions constituting,

Chairman of the Board; and/or emanating from, unsafe and unsound

2. Governor of the BSP; banking practice/s, as determined by the PDIC, in

3. President of the PDIC, who shall be appointed consultation with the BSP, after due notice and

by the President of the Philippines to serve on hearing, and publication of a cease and desist order

a full-time basis for a term of six (6) years. He issued by the PDIC against such deposit accounts or

shall also serve as Vice-Chairman of the Board; transactions; and

and d. Deposits that are determined to be the proceeds of

4. Four (4) members from the private sector to be an unlawful activity as defined under R.A. No. 9160,

appointed by the President of the Philippines, as amended (Anti-Money Laundering Act of 2001).

who shall serve for a term of six (6) years

subject to only one (1) reappointment. VI. Rules in Determining Insured Deposit

c. No person shall be appointed as member of the a. PDIC liability is on a per bank basis. Accounts in a

Board unless he/she is: bank, even though maintained in several branches,

1. of good moral character; are to be added together, provided that they are

2. of unquestionable integrity and responsibility; maintained in the same right and capacity for his

3. of known probity and patriotism; benefit, either in his own name or in the name of

4. of recognized competence in economics, others.

banking and finance, law, management b. A joint account, regardless of whether the

administration or insurance; and conjunction 'and,' 'or,' 'and/or' is used, shall be

5. at least thirty-five (35) years of age. insured separately from any individually-owned

deposit account.

II. Functions of the PDIC c. If the account is held jointly by two or more natural

a. Insure the deposit liability of banks in an account up persons, or by two or more juridical persons or

to P500,000.00 for every single depositor of each entities, the maximum insured deposit shall be

bank irrespective of the number of accounts divided into as many equal shares as there are

therewith; and individuals, juridical persons or entities, unless a

b. As a basic policy, to promote and safeguard interest different sharing is stipulated in the document of

of the depositing public by way of providing deposit.

permanent and continuing insurance coverage on d. If the account is held by a juridical person or entity

all insured deposits. jointly with one or more natural persons, the

maximum insured deposits shall be presumed to

III. Deposit Insurance belong entirely to such juridical person or entity.

All deposits in banks are insured with the PDIC. The term e. The aggregate of the interest of each co-owner over

deposit means the unpaid balance of money or its several joint accounts, whether owned by the same

equivalent received by a bank in the usual course of or different combinations of individuals, juridical

business and for which it has given or is obligated to give persons or entities, shall likewise be subject to the

credit to a commercial, checking, savings, time or thrift maximum insured deposit of P500,000.00.

account, or issued in accordance with the rules and f. No owner/holder of any passbook, certificate of

regulations of the Bangko Sentral ng Pilipinas (BSP) and deposit, or other evidence of deposit shall be

other applicable laws. recognized as a depositor unless the passbook,

certificate of deposit, or other evidence of deposit

Risk Insured: Bank closure only; losses due to bank is determined by the PDIC to be an authentic

robberies are not covered. document or record of the issuing bank.

IV. Coverage VII. Prohibition on Splitting of Deposits

The term insured deposit means the amount due to The penalty of imprisonment of 6 to 12 years and/or a

any bona fide depositor for legitimate deposits in an fine of P50,000 to P10,000,000 shall be imposed upon a

insured bank net of any obligation of the depositor to director, officer, employee or agent of a bank for

the insured bank as of date of closure, but not to exceed splitting of deposits or creation of fictitious or

Five Hundred Thousand Pesos (P500,000.00). fraudulent loan or deposit accounts.

CA51025: Regulatory Framework and Legal Issues in Business

Module 4.1: Special Banking Laws

Page 3 of 4

Splitting of Deposits – occurs whenever a deposit

account with an outstanding balance of more than

the statutory maximum amount of insured deposit

maintained under the name of natural or juridical

persons is broken down and transferred into two

(2) or more accounts in the name/s of natural or

juridical persons or entities who have no beneficial

ownership on transferred deposits in their names

within one hundred twenty (120) days immediately

preceding or during a bank-declared bank holiday,

or immediately preceding a closure order issued by

the Monetary Board of the BSP for the purpose of

availing of the maximum deposit insurance

coverage.

VIII. Payment of Insured Deposits

a. When made: The proceeds of the insurance shall be

paid by the PDIC to the depositor whenever the

insured bank is closed on account of insolvency, or

upon expiration or revocation of a bank’s corporate

term.

b. Condition precedent to payment: Filing of claim

within two (2) years from actual takeover of the

closed bank by a receiver. An insured bank shall be

deemed to have been closed on account of

insolvency when ordered closed by the Monetary

Board of the BSP.

c. Manner of payment: Payment of insured deposits

shall be made in:

(1) Cash; or

(2) Transferred deposit - a deposit in an insured

bank made available to a depositor by the PDIC

as payment of insured deposit of such

depositor in a closed bank and assumed by

another insured bank.

d. Effect of payment: Payment by PDIC to the

depositor of his insured deposit shall gave the

following effects:

(1) Discharges the PDIC from further liability; and

(2) Subrogates the PDIC to all the rights of the

depositor against the closed bank to the extent

of such payment.

CA51025: Regulatory Framework and Legal Issues in Business

Module 4.1: Special Banking Laws

Page 4 of 4

You might also like

- AMLA Latest Amendments 2023 (Anti-Money Laundering Act Philippines)Document10 pagesAMLA Latest Amendments 2023 (Anti-Money Laundering Act Philippines)Atty. Javier Law Vlog - Law Lectures for Students80% (5)

- Judicial Affidavit of The AccusedDocument7 pagesJudicial Affidavit of The AccusedErwin April MidsapakNo ratings yet

- Capital Structure & Leverage - ExercisesDocument11 pagesCapital Structure & Leverage - ExercisesDrehfcie100% (1)

- Bank Secrecy LawDocument33 pagesBank Secrecy LawTen Laplana100% (4)

- RFBT - Chapter 6 - Bank Secrecy LawDocument4 pagesRFBT - Chapter 6 - Bank Secrecy Lawlaythejoylunas21No ratings yet

- For Print Notes Banking LawsDocument10 pagesFor Print Notes Banking LawsKei TamundongNo ratings yet

- Banking Laws: Ra 1405 - Secrecy of Bank DepositsDocument6 pagesBanking Laws: Ra 1405 - Secrecy of Bank DepositsNica ChanNo ratings yet

- PDIC, Secrecy of Bank Deposit and Anti Money LaunderingDocument20 pagesPDIC, Secrecy of Bank Deposit and Anti Money LaunderingCarla LisingNo ratings yet

- Notes Sa LawDocument11 pagesNotes Sa LawJoana Marie ManaloNo ratings yet

- Highlights of RDocument3 pagesHighlights of RVincient LeeNo ratings yet

- Secrecy of Bank DepositsTruth in LendingAMLADocument9 pagesSecrecy of Bank DepositsTruth in LendingAMLAJalod Hadji AmerNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument49 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCiara De LeonNo ratings yet

- Assignnment 3 NotesDocument5 pagesAssignnment 3 NotesAna Marie VirayNo ratings yet

- Law On Secrecy of Bank DepositsDocument4 pagesLaw On Secrecy of Bank DepositsKerwin Lester MandacNo ratings yet

- Law On Secrecy of Bank Deposits: R.A. No. 1405, As AmendedDocument33 pagesLaw On Secrecy of Bank Deposits: R.A. No. 1405, As AmendedEricka SantiagoNo ratings yet

- 3 Secrecy of Bank DepositsDocument3 pages3 Secrecy of Bank DepositsSherina Mae GonzalesNo ratings yet

- Spec Com H.ODocument3 pagesSpec Com H.OmtabcaoNo ratings yet

- Topic 1: Anti-Money Laundering ActDocument4 pagesTopic 1: Anti-Money Laundering ActchxrlttxNo ratings yet

- Wherever Committed.: An Act Further Strengthening The Anti-Money Laundering LawDocument4 pagesWherever Committed.: An Act Further Strengthening The Anti-Money Laundering LawGreghvon MatolNo ratings yet

- SECRECY OF BANK DEPOSITS NotesDocument2 pagesSECRECY OF BANK DEPOSITS NotesWinna Yu OroncilloNo ratings yet

- SBD ACA Palma, JDADocument3 pagesSBD ACA Palma, JDAJames Daniel PalmaNo ratings yet

- Secrecy of Bank DepositsDocument8 pagesSecrecy of Bank DepositsCyrine CalagosNo ratings yet

- Bank Secrecy LawDocument6 pagesBank Secrecy LawJillian Mitziko LimquecoNo ratings yet

- RFBT BankingDocument10 pagesRFBT Bankingferdinandstewart RapizNo ratings yet

- Bank Secrecy LawDocument8 pagesBank Secrecy LawHermie Dela CruzNo ratings yet

- Bank Secrecy ActDocument9 pagesBank Secrecy ActBea GarciaNo ratings yet

- Summary Bank Secrecy LawDocument2 pagesSummary Bank Secrecy LawBli100% (1)

- Secrecy of Bank DepositDocument5 pagesSecrecy of Bank DepositAngelica RoblesNo ratings yet

- Republic Act No. 1405 - An Act Prohibiting: Module 1: SBDDocument3 pagesRepublic Act No. 1405 - An Act Prohibiting: Module 1: SBDRoylyn Joy CarlosNo ratings yet

- R.A. 9160 - Anti-Money Laundering Act of 2001Document14 pagesR.A. 9160 - Anti-Money Laundering Act of 2001Ed NaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument8 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJen AnchetaNo ratings yet

- R.A. 9160Document8 pagesR.A. 9160Jasmin GalacioNo ratings yet

- Secrecy in Bank Deposits - FinalDocument32 pagesSecrecy in Bank Deposits - FinalDeb BieNo ratings yet

- Anti Money Laaundering Act of 2001 RA 9160 PDFDocument7 pagesAnti Money Laaundering Act of 2001 RA 9160 PDFErica MailigNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument23 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJesse Myl MarciaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument8 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledrmelizagaNo ratings yet

- Bank Secrecy Law and AmlaDocument16 pagesBank Secrecy Law and AmlaKaryll Shaine BelicinaNo ratings yet

- Ra 9160Document5 pagesRa 9160Red Pirate MCNo ratings yet

- Bank Secrecy ReviewerDocument5 pagesBank Secrecy ReviewerRizellLoey ParkNo ratings yet

- Secrecy of Bank Deposits Law UpdatedDocument3 pagesSecrecy of Bank Deposits Law UpdatedMarjorie UrbinoNo ratings yet

- 04.1 - AmlaDocument11 pages04.1 - AmlaKaisser Niel Mari FormentoNo ratings yet

- Anti-Money Laundering Act - NotesDocument5 pagesAnti-Money Laundering Act - NotesHads LunaNo ratings yet

- RA 1405 - Secrecy On Bank DepositsDocument8 pagesRA 1405 - Secrecy On Bank DepositsJona FranciscoNo ratings yet

- Banking Laws Bank Secrecy Law PurposeDocument9 pagesBanking Laws Bank Secrecy Law PurposeTrevor Del MundoNo ratings yet

- Anti-Money Laundering Act of 2001, Republic Act No. 9160Document17 pagesAnti-Money Laundering Act of 2001, Republic Act No. 9160Mak FranciscoNo ratings yet

- Republic Act No 1405Document15 pagesRepublic Act No 1405Jhoanne CalvoNo ratings yet

- Laws Governing BankingDocument12 pagesLaws Governing BankingAngel Joy HelicameNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument9 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledChase DaclanNo ratings yet

- Banking - Deposit Secrecy AMLA FCDDocument35 pagesBanking - Deposit Secrecy AMLA FCDyzarvelascoNo ratings yet

- Republic of The Philippines Metro Manila Twelfth Congress First Regular SessionDocument14 pagesRepublic of The Philippines Metro Manila Twelfth Congress First Regular SessionWilliam MalangNo ratings yet

- Anti Money Laundering Act R.A. No. 9160Document12 pagesAnti Money Laundering Act R.A. No. 9160Joseph Tangga-an GiduquioNo ratings yet

- SPecial Penal (AMLA, Human Scurities Act)Document61 pagesSPecial Penal (AMLA, Human Scurities Act)Loida Ryan Gases PalaparNo ratings yet

- Anti-Money Laundering Law (R.a. 9160, As Amended by R.A. 9194)Document10 pagesAnti-Money Laundering Law (R.a. 9160, As Amended by R.A. 9194)JP De LeonNo ratings yet

- Notes Bank SecrecyDocument9 pagesNotes Bank SecrecyLudica Oja100% (1)

- Anti-Money Laundering Act of 2001 (Ra 9160)Document11 pagesAnti-Money Laundering Act of 2001 (Ra 9160)JEP WalwalNo ratings yet

- Banking LawsDocument8 pagesBanking LawsAmphee ZyNo ratings yet

- Ramon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesDocument2 pagesRamon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesWresen Ann JavaluyasNo ratings yet

- Terrorism Financing Prevention and Suppression Act of 2012Document4 pagesTerrorism Financing Prevention and Suppression Act of 2012Jage Joseph SuropiaNo ratings yet

- Amla 9194 10365Document11 pagesAmla 9194 10365Kyla RoxasNo ratings yet

- Secrecy of Bank DepositsDocument9 pagesSecrecy of Bank DepositsMADEE VILLANUEVANo ratings yet

- Secrecy of Bank DepositsDocument4 pagesSecrecy of Bank DepositsRoseanneNo ratings yet

- Home Office & Branch Lecture NotesDocument32 pagesHome Office & Branch Lecture NotesDrehfcieNo ratings yet

- AMLADocument8 pagesAMLADrehfcieNo ratings yet

- Module 6 - FINAL STUDY and EVALUATION of INTERNAL CONTROLDocument68 pagesModule 6 - FINAL STUDY and EVALUATION of INTERNAL CONTROLDrehfcieNo ratings yet

- Module 7 - Substantive Test and Documentation (Autosaved)Document59 pagesModule 7 - Substantive Test and Documentation (Autosaved)DrehfcieNo ratings yet

- Chapter 1 Introduction To FMIDocument56 pagesChapter 1 Introduction To FMIDrehfcieNo ratings yet

- Factor Analysis in Information Risk (Privacy Version)Document8 pagesFactor Analysis in Information Risk (Privacy Version)Otgonbayar TsengelNo ratings yet

- Austin Theory of Legal PositivismDocument3 pagesAustin Theory of Legal PositivismSaad KhanNo ratings yet

- Meralco v. Prov of LagunaDocument2 pagesMeralco v. Prov of LagunaJoms TenezaNo ratings yet

- Jurisdiction (Three Hours) Lesson OutlineDocument7 pagesJurisdiction (Three Hours) Lesson OutlineChaNo ratings yet

- Ruling On Contempt of Court ApplicationDocument10 pagesRuling On Contempt of Court ApplicationJael LumumbaNo ratings yet

- UN Charter (Full Text) - United NationsDocument23 pagesUN Charter (Full Text) - United NationsTracy LeongNo ratings yet

- Gina Leviste V SSSDocument2 pagesGina Leviste V SSSTootsie Guzma100% (1)

- Mohamed Ali Selim - Petition To Enter Guilty PleaDocument5 pagesMohamed Ali Selim - Petition To Enter Guilty PleaPatch MinnesotaNo ratings yet

- LAW ENFORCEMENT ADMINISTRATION 200 Item - KeyDocument27 pagesLAW ENFORCEMENT ADMINISTRATION 200 Item - KeyeyeNo ratings yet

- Consti Case 11-20Document131 pagesConsti Case 11-20mary rose lacorteNo ratings yet

- G8 SCREENING TEST - Silent ReadingDocument2 pagesG8 SCREENING TEST - Silent ReadingGVBINHSJane VillasorNo ratings yet

- Defamation & Breach of ConfidenceDocument14 pagesDefamation & Breach of ConfidenceTashalee WynterNo ratings yet

- Sample PleadingsDocument36 pagesSample PleadingsAngela ParadoNo ratings yet

- Section 5: Student Discipline FormationDocument3 pagesSection 5: Student Discipline FormationJulius ManaloNo ratings yet

- Behind Bars in BrazilDocument227 pagesBehind Bars in BrazilferreiraccarolinaNo ratings yet

- Duty of Care NotesDocument4 pagesDuty of Care NotesIvan LeeNo ratings yet

- Rick Butler, Cheryl Butler, and GLV's Motion For Sanctions Against Plaintiff Laura Mullen and Her AttorneysDocument58 pagesRick Butler, Cheryl Butler, and GLV's Motion For Sanctions Against Plaintiff Laura Mullen and Her AttorneysD'Ambrose P.C.No ratings yet

- Marital Rape JurisprudenceDocument35 pagesMarital Rape JurisprudencePEDRO MOMONo ratings yet

- Ra 7876 - Senior Citizens Center Act of The PHDocument3 pagesRa 7876 - Senior Citizens Center Act of The PHMark Angelo Magbatoc RiveraNo ratings yet

- Human Trafficking Data Collection Activities, 2021Document8 pagesHuman Trafficking Data Collection Activities, 2021Yogesh SinghNo ratings yet

- 15 Matias Vs Salud Digest (Art. 805)Document2 pages15 Matias Vs Salud Digest (Art. 805)Joshua Erik MadriaNo ratings yet

- La Ode Ardi Rasila V Public ProsecutorDocument17 pagesLa Ode Ardi Rasila V Public ProsecutorHAIFA ALISYA ROSMINNo ratings yet

- People vs. AzarragaDocument4 pagesPeople vs. AzarragaFiona Ann Loraine ThiamNo ratings yet

- The Publics RecordsDocument10 pagesThe Publics RecordsemojiNo ratings yet

- Motion For Consolidation SampleDocument3 pagesMotion For Consolidation SampleMarieNo ratings yet

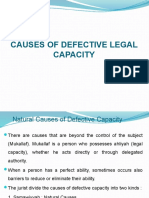

- Causes of Defective Legal CapacityDocument16 pagesCauses of Defective Legal CapacityAtikah Jumat50% (2)

- Ips List HomeDocument8 pagesIps List HomeHimalayarajsinh ParmarNo ratings yet

- People VS PalijonDocument3 pagesPeople VS PalijonRyannDeLeonNo ratings yet

- Arellano University School of Law Remedial Law Department Syllabus: School Year 2020-2021 Remedial Law Review IDocument31 pagesArellano University School of Law Remedial Law Department Syllabus: School Year 2020-2021 Remedial Law Review IVic CajuraoNo ratings yet