0% found this document useful (0 votes)

2K views5 pagesAnswer-Key Chapter-6 Revised

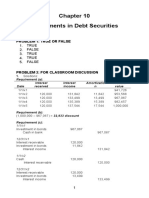

The document contains practice problems and solutions related to investments in financial instruments. Problem 1 contains multiple choice questions. Problem 3 involves calculating gains and dividend income for shares of Honey Company stock. Problem 4 provides adjustments to the investment account of Myra Company. Problem 7 shows the amortization of a bond issued at a premium. Problem 9 involves discount amortization for a bond.

Uploaded by

Mcy CaniedoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views5 pagesAnswer-Key Chapter-6 Revised

The document contains practice problems and solutions related to investments in financial instruments. Problem 1 contains multiple choice questions. Problem 3 involves calculating gains and dividend income for shares of Honey Company stock. Problem 4 provides adjustments to the investment account of Myra Company. Problem 7 shows the amortization of a bond issued at a premium. Problem 9 involves discount amortization for a bond.

Uploaded by

Mcy CaniedoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

- Investments in Financial Instruments Overview

- Solutions: Trading Securities

- Solutions: Equity Investments

- Solutions: Amortization

- Solutions: Debt Investments