Professional Documents

Culture Documents

Daily Equity Market Report - 18!08!2021

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 18!08!2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

18TH AUGUST, 2021

DAILY EQUITY MARKET REPORT

EQUITY MARKET HIGHLIGHTS: GSE-CI gained 2.09 GSE EQUITY MARKET PERFORMANCE

points to close at 2,750; returns 41.64% (YTD). Indicator Current Previous Change

GSE-Composite Index 2,750.15 2,748.06 2.09 pts

The GSE Composite Index (GSE-CI) gained 2.09 points to close at 2,750.15 YTD (GSE-CI) 41.64% 41.54% 0.24%

representing a 41.64% YTD return. This is due to price appreciation in GSE-Finance Stock Index 1,909.91 1,909.91 0.0 pts

YTD (GSE-FSI) 7.13% 7.13% 0.00%

Unilever Ghana PLC. (UNIL) which gained 9.92% to close at GH¢3.88.

Market Cap. (GH¢ MN) 62,737.14 62,715.27 21.87

UNIL has hereby gained 94% since it last traded the lowest this year Volume Traded 53,207 5,623,223 -99.05%

Value Traded (GH¢) 109,312.50 7,130,144.43 -98.47%

(GH¢2.00) on 19th July 2021.

The GSE Financial Stock Index (GSE-FSI) remained unchanged to close at TOP TRADED EQUITIES

Ticker Volume Value (GH¢)

1,909.91 translating into a YTD return of 7.13%. Market Capitalization on

MTNGH 21,872 27,558.72

the other hand climbed upwards to close at GH¢62.73 billion. UNIL 19,200 74,338.50

ETI 10,666 639.96

A total of 53,207 shares valued at GH¢109,312.50 was traded on

EGH 732 5,350.92 68% of value traded

Wednesday compared to 5,623,223 shares valued at GH¢7,130,144.43 GGBL 300 450.00

that was traded on the previous day.

At close of market, eight (8) equities changed hands with Unilever GAINERS & DECLINERS

Ticker Close Price Open Price Change Y-t-D Change

PLC (UNIL) recording the most trades per value, accounting for (GH¢) (GH¢)

68.01% of the total value traded. UNIL 3.88 3.53 9.92% -53.20%

EQUITY UNDER REVIEW: SCANCOM PLC (MTNGH)

Share Price GH¢1.26 KEY ECONOMIC INDICATORS

Price Change (YtD) 96.88% Indicator

Market Cap. (GH¢) 15,486.00 Monetary Policy Rate June 2021 13.50%

Dividend Yield 6.349% Real GDP Growth Q1 2021 3.1%

Earnings Per Share GH¢0.1413 Inflation June 2021 7.8%

Avg. Daily Trade Volumes 1,903,894 Reference rate August 2021 13.51%

Value Traded (YtD) GH¢259,606,618.00 Source: GSS, BOG, GBA

INDEX YTD PERFORMANCE

45.00%

40.00%

35.00%

30.00%

25.00%

20.00%

15.00%

10.00%

5.00%

0.00%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Fashion Business PlanDocument10 pagesFashion Business PlanOlome Emenike60% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Finance Sitxfin003 004Document32 pagesFinance Sitxfin003 004eshwar jampana100% (1)

- Sunley CaseDocument5 pagesSunley CasePeterNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

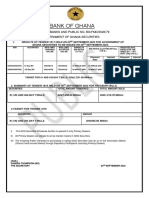

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- The Shape of Ai Governance To ComeDocument15 pagesThe Shape of Ai Governance To ComeHajar AgradNo ratings yet

- Ics 2210 System Analysis and Design 2Document3 pagesIcs 2210 System Analysis and Design 2123 321No ratings yet

- PMBOK 7th Edition (iBIMOne - Com) - ENG-11Document5 pagesPMBOK 7th Edition (iBIMOne - Com) - ENG-11Felipe Guimaraes PazinNo ratings yet

- Asset Management: Management of Physical AssetsDocument40 pagesAsset Management: Management of Physical AssetsJulio CesarNo ratings yet

- Digital Marketing RemovedDocument11 pagesDigital Marketing RemovedManoj DewanNo ratings yet

- Revised Stores Shield Criteria - Letter 12072023 - PCMM All Zonal RailwaysDocument7 pagesRevised Stores Shield Criteria - Letter 12072023 - PCMM All Zonal Railways1005 ABIRAME H.SNo ratings yet

- Assignment No 6Document4 pagesAssignment No 61346 EE Omkar PrasadNo ratings yet

- A Short History of Financial EuphoriaDocument61 pagesA Short History of Financial EuphoriaJatinder Singh Sodhi100% (3)

- 2021 RSET Bicol Region PDFDocument536 pages2021 RSET Bicol Region PDFGerald Villarta MangananNo ratings yet

- 64bf055a20eabc7f1d348ee9 - Cold Emailing PlaybookDocument75 pages64bf055a20eabc7f1d348ee9 - Cold Emailing Playbookemre.email.5No ratings yet

- SCM Unit 01 - 05-Mcq'sDocument34 pagesSCM Unit 01 - 05-Mcq'sManoj Harry100% (2)

- Rubine Store: Shop Rubine Malaysia Service CenterDocument1 pageRubine Store: Shop Rubine Malaysia Service CenterChristy WongNo ratings yet

- Registration: The Cost of Business and Licensing in Ethiopia and Options For ReformDocument156 pagesRegistration: The Cost of Business and Licensing in Ethiopia and Options For ReformAshenafi GirmaNo ratings yet

- Annex A - GBA Interview ToolDocument4 pagesAnnex A - GBA Interview ToolYumul JacyNo ratings yet

- Bus Comm Touchstone 1 Ariel SalmonDocument2 pagesBus Comm Touchstone 1 Ariel SalmonArieSpearsNo ratings yet

- CHAPTER 6 Finding The Voice of The UserDocument17 pagesCHAPTER 6 Finding The Voice of The UserMir JamalNo ratings yet

- Report Information: Fruit and Vegetable Processing Industry in India 2020Document3 pagesReport Information: Fruit and Vegetable Processing Industry in India 2020Neeharika ReddyNo ratings yet

- WindForce PLC AR 2021Document232 pagesWindForce PLC AR 2021Wishva WidanagamageNo ratings yet

- Jio Invoice 290323Document2 pagesJio Invoice 290323Deepak KiniNo ratings yet

- Lubrita International: Lubrita Company Born in Europe and Working Worldwide!Document4 pagesLubrita International: Lubrita Company Born in Europe and Working Worldwide!spyros_peiraiasNo ratings yet

- Group Project On "Bloop" Ice-Cream MKT 460 Strategic Marketing Mr. Rafsan ElahiDocument23 pagesGroup Project On "Bloop" Ice-Cream MKT 460 Strategic Marketing Mr. Rafsan ElahiRifat ChowdhuryNo ratings yet

- SudheerRJarugu (22 0)Document9 pagesSudheerRJarugu (22 0)Deepak BallakurNo ratings yet

- Bangalore TicketDocument3 pagesBangalore TicketRameshbabu SNo ratings yet

- Innovative HR Strategic Practices of Indian and Foreign MncsDocument4 pagesInnovative HR Strategic Practices of Indian and Foreign MncsTirtha NandiNo ratings yet

- Project 1 SlidesDocument11 pagesProject 1 SlidesmaxNo ratings yet