Professional Documents

Culture Documents

Chap 16

Uploaded by

Chan MyaeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 16

Uploaded by

Chan MyaeCopyright:

Available Formats

Chapter 16

Market Value of Share

= (Highest Quoted price+Lowest quoted price)/2

Matching Rules => Allowable Cost

1. Same day acquisition

2. Following 30 days acquisition (FIFO basis)

3. Share Pool

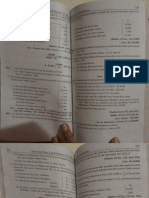

Example 2

Disposal Share = 4000 shares

1. 500 shares

2. 400 shares

3. 3100 shares

1. Same day = 500 shares

Sale Proceed (4.1 x 500shares) 2050 4.1

(-) Cost -2000

Gain 50 Net Gain on Sale

= 50 -40 +4296

2. Following 30 days = 400 shares 4306

Sale Proceed 1640

(-) Cost -1680

Loss -40

3. Share Pool = 3100 shares

Sale Proceed 12710

(-) Cost -8414

Gain 4296

Working

Share Pool

No of Share Cost of Share

1 July 1998-Acquire 1000 2000

11 April 2003 - Acquire 2500 7500

3500 9500

17 July 2019 - Sold -3100 -8414 =9500/3500*3100

Balance 400 1086

Example 3

3. Share Pool (Oct 2019)

Sale proceed 6000

(-) Cost -3833

Gain 2167

Working

Share Pool

No of Share Cost of Share

1 Oct 1999-Acquire 10000 15000

1 Feb 2012- Right issue 5000 13750 (5000shares x 2.75)

15000 28750

Oct 2019 - Sold -2000 -3833 =28750/15000 x 2000share

Balance 13000 24917

Example 4 1 share => 2 Oshare

1 Pshare

Original => 3000 shares 6000 Ordinary share Part disposal => Cost allocated => Market Va

3000 Preference share

Reorganisation Market Value £ Cost

Original 3000 shares 6000 O share 6000 x 2 12000 10600 = 13250*12000/15000

3000 P share 3000 x 1 3000 2650 = 13250*3000/15000

15000 13250

Example 5 5 share => 2 Oshare

2 Cash

P pls's O share = 50000 - 20000 Ordinary share

Cost = 2.1*50000=105000 - £20000

Take over Market Value £ Cost

P pls's O share = 50000 20000 O share 20000 x £6 120000 90000 =105000*120000/140

Cash £20000 20000 15000 =105000*20000/1400

140000 105000

For Cash received

Sale Proceed 20000

(-) Cost -15000

Gain 5000

base cost of the ordinary shares in L plc = 90000

per share

2 share --- 1 Share

10000 share ---- ? =10000*1/2

allocated => Market Value as a base

= 13250*12000/15000

= 13250*3000/15000

=105000*120000/140000

=105000*20000/140000

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- Acctg. Ed 1 - Module 10 Accounting Cycle of A Merchandising BusinessDocument35 pagesAcctg. Ed 1 - Module 10 Accounting Cycle of A Merchandising BusinessChen Hao100% (1)

- For Domestic Corporations: 1. Salient Features of The CREATE LawDocument6 pagesFor Domestic Corporations: 1. Salient Features of The CREATE LawJean Tomugdan100% (1)

- CA Kiran P FirodiyaDocument6 pagesCA Kiran P FirodiyaAngel RiaNo ratings yet

- Ultratech Cement Limited Swot Analysis BDocument6 pagesUltratech Cement Limited Swot Analysis BMohd HussainNo ratings yet

- 14 Financial Statement Analysis: Chapter SummaryDocument12 pages14 Financial Statement Analysis: Chapter SummaryGeoffrey Rainier CartagenaNo ratings yet

- Reverta Financial Report 1st Half 2017Document14 pagesReverta Financial Report 1st Half 2017powpizzaNo ratings yet

- Audit Important Case Studies For PCC and IPCCDocument30 pagesAudit Important Case Studies For PCC and IPCCsulabhpathak1987No ratings yet

- SKB Cashflow (Nina A 17810092)Document3 pagesSKB Cashflow (Nina A 17810092)Hanif ShaifaNo ratings yet

- Corporate Governance Under The SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - by Anuradha Roy Chowdhury (Ghosh)Document16 pagesCorporate Governance Under The SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - by Anuradha Roy Chowdhury (Ghosh)HIMANSHI HIMANSHINo ratings yet

- Chapter Two For Accounting 111Document31 pagesChapter Two For Accounting 111mohamad200579No ratings yet

- Corporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementDocument39 pagesCorporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementSichen UpretyNo ratings yet

- Corporate Taxation: Formation, Reorganization, and LiquidationDocument33 pagesCorporate Taxation: Formation, Reorganization, and LiquidationMo ZhuNo ratings yet

- 1.evaluation of Indian Construction CompaniesDocument7 pages1.evaluation of Indian Construction CompaniesManzal ParikhNo ratings yet

- Cash and Accrual Discussion301302Document2 pagesCash and Accrual Discussion301302Gloria BeltranNo ratings yet

- Case 3.1 Enron FDocument3 pagesCase 3.1 Enron FswetaNo ratings yet

- Task 3 - Model AnswerDocument4 pagesTask 3 - Model AnswerHarry SinghNo ratings yet

- Contoh Eliminasi Lap - Keu KonsolidasiDocument44 pagesContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniNo ratings yet

- Mid-Term Examination Financial Accounting II Duration:90mnDocument3 pagesMid-Term Examination Financial Accounting II Duration:90mnDavin HornNo ratings yet

- Bronson Corporation 2017 Income Statement (In Mllions)Document4 pagesBronson Corporation 2017 Income Statement (In Mllions)Dianne CastroNo ratings yet

- ACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesDocument5 pagesACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesCaro, Christilyn L.No ratings yet

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (24)

- Investment Bank in BangladeshDocument13 pagesInvestment Bank in BangladeshTopu RoyNo ratings yet

- Practice FRA BSAFDocument52 pagesPractice FRA BSAFHafiz Abdullah MushtaqNo ratings yet

- AssertionsDocument15 pagesAssertionsVictor JonesNo ratings yet

- Session 5 Security Market IndicesDocument50 pagesSession 5 Security Market IndicesUjjwal AiranNo ratings yet

- 11 - Working Capital ManagementDocument39 pages11 - Working Capital Managementrajeshkandel345No ratings yet

- Chapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A FinalDocument26 pagesChapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A Finalrandom17341No ratings yet

- Financial Management MCQsDocument27 pagesFinancial Management MCQsYogesh KamraNo ratings yet

- Ifos 2 BookDocument15 pagesIfos 2 BookArthi . MNo ratings yet