Professional Documents

Culture Documents

Problem 2

Problem 2

Uploaded by

mhikeedelantarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 2

Problem 2

Uploaded by

mhikeedelantarCopyright:

Available Formats

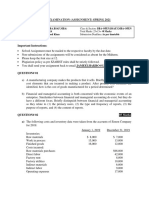

PROBLEM 2(2points each)

You are engaged in checking the transactions and books of Makina Co. for the

year 2019. To reduce the workload at year-end, the company took its annual

physical inventory under your observation on Nov 30, 2019.

The company's inventory account, which includes raw materials and work in

process, is on perpetual basis and it uses the FIFO method of pricing.

it ha no finished goods inventory account.

The company's physical inventory revealed that the book inventory of

181,710.00 was undersated by 9,000.00 . To avoid distorting the

interim financial statements, the company decided not to adjust the book

inventory until year-end excecpt for obsolete items.

You found out this information about the Nov 30 inventory.

a. Pricing tests showed that the physical inventory was overpriced by 6,600.00

b. Footing and extension errors resulted in a 450.00 understatement

of the physical inventory.

c. Direct labor included in the physical inventory amounted to 30,000.00 .

overhead was included at the rate of 200% of direct labor. You determined that

the amount of direct labor and the overheadrate was proper.

d. The physical inventory included obsolete materials recorded at P750.

During December, these materials were removed from the inventory account

by a charge to cost of sales. Your checking also disclosed the following

information about December 31, 2019 inventory.

Total debits to certain accounts during december are:

Purchases 74,100.00

Direct labor 36,300.00

Manufacturing overhead expense 75,600.00

Cost of sales 205,800.00

e. The cost of sales of 205,800.00 included direct labor of 41,400.00

f. Normal scrap loss on established product lines are negligible. However, a special

order started and completed during december had excessive scrap loss of 2,400,

which was charged to Manufacturing overhead Control.

Questions:

5. What is the inventory per physical count o Nov 30, 2019.

6. What is the correct amount of physical inventory at Nov 30, 2019.

Assumption: Without prejudice to your answers to questions 5&6, assume that

the correct amount of the inventory at November 30, 2019 was 173,100.00

7.What is the materials inventory at December 31, 2019

8. What is the amount oof direct labor cost included in the December 31, 2019

inventory?

9. What is the correct inventory at December 31, 2016?

You might also like

- This Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)Document5 pagesThis Study Resource Was: CASTILLO, Lauren Financial Management Mam Barquez BSA-3 Problem 1 (Pro Forma Statements)KATHRYN CLAUDETTE RESENTE100% (2)

- ISO 45001 2018 Gap Analysis Checklist Sample PDFDocument5 pagesISO 45001 2018 Gap Analysis Checklist Sample PDFMuhammad Iqbal NiyaziNo ratings yet

- Job Order Costing QuizDocument5 pagesJob Order Costing Quizxenoyew100% (1)

- VIRAY, NHICOLE S. Audit of Inventory 3 For QuizDocument2 pagesVIRAY, NHICOLE S. Audit of Inventory 3 For QuizZeeNo ratings yet

- Transgender Cadet PolicyDocument8 pagesTransgender Cadet PolicyCadet Library100% (1)

- COACCON Exercise2Document12 pagesCOACCON Exercise2Cielo PulmaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Exp 3 (Prep - of Na2S2O3.5H2O) & 4 (Excercise)Document19 pagesExp 3 (Prep - of Na2S2O3.5H2O) & 4 (Excercise)KarzanNo ratings yet

- Arc Welding MachineDocument20 pagesArc Welding MachineKavipriyan Kavi100% (3)

- Understanding The Essentials of Critical Care Nursing by Perrin - Test BankDocument50 pagesUnderstanding The Essentials of Critical Care Nursing by Perrin - Test BankalishcathrinNo ratings yet

- Guide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?From EverandGuide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?No ratings yet

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Document6 pagesProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNo ratings yet

- Job Order CostingDocument10 pagesJob Order CostingGennelyn Grace Penaredondo100% (1)

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- Qualifying Exam Reviewer 2017 - CostDocument12 pagesQualifying Exam Reviewer 2017 - CostAdrian Francis100% (1)

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- Smpep - Solar SusieDocument94 pagesSmpep - Solar SusieRavindraNo ratings yet

- (OH Is Overapplied) (Actual Activity) (ABC) : (Have A Difference)Document21 pages(OH Is Overapplied) (Actual Activity) (ABC) : (Have A Difference)Janna Mari FriasNo ratings yet

- CH 19Document12 pagesCH 19Felicia Carissa0% (1)

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- SS 530 - Energy Efficiency Standard (Formerly CP 24) EditableDocument24 pagesSS 530 - Energy Efficiency Standard (Formerly CP 24) EditableKanagaraj Ganesan100% (1)

- Audit of Inventory 3 For QuizDocument3 pagesAudit of Inventory 3 For Quizmarili ZarateNo ratings yet

- Notre Dame of Midsayap College: AssignmentDocument2 pagesNotre Dame of Midsayap College: AssignmentMarites AmorsoloNo ratings yet

- Job Order Costing Difficult RoundDocument8 pagesJob Order Costing Difficult RoundsarahbeeNo ratings yet

- Cost: Multiple ChoiceDocument8 pagesCost: Multiple ChoiceKimberly RamosNo ratings yet

- Inventory 2021Document8 pagesInventory 2021RHENNA MAY RISCEL OPEÑANo ratings yet

- 2020 Practice MCQsDocument28 pages2020 Practice MCQsĐàm Quang Thanh TúNo ratings yet

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDocument4 pagesProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Cost Accounting Worksheet Chap 3Document5 pagesCost Accounting Worksheet Chap 3Muhammad UsmanNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Job Costing: Problem 1. The Showa Manufacturing Company Recorded The Following Transactions DuringDocument3 pagesJob Costing: Problem 1. The Showa Manufacturing Company Recorded The Following Transactions DuringMaria BeatriceNo ratings yet

- Job Order Assignment PDFDocument3 pagesJob Order Assignment PDFAnne Marie100% (1)

- PRTC Manufacturing Co.Document2 pagesPRTC Manufacturing Co.hersheyNo ratings yet

- Acc101 Probset1 v2Document5 pagesAcc101 Probset1 v2BamPanggatNo ratings yet

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- This Job?Document6 pagesThis Job?JO SH UANo ratings yet

- Practice Problem Job CostingDocument4 pagesPractice Problem Job CostingDonna Zandueta-TumalaNo ratings yet

- Exam # 2 Chapter 15, 16, 17 ReviewDocument2 pagesExam # 2 Chapter 15, 16, 17 ReviewAnnNo ratings yet

- Acctg 201 Quiz ReviewerDocument6 pagesAcctg 201 Quiz ReviewerJyNo ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Activity 1 - Manufacturing Accounting Cycle: Problem 1Document2 pagesActivity 1 - Manufacturing Accounting Cycle: Problem 1AJ OrtegaNo ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- Worksheet1-Basics & COGSDocument5 pagesWorksheet1-Basics & COGSmohsinmustafa.2001No ratings yet

- Budgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The QuestionDocument17 pagesBudgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The Questionaldrin elsisuraNo ratings yet

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- Cost Accounting Cycle ProblemsDocument3 pagesCost Accounting Cycle ProblemsAnonymous sn5Tcc100% (1)

- COMM305 MT1 Practice Problems (F21)Document9 pagesCOMM305 MT1 Practice Problems (F21)Rachel KantersNo ratings yet

- Prelim ExamFDocument4 pagesPrelim ExamFMa Jodelyn RosinNo ratings yet

- Set eDocument4 pagesSet eKurt HendiveNo ratings yet

- Inventories Quiz NotesDocument7 pagesInventories Quiz NotesMikaella Nicole PechardoNo ratings yet

- DocxDocument19 pagesDocxcherry blossomNo ratings yet

- D) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDocument5 pagesD) Underapplied Overhead of $3,500.: AMIS 4310 Job CostingDaniella Mae ElipNo ratings yet

- AP Inventories 2ndsetDocument7 pagesAP Inventories 2ndsetMaritessNo ratings yet

- Job Order Costing SeatworkDocument7 pagesJob Order Costing SeatworksarahbeeNo ratings yet

- Financial Statements ER Problem 2 SolutionDocument11 pagesFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- NormalDocument2 pagesNormalPatrisha0% (2)

- Cost Accounting Mastery - 2Document2 pagesCost Accounting Mastery - 2Mark Revarez0% (1)

- Intermediate Acctg 1 - Inventories11Document3 pagesIntermediate Acctg 1 - Inventories11GraceNo ratings yet

- Managerial Accounting - Quiz 1: High-Low - Hidden HillsDocument8 pagesManagerial Accounting - Quiz 1: High-Low - Hidden HillsSadia FahadNo ratings yet

- ACCG 2000 Week 3 Homework Questions PDFDocument3 pagesACCG 2000 Week 3 Homework Questions PDF张嘉雯No ratings yet

- Cost Accounting Self Assessment Materials Labor and OverheadDocument4 pagesCost Accounting Self Assessment Materials Labor and OverheadDarwyn HonaNo ratings yet

- Process CostingDocument18 pagesProcess CostingCheliah Mae ImperialNo ratings yet

- Week 5 Normal Job Order CostingDocument8 pagesWeek 5 Normal Job Order CostingRujean Salar AltejarNo ratings yet

- Chapter 02 and 04 Extra ProblemsDocument4 pagesChapter 02 and 04 Extra ProblemsElvan Mae Rita ReyesNo ratings yet

- Inventories Problem No. 1Document4 pagesInventories Problem No. 1Ren EyNo ratings yet

- Cost FlowDocument30 pagesCost FlowAndrea Nicole MASANGKAYNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- B 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToDocument4 pagesB 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToKATHRYN CLAUDETTE RESENTENo ratings yet

- SW 5 FallaciesDocument2 pagesSW 5 FallaciesKATHRYN CLAUDETTE RESENTENo ratings yet

- Finmrkr Chapter 11 NotesDocument12 pagesFinmrkr Chapter 11 NotesKATHRYN CLAUDETTE RESENTENo ratings yet

- Assignment in MathDocument1 pageAssignment in MathKATHRYN CLAUDETTE RESENTENo ratings yet

- Berago Anjelica MDocument7 pagesBerago Anjelica MKATHRYN CLAUDETTE RESENTENo ratings yet

- Module 3 Basics of Capital Budgeting WITH NO ANSWERSDocument9 pagesModule 3 Basics of Capital Budgeting WITH NO ANSWERSKATHRYN CLAUDETTE RESENTENo ratings yet

- Accbusc Module 1Document20 pagesAccbusc Module 1KATHRYN CLAUDETTE RESENTENo ratings yet

- Key Definitions: The Five-Step Model FrameworkDocument9 pagesKey Definitions: The Five-Step Model FrameworkKATHRYN CLAUDETTE RESENTENo ratings yet

- Probs 1..2..3 Page 147Document1 pageProbs 1..2..3 Page 147KATHRYN CLAUDETTE RESENTE25% (4)

- Cri THNKDocument2 pagesCri THNKKATHRYN CLAUDETTE RESENTENo ratings yet

- Document 92Document2 pagesDocument 92KATHRYN CLAUDETTE RESENTENo ratings yet

- Page 153Document1 pagePage 153KATHRYN CLAUDETTE RESENTENo ratings yet

- Prob 3 & 4 Page 179Document1 pageProb 3 & 4 Page 179KATHRYN CLAUDETTE RESENTE100% (1)

- Module 1 - Seatwork Answer KeyDocument3 pagesModule 1 - Seatwork Answer KeyKATHRYN CLAUDETTE RESENTENo ratings yet

- Probs. 4 To 5 Page 213Document1 pageProbs. 4 To 5 Page 213KATHRYN CLAUDETTE RESENTENo ratings yet

- Prob 4 Page 343Document1 pageProb 4 Page 343KATHRYN CLAUDETTE RESENTENo ratings yet

- MODULE 4: Decision Theories: 10/9/2020 DLS CSB OPTNMGT: Francisco T. Africa 1Document24 pagesMODULE 4: Decision Theories: 10/9/2020 DLS CSB OPTNMGT: Francisco T. Africa 1KATHRYN CLAUDETTE RESENTENo ratings yet

- Statement of Cash Flows - Direct Method FormulaDocument1 pageStatement of Cash Flows - Direct Method FormulaKATHRYN CLAUDETTE RESENTENo ratings yet

- Assign 1 - Valuation of Contributions of PartnersDocument1 pageAssign 1 - Valuation of Contributions of PartnersKATHRYN CLAUDETTE RESENTENo ratings yet

- Uslim AW: Khurshid Ahmad Khan vs. State of UP 2015 Supreme CourtDocument22 pagesUslim AW: Khurshid Ahmad Khan vs. State of UP 2015 Supreme CourtYash GargNo ratings yet

- PEOPLE V. JAURIGUE C.A. No. 384Document3 pagesPEOPLE V. JAURIGUE C.A. No. 384yanyan yuNo ratings yet

- De On Thi Vao Lop 10 Mon Tieng Anh Nam 2020 2021 So 2Document5 pagesDe On Thi Vao Lop 10 Mon Tieng Anh Nam 2020 2021 So 2Tuan NguyenNo ratings yet

- What Are Uterine FibroidsDocument4 pagesWhat Are Uterine FibroidsmkarjunNo ratings yet

- Practical Research 2: Quarter 1 - Module 1Document39 pagesPractical Research 2: Quarter 1 - Module 1DAFFY JELL ECHECHENo ratings yet

- Computer SystemDocument19 pagesComputer Systemkookie bunnyNo ratings yet

- The Many Benefits of Continuity of CareDocument3 pagesThe Many Benefits of Continuity of CaremccallumNo ratings yet

- The Study of Unit Cost and Quality of Education of Ghazanfar Institute of Health Science and Private Institutes in Kabul Province For The Years of 2009-2012Document13 pagesThe Study of Unit Cost and Quality of Education of Ghazanfar Institute of Health Science and Private Institutes in Kabul Province For The Years of 2009-2012National Graduate ConferenceNo ratings yet

- Barriers To Physical ActivityDocument4 pagesBarriers To Physical ActivityGeorge OstNo ratings yet

- Fishball SauceDocument3 pagesFishball SauceGrace Denito RaymundoNo ratings yet

- PDFDocument2 pagesPDFsaravanan_c1No ratings yet

- Counselling Schedule For 2nd Round of Counselling For MBBS BDS Courses 133Document1 pageCounselling Schedule For 2nd Round of Counselling For MBBS BDS Courses 133Dog CatNo ratings yet

- Storyboard - Normalcy and Prudent Parenting Elearning CourseDocument37 pagesStoryboard - Normalcy and Prudent Parenting Elearning Courseapi-87117284No ratings yet

- Batov ASNT Fall Conference 2016Document3 pagesBatov ASNT Fall Conference 2016Alan MontagueNo ratings yet

- Sikament® - R2004Document2 pagesSikament® - R2004omar112233No ratings yet

- Project:Lng School at Sur: Chillers MAS Comparision Report ManufactureDocument4 pagesProject:Lng School at Sur: Chillers MAS Comparision Report ManufacturePradeep SukumaranNo ratings yet

- Veera BhadrappaDocument2 pagesVeera BhadrappaVasanth KumaranNo ratings yet

- S1.4.5.) Datasheet PRESSURE GAUGEDocument3 pagesS1.4.5.) Datasheet PRESSURE GAUGEEkoNo ratings yet

- Tool Box Talk: Horseplay in The WorkplaceDocument1 pageTool Box Talk: Horseplay in The WorkplaceVishnuNo ratings yet

- Induction Melting Furnace Safe Use, Safe Operation Method - Luoyang Shennai Power Equipment Co., LTDDocument5 pagesInduction Melting Furnace Safe Use, Safe Operation Method - Luoyang Shennai Power Equipment Co., LTDDaveNo ratings yet

- Vol5Iss1CR1Ganapathy 2Document3 pagesVol5Iss1CR1Ganapathy 2Brent AllieNo ratings yet

- QaQc DocDocument120 pagesQaQc DocAnang QosimNo ratings yet

- A Report On Organizational Study Done at CHATHANNOR CO-OPERATIVE SPINNING MILLDocument73 pagesA Report On Organizational Study Done at CHATHANNOR CO-OPERATIVE SPINNING MILLanoopvince123No ratings yet